LendingClub Corporation ( ) held its Q4 2021 earnings call this week (January 26, 2022). The company completed acquisition of Radius Bank on February 1, 2021, so this earnings call illustrated the first (almost) full year of operations under the banking model. The company exceeded its own guidance on originations, revenue and income, delivering another strong quarter and outstanding full year results.

Source: Q4, 2021 Earnings Presentation

A quick intro for those, who are not familiar with LendingClub history: the company was founded in 2006 and initially pursued a peer-to-peer lending model, connecting borrowers with individual investors (and of course, as any FinTech, promising to disrupt the banking industry). Over the years, the company (and pretty much the whole peer lending industry) realised that scalling consumer lending business requires cheap capital (i.e. banks fund their lending via almost free deposits, while peer lenders had to provide double-digit returns to attract individual investors). At first, they started selling the loans to institutional investors, then banks, and eventually decided to become a bank themselves, shutting down the peer-to-peer model.

Following acquisition of Radius Bank, LendingClub started positioning themselves as a “Marketplace Bank”, meaning they would continue selling part of originated loans to institutional investors and banks as before (and generate income via origination fees), but would retain the other part of originations on their balance sheet (and earn interest income through the lifetime of the loan). Over time, interest income is expected to generate sizeable revenue stream, and eventually help the company achieve profitability (LendingClub lost money in all their years of being a public company).

Source: LendingClub Bank Presentation

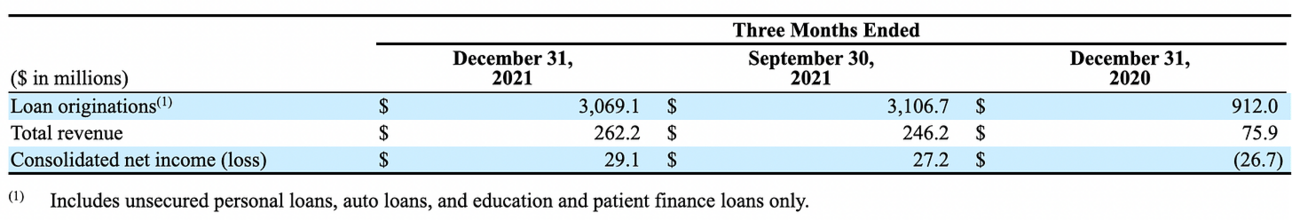

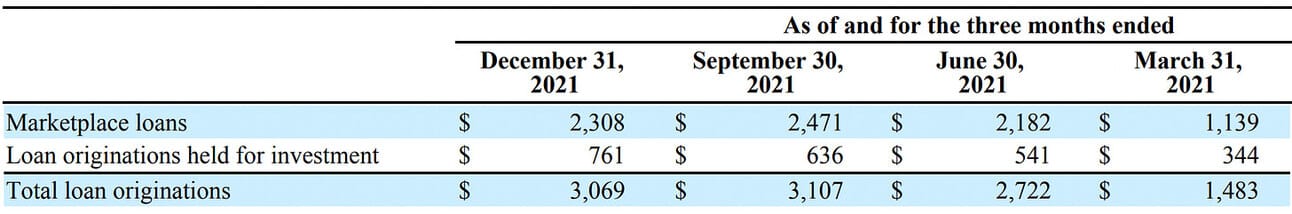

Q4 20221 earnings call clearly illustrated that the “Marketplace Bank” model actually works (LendingClub completed the year with net income for the first time as a public company), but first things first - as for any lender, loan originations volume is the key performance metric. LendingClub originated $3.1 billion in loans in Q4, 2021, and $10.4 billion in loans for the full year.

