There is a tendency among payment companies to position themselves as software businesses. Toast is a software company, Lightspeed Commerce is a software company….Today I would like to profile a payments company that does not follow this trend. Shift4 Payments (NYSE: ) is in the business of accepting and processing payments and does not pretend to be something else. Similar to Toast and Lightspeed Commerce, Shift4 offers Point-of-Sale software, an e-commerce platform, and a number of other software solutions (marketing, loyalty, ticketing, etc.), but payment processing is at the core of what the company does.

Perhaps, it is the focus on its core competence that allowed the company to deliver consistent revenue growth while maintaining profitability on an Adjusted EBITDA basis. Shift4 also reached GAAP profitability in its latest reported quarter, so perhaps, being a payments company, and not a software business, is not such a bad thing after all. Anyways, let’s take a closer look at Shift4 Payments.

Business Overview

In their own words, Shift4 Payments is “a leading independent provider of payment acceptance and payment processing technology solutions in the United States.” The company provides its merchant clients with end-to-end solutions for accepting payments including merchant acquiring, Point-of-Sale (POS) software, integrated hardware (under the brands Harbortouch and SkyTab), payment processing, as well as e-commerce platform capabilities (under the brand Shift4Shop). The company’s closest competitors in the United States are Square, Toast, and Lightspeed Commerce.

Image source: SkyTab by Shift4

Shift4 merchants operate across multiple verticals, including food and beverage, hospitality, sports and entertainment, gaming, specialty retail, and non-profits, and range from small and medium-sized businesses to large enterprises. The company refers to its restaurant, hospitality, and retail customers as “High growth core”, and sports and entertainment, gaming, non-profits, and e-commerce customers, as “New verticals”.

The company served over 200,000 customers at the end of 2021, including such well-known brands as Burger King, Wendy’s, Best Western, Wyndham Hotels & Resorts, and Hilton. In November 2021, the company also signed a 5-year deal to process payments for Elon Musk’s Starlink.

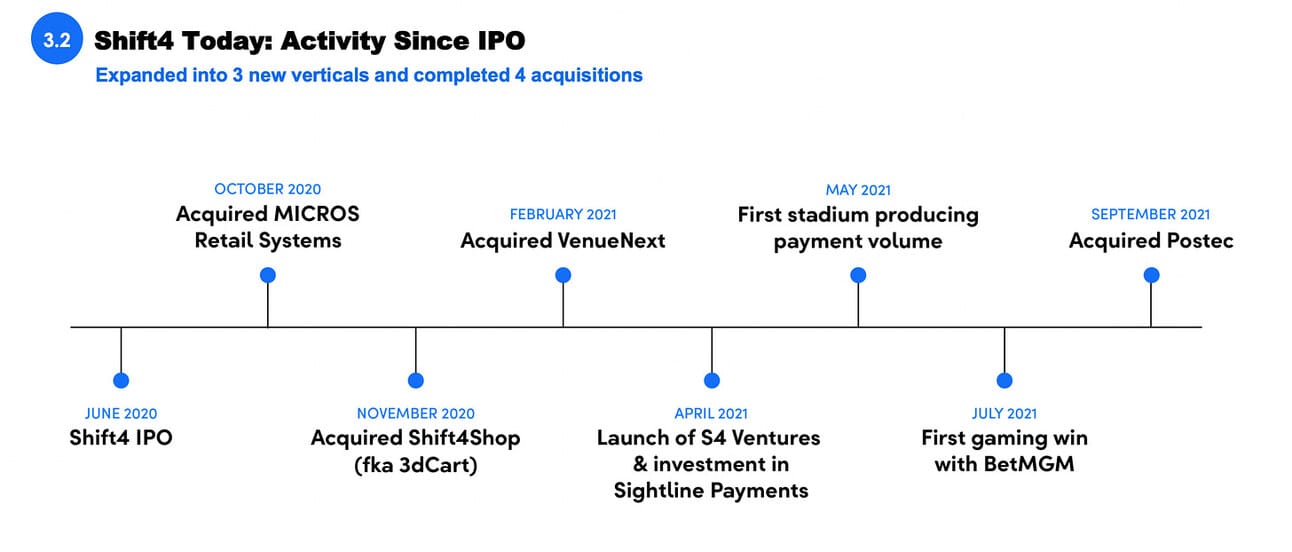

As I wrote in “Fintech companies powering “in real life” commerce“, Shift4 Payments was founded in 1999 and went through several iterations, changing the name along the way. In 2018, still operating under the name Lighthouse Network, the company acquired a payment gateway provider Shift4 Corporation and rebranded the whole group into Shift4 Payments.

