Toast, a company providing POS software and payments processing for restaurants, reported its Q2 2022 results earlier in the month. The company delivered strong top-line growth, increasing the number of serviced restaurant locations by 42% YoY, and growing revenue by 58% YoY. The second quarter was also a seasonally strong quarter, as the summer season kicked in, COVID-19 restrictions were lifted, and people started spending on dining out.

However, as I pointed out in my previous review, the growth comes at the cost of gross profitability: hardware sales and professional services had (again) negative gross profit contribution resulting in the gross profit margin declining from 20.8% in Q2 2021, to 16.7% in Q2 2022. You can think of gross profit margin, as the percentage of revenue left for covering operating expenses, paying taxes, and compensating shareholders. At the moment, operating expenses exceed 30% of the revenue, so the company has to make a major leap in either gross profitability or scale to become profitable.

Most likely, the company’s management has a plan to make this magic leap, and I am just too skeptical. The future will tell, but in the meantime, let’s look at the company’s Q2 2022 financials!

If you are new to Toast, I suggest reading my previous reviews:

…and if you are new to Popular Fintech, subscribe to receive upcoming reviews:

Gross Payment Volume

Toast reported $23.3 billion in Gross Payment Volume in Q2 2022, which represents a 62% growth compared to Q2 2021. As can be seen from the chart below, Toast delivered a strong sequential increase in GPV (31% QoQ). This is a seasonality factor in the Toast business, as the company experienced similar jumps in Q2 2019, Q2 2021, and now Q2 2022 (Q2 2020 is not representative, as this marked the beginning of the COVID-19 pandemic).

The growth in Gross Payment Volume was driven by two factors: a) growth in restaurant locations, and b) increase in the average GPV per restaurant location. Thus, the company reported over 68 thousand serviced restaurant locations at the end of Q2 2022, which represents a 42% growth YoY. Growth in restaurant locations is clearly a mission-critical metric for the company, and it has been consistently growing locations at around a 40% YoY rate.

The average Gross Payment Volume per restaurant location increased 13% YoY, from $316K in Q2 2021 to $358K in Q2 2022. The increase in the average GPV per location was the key driver behind the strong sequential increase in GPV for the quarter. As you can see from the chart below, the average GPV per location increased from $299K in Q1 2022 to $358K in Q2 2022 (20% QoQ).

Revenue and Take Rate

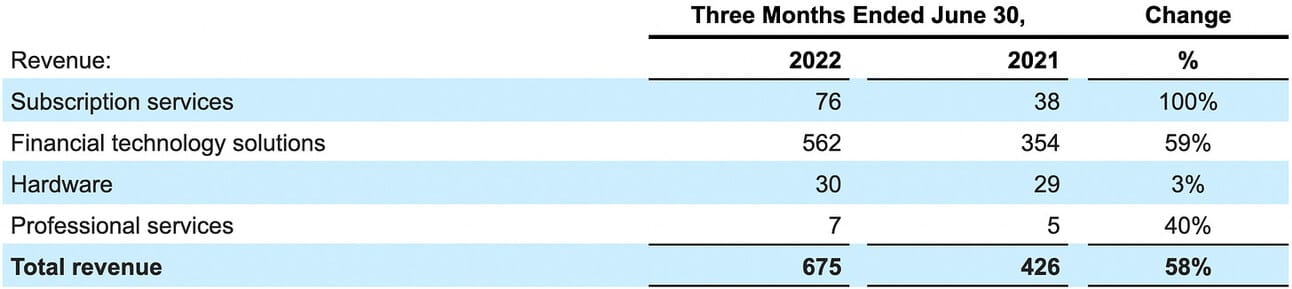

Toast reported $675 million in revenue for the quarter, up 58% from Q2 2021. The core component of the revenue, “Financial technology solutions” (payment processing) grew 59% YoY, “Subscription services” grew 100% YoY and hardware sales increased just 3% YoY.

It is not surprising that the revenue growth follows the growth in Total Gross Payment volume, given the fact that payment processing contributed over 80% of the total company’s revenue. Nevertheless, it is worth mentioning that Toast managed to deliver a 59% YoY revenue growth despite the hard comps of Q2 2021. As you will see later in the text, the company also aims to deliver 50%+ revenue growth for the full year of 2022.

The Take Rate (Financial technology revenue over Gross Payment Volume) decreased slightly from 2.5% in Q2 2021 to 2.4% in Q2 2022; however, this change is insignificant and was, most likely, driven by the change in the payment method mix (offline/online, debit/credit). Toast’s ability to keep restaurant location growth while maintaining the Take Rate is a positive factor, and suggests the competitiveness of the company’s payment processing pricing.

The company’s management guided for revenue of $700 million to $730 million in Q3 2022, and revenue in the range of $2,620 million to $2,660 million for the full year 2022. This guidance implies a YoY growth rate of 44-50% for the quarter and 54-56% for the full year of 2022.

