This week PayPal ( ), the pioneer of FinTech industry, held its Q4 2021 and FY 2021 earnings call. Despite what seemed to be a good quarter and a good year, the earnings call was confusing, as the company’s management seemed to be caught off guard by pretty much everything out there from inflation, to supply chain disruptions, to the low engagement of customers acquired through incentive-based campaigns. The company also guided for no growth in Earnings Per Share (EPS) next year (despite forecasting 15-17% growth in revenue), causing the share price to plummet almost 25% the next day.

The company’s management indicated that 2022 guidance is conservative and is negatively impacted by several headwinds (such as final steps in separation from eBay, which will be fully completed by mid-2022 ), and returning to 20%+ earnings growth is still on the table starting from 2023. Let’s try to decompose PayPal’s performance in an attempt to understand if this was just a terrible presentation by the management, or if investors should really be concerned with the company’s performance going forward. After all, despite the drawdowns, PayPal is still trading at growth stock multiples, and growth is vital for the company.

Source: Paypal Earnings Release

How PayPal makes money

Let’s start with revisiting how PayPal makes money: the company generates most of its revenue by facilitating payment transactions and charging a fee for that (“Transaction revenues” in the table below). The company helps merchants accept payments online and offline (via multiple solutions such as “Checkout”, and “Zettle”), it supports peer-to-peer payments (via PayPal and Venmo wallets), as well as powers embedded payments for various services and software solutions (via Braintree). PayPal is also a global player with 46% of its revenues generated outside of the United States.

Thus, the key metrics for the company in terms of revenue generation are the number of customers (“Active Accounts” in PayPal’s terminology), customer activity in terms of payment value (or “Total Payment Volume”), and the fee level (“Take Rate”). PayPal will continue to grow by either acquiring new customers, increasing payment volume per customer, increasing the fee levels generated from the resulting payment volume, or some combination of all three. The company provides these metrics in the investor updates (see the “Supplemental Information” in the Investor Update presentation).

The key expenses for the company are “Transaction expenses” and “Transaction and credit losses” (please see the table below). As an example, PayPal charges a merchant for collecting payments online, and then occurs card scheme and processing costs, as well as pays “interchange fees” to the card issuers. In addition, PayPal also occurs similar costs when consumers top up their PayPal wallets with debit or credit cards. Finally, there are costs associated with fraud and merchant defaults (hence the name “losses”).

Finally, PayPal incurs Customer support, Sales and marketing, Technology and development, and General and administrative costs, as well as pays taxes. As PayPal uses stock-based compensation, part of the above costs is a “non-cash item”, meaning that these costs do not decrease the company’s cash balance (please see below on this, in the section “Net Income”).

Active Accounts

PayPal completed 2021 with 426 million Active Accounts, adding 49 million in Net New Active Accounts (NNAs) through the year (13% YoY growth). However, as can be seen from the chart below customer growth rapidly decelerated at the year-end, with YoY growth of just 13% in Q4 2021. Moreover, during the earnings call, company management announced that they are “pivoting” their focus away from customer growth to customer engagement, and do not see the previously set mid-term target of 750 million customers as achievable.

The company’s management indicated that the reasons for the “pivot” away from customer growth lie in the fact that the customers, that were acquired through incentives-based marketing campaigns of 2020-2021, show low engagement and make little contribution to the company’s bottom line. Moreover, some customers clearly "gamed” such incentives-based campaigns, opening multiple accounts. Thus, the company had to close over 4 million illegally opened accounts in Q4 2021.

In 2022 company guided for 15-20 million Net New Active Accounts, which would represent 3.5-4.7% YoY growth. As can be seen from the chart above, this would be unprecedentedly low customer growth, as the company grew above 10% even before the boost in e-commerce driven by the pandemic.

Total Payment Volume

PayPal reported a $340 billion Total Payment Volume in Q4, 2021, and (stunning) $1.25 trillion for the full year (which represents 33% YoY growth). However, as can be seen from the chart below, quarterly YoY growth in Total Payment Volume started decelerating by year-end (i.e. Q1 2021 TPV grew 50% YoY, while Q4 2021 TPV grew 23% YoY).