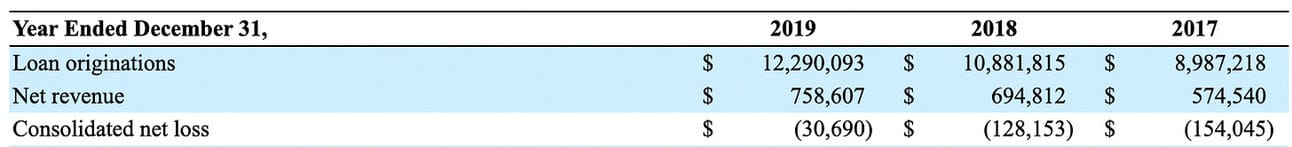

Comparing loan origination volumes with 2020 on either quarterly ($3.1 billion in Q4, 2021 vs $0.9 billion in Q4, 2020, or 250% growth YoY) or annual basis ($10.4 billion in 2021 vs. $4.3 billion in 2020, or 140% growth YoY), might hint for impressive growth; however, this would be misleading. During the pandemic, LendingClub scalled down originations considerably; and thus, 2021 performance looks outstanding. However, comparing 2021 results with previous years, one can see that this was not even the best year for the company in terms of origination volumes, as LendingClub originated $12.3 billion in loans in 2019.

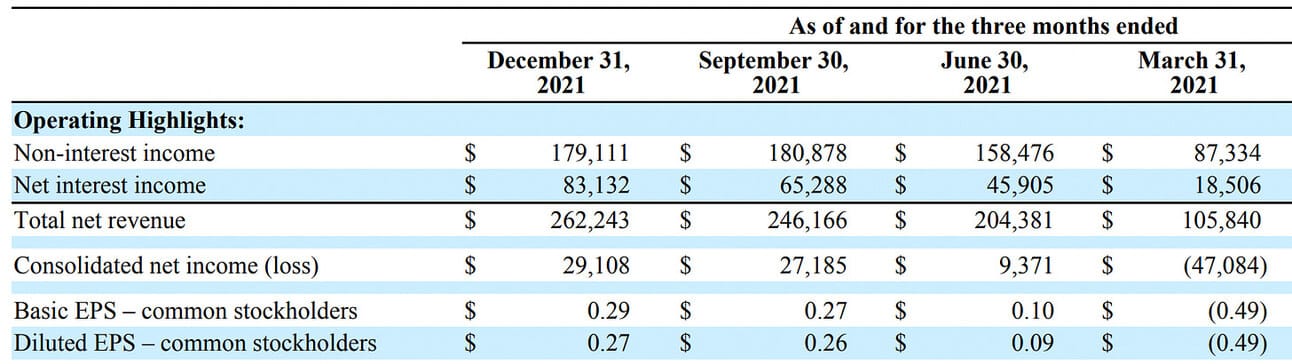

LendingClub generated $262.2 million in net revenue (marketplace revenue and other non-interest income + net interest income from its loan portfolio) in Q4, 2021, and $818.6 million in net revenue for the full year of 2021.

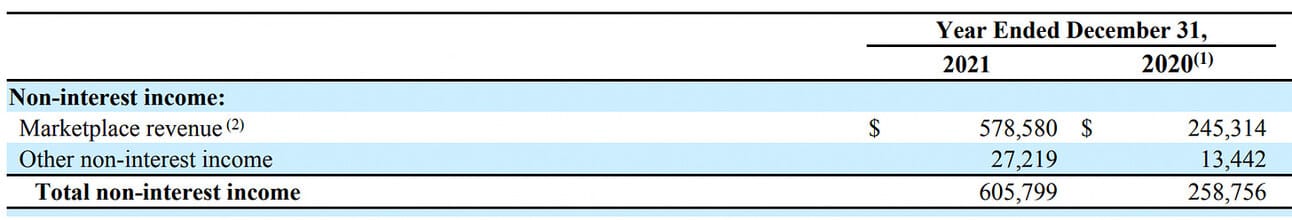

Out of total revenue, marketplace revenue contributed $170.6 million in Q4, 2021 and $578.6 million for the full 2021. In addition to marketplace revenue, LendingClub generates other non-interest income (i.e. cards income, account fees, etc.); thus, the company earned $179.1 million in non-interest income in Q4, 2021, and $605.8 million in non-interest income for the full year.

