Hi!

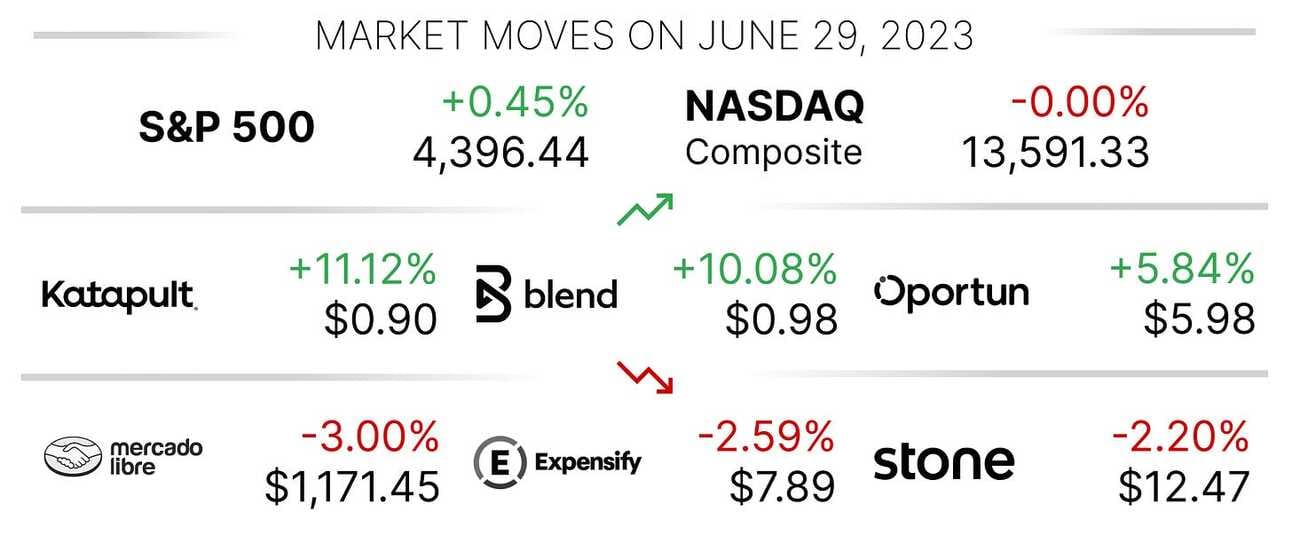

We are two quarters into 2023. There are few exceptions, but for the most part, this year has been good to publicly-traded Fintech companies (check the charts below). Hope this will continue into the second half of the year! In the meantime:

Square launched a credit card for sellers,

Visa acquired Brazilian Fintech startup Pismo, and

PayPal introduced Tap to Pay for Venmo

Thank you for reading and have a great weekend!

Jevgenijs

Square Launches Credit Card for Sellers

Square (NYSE: SQ) announced the launch of Square Credit Card to cater to the financing needs of its U.S. sellers. The Square Credit Card, powered by American Express (NYSE: AXP), offers sellers more spending flexibility and rewards tied to their business. The Square Credit Card has no late or annual fees, and features “a credit limit determined by the sales a seller processes through Square”. Square, which previously offered only debit cards, disclosed that through the first five months of 2023, Square sellers “spent more than $1 billion using their debit cards, a 20% increase when compared to the same period last year.”

Source: Square

Square is also expanding the capabilities of its Square Loans product. Thus, large sellers will now have the option to repay loans on a fixed monthly schedule, providing a more predictable repayment structure compared to daily repayments. This new financial option, along with the Square Credit Card, are currently in beta and have been well-received, particularly among upmarket sellers. Since the beta launch, upmarket sellers have accounted for 25% of Credit Card spend and 30% of originations from loans with fixed monthly payments, according to the company’s press release on the launch.

Square Credit Card and Square Loans are part of the Square Banking suite of financial products, which includes checking and savings accounts, debit (and now) credit cards, as well as lending products. Square’s Banking products seamlessly work with its ecosystem of solutions like payments and Square Payroll, providing sellers with a unified view of their payments, account balances, expenditures, and financing options. In 2021, Square launched an industrial bank, Square Financial Services, after completing the charter approval process with the Federal Deposit Insurance Corporation and the Utah Department of Financial Institutions.

✔️ Square Unveils Square Credit Card and New Cash Flow Management Products in Beta as Banking Adoption Grows

✔️ Square Launches Credit Card, New Loan Options, Early Deposit Access

✔️ Introducing Square Banking, a Suite of Powerful Financial Tools for Small Businesses

✔️ Square Financial Services Begins Banking Operations

Visa Acquires Brazilian Fintech Startup Pismo

Visa (NYSE: V) has entered into a definitive agreement to acquire Pismo, a cloud-native issuer processing and core banking platform operating in Latin America, Asia Pacific, and Europe, for $1 billion in cash. The acquisition of Pismo will enable Visa to offer core banking and issuer processing services across debit, prepaid, credit, and commercial cards, as well as provide its clients with connectivity to emerging payment systems, such as Pix in Brazil. The transaction is subject to regulatory approvals and is expected to close by the end of 2023.

