Please note that Affirm’s fiscal year ends on June 30. Thus, Affirm’s Fiscal Year Q1 2023 (referred to as FY Q1 2023) is Calendar Year Q3 2022 (referred to as Q3 2022). I will mostly operate with calendar year quarters in the text below.

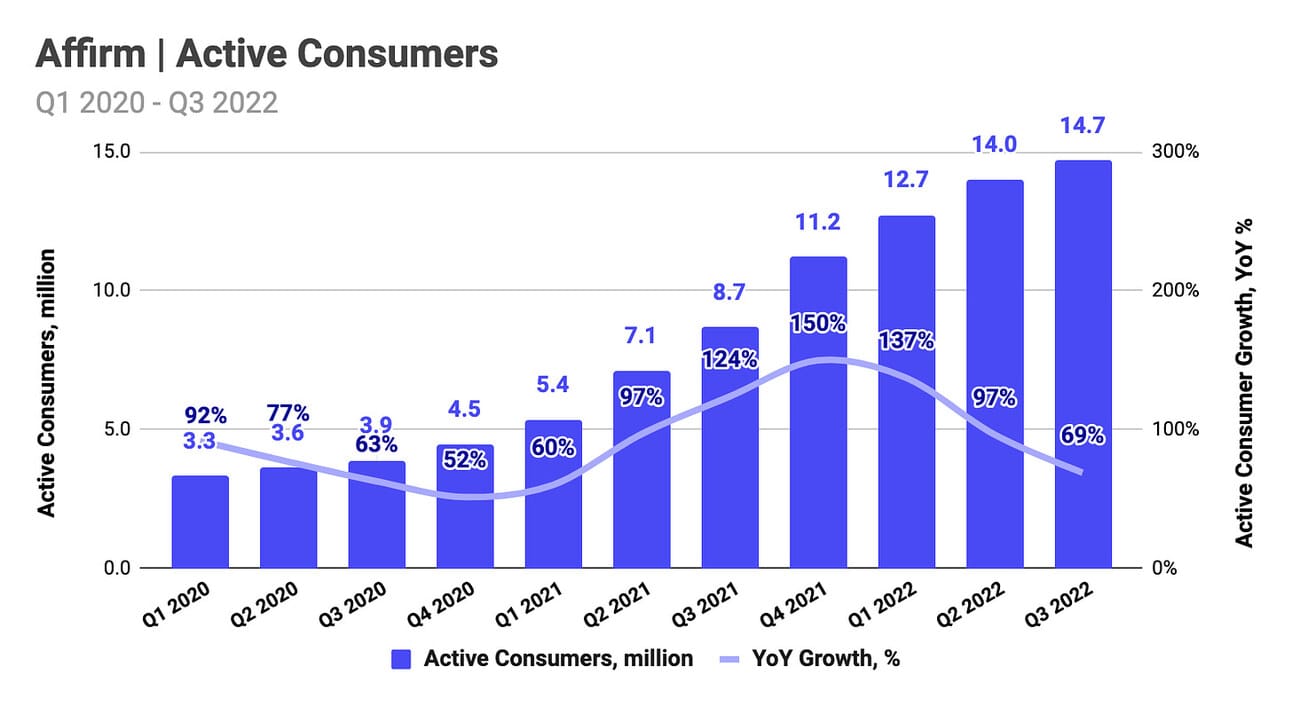

That’s been two years since Affirm (NASDAQ: ) went public, and the company’s growth since its last quarter of being private has been nothing short of spectacular. The number of active consumers increased from 4.5 million at the end of Q4 2020 to 14.7 million at the end of Q3 2022. Quarterly Gross Merchandise Volume grew from $2.1 billion to $4.4 billion, and quarterly revenue grew from $204.0 million to $361.6 million. Affirm also stroke partnerships with such companies as Amazon, Shopify, and Target.