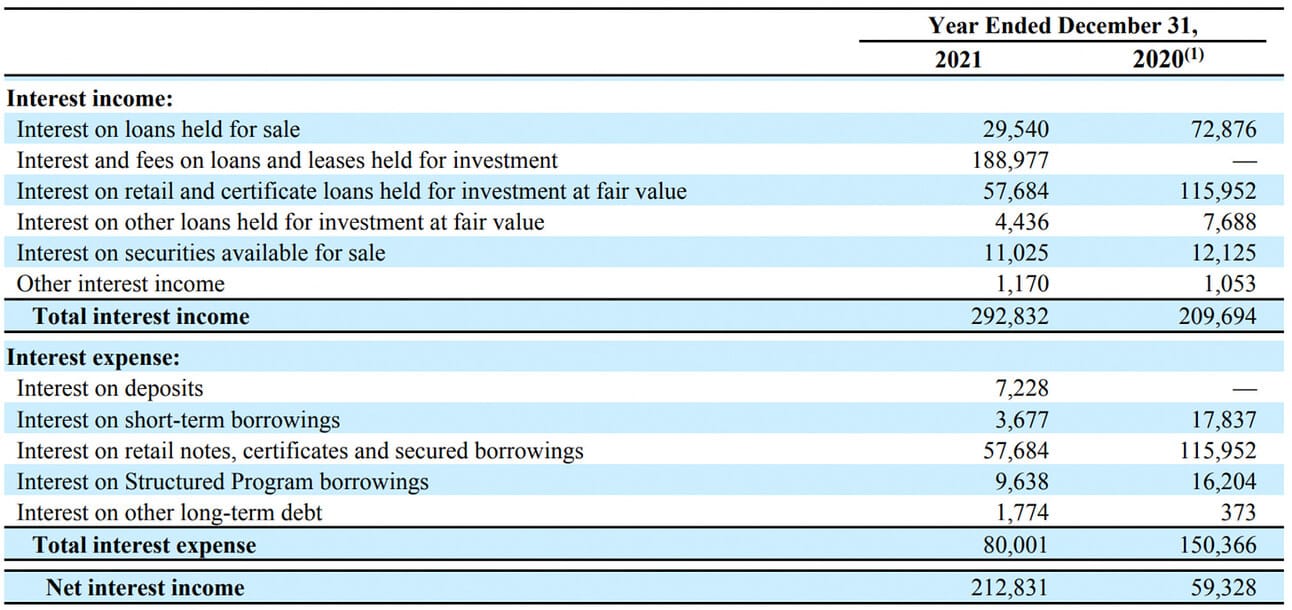

LendingClub generated $83.1 million in net interest income in Q4, 2021 and $212.8 million in net interest income for the full year.

