Affirm ( ) reported its Q1 2022 (Fiscal Q3 2022) results last week. Affirm’s stock price was decimated over the last couple of quarters despite strong results. I believe Affirm’s stock price is a reflection of everything that the investors are concerned about at the moment, starting from the rising interest rates, to historically-high inflation, to the prospects of an economic recession. The company is not yet profitable, it heavily relies on external funding to fuel its lending, and its customer will surely be impacted by the economic recession should we see one.

Nevertheless, the company delivered another strong quarter with growth across the board, including Active Customers, Gross Merchandise Volume, Revenue, and Gross Profit. There is a risk that some Fintech companies will not survive this market downturn. I don’t think Affirm will be one of them. Let’s look at their numbers to understand why I believe so.

Please note that the fiscal year 2022 for Affirm ends in June, 2022. I tried to indicate “fiscal” and “calendar” for all the periods in the text to avoid any confusion.

Active Consumers and Merchants

Affirm finished Q1 2022 (Fiscal Q3 2022) with 12.7 million active customers, representing a 137% YoY growth and a 13% growth. Affirm defines an active “as a consumer who engages in at least one transaction on our platform during the 12 months prior to the measurement date.”

On the other side of their network, Affirm finished the quarter with over 207 thousand active merchants, representing a 1,700% YoY growth and a 23% growth sequentially. The astronomic merchant growth over the last few quarters is the result of Affirm’s partnership with Shopify (whereas merchants using the Shopify platform enable the “Shop Pay” payment method, which is powered by Affirm). The companies announced the prolongation of their exclusive partnership until June 2025.

If my understanding is correct, within the scope of Affirm’s partnership with Amazon, Amazon acts as the merchant on behalf of the sellers on its platform. Thus, this partnership is not contributing to the active merchant growth.

On the positive side, the company announced several partnerships with payment processors, including Verifone, Fiserv, Global Payments, Adyen, and Stripe. These partnerships will simplify enabling Affirm payment methods for merchants that use the above-mentioned companies as their merchant acquirers.

Gross Merchandise Volume

Affirm reported $3.9 billion in Gross Merchandise Volume in Q1 2022 (Fiscal Q3 2022), which represents a 73% YoY growth. The sequential decline in GMV is natural, as the first quarter of a year is usually a slow season for merchants.

The company guided for $3.95 to $4.05 billion in Gross Merchandise Volume in Q2 2022 (the last quarter of its Fiscal 2022 year), which would represent a 59-63% YoY growth. GMV guidance for the full fiscal year 2022 is $15.04 to $15.14 billion, which would represent approximately 82% YoY growth on an annual basis.

The management did not give guidance past Q2 2022. Guidance for Q2 2022 looks strong, but I believe the question remains about what happens next given historic levels of inflation and the prospects of an economic recession. I think the company’s share price is a reflection of investors’ pessimism about consumer spending in deteriorating economic conditions. The management did not spend much time talking about the economy on the earnings call, but I think we should keep in mind the potential impact of an economic recession on the company’s growth going forward.

What is also a bit puzzling to me is the lack of a major GMV boost from the partnership with Amazon. The company announced the partnership in August 2021 and Q4 2021 ($4.5 billion in GMV) looked like a preview of what might come out of this partnership. Yet, another quarter passed and looks like everyone forgot about this deal.

Loan Portfolio

Affirm finished Q1 2022 (Fiscal Q3 2022) with $2.5 billion of loans on their balance sheet (“Loans Held for Investment”), and $6.7 billion in the Total Platform Portfolio. The company defines Total Platform Portfolio as “the loans s the unpaid principal balance outstanding of all loans facilitated through its platform as of the balance sheet date, including loans held for investment, loans held for sale, and loans owned by third-parties.”

As a reminder, Affirm retains a portion of the originated loans on its balance sheet and sells or securitizes the remaining part of the originations. Loans on the balance sheet generate interest income, while loan sales generate one-time “gain on sale” revenues, as well as servicing income for the duration of the loan. Thus, the size of the “Loans Held for Investment” portfolio is a driver for interest income, while the Total Platform Portfolio is a driver of the servicing income.