Image source: Pismo

Pismo, co-founded by Daniela Binatti and Ricardo Josuá in 2016, enables banks and fintech companies to launch a wide range of products, including cards and payments, digital banking services, digital wallets, and marketplaces. The company competes with the likes of Fiserv’s Finxact, SoFi’s Galileo and Technisys, Marqeta, Mambu, as well as solutions from established industry vendors such as FIS, Temenos, and Oracle. In 2021, Pismo raised $108 million from investors led by SoftBank, Amazon, and Accel, bringing its total funding to $118 million.

The acquisition of Pismo marks the biggest acquisition for Visa since late 2021. Thus, in 2021 Visa abandoned its plans for a $5.3 billion acquisition of Plaid due to legal hurdles presented by antitrust regulators. This unexpected setback led Visa to explore alternative opportunities in the financial technology space. Consequently, in the same year, Visa forged ahead and struck a deal to acquire Tink, a Swedish open-banking platform, for approximately $2 billion. Later in the year, Visa acquired a UK cross-border payments company Currencycloud for $963 million.

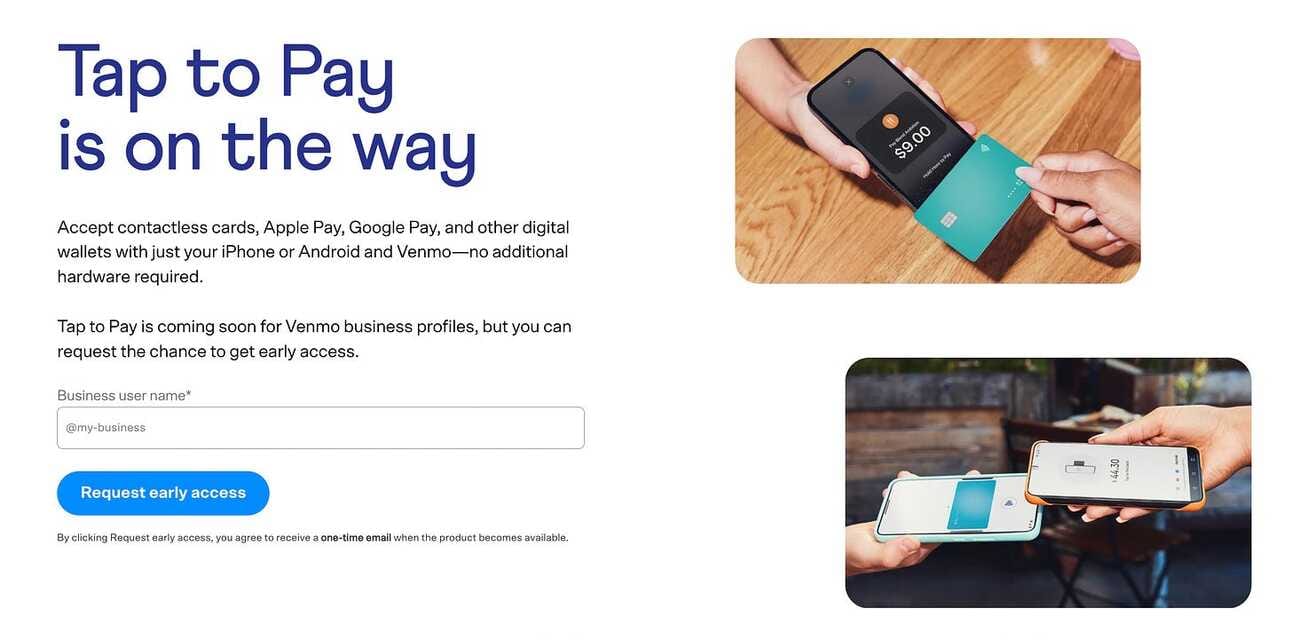

PayPal Introduces Tap to Pay for Venmo

PayPal (NASDAQ: PYPL) announced the introduction of “Tap to Pay” for Venmo, a feature allowing small U.S. businesses to accept contactless payments through their mobile devices. “Tap to Pay” eliminates the need for additional hardware or upfront costs, enabling companies to accept contactless payments, including cards and digital wallets, directly on their mobile devices. This feature is being rolled out to select Venmo business profile users and will soon be available for all Venmo business profile users in the country.

Source: PayPal

With “Tap to Pay”, businesses can accept payments and manage transactions within the Venmo app, with funds settling into their Venmo accounts. Tap to Pay is already being used and benefiting businesses such as Brothas Cookies, Dear Mama LA, GBarney Nails, and Magical Box Bakery. "Tap to Pay is the last milestone in the democratization of in-person card payments, where users can start taking card payments with no setup cost in a matter of minutes," commented Ed Hallett, Head of Product, Microbusiness at PayPal, on the launch.

