Toast ( ), a provider of Point of Sales software and hardware for restaurants, went public on November 11, 2021. As per the company’s website, it provides a “single [SaaS] platform…and financial technology solutions that give restaurants everything they need to run their business across point of sale, operations, digital ordering and delivery, marketing and loyalty, and team management.”

It turned out that serving restaurants might be a risky endeavor when a pandemic takes over the world and the government orders lockdowns and curfews. Thus, less than a year and a half before its IPO, Toast had to fire half of its workforce as the pandemic put its clients at risk of survival. Nevertheless, the company survived and hopes to accelerate its growth as the economy reopens and people return to dining. Let’s review Toast’s financials and its ambitions for the year (spoiler: reaching profitability is not one of them).

Business Overview

Toast sells restaurants proprietary Point of Sale software and hardware, as well as helps them accept payments at their physical locations, as well as online. Toast’s integrated solutions, such as Toast Flex depicted below, allow restaurants to manage orders and accept payments by debit and credit cards, NFC-enabled wallets, as well as QR codes printed on the cheques.

Restaurants are complex and (according to Toast management) underserved businesses; thus, over time, Toast started expanding its core product offering (Point of Sale, Toast Hardware, and Payment Processing) with additional software components, aiming to become an “operating system for restaurants”. Such products cover various aspects of running a restaurant and include Digital Ordering & Delivery, Team Management, Restaurant Operations, Marketing & Loyalty, Platform & Insights, and others. Toast is also working on expanding its financial services offering beyond payment processing. Thus, the company launched Toast Capital, which provides merchant working capital loans.

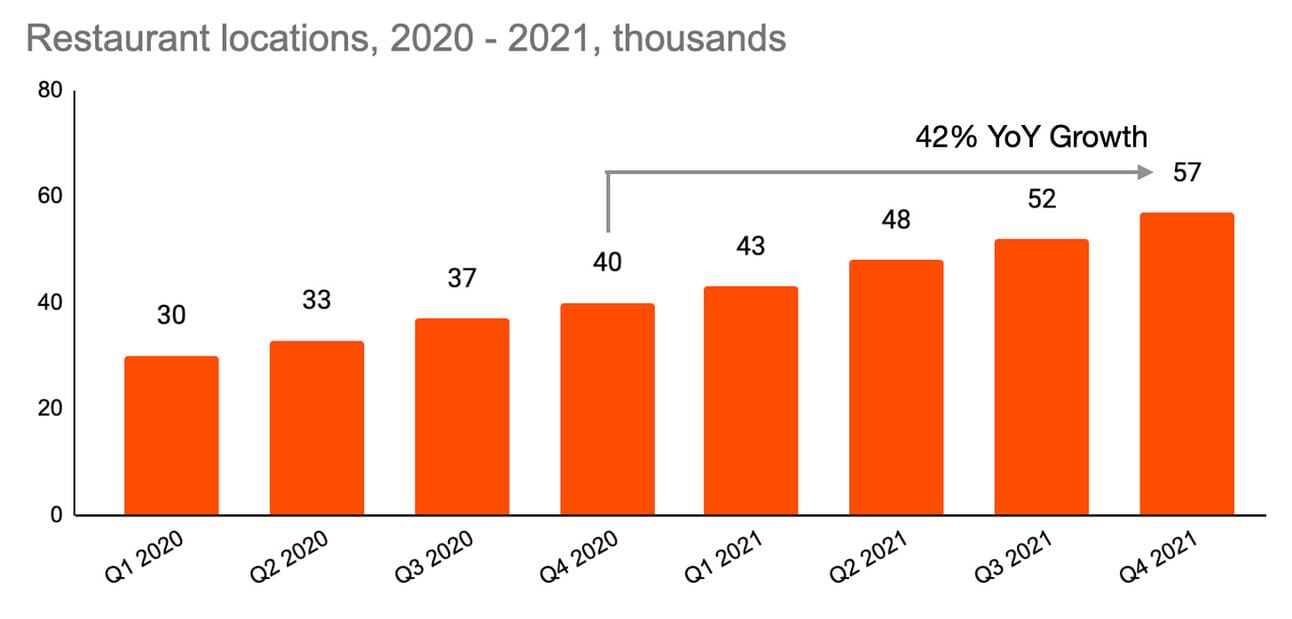

At the end of 2021, the company’s products were used at more than 57,000 restaurant locations, and the customer base kept growing despite the challenging environment and lockdowns. Toast estimates that there are 860,000 restaurant locations in the United States and 22 million restaurant locations globally, and expects its Total Addressable Market (as measured by the restaurant spend on technology) to reach $55 billion in the United States and $110 billion globally by the end of 2024.