During the quarter, there was news about failed securitization attempts by Affirm. However, the company reported completion of a $500 million asset-backed securitization in May 2022. As per the earnings report, the company has over $9 billion in committed funding capacity, which exceeds the current Total Platform Portfolio of $6.7 billion. The rising rates and higher risk premiums will impact the company going forward, but at least for now, it looks like the funding is available and the impact is limited to the cost of funding.

Revenue and Take Rate

Affirm reported $354.8 million in revenue for the quarter, which presents a 53.8% YoY growth, and a 1.7% sequential decline. The key components of the revenue were “network revenue” (41% of the total revenue) and “interest income” (38% of the total revenue).

As I mentioned above, “network revenue” and “interest income” have different drivers for growth (GMV and LHI respectively), and as these two revenue sources comprise almost 80% of the total revenue of the company, it is important to look into those separately. For instance, although the total revenue grew 53.8% YoY, the network revenue grew only 29% YoY, and the interest income grew 42% YoY.

As can be seen from the chart below, the Take Rate (calculated as Total network revenue divided by the GMV) compressed from 5.0% in Q1 2021 to 3.7% in Q1 2022; hence, the network revenue grew slower than the GMV. Take Rate is a function of the product mix (i.e. Affirm charges merchants a higher rate for 0% APR loans). In addition, Affirm only earns an interchange fee in case it doesn’t have a relationship with a merchant (i.e. Affirms consumer paid with a virtual or Debit+ card). The chart below illustrates a downtrend for the Take Rate, so it is important to monitor how this evolves going forward.

Interest Income is a function of the size of the loan portfolio and the gross interest yield (for simplicity, I calculated annualized gross yield as Interest income / Average LHI portfolio * 4). As can be seen from the chart below, the growth in the Interest Income was supported not only by the size of the portfolio, but also by the increasing interest yield. Similar to the Take Rate, portfolio size and average yield are key metrics to monitor going forward.

Affirm guided for $345 to $355 million in total revenue in Q2 2021 (Fiscal Q4 2022), which would represent a 32-36% YoY growth. The full fiscal year 2022 revenue guidance is $1.33 to $1.34 billion.

Affirm is guiding for a sequential increase in GMV ($3.95 to $4.05 billion) in Q2 2022, and no growth, or even slight reduction, in revenue ($345 to $355 million). This suggests either a further compression in the Take Rate, Portfolio Yield or both.

Gross Margin

Affirm uses a metric called “Revenue Less Transaction Costs” as a measure of gross profitability. The metric is calculated by deducting operating costs that are directly related to the provision of the service (such as provisions, funding costs, and payment processing), from the total revenue.

Thus, Affirm reported Revenue Less Transaction Costs of $182.4 million for Q1 2022 (Fiscal Q3 2022), which represents a 36.5% YoY growth. Please note that in Q1 2021 Affirm had a release of provisions for credit losses (hence “negative” costs), which impacts comparison.

As can be seen from the chart below, Affirm’s gross margin in Q1 2022 was 51.4%, a decrease from 57.9% in Q1 2021, but an improvement from the 50.8% in Q4 2021. Again, please keep in mind in Q1 2022 Affirm booked provisions for credit losses, while it made provisions release in Q1 2021.

On the earnings call, Affirms management mentioned that they look at Revenue Less Transaction Costs as a percentage of GMV, and aim for a 3-4% margin in the long-term. In Q1 2022, Revenues Less Transaction Costs comprised 4.7% of the GMV, which means that the company’s management expects a compression in the Take Rate, Portfolio Yield, or Gross Margin (or most likely, a combination of all three).

The company guided for $160 to $165 million in Revenue Less Transaction Costs in Q2 2022 (Fiscal Q4 2022), and $638 to $643 million for the full fiscal year 2022. This would represent a 45-48% Gross Margin for the quarter, and a 48% Gross Margin for the full year. Perhaps, higher interest rates start impacting the company’s gross margin.

