Last week Affirm ( ) held its Fiscal Q2 2022 (calendar Q4 2021) earnings call and this brought a lot of drama. First, they accidentally tweeted part of their results during the trading hours, and then the stock price started collapsing after the release of the full set of information. I believe this was the guidance that they provided that led to the price collapse, rather than the accidental tweet. In particular, Affirm included the impact of their partnership with Amazon in their guidance for the remainder of the fiscal year (calendar H1 2022), and it looks like investors expected bigger numbers.

I guess that the stock will continue to be highly volatile, as the management focuses on the network growth (growing both the number of consumers and merchants), and their go-to-market strategy includes partnering with massive players such as Shopify, Amazon, and Verifone. New partnerships will most likely drive the share price up once announced, and investors will penalize the stock if those partnerships don’t meet their expectations. In any case, it is worth looking past partnership announcements, and start digesting the company’s fundamentals to see if, eventually, it can become a profitable business.

Please note that the fiscal year 2022 for Affirm ends in June, 2022. I tried to indicate “fiscal” and “calendar” for all the periods in the text to avoid any confusion.

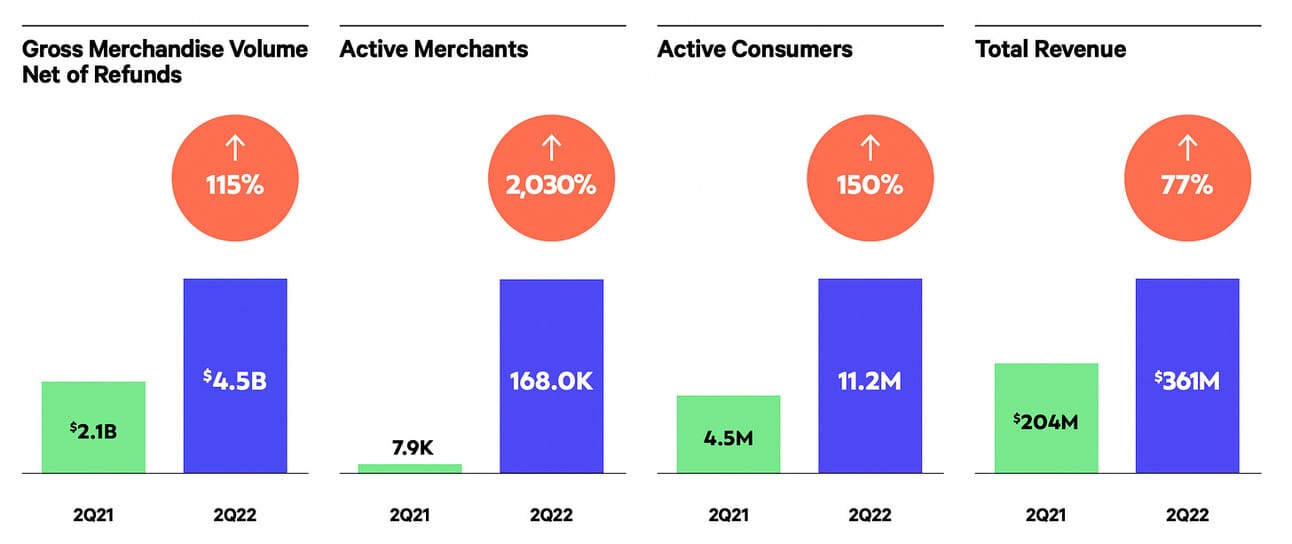

Source: Affirm Q2 2022 Infographic

How Affirm makes money

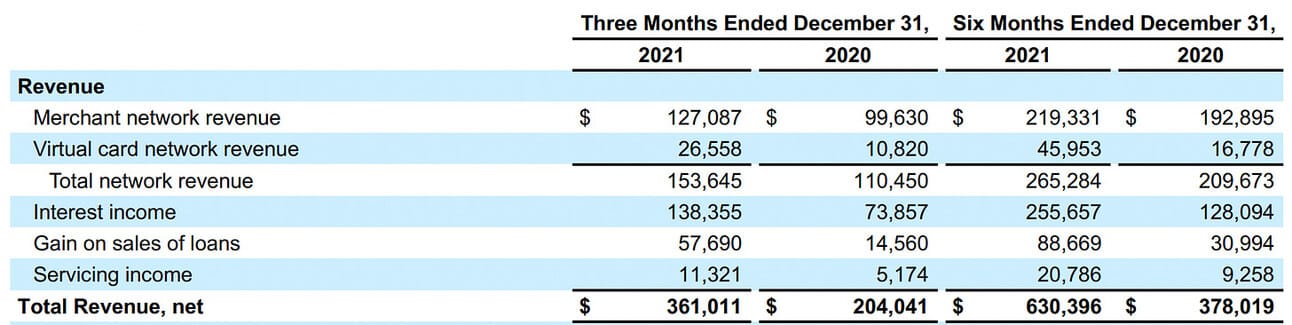

Affirm makes money from two primary activities: a) charging merchants a fee for transactions paid using Affirm payment methods (i.e. consumers paying with Affirm installments, or Affirm Virtual Card, instead of credit cards), b) charging consumers interest on installment loans. The former is called “Network revenue” in Affirm’s reports, and the latter comprises several revenue streams, such as “Interest income” (interest that Affirm earns on the loans it holds on its balance sheet), “Gain on sales of loans” (Affirms sells part of their loan origination to institutional investors, booking gain on sale in this position), and “Servicing income” (income is generated from servicing loans sold to institutional investors).

