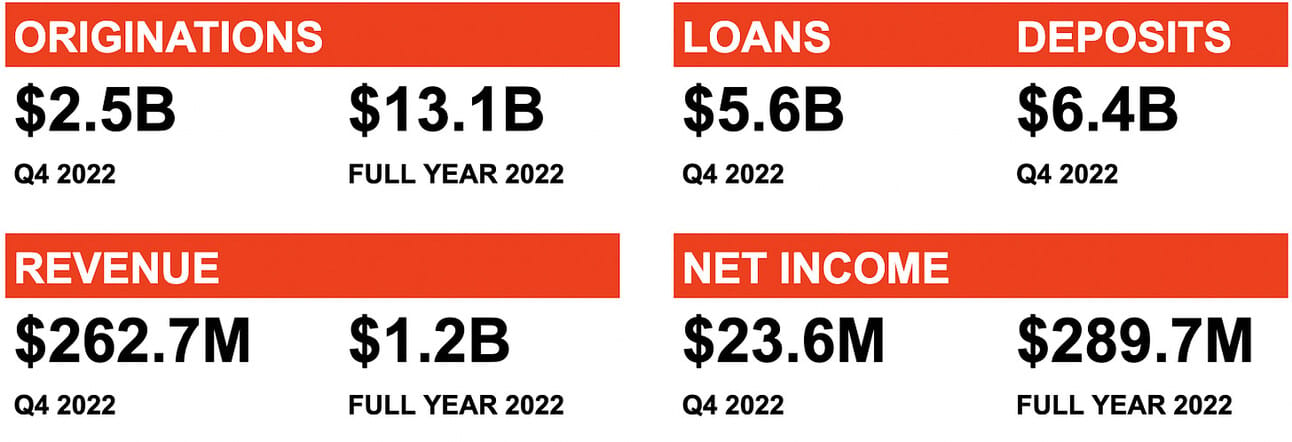

Last year was transformative for LendingClub. The company grew its revenue to $1.2 billion (compared to $0.6 billion in 2021) and reported a Net Income of $289.7 million (compared to $18.6 million in 2021). The loan portfolio reached $5.6 billion and deposits reached $6.4 billion by the end of the year. However, LendingClub has not yet reached the scale, which allows it to profitably go through an economic cycle. Interest income is not sufficient to cover operating expenses and provisions, and the company still relies on loan origination fees to maintain profitability.

Thus, the company’s management guided for barely breaking even in Q1 2023, and I expect a return to losses if the U.S. economy falls into a recession and origination volumes decline further. In addition to navigating a tough economic environment, I believe the company needs to start thinking about diversifying its business and reigniting growth after the clouds clear. The Radius Bank bank gave the company new competencies (commercial banking, SME lending), so there is a lot to build on. In the meantime, let’s review the company’s Q4 2022 results.

If you are new to LendingClub, I suggest reading my previous reviews:

Loan Originations

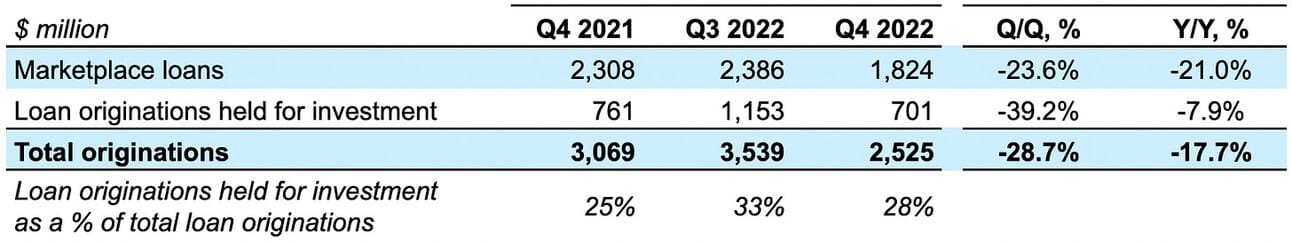

LendingClub reported $2.53 billion in loan originations in Q4 2022, which represents a 17.7% decline compared to Q4 2021, and a 28.7% decline compared to Q3 2022. LendingClub retained 28% of the total loan originations or $0.70 billion on its balance; however, the company also acquired a $1.05 loan portfolio from MUFG Union Bank (loans were originated by LendingClub and it continued to service then). Including the acquired loan portfolio, LendingClub added $1.75 billion in loans to its balance sheet, compared to $0.76 billion in Q4 2021 and $1.15 billion in Q3 2022.

