Block, Inc ( ) reported Q2 2022 earnings earlier in the month. As expected, the company’s performance was shadowed by the declining revenue from Bitcoin trading, as well as an impairment it booked on its Bitcoin holdings. Nevertheless, as I argued previously, Bitcoin revenue doesn’t really matter, as the majority of Block’s gross profit is contributed by Square and Cash App.

Moreover, I would argue that Afterpay, although a minor contributor at the moment, could be a strong driver of the company’s growth going further. Block views Afterpay as the bridge between Cash App users and Square merchants. Thus, Jack Dorsey spent a lot of time at the company’s earnings call discussing “Discover” functionality in Cash App. More on that below, but in short, “Discover” is expected to expose Square merchants to the 47 million Cash App users. As you can imagine, 47 million people can generate a lot of revenue for those merchants, and Block will be the beneficiary of that.

Without further ado, let’s break down Block’s Q2 2022 financial results!

If you are new to Block, I suggest reading my previous reviews:

…and if you are new to Popular Fintech, subscribe to receive future reviews:

On Afterpay business model

Q2 2022 was the first full quarter of Afterpay being a part of Block. Afterpay still has a minor contribution to the overall company’s performance (4.7% of the total revenue and 10.2% of gross profit), but I still think it is important to touch on its business model.

Afterpay is Buy Now Pay Later (BNPL) service allowing customers to split the payment into 4 installments (paid over 6 weeks). The company does not charge the consumer any interest and makes money by charging the merchant. The promise to the merchant is that this payment option increases sales. There are multiple flavors of BNPL services around the globe, but I wanted to stress that Afterpay focuses on short-term financing (as opposed to i.e. Affirm which also offers longer-duration financing), and makes money almost exclusively from merchant fees (and not from the interest).

