Earlier this week, Nubank ( ), the world’s largest neobank with over 48 million customers, started trading on New York Stock Exchange under the ticker $NU. The company closed its first trading day with a share price of $10.33 valuing the company at almost $48B (or more than Itaú Unibanco, the largest traditional bank in Latin America). As the outcome of the offering, Nubank raised $2.6B in new capital to fuel further growth across existing and new markets.

Previously, the company raised over $2B in venture rounds, including $500M from Warren Buffet’s Berkshire Hathaway in its latest funding this past summer, which valued the company at $30B.

Image source: Redpoint on Twitter

IPO of Nubank is a critical milestone for the whole FinTech industry, as we finally see how public markets value neobanks. Nubank took the first brave step and laid the foundation for expected IPOs of numerous neobanks across the world, such as Chime, Revolut, Monzo, and others, in the coming years.

Similar to other publicly traded issuers, we now have access to the company’s financial statements, so let’s digest the F-1 form (registration statement with SEC for non-US companies going public).

Most of the company’s 48 million customers are based in Brazil

Founded in 2013, Nubank operates in Brazil, Mexico, Colombia (the company has offices in Argentina, Germany, and the United States; however, those serve as engineering and support hubs), and offers a full range of financial services for private individuals, such as current and savings accounts, payments, debit and credit cards, consumer lending, life insurance, and brokerage. It also offers current accounts, as well as debit and credit cards for businesses. Needless to say, the services are offered via superior online and mobile experience and the company doesn’t rely on branches for serving its customers.

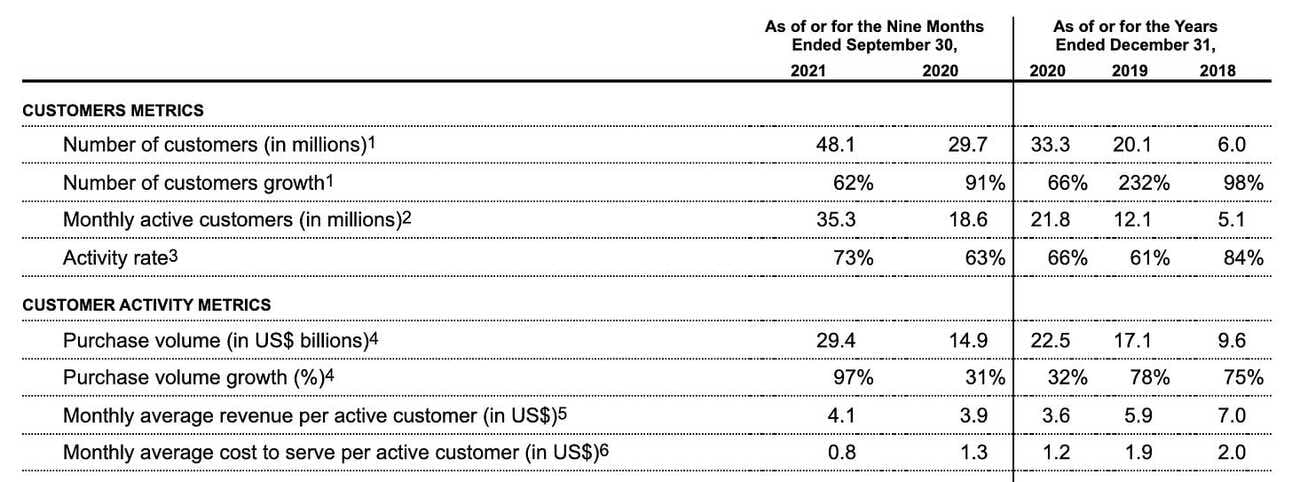

The company reports having 48.1 million customers at the end of September 2021 (of which 47 million are private individuals, and 1.1 million are SME customers); however, given the phase of growth of their customer base (on average, they have been adding 1.5 million new customers per month during the last 12 months), one can expect the company to cross the 50 million mark before year-end.

