Affirm closed its fiscal year 2022 on a strong note (Q2 2022 was the final quarter of the company’s fiscal year), reporting growth in customers, revenue, and gross profit. After listening to the earnings calls of other Fintech companies, I expected Affirm’s management to talk cautiously about the economic outlook and maybe even guide for a more prudent increase in expenses. Instead, Max Levchin, the company’s founder and CEO, spoke about international expansion (the company is planning to launch in the UK), launching Affirm Rewards (to level the BNPL offering with credit cards), and potential acquisitions. The company also guided for continued revenue growth, and further increase in operating expenses.

I guess, if we were still in 2021 I would welcome the cheerful outlook, but it looks like the bearish sentiment finally got to me as well, and I am concerned if Affirm can actually deliver on its promises. I will keep my fingers crossed for them, but in the meantime, let’s break down their fiscal Q4 2022 financials (as this is the end of the fiscal year for them, this review turned out to be a lengthy one, sorry about that).

If you are new to Affirm, I suggest reading my previous reviews:

…and if you are new to Popular Fintech, subscribe to receive upcoming updates:

Active Consumers and Merchants

Affirm finished the quarter with 14 million active consumers, representing a 97% increase compared to FY Q4 2021 (Q2 2021). The active consumer growth rate slowed down in 2022, but Affirm continues adding new customers on a sequential basis. As a reminder, Affirm defines an active “as a consumer who engages in at least one transaction on our platform during the 12 months prior to the measurement date.”

Affirm reported 234.8 thousand active merchants using the service at the end of the quarter, which represents a 710% growth compared to FY Q4 2021 (Q2 2021). As I wrote previously, merchant growth is primarily driven by the company’s partnership with Shopify, which makes Affirm's service available to merchants using the Shopify platform. Affirm defines an active merchant “as a merchant which engages in at least one transaction on our platform during the 12 months prior to the measurement date.”

Affirm continued establishing new and expanding existing partnerships during the quarter. Thus, the company expanded cooperation with WooCommerce, an e-commerce platform, and Stripe, a payments processor, as well as established a partnership with SeatGeek, a mobile ticketing platform. I believe having over 14 million active consumers on the platform will help the company open more merchant doors in the future.

Gross Merchandise Volume

Affirm reported $4.4 billion in Gross Merchandise Volume (GMV) for the quarter, which represents a 77.1% growth compared to FY Q4 2021 (Q2 2021), and a 12% growth sequentially. Affirm guided for flat GMV growth sequentially (see the guidance below), which is reasonable given the economic outlook.

Affirm provided the data on the composition of GMV by category, as well as the volume growth of those categories. For example, you can see on the chart below that “General merchandise” constituted 23% of the volume, and grew 477% YoY. The only category that contracted was the “Sporting goods and outdoors”, which is the result of Peloton sales losing steam (Peloton was the first major merchant for Affirm).

The main takeaway from the chart above is that the company’s GMV mix is well diversified across different categories, and while the growth in some categories is slowing down (i.e. “Home / Lifestyle”), other categories compensate for that (i.e. “Travel / Ticketing”). The company’s quarterly filing also notes that “for the year ended June 30, 2022, there were no merchants that exceeded 10% of total revenue.”

The company’s management guided for $4.20 to $4.40 billion in Gross Merchandise Volume in FY Q1 2023 (Q3 2022), and $20.50 to $22.00 billion in Gross Merchandise Volume for the full fiscal year 2023. This guidance implies a 55-62% YoY growth for the quarter and a 32-42% growth on a full-year basis.

Loan Portfolio

The company reported $2.5 billion in “loans held for investment” (loans that the company plans to retain on its balance sheet), and $7.1. in total platform portfolio at the end of Q2 2022. The portfolio of loans held for investment grew 24% over the course of the year and remained flat sequentially. The total platform portfolio grew 51% compared to FY Q4 2021 (Q2 2021), and 6% sequentially.

As you can see, the company reported $4.4 billion in Gross Merchandise Volume in FY Q4 2022 (which in the case of Affirm is the same as loan originations), but the total platform portfolio increased by merely $0.4 billion. The reason for that is the high loan portfolio amortization rate, given the short average loan duration. Thus, a chart from the company’s earnings release illustrates that the average weighted loan duration for the total platform portfolio decreased from 19 months in Q2 2020 to 13 months in Q2 2022.