The company’s management guided for $1.9 to $2.2 billion in loan originations in Q1 2023, and it plans to retain 30-40% of originated loan volume on the company’s balance sheet ($0.7 - $0.8 billion). This guidance implies a 32-41% decline in loan originations compared to Q1 2022, and a 13-25% decline compared to Q4 2022, and would mark the lowest origination volume since LendingClub became a bank in Q1 2021.

There were two reasons for the declining origination volumes in Q3 and Q4 2022: a) weak investor demand for marketplace loans, as the company struggled to pass increasing rates to the borrowers to match return expectations, and b) tighter underwriting policy, as the company started incorporating deteriorating economic conditions in its credit decisions. Loan origination volume is the key driver of LendingClub’s revenue, as it directly impacts non-interest income (loan origination fees, gain sale of loans), and indirectly impacts net interest income (volume of loans retained on the balance sheet, size of the loan book).

The lending business is a reflection of the economy, and, as of this writing, economists see two paths for the U.S. economy. In the case of a soft landing, the economy avoids falling into a recession, and the Federal Reserve will soon stop raising rates, but will keep them elevated into 2024 until inflation reaches the policy target. In the case of a recession, the economy collapses in 2023, and the Federal Reserve will be forced to cut the rates. Consequently, in the case of a soft landing, LendingClub’s Q1 2023 guidance could be the lowest origination point, while in the case of a recession, it is fair to assume that the origination volumes will continue falling.

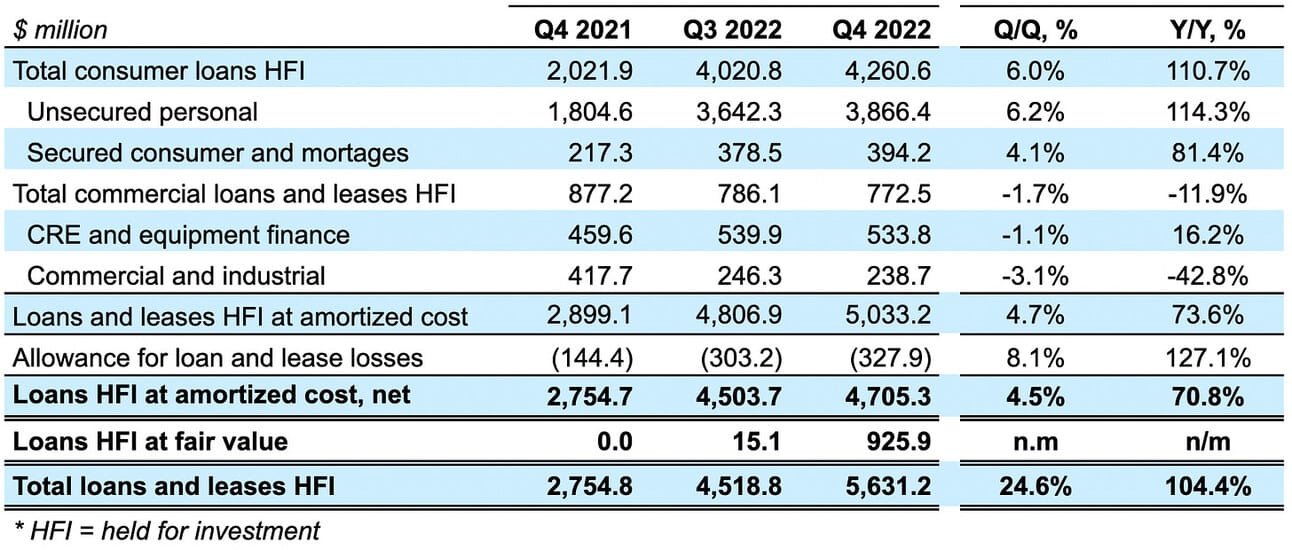

Loan Book and Deposits

At the end of Q4 2022, LendingClub had $5.63 billion in loans on its balance sheet (net of allowance for losses), which represents a 104.4% increase compared to Q4 2021 and a 24.6% increase compared to Q3 2022. Due to the short-term nature, LendingClub booked the portfolio it acquired from MUFG Union Bank as “Loans held for investment at fair value.” Including the acquired portfolio, consumer loans represented 87.0% of LendingClub's loan book (gross of allowance for losses), and commercial loans represented the remaining 13%.