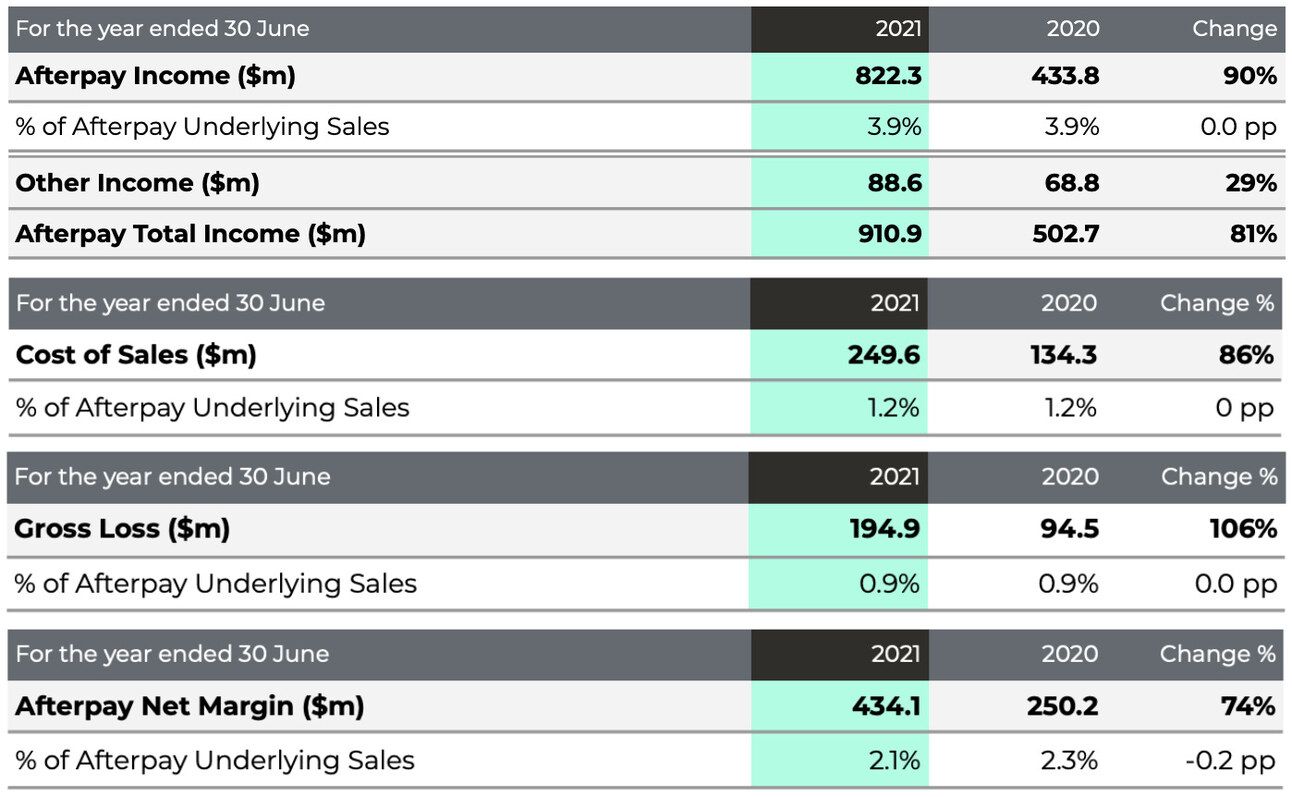

The tables below show the last full fiscal year results of Afterpay as an independent company (year ended June 30, 2021). Please note that the values are in Australian dollars. As you can see, the company measured sales as a % of underlying sales (you can think of this percentage as the Take rate), and the two core cost items were a) cost of sales (i.e. processing repayments), and b) gross loss (loss resulting from customers defaulting on their obligations).

After adjusting for late fees and extra income, recoveries, and funding costs, the company reported a Net Margin of $434.1 million, which represented 2.1% of Underlying sales and 47.7% of Total Income. 47.7% would be a good representation of the company’s gross profit margin.

So if you think for a moment about the Afterpay business, then you will see more similarities with payments rather than with lending. Its revenue is driven by the volume of merchant sales, it has a similar gross profit margin after deducting credit losses and funding costs, and the loan book is not accumulating due to short maturity (Afterpay turns the capital 15 times a year). Afterpay is essentially an additional payment method for merchants, similar to non-revolving credit cards.

On “connecting ecosystems”

During Block’s Investor Day 2022, as well as at the earnings call, Jack Dorsey, the company’s CEO, spoke at large about connecting the Cash App and Square’s ecosystems, and how the acquisition of Afterpay will enable that. In particular, the company has already integrated Afterpay into its Square offering, allowing customers to split their online and offline purchases into installments. As the next step, Block is introducing the “Discover” tab within the Cash App, a functionality that will allow Cash App users to discover Square and Afterpay merchants based on their location and the activity of their friends.

As you can imagine, 47 million Cash App users can generate a lot of demand for Square and Afterpay merchants. Merchant discovery is a somewhat unappreciated element of Afterpay’s business; however, in combination with the Cash App’s user base, this can become a strong growth driver for years to come. “Discover” functionality not only introduces a new revenue stream for Block (charging merchants for the leads, or referred customers), but is also expected to increase the frequency of Cash App usage (as it kind of creates an equivalent of digital “window shopping”).

I believe Block could have created “Discover” functionality without Afterpay, but it is worth noting that the Afterpay merchant base is very complimentary to Square’s: while Square has a heavy presence in SME segment, Afterpay works mostly with large retailers. Personally, I am very excited to see what comes out of this venture!

Revenue

Block, Inc. generated $4.4 billion in revenue in Q2 2022, which represents a 6% decline compared to Q2 2022. Excluding Bitcoin revenue, Block, Inc. generated $2.62 billion in revenue during the quarter, which represents an increase of 34% compared to Q2 2021.

At the beginning of the year, Block completed the acquisition of Afterpay, a Buy Now Pay Later (BNPL) service. Afterpay contributed $208 million in revenue in Q2 2022. Block attributes 50% of Afterpay revenue to the Square segment, and 50% to the Cash App segment.

I argued in my previous reviews that it is important to think about Block’s business in two segments: Square and Cash App. Thus, Square’s revenue stood at $1.73 billion for the quarter (or $1.62 billion excluding the contribution from the Afterpay business), which represents a 32% YoY growth including Afterpay, and a 24% YoY growth excluding Afterpay revenue.