The company generates revenue from a) payment processing (82% of the revenue in 2021), b) software subscriptions (10% of the revenue in 2021), c) hardware sales (7%), and d) professional services (1%). The key driver for payment processing revenue is the Gross Payment Volume (value of processed payments) and the Take Rate (fees as % of the GPV), while the drivers for the software and hardware revenue are the number of locations, number of software products used, hardware configuration and employee count.

Gross Payment Volume and Take Rate

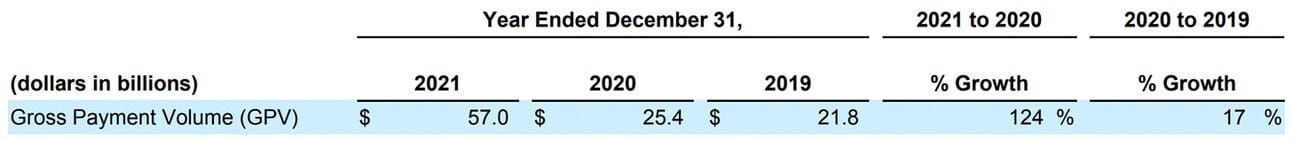

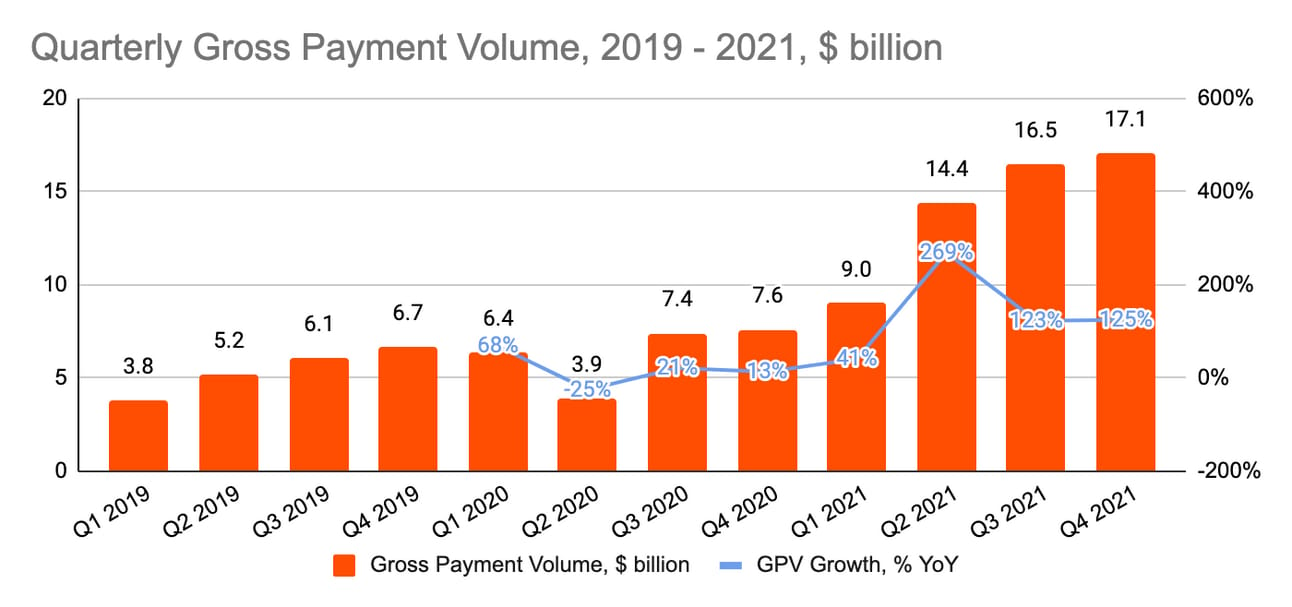

Toast processed $57.0 billion in Gross Payment Volume in 2021, which represents a 124% YoY growth. The YoY growth number should be taken into account with reservations, as the pandemic forced many of Toast’s customers to shut down their restaurants in 2020 resulting in limited offline sales volumes.