It should be noted that the company still reports TPV and Revenue numbers excluding eBay contribution (“ex-eBay” in the Investor Update), as the companies are still parting ways and PayPal is losing eBay volumes. Thus, Total Payment Volume excluding eBay grew 38% YoY in 2021. During the earnings call, management commented that the transition from eBay will be fully completed by the end of Q2 2022, and the company will further report a single set of numbers. The charts below illustrate the impact of eBay over the last five quarters.

PayPal guided for 19-22% YoY growth in Total Payment Volume in 2022 (and 21-24% YoY growth in TPV excluding eBay). The company consistently delivered TPV growth above 20% in the last five years (including the pre-pandemic years); however, as illustrated above that growth was supported by the double-digit growth in Active Accounts. Thus, the company’s efforts in increasing the average Total Payment Volume per account will be critical in achieving guidance. Management promised to start reporting ARPU (average revenue per user) numbers sometime in 2021.

Revenue and Take Rate

PayPal reported $6.9 billion in Revenue in Q4 2021, and $25.4 billion in Revenue for the full year of 2021 (which represents 18% YoY growth). Similarly, to Total Payment Volume, the company reports separately revenue excluding eBay contribution. Thus, revenue grew 29% YoY ex-eBay.

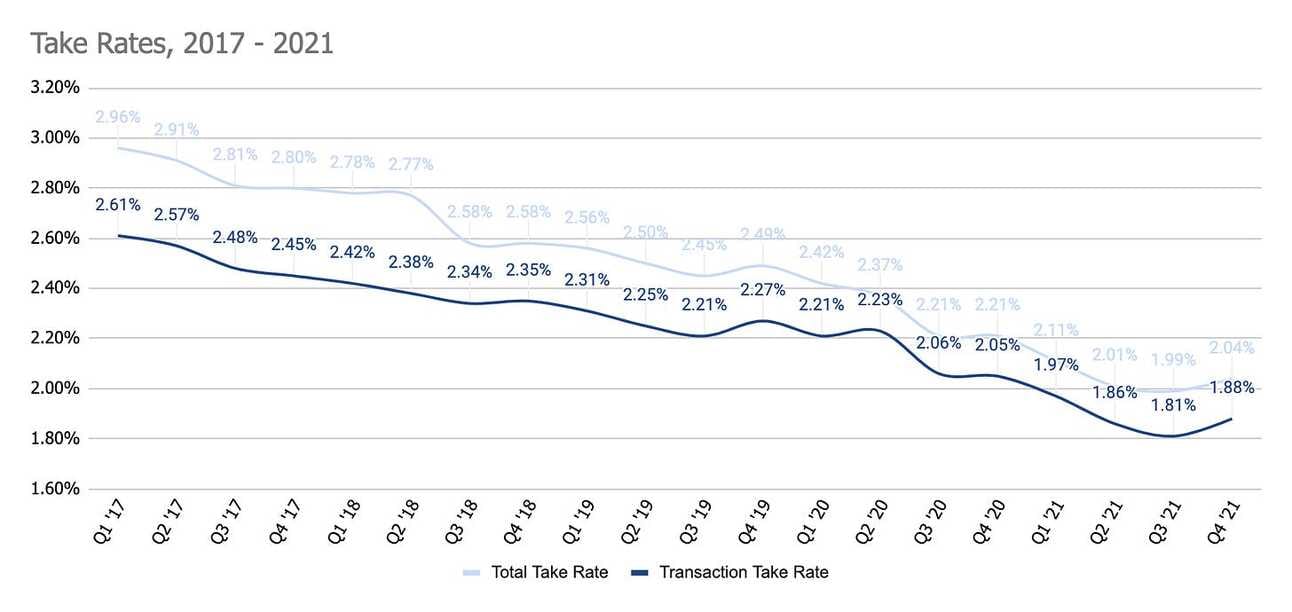

However, if you compare the charts of the TPV and Revenue growth, you will see that revenue grew at a lower rate. For instance, TPV grew 156% from Q4 2017 to Q4 2021, while revenue grew only 86%. The reason is the decreasing “Take Rate”, or the percentage that PayPal earns from the processed payments volume. The chart below clearly illustrates that PayPal has been facing both a decline in the Total Take Rate, as well as a decline in extra revenue it generates from the non-transaction take rate (as seen from the narrowing gap between the Total Take Rate and Transaction Take Rate).