One of the misconceptions about Affirm is that it offers only interest-free loans, thus making money only from merchant fees. In reality, 56% of the loans originated last quarter were interest-bearing. Affirm does differentiate its merchant fees, charging merchants more for interest-free loans; thus, Affirm’s “Take Rate” heavily depends on the product mix. As one can see from the table below, 38% of Affirm’s revenue in the last quarter came in the form of interest income.

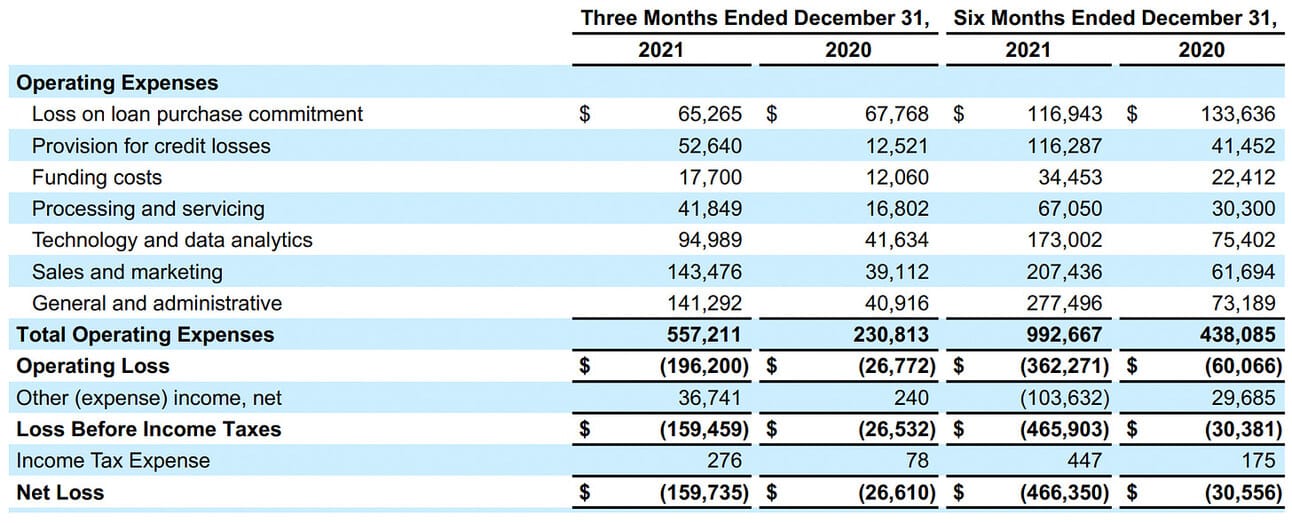

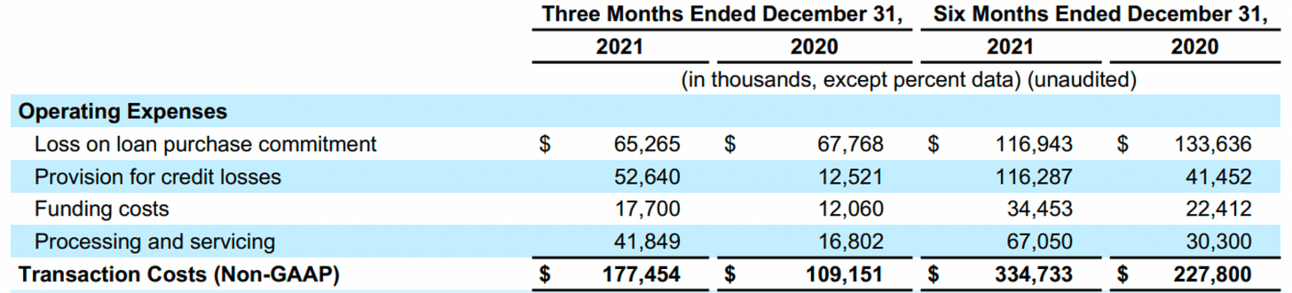

Affirm’s costs comprise four main positions: a) “Transaction costs”, which include “Loss on loan purchase commitment”, “Provision for credit losses”, “Funding costs”, as well as “Processing and servicing”, b) “Technology and data analytics” costs, which include salaries, stock-based compensation, and personnel-related costs for engineering, product, credit and analytics staff, c) “Sales and marketing” costs, which include marketing and promotional costs, as well as compensation of marketing personnel, and finally, d) “General and administrative” costs, which include “expenses related to our finance, legal, risk operations, human resources, and administrative personnel”.