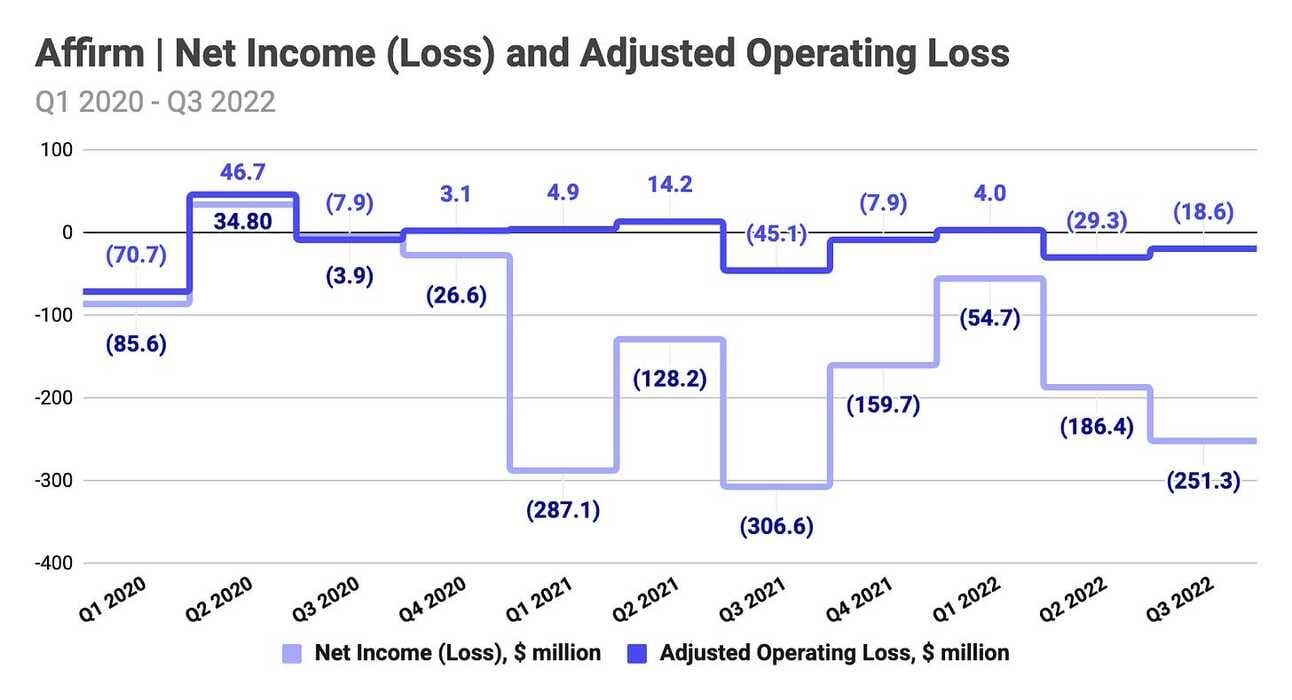

However, Affirm’s Operating Loss increased from $26.8 million in Q4 2020 to $287.5 million in Q3 2022. The company’s management is committed to achieving profitability on an adjusted basis by the end of the Fiscal Year 2023 (Q2 2023), but the path to GAAP profitability is very unclear. Don’t get me wrong, I genuinely want Affirm to succeed, and the company has close to $2.8 billion in cash and equivalents, so is unlikely to run out of money. Nevertheless, it would be good to see at least some proof that Buy Now Pay Later model is financially viable.

If you are new to Affirm, I suggest reading my previous reviews:

Active Consumers and Merchants

Affirm reported 14.7 million active consumers at the end of Q3 2022 (FY Q1 2023), which represents a 69.1% growth compared to Q3 2021, and a 5.0% growth compared to Q2 2022. In addition, the company continued to increase customer engagement, growing the average number of transactions per active consumer from 2.3 in Q3 2021 to 3.3 in Q3 2022. Affirm defines an active consumer as a consumer, who engages in at least one transaction during the last 12 months.

Affirm reported 0.25 million active merchants at the end of Q3 2022 (FY Q1 2023), which represents a 139.6% increase compared to Q3 2021, and a 4.3% increase compared to Q2 2022. As a reminder, in June 2021 Affirm partnered with Shopify on Shop Pay Installments, which allowed merchants, that use the Shopify platform, to offer Affirm as a payment option at their online stores. Affirm defines an active merchant as a merchant, which engages in at least one transaction during the last 12 months.