The company went public in June 2020 and has since then continued to pursue acquisitions to grow its customer base or expand into new verticals. For instance, in 2020 Shift4 acquired 3dCart, which became the foundation for Shift4Shop, the company’s e-commerce offering. In 2021, Shift4 acquired VenueNext, which allowed the company to expand into the sports and entertainment vertical.

Image source: Investor Day Presentation

In March 2022 the company announced the acquisition of The Giving Block, a platform for non-profits to accept cryptocurrency donations, and Finaro, a European e-commerce acquirer with a banking license. The premise is that the acquisition of The Giving Block will boost the company’s presence in the non-profit segment, while the acquisition of Finaro, will springboard the company’s global expansion.

Payment Volume

The company does not regularly disclose the number of customers, customer locations, or the total value of gross merchandise sold via the company’s POS solutions. Thus, “end-to-end payment volume” is pretty much the only non-financial metric disclosed regularly. Shift4 defines “end-to-end payment volume” as “the total dollar amount of card payments that we authorize and settle on behalf of our merchants.”

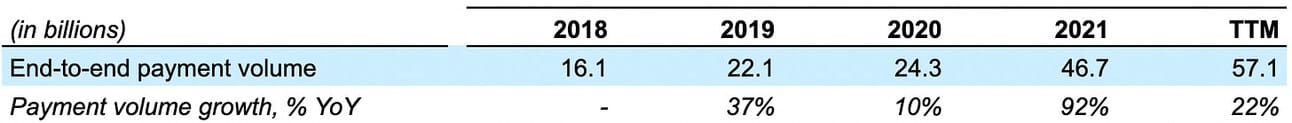

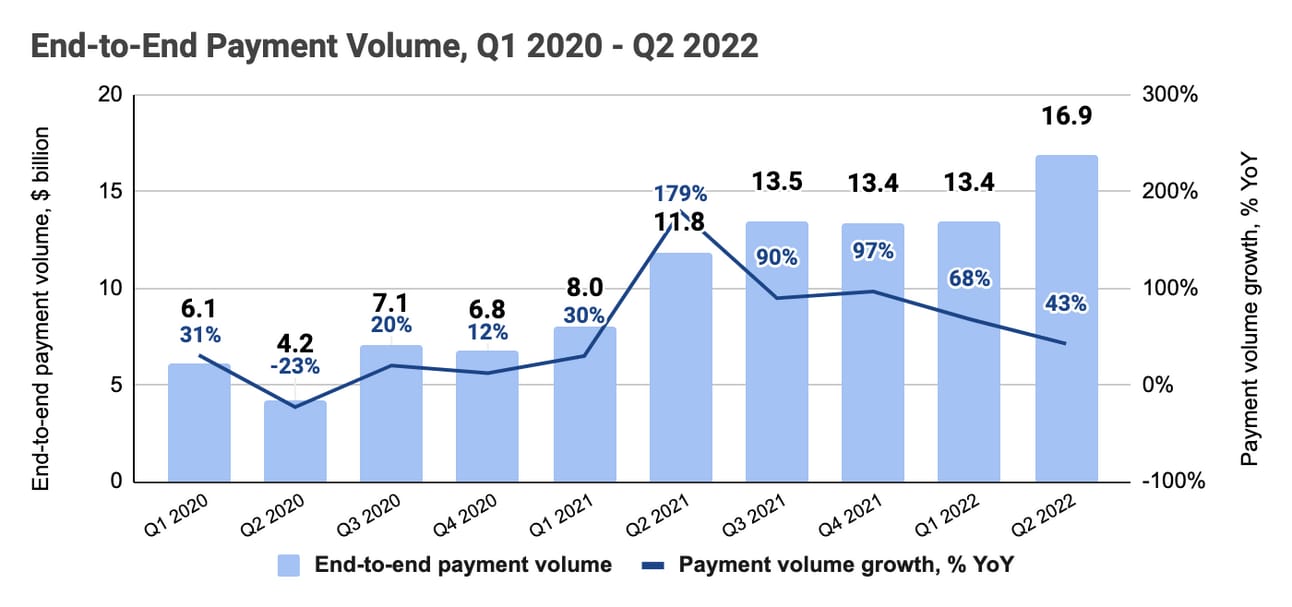

