There are several Fintech rivalries that have fascinated me, such as Block and PayPal, Affirm and Klarna, SoFi and LendingClub, and, most recently, Toast and Shift4 Payments. Rivalries between publicly traded companies are especially interesting. You get a lot of information about their past performance through quarterly reports, and, on top of that, you can use valuation multiples as a gauge for future growth. After I started writing a newsletter about these rivalries, I realized that it would be impossible to cover them all at once; thus, I broke this letter into a mini-series. This is the second part, featuring SoFi, LendingClub, Affirm, and Klarna.

You can read the first part, which features Block (NYSE: ), PayPal (NASDAQ: ), Toast (NYSE: ), and Shift4 Payments (NYSE: ), by following the link 👉🏻 “Fintech Rivalries: How Fintech Companies Stack Up Against Each Other, Part 1.”

SoFi vs. LendingClub

LendingClub and SoFi are U.S. Fintech consumer lenders that recently became banks. Thus, LendingClub got a banking charter by acquiring Radius Bank in February 2021, and SoFi got a charter by acquiring Golden Pacific Bank in February 2022. Radius Bank acquisition gave LendingClub know-how in new categories, like small business lending and equipment finance. Nevertheless, personal loans were, are and, most likely, will remain the core focus for the company.

On contrary, before the pandemic, SoFi’s bread and butter was student loan refinancing. However, after the student loan repayment moratorium was introduced in March 2020, the company regrouped and scaled its personal loans business. In addition, SoFi works on diversifying its product offering into brokerage services and credit cards, as well as acquired two software companies serving other Fintech players, Gallileo (card issuing platform) and Technysis (core banking software).

As of this writing, SoFi (NASDAQ: ) had a market capitalization of $6.31 billion, compared to the market capitalization of $1.07 billion for LendingClub (NYSE: ). SoFi and LendingClub traded at Price / Book multiples of 1.2 and 0.9 respectively.

The two companies have a similar scale. Thus, in 2022 LendingClub reported loan originations of $13.1 billion, compared to the $13.0 billion reported by SoFi. Loan originations started cooling down in the second half of 2022 due to weaker investor demand (both companies still rely on third parties to fund a portion of their originations), as well as tighter underwriting standards, and will most likely remain suppressed in 2023. However, the student loan repayment moratorium is expected to finally end in late 2023 (the moratorium was extended multiple times), which should a meaningful boost to SoFi’s student lending business (at its peak in Q4 2019, SoFi originated $2.4 billion in student loans, compared to $0.4 billion in Q4 2022).