Gross Merchandise Volume

Affirm reported $4.39 billion in Gross Merchandise Volume in Q3 2022 (FY Q1 2023), which represents a 61.8% growth compared to Q3 2021, and a 0.3% decline compared to Q2 2022. The “Average Order Value” (AOV), or the average transaction amount, declined from $402 in Q3 2021 to $331 in Q3 2022. As noted earlier, the average number of transactions per active user increased from 2.3 to 3.3 during the same timeframe, suggesting an increase in spend per active customer over the last year (average number of transactions multiplied by AOV).

This quarter, Affirm provided a breakdown of Gross Merchandise Volume by product (see the chart below). Thus, the share of interest-bearing loans increased from 54.6% in Q3 2021 to 63.7% in Q3 2022 (FY Q1 2023). In absolute terms, the volume of interest-bearing loan originations increased from $1.48 billion in Q3 2021 to $2.80 billion in Q3 2021 (88.5% YoY growth), the volume of “Pay in 4” loan originations increased from $0.42 billion to $0.78 billion (86.7% YoY growth), while the volume of “Core 0%” loan originations remained unchanged at $0.82 billion.

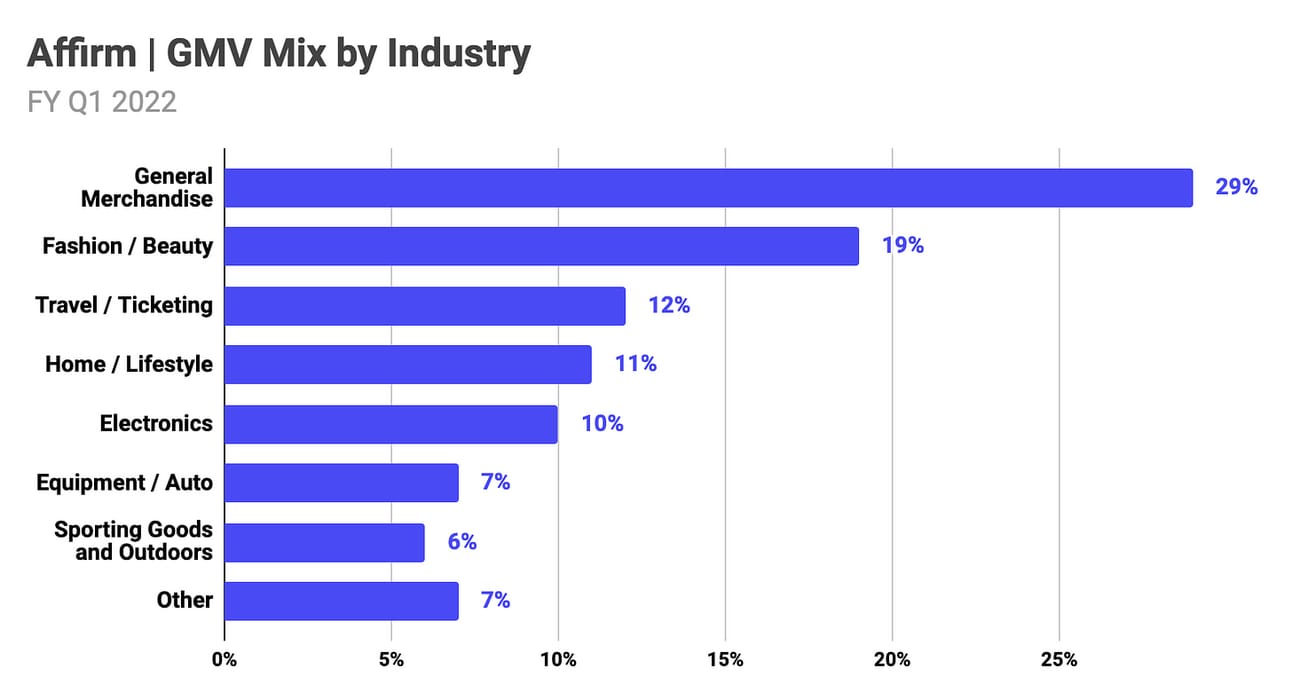

Finally, Affirm continues to provide a breakdown of its Gross Merchandise Volume by the category of the retailer. In Q3 2022 (FY Q1 2023), similar to the previous quarter, the largest category was “General merchandise” (29% of GMV), which includes such retailers as Amazon, Walmart, and Target, followed by “Fashion / Beauty” (19% of GMV), “Travel / Ticketing” (12% of GMV), “Home / Lifestyle” (11% of GMV) and others. The share of the “General merchandise” category increased from 23% in the previous quarter, as it continues to grow at an incredible pace of 508% YoY.

The company’s management guided for GMV of $5.73 to $5.83 billion in Q4 2022 (FY Q2 2023), which implies a 29-31% growth compared to Q4 2021, and GMV of $20.50 to $21.50 billion for the full Fiscal Year 2023 (Q3 2022 - Q2 2023). Previously, the company’s management guided for GMV of $20.50 to $22.0 billion for the full Fiscal Year 2023.

Loan Portfolio

Affirm reported the Total Platform Portfolio of $7.30 billion at the end of Q3 2022 (FY Q1 2023), which represents a 46.0% increase compared to Q3 2021, and a 2.8% increase compared to Q2 2022. The company held $2.68 billion, or 36.7%, of the Total Platform Portfolio on its balance sheet (“Loans Held for Investment”). Moreover, 62% of the on balance sheet portfolio was securitized (meaning loans were pledged as collateral in securitizations). Thus, only about $1 billion in loans were truly “owned” by the company at the end of the quarter.

