In February 2020, LendingClub announced the acquisition of Radius Bank, intending to create the first “marketplace bank”. The strategy was to retain a portion of the loan originations on the company’s balance sheet, over time building a loan portfolio that can provide an income “cushion” for the periods, when the demand for marketplace loans weakens. A year later, LendingClub completed the acquisition and we got to witness the company’s loan portfolio growing consistently, quarter over quarter, reaching $4.5 billion by the end of the last reporting cycle.

Last week LendingClub reported its Q3 2022 results, and the key takeaway was that the demand for marketplace loans finally started weakening. Investors increased their return expectations as the Federal Reserve keeps rising rates, and the company is being cautious about passing through those rate increases to the borrowers. The uncertainty about the economy doesn’t give a reason to believe that this is a temporary bump on the road, so, I guess, we now get to witness a period of that on-balance-sheet portfolio being the key revenue driver.

Let’s review the company’s Q3 2022 results, but before we do that…I believe LendingClub’s management deserves a round of applause for buying Radius Bank. It would be a very sad earnings report if not for the banking charter.

If you are new to LendingClub, I suggest reading my previous reviews:

Loan Originations

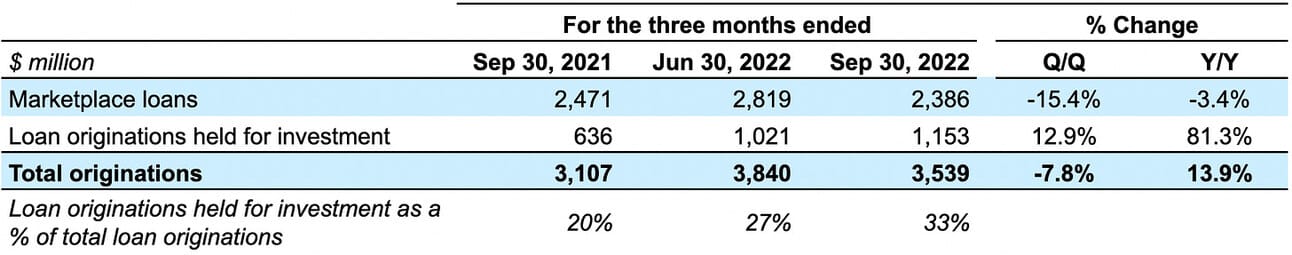

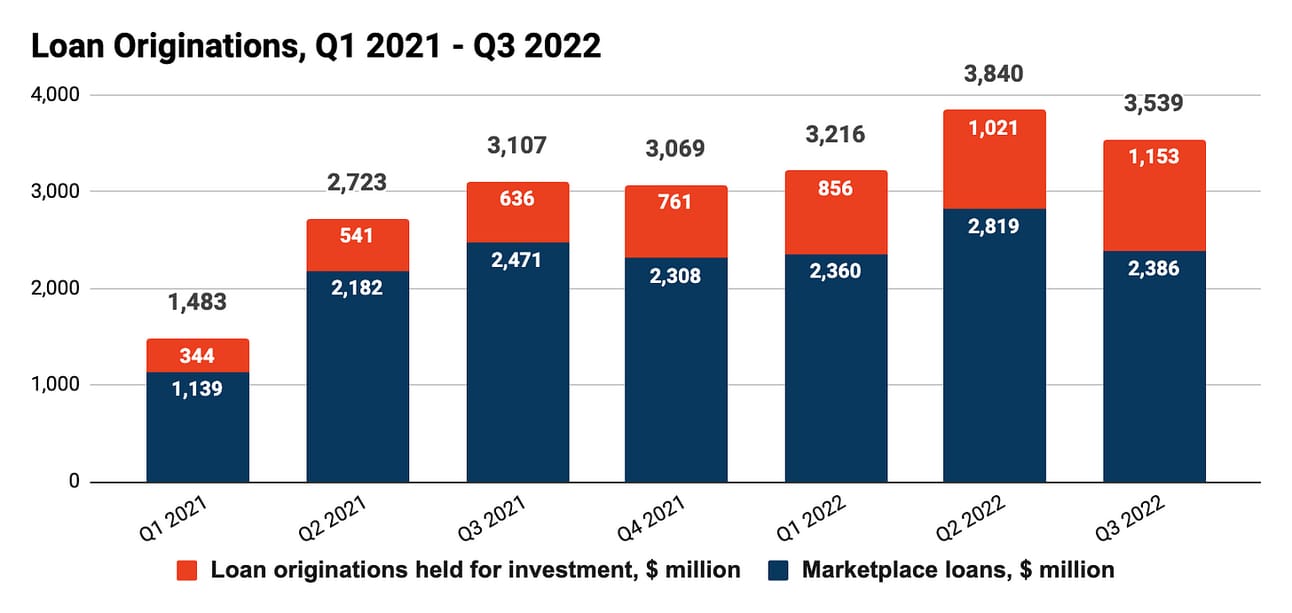

LendingClub reported $3.54 billion in loan originations in Q3 2022, which represents a 13.9% increase compared to Q3 2021, and a 7.8% decline compared to the previous quarter. The company retained 32.6% of the total originations on its balance sheet (“Loan originations held for investment” in the table below) and sold the remaining 67.4% through its marketplace (“Marketplace loans” in the table below). This was the higher percentage of retained loans since the company started building its loan book after completing the acquisition of Radius Bank.

The sequential decline in loan originations is the result of weaker demand from institutional investors. Thus, as you can see from the chart below, the volume of loans sold through the marketplace declined by $433 million or 15% compared to the previous quarter. If you follow Upstart, a competing online lender, then weakening demand from institutional investors should not be a surprise. Federal Reserve is raising rates rapidly, and online lenders struggle to pass the rate increase to borrowers (to provide an attractive return for loan buyers).

Luckily, LendingClub has its own balance sheet and can fund a portion of loan originations using deposits (in retrospect, buying Radius Bank was a genius move). However, its capacity to retain loans is determined by the growth in deposits, sufficiency of capital, and the management’s willingness to sacrifice profits in the short term (the company needs to book provisions for credit losses that negatively impact net income).