Active Customers and Merchants

Affirm closed 2021 (Fiscal Q2 2022) with 11.23 million active customers using its products (consumers that made at least one transaction over the last 12 months), which represents 29% QoQ and 150% YoY growth. The company has been consistently growing its customer base thanks to the partnerships with Shopify and now Amazon, and the growth rate accelerated in 2021.

It should be noted that Affirm’s partnership with Amazon is in its early phase; thus, the company did an initial rollout of its point-of-sale solution only in November, 2021. Therefore, one can expect that Affirm’s customer base will be further boosted in 2022, as Amazon rolls out the solution to a larger set of merchants.

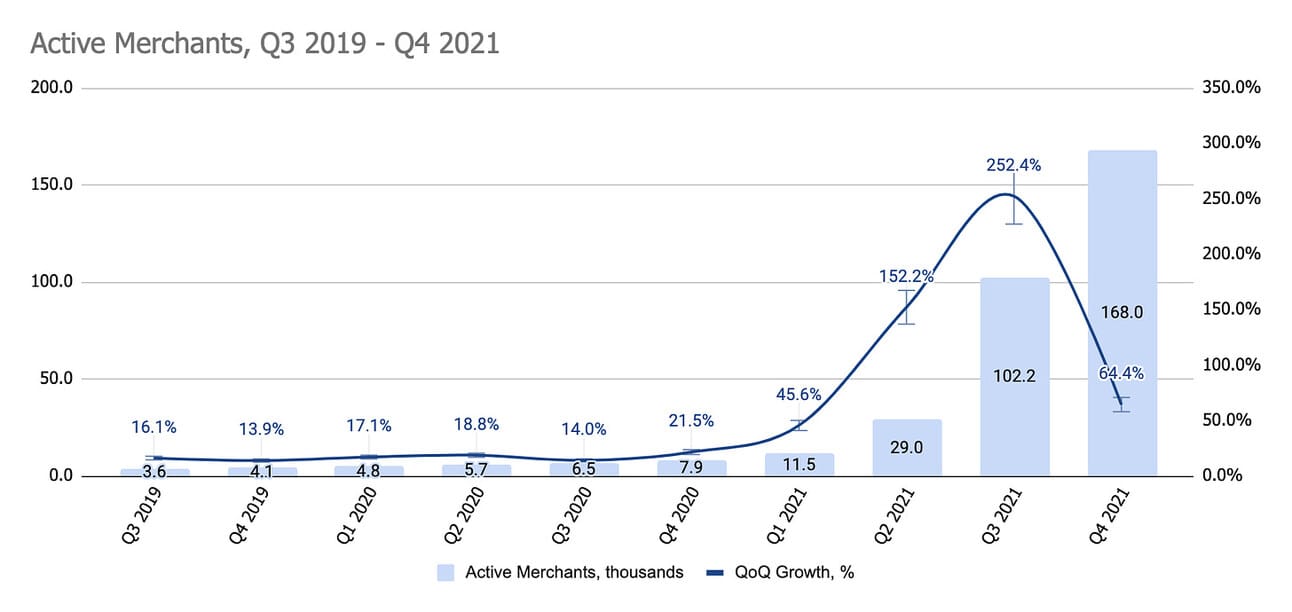

Affirm also reported having 168 thousand Active Merchants using its solutions at the end of 2021, which is a stunning 2030% YoY growth (Active Merchant defined as a merchant using Affirm’s solution at least once in the last 12 months). The incredible growth in the merchant base in 2021 was the result of Affirm’s partnership with Shopify. Thus, the companies announced their partnership in July, 2020, but rolled out the solution fully only a year later, in June, 2021.

Similarly to consumer accounts, one can expect strong merchant growth also in 2022, as Affirm and Amazon expand their partnership to a larger set of merchants. In addition, Affirm announced a partnership with Verifone, one of the leaders in the payment terminal business. This partnership aims to bring Affirms BNPL solution to the physical world (which is still much larger than the world of e-commerce).

On the final note, Max Levchin, CEO and founder of Affirm, reiterated on the latest earnings call that company’s utmost goal at this stage is the growth of its network. For reference, Paypal, the leader in the space, boasts 426 million Active Accounts, of which 34 million are merchants.