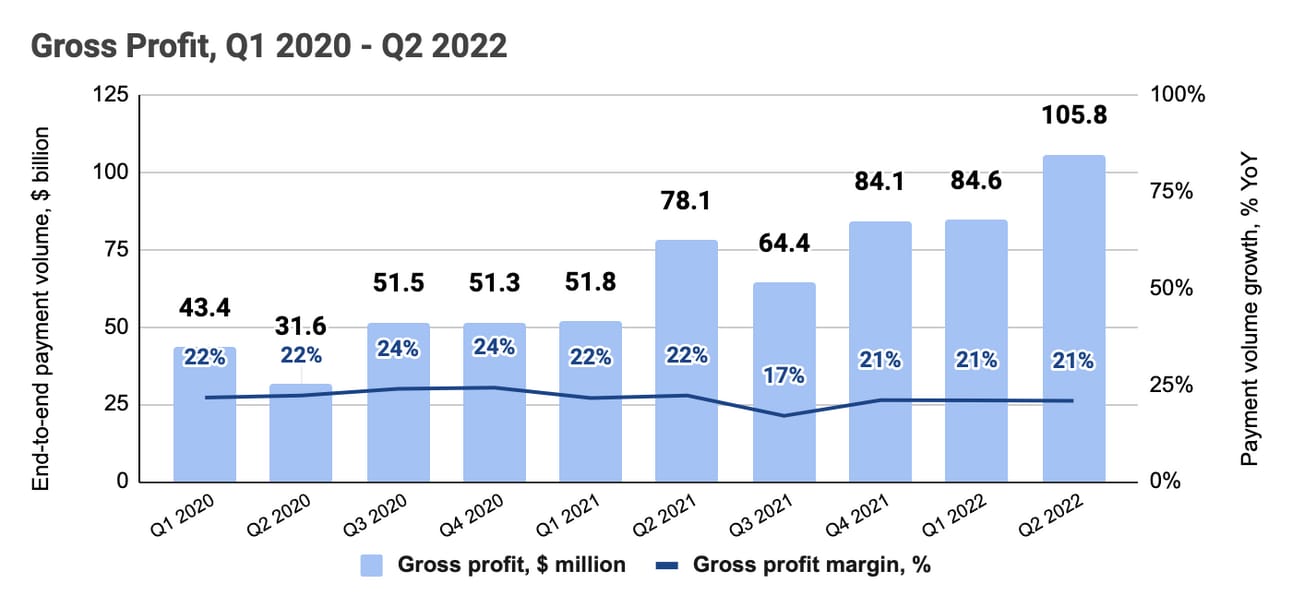

Shift4’s end-to-end payment volume grew at a CAGR of 42% during the 2018-2021 period, reaching $46.7 billion in 2021. The company’s management is expecting end-to-end payment volume to reach $68-70 billion in 2022, which would represent a 46-50% increase compared to 2021.

If you read my profile of Lightspeed Commerce (NYSE: LSPD), you’d remember that the company reports two metrics, Gross Transaction Value (GTV), and Gross Payment Volume (GPV). In short, GTV is the total value of the transactions initiated from Lightspeed POS terminals, while GPV is a portion of GTV, which was processed by Lightspeed end-to-end.

In the case of Shift4, the company reports only the “end-to-end payment volume”, which would be the equivalent of the Gross Payment Volume for Lightspeed. “End-to-end volume” does not include volume processed by gateway-only customers via third-party processors. Migration of such “gateway-only” customers to end-to-end payment processing is one of the key priorities for the company. Shift4 estimates the migration opportunity at $180 billion in end-to-end payment volume in their Q4 2021 shareholder letter.

The acquisition of Finaro is expected to contribute approximately $15 billion to the total end-to-end payment volume in 2023 (following the expected closing of the transaction at the end of 2022).