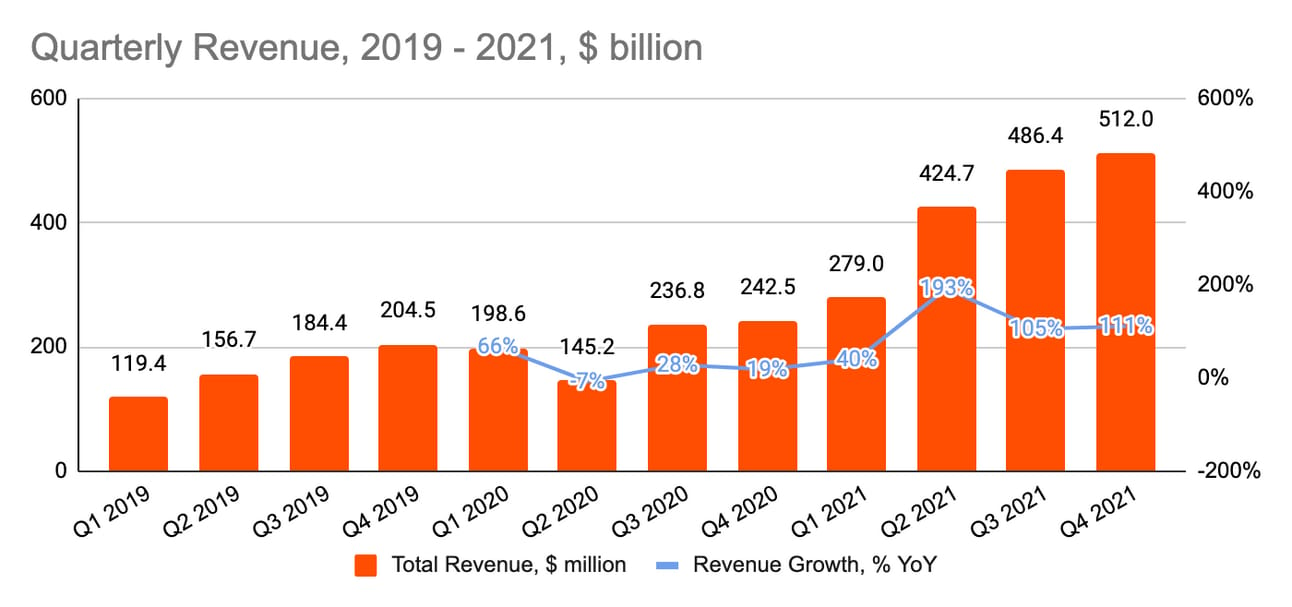

The impact of the pandemic can be clearly seen on the quarterly Gross Payment Volume chart; thus, you can see a drop in volumes in Q2 2020 following the restaurant shutdowns, as well as the acceleration of the volumes starting from Q2 2021 with the economy reopening. In addition to their Point of Sale (POS) product, Toast provides solutions for online and takeout ordering; thus, as the restaurants adjusted their business to the reality of the pandemic, Toast GPV continued to grow, and the company even managed to post modest growth in GPV numbers for the year.

