Last week I profiled five companies offering Point-of-Sale (POS) solutions, including Square, Toast, Lightspeed Commerce, Shift4 Payments, and Shopify (you can read the update by following the link 👉🏻 “Fintech companies powering "in real life" commerce”). These companies target different customer segments and geographies, but they all have one thing in common: financial services are important drivers of their revenue growth. They might have started as pure software vendors, but, over time, started offering payment processing and working capital solutions.

Today I would like to profile Lightspeed Commerce (NYSE: LSPD, TSX: LSPD). Lightspeed Commerce serves more than 300,000 small and medium-sized companies in the hospitality and retail segments and operates in more than 100 countries. Founded in 2005 in Canada, the company masterfully expanded through acquisitions: i.e. it entered the hospitality segment by acquiring a Belgian startup POSIOS, added e-commerce capabilities by acquiring a Dutch startup SEOshop, and grew internationally through the acquisitions of ShopKeep and Vend.

Last year, Lightspeed announced acquisitions of Ecwid and NuOrder (spending a total of $925 million), as well as raised $823 million in additional capital through a public offering. I guess, there are many exciting things ahead for Lightspeed, so let’s learn more about this company!

Please note that the company’s fiscal year ends on March 31. For example, Fiscal 2022 means the period from Q2 2021 to Q1 2022.

Business Overview

In their own words, “Lightspeed offers a cloud-based commerce platform that connects suppliers, merchants, and consumers while enabling omnichannel experiences. Our software platform provides our customers with the critical functionality they need to engage with consumers, manage their operations, accept payments, and grow their businesses.” Let’s break that statement down.

The company offers two flagship products Lightspeed Retail and Lightspeed Restaurant, which are cloud-based software solutions targeted at restaurants, hospitality, and retail businesses. Lightspeed products allow businesses to accept customer orders via online, mobile, and offline Point-of-Sale (“engage with customers”), manage products, menus, inventory, and employees (“manage their operations”), as well as accept customer payments (“accept payments”) either using Lightspeed payment processing capabilities or using third-party processors.

Image source: Lightspeed Retail

The company targets primarily “sophisticated” small and medium-sized businesses, and at the end of Fiscal 2022 (end of March 2022), 63% of the customers represented retail merchants, while 37% represented hospitality businesses. Lightspeed was founded in 2005 in Canada (the company has a dual listing, on New York and Toronto Stock Exchanges), but since then has become a truly global business (organically and, as noted earlier, through masterful acquisitions). Thus, at the end of Fiscal 2022, only 51% of Lightspeed customers were based in North America.

The company positions itself as a software business; however, like many other point-of-sale solution vendors, it realized the potential in offering its clients end-to-end payment processing and working capital financing solutions. Thus, in 2019 the company launched Lightspeed Payments, and in 2021 launched Lightspeed Capital. Payment processing, in particular, has strong potential to drive the company’s revenue growth for years to come, as only 13% of the total payments initiated from Lightspeed POS solutions are processed by the company (and the rest are processed by third parties). The company also offers a full suite of POS hardware, such as payment terminals.

Image source: Lightspeed Payments

Finally, in 2021 Lightspeed made two additional acquisitions. The company acquired an e-commerce platform Ecwid (for $500 million), and a B2B ordering platform NuOrder (for $425 million). NuOrder became the backbone of the Lightspeed Supplier Network, which allows merchants to order products directly from suppliers within the Lightspeed solution. Lightspeed Supplier Network is still in the pilot mode and is the company’s long-term bet, which means it is not expected to make a meaningful financial contribution in the short term.