Transaction-based revenue, the core of Square’s business (79% of total revenue), grew 21.8% YoY driven by the growth in Gross Processing Volume (22.6% YoY) and offset by a minor decline in the Take Rate (from 2.87% in Q2 2021 to 2.81% in Q2 2022). “Subscription and services-based revenue” grew 110% YoY, primarily due to the consolidation of $104 million in Afterpay revenue, and contributed 18.4% of the total revenue (up from 11.5% in Q2 2021). Excluding Afterpay, “subscription and services-based revenue” grew 41% YoY.

In summary, the growth of Square’s revenue is clearly decelerating; however, it is still impressive (24% YoY excluding Afterpay). Given the high share of transaction-based revenue, Square’s performance will continue to be driven by the GPV growth, which, I believe, makes investors uncomfortable given the economic uncertainty ahead. As I will illustrate below, Square contributes more than 50% of Block’s Gross Profit, thus, an economic recession (if one comes) and consequent decline in consumer spending, will have a meaningful impact on the company’s financials.

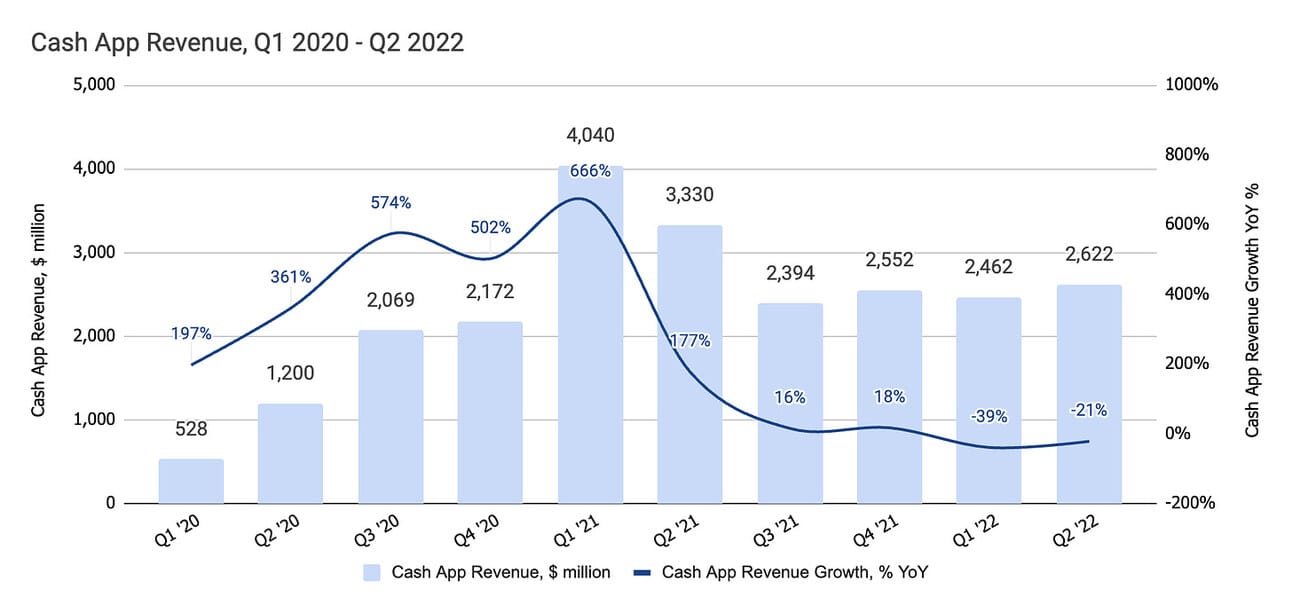

Cash App generated $2.62 billion in revenue in Q2 2022, which represents a decline of 21% compared to Q2 2021. As argued previously, one should look at Cash App performance excluding Bitcoin revenue. My reasoning is that Bitcoin revenue is highly volatile, driven by market sentiment (read price of Bitcoin), and makes less than 3% gross profit contribution.