Loan Book and Deposits

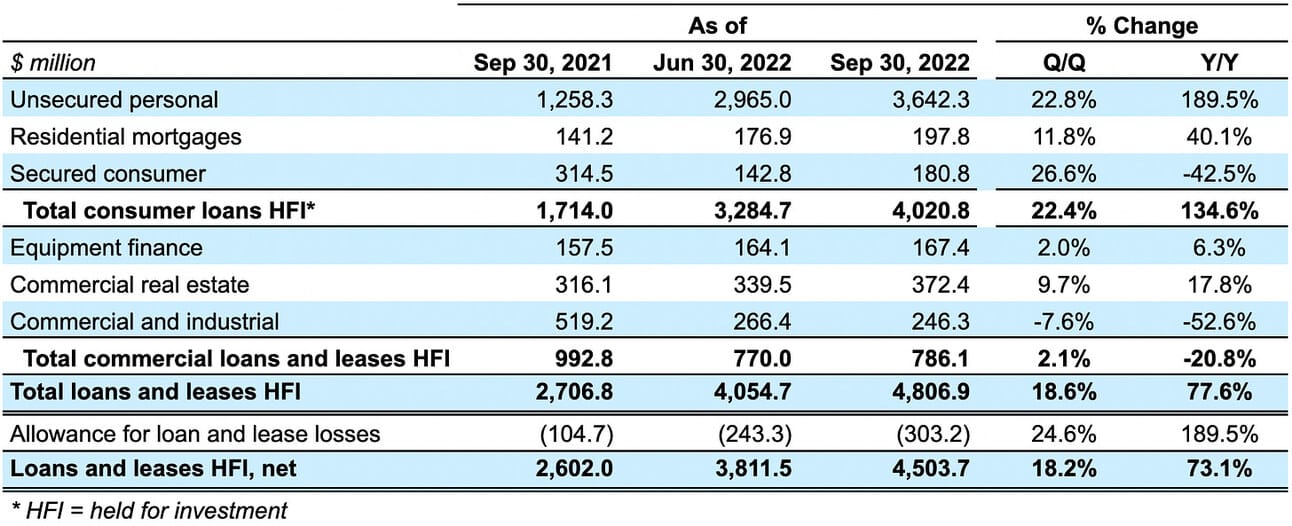

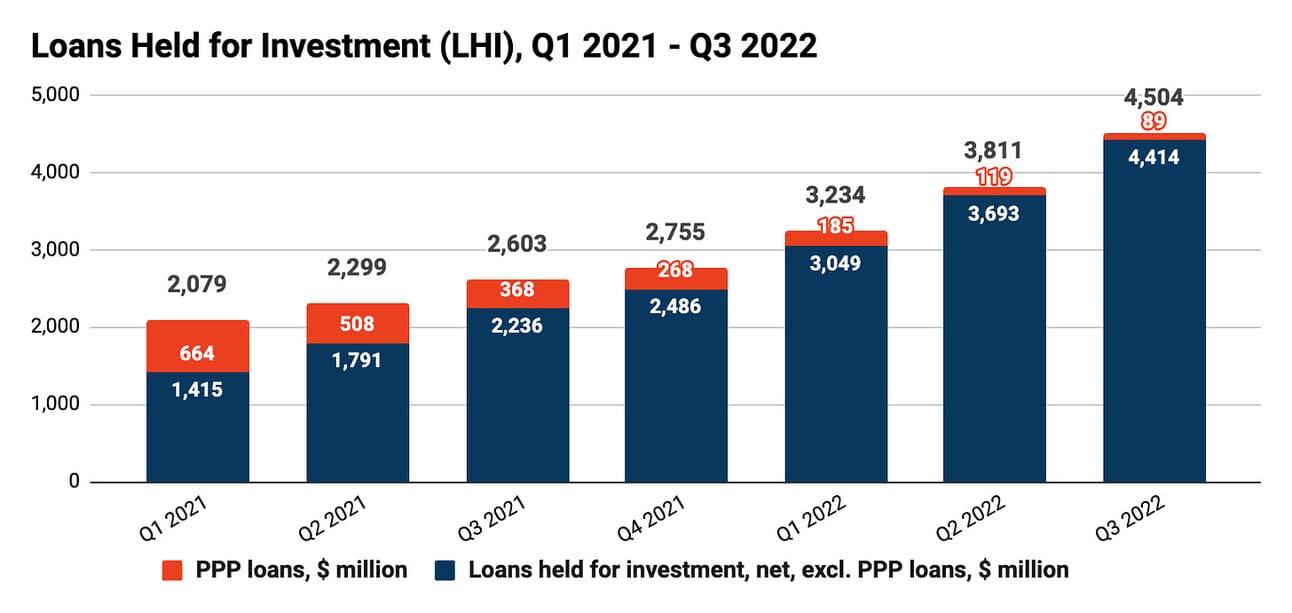

At the end of Q3 2022, LendingClub had $4.5 billion in loans on its balance sheet (net of allowance for losses), representing a 73.1% increase compared to Q3 2021 and an 18.2% increase to the previous quarter. Unsecured consumer loans represented 76% of the total loan book at the end of the quarter, up from just 46% a year ago, as the company continued to run down commercial and industrial (including loans issued under the Paycheck Protection Program), as well as secured consumer loan portfolios.

The company’s management continues to methodically build a portfolio of high-yield personal loans, a strategy that they committed to with the acquisition of Radius Bank. What I am curious about is what happens next. If my calculation is correct, then retaining 20-25% (and even 30%) of the total originations will start having only a marginal income impact in late 2023 / late 2024 (as the volume of retained loans will be almost equal to amortization of the portfolio). Thus, LendingClub will have to either retain a larger share of originations (to the point of keeping all of them) or build a new lever of growth (i.e. commercial lending).