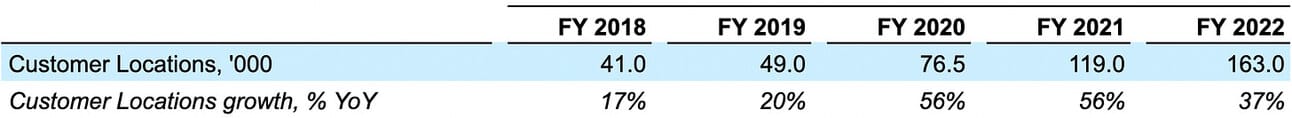

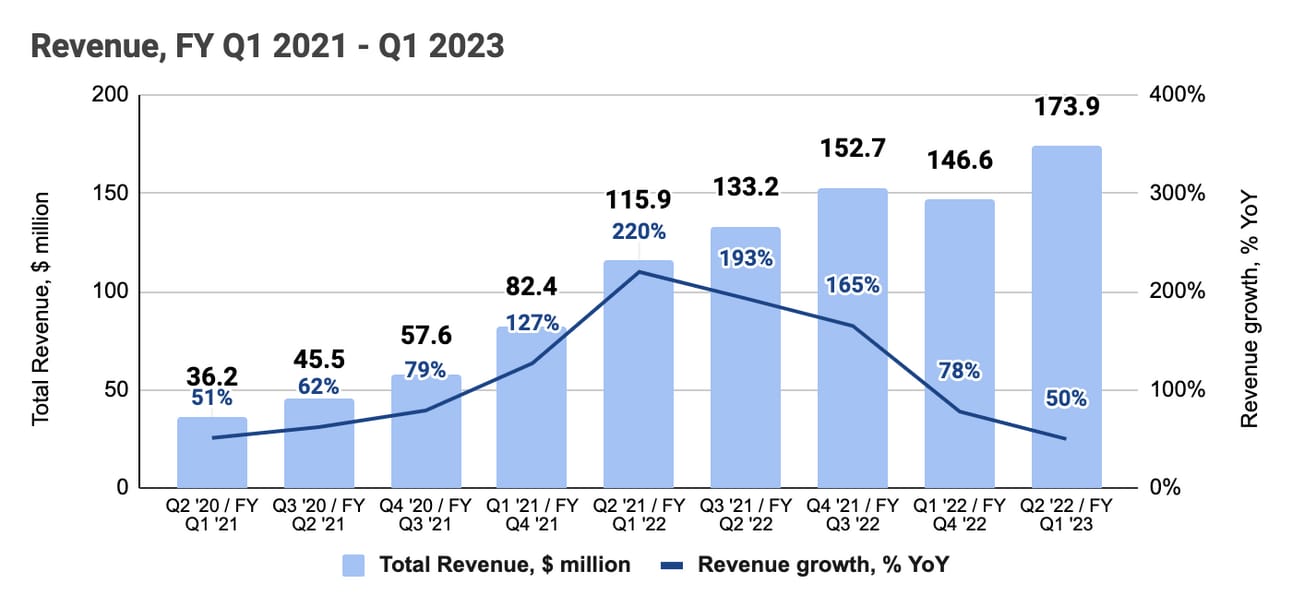

Customer Locations

One of the key operating metrics for Lightspeed is “customer locations”. The company defines “Customer Location” as “a billing merchant location for which the term of services has not ended, or with which we are negotiating a renewal contract.” Lightspeed grew customer locations at a Compound Annual Growth Rate (further in the text just CAGR) of 41% during the Fiscal 2018-2022 period, reaching 163,000 locations by the end of Fiscal 2022.

In addition, the company served approximately 160,000 Ecwid customer locations, bringing the total to 323,000 locations. As mentioned above, Lightspeed focuses on serving “sophisticated” customers (multiple locations, multiple distribution channels, etc.), and some of the Ecwid customers do not fit this profile. As the result, the company estimates that around 10,000 Ecwid customers will churn.