The company decided not to originate “commercial real estate” and “equipment finance” loans going further (apparently, the scale did not justify the overhead cost, and the teams running these products became part of the reorganization), but will continue originating government-guaranteed loans to small businesses under the SBA programs. Scott Sanborn commented on the earnings call, that small business loans are close to personal loans in their dynamic, have variable interest rates, and can be sold to third-party investors in case such a need arises. Interestingly, SoFi’s CEO also mentioned SBA loans during the latest earnings call.

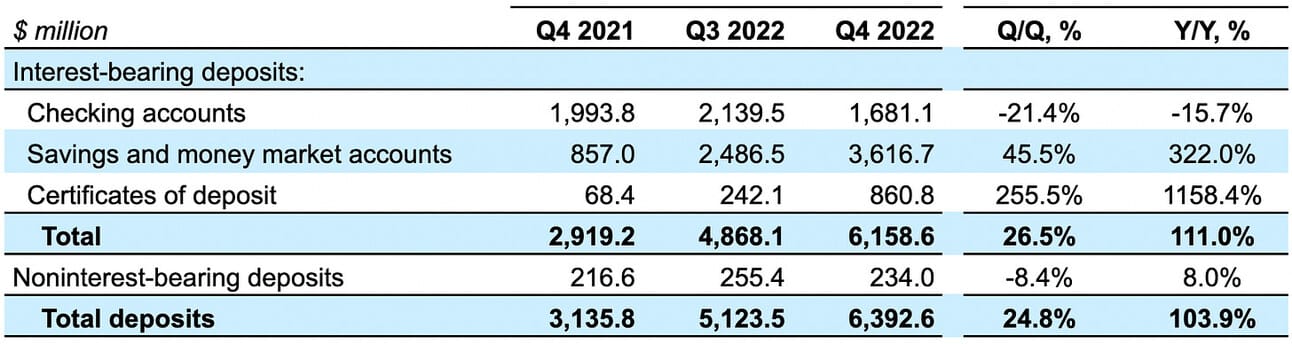

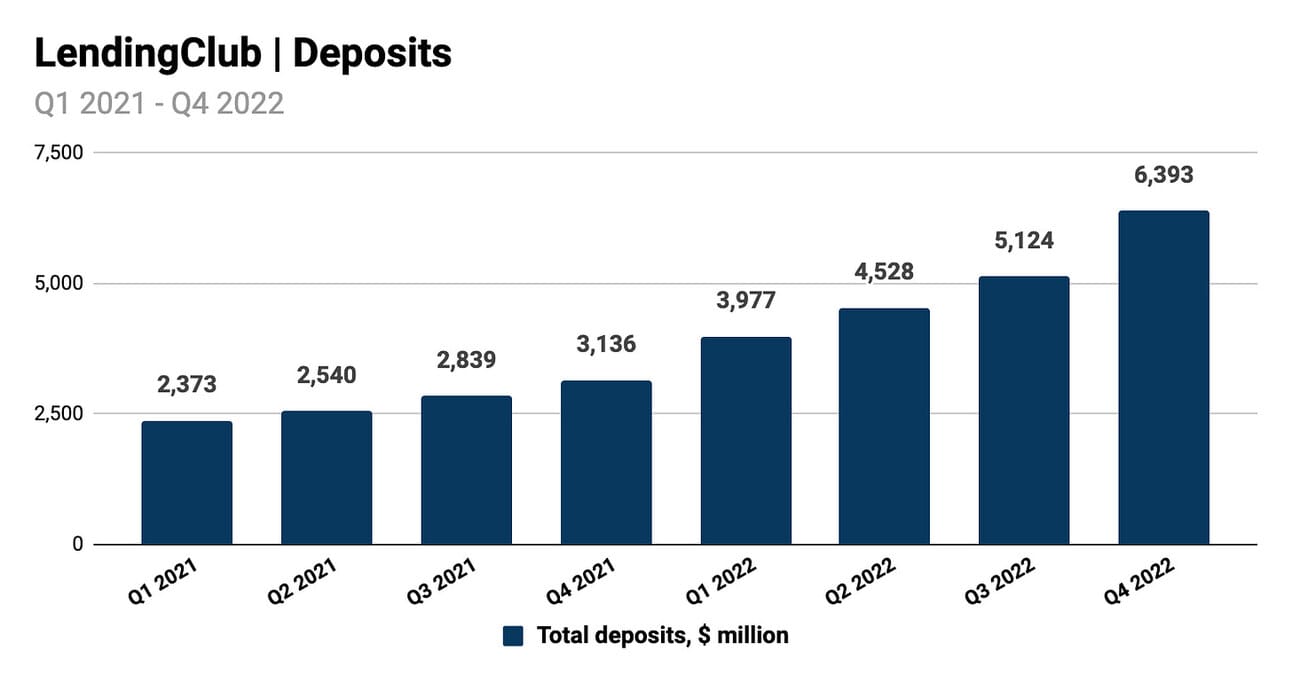

LendingClub finished Q4 2022 with $6.39 billion in deposits, which represents a 103.9% increase compared to Q4 2021, and a 24.8% increase compared to Q3 2022. The company’s guidance for loan originations, suggests that the volume of loans that it plans to retain on its balance sheet in Q1 2023 will barely offset loan portfolio amortization (repayments), and the size of the portfolio will remain flat. However, the company continues to attract new deposits and offers a competitive rate on its high-yield savings accounts. So how do they plan to use those deposits?

The most obvious use for new deposits would be to retain more than the indicated 30-40% of loan originations on the company’s balance sheet. In the case of a recession, LendingClub will most likely have to step in with its balance to support borrower demand. The second use for extra deposits would be further loan portfolio acquisitions similar to the MUFG Union Bank deal. Ideally, those loans would be originated by LendingClub, but I believe they could also pursue an acquisition of a portfolio originated by another lender. Finally, the company could be preparing for scaling its small business lending program, as a way to diversify the business.