Revenue

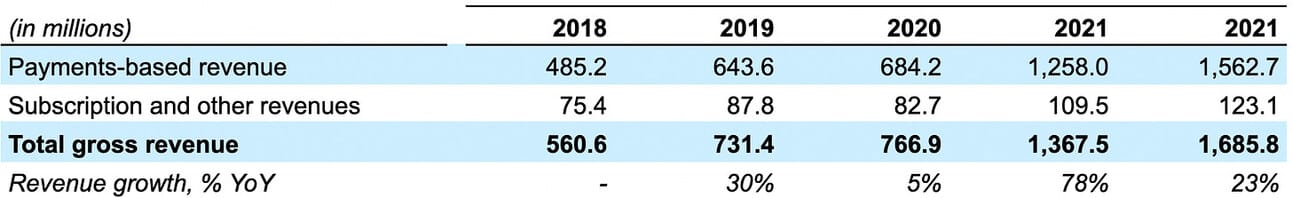

Shift4 breaks down its revenue into two components: a) Payments-based revenue, which includes fees for payment processing services and gateway services, and b) Subscription and other revenues, which include software fees for Point-of-Sale systems and Shift4Shop e-commerce platform, as well as hardware leases.

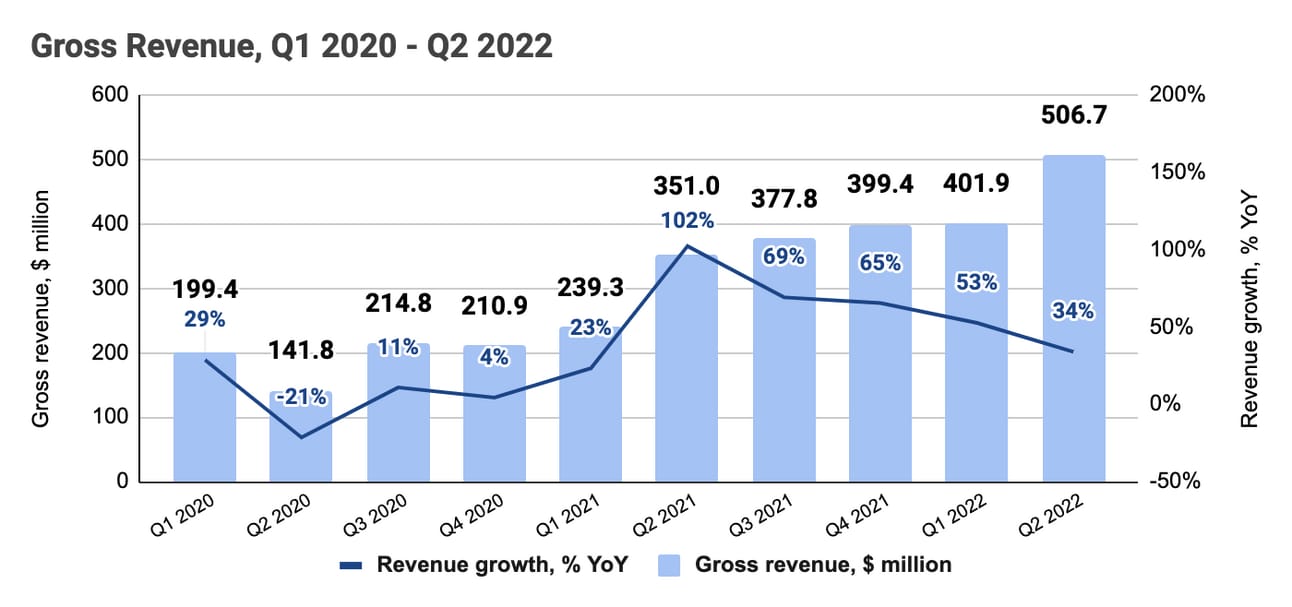

Shift4’s total gross revenue grew at a CAGR of 35% during the 2018-2021 period, reaching $1.37 billion in 2021. Payments-based revenue grew at a CAGR of 37%, while Subscription and other revenue grew at a CAGR of 13%. The company’s management guided for $1.9-2.0 billion in gross revenue in 2022, which would represent a 39-46% YoY growth.