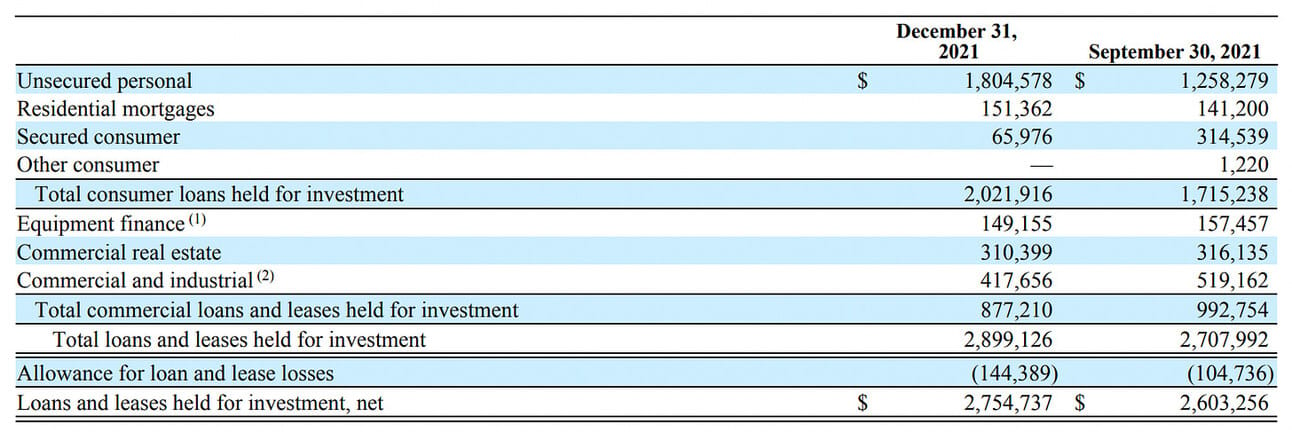

It should be noted that Radius Bank had a loan portfolio prior to acquisition, but the key driver for the interest income in 2021 were consumer loans generated by LendingClub. The breakdown below illustrates that “Unsecured personal loans” generated $60.4 million (or 72%) out of total net interest income of $83.1 million.

Following acquisition of Radius Bank, management of the company voiced the ambition to retain 15-25% of the originated loans, which they executed well in 2021 and expected to continue doing in 2022. In its first year of operating under “Marketplace Bank” model, the company sold $8.1 billion in originated loans via its marketplace, and retained $2.3 billion (or 22% of total originations) on its balance sheet (“Loan originations help for investment”).

At the end of the year, LendingClub held $1.8 billion in unsecured consumer loans on their balance sheet. The rest of the loan book includes loans originated by Radius Bank, such as mortgages, commercial real estate loans, and loans issued under Paycheck Protection Program (PPP). LendingClub stopped issuing some of these loans (i.e. mortgages) and PPP loan book is running down quickly; thus, high yielding consumer loans will contribute higher share of the loan book in the future.

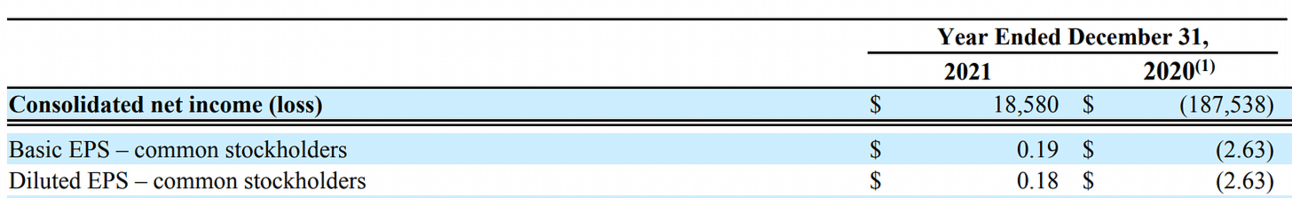

As the result of recovering origination volumes to pre-pandemic levels, as well as increasing net interest income, LendingClub managed to generated net income for the first time in company’s history. Thus, the company generated $29.1 million in net income in Q4, 2021, and $18.6 million for the full 2021.

The transformation is even better visible if one looks at the evolution of income throughout 2021 by quarter. Thus, non-interest income doubled from Q1, 2021 to Q4, 2021 due to the growth in origination volumes, and net interest income increased almost 4.5 times due to the growing loan book. As mentioned earlier, the “Marketplace Bank” model translated into tangible results already in its first year.