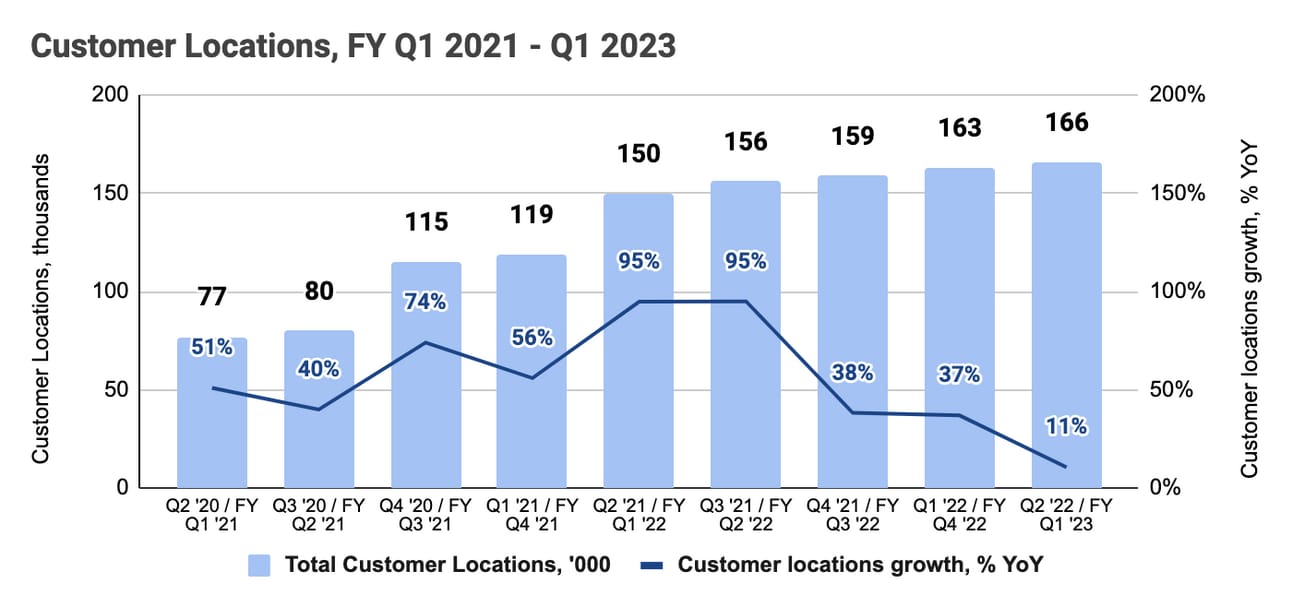

Gross Transaction Value

Two additional operating metrics that the company reports are “Gross Transaction Volume” and “Gross Payment Volume”. Lightspeed defines “Gross Transaction Volume” or “GTV” as “the total dollar value of transactions processed through our cloud-based software-as-a-service platform, in the period, net of refunds, inclusive of shipping and handling, duty and value-added taxes.”

Lightspeed’s GTV grew at a CAGR of 62% during the Fiscal 2018 - 2022 period and reached $72.5 billion in Fiscal 2022. Most of the transactions are processed through third-party acquirers (more on that below); however, Lightspeed still charges its customers a volume-based fee for such transactions.

When the transaction is processed by Lightspeed Payments, the company counts it towards “Gross Payment Volume”. More specifically, the company defines “Gross Payment Volume” or “GPV”, as “the total dollar value of transactions processed, in the period through our payments solutions in respect of which we act as the principal in the arrangement with the customer, net of refunds, inclusive of shipping and handling, duty and value-added taxes.”

The company has been actively selling its payment processing solution, and the payments penetration (share of Gross Transaction Value processed by Lightspeed Payments) reached 15%, or $3.3 billion, in Fiscal Q1 2023. Lightspeed makes more money (in terms of revenue) when handling payments end-to-end; thus, increasing payment penetration is one of the key priorities for the company.