What separates Affirm from some of its competitors (as well as other online lenders), is the company’s ability to secure funding despite the market turbulence and economic uncertainty. Thus, the company increased its funding capacity during the quarter by “over $1.6 billion of net new committed capital”, in the form of warehouse and forward flow agreements. As of the end of Q2 2022, the company had $10.6 billion in total funding capacity, which was well above the total platform portfolio of $7.1 billion.

I believe the strong demand from the funding partners (as illustrated by increased Funding Capacity), is driven by a) the short duration of Affirm’s portfolio, which allows the company to adjust its credit policies and pricing frequently to reflect changing economic conditions, and b) relatively strong performance of the portfolio (at least for now) despite the deteriorating economy. Similar to Upstart, Affirm is serving customers with a thin credit file and its credit models have not been tested by a recession. However, at least for now, Affirm’s models seem to hold (as reflected by delinquency rates and allowance levels).

Revenue and Take Rate

Affirm reported $364.1 million in revenue for the quarter, which represents a 39% increase compared to FY Q4 2021 (Q2 2021). The company’s largest components of the revenue, “total network revenue” (41% of the total revenue) and ”interest income” (38% of the total revenue) grew 39% YoY and 33% YoY respectively.

The company reported $1.35 billion in total revenue for the full fiscal year 2022, which represented a 55% growth compared to the fiscal year 2021. Total network revenue grew 30% YoY and the interest income grew 61% YoY. Please note the major leap in virtual card network revenue (102% YoY), which indicates Affirm product usage outside of Affirm network (consumers using the virtual card to pay for goods and services).

The company’s management guided for $345 to $365 million in revenue for FY Q1 2023 (Q3 2022) and $1,625 to $1,725 million in revenue for the full fiscal year 2023 (Q3 2022 - Q2 2023).

This guidance implies a 28-35% YoY growth for the next reporting quarter, and 20-28% YoY growth for the full fiscal year. Nevertheless, if you plot the next quarter's revenue guidance (at its upper end) on the chart below, you will see four quarters of flat revenue of around $360 million (Q4 2021 - Q3 2022).

As mentioned above, the key components of Affirm’s revenue are the network fee and the interest income. The network fee revenue is the function of the GMV and the Take Rate, while the interest income is the function of the size of the on-balance sheet portfolio and the average yield. Therefore, it is logical to expect the network fee in the next reporting quarter to be approximately the same given the GMV guidance, and stabilization of the take rate (see the chart below)….

…have the interest income to also stay at approximately the same level because of the flat on-balance sheet portfolio (discussed above) and stabilization in the portfolio yield (see the chart below).

Still, Affirm guided for a 20-28% YoY growth for the full fiscal year, so my understanding is that they expect the revenue to ramp up during the holiday season (FY Q2 2023 or calendar Q4 2022), and in the second half of the fiscal year. This guidance goes against the expectations of an economic slowdown (or even a recession), but Affirm has not missed single guidance, so let’s see how they deliver on their guidance this time.