Revenue

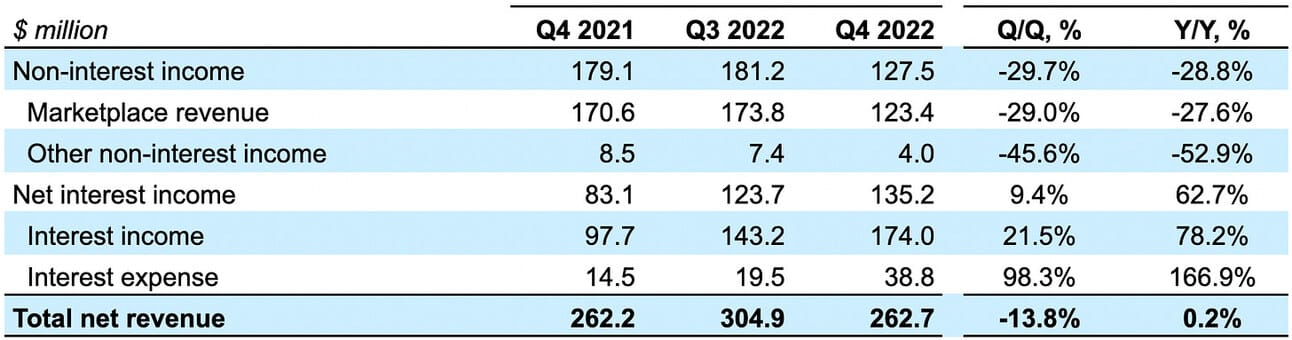

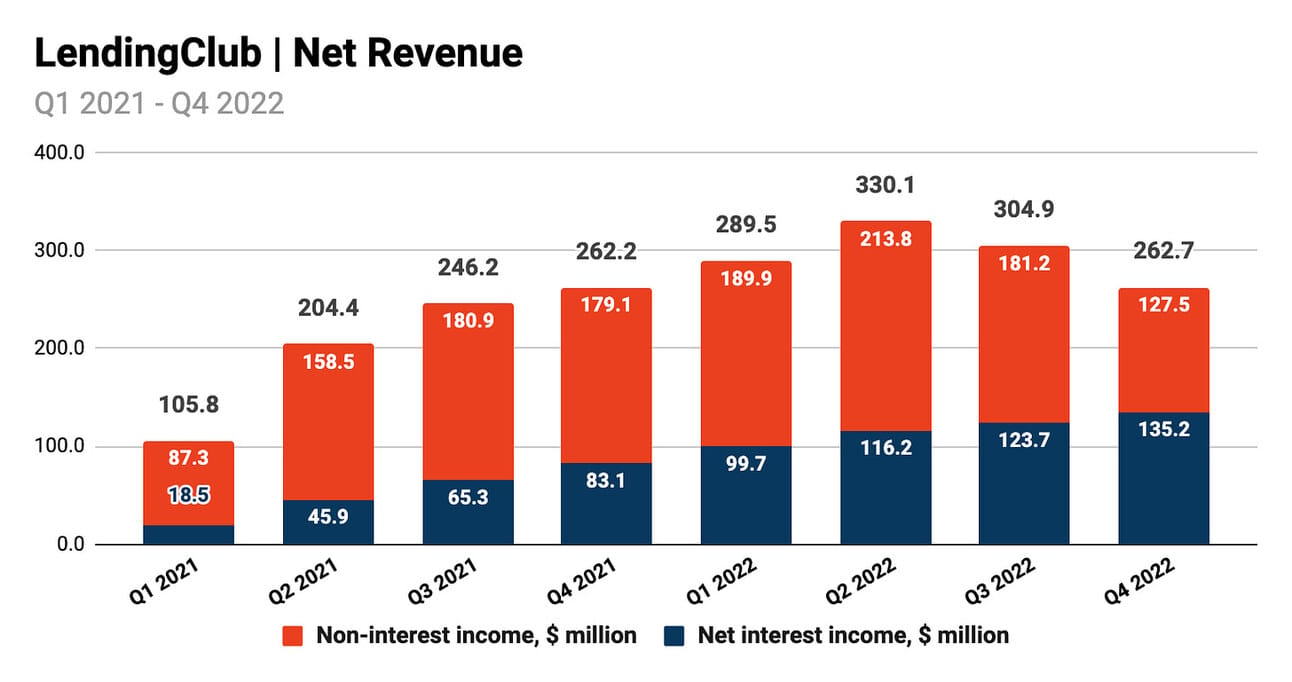

LendingClub reported $262.7 million in total net revenue for the quarter, which was almost unchanged from Q4 2021, and represents a 13.8% decline from Q3 2022. As the company keeps retaining loans on its balance sheet, Net interest income overtook Non-interest income and contributed 51.5% of the total revenue, compared to 31.7% in Q4 2021, and 40.6% in Q3 2022. Non-interest income is primarily driven by the marketplace volumes (loan origination fees, gain on sales of loans contributing 80-85%). Thus, in Q4 2022 it was negatively impacted by lower origination volumes and a fair value adjustment on the acquired MUFG portfolio.

The company’s management guided for “pre-provision net revenue” (net revenue less non-interest expenses) of $55 - 70 million in Q1 2023, compared to pre-provision net revenue of $82.7 million in Q4 2022.

The company’s management did not provide net revenue guidance, but let’s try deducing it from the “pre-provision net revenue” guidance. The workforce reduction that LendingClub announced in January 2023, was expected to “result in annualized run-rate savings in compensation and benefits of approximately $25 to $30 million in 2023” (or $6.2 - 7.5 million per quarter). In addition, marketing expenses should be $5.0 - 8.0 lower due to smaller volume origination, which would bring non-interest expenses to $165 - 180 million. Thus, we should expect net revenue of $220 - 250 million in Q1 2023, of which $80 - 100 million will be non-interest income.

