Hi!

Hope you had a fantastic weekend! My first newsletter was about Nubank preparing to go public. Since then the company has become the fourth-largest financial institution in Brazil in terms of the number of customers, turned to profitability, and as of last week, has a credit rating that is on par with Brazil's sovereign rating. All of that in less than 2 years! More on that in today’s newsletter:

S&P Global assigns a ‘BB-’ rating to Nubank,

Apple launches Tap to Pay in Brazil, and

Shift4 partners with Give Lively

Thank you for reading and have a great week!

Jevgenijs

p.s. have feedback? DM me on Twitter

S&P Global Assigns ‘BB-’ Rating to Nubank

S&P Global Ratings has assigned a BB- international rating to Nubank’s (NYSE: NU) main operating subsidiary, Nu Financeira, and the holding company, Nu Holdings, highlighting their strong growth, solid capital structure, and efficiency. This rating is on par with Brazil's sovereign rating, as well as the rating of Brazil’s largest banks, Bradesco and Banco du Brazil, and reflects the company's ability to meet financial obligations. Nu Holdings Ltd. itself does not possess any debt; however, it provides guarantees for the debt of its subsidiaries in Mexico and Colombia, which amounts to $740 million. “S&P’s rating is a statement of our long-term vision, a reinforcement that our business model is solid and on the right path,” commented David Vélez, Nubank’s founder and CEO.

In the second quarter of 2023, Nubank added 4.6 million customers bringing the total number of customers to 83.7 million. Nubank is now the fourth-largest financial institution in Brazil in terms of the number of customers. Revenue increased by 61% YoY to $1.87 billion, while gross profit increased 20% YoY to $782 million. Net income for the quarter was $224.9 million compared to a net loss of $29.9 million a year ago. Nubank had an interest-earning loan portfolio of $6.3 billion (up 97% YoY), while the total deposits were $18.0 billion (up 35% YoY). During the quarter the company executed a round of layoffs in Brazil, as well as struck a number of partnerships, including retail giant Amazon, Uber, and travel platform Hopper.

Apple Launches Tap to Pay in Brazil

Apple (NASDAQ: AAPL) has officially launched Tap to Pay in Brazil, allowing retailers, to securely and easily accept Apple Pay, credit and debit cards through contactless transactions, and other digital wallets using only an iPhone and the partner app for iOS. Tap to Pay is initially available for CloudWalk's InfinitePay customers, and Apple is collaborating with partners like Stone (NASDAQ: STNE), SumUp, and Nubank (NYSE: NU) to expand Tap to Pay to more sellers in the country. Tap to Pay on the iPhone works with contactless debit and credit cards from major payment networks like American Express, Mastercard, and Visa, and requires no additional equipment to accept contactless payments.

Image source: Apple

“Tap to Pay” is a payment technology that allows consumers to make contactless payments by tapping their mobile devices or contactless-enabled payment cards on an NFC-enabled smartphone, or a wearable device. Stripe was Apple’s first partner for the “Tap to Pay” functionality on iOS devices after its launch in 2022 and introduced the support for Android devices in February this year. Block’s Square followed similar timelines, launching “Tap to Pay” for iOS devices last year, and expanding to Android devices in April. As of now, most leading acquirers provide the service tailoring it to the needs of their client base (i.e. PayPal launched Tap to Pay for Venmo, and Adyen integrated its solution into the Oracle Payment Cloud Service aiming to cater to businesses in the food and beverage industry).