Excluding Bitcoin, Cash App generated $836 million in revenue during Q2 2022, which represents a 38% increase compared to Q1 2022. As mentioned above, Cash App revenue includes 50% of Afterpay’s revenue (or $104 million). Excluding the contribution from Afterpay, Cash App revenue grew 20.7% compared to Q2 2021.

The number of monthly transacting users increased 17.5% YoY, from 40 million transacting users in June 2021 to 47 million transacting users in June 2022. The revenue growth outpacing the growth in transacting users suggests that Cash App improved monetization or average revenue per client. As the company continues adding additional services, such as Cash App Borrow and, most importantly, the above-mentioned “Discover”, I would expect the revenue growth to come from both, user growth and better user monetization.

Gross Profit

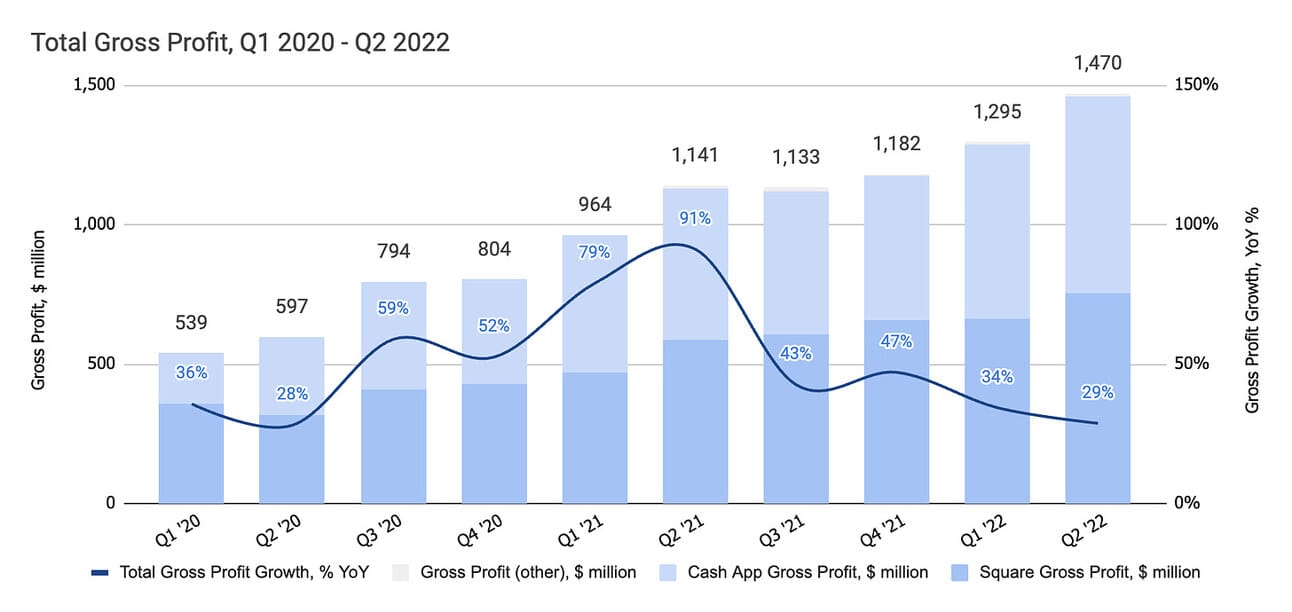

Block reported $1.47 billion in gross profit for the quarter, which represents a 29% growth compared to Q2 2021. Afterpay contributed $150 million in gross profit for the quarter, which was equally attributed to Square and Cash App segments ($75 million each). Excluding Afterpay, Block’s gross profit grew 15.7% YoY.

It is important to decompose segment results into components. Thus, Square’s segment includes contributions from Square and Afterpay, while Cash App’s segment includes contributions from Cash App, Afterpay, and Bitcoin. As the Afterpay acquisition was closed in early 2022, the Q2 2021 numbers do not include the contribution from Afterpay, while Q2 2022 numbers do.