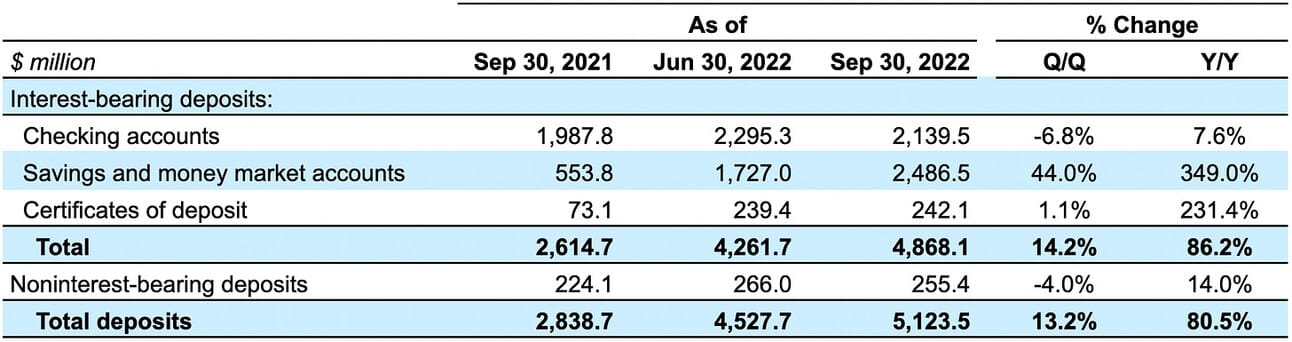

LendingClub reported $5.1 billion in total deposits at the end of the quarter, which represents an 80.5% increase compared to Q3 2021, and a 13.2% increase sequentially. The company keeps building its deposit base by offering competitive rates on savings accounts (3.12% APY as of this writing). As can be seen from the breakdown below, the balance on the savings accounts increased by 349% compared to Q3 2021, and 44% sequentially, while the balance on the checking accounts remained almost unchanged.

As per the management’s comments during the earnings call, high-yield savings accounts will remain the key source of funding in the near future. It should also be noted, that the company “inherited” from Radius Bank a portfolio of business clients, which are an additional source of potential funding. At least for now, it doesn’t look like deposits would be a limiting factor for growth in the short term.