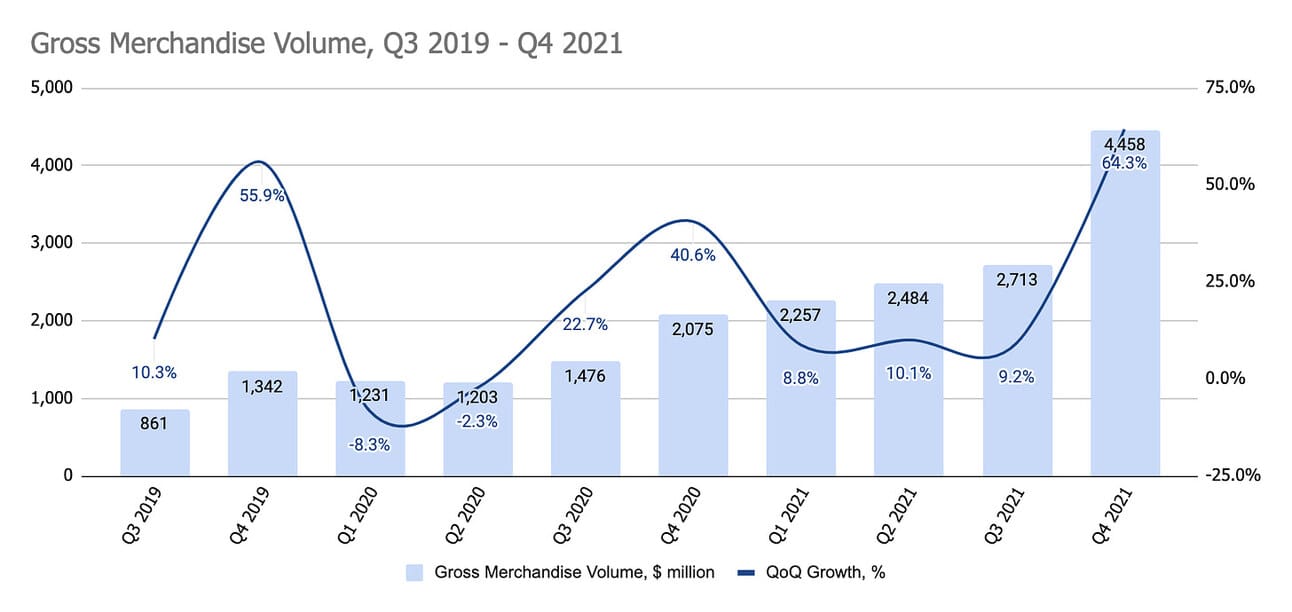

Gross Merchandise Volume

Affirm reported $4.46 billion in Gross Merchandise Volume in Fiscal Q2 2022 (calendar Q4, 2021), which represents 115% YoY growth. GMV for the full calendar 2021 was $11.9 billion, up 100% from calendar 2020. The QoQ spike was driven by the kick-off of the partnership with Amazon, and provides a hint on the potential scale once the partnership is fully rolled out.

The company guided for $3.61 - 3.71 billion in GMV in Fiscal Q3 2022 (calendar Q1 2022), and $14.58 - 14.78 billion for the full Fiscal Year 2022 (implying $3.8 - 3.9 billion in GMV in Fiscal Q4 2022).

My understanding is that the share price was penalized after the earnings call for the low guidance, especially, taking into the fact that the guidance included GMV from the partnership with Amazon (which everyone had very high hopes for). However, it took Affirm a year to fully roll out the partnership with Shopify, so I wouldn’t exclude that the full rollout of the partnership with Amazon falls outside of this fiscal year and will happen sometime after June, 2022.

In summary, it is hard to do any meaningful guesses about the company’s GMV past the guidance horizon because large partnerships trigger non-linear spikes in the volumes. Therefore, I will follow updates on the already announced partnerships with Amazon and Verifone, as well as look for new announcements.