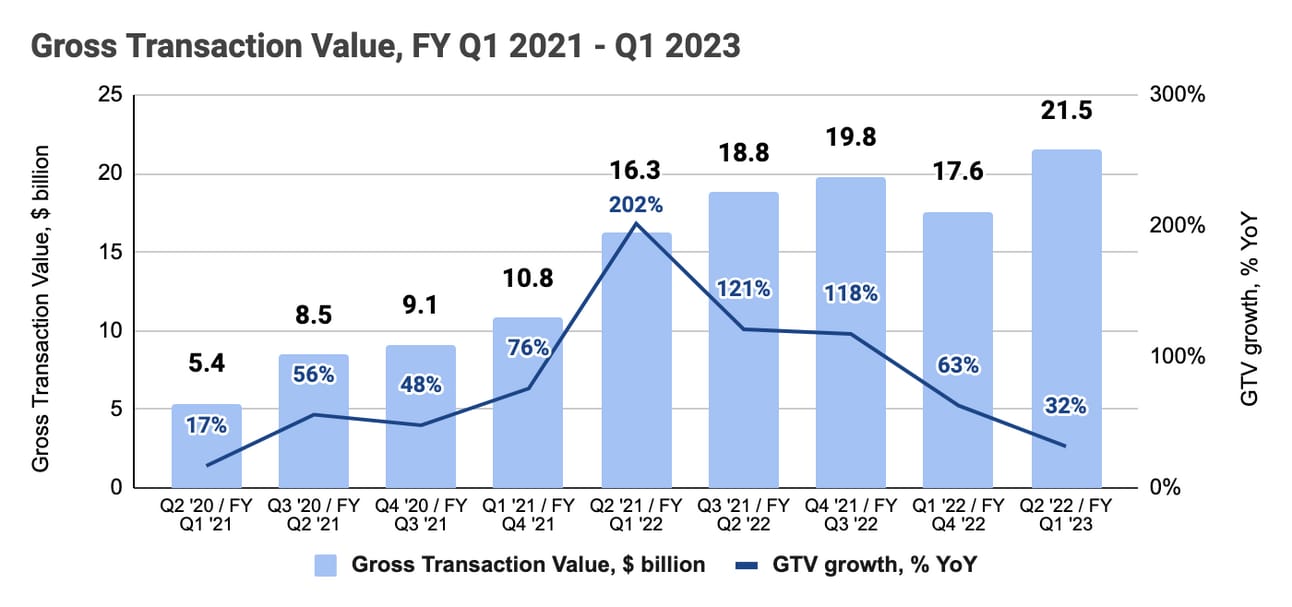

Revenue

Lightspeed’s revenue consists of three components: a) subscription revenue (fees for using the software solution), b) transaction-based revenue (volume-based fees, charged as a percentage of GTV), and c) hardware and other revenue. Lightspeed charges its customers transaction-based fees in both cases, when the payment (that is initiated from a Lightspeed POS solution) is processed by a third-party processor, and when the payment is processed by Lightspeed.

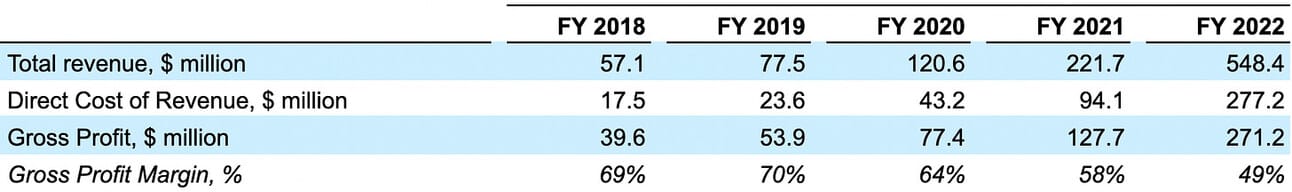

Lightspeed's total revenue grew at a CAGR of 76% over the Fiscal 2018-2022 period and reached $548.4 million in Fiscal 2022. In Fiscal 2022, subscription revenue represented 45%, transaction-based revenue represented 48%, and hardware and other revenue represented 7% of the total revenue. In Fiscal Q3 2022, Lightspeed completed the acquisition of Ecwid, which added $15.5 million to the Fiscal 2022 revenue.

Although Lightspeed offers e-commerce solutions, the vast majority of the company’s business is offline. Thus, the reopening of the economies after the pandemic lockdowns was a strong tailwind for the company’s revenues. As the chart below illustrates, the revenue growth rate is slowing down, but the company still expects a 35-40% revenue growth in Fiscal 2023 (or $740-760 million).