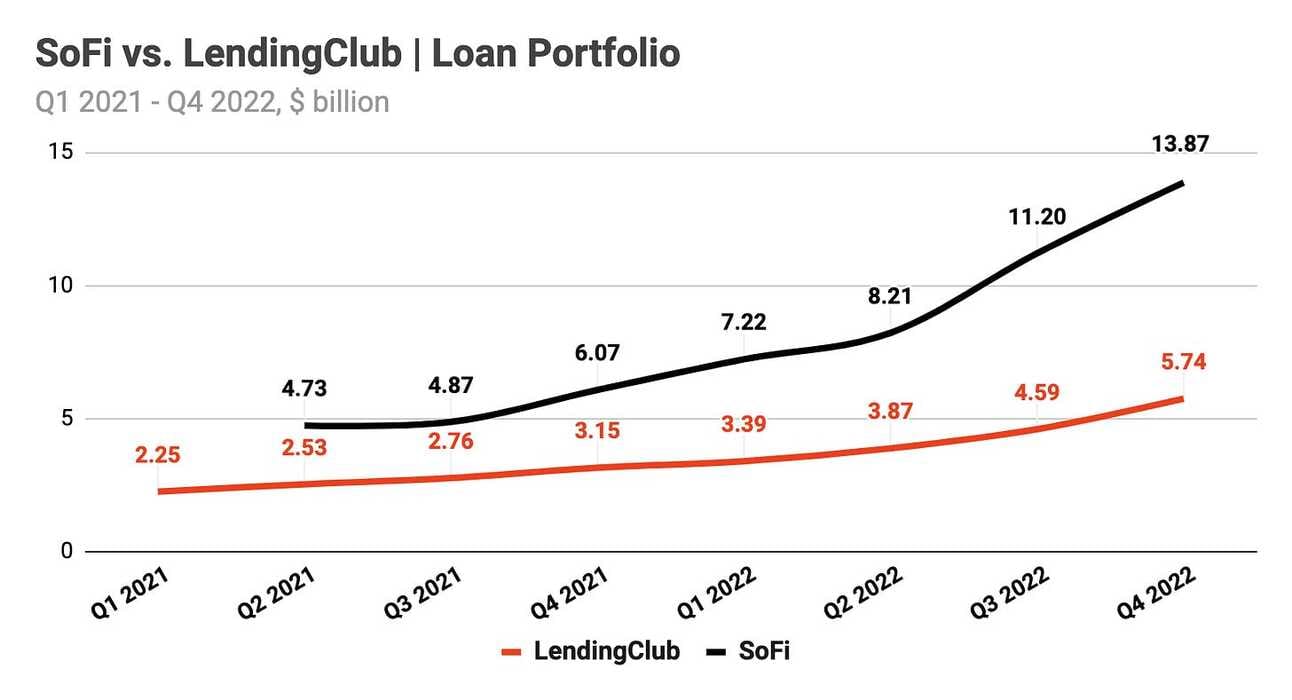

SoFi is being more aggressive in using its balance sheet. Thus, the company’s loan portfolio grew from $6.07 billion at the end of 2021 to $13.87 billion at the end of 2022. This compares to LendingClub’s portfolio growing from $3.15 billion at the end of 2021 to $5.74 billion at the end of 2022. In the second half of 2022, both companies started buying back loans (that they previously originated and continued servicing), as a way to compensate for a slowdown in loan originations. LendingClub relies primarily on deposits to fund its loan portfolio growth, while SoFi uses a variety of funding sources. At the end of 2022, SoFi and LendingClub had $7.34 billion and $6.39 billion in deposits respectively.