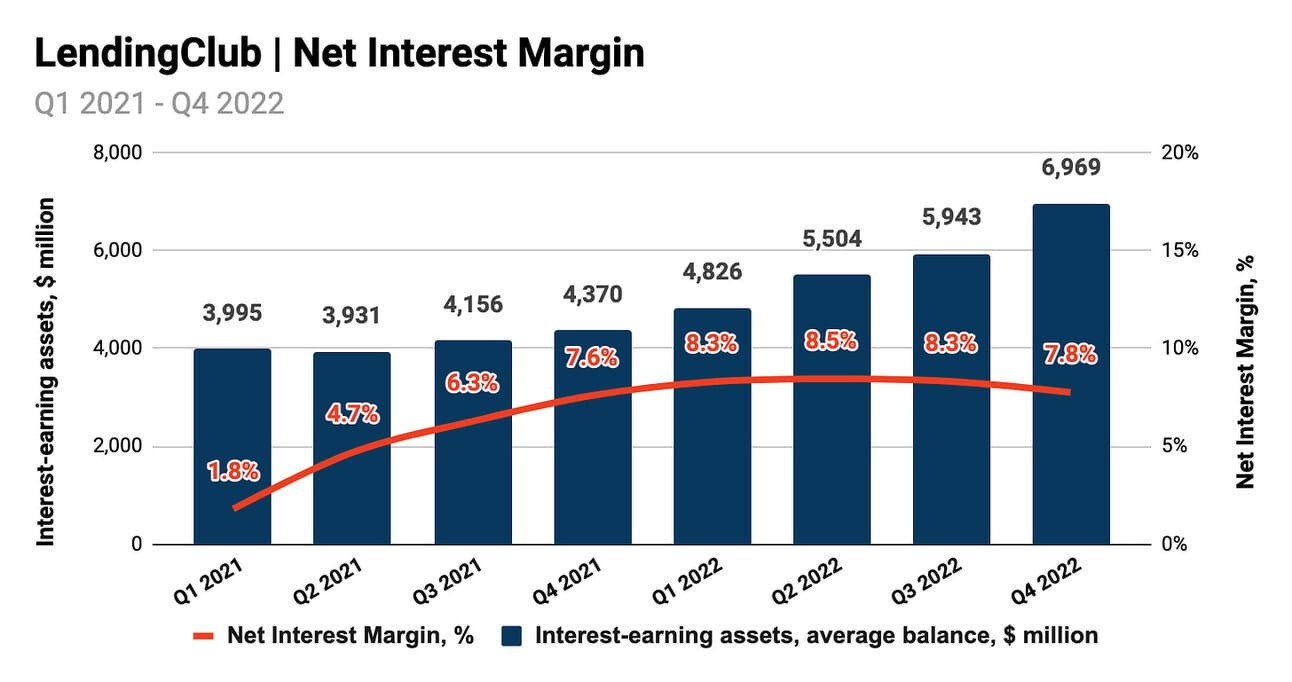

Net Interest Margin (Net Interest Income over average interest-earning assets) stood at 7.8% in Q4 2022, compared to 7.6% in Q4 2021 and 8.3% in Q3 2022. Sequential compression of the NIM is the result of a higher cost of funding. Thus, the average balance of interest-earning assets increased from $5.94 billion in Q3 2022 to $6.97 billion in Q4 2022, while the average yield increased from 9.64% to 9.99%. At the same time, the average balance of interest-bearing liabilities increased from $4.70 billion in Q3 2022 to $5.68 billion in Q4 2022, and the average rate that the company pays for it increased from 1.65% to 2.71%. Deposits (checking, money market, savings accounts, and CDs) represented 97% of these liabilities.

LendingClub estimates that personal loans originated in 2023 are expected to generate a 10.1% NIM (15% average interest rate, less 5% rate on brokered deposits). Thus, NIM should not decline materially below the current point, especially given the fact that the company will not be originating low-yielding CRE and equipment finance loans going further. A stable NIM implies that LendingClub’s Net Interest Income in the coming periods will be primarily a function of the size of its loan book (which, in turn, is a function of loan origination volume, the share of retained loans, and the speed of portfolio amortization).

In summary, per the company’s guidance, Q1 2023 will be the third consecutive quarter of declining revenue due to lower origination volumes and, consequently, lower non-interest income. As discussed above, in the case of a soft landing, Q1 2023 will be the “bottom” of origination volumes, and the revenue should stabilize throughout 2023. However, in case of a recession, the origination volumes, and thus, revenue will continue deteriorating further.