Gross Profit

Toast reported $113 million in Gross Profit for the quarter, which represents an increase of 27% compared to Q2 2021. The company's gross profitability is my main concern (and my main puzzle), and the stark difference between the revenue and gross profit growth in Q2 2022 (58% YoY vs. 27% YoY) is a good illustration of this concern.

As you can see from the table below, the gross profit for “Financial technology solutions” grew 54% YoY, and the gross profit for “Subscription services” grew 96% YoY, which is in line with the revenue growth of the respective services. However, hardware sales and professional services made negative gross profit contributions of $31 million and $18 million respectively.

Toast clearly can deliver restaurant location (and consequently revenue) growth, and, in my opinion, the next challenge the company needs to address is improving its gross profitability. I see two areas of potential improvement: a) increasing the gross profit margin for payment processing (i.e. renegotiating processing agreements), and b) lowering negative contribution from hardware sales and professional services.

The company delivered a total gross profit margin of 16.7% in Q2 2022, a decline from a gross profit margin of 20.8% in Q2 2021. As illustrated above, the decline in gross profitability in Q2 2022 was driven by the negative contribution from hardware sales and professional services. At the same time, “Financial technology solutions” delivered a gross profit margin of 20% (vs. 21% in Q2 2021), and “Subscription services” delivered a gross profit margin of 60% in Q2 2022 (vs. 66% in Q2 2021).

Operating Expenses

Toast reported $212 million in total operating expenses during the quarter, a 51% increase from Q2 2021, which resulted in a Loss from operations of $99 million. As you can see from the breakdown below, operating costs increased across all three reported categories: Sales and marketing (up 88% YoY), Research and development (up 34% YoY) and General and administrative (up 39% YoY).

The ratio of operating expenses over revenue improved marginally compared to Q2 2022 (31% in Q2 2022 vs. 33% in Q2 2021) and sequentially (31% in Q2 2022 vs. 36% in Q1 2022). However, as I argued before, spending >30% of revenue on operating expenses while generating <20% in gross profit cannot last forever.

Therefore, I believe the company needs to start making meaningful steps towards a) increasing gross profit margin, and b) lowering operating expenses (as a percentage of revenue). However, this might be difficult without hurting revenue growth, as the company would need to raise hardware and professional services prices (or even the Take Rate) or cut marketing spending.

Net Income (Loss) and Adjusted EBITDA

Toast reported a Net Loss of $54 million for the quarter, which was an improvement from a Net Loss of $135 million in Q2 2021. The company also reported a negative Adjusted EBITDA of $33 million, down from a positive Adjusted EBITDA of $11 million in Q2 2021.

As can be seen from the table above, the key adjustments in calculating the Adjusted EBITDA for the quarter were stock-based compensation (+$59 million) and change in fair value of warrant liability (-$44 million), which is related to the “warrants issued to purchase shares of our convertible preferred stock and our common stock.”

The company’s management guided for an Adjusted EBITDA in the range of negative $30 to $40 million in Q3 2022, and an Adjusted EBITDA in the range of negative $140 to $160 million for the full year.

As of June 30, 2022, the company had cash and cash equivalents of $697 million, marketable securities of $482 million, and $330 million available under the company’s credit facility.

Things to Watch in 2022

Gross profit margins. I understand that the company is focused on revenue growth, and improving gross margins is not a priority. However, I just don’t see Toast becoming a profitable company with gross profit margins of 16-17%. I believe my main question is: can Toast keep its customers happy (and not churning) if they have to raise prices?

Operating expenses. Toast had massive layoffs in April 2020, when the pandemic hit (layoffs impacted 50% of the staff). However, if the company aims to continue operating with low gross profit margins, it has to become cost-conscious soon. I doubt that the company would go through another round of layoffs, but a slowdown in expense growth should be expected.

(Potential) recession impacting revenues. Toast’s management has proven that they can consistently grow revenues without negatively impacting the Take Rate. However, consumer spending is outside of the management’s control, and a recession might hinder the company’s growth. The company’s management raised the revenue guidance for the year, so, I guess, they don’t see a recession coming this year.

In summary, Toast delivered another quarter of strong revenue growth and terrible gross margins. Surprisingly, despite (supposedly) changed sentiment, the focus on growth at all costs is still being rewarded by investors. I might be missing something about Toast’s business model, but I’d like to see at least some improvement in gross profitability before changing my (skeptical) opinion.

Source of the data used above: Investor Relations

Disclosure & Disclaimer: despite rocky performance in 2021 and the first half of 2022, I have open positions in most of the companies covered in this newsletter, as I am extremely bullish on the transformation in the financial services industry. However, none of the above is financial advice, and you should do your research.