Merchant acquiring is an area, in which Fintech companies managed to achieve scale and, to some degree, “disrupt” the established players. PayPal, Stripe, and Adyen dominate online payments, and companies like Square, Toast, and Shift4 are making strides in the offline world.

The common angle of attack for all these newcomers is better software. Fintech companies don’t sell plain vanilla payment terminals: their terminals come with software that helps merchants with taking customer orders, managing inventory, running marketing campaigns, paying personnel, and, of course, accepting payments.

JPMorgan is still the largest merchant acquirer in the world, but the five companies mentioned below are growing fast and competing furiously. Of course, JPMorgan has a lot of money to throw at the problem, but for now, the competition is on!

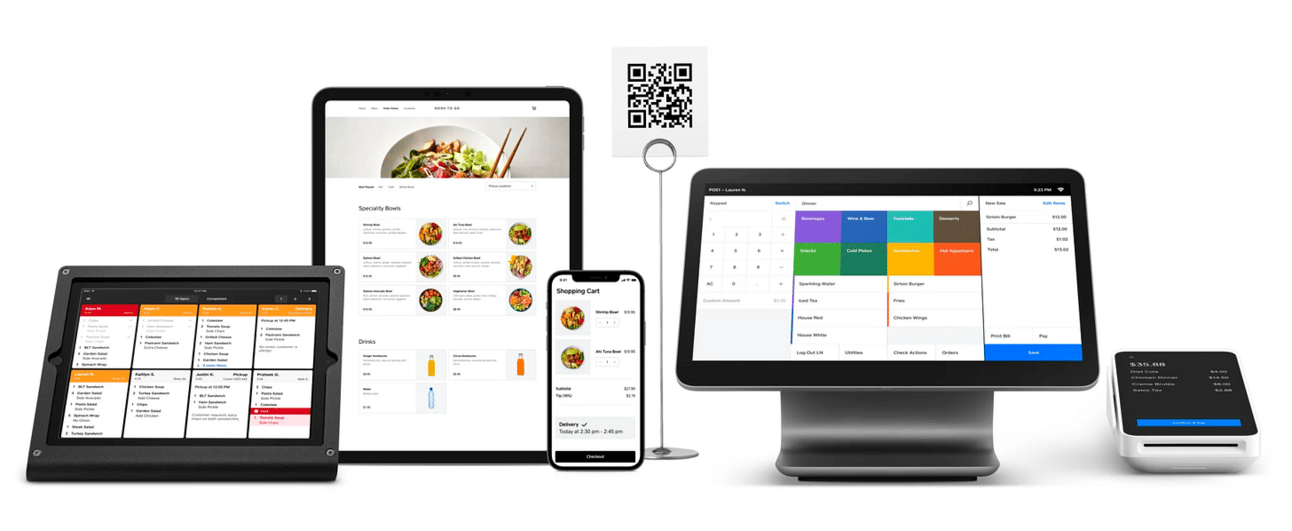

Image: Square for Restaurants

Square | NYSE: SQ |

Founded in 2009 by Jack Dorsey and Jim McKelvey, Square started by offering small merchants a solution for accepting card payments using their iPhones and a card reader that had to be plugged into a headphones jack. Over time, the company became a full-scope merchant acquirer, offering online and offline acquiring, payment terminals and cash registers, POS, marketing, and payroll software solutions, as well as banking and working capital financing. The company primarily serves small and medium-sized businesses but actively pursues bigger merchants.

In 2021, Square’s parent company rebranded into Block, Inc., as it outgrew its merchant acquiring business. Besides Square, Block, Inc. includes a digital wallet company Cash App, a Buy-Now-Pay-Later lender Afterpay, a music streaming business TIDAL, and several Bitcoin-related initiatives, such as TBD. In Q2 2022 Square processed $48.3 billion in Gross Payment Volume, which represented a 25% YoY growth, and reported $1.73 billion in revenue, which represented a 32% YoY growth.

As outlined during the company’s Investor Day 2022 in May, the company’s priorities going further are a) further development of its omnichannel software offering (supporting merchants in in-person, over-the-phone, online, and social commerce), b) going global (the company operates in the U.S., Canada, Japan, Australia, and the U.K., and in 2021 expanded to Spain and France), and c) growing upmarket (serving larger restaurants, retailers and service businesses). You will also hear a lot about Square integrating the Afterpay BNPL offering.

