Last week LendingClub ( ) reported Q2 2022 results. The company originated a record $3.8 billion in loans and retained over $1 billion of those on its balance sheet. The company’s management is doing what they promised investors to do: keep building a high-yield personal loan book that generates interest income. The strategy has been playing out nicely so far with the Net Income for the quarter reaching $46.8 million (excluding the one-time tax benefit), up from $9.4 million a year ago.

What clouded the earnings report is the economic uncertainty, and, as the result, the company’s management guiding for lower origination volumes, revenue, and net income for the remainder of the year. Recessions do not treat lenders well, and if the economy indeed takes a deep nosedive, this will be a real-life stress test for LendingClub (now) the bank. The short-lived recession of Q2 2020 was devastating for LendingClub’s pure marketplace model, so let’s see how it fairs with a banking charter. However, if the recession turns out to be a mild one, I would expect LendingClub to continue beating its own guidance. Anyways, let’s review the company’s Q2 2022 results.

If you are new to LendingClub, I suggest reading my previous reviews of the company:

Loan Originations

LendingClub reported $3.84 billion in loan originations during Q2 2022, which represents a 41% YoY growth. The company retained 26.6% of the loan originations on its books (“loan originations held for investment”), and sold the remaining origination volume through the marketplace.

The company’s management guided for $13.5 billion in originations in 2022 during the Q1 2022 earnings call and did not revise this guidance during the Q2 2022 earnings call. Therefore, it looks like they expect a slowdown in the origination volumes during the second half of 2022 ($13.5 billion less $7.06 billion already originated in H1 2022 leaves $6.44 billion to originate in H2 2022). I’d guess the management is trying to incorporate economic uncertainty into its guidance.

Loan Book and Deposits

LendingClub finished Q2 2022 with $3.8 billion in loans held for investment (HFI), which represents a 66% growth compared to Q2 2022, and 18% growth sequentially. The company keeps running down its Paycheck Protection Program (PPP) book, and increasing its consumer and commercial loans book.

In particular, as can be seen from the loan book breakdown below, the growth comes primarily from the company’s program to retain unsecured personal loans. Interestingly, the company keeps underwriting equipment finance and commercial real estate loans, the expertise they “inherited” from the acquisition of Radius Bank. I haven’t heard the management addressing this topic in detail, so it is difficult to comment on what is the company’s strategy for this segment.

LendingClub finished Q2 2022 with $4.53 billion in deposits, which represents a 78% growth compared to Q2 2022, and a 14% growth sequentially. At least for now the company is able to support the growth of its loan book with deposit growth.

It should be noted that the key driver fuelling the deposit growth at LendingClub is the money market accounts (see the market below). Essentially, LendingClub is offering highly competitive rates on savings accounts (money market accounts), instead of relying on the balances from the customers that it already serves (consumers or businesses). As of this writing, LendingClub was offering 2.07% APY.

Revenue

LendingClub reported $330.1 million in revenue (net interest income + non-interest income) for the quarter, which represents a 62% growth compared to Q2 2021. Net interest income reached the level of $116.2 million, up 153% YoY, and non-interest income reached the level of $213.8 million, up 35% YoY.

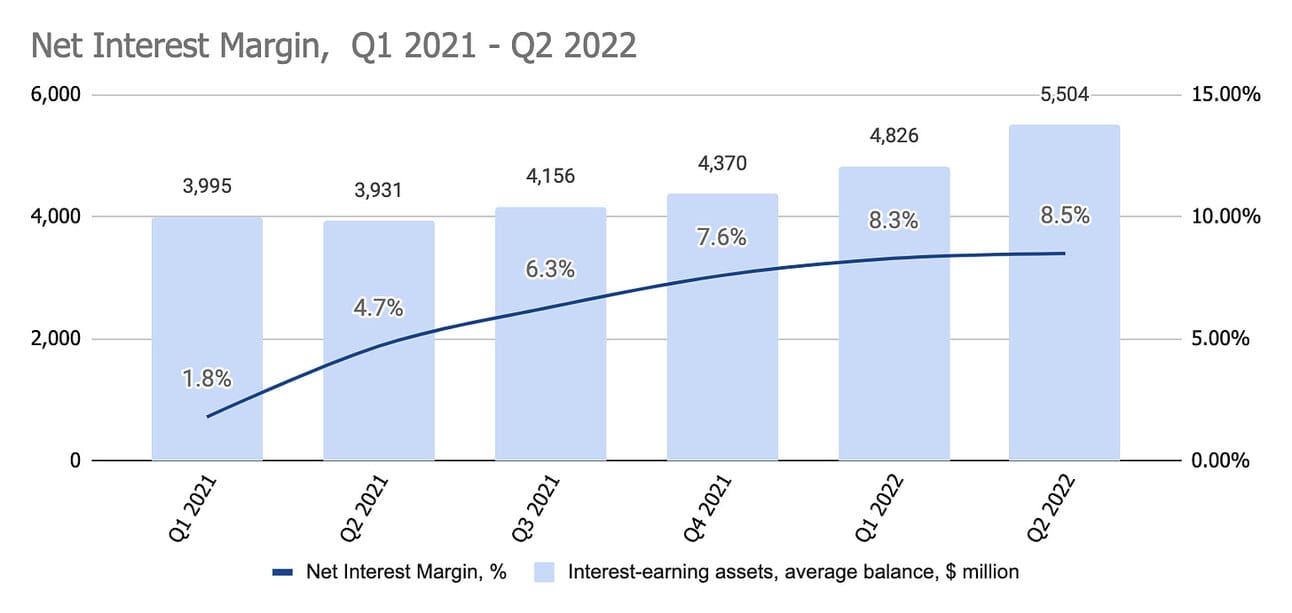

The buildup of the loan book continues driving interest income growth, but, on top of that, LendingClub managed to improve its Net Interest Margin (net interest income over interest-earning assets, such as loans and cash). As can be seen from the chart below, the NIM margin grew from 4.7% in Q2 2021 to 8.5% in Q2 2022. The improvement is driven by the rundown of the PPP loan book, as well as the continued build-up of the high-yielding personal loan book.