Affirm reports a breakdown of its on balance sheet portfolio (“Loans Held for Investment”) in terms of interest-bearing and 0% APR loan balances. Thus, in Q3 2022 (FY Q1 2023) the average 0% loan balances represented 37% of the total on balance sheet portfolio, compared to 41% in Q3 2021, and 36% in Q2 2022. At the end of Q3 2022 (FY Q1 2023), the weighted average remaining term was 13 months for the Total Platform Portfolio, and 9 months for the on balance sheet portfolio, compared to 15 and 11 months respectively a year ago.

In stark contrast to other online lenders, Affirm does not seem to have issues with securing funding for its originations. Thus, the company increased its funding capacity by $470 million through multiple instruments (forward flow, warehouse, and asset-backed securitization), finishing the quarter with $11.1 billion in total funding capability. Please note that due to the low average duration of the loans that the company currently originates, this funding capacity allows Affirm to fund more than $24 billion in annual Gross Merchandise Volume. At the end of Q3 2022 (FY Q1 2023), only 66% of the company’s funding capacity was utilized.

Revenue

Affirm reported $361.6 million in revenue in Q3 2022 (FY Q1 2023), which represents a 34.2% increase compared to Q3 2021, and a 0.7% decline compared to Q2 2022. “Network revenue” contributed 38.7% of total revenue and grew 25.3% YoY, “Interest income” contributed 37.8% of total revenue and grew 16.6% YoY, “Gain on sales of loans” contributed 17.6% of total revenue and grew 105.3% YoY, and “Servicing income” contributed 5.9% of total revenue and grew 125.8% YoY.

Revenue growth in Q4 2021 (34.0% QoQ) was the outcome of a holiday season coinciding with Affirm fully rolling out its partnerships with Shopify and Amazon. However, as you can see from the chart below, the company’s revenue has plateaued since. “Network revenue” and “Gain on sales of loans”, which represented 56.3% of the company’s revenue in Q3 2022 (FY Q1 2023), are primarily driven by Gross Merchandise Volume, while “Interest income” and “Servicing income”, which represented the remaining 43.7% of the company’s revenue, are primarily driven by the size of the portfolio (owned or serviced by Affirm).