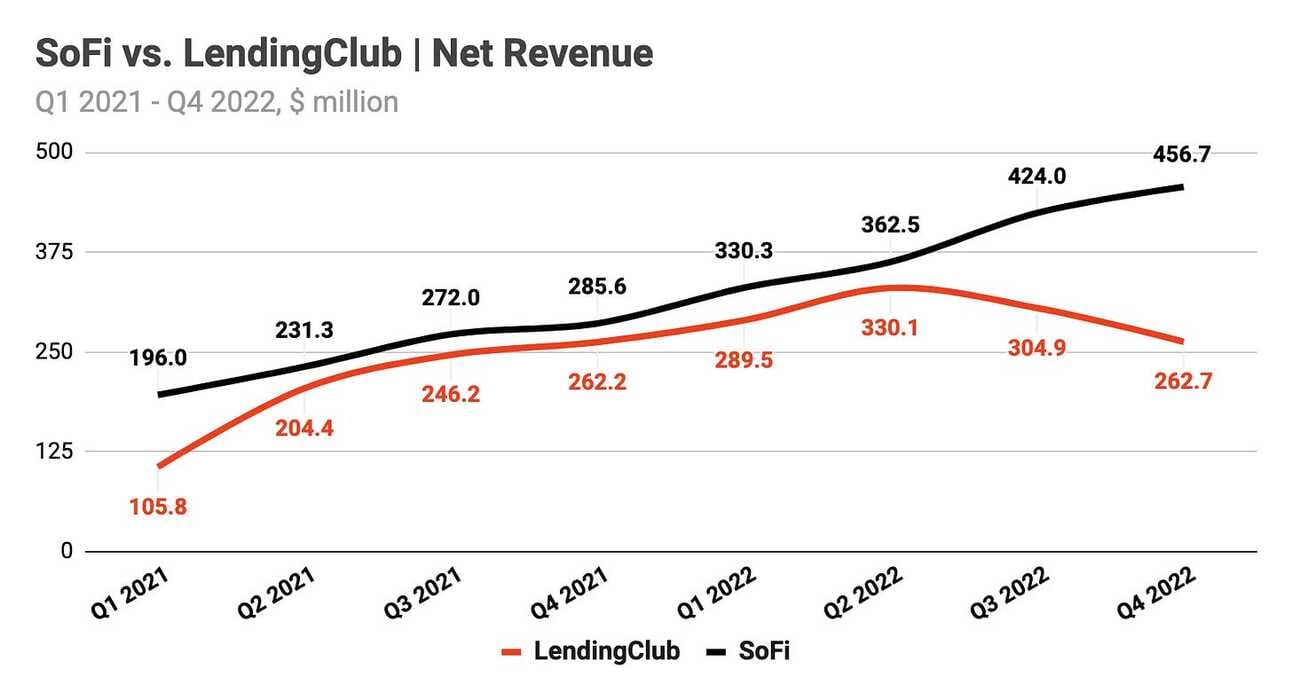

In Q3 2022, the two companies started diverging on their revenue growth. Thus, while SoFi continued to report revenue growth throughout 2022 reaching $456.7 million in Q4 2022, LendingClub’s revenue declined from its peak of $330.1 million in Q2 2022 to $265.7 million in Q4 2022. SoFi’s move aggressive use of the balance sheet drove interest income growth, and the company’s non-interest income turned out to be more resilient (than LendingClub’s) due to business diversification. Both companies guided for a sequential decline in revenue in Q1 2023. Thus, LendingClub guided for “pre-provision net revenue” of $50 - 70 million, which implies net revenue of $220 - 250 million, and SoFi guided for “adjusted revenue” of $430-440 million, which implies net revenue of $445 - 455 million.