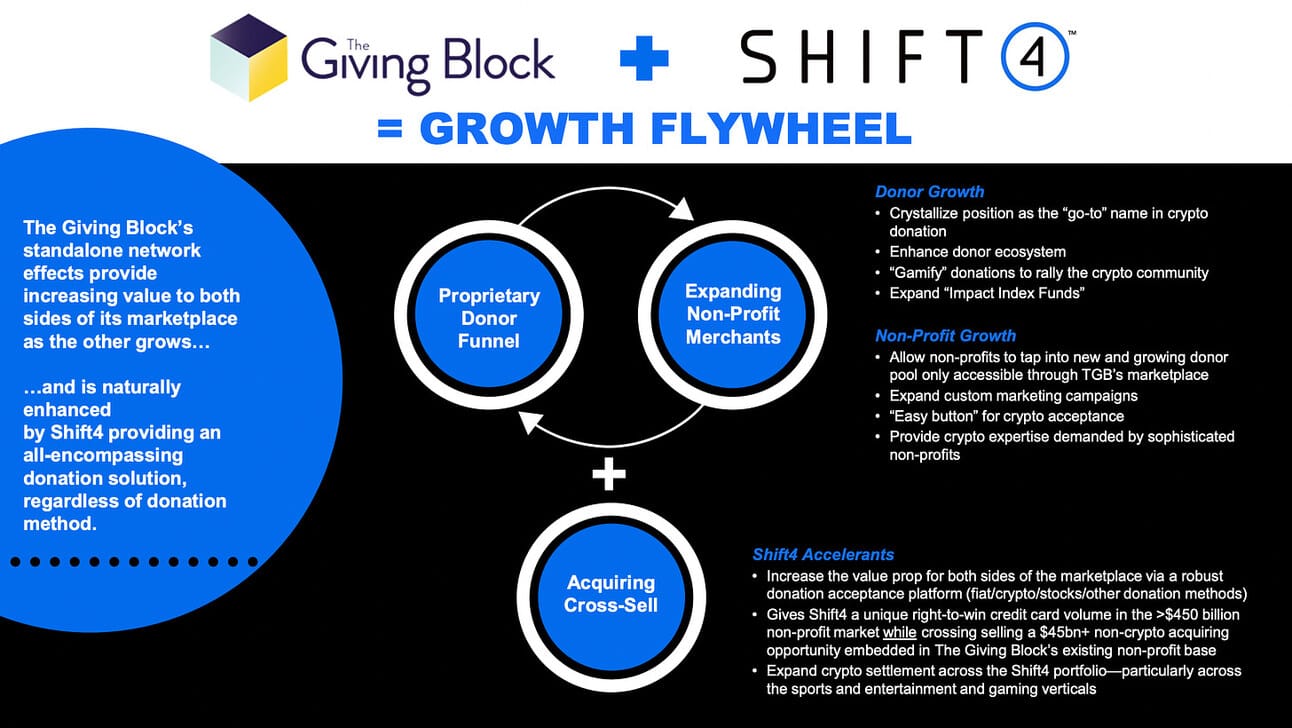

Shift4 Partners with Give Lively

Shift4 Payments (NYSE: FOUR) is partnering with Give Lively, a fundraising platform for nonprofits. Give Lively will integrate Shift4 as a payment processor, offering low transaction fees and expanding donation options to include stocks and cryptocurrencies. The collaboration, which is set to launch in 2024, intends to simplify the donation process for donors and nonprofits, allowing them to focus on their missions. "This exciting partnership with Shift4 is a huge win for both donors and nonprofits. It will bring lower costs and more giving options to donors, as well as new tools that simplify giving for our 8,600 member nonprofits,” commented David DeParolesa, CEO of Give Lively.

Image source: The Giving Block Acquisition Announcement

In early 2022, Shift4 announced the acquisition of The Giving Block, a company specializing in cryptocurrency fundraising for nonprofits. Shift4 planned to incorporate The Giving Block into its offering to capitalize on a $45+ billion cross-sell opportunity by “bundling crypto donation capabilities with traditional card acceptance.” The terms of the deal included $54 million in up-front consideration and a potential earnout of up to $246 million. “Cryptocurrency is becoming increasingly mainstream as more people want to invest, transact and donate in crypto. We intend to be at the forefront of this movement and leverage The Giving Block technology across the entire Shift4 enterprise,” commented the company’s founder and CEO, Jared Isaacman on the acquisition.