Given the company’s strong footprint in the restaurants and hospitality segments, the company’s revenue experienced strong headwinds during the pandemic lockdowns. Elimination of lockdown restrictions and opening up of the economy, in turn, served as a boost to the company’s growth in 2021 and early 2022 (see the chart below.) As the result, neither 2020, nor 2021, are representative years. However, on average, the company delivered a 35% YoY growth in quarterly revenue during these two years, which is in line with the 2022 guidance.

Shift4 earns a percentage of the transaction value when it processes the payment end-to-end, and a flat fee per transaction, when the company acts only as a gateway and the payment is processed by a third-party processor. Migration of gateway customers (customers acquired with Shift4 Corporation in 2018) to end-to-end processing is one of the key priorities for the company. Per the company’s calculations, end-to-end processing delivers a 4.2 uplift in gross profit per customer.

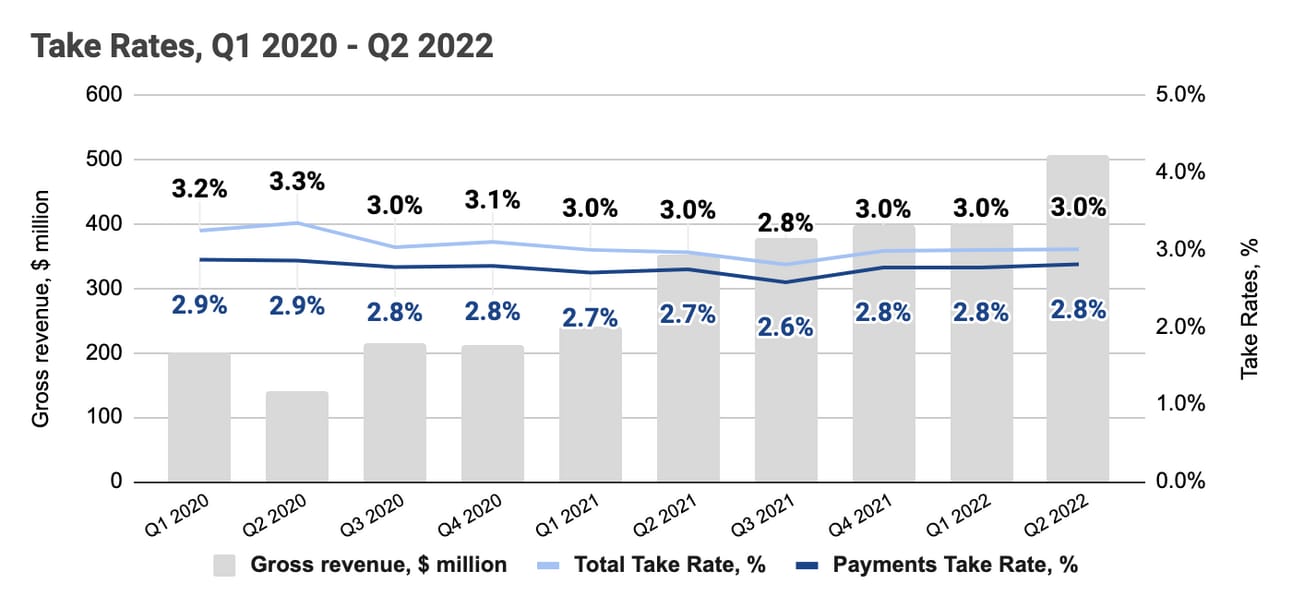

The company’s Take Rates (both, the Total Take Rate, calculated as total revenue divided by end-to-end payment volume, as well as Payments Take Rate, calculated as payments-based revenue divided by end-to-end payment) have been quite stable over the last 10 quarters (see the chart below).

Please note that the company’s Take Rates shown above are a bit “inflated” because the company generates revenue also from the payment volume processed by other payment processors (and the correct way to calculate Takes Rates would be to divide revenue by the total payment volume, not just end-to-end payment volume).