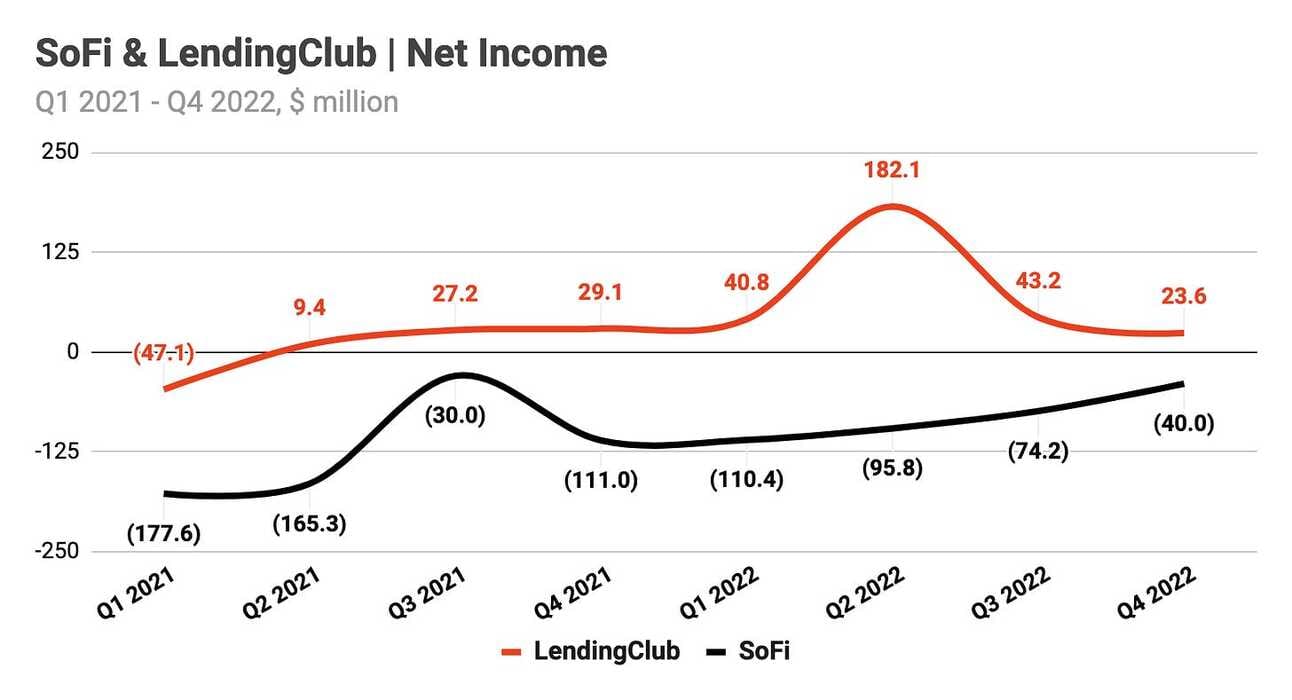

Finally, let’s take a look at Net Income. In Q4 2022, LendingClub reported a Net Income of $23.6 million, while SoFi reported a Net Loss of $40.0 million. LendingClub managed to reach GAAP profitability in Q2 2021, right after completing the acquisition of Radius Bank. However, as I argued in my latest review, the company has not yet built a sufficiently large loan portfolio to profitably go through a recession (the company’s guidance suggests barely breaking even in Q1 2023). At the same time, SoFi’s losses keep narrowing and the company’s management made a commitment to reach GAAP profitability in Q4 2023. We are yet to see if they manage to achieve this ambitious goal, but so far, SoFi has been very consistent with delivering on its guidance (despite the never-ending headwinds, like multiple extensions of the student loan repayment moratorium).

SoFi and LendingClub are the pioneers of online lending that understood the importance of a balance sheet in this business. However, while LendingClub uses its banking charter purely to capture more income from the loans it issues, SoFi went all-in and is building a full-service consumer bank. Which bank do you want to bet on?

Affirm vs. Klarna

The four largest players in the “Buy Now Pay Later” space globally are PayPal, Afterpay, Klarna, and Affirm. Afterpay used to be an independent publicly traded company, but in 2022 it was acquired by Block, Inc. Affirm and Klarna have a similar product range, offering both, zero-interest rate loans subsidized by merchants, as well as longer-term installment loans that carry interest. Klarna operates across 45 countries and claims to have 150+ million active consumers (of which 30 million are in the U.S.), while Affirm operates only in the United States and Canada (and to a limited extent in Australia) and the company reported 15.6 million active consumers on its latest earnings call. An important difference between the two is that Klarna became a bank in 2017, which allows it to use consumer deposits to fund lending.

As of this writing, the market capitalization of Affirm (NASDAQ: ) was $3.73 billion, and the shares were trading at 1.5 Price / Book multiple. Klarna is not publicly traded, but it raised $800 million in new funding in July 2022 at a post-money valuation of $6.7 billion. Affirm had a market cap of $6.12 billion on the day when Klarna announced its funding round, so it would be fair to assume that Klarna’s market cap today would be around $4.0 billion.