“Network revenue” grew slower than GMV (25.3% YoY vs. 61.8% YoY), which can be explained by the compression of the gross take rate (network revenue divided by GMV). As the chart below illustrates, Affirm’s take rate declined from 4.1% in Q3 2021 to 3.2% in Q3 2022. There were two reasons for that. First, as I mentioned earlier, the share of “Core 0% APR” loans in total GMV declined from 30.1% in Q3 2021 to 18.6% in Q3 2022 (Affirm charges 10%+ network fee on 0% APR loans, compared to single-digit fee on interest-bearing loans). Second, in Q4 2021 the company fully onboarded Amazon, which is clearly paying a much lower network fee than other merchants (you can see a drop in the take rate taking place in Q4 2021)

The company’s loan portfolio (“Loans Held for Investment”) increased by 19.7% compared to a year ago (from $2.24 billion in Q3 2021 to 2.68 billion in Q3 2022), while the interest income increased only by 16.6%. Interest income growth was driven by the growth of the on balance sheet loan portfolio and the increase of the share of interest-bearing loans, but was partially offset by the declining yield. As discussed above, the share of the interest-bearing loans in the on balance sheet portfolio increased from 59% in Q3 2021 to 63% in Q3 2021, and as you can see from the chart below, the annualized portfolio yield (interest income divided by the average loan balance) declined from 22.0% in Q3 2021 to 21.1% in Q3 2022.

The company’s management guided for $400 to $420 million in revenue in Q4 2022 (FY Q2 2023), which implies 11-16% growth compared to Q4 2021, and $1.60 to $1.68 billion in revenue for the full Fiscal Year 2023 (Q3 2022 - Q2 2023). Previously, the company’s management guided for $1.63 to $1.73 billion in full Fiscal Year 2023 revenue.

I believe one of the key questions for Affirm is what will happen with GMV and revenue past Q4 2022. GMV and revenue plateaued and have remained flat for the last four quarters. The management full-year (FY 2023) guidance suggests that GMV will increase in Q4 2022 (FY Q2 2023) and then will either decline (lower end of the guide) or will plateau (upper end of the guide). However, the revenue guide suggests continued growth past Q4 2022 (FY Q2 2023), which is difficult to reconcile with the guide of flat or even declining GMV.

Gross Profit

Affirm reported $182.3 million in Revenue Less Transaction Costs (RLTC) in Q3 2022 (FY Q1 2023), which represents a 62.6% growth compared to Q3 2021 and a 1.1% decline compared to Q2 2022. Revenue Less Transaction Costs is the company’s way of measuring gross profitability and is calculated by deducting transaction costs from revenue. In Q3 2022 (FY Q1 2023), “Provision for credit losses” contributed 35.8%, “Processing and servicing“ costs contributed 30.3%, “Loss on loan purchase commitment” contributed 19.9%, and “Funding costs” contributed 14.0% of the total transaction costs.

If you look at the chart below, you will notice that Q3 2021 (FY Q1 2022) was not representative in terms of Revenue Less Transaction Costs, and thus, RLTC growth rate in Q3 2022 (FY Q1 2023) is “inflated” due to weak comparables. In Q3 2021, Affirm started building its Allowance for credit losses, which translated into increasing “Provision for credit losses” in the income statement. Over the last four quarters, Revenue Less Transaction Costs and the gross profit margin (RLTC divided by total revenue) remained stable, at $182-184 million and 50-51% respectively. Many things changed during those four quarters (i.e. interest rates skyrocketed), so let’s unpack how Affirm managed to keep the gross profit margin unchanged.

In Q3 2022 (FY Q1 2023) the company made provisions for credit losses in the amount of $61.9 million (please note a slight difference to the expense booked in the income statement) and booked charge-offs (net of the recoveries) in the amount of $64.2 million, finishing the quarter with $153.0 million in allowance for credit losses. At the end of Q3 2022 (FY Q1 2023), allowance for credit losses was equal to 5.7% of the on balance sheet portfolio (“Loans Held for Investment”), compared to 6.8% in Q3 2021 and 6.2% in Q2 2022.