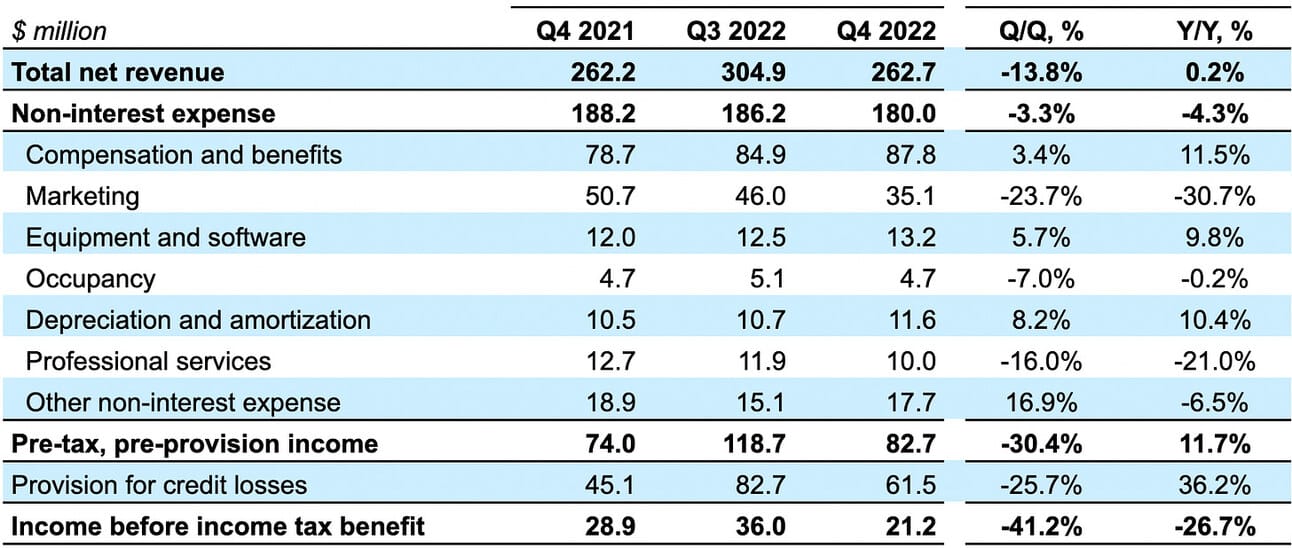

Operating Expenses and Provisions

LendingClub reported $180.0 million in non-interest expenses in Q4 2022, representing a 4.3% decline compared to Q4 2021 and a 3.3% decline compared to Q3 2022. Provision for credit losses was $61.5 million, representing a 36.3% increase compared to Q4 2021 and a 25.7% decline compared to Q3 2022. The company reported $82.7 million in pre-provision income and $21.2 million in income before income tax for the quarter, compared to $74.0 in pre-provision income and $28.9 in income before income tax in Q4 2021.

I argued earlier that a strong aspect of LendingClub’s “marketplace bank” model was that its non-interest income was covering the company’s non-interest expense. However, as the marketplace origination volumes sharply declined, this was not the case in Q4 2022 ($127.5 million in non-interest income vs. $180 million in non-interest expense) and is not expected to be the case in Q1 2023. Thus, as detailed earlier in the text, I estimate a non-interest expense of $165 - 180 million, compared to a non-interest income of $80 - 100 million in Q1 2023. Marketing is the only variable component of LendingClub’s non-interest expenses, so as revenue declined, the efficiency ratio increased from 61.1% in Q3 2022 to 68.5% in Q4 2022.

LendingClub reported $61.5 million in provision for credit losses for the quarter, compared to $45.1 million in Q4 2021 and $82.7 million in Q3 2022. Relative to the origination volumes, provision for credit losses increased to 8.8%, compared with 6.0% in Q4 2021 and 7.2% in Q3 2021. Increasing provisions reflect the company’s expectations for higher loss ratios in the future, which are in turn a reflection of the rising delinquency rates. If the provision rate remains the same, we can expect $62 - 71 million in provision for credit losses in Q1 2023. However, I believe it is a fair assumption that the company will have to provision more in the coming future given the economic outlook (even if this outlook does not eventually materialize).

Let’s put it all together: $220 - 250 million in revenue, less $165 - 180 million in non-interest expense, less $62 - 71 million in provision for credit losses, resulting in zero (or around zero) in income before tax in Q1 2023. In the case of soft lending of the economy, the company’s revenue is not expected to deteriorate further, and thus, we can expect the company to operate at breakeven (or minor profit) past Q1 2023. However, a recession would put further pressure on the company’s revenue, and, given that LendingClub’s costs are primarily fixed, would lead to losses.