Revenue

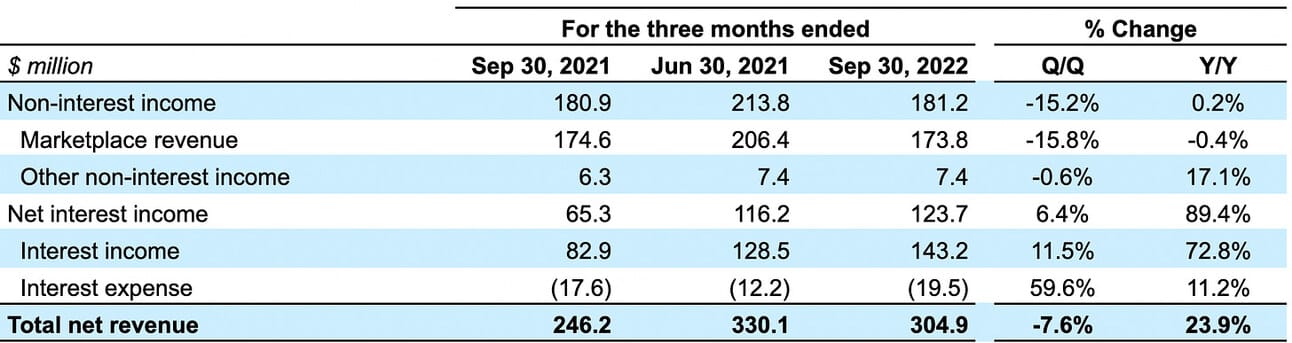

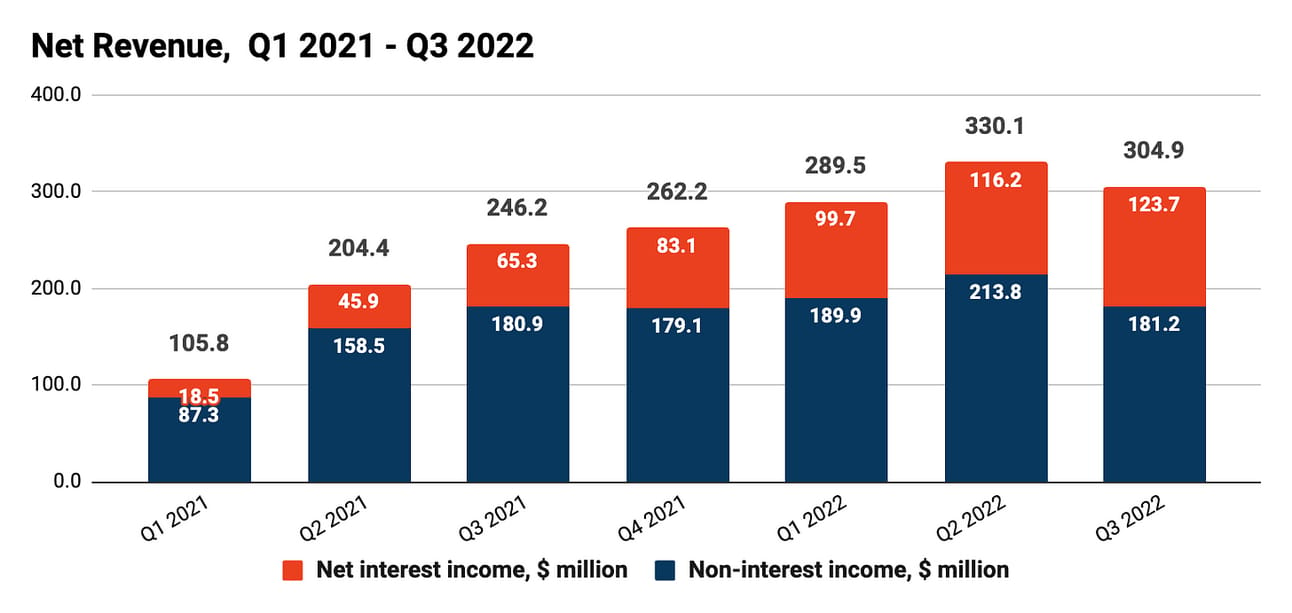

LendingClub reported $304.9 million in revenue for the quarter, which represents a 23.9% increase compared to Q3 2021, and a 7.6% decline sequentially. Net interest income contributed 40%, and non-interest income contributed 60% of the total net revenue. A year ago, the net interest income share in the total income was 27%.

The sequential decline in net revenue was the result of the lower origination volume, and specifically, the lower volume of loans sold through the marketplace. Thus, marketplace revenue declined by $32.5 million or 15.8% compared to Q2 2022. Again, drawing parallels to Upstart, this quarter was a clear illustration of the drawbacks of the marketplace model, as a decline in volume translated into an immediate decline in revenue.

Net Interest Margin (net interest income over average interest-earning assets) stood at 8.3%, which represents an increase from 6.3% in Q3 2021 and a decrease from 8.5% in Q2 2022. The change compared to the previous year was the result of the increased share of high-yield personal loans in the portfolio, while the sequential decline was the result of a higher cost of funding (read APY offered on high-yield savings accounts).

Scott Sanborn, the company’s CEO, spoke on the earnings call about a lag between the fed funds rate hikes and the increases in the rates offered by LendingClub to borrowers. Thus, to stay competitive, the company increases rates only after credit card companies increase their rates (“the Fed moves, then the credit cards move, and then we move”), which happens after 1-2 billing cycles. In any case, the trajectory of the Net Interest Margin is something to monitor closely.

The company’s management guided for $255-265 million in total net revenue in Q4 2022 and $1.18 - 1.19 billion in total net revenue for the full year. This would represent a -3% to 1% change compared to total net revenue in Q4 2022, and a 13-16% decline in total net revenue sequentially.