At the same time, annualized charge-off rate (net charge-offs during the quarter divided by the average “LHFI” balance in the quarter multiplied by 4) increased from 5.0% in Q3 2021 to 9.9% in Q3 2022. It could be that decreasing allowance for credit losses reflects a shorter duration of the loan portfolio compared to a year ago (as mentioned earlier, the weighted average remaining term for the on balance sheet portfolio decreased from 11 months in Q3 2021 to 9 months in Q3 2022), but it also could be that Affirm is simply under-provisioning given the current charge-off rates.

As noted earlier, "Loans Held for Investment” increased from $2.24 billion in Q3 2021 to $2.68 billion in Q3 2022. Affirm uses a combination of funding debt, convertible senior notes, a revolving credit facility, as well as loan securitization to fund loans that it holds on the balance sheet. The senior convertible notes carry no interest and the credit facility is still undrawn; thus, the Funding costs increased primarily due to the increase in the balance of the funding debt and securitization notes (an increase of $0.43 billion compared to Q3 2021, which is proportional to the increase in the “Loans Held for Investment”), as well as rising interest rates.

In March 2022, the Federal Reserve started raising rates, which, as can be seen from the chart below, translated into a rising cost of funding for Affirm. I calculate the cost of funding as “Funding costs” for the quarter divided by the average balance of “Loans Held for Investment” and multiplied by four for annualization (as noted in the previous paragraph, “Loans Held for Investment” is a good proxy for the amount that Affirm needs to fund). In Q4 2022, the Federal Reserve increased the fed funds rate further and we can expect Affirm’s cost of funding to continue rising. Thus, even if the balance of the “Loans Held for Investment” does not increase, the Funding costs will.

Finally, processing and servicing costs have been increasing on a relative basis compared to both Gross Merchandise Volume and Total Revenue. Thus, as can be seen from the chart below, processing and servicing costs increased from 9.4% of total revenue in Q3 2021 to 15.0% of total revenue in Q3 2022 (and from 0.93% of GMV in Q3 2021 to 1.24% of GMV in Q3 2022). The increase in the company’s processing and servicing costs compared to Q3 2021 was primarily driven by the increase in payment processing fees related to increased payment volume, as well as an increase in processing fees paid to platform partners due to integrations and short-term promotions.

The company’s management guided for $156 to $166 million in Revenue less transaction costs (RLTC), which implies a 10-15% decline compared to Q4 2021, and $715 to $765 million in Revenue less transaction costs for the full Fiscal Year 2023 (Q3 2022 - Q2 2023). Previously, the company’s management guided for $760 to $810 million in RLTC for the full Fiscal Year 2023.

The management’s guidance suggests a 39-41% gross profit margin in Q4 2022 (FY Q2 2023), and a 43-45% gross profit margin for the full Fiscal Year 2023 (Q3 2022 - Q2 2023), which is a meaningful decline compared to the 50%+ gross margin that the company reported in the last four quarters. Let’s see the next quarterly results, but it looks like the company’s management expects the rising funding and processing costs to finally translate into a lower gross profit margin.