Gross Profit

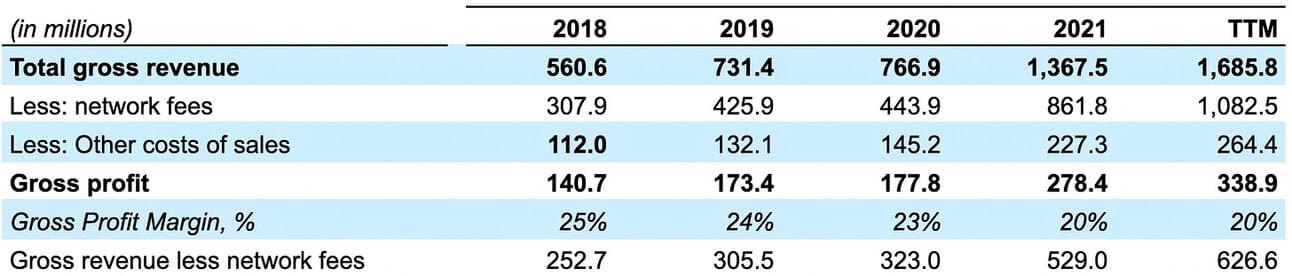

In order to calculate gross profit, the company deducts network fees, which include interchange and processing fees, and other costs of sales, which include sales commission to third-party distributors, cost of hardware, and amortization of capitalized software development expense, from the revenue.

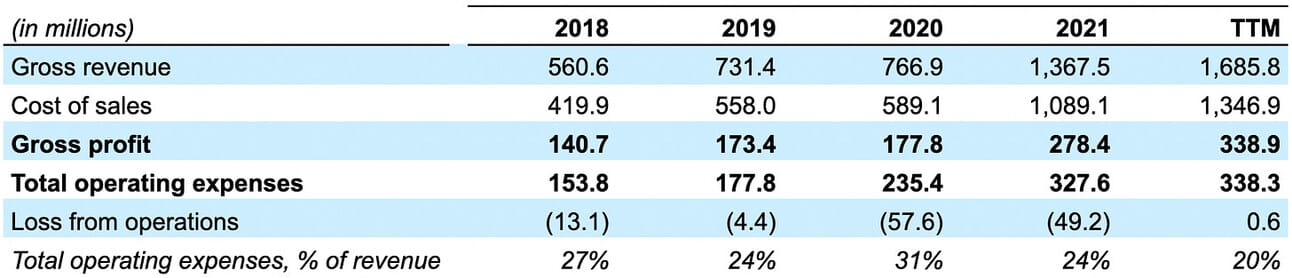

The company’s gross profit grew at a CAGR of 26% during the 2018-2021 period, reaching 278.4 million in 2021. The gross profit margin gradually declined from 25% in 2018 to 20% in 2021. The company also reports a non-GAAP metric “gross revenue less network fees”. I don’t really understand the value of this metric, so I will ignore it for now.

In terms of the gross profit margin, Shift4 is similar to Toast (which operates with gross margins of less than 20%). In contrast, Square and Lightspeed Commerce both consistently deliver 40%+ gross profit margins. The difference lies in a small share of the software revenue, which usually has higher margins than merchant acquiring and payment processing.