As the loan book continued to increase during the quarter, net interest income in Q4 2022 will be higher. Thus, the sequential decline in revenue should come from an even smaller volume of loans sold through the marketplace.

Operating Expenses and Provisions

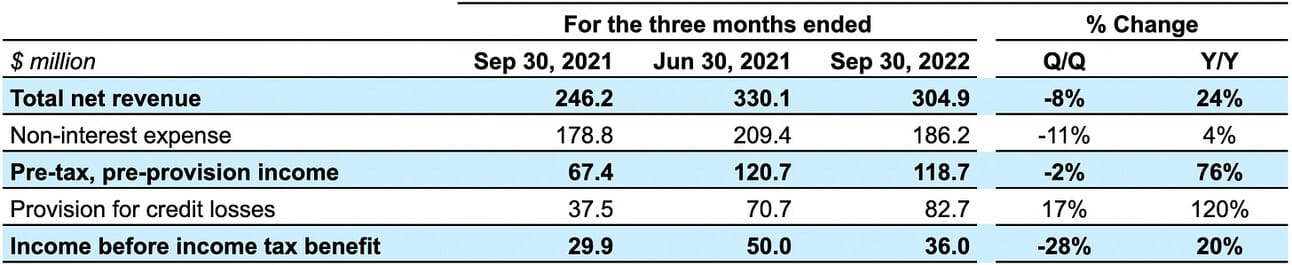

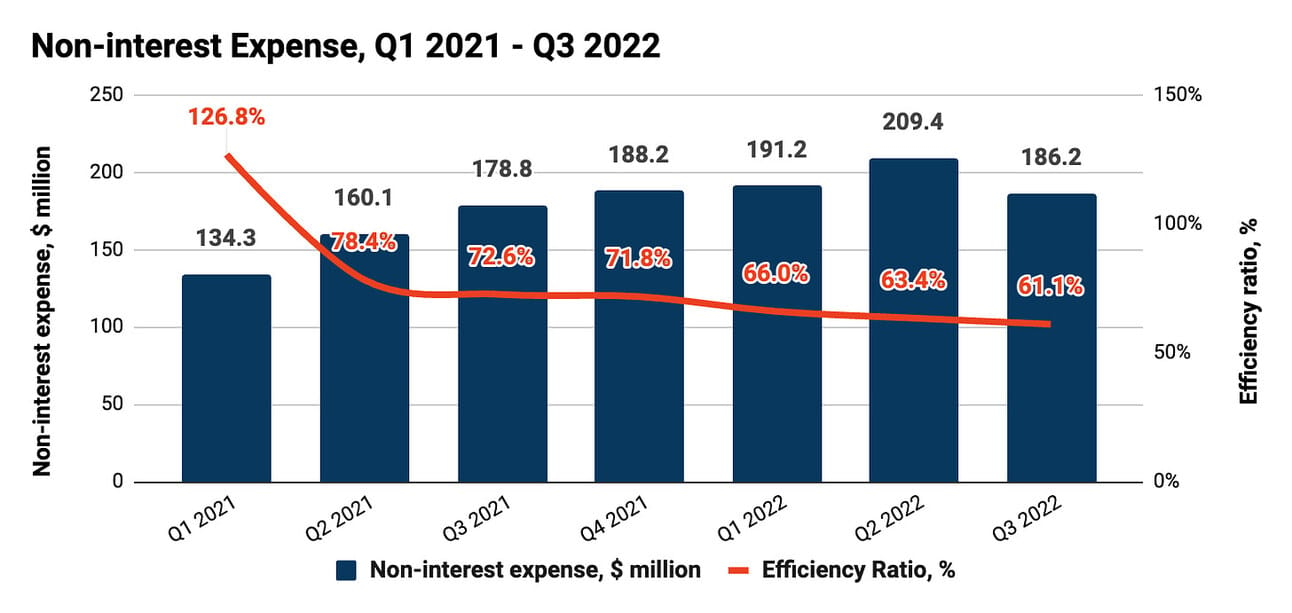

In Q3 2022, LendingClub reported $186.2 million in non-interest expenses, which represents a 4% increase compared to Q3 2021, and an 11% decline sequentially. The company also booked $82.7 million in provisions for credit losses, which represents a 120% increase compared to Q3 2021, and a 17% increase sequentially. As the result, income before income tax benefit stood at $36.0 million.