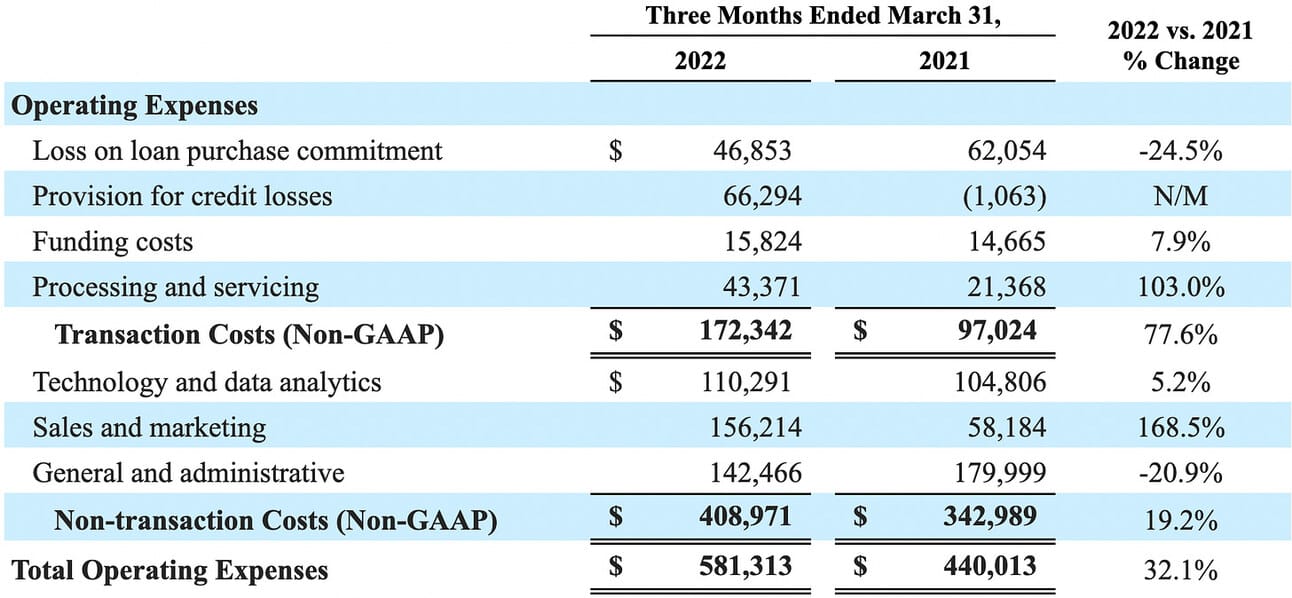

Operating Expenses

Affirm reported $581.3 million in total operating expenses in Q1 2022 (Fiscal Q3 2022), which consisted of $172.3 million in transaction costs (discussed above), and $409.0 million in non-transaction costs. Operating expenses included $98.4 million in share-based compensation (a decrease from $179.6 million in share-based compensation in Q1 2022).

Please note that the increase in the “Sales and marketing” expenses included $119 million in expenses related to warrants and other share-based payments in connection with the Shopify partnership. As part of the partnership, Affirm issued warrants to Shopify as an incentive and now accounts for the depreciation of this agreement (which was classified as an asset) and the change in the fair value of the warrants. Without the impact of warrants, “Sales and marketing” costs would stand at $37.2 million (compared to $41.3 million in Q1 2021).

In addition, Affirm capitalizes part of the Technology and data analytics costs (and expenses amortization). Thus, “$34.4 million salaries and personnel costs that relate to the creation of internally-developed software were capitalized into property, equipment, and software, and we recorded amortization expense of $6.4 million.” Without capitalization (and amortization) impact “Technology and data analytics” expenses would stand at $138.3 million (compared to $113.8 million for Q1 2021).

Finally, “General and administrative” expenses were relatively lower compared to Q1 2021; however, Affirm went public in Q1 2021 incurring a lot of one-time expenses related to the IPO.