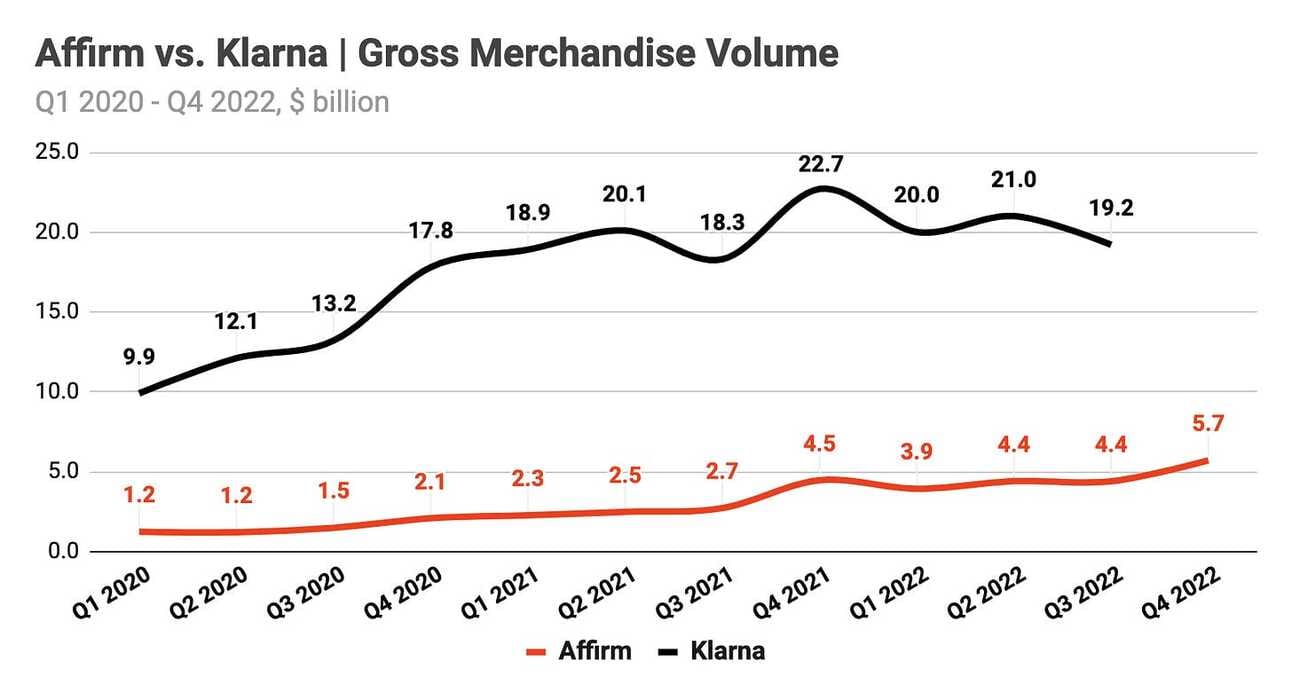

Klarna dwarfs Affirm in terms of Gross Merchandise Volume (GMV). Thus, in Q3 2022 Klarna reported $19.2 billion1 in GMV, while Affirm reported only $4.4 billion. Gross Merchandise Volume represents the dollar amount of transactions processed by either Klarna or Affirm, whereas “processed” means financed either through a zero-interest rate or interest-bearing loan. Thus, in the case of BNPL lenders, GMV can be treated as origination volume. As of this writing, Klarna has not yet reported its Q4 2022 results, but given that it was a holiday season I would expect sequential growth from Q3 2022 volume.