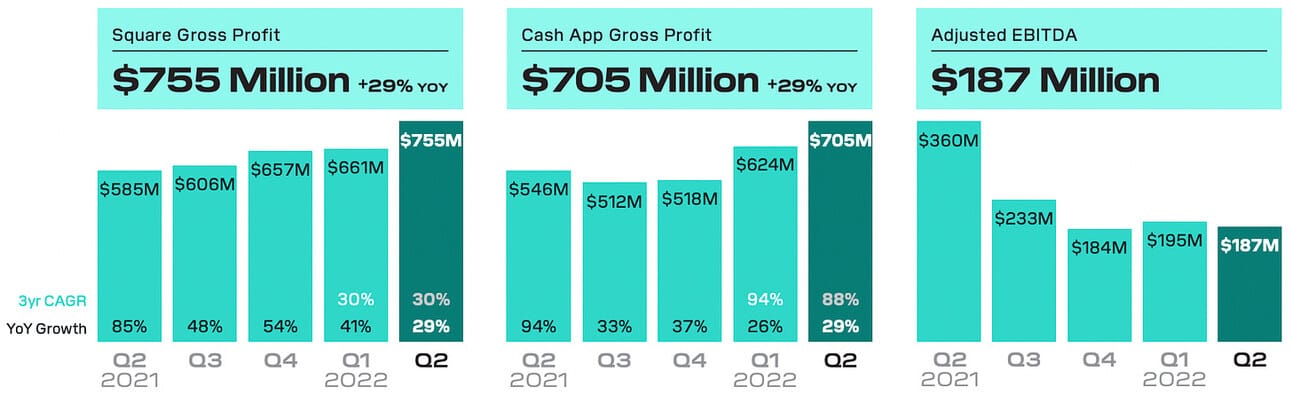

Square contributed $755 million in gross profit in Q2 2022, which represents a 29% YoY growth. Excluding the Afterpay contribution, Square’s gross profit grew 16.3% compared to Q2 2021. The gross profit growth is clearly decelerating driven by the decelerating GPV growth and higher cost of revenue (lower gross profit margin).

Cash App contributed $705 million in gross profit, which represents a 29% YoY growth. Excluding the Afterpay contribution, Cash App’s gross profit grew 15.3% compared to Q2 2021. Finally, excluding both Bitcoin and Afterpay, Cash App’s gross profit grew 19.8% compared to Q2 2021.

In Q2 2022, Block reported a decline in gross profit margin for Square (43.8% in Q2 2022 compared to 44.6% in Q2 2021) driven by a larger share of credit card transactions that have a higher cost of processing than debit cards. Total gross profit margin improved from 24.4% in Q2 2021 to 33.4% in Q2 2022 driven by lower Bitcoin revenue. As you can see from the chart below, the gross profit margin of Cash App excluding Bitcoin remained stable.

In summary, Square’s gross profit excluding Afterpay grew 16.3% YoY, and Cash App's gross profit excluding Afterpay and Bitcoin grew 19.8% YoY. Afterpay contributed $150 million in gross profit, and Bitcoin contributed $41 million in gross profit on top of that.

Operating Expenses

Block reported $1.68 billion in operating expenses for the quarter, a 65.7% increase compared to Q2 2021. As the operating expenses exceed the gross profit, the company finished the quarter with an operating loss of $213.8 million.

Operating expenses represented 38.2% of the total revenue, up from 21.7% in Q2 2021 and down from 38.4% sequentially. The growth in operating expenses was partially driven by the increase in product development expenses and consolidation of Afterpay.

During the earnings call, Amrita Ahuja, the company’s CFO, discussed at large the ongoing efforts to reduce the pace of operating expenses growth to reflect the worsening economic outlook: “We pulled back on experimental and less efficient go-to-market spend, adjusted risk loss estimates based on more current trends and slowed the pace of hiring.” The chart below greatly illustrates the rump up of costs during 2021; hopefully, we will see those costs coming down (at least on a relative basis) in 2022.