Operating Expenses

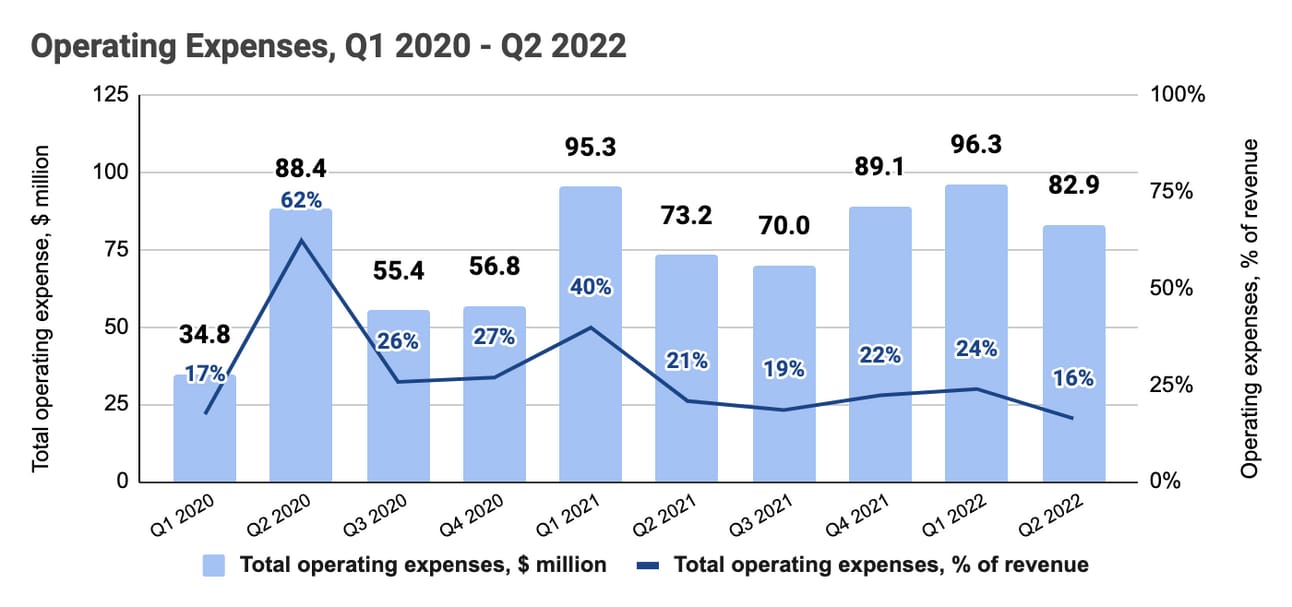

Shift4 operating expenses primarily consist of “General and administrative expenses” (67% of total operating expenses in 2021), “Depreciation and amortization” (19%), “Advertising and marketing expenses” (9%), and “Professional fees” (5%).

During the 2018-2021 period, total operating expenses consistently exceeded gross profit, resulting in a loss from operations. In 2021, total operating expenses were $327.6 million, resulting in a loss from operations of $49.2 million. However, as can be seen from the table below, the company operated at break-even in the last twelve reported months (Q3 2021 - Q2 2022).

Shift4 might not be commanding the highest gross profit margins in the industry, but it compensates for this with efficiency on the operating expenses side. For instance, in 2021 operating expenses, represented 24% of gross revenue, and the ratio fell even further, to 20% of gross revenue, in the trailing twelve months period. Overall, Shift4 seems to be on the verge of GAAP profitability.