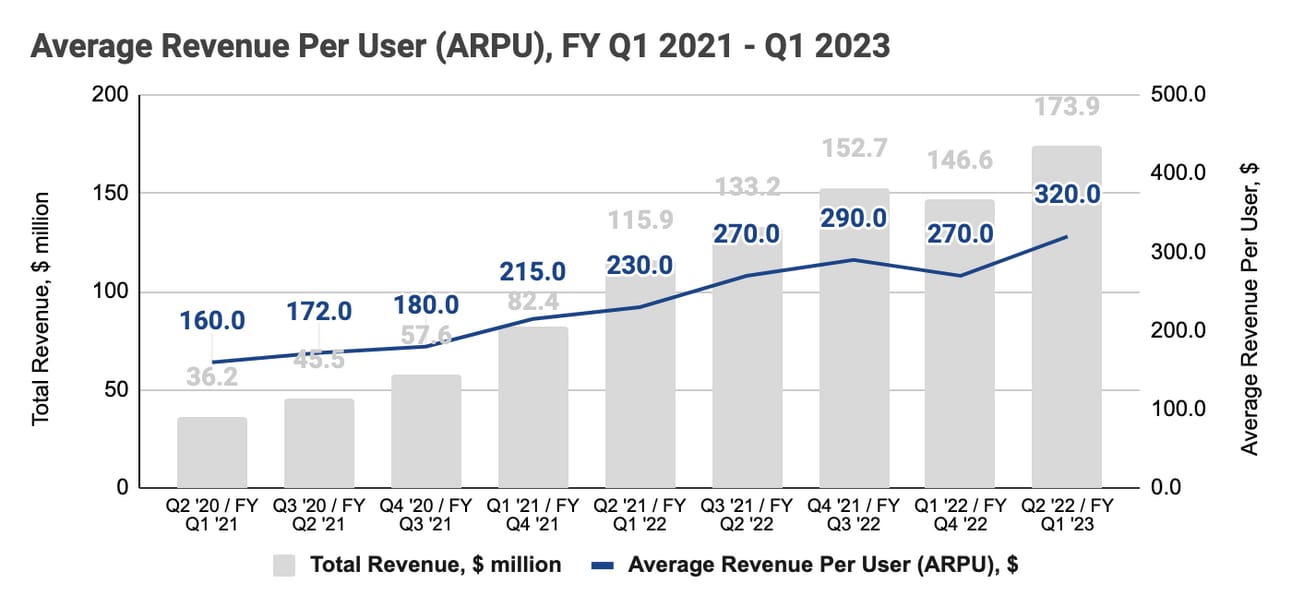

The company has been consistently increasing the Average Revenue Per User. Lightspeed defines “ARPU” as “the total subscription revenue and transaction-based revenue in the period divided by the number of Customer Locations in the period.” The growth in the ARPU (illustrated in the chart below) came from customers adopting more products, and from a higher payment penetration rate.

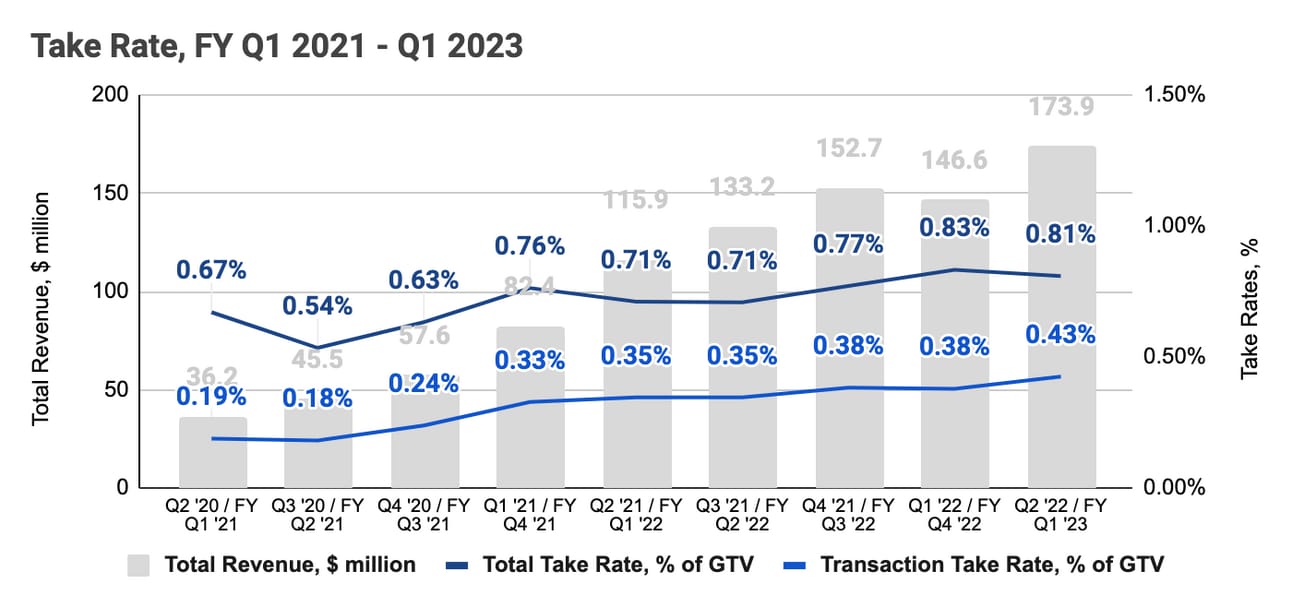

There are two ways to measure the gross take rates in the case of Lightspeed: a) by dividing total revenue by Gross Transaction Value (“Total Take Rate”), and b) by dividing only transaction-based revenue by the Gross Transaction Value (“Transaction-based Take Rate”). The chart below illustrates the evolution of both, total and transaction-based takes, and as you can see, both have been consistently improving. Increasing transaction-based take rate illustrates well the benefit of the higher payment penetration rate.