In Q2 2022, the company recognized a bitcoin impairment loss of $36 million on its Bitcoin investment. The accounting principles dictate the company to recognize the losses when the price of Bitcoin decreases, but do not allow recognition of gains when the price increases. As per the company’s comments, the value of their Bitcoin holding has already appreciated enough to recoup the impairment, but they will not be able to recognize this gain unless they sell their coins. In any case, Bitcoin impairment had a minor impact on the company’s financial performance.

Net Income and Adjusted EBITDA

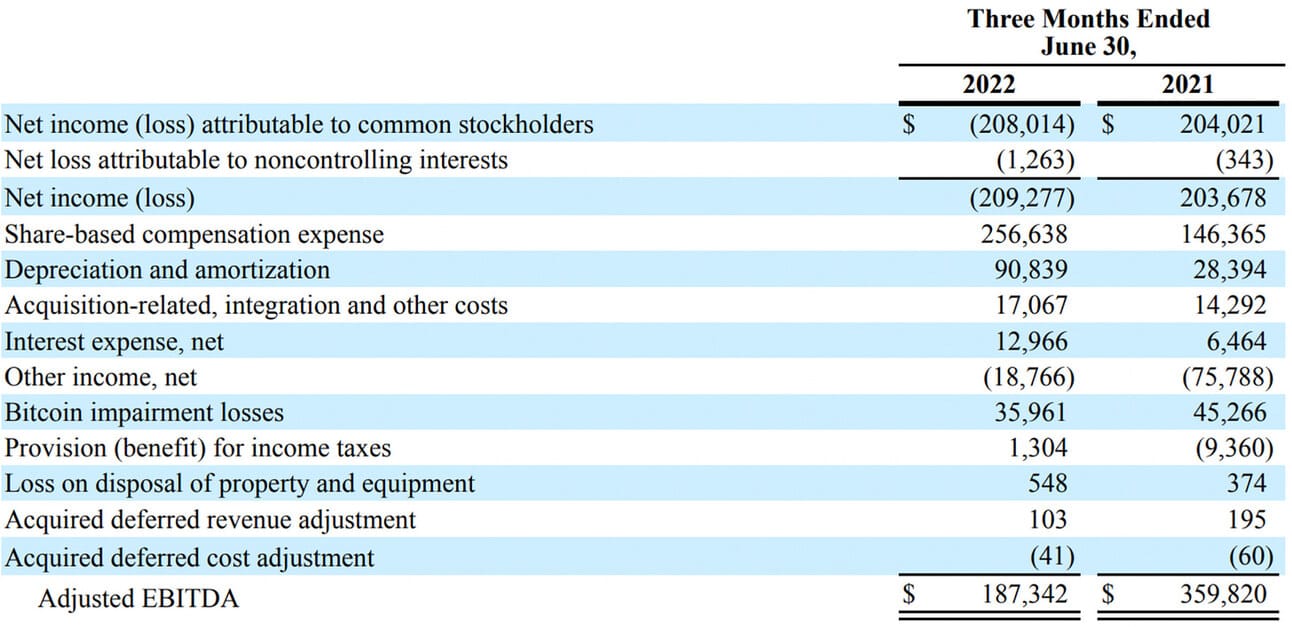

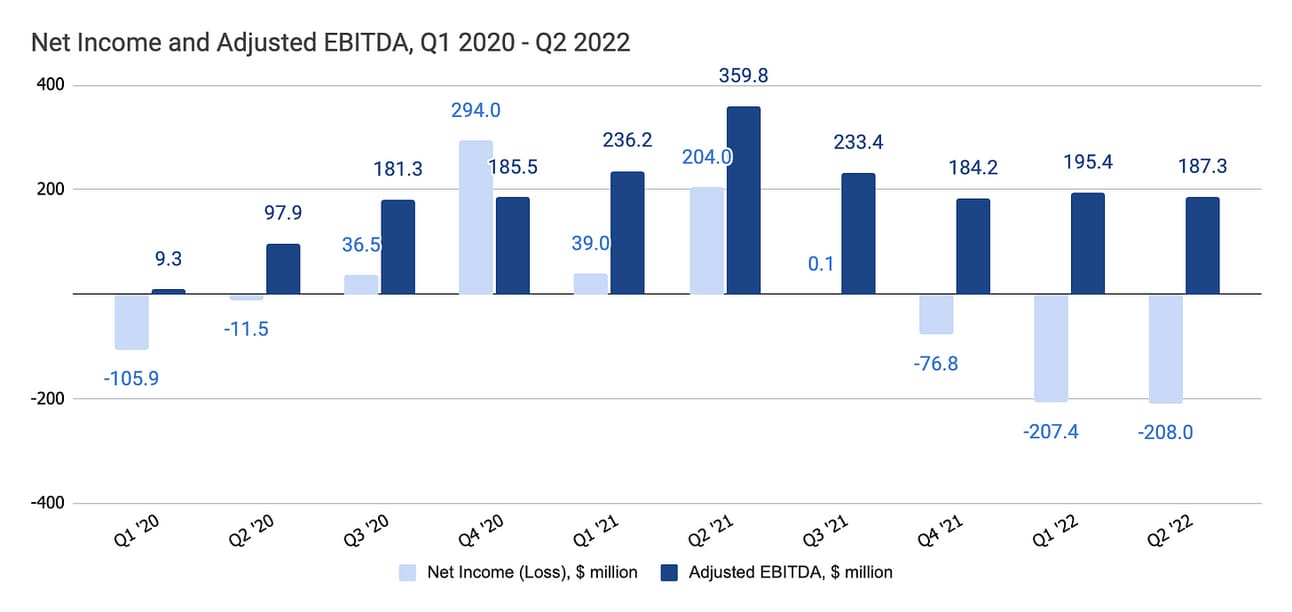

Block reported a Net Loss of $209.3 million for the quarter, a decrease from a Net Income of $203.7 million a year ago. Please note that last year’s results were positively impacted by a spike in Bitcoin trading activity, which contributed to profitability.

The company reported $187.3 million in Adjusted EBITDA, down from Adjusted EBITDA of $359.8 million a year ago. The company calculates the Adjusted EBITDA by adjusting the Net loss by share-based compensation, depreciation and amortization, as well as one-off expenses, such as Bitcoin impairment, and acquisition-related costs. The company does not provide guidance, but its CFO noted that “we expect to deliver greater adjusted EBITDA in the second half of 2022 compared to the first half of the year.”

The company finished the quarter with “$6.2 billion in cash, cash equivalents, restricted cash, and investments in marketable debt securities.”

Things to Watch in 2022

Square revenue. As highlighted above, GPV growth, the key driver for Square’s revenue is decelerating. If the recession comes in the second half of the year, it should impact consumer spending and thus, Square’s revenue. Square still contributes more than half of Block's gross profit, and thus, has a major impact on the company’s financial performance.