Net Income (loss) and Adjusted EBITDA

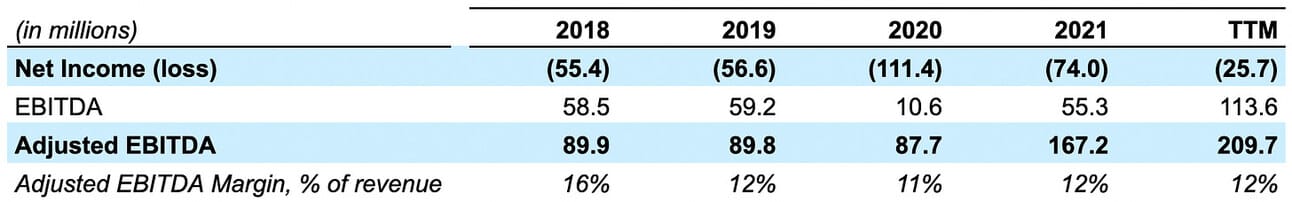

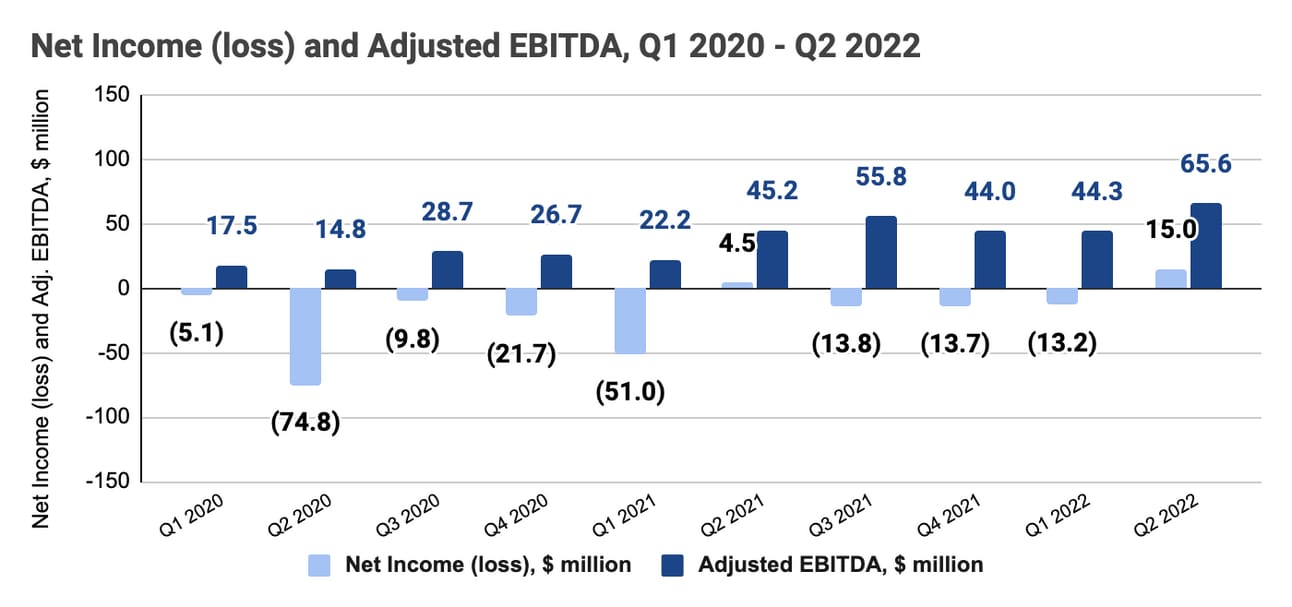

In 2021, Shift4 reported a Net loss of $74.0 million and an Adjusted EBITDA of $167.2 million. The company calculates Adjusted EBITDA by deducting depreciation and amortization, interest and income tax expenses, share-based compensation, as well as one-time charges, such as costs related to acquisitions of company restructuring, from revenue.

As can be seen from the table above Shift4 has been profitable on an Adjusted EBITDA basis for the past 5 reported years. The company’s management guided for $225-265 million in Adjusted EBITDA for the full year of 2022, which would represent an 11-13% Adjusted EBITDA Margin. The acquisition of Finaro is expected to contribute approximately $30 million in Adjusted EBITDA in 2023.

Shift4 had over $1 billion in cash and cash equivalents at the end of Q2 2022 giving the company ample resources to pursue additional investments.

Things to Watch

Gateway migration. Migration of the gateway-only customers to Shift4 end-to-end payment processing is a dominating theme during the company’s earnings calls. This migration has been underway for four years now (since the acquisition of Shift4 Corporation), and it sounds like Shift4 is becoming more aggressive about it. The company estimates the migration potential at $180 billion in end-to-end payment volume, which is 4 times what the company processed in 2021.

New verticals. I believe the acquisition of VenueNext is a great example of how masterful Shift4 has become at expanding into new verticals through acquisitions. In three months following the acquisition, Shift4 had the first stadium using the company’s payment capabilities. While the migration of the gateway-only customers provides short-term growth potential, new verticals are critical for sustaining growth momentum over the medium to longer term.

International expansion. The acquisition of Finaro is expected to close by the end of the year, which would give Shift4 a strong customer base in Europe and the UK, as well as a springboard for the expansion into Asia (Finaro has regulatory approvals in Singapore and Japan). It should be noted that Finaro is primarily an e-commerce acquirer serving many digital-only customers, and thus, venturing into offline acquiring (i.e. with SkyTab or VenueNext brands), is not straightforward.

Acquisitions. Shift4 has successfully ventured into new verticals through acquisitions, and given the company’s strong cash position, I would expect this strategy to continue. Expansion into new verticals, international growth… you name it. The company does seem to shy from pursuing any levers of growth.

p.s. if you visit the Shift4 website, you’ll notice lots of stars and images of space. Curious why? In 2021, Shift4 partnered with SpaceX for an all-civilian mission to orbit, Inspiration4. The mission was commanded by Jared Isaacman, the founder and CEO of Shift4. It looks like getting Starlink as their client might have had something to do with this cooperation.

Source of the data used above: Investor Relations

Disclosure & Disclaimer: despite rocky performance in 2021 and 2022, I own shares in most of the companies covered in this newsletter, as I am extremely bullish on the long-term transformation in the financial services industry. However, none of the above is or should be considered financial advice, and you should do your own research.