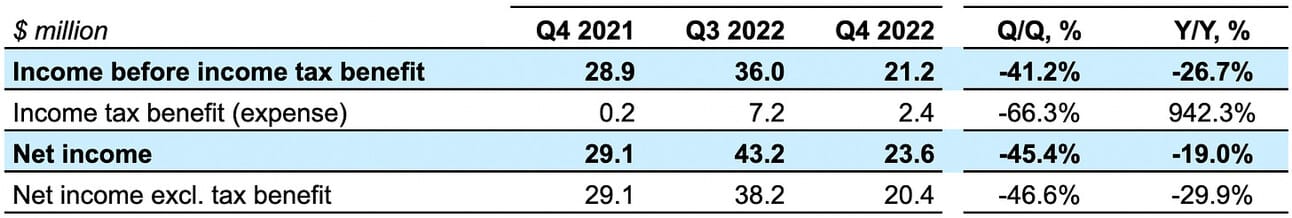

Net Income

LendingClub reported $23.6 million in Net Income for the quarter, which represents a 19.0% decline compared to Q4 2021, and a 45.4% decline compared to Q3 2022. The company booked a tax benefit of $2.4 million for the quarter; thus, Net Income excluding tax benefit was $20.2 million. The company’s CFO mentioned on the earnings call that he “expects less volatility in taxes” in 2023. LendingClub reported a Net income of $289.7 million for the full year 2022 (or $146.2 million excluding income tax benefit), compared to a Net income of $18.6 million in 2021.

As I argued above, depending on which economic forecast materializes (a “soft landing” or a recession), we should expect LendingClub to either operate at breakeven or to start reporting losses later in 2023. Despite the rapid growth of the loan portfolio, the company has not yet reached the scale at which it can go through a recession while maintaining profitability. LendingClub still relies on origination volumes to generate loan origination fees and replenish loan amortizations. Thus, it desperately needs the Federal Reserve to successfully “soft land” the economy to avoid returning to losses.

The management deserves credit for pursuing the banking license, as it made the company’s revenue more resilient to fluctuations in investor demand for marketplace loans. However, I believe that this mission is on track and it is time to start thinking about further growth. The Radius Bank acquisition gave LendingClub new competencies (commercial banking, SME lending, mortgages), so, perhaps, the company could build on those. SoFi managed to transition from being a single-product company, and I believe LendingClub will be able to do the same.

Things to Watch in 2023

Origination volumes. Origination volumes are the key driver of the company’s revenue; and thus, profitability. LendingClub’s management guided for a further decline in origination volumes in Q1 2023, but what happens past the first quarter of the year will depend on the economy. In case the Federal Reserve manages to pull off a “soft landing”, then we could see origination volumes “bottom” in Q1 2023 and remain stable for the rest of the year. However, a recession will, most likely, lead to a further decline in investor appetite; and thus, originations.

Loan portfolio. The size of the company’s loan portfolio is a function of origination volume, the share of origination volume retained on the balance sheet, and the speed of the loan portfolio amortization. My understanding is that LendingClub plans to maintain the portfolio flat (at least in Q1 2023) by retaining a share of originations covering amortization. However, the company keeps attracting deposits in case the deteriorating investor demand will require it to step in, and start putting more loans on its balance sheet.

Loan quality. A bigger loan portfolio is a good thing…as long as the loans are of good quality. Delinquency rates are rising, which the company’s management attributes to the portfolio growth slowing down. However, it is unreasonable to assume that rising delinquencies are purely a “normalization effect” and that worsening economic conditions have no impact. As a reminder, LendingClub’s credit models were never tested by a severe recession, as the company was founded in 2006, but started scaling only after the Global Financial Crisis.

Medium to long-term strategy. As interest income surpassed non-interest income in Q4 2022, we can call the transition to the “marketplace bank” model complete. The turbulence of 2022 clearly showed that a banking charter provides resilience to the company’s revenues. Therefore, the logical question would be “what’s next?”, and how does the company plan to grow from here? I believe diversification of both, interest income (through new lending products) and non-interest income (through non-lending products), would be a logical next step.

Disclosure & Disclaimer: I own shares in several companies that I write about in this newsletter, as I am bullish on the transformation in the financial services industry. However, the information contained in this newsletter is intended for informational purposes only and should not be considered financial advice. You should do your own research or seek professional advice before making any investment decisions.