You can learn more about the company by reading my earlier posts:

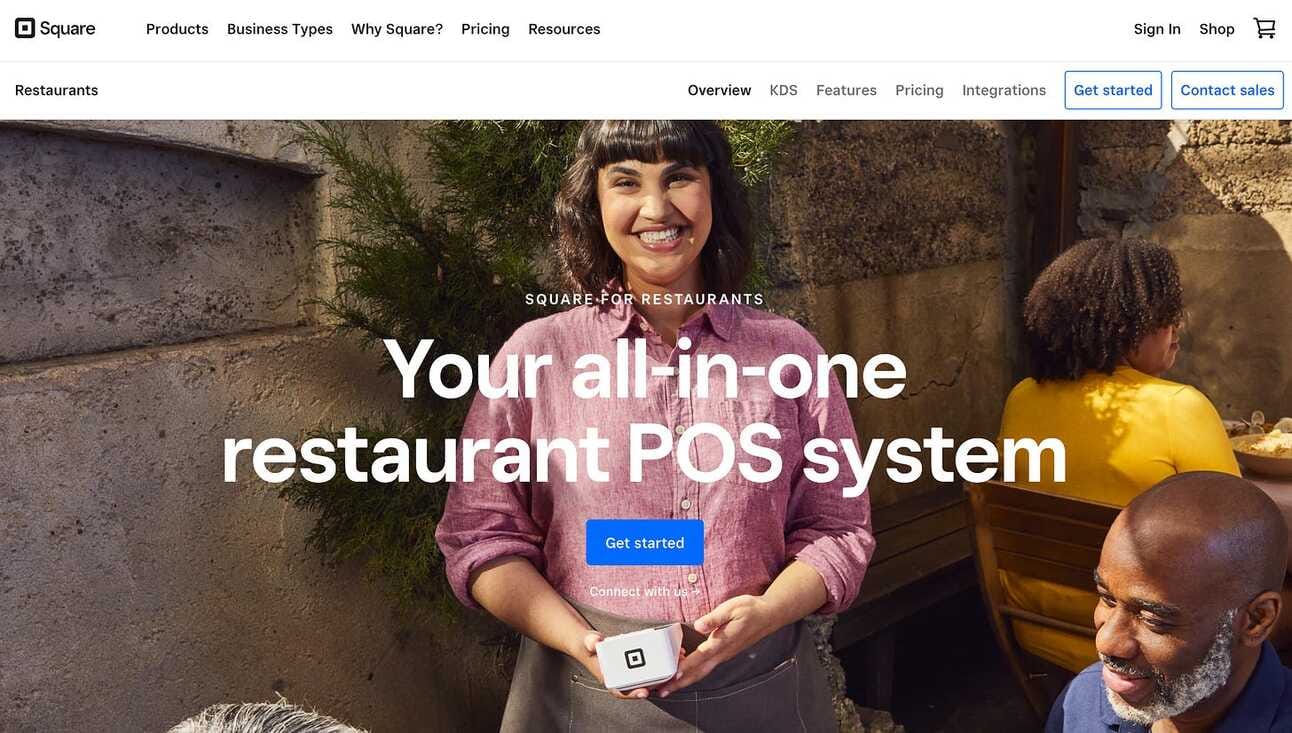

Toast | NYSE: TOST |

Market capitalization (Q3 2022): $8.64 billion

Revenue (2021 / TTM): $1.71 billion / $2.21 billion

Total Payment Volume (2021 / TTM): $57.0 billion / $89.1 billion

Founded in 2012, Toast aims to become “the operating system for restaurants”. At its core, the company offers restaurants a Point-of-Sale software solution, payment terminals, and payment processing. However, over the years the company has expanded its software offering to include ordering and delivery, team management, operations, as well as marketing and loyalty solutions. The company focuses solely on the restaurant segment, which differentiates it from the other providers on this list.

Toast was hit hard by the COVID-19 lockdowns, and had to lay off 50% of its staff in April, 2020. However, the company adjusted to the new reality by launching online and pick-up ordering solutions, and eventually went public in September 2021. In Q2 2022, the company served 68,000 restaurant locations, processed $23.3 billion in Gross Payment Volume, which represented a 62% YoY growth, and reported $675 million in revenue, which represented a 59% YoY growth.

With the pandemic in the rear mirror, the company has been growing at an impressive speed in terms of restaurant locations, GPV, and revenue. However, it operates with low gross profit margins and is yet to reach profitability even on an Adjusted EBITDA basis. Thus, on the most recent earnings call, the company’s management guided for a negative Adjusted EBITDA of $140-160 million in 2022 and restrained from giving a timeline for reaching profitability.