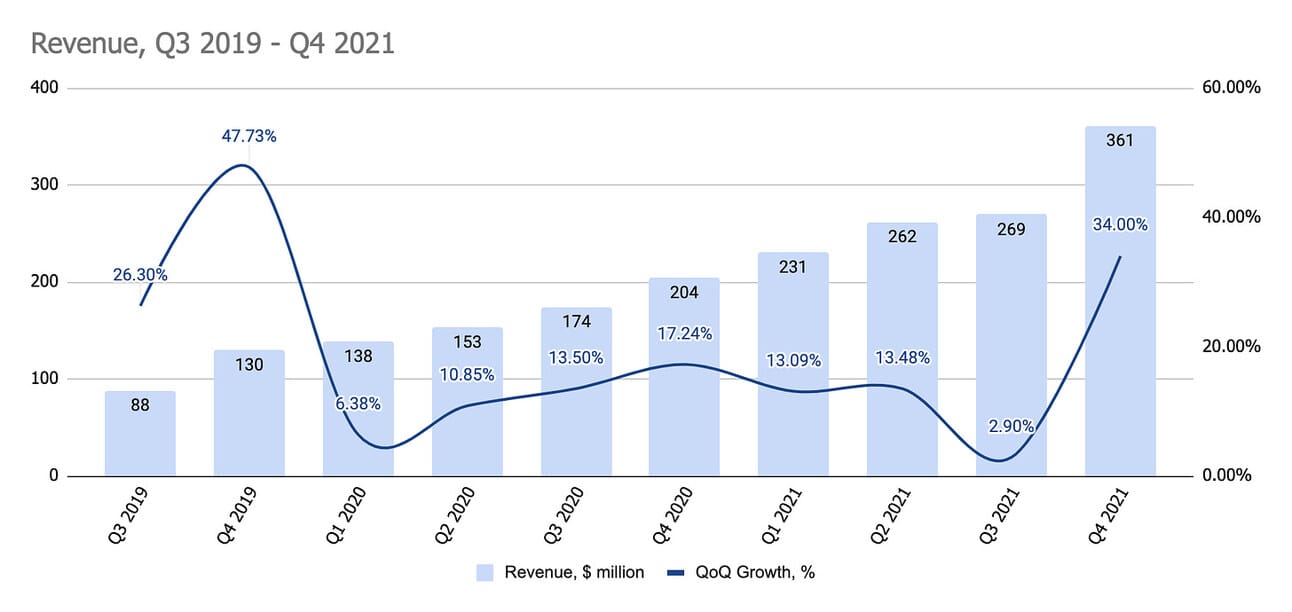

Revenue, Take Rate, and Interest Income

Affirm reported $360 million in revenue in Fiscal Q2 2022, which represents 34% QoQ and 77% YoY growth. The revenue for the full calendar 2021 was $1.12 billion, or 68% YoY growth compared to the full calendar 2020.

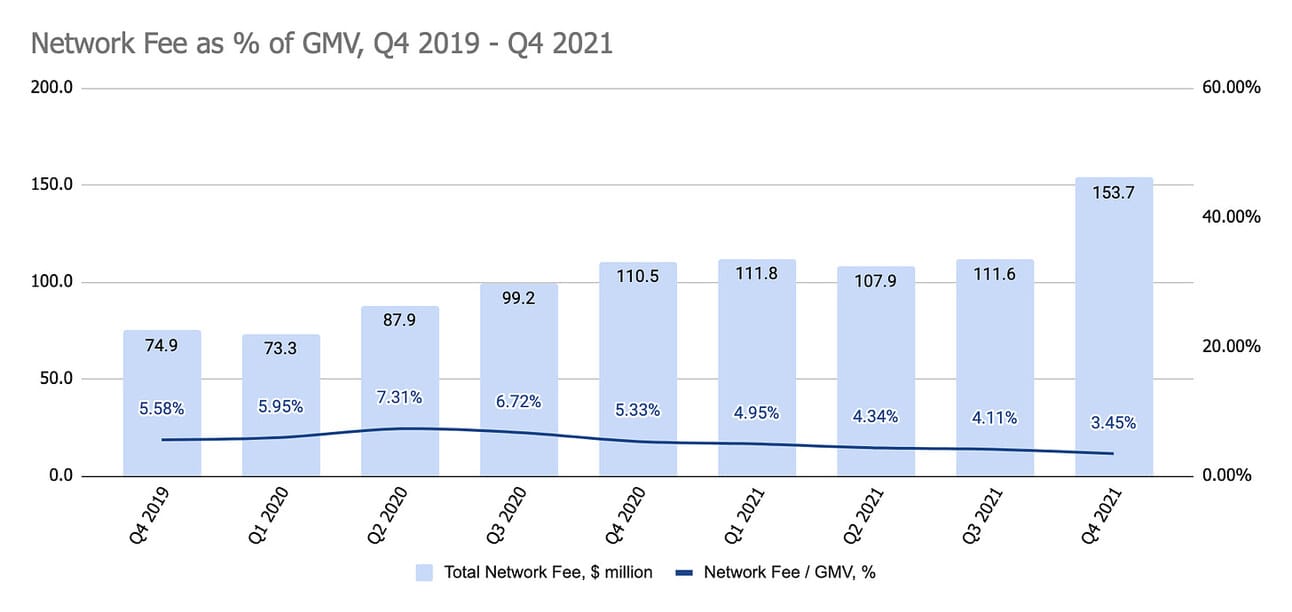

The revenue in Fiscal Q2 2022 grew less than the GMV, suggesting that the Take Rate (as measured by the Network Fee / GMV) might have decreased. The management explained the drop in the Take Rate by the lower fee levels received from the Amazon partnership and the change in the product mix (larger proportion of Split Pay in the GMV mix).

The company reports average Take Rates by product line (but does not provide details of individual partnerships). Over the last two years Take Rate levels have been quite stable across all company’s products, and the downtrend in the Average Take Rate is indeed coming from a higher share of low take rate products in the GMV mix (check Slide 13 in the Earnings Supplement).