The company guided for 15-17% growth of revenue in 2022 (19-21% growth ex-eBay), which is lower than the guidance for the TPV of 19-22% (21-24% ex-eBay). Thus, one can conclude that the company does foresee a further reduction in the Take Rate. In summary, decreasing Take Rate will be another headwind for PayPal in its path to continued growth.

Transaction and Loan Loss Expenses

As noted above, “Transaction Expense” and “Transaction and Credit Losses” contribute a major part of the company’s operating expenses. PayPal reports “Transaction Expense Rate” and “Transaction and Loan Loss Rate” (calculated as % of Total Payments Volume). In addition, they report “Transaction Margin”, which is calculated as “total revenue less transaction expense and transaction and loan loss, divided by total revenue”, and essentially represents the percentage of revenue “left” after the costs associated with processing transactions.

Transaction above illustrates that Transactions Expense Rate has been quite stable during the 2017 - 2019 period; then, dropped with the pandemic in 2020, and started going up again in the second half of 2021. Transaction and Loan Loss Rate has been declining more consistently, and also experienced an uptick in late 2021. As transaction expenses represent such a large portion of company operating expenses, it is critical to see how the Transaction Expense Rate evolves going forward.

In terms of Transaction Margin, we can see a consistent decline trend during 2017-2019, then an uptick with the beginning of the pandemic, and then a decline again in 2021. It is important to keep in mind that the company occurs transaction expenses from total payments volume, irrespectively of the revenue. Thus, a declining Transaction Margin means that the transaction costs grow faster than the revenue. Again, a decrease in the Transaction Margin that the company experienced in 2021 can negatively impact the company’s Operating Income; and thus, the trend shall be monitored closely going forward.

Net Income

PayPal reported $1.32 billion in Non-GAAP Net Income for Q4, 2021 and $5.46 billion in Non-GAAP Net Income for the full year (19% YoY growth), which translated into $4.60 in Non-GAAP Earnings Per Share (EPS).

It is important to note that the company uses primarily non-GAAP measures of their Net Income and EPS. Thus, GAAP Net Income for the year was $4.17 billion, and the GAAP Earnings Per Share were $3.52, as illustrated in the table below.

Adjustments for the non-GAAP income include stock-based compensation, amortization of intangible assets (acquisitions), as well as a few other minor items.

The company’s management guided for $4.60 - 4.75 Non-GAAP, and $2.97-3.15 GAAP Earnings Per Share in 2022. Essentially, they guided for 0-3% growth in Non-GAAP EPS despite the projected 15-17% growth in revenue. Moreover, guidance for the GAAP EPS represents a decline of 10-15% from 2021.

I will leave the discussion, on whether stock-based compensation should not be considered a cost to the company, and thus, excluded from the Net Income, for some other time. However, the chart below illustrates that GAAP Net Income slightly declined already in 2021.

Things to Watch in 2022

Let’s try to summarize things to watch this and in the coming years:

PayPal consistently grew Total Payments Volume (TPV) in double digits over the last five years; however, this growth was supported by strong growth in Active Accounts. As the management pivoted away from Active Accounts growth, sustaining double-digit growth in TPV might be a challenge

Take Rate, or the percentage of TPV that the company books as revenue, has been consistently declining over the past five years. Thus, the company will have a further headwind to its revenue growth if this trend continues in 2022 and beyond

PayPal experienced growing Transaction Expense and declining Transaction Margin during 2021. If the company does not manage to reverse these trends, this will put pressure on the operating income even if the company manages to grow TPV and Revenues.

Finally, PayPal guided for almost no growth in non-GAAP Earnings Per Share in 2022 despite expected growth in revenue. Furthermore, GAAP EPS is expected to decline. This means that the company is expecting a considerable increase in costs this year, which might not be temporary.

Disclosure & Disclaimer: despite rocky performance in 2021 and early 2022, I have open positions in most of the companies covered in this newsletter, as I am extremely bullish on the transformation in the financial services industry. However, none of the above is financial advice, and you should do your research.