The company’s management guided for $280 to $300 million in revenue in Q3 2022, and $1.15 to $1.25 billion in revenue for the full year. The full-year guidance implies revenue of $530 to 630 million in H2 2022, meaning flat or decreasing for the rest of the year (driven by the lower origination volumes, and thus, lower non-interest income).

In the light of the expected decline in the origination volumes in H2 2022 (as per the guidance discussed above), I believe an important decision that the company’s management will have to make in Q3 and Q4 2022 is what share of originations to retain on the company’s books. Keeping a lower proportion of origination will support the revenue in the short term (through marketplace fees), while a higher proportion will support the revenue in the medium term (through interest income in the next quarters).

Operating Expenses and Provisions

LendingClub reported $209.4 million in non-interest expenses (operating expenses) for the quarter, which represents a 31% growth compared to Q2 2021, and a 10% growth sequentially. As I noted in my previous review, the beauty of LendingClub is that the non-interest income (income that the company earns through its marketplace) is covering the non-interest costs.

As the revenue grew at a faster pace than the operating expenses, the Efficiency Ratio (non-interest expense over the total net revenue) improved for YoY and sequentially. Thinking a bit ahead, I would expect this ratio to continue declining if the company continues originating a sufficient volume of loans to cover its non-interest expenses with non-interest income (while the interest income will continue compounding with the growing loan book).

On top of the non-interest expenses, the company booked $70.1 million in provisions for credit losses in the quarter (credit loss expense), which represents 6.86% of the loan origination volumes. According to CECL, the company is booking provisions for originated loans based on the expected losses. As the company continues building its loan book, provisions (and actual charge-offs) will play an important role in its profitability (especially if the economic situation worsens).

Net Income

The company reported $182.1 million in Net Income for the quarter, BUT it booked the tax benefit of $135.3 million. Excluding the tax benefit, the company generated $46.8 million in Net Income, which represents a 398% growth YoY and a 15% growth sequentially.

The chart below perfectly illustrates the impact of LendingClub acquiring Radius Bank. As you can see, the Net Income keeps growing from quarter to quarter, as the company is accumulating more loans on its balance sheet. In my previous reviews, I wrote that my investment thesis doesn’t rest on the loan origination growth, but rather on LendingClub building a loan book by retaining a share of originations (and thus growing interest income). With the origination growth slowdown (as per the guidance) this thesis will be put to the test.

The company’s management guided for a Net Income of $30 to $40 million in Q3 2022, and a Net Income of $145 to $165 million for the full year 2022 (excluding the tax benefit of $135 million booked in Q2 2022). This guidance implies not only a decline in Net Income in Q3 2022, but also a further decline in Q4 2022 (i.e. $165 million - $40.8 million (Q1) - $46.8 million (Q2) - $40 million (Q3) = $37.4 million in Q4 2022).

LendingClub’s management is notorious for giving conservative guidance. This time they seem to have incorporated to following concerns: a) slowdown in originations in consequently lower revenue in H2 2022, and b) higher provisions and consequently lower net income in H2 2022. However, given the economic uncertainty, this is understandable.

Things to Watch for the rest of 2022

Loan origination volumes. The company’s management is clearly guiding for a negative impact of the weakening economy on loan origination volumes. However, I believe no one can estimate at this point how ugly things will turn out. In theory, a mild recession might benefit LendingClub as consumers start refinancing their credit card debt to lower expenses, but recessions are rarely good for lenders.

Share of retained loans. If the origination volumes indeed decrease due to the economic situation, it will be up to the company’s management to decide whether to sell more of those loans via its marketplace (boosting short-term revenue) or keep building its own loan book. Of course, there is also a risk of marketplace activity halting in case of a severe recession.

Provisions for credit losses. My interpretation of the Net income guidance is that the company’s management expects higher provisions for credit losses in the coming quarters, and given economic uncertainty this is understandable. Provisions for credit losses and actual charge-offs will serve as an indication of the quality of LendingClub’s loan originations.

In summary, nothing fundamentally new was reported by the company’s management this time. The company keeps building its own loan book, which will boost interest income over time. There is clearly uncertainty ahead, which will / might impact origination volumes and thus, revenue, as well as require the company to put aside more money in the form of provisions. However, over the longer-term LendingClub is on the right path to becoming a highly profitable company.

Source for all financial information: Investor Relations

Disclosure & Disclaimer: despite rocky performance in 2021 and early 2022, I own stock in most of the companies covered in this newsletter, as I am extremely bullish on the transformation in the financial services industry. However, none of the above is financial advice, and you should do your research.