Gross Profit

Lightspeed calculates gross profit by deducting “Direct Cost of Revenue” from the total revenue. “Direct Cost” includes the subscription cost of revenue (primarily salaries and other employee-related costs of the support team, hosting infrastructure, and corporate overhead), transaction-based cost of revenue (primarily interchange, processing, bank settlement, and third-party processing fees), and hardware and other cost of revenue (primarily cost of the hardware, shipping and handling costs, and the cost of professional services provided to customers).

The company’s gross profit grew at a CAGR of 62% over the Fiscal 2018-2022 period and reached $271.2 million in Fiscal 2022. Lightspeed’s gross profit margin has been declining since Fiscal 2019 driven by the higher share of transaction-based revenue (which has a lower gross profit margin and the subscription revenue), as well as declining gross profit margins for the transaction-based and hardware revenue.

As the chart below illustrates, the company has been consistently delivering 70%+ gross profit margin on its subscription revenue; however, the gross profit margin for the transaction-based revenue has been declining consistently since Fiscal Q3 2021, and the hardware revenue turned to a negative gross profit contribution in Fiscal Q4 2021.

One of the reasons for the declining transaction-based revenue comes from the fact that according to IFRS, Lightspeed books net retained fee as its revenue in case a payment is processed by a third party, and books a gross fee charged to the merchant in case a payment is processed by Lightspeed Payments.

Per the management’s comments, the transaction-based revenue share in the total revenue will continue increasing driving down the overall gross profit margin for the business. However, it is also important to monitor the evolution of the gross profit margins for transaction-based and hardware revenue, as those create additional pressure on the overall gross profit margin.

Operating Expenses

Lightspeed groups its operating expenses into “Sales and marketing”, “Research and development”, and “General and administrative” expenses, as well as depreciation and amortization of assets and acquisition-related expenses. In Fiscal 2022, “Sales and marketing” contributed 37%, “Research and development” contributed 21%, and “General and administrative” contributed 16% of the total operating expenses.

The company has been reporting an operating loss for the past 5 fiscal years, as operating expenses exceeded the gross profit. In Fiscal 2022 the company reported $589.5 million in operating expenses, which resulted in a $318.3 million operating loss. Note that the operating margin declined from negative 38% in Fiscal 2018 to negative 58% in Fiscal 2022 driven by compressing gross profit margins, rising share-based compensation, and accumulating amortization expenses from the acquisitions.

For instance, operating expenses in Fiscal 2022 included $155.8 million in depreciation and amortization expenses and acquisition-related costs (up from $50.1 million in Fiscal 2021). In addition, “direct cost of revenue”, “sales and marketing”, “research and development” and “G&A” expenses included a total of $109.1 million in share-based compensation (up from $44.8 million in Fiscal 2021).