PayPal is behind its competitors on this launch. Thus, Stripe was Apple’s first partner for the “Tap to Pay” functionality on iOS devices and introduced the support for Android devices in February. Block’s Square followed similar timelines, launching “Tap to Pay” for iOS devices last year, and expanding to Android devices in April. “Tap to Pay” is a payment technology that allows consumers to make contactless payments by tapping their mobile devices or contactless-enabled payment cards on an NFC-enabled smartphone, or a wearable device.

✔️ Introducing Tap to Pay for Venmo and PayPal Zettle Businesses in the U.S.

✔️ PayPal launches support for Tap to Pay for merchants using Venmo and Zettle

✔️ Square Debuts Android Tap to Pay for Merchants

✔️ Stripe expands Tap to Pay to Android

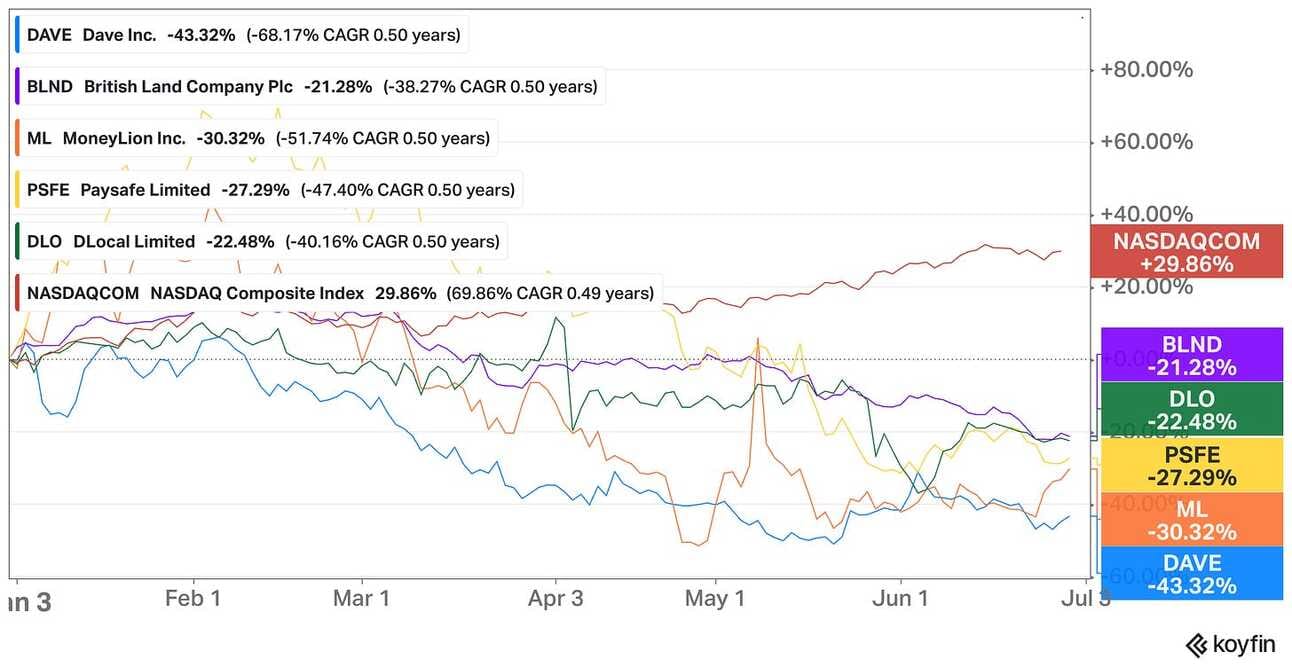

It’s the last day of the second quarter of 2023, so today I decided to take a look at the best and worst-performing Fintech stocks this year. Without further ado…

The best-performing Fintech stocks year-to-date are Upstart (+168%), Coinbase (+104%), Nubank (+91%), SoFi (+88%), and Shopify (+83%).

…and the worst-performing Fintech stocks year-to-date are Dave (-43%), MoneyLion (-30%), Paysafe (-27%), dLocal (-22%), and Blend (-21%).

NB! I excluded Bitcoin miners from the list. Marathon Digital, Riot Platforms, Hut 8, HIVE and Bitfarms are all up more than 200%.

Group Creative Director, Square Hardware

@ Square

🇺🇸 New York, NY or Los Angeles, CA, United StatesProduct Manager, Square Banking Platform

@ Square

🇺🇸 San Francisco, CA, United StatesSenior Manager, Fintech Partnerships

@ Visa

🇺🇸 Foster City, CA, United StatesDirector, Digital and Fintech Partnerships

@ Visa

🇸🇬 SingaporeSenior Product Manager - Venmo Payments

@ PayPal

🇺🇸 San Jose, CA or New York, NY, United States

Cover image source: Square

Disclaimer: Information contained in this newsletter is intended for educational and informational purposes only and should not be considered financial advice. You should do your own research or seek professional advice before making any investment decisions.