Afterpay Impact. On its own, Afterpay has a minor impact on the company’s financials; however, the above-mentioned role of connecting Cash App and Square’s ecosystem should (eventually) have a meaningful impact. As I write in the text, 47 million Cash App users should be able to generate a meaningful boost to Square and Afterpay sales.

Operating expenses. The company’s management voiced their commitment to slow down expense increases to reflect economic realities. Some analysts are concerned that cost-cutting might negatively impact the growth of the company, as well as hinder its ability to gain market share. My take is that Block is big enough to find pockets of inefficiencies to avoid cutting on strategic initiatives.

International expansion. In the mid-term, I see a lot of potential for Block (and specifically for Square) to grow internationally. Economic uncertainty might be taking away managerial attention, but the company reiterated its plans to grow internationally at Investor Day, and the acquisition of Afterpay should help with that.

In summary, it was a strong quarter for Block, but I believe investors are concerned with the impact of a (potential) economic recession on its business. If consumer spending drops, it will be reflected in Block’s earnings, so the concerns are fair. However, in the longer term, I see great things ahead for the company!

Source of the data used above: Investor Relations

Disclosure & Disclaimer: despite rocky performance in 2021 and the first half of 2022, I have open positions in most of the companies covered in this newsletter, as I am extremely bullish on the transformation in the financial services industry. However, none of the above is financial advice, and you should do your research.