Net Income and Adjusted EBITDA

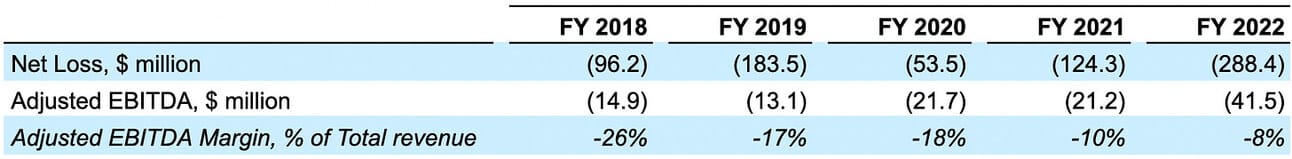

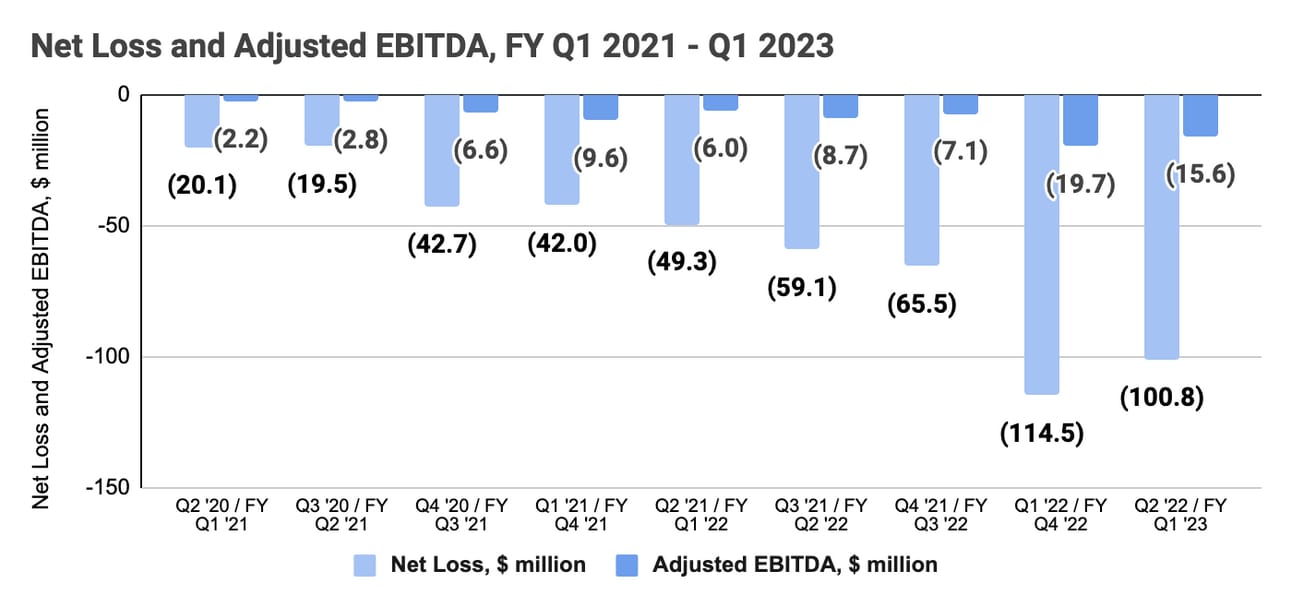

Lightspeed reported a Net Loss of $288.4 million and a negative Adjusted EBITDA of $41.5 million in Fiscal 2022. The company calculates the Adjusted EBITDA by adjusting the Net Loss with share-based compensation, depreciation and amortization, income taxes, foreign exchange losses, as well as one-time expenses (primarily related to acquisitions).

Adjusted EBITDA Margin has been steadily improving over the last five fiscal years reaching negative 8% in Fiscal 2022. The company’s management guided for a negative Adjusted EBITDA margin of 5% in Fiscal 2023, and expressed the ambition to reach Adjusted EBITDA profitability in Fiscal 2024.

As of June 30, 2022, Lightspeed had approximately $915 million in unrestricted cash and cash equivalents, which means the company has sufficient resources to reach profitability and boost its growth through further acquisitions (if the management decides to continue this path).

Things to Watch

Payments penetration. I would expect that, given the low payment penetration rate, the adoption of Lightspeed Payments solutions will continue to drive the company’s growth for years to come. Bundling POS software with payments allows for delivering a better experience for the customers, and higher revenue for the company. Over time we should also hear more about the company’s working capital solutions offered by Lightspeed Capital.

Gross margins. As mentioned in the text, the increasing adoption of Lightspeed Payments (and the consequently increasing share of the transaction-based revenue) results in gross profit margin compression (payments have lower margins than software). What I will be looking for is the stabilization of gross profit margins, and if those end up around 40% (think of Square), or around 20% (think of Toast).

Path to profitability. The company’s management made a bold commitment to reach profitability on an Adjusted EBITDA basis in Fiscal 2024 (calendar Q2 2023 - Q1 2024). The company has been consistently improving its Adjusted EBITDA margin each year, so the commitment seems achievable. However, what is important is how the company gets there: through improving its cost discipline (cutting costs), or through a bigger scale (having more money in gross profit to cover operating expenses).

Acquisitions. In August 2021, Lightspeed raised $823 million in additional capital through a public offering (perfect timing, isn’t it?). The company has more cash than it needs even if reaching profitability will take longer. As noted, it has effectively used acquisitions to grow before, so we might expect more acquisitions to come.

Source of the data used above: Investor Relations

Disclosure & Disclaimer: despite rocky performance in 2021 and 2022, I own shares in most of the companies covered in this newsletter, as I am extremely bullish on the long-term transformation in the financial services industry. However, none of the above is or should be considered financial advice, and you should do your own research.