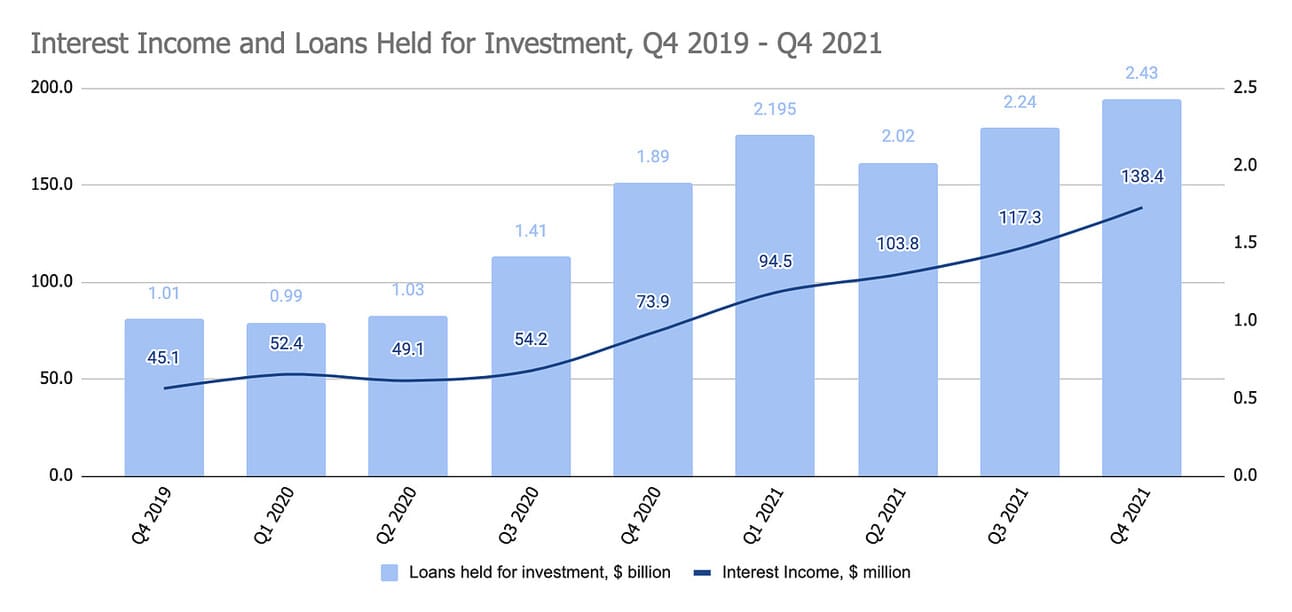

In the case of Affirm, it is important to also look at the Total Revenue / GMV ratio, because besides charging merchants a fee, the company also earns money on the interest-bearing loans. For instance, the company generated $138.4 in Interest Income in Fiscal Q2 2022 and had $2.43 billion in Loans Held for Investment on its balance sheet.

As the result, one can see from the chart below that Affirm’s Total Revenue comprised 8.1% of the GMV. As Affirm keeps part of the originations on its loan book, the loan book will keep increasing, driving up the interest income. This level of revenue (as % of GMV) gives the company a strong footing and room for maneuvers in case it will have to compete on the price.

Affirm guided for $325 - 335 million in revenue in Fiscal Q3 2022, and $1,290 - 1,310 million for the full Fiscal Year 2022 (implying revenue of $335 - 345 million in Fiscal Q4 2022).

Similarly to GMV, it is hard to see how the revenue will grow past the guidance timeframe; however, one can expect further downwards pressure on the take rate (especially as Amazon partnership expands). At the same time, the revenue will have tailwinds in the form of interest income from the compounding loan book.

Transaction Costs

Affirm defines “Transaction Costs” as the sum of “Loss on loan purchase commitment”, “Provision for credit losses”, “Funding costs”, and “Processing and servicing” costs. Provisions for credit losses, funding, and servicing costs are quite straightforward for a company providing consumer lending; but “Loss on loan purchase commitment” requires special explanation.

Most of the loans facilitated by Affirm are issued by their banking partners and later purchased by Affirm at their principal value (plus accrued interest). However, when Affirm (or rather their banking partner) issues an interest-free loan, Affirm has to book such loan purchase at “fair value”, which is less than the paid principal value (and equals to principal repayments discounted by “fair” interest rate). Affirm then books the difference between the amount paid to the banking partner (principal amount) and the “fair value” as the “Loss on loan purchase commitment”. As the loan is later repaid by the borrower, Affirm amortizes this loss as interest income (reflected in the Revenue), so the net effect is zero.