LendingClub continued to improve its operating efficiency. Thus, the efficiency ratio (non-interest expense over total net revenue) declined sequentially from 63.4% in Q2 2022 to 61.7% in Q3 2022, despite lower revenue (although it sounds illogical, a lower efficiency ratio is better). It should be noted, however, that the decline was primarily driven by lower marketing spend, as the company faced weaker loan demand from marketplace investors. Marketing expenses as % of loan originations declined from 1.6% in Q2 2022 to 1.3% in Q3 2022.

The sequential increase in provision for credit losses ($82.6 million in Q3 2022 vs. $70.1 million in Q2 2022, see the chart below) is the result of a) a higher volume of loans retained on the balance sheet ($1.02 billion in Q2 2022 vs. $1.15 billion in Q3 2022), and b) a higher provision rate against newly originated loans (6.9% in Q2 2022 vs. 7.2% in Q3 2022). A higher provision rate reflects the management’s expectations of higher losses in the future due to “a less favorable economic outlook”.

LendingClub’s non-interest income continues to (almost entirely) cover non-interest expenses ($181.2 million in non-interest income vs. $186.2 million in non-interest expenses), which means that the interest income (less provisions for credit losses) goes directly to the bottom line.

Net Income

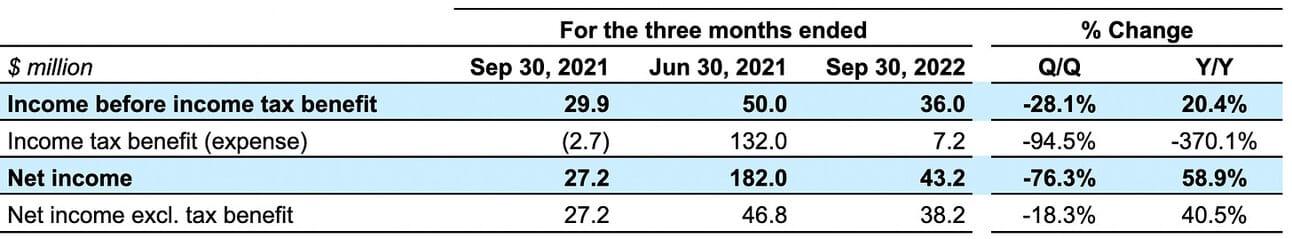

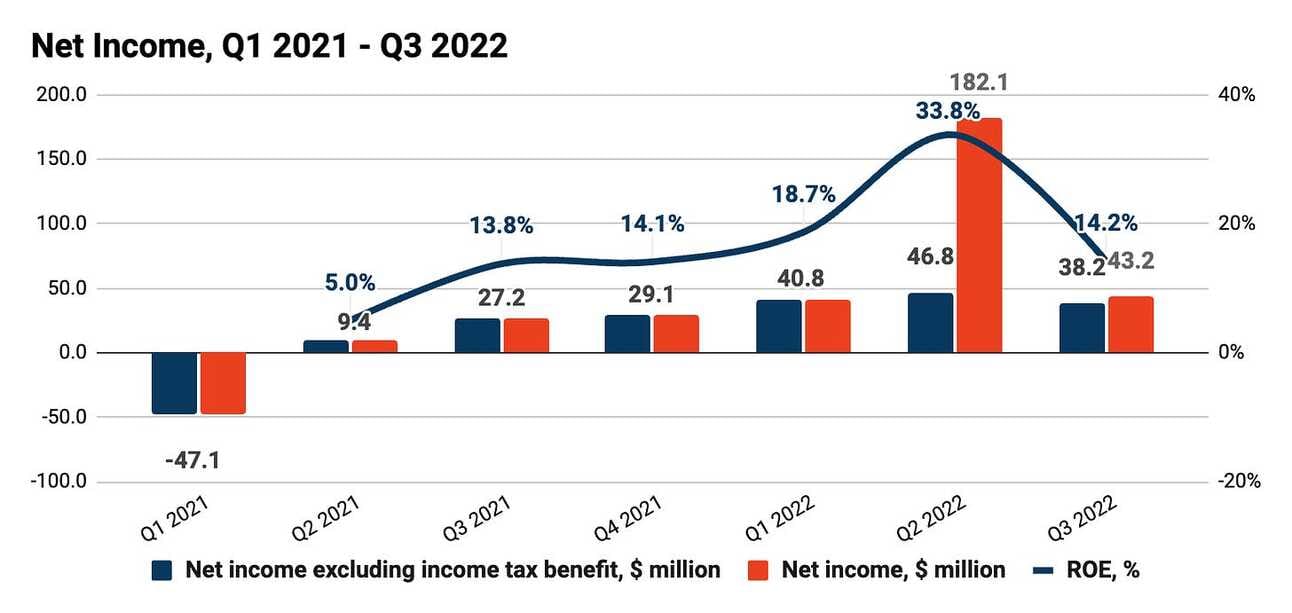

The company reported a net income of $43.2 million for the quarter, which represents a 58.9% increase from Q3 2021, and a 76.3% decline sequentially. In its two latest quarters, LendingClub booked tax benefits, which impacted its net income. Thus, looking at net income excluding the tax benefit might provide a better picture of the current profitability. In Q3 2022, net income excluding tax benefit was $38.2 million, which represents an increase of 40.5% compared to Q3 2021 and an 18.3% decline sequentially.

The company’s management guided for a net income of $15-25 million in Q4 2022, which would represent a 45-62% sequential decline, and a net income of $280-290 million for the full year 2022. The management slightly lowered the upper limit of the guidance (in Q2 2022 the company guided for $280-300 million in net income for the full year), which I believe was the reason for the stock decline post earnings.

I believe LendingClub “matures” as a banking charter holder, Return on Equity (ROE) and Return on Tangible Equity (RoTE) will start getting more attention in the company’s reporting and during the earnings calls. The company delivered a 14.2% ROE in Q3 2022 and finished the quarter with $1.12 billion in common equity.