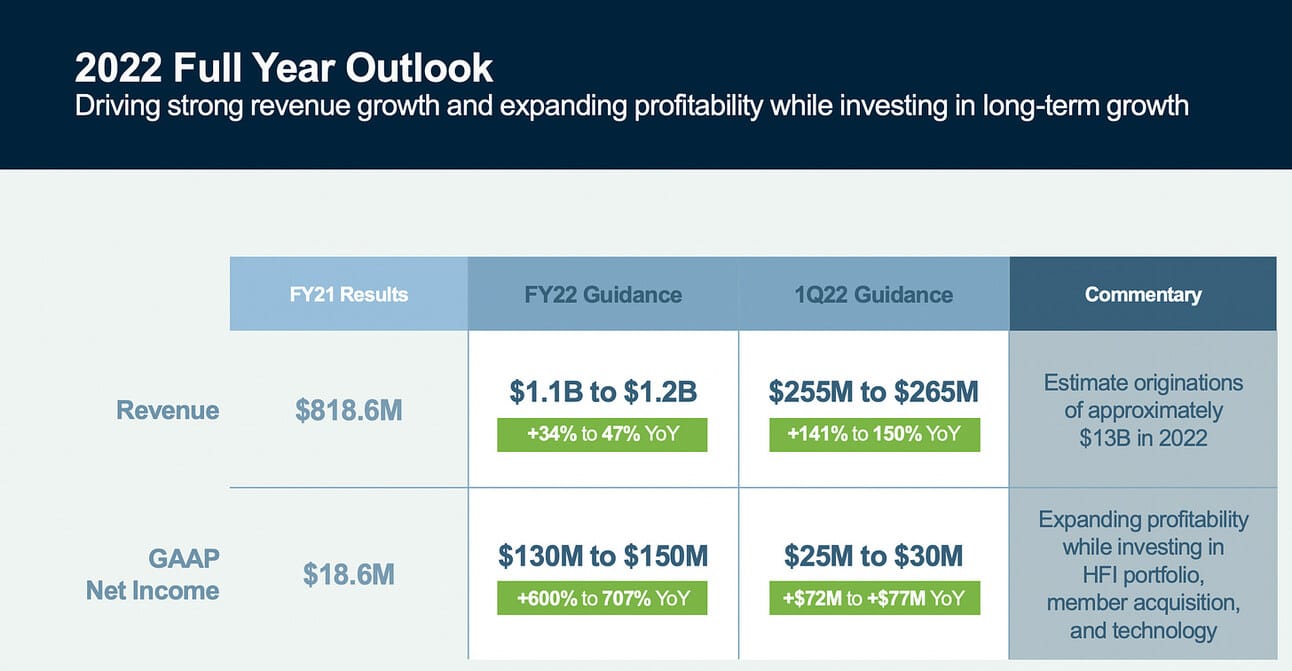

Looking ahead at 2022, management gave guidance of $130 to $150 million in income on $1.1 to 1.2 billion net revenue. The company also guided for $13 billion in originations, which, as mentioned above, would be the all time record beating the $12.3 billion originated in 2019 (but nevertheless being reasonable forecast given originations in the last quarters of 2021).

Source: Q4, 2021 Earnings Presentation

Despite a record guidance on originations and income, company’s agenda for 2022 (as expressed by management comments during the call) is quite uneventful. Thus, the company will continue building the loan book by retaining 15—25% of the originated loans, and will invest in technology to fully integrate Radius Bank into LendingClub operations.

Management did not indicate any upcoming product launches, and reiterated their dedicated focus on fully transitioning to the Marketplace Bank model. Thus, the things to watch in 2022 are

Origination volumes. Management has been quite cautions in giving guidance during 2021, which allowed them to consistently exceed expectations (can they do it in 2022 as well?)

Share of retained loans. Management reiterate intention to keep 15-25% of the originated loans on their balance sheet; however, given expected $13 billion in originations, this is quite a wide range of $1.95 to $3.25 billion.

Growth of the loan book. As illustrated above, LendingClub originates high yielding consumer loans that increase overall yield on the total loan book. Thus, both the size of the book and the yield are expected to grow considerably

In summary, it was a great year for LendingClub and the bet on buying Radius Bank and the “Marketplace Bank” model started translating into profits already in the first year!

Source for all financial information: LendingClub Quarterly Fillings

Disclosure & Disclaimer: despite rocky performance in 2021 and early 2022, I have open positions in most of the companies covered in this newsletter, as I am extremely bullish on the transformation in the financial services industry. However, none of the above is financial advice, and you should do your research.