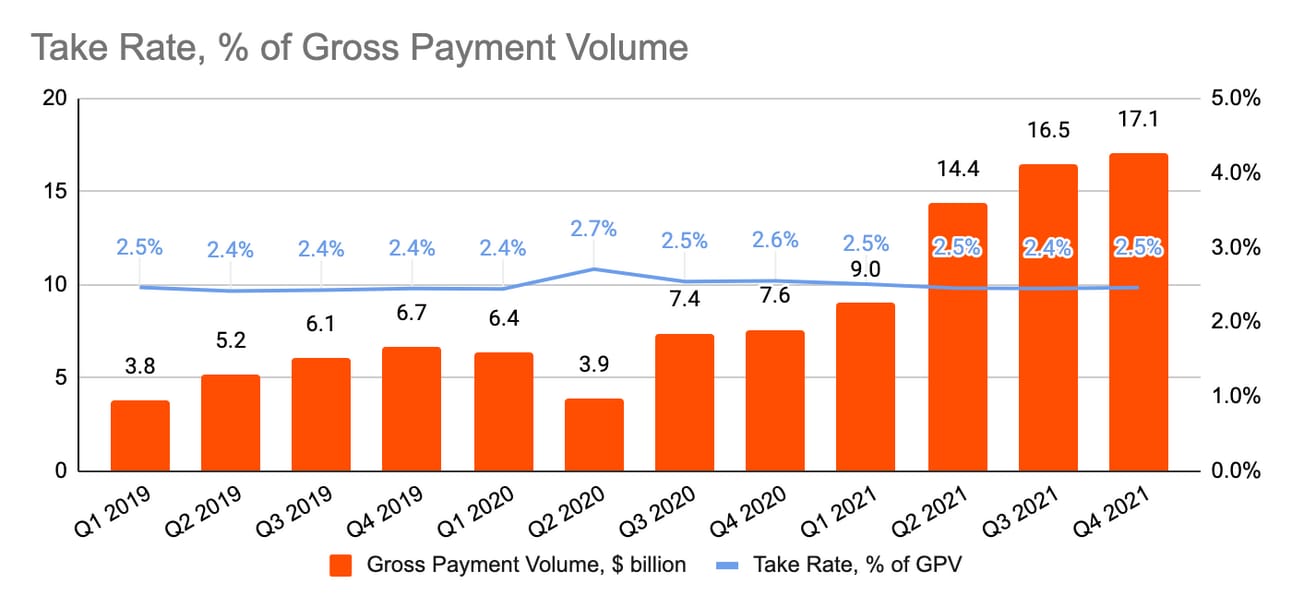

The average Take Rate (revenue that Toast charges its customers as a percentage of Gross Payment Volume) was 2.46% in 2021, and as can be seen from the chart below it has been quite stable throughout the last three years. Minor fluctuations across the quarters can be explained by the change in the payment type mix (i.e. similarly to other acquirers, Toast charges higher fees for online payments or payments with a credit card). It should be noted that Toast does not report separately payment processing revenue; thus, I used “Financial technology solutions” numbers, which include the revenue from payment processing and Toast Capital (working capital loans provided by third parties, but originated and serviced by Toast).

With the relatively stable Take Rate, Toast’s revenue from payment processing will be driven by the growth in the Gross Payment Volume, which in turn is driven by the number of customers, and the number of locations (or the same drivers as for the other components of the revenue, which are software and hardware sales). In the future (I plan to follow the progress of Toast through their quarterly earnings reports), I should probably look at the relative metrics, such as locations per client, GPV per location, software revenue per location, and hardware revenue per location.