Operating Expenses

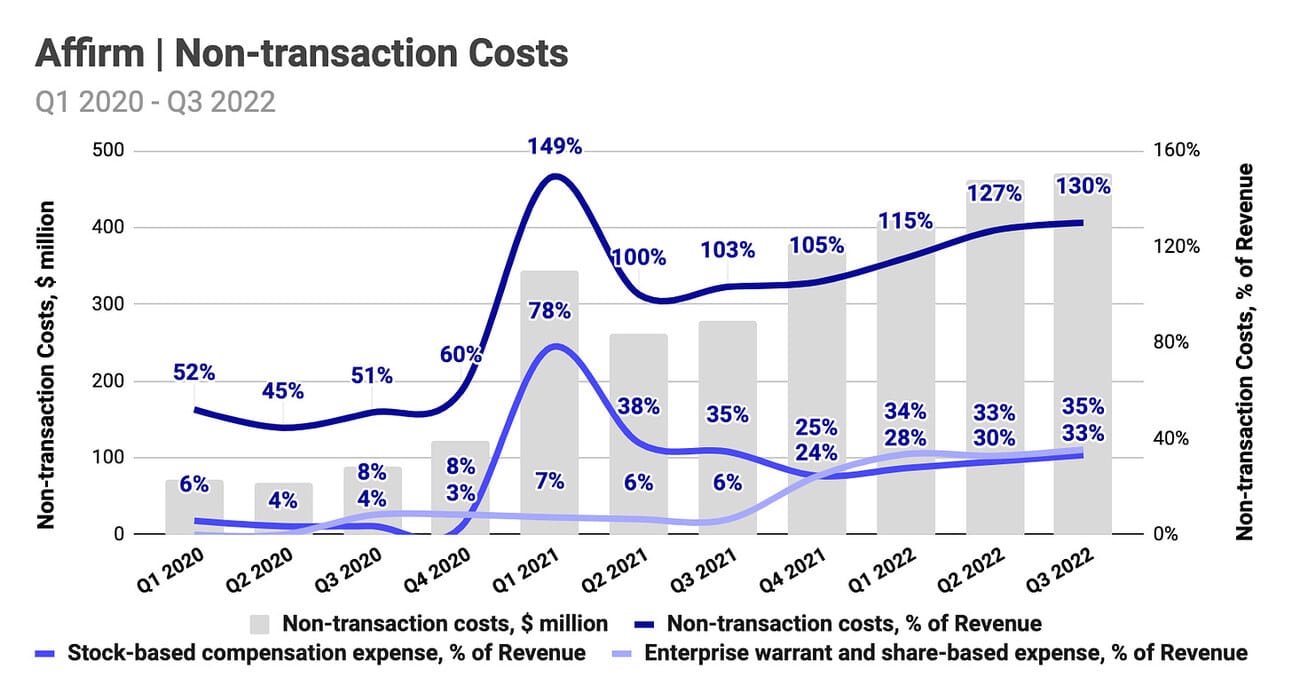

Affirm reported $649.1 million in total operating expenses for the quarter, of which $179.3 million were transaction costs (discussed above) and $469.8 million were non-transaction costs. Non-transaction costs increased by 68.9% compared to Q3 2021, and 1.8% compared to Q2 2022. “Sales and marketing” costs contributed 34.9% of the total non-transaction costs for the quarter and grew 156.2% YoY, “General and administrative” costs contributed 34.3% and grew 18.2% YoY, and “Technology and data analytics” costs contributed 30.9% and grew 85.8% YoY.

As always, it is worth expressing operating expenses relative to revenue and comparing this ratio to the gross profit margin. In the case of Affirm, we should use the ratio of non-transaction costs to revenue. Thus, as you can see in the chart below, the ratio of non-transaction costs to revenue increased from 103.3% in Q3 2021 to 129.9% in Q3 2022 (FY Q1 2023). It should be noted, the non-transaction costs include “enterprise warrant and share-based expense”, which is a fluctuation in the value of the warrants that Affirm granted to Shopify and Amazon, as part of the partnership deals. Excluding this expense, the ratio of non-transaction costs to revenue actually slightly decreased from 93.6% in Q3 2021 to 94.5% in Q3 2022.

In addition, non-transaction costs include stock-based compensation, which, relative to revenue, stayed almost unchanged, decreasing from 34.6% in Q3 2021 to 33.1% in Q3 2022. Excluding warrant expense and stock-based compensation, non-transaction expenses decreased from 62.3% in Q3 2021 to 61.3% in Q3 2022. This is still more than the company earned in gross profit (remember the 50%+ margin from the text above?), especially given the expected gross profit margin compression per the management’s guidance.

As a result of the non-transaction costs exceeding gross profit (or “Revenue Less Transaction Costs”), the company reported an Operating loss of $287.5 million for the quarter, compared to an Operating loss of $166.1 million in Q3 2021, and $277.2 million in Q2 2022. The chart below perfectly illustrates that on a non-adjusted GAAP basis, Affirm’s operating loss has been increasing despite four quarters of flat revenue. Moreover, the trend most likely will continue given the guidance of decreasing “Revenue Less Transaction Expense” from $182.3 million in Q3 2022 (FY Q1 2023) to $156-$166 million in Q4 2022 (FY Q2 2022).