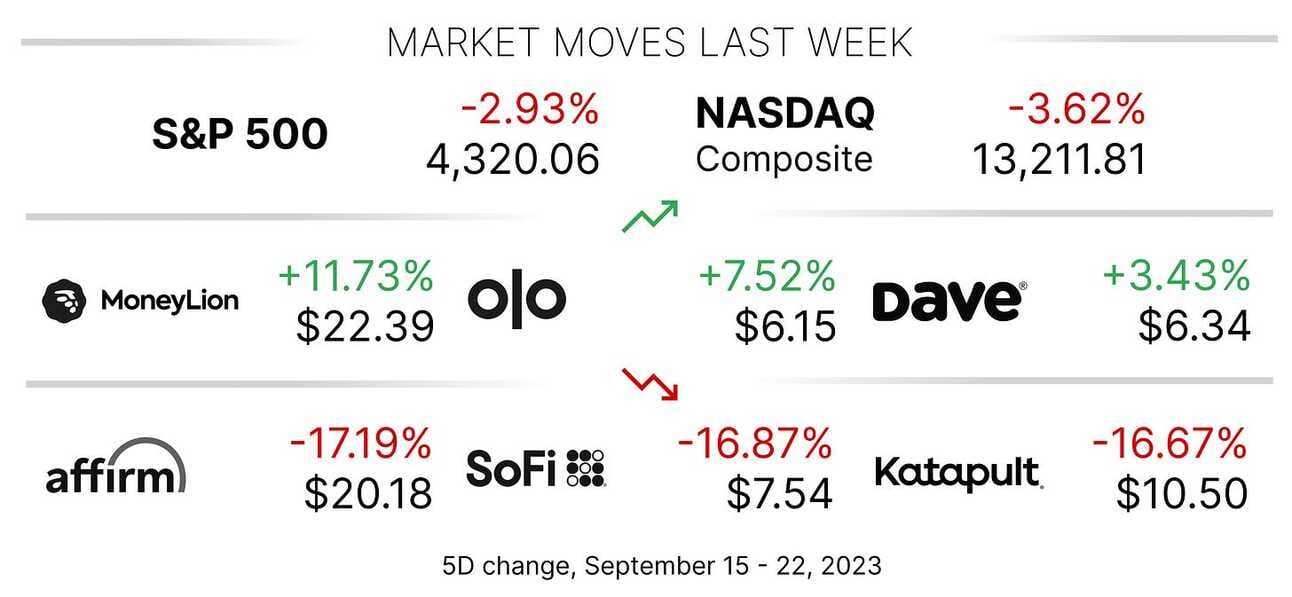

Today’s Chart of the Day is my regular check-in on the best-performing Fintech stocks. Year-to-day, the leaders are Remitly (NASDAQ: RELY) +115%, Affirm (NASDAQ: AFRM) +108%, Upstart (NASDAQ: UPST) + 100%, Coinbase (NASDAQ: COIN) + 100% and Paymentus (NYSE: PAY) + 95%. Let’s see what the last quarter of the year brings.

Big Data Engineer - Wallet & Apple Pay

@ Apple

🇺🇸 Austin, TX, United StatesMachine Learning Engineer - Apple Pay

@ Apple

🇺🇸 Austin, TX, United StatesProduct Manager - Apple Cash

@ Apple

🇺🇸 Santa Clara Valley, CA, United StatesDirector, Corporate Communications and Culture

@ Shift4 Payments

🇺🇸 Multiple locations, United StatesDirector, Data Systems & Business Intelligence

@ Shift4 Payments

🇺🇸 Multiple locations, United States

Cover image source: Nubank

Disclaimer: Information contained in this newsletter is intended for educational and informational purposes only and should not be considered financial advice. You should do your own research or seek professional advice before making any investment decisions.