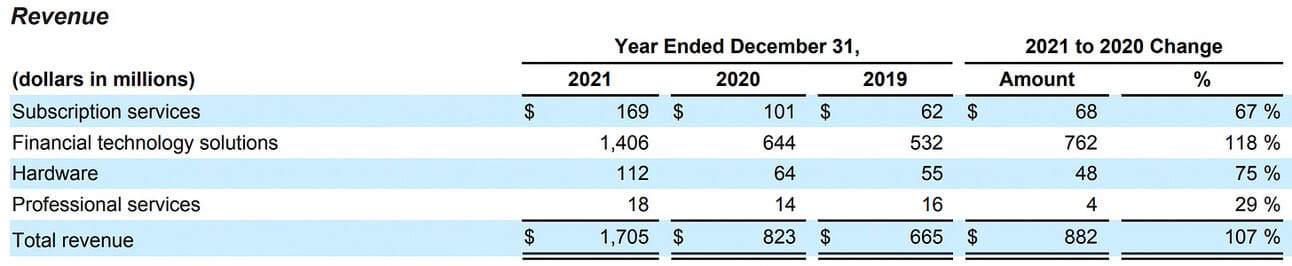

Revenue

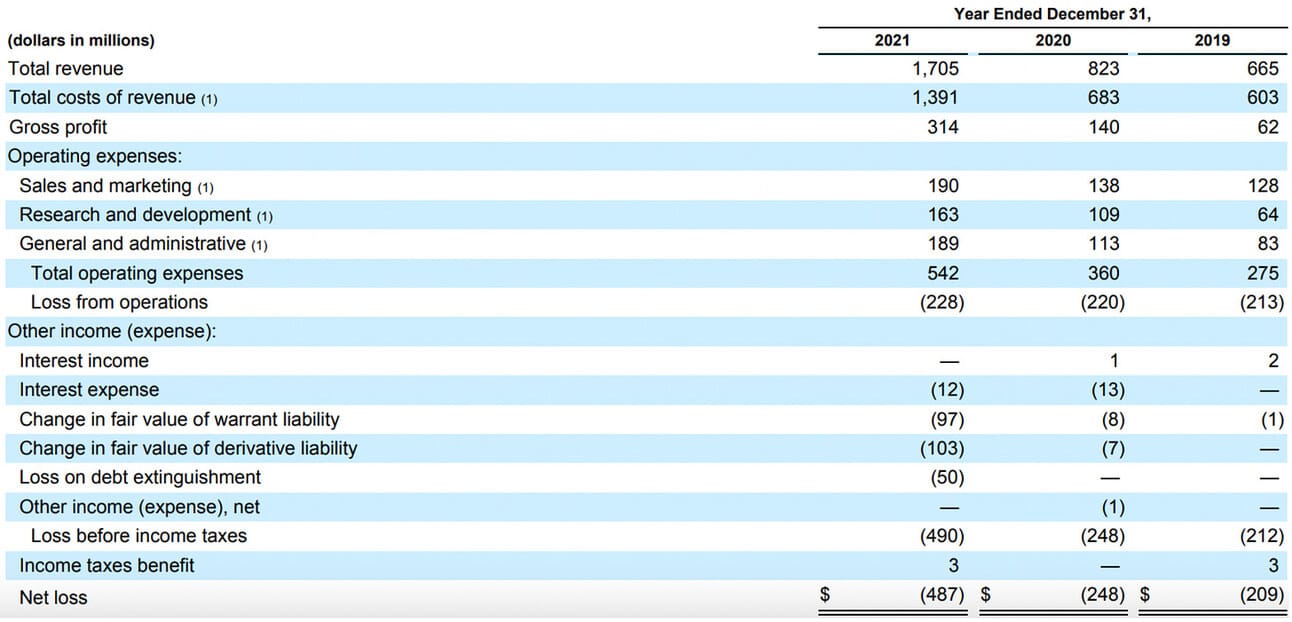

Toast generated $1.71 billion in revenue in 2021, which represents a 107% YoY growth. Toast’s largest revenue component, “Financial technology solutions" (which, as a reminder, includes revenue from payment processing and origination of working capital loans), grew the fastest at a 118% rate YoY. Revenue from Software and Hardware services grew at 67% and 75% YoY respectively.

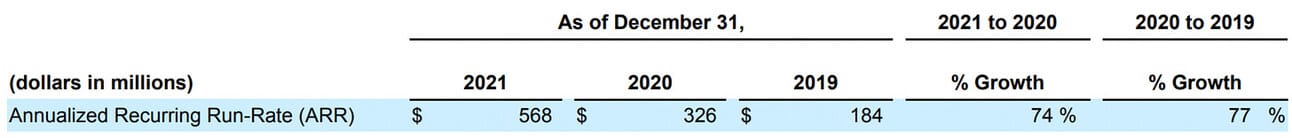

Toast uses Annualized Recurring Run-Rate (ARR) as one of the key operational metrics in their reporting (calling it their “North Star”), which is a common metric for software businesses (and not so common for financial service providers). To calculate ARR they multiply monthly subscription revenue (at the end of the period) by 12 and add quarterly payment processing revenue (net of direct costs) multiplied by 4 (so the formula looks something like this: ARR = Subscription revenue from the latest month * 12 + Payment Processing Gross Profit from the latest quarter * 4).

To be honest, this metric is a bit confusing in this context (as it mixes Gross revenue from software subscriptions with Gross profits from payment processing, as well as excludes such components as Hardware revenue), but perhaps, it will start making sense as I continue following the company’s progress. Anyways, the company reported $568 million in ARR at the end of 2021.

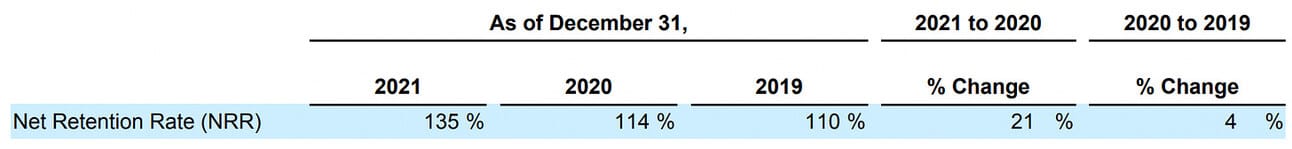

Toast reported Net Retention Rate (NRR) of 135% for 2021, an improvement from the NRR of 114% in 2020. Net Retention Rate essentially reflects a company’s ability to retain its existing customers. Thus, in the case of Toast, NRR of 135% means that the customers that were with the company in 2020 grew their spending on Toast services by 135% in 2021 (factoring in the churn).