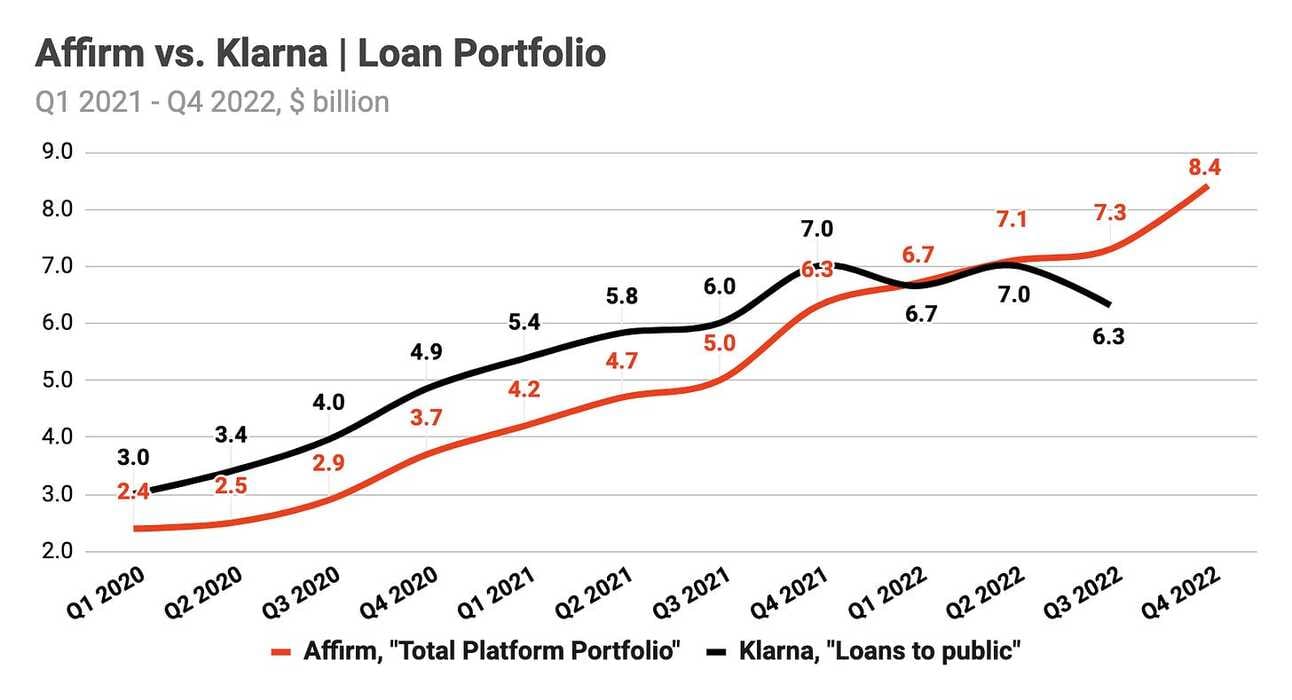

Klarna might look like a much bigger player if you look at the company’s geographical footprint, the number of consumers, or GMV, but in terms of the loan portfolio, it has a similar scale to Affirm. Thus, at the end of Q3 2022, Klarna reported a loan portfolio of $6.3 billion, while Affirm reported a loan portfolio of $7.3 billion. It is important to note, that Klarna holds all (or most) of the originated loans on its balance sheet (because, as a bank, it has deposits to fund those loans), while Affirm relies on different funding instruments and arrangements to fund its loan originations. Thus, in this comparison, I used what Affirm calls the “Total Platform Portfolio”, which includes loans held by the company on its balance sheet, loans owned by the securitization trusts, and loans sold to third-party investors.

BNPL companies, such as Affirm and Klarna, make money through interest income (hence, the importance of the size of the loan portfolio), as well as commission income, which comes from the fees paid by either merchants or consumers (hence, the importance of GMV). In Q3 2022, Klarna reported a total revenue of $438 million, compared to the $362 million reported by Affirm. Affirm generates higher interest income on its loan portfolio than Klarna, but Klarna earns more in commissions. Given a similar size of the loan portfolio, higher commission income essentially means that Klarna is issuing shorter-duration loans (more of “Pay in 4” than installment loans) and turning its loan book over faster (hence, higher GMV).