Gross Margin

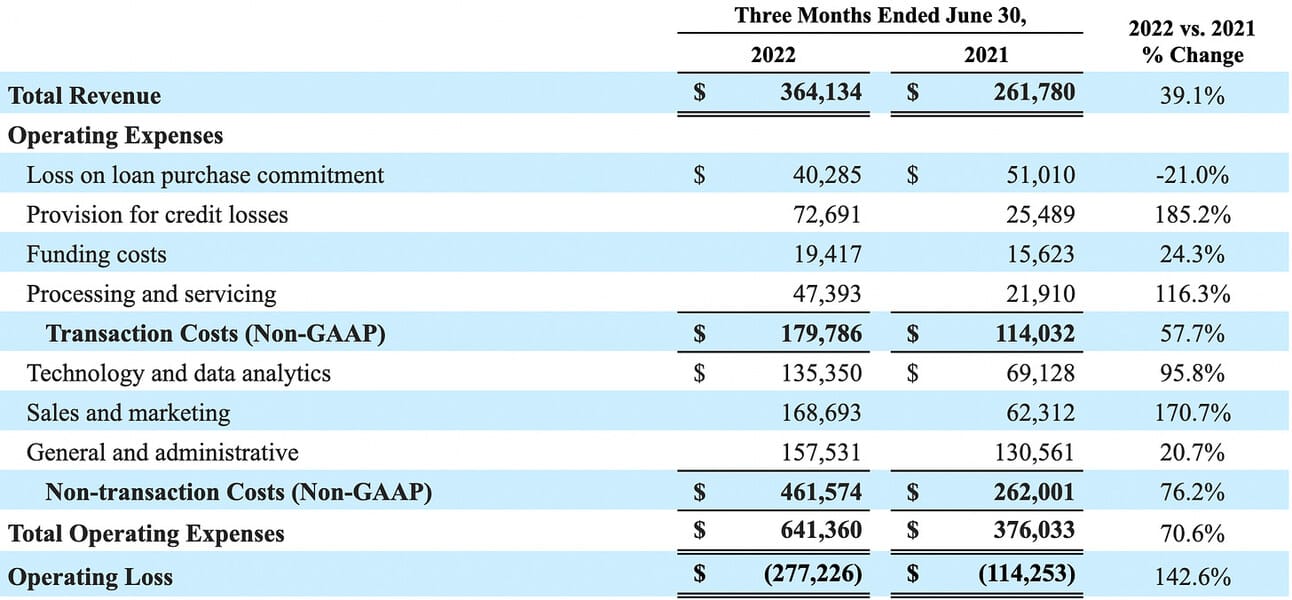

Affirm reported $184.4 million in “Revenue less transaction costs” for the quarter, which is the company’s measure of gross profit. This represents a 24.8% growth compared to FY Q4 2021 (Q2 2022). As you can see from the table below, the key drivers of transaction cost increase were provisions for credit losses (185% YoY), and processing and servicing expenses (116% YoY).

The company reported $662.4 million in “Revenue less transaction costs” for the full fiscal year 2022, representing an increase of 53% compared to the fiscal year 2021. On an annual basis the growth in the “revenue less transaction costs” was in line with the growth in total revenue.

The company’s management guided for $169 to $177 million in “revenues less transaction costs” in FY Q1 2023 (Q3 2022), and $760 to $810 million in “revenue less transaction costs” for the full fiscal year 2023. This guidance implies a 51-58% growth YoY and a 4-8% decrease sequentially on a quarterly basis and a 15-22% growth on an annual basis.

As can be seen from the chart below, gross profit margins stabilized at around 50% in the last three quarters; however, the guidance suggests a decrease to the 47-48% level. The performance of the credit portfolio (and respective provisions for credit losses) will be one of the key drivers of the gross profit margins, but (at least for now) Affirm enjoys rich gross profit margins for what, in its essence, is a payments business.

Operating Expenses

Affirm reported $641.4 million in operating expenses for the quarter (an increase of 70% YoY), which lead to an Operating loss of $277.3 million (an increase of 142% YoY). We have discussed the drivers behind the transaction costs above, but the non-transaction costs were driven by a 170% increase in sales and marketing and a 95% increase in technology and data analytics expenses.

For the full fiscal year 2022, the company reported operating expenses of $2.2 billion (an increase of 76% YoY), which lead to an Operating loss of $866 million (an increase of 125% YoY). Similar drivers as for the latest quarter, but the increased spend on sales and marketing clearly stands out.

So far I have pointed out strong aspects of Affirm: customer growth, strong credit performance, and the management’s confidence to grow revenue despite the deteriorating economic conditions. However, the chart below is really scary. As you can see, the operating loss has been increasing on both an absolute and relative (to revenue) bases. I understand that the company is using the momentum to scale the business and gain market share, but I guess they need to turn this trend around at some point.

Net Loss and Adjusted Operating Income

Affirm reported a Net Loss of $186.4 million for the quarter (up from a Net Loss of $123.4 million in Fiscal Q4 2021), and a Net Loss of $707.4 million for the fiscal year 2022 (an increase from $441 million in the fiscal year 2021). The “Other (expense) income, net” position in the tables below primarily relates to the acquisition of PayBright (it was a partially stock-based acquisition, thus, the decreasing price of Affirm shares resulted in a fair value gain), and interest-rate hedging expenses.