Net Loss and Adjusted Operating Income

Affirm reported $54.7 million in Net Loss for the quarter, an improvement from a $287.1 million loss in Q1 2021. Please note that Net Loss was heavily impacted in both Q1 2022 and Q1 2022 by the “Other (expense) income, net” position. As per the company’s quarterly filing, this position primarily relates to the acquisition of PayBright (a BNPL company in Canada, that Affirm acquired). As the acquisition price was paid primarily in Affirm stock, fluctuation in the Affirms stock price created an “artificial” income in Q1 2022, and a loss in Q1 2021.

Given the impact of PayBright, it probably makes sense to look at the Operating Loss over this period. Thus, Affirm reported an Operating Loss of $226.6 million for the quarter, an increase from $209.3 million in Q1 2021. I believe the chart below illustrates well the impact of the IPO (January 2021) on the company’s Operating Loss.

The company’s management uses Adjusted Operating Income (Loss) as a measure of the company’s ongoing profitability. The company calculates Adjusted Operating Loss by adjusting GAAP Operating Loss for the depreciation and amortization, stock-based compensation, expenses related to enterprise warrant, and a few other one-time costs. Adjusted Operating Income looks like Adjusted EBITDA except interest expenses (Adjusted Operating Income does not include adjustments for interest expenses, as they are a crucial component of the company’s operating costs).

Affirm reported $4 million in Adjusted Operating Income for the quarter. However, the company’s management guided for a negative Adjusted Operating Margin of 11-15% in Q2 2022 (Fiscal Q4 2022), which, given the revenue guidance implies $38-53 million in Adjusted Operating Loss. The company also guided for a negative Adjusted Operating Margin of 5.6 - 6.6% for the full fiscal year 2022.

Affirm shareholder letter included the company’s ambition to “achieve sustained Adjusted Operating Income profitability on a Run Rate basis by the end of the Fiscal Year 2023.”

Things to Watch in 2022

Please note, that Affirm’s fiscal year ends on June 30, 2022; thus, the company did not provide any guidance past Q2, 2022. Guidance for the remainder of the calendar year 2022 is expected with the company’s Q2 2022 (Fiscal Q4 2022) earning results.

Growth in Gross Merchandise Volume. GMV is the prime driver of the Network revenue and indirect driver of the Interest Income (as the company’s loans are short-term, it depends on new originations to maintain the size of the portfolio). Affirm guided for 59-63% YoY growth in GMV in Q2 2022, but the question remains, what growth rate can be expected over the longer term.

Evolution of Gross Margins. So far the company enjoys gross margins over 50%. Gross margins are essentially a function of the provisions for loan losses, the share of 0% APR loans in the mix, funding costs, and processing costs. Given the economic conditions and the rising interest rates, it is unreasonable to expect the gross margins to remain at the same level going forward.

Operating Expenses and Adjusted Operating Income. The ambition to exit fiscal 2023 (ending June 30, 2023) with run-rate profitability on the Adjusted Operating Income basis was the only guidance that the management gave for the upcoming fiscal year. The company has been flirting with Adjusted Operating Income profitability, and a bigger scale (and the resulting higher gross profit) should cement that.

Launch of Debit+ card. The company’s guidance does not include any impact from the rollout of the Debit+ card. The company has almost 13 million active consumers, so if the Debit+ card really adds value (as advertised), then I believe it can be scaled quite quickly.

In summary, it was a strong quarter. During the earnings call, the company’s management did not try to blame the economy or the rising interest rates, and instead gave reassurance on the growth prospects and funding availability. They clearly projected confidence in what they are doing and had strong results to back this confidence with.

Source of the data used above: Investor Relations

Disclosure & Disclaimer: despite rocky performance in 2021 and early 2022, I have open positions in most of the companies covered in this newsletter (including Affirm), as I am extremely bullish on the transformation in the financial services industry. However, none of the above is financial advice, and you should do your research.