You can learn more about the company by reading my earlier posts:

Shift4 | NYSE: FOUR |

Market capitalization (Q3 2022): $3.59 billion

Revenue (2021 / TTM): $ 1.37 billion / $1.69 billion

Total Payment Volume (2021): $46.8 billion / $57.2 billion

Founded in 1999 Shift4 Payments went through a number of iterations changing the name along the way. In 2018, still operating under the name Lighthouse Network, the company acquired a payment gateway provider Shift4 Corporation and rebranded the whole group into Shift4 Payments. As of today, the company offers POS software solutions, POS hardware, and payment processing for retail, restaurant, leisure, and hospitality industries, and aggressively pursues new verticals, such as sports and entertainment, theme parks, gaming, and non-profits.

One of the key priorities for Shift4 is the migration of the gateway clients (the clients it acquired with Shift4 Corporation) from third-party payment processing to its own payments platform. In Q2 2022, the company processed $16.4 billion in Gross Payment Volume (referred to by the company as “End-to-End Payment Volume”), which represented a 43% YoY growth, and reported a revenue of $506 million, which represented a 44% YoY growth.

In 2021, Shift4 announced two notable acquisitions: The Giving Block, a platform for non-profits to accept cryptocurrency donations, and Finaro, a European e-commerce acquirer with a banking license. The premise is that the acquisition of The Giving Block will boost the company’s presence in the non-profit segment, while the acquisition of Finaro, will springboard the company’s global expansion. Oh…and in November 2021 the company signed a 5-year deal to process payments for Elon Musk’s Starlink.

Lightspeed | NYSE: LSPD |

Founded in 2005 in Canada, Lightspeed Commerce offers two flagship Point-of-Sale solutions, Lightspeed Restaurant and Lightspeed Retail, payment processing and POS hardware, as well as several adjacent software solutions that support its clients in i.e. inventory management and marketing. As the product names suggest, the company focuses on restaurants and hospitality, as well as retail segments. The company operates in more than 100 counties with 49% of the customer locations being outside of the United States and Canada.

The company positions itself as a software business; however, in the fiscal year 2022 (Q2 2021 - Q1 2022), transaction-based revenue surpassed subscription revenue, as the company started scaling its proprietary payment processing. In Q2 2022 (fiscal Q1 2023), the company serviced 326,000 customer locations, processing $3.3 billion in Gross Payment Volume, which represented a 96% YoY growth, and reported $173.9 million in revenue, which represented a 50% YoY growth.

The company processes only 15% of the payments initiated via its POS solutions (the rest is processed by third-party acquirers), so there is still a lot of potential for increasing the adoption of Lightspeed's proprietary payment capabilities. At the same time, the company keeps growing its customer base, investing in its software (i.e. Lightspeed Ecommerce) and financial services (Lightspeed Capital) offerings, and scaling its sales efforts globally. The company also made several high-profile acquisitions to fuel its growth.

Shopify | NYSE: SHOP |

Market capitalization: $34.25 billion

Revenue (2021 / TTM): $4.61 billion / $5.00 billion

Total Payment Volume (2021 / TTM): $85.8 billion / $95.1 billion

I’d guess, you might be surprised to see Shopify on this list. Founded in 2006, the company is mostly known for offering an e-commerce platform that helps merchants launch online stores. However, at some point, the company realized that it can also monetize payments, and in 2021, “Merchant Solutions” revenue, which primarily consists of payment processing fees, contributed $3.27 billion, or 71% of the company’s total revenue. In 2013, the company also launched an offline Point-of-Sale solution to support its customers with in-store commerce.

In July 2022, the company announced layoffs impacting 10% of its staff, as the pandemic-induced e-commerce growth evaporated and returned to historic levels. The company made a bet that COVID-19 triggered a fundamental shift in how people shop and had to scale back after realizing that this bet didn’t materialize. Nevertheless, in Q2 2022, the company processed $24.9 billion in Gross Payment Volume, which represented a 23% YoY growth, and reported $1.3 billion in revenue, which represented a 16% YoY growth.

We can expect Shopify to continue investing in its payment capabilities both online and in real life. For instance, the company processes slightly over 50% of Gross Merchandise Value (total sales of merchants using the Shopify platform), so there is a potential to increase GPV by upselling merchants to Shopify’s proprietary payment solution. In addition, the company is investing in Shopify Pay, its online checkout solution, and is expanding the Shopify Point-of-Sales solution globally (POS offering is already available in 13 countries). We might endlessly argue if Shopify is a Fintech company or not, but they are definitely a force in payments.

Disclosure & Disclaimer: despite rocky performance in 2021 and 2022, I own shares in most of the companies covered in this newsletter, as I am extremely bullish on the long-term transformation in the financial services industry. However, none of the above is or should be considered financial advice, and you should do your own research.