The company guided for 2022 revenue in the range of $2,349 million to $2,409 million, which would represent 38-41% YoY growth. As discussed above, given a relatively stable Take Rate, we can recalculate revenue guidance into Gross Payment Volume guidance. Thus, the revenue of $2,349 to $2,409 million at an average Take Rate of 2.46% (average for 2021) requires GPV of $95.5 to $97.9 billion.

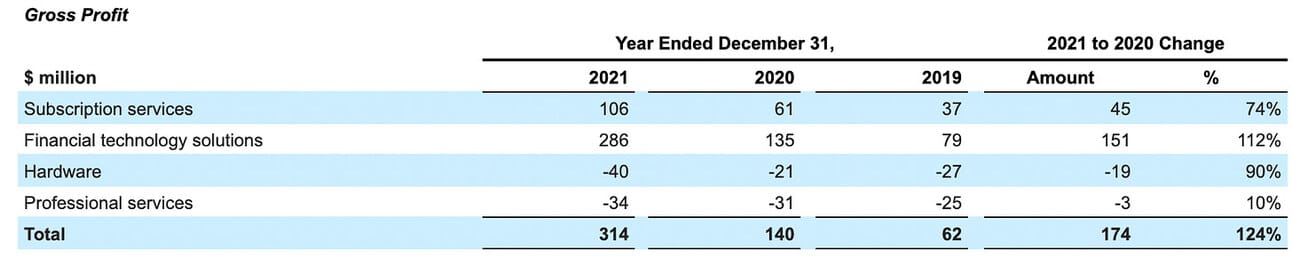

Gross Profit and Gross Profit Margins

Toast reported Gross Profit of $314 million for the full year 2021, which represents a 124% YoY growth. Gross Profit is a measure of margin service or product profitability and is calculated as revenue less directly attributable costs (i.e. payment processor fees). You can think of Gross Profit as the money left for covering sales and marketing, research and development, as well as general and administrative costs.

Hardware and Professional services continued to generate Gross Loss in 2021, as the revenue these products generate did not cover the direct costs. During the earnings call, the company’s management attributed it to supply chain disruptions and rising wages, but the pre-pandemic numbers (2019) suggest that these segments were money-losing even before the pandemic-induced challenges. The costs of revenue for Subscription services grew at a slower pace than the segment’s revenue (67% YoY growth in revenue vs. 58% YoY growth in the costs), while the costs of revenue for the Financial technology solutions segment grew at a slightly higher pace than its revenue (118% YoY growth in revenue vs. 120% YoY growth in the costs).

Toats earned a 63% Gross Profit margin on its Subscription services and a 20% margin on its Financial technology solutions. While the subscription gross profit margin is healthy and comparable to other software players in the industry, the gross margin from financial services is considerably lower than of its peers. For reference, Square generates a gross profit margin in excess of 40%.

My understanding is that such a gross margin level can be explained by the fact that Toast is not the payment processor and uses Worldpay for processing card payments. In its annual filing, the company mentioned that the agreement with Worldpay was prolonged for another three years; thus, one should not expect a drastic improvement in Toast’s gross profit margin from payment processing.