Things to Watch

Origination volumes. Given the guidance, the management expects the origination volumes to decline further in Q4 2022, which I would expect to be driven by weaker demand from marketplace investors. The current “story” is that the demand is hindered by lower expected returns offered to investors, as the company struggles to pass higher rates to borrowers. However, the economic outlook is not improving, so I wouldn’t be surprised if the demand deteriorates even further as some investors take a pause to see what happens next.

Provisions for credit losses. Provisions for credit losses continue to increase, not only because of the higher loan origination volumes, but also because the company incorporates the economic uncertainty and builds the allowance reserve. If the U.S. economy goes into a recession, it will be the first real stress test for LendingClub’s scoring models (the company was founded before the Global Financial Crisis of 2007-2009, but it operated at a tiny scale back then). Thus, charge-off rates and provisions should get special attention from investors.

2023 guidance. The company is expected to provide guidance for 2023 on the next earnings call, and my main question is what is next? LendingClub’s team has proven that they can execute the “marketplace bank” model (build a high-yield loan portfolio, generate recurring interest income, etc.). However, at some point in late 2023 or early 2024, the build-up of the loan portfolio will stop being an earnings growth driver. I hope the company’s management will start at least penciling in the growth strategy for the coming years on the next earnings call.

In summary, it was a good quarter for LendingClub, but higher interest rates and investor concerns about the economic outlook started negatively impacting the “marketplace” side of the business. Economic prospects are not improving, so the company will have to rely on its own balance sheet until the recession clouds clear. Thanks to the management for getting that banking charter back in the day!

Source for all financial information: Investor Relations

Disclosure & Disclaimer: despite rocky performance in 2021 and 2022, I own shares in most of the companies covered in this newsletter, as I am extremely bullish on the transformation in the financial services industry. However, none of the above is or should be considered financial advice, and you should do your own research.