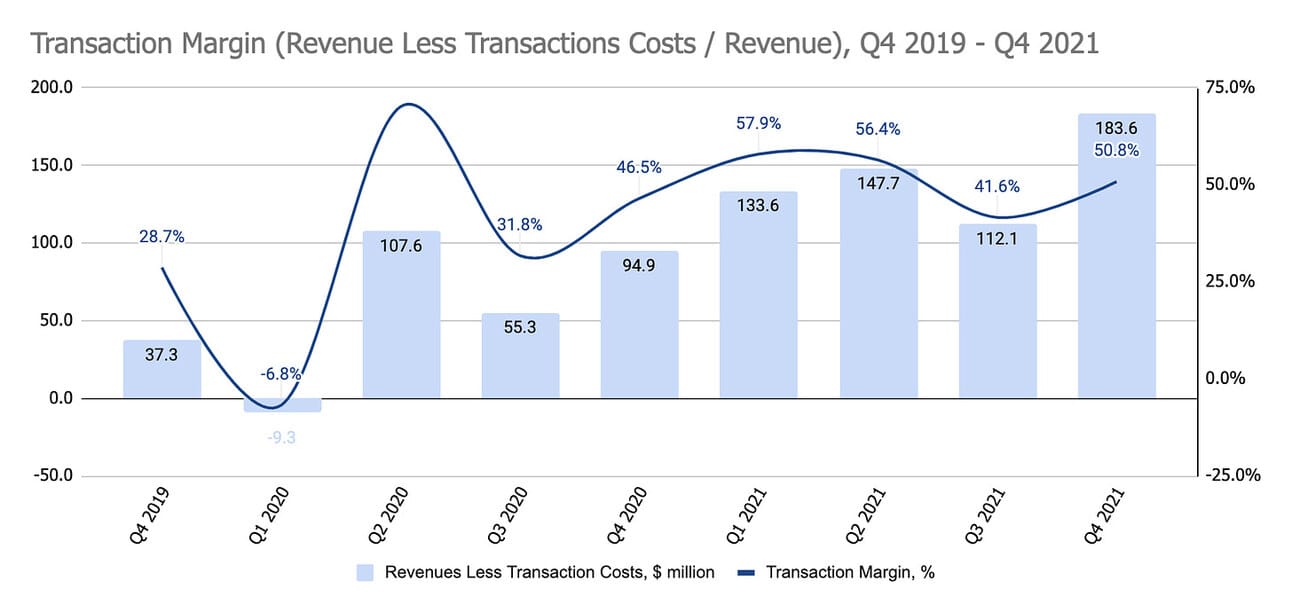

In its non-GAAP reporting, Affirm uses the term “Revenue Less Transaction Costs”, which is calculated as “Total Revenue” minus all costs under the category “Transaction costs”, and represents sort of gross profit contribution (money left for covering all personnel, marketing, legal and administrative costs).

As the transaction costs are driven by the transaction volume and the product mix, it makes sense to look at the “Transaction Margin”, or the percentage of revenue that is left after covering the costs directly associated with transactions. Unfortunately, the short timeframe of publicly available information does not yet allow us to understand what is a “normal” Transaction Margin for Affirm, and make any conclusions on the trends.

If we try to draw parallels with Paypal, we can expect Transaction Margin to stay within 50-55% range, meaning around half of Affirms revenue would remain after covering transaction-related costs. However, management’s guidance for the rest of the year suggests a lower margin.

Thus, Affirm guided for “Revenue Less Transaction Costs” of $138 - 143 million in Fiscal Q3 2022, and $585 - 595 million for the full Fiscal Year 2022. Such guidance implies the Transaction Margin of 41%-45% in Fiscal Q3 2022, and 45-46% for the full Fiscal Year 2022.

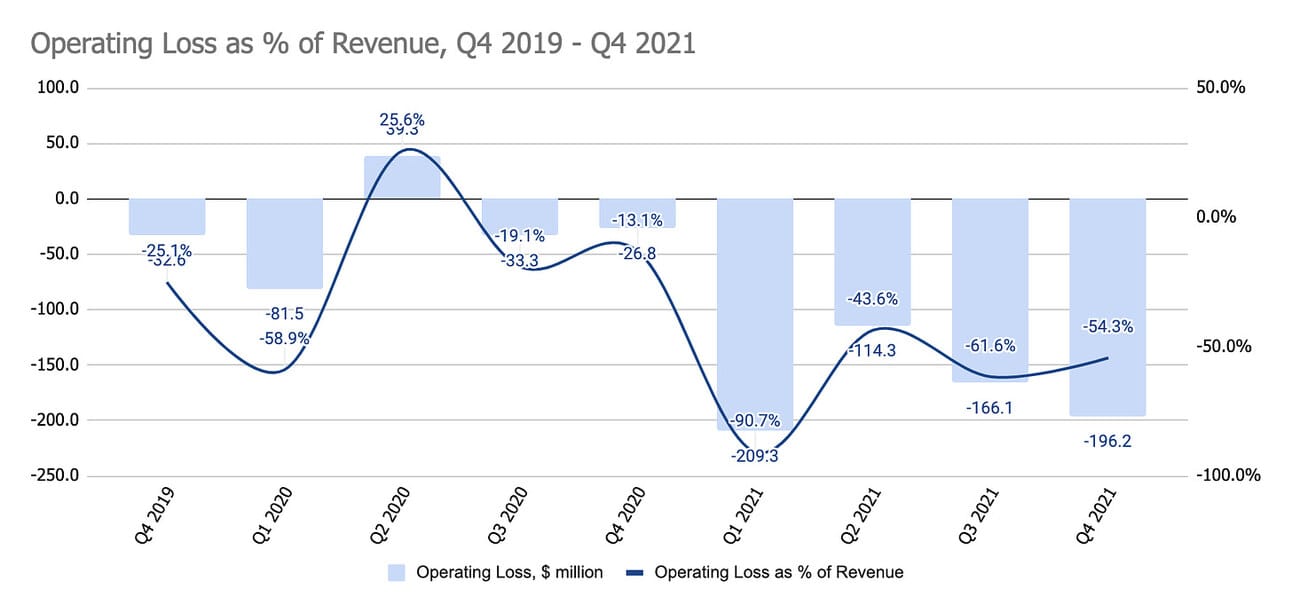

Net Income (Loss)