Net Loss and Adjusted EBITDA

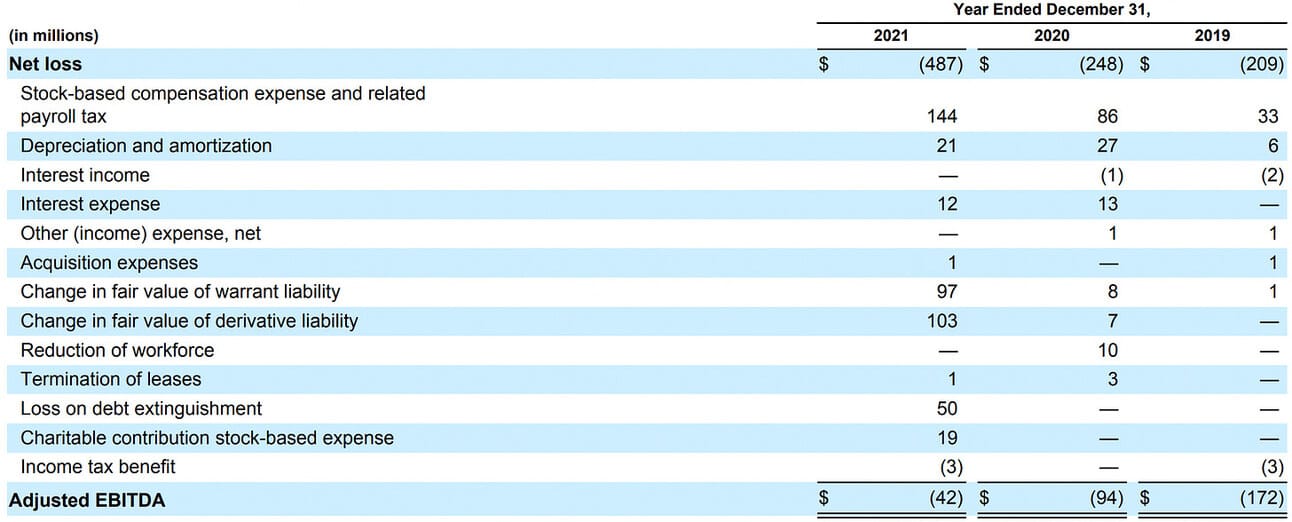

Toast reported a Loss from operations of $228 million (an increase from the Loss from operations of $220 million in 2020), and a GAAP Net Loss of $487 million in 2021 (an increase from a GAAP Net Loss of $248 million in 2020).

Before making any conclusions about the increasing Net Loss, one should remember that 2021 was the year when Toast went public; thus, incurring multiple one-offs and non-cash costs, such as stock-based compensation. Perhaps, performance in 2021 should be better evaluated on an Adjusted EBITDA basis (see below), but as of now, the company is far from reaching profitability (and doesn’t aim for it in the short-term based on their 2022 guidance) on both adjusted and non-adjusted bases.

The company reported an Adjusted EBITDA of negative $42 million for the full year of 2021. The main adjustments include stock-based compensation, changes in the fair value of warrants and derivative liability, as well as the loss the company took on repayment of its convertible note (“Loss on debt extinguishment”).

On an Adjusted EBITDA basis, the company’s performance in 2021 improved compared to 2020; however, Toast guided for an Adjusted EBITDA in the range of negative $200-240 million in 2022. So the company expects to increase its revenue to $2.3-$2.4 billion, and still significantly increase its losses. On the earnings call, the management commented that the increasing losses will result from continued investments “in research and development, as well as in sales and marketing to cost-effectively capture our market share.”

Things to watch in 2022

Use of the IPO proceeds. The company raised $950 million in its IPO last year, and most of the money is still in its accounts. As mentioned above, the company plans to invest aggressively in R&D, as well as sales and marketing, so part of the IPO proceeds should cover the losses. However, I would not exclude the option of Toast trying to boost its growth through acquisitions.

Growth in clients and restaurant locations. As explained in the text, the number of served restaurant locations is the fundamental driver not only for the software and hardware segments, but also, indirectly, for the payment processing segment. Toast’s management sees a large market potential and with the money, that the company raised in its IPO, it has the resources to go after new clients more aggressively.

Growth in software revenue. The company presents itself as a software business, but most of the revenues come from payment processing, which is a business with a much lower profit margin. It will be interesting to see if the company can move away from the low-margin business and scale its software revenue.

Growth in the lending business. Providing working capital loans to merchants (Toast Capital) is a logical growth path for Toast, so I would like to see how quickly they can scale this business. The beauty of being a merchant acquirer is that Toasts sees their customer revenues, and thus, can rely on this data in making credit decisions.

International expansion. 2022 will be the year when Toast will be setting up a foundation for its international expansion. And although the company is not expecting a significant revenue impact from its international operations this year, it will be interesting to see the geographies and customer segments it will go after.

Source of the data used above: Investor Relations

Disclosure & Disclaimer: despite rocky performance in 2021 and early 2022, I have open positions in most of the companies covered in this newsletter, as I am extremely bullish on the transformation in the financial services industry. However, none of the above is financial advice, and you should do your research.