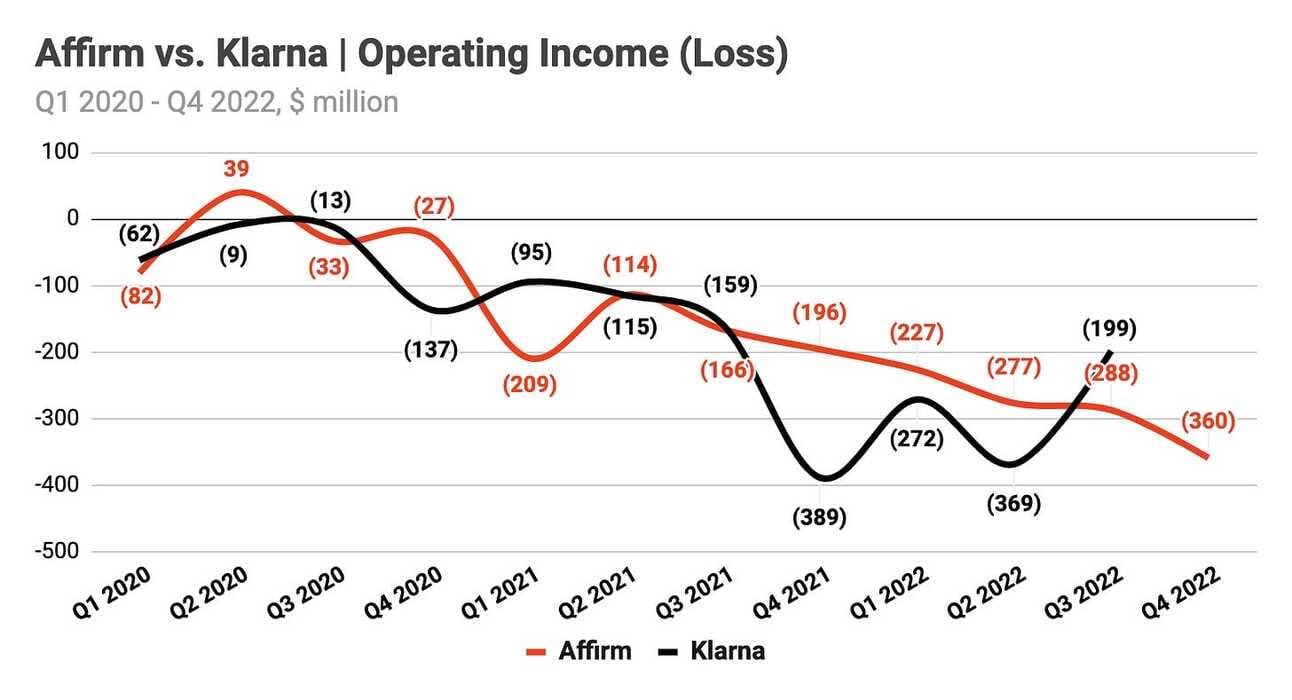

Finally, let’s look at the “profitability” of these companies. Klarna reported an Operating Loss of $199 million in Q3 2022, its latest reported quarter, compared to the $288 million reported by Affirm (Affirm’s operating loss increased further to $360 million in Q4 2022). Klarna has executed two rounds of layoffs in 2022, cutting more than 10% of its workforce. Affirm avoided firing people until February this year, when the company finally decided to reduce its workforce by 19%. It should be noted that both companies have profitable unit economics, and these are the excessive operating expenses that lead to operating losses. CEOs of both companies have committed to reaching profitability (although on an adjusted basis) by mid-2023; however, the path to non-adjusted profitability remains unclear.

Klarna should report its Q4 2022 results sometime soon. If the company reports a further increase in its operating loss (like Affirm did on its latest earnings call), expect a new wave of “BNPL is dead” headlines. I, in the meantime, will keep my fingers crossed for them, as I root for the success of every Fintech company out there.

I cover SoFi, LendingClub and Affirm earnings every quarter:

Consider becoming a paid subscriber to receive upcoming earnings reviews.

To be continued…

Cover image source: Klarna

Disclosure & Disclaimer: I own shares in several companies that I write about in this newsletter, as I am bullish on the transformation in the financial services industry. However, the information contained in this newsletter is intended for informational purposes only and should not be considered financial advice. You should do your own research or seek professional advice before making any investment decisions.