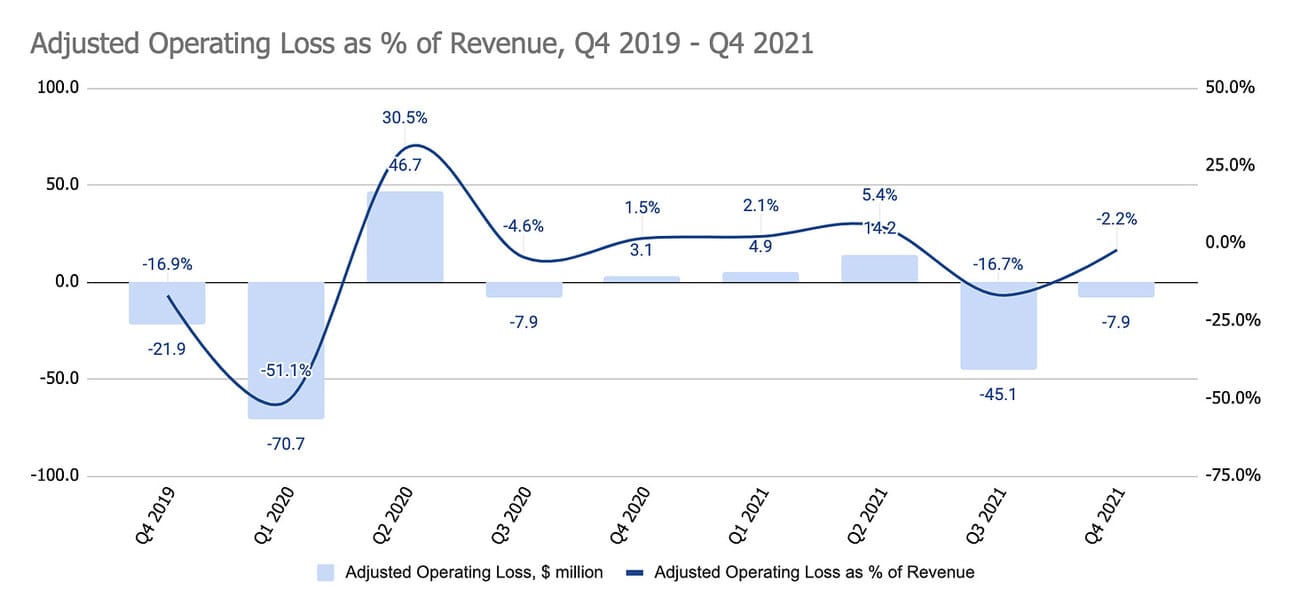

Affirm reported $196.2 million in Operating Loss in Fiscal Q2 2022 (calendar Q4 2021), which is a 632% YoY increase compared to Fiscal Q2 2021 (calendar Q4 2020) Operating Loss of $26.8 million. Company’s loss for the calendar year 2021 was $685 million.

When looking at the Operating Loss one should take into account two factors: a) this was the first full year for Affirm as a public company; thus, the company had to book the costs associated with stock-based compensation and warrants following the IPO, b) the company went public with the purpose of raising capital and investing it in the growth. Thus, Adjusted Operating Loss (which excludes the impact of stock-based compensation and other non-cash items) was $7.9 million in Fiscal Q2 2022, and $33.9 million for the full calendar year 2021.

The company guided for the Adjusted Operating Loss of -21% to -19% of the Revenue (or $61.8 - 70.4 million) for the Fiscal Q3 2022, and -14% - 12% for the Fiscal Year 2022 (or $154.8 - 183.4 million).

Things to Watch in 2022

Company’s management reiterated the focus on growing the size of the network (meaning the number of active customers and merchants), even if this requires exceeding expectations on losses. Thus, growth in customers is a better metric for management’s performance than company’s profitability

Company’s Gross Merchandise Volume and Revenue will continue to be driven by large scale partnerships, such as the partnerships with Shopify and Amazon. Thus, expect new partnerships and with them large jumps in GMV volumes and large fluctuations in stock price, when those jumps don’t meet or exceed investor expectations

Block recently acquired Afterpay, a competitor of Affirm. Block’s Square has a large merchant base, so it will be interesting to see if this acquisition will have negative impact on Affirms ability to grow merchant base, or company’s margins (but as mentioned above, Affirm has buffer in its margins). Read more on how Affirm compares to Afterpay here.

Finally, Affirm is working on launching a Debit+ card (a debit card allowing consumers to later split a purchase into installments). I didn’t touch on this topic at all, and the company does not include Debit+ card impact in the guidance. In short, Affirm can start monetising its customer base outside of its network (consumers using Debit+ card at non-Affirm merchants).

Disclosure & Disclaimer: despite rocky performance in 2021 and early 2022, I have open positions in most of the companies covered in this newsletter, as I am extremely bullish on the transformation in the financial services industry. However, none of the above is financial advice, and you should do your research.