Net Loss and Adjusted Operating Income

Affirm reported a Net Loss of $251.3 million in Q3 2022 (FY Q1 2023), compared to a Net loss of $306.6 million in Q3 2021 and $186.4 million in Q2 2022. Please note that Q3 2021 result was negatively impacted by $140.4 million in “Other expenses”, which were primarily related to the acquisition of PayBright which became the company’s arm operating in Canada. On contrary, in Q3 2022, Affirm booked $36.0 million in “Other income,” which was primarily related to the company’s hedging positions against the rising interest rates.

Affirm also reported $18.6 in Adjusted Operating Loss in Q3 2022, compared to an Adjusted Operating Loss of $45.1 million in Q3 2021, and $29.2 million in Q2 2022. The company is using Adjusted Operating Loss as a measure of profitability on an adjusted, non-GAAP bases, and calculates it by deducting depreciation and amortization, stock-based compensation, fair value gain (loss) on enterprise warrant, and other non-recurring expenses. As discussed above, both, stock-based compensation and fair value gain (loss) on enterprise warrant, have a meaningful impact on the company’s profitability.

Affirm’s management reiterated their commitment to reach profitability on an Adjusted Operating Income basis by the end of FY 2023 (Q2 2023). The chart below shows that the company has been flirting with profitability on an adjusted basis; thus, I wouldn’t doubt Affirm’s ability to achieve it on a more sustainable level. However, at some point, the company’s management should show the path to non-adjusted profitability, which currently is very unclear.

The company’s management guided for a negative Adjusted Operating Margin of 16-20% in Q4 2022 (FY Q2 2023), which, given the revenue guidance, implies an Adjusted Operating Loss of $67-80 million in the quarter. The company’s management also guided for a negative Adjusted Operating Margin of 5.5 - 7.0% for the full Fiscal Year 2023 (Q3 2022 - Q2 2023), which implies an Adjusted Operating Loss of $92-112 million.

Affirm finished Q3 2022 (FY Q1 2023) with $1.53 billion in cash and cash equivalents, as well as $1.24 billion in short-term investments (primarily certificates of deposits, corporate bonds, commercial paper, and government bonds).

Things to Watch in 2023

Growth Past 2022. Affirm’s growth prospects past 2022 are probably the biggest unknown. The company is guiding for continued revenue growth in 2023; however, this is difficult to reconcile with a flat GMV guidance. It might be that the company expects its revenue structure to tilt towards interest income, as it builds a portfolio on interest-bearing loans. Affirm has an unused funding capacity of $3.7 billion and keeps onboarding new funding partners; thus, it has the means to pursue this strategy.

Gross Profit Margin. There are multiple headwinds that will eventually translate into gross profit margin compression. The cost of funding and processing expenses are rising, and the company will have to increase provisions for credit losses, should the delinquencies continue to trend higher. The company’s management is already guiding for the gross profit margin to decline below 50%, though it should be noted that Affirm has not yet used repricing (on either the consumer or merchant side), as a tool to improve its profitability.

Profitability. The management reiterated its commitment to achieving profitability on an Adjusted Operating Income basis by the beginning of the fiscal year 2024 (Q3 2023 - Q2 2024). However, the Operating loss on a non-adjusted GAAP basis looks plain scary and keeps increasing (from $166.1 million in Q3 2021 to $287.5 million in Q3 2022). I would not doubt the company’s ability to achieve profitability on an adjusted basis, but at some point, the management should show a path to GAAP profitability, which currently is less than clear.

Acquisitions. The company has close to $2.8 billion in cash, cash equivalents, and short-term securities, and a 14.7 million strong loyal customer base. These factors create a perfect investment case for an acquisition that would broaden Affirm’s product offering and would be monetizable in the short to medium term through cross-selling. I expected Debit+ to become such a product, but Affirm is not rushing with rolling it out of beta (the rollout is expected in early 2023).

Source of the data used above: Investor Relations

Disclosure & Disclaimer: I own shares in several companies that I write about in this newsletter, as I am bullish on the transformation in the financial services industry. However, the information contained in this newsletter is intended for informational purposes only and should not be considered financial advice. You should do your own research or seek professional advice before making any investment decisions.