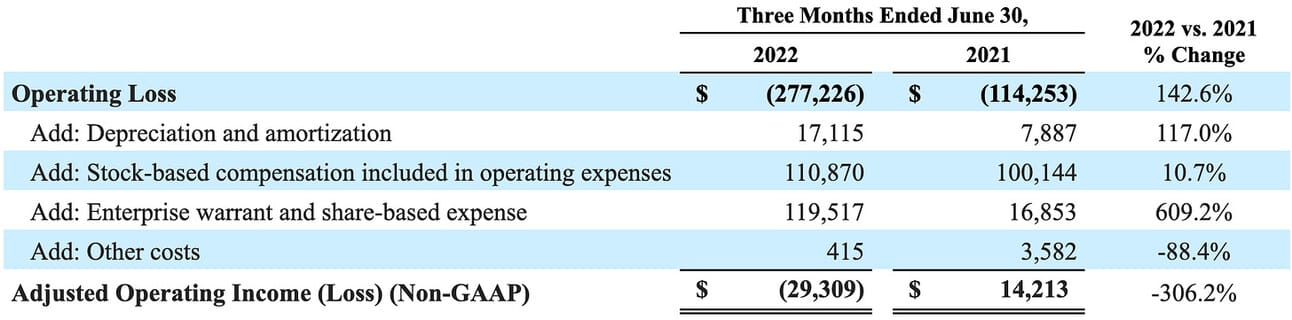

Affirm uses “Adjusted Operating Income (Loss)” as a measure of its non-GAAP profitability. The company adjusts the Operating loss by depreciation and amortization, stock-based compensation, and changes in the fair value of warrants. As a reminder, Affirm issued Shopify and Amazon warrants to purchase its shares as an incentive for establishing partnerships.

The company reported $29.3 million in Adjusted Operating Loss for the quarter (vs. Adjusted Operating Income of $14.2 million a year ago) and $78.3 million in Adjusted Operating Loss for the full fiscal year 2022 (vs. Adjusted Operating Income of $14.3 million in fiscal 2021).

The company’s management guided for a negative Adjusted Operating Margin of 10-12% in FY Q1 2023 (Q3 2022) and a negative Adjusted Operating Margin of 4.5-6.5% for the full fiscal year 2023. This guidance implies an Adjusted Net Operating Loss of $36-41 million in FY Q1 2022 and an Adjusted Net Operating Loss of $77-105 million for the fiscal year 2023.

As can you see from the chart below, Affirm’s management is guiding for a larger Adjusted Operating Loss (relative to revenue) in the upcoming reporting quarter. Essentially, based on the guidance, the Operating Loss will continue rising on both an adjusted and non-adjusted basis. We should give the management a credit for being this bold in the current market environment. As of June 30, 2022, the company has approximately $1.3 billion of cash and cash equivalents.

Things to watch in 2022

GMV and Revenue. Affirm’s management guided for GMV and revenue growth in the next fiscal year despite a clouded economic outlook. Affirm has been growing faster than the market by striking large partnerships (Shopify, Amazon), but I believe they have reached the scale at which deterioration of consumer demand will hurt them as well.

Operating expenses (and losses). Every company I am following is adjusting its expenses to reflect the changing market environment and the potential of an economic recession. Some lay people off, some slow down or freeze hiring. Affirm, on the other hand, seems to be still running at full speed and even guided for a bigger operating loss margin.

Launch of Debit+. Max Levchin, the company’s founder and CEO, has been discussing the Debit+ card and its potential for a while now. However, the company again excluded the impact of the Debit+ card from its guidance. My understanding is that the company is investing heavily into this product, so at some point, they need to show the results to back this investment.

Acquisitions. There was a discussion about potential acquisitions during the company’s earnings call. Max Levchin said the company is actively looking the companies that could be a good fit for Affirm. Affirm has a large customer base, lots of committed funding, and apparently a strong credit team. I believe this could add a lot of value to some of the early-stage startups out there.

In summary, Affirm keeps growing its customer base and revenue, the credit models are (so far) withstanding the deterioration of the economy, and the company’s capital partners are ready to fund future originations. At the same time, the company keeps increasing its operating expenses, so if the revenue projections don’t leave up to the expectations, we might see some ugly losses.

Source of the data used above: Investor Relations

Disclosure & Disclaimer: despite rocky performance in 2021 and the first half of 2022, I have open positions in most of the companies covered in this newsletter (including Affirm), as I am extremely bullish on the transformation in the financial services industry. However, none of the above is financial advice, and you should do your research.