It should be noted, that Nubank launched its products to the public in Mexico and Colombia only last year, so the customer base is heavily concentrated in Brazil. I haven’t found the number of customers by country, but the filing mentions 700K customers in Mexico as an illustration of successful expansion to other markets, so I’d guess, the customer base in Colombia is even smaller.

Given Brazil’s population of 212 million people (of which 103 million people of working age), Nubank already serves 20%+ of the total population and 45%+ of the working population. For reference, the largest bank in Brazil (and the whole of Latin America), Itaú Unibanco, claim to serve 60 million retail customers. The population of Mexico and Colombia is 127 million and 48 million people respectively.

I believe it is fair to conclude that expecting prolonged rapid growth in the customer base in Brazil would be unreasonable. Nubank team proudly talks about providing services to the previously unbanked population of Brazil, but even with this segment in mind, customer growth in Brazil will most likely slow down considerably in the coming 1-2 years. This makes the bank’s ambition in Mexico and Colombia critical to the continued growth of the company.

Revenue is primarily driven by consumer lending and interchange fees

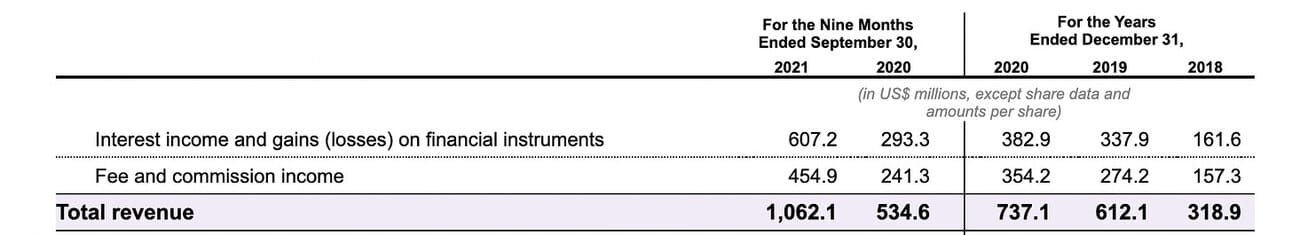

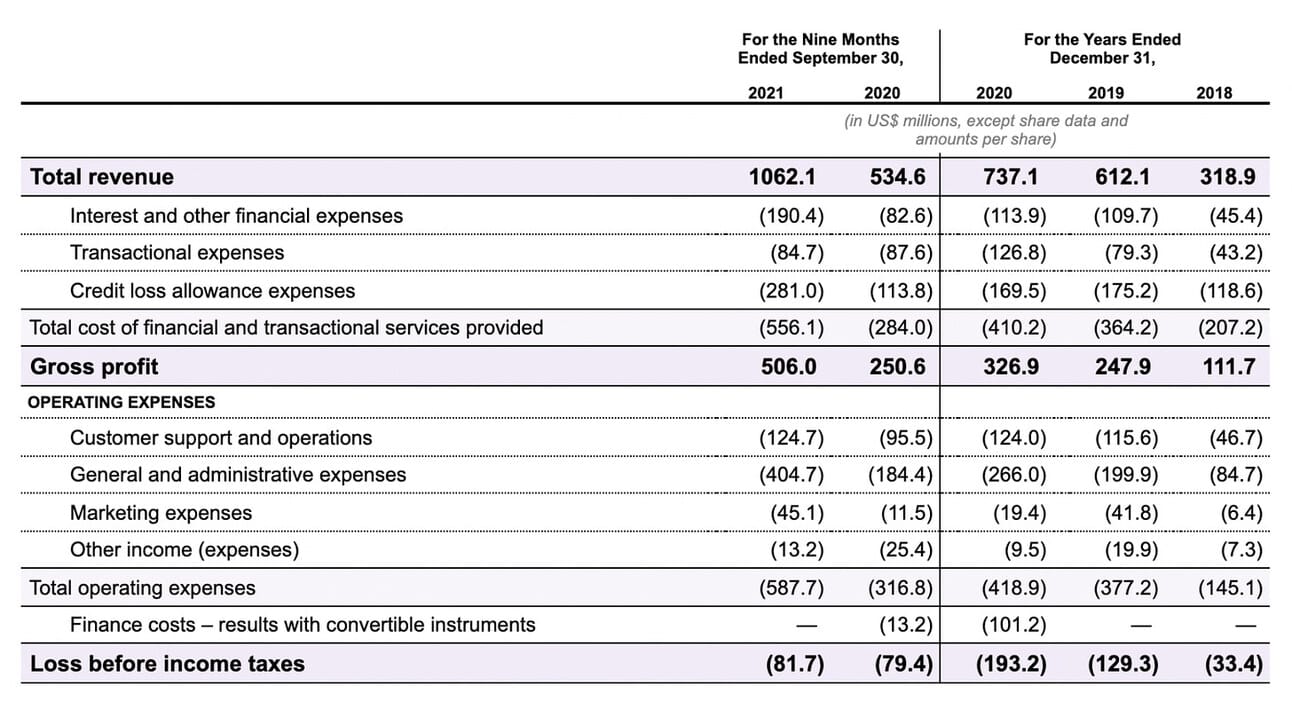

Nubank surpassed $1B in revenue in the first nine months of 2021. The revenue doubled over the last year and the growth came from both Interest income (income that is driven by the size of the loan book that builds over time) and Fee and commission income (income that is driven by customer activity during the reporting period).

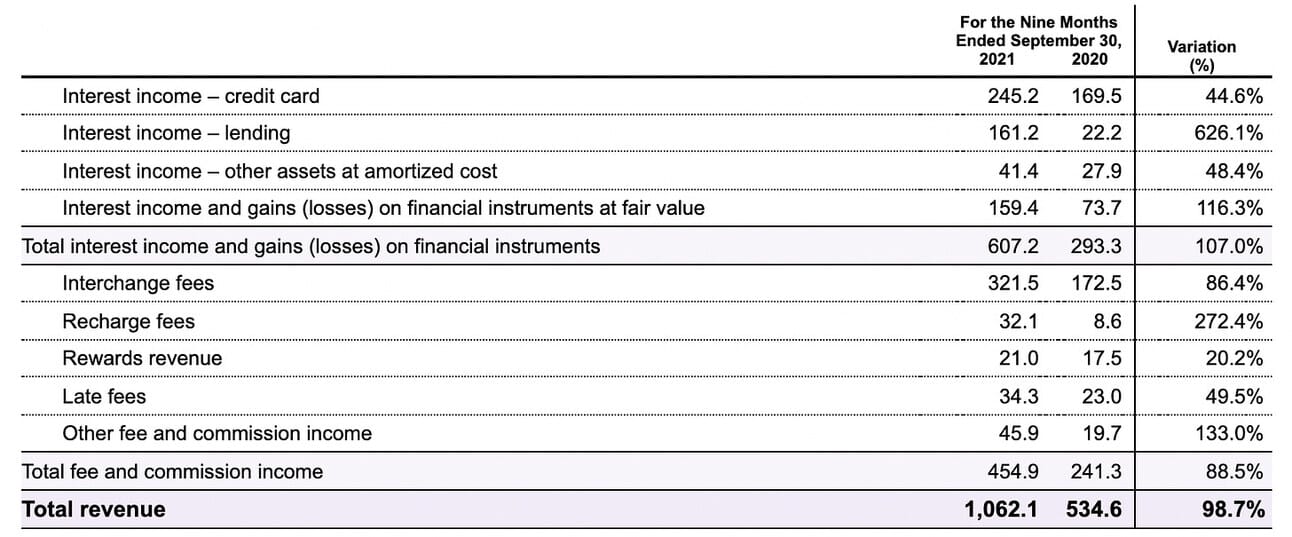

Out of $607.2M in Interest income, $406.4M or 67% came from the credit card and consumer lending products (“Interest income - credit card” and “Interest income - lending”). These two positions combined grew 112% YoY and a comment to the table mentions that the rapid growth in the “Interest income - lending” position (626.1% YoY growth) came from “[growing customer base] and the easing in lending policies compared to 2020”. Hopefully, this was easing of tight lending policies installed during the pandemic year (all lenders were more cautious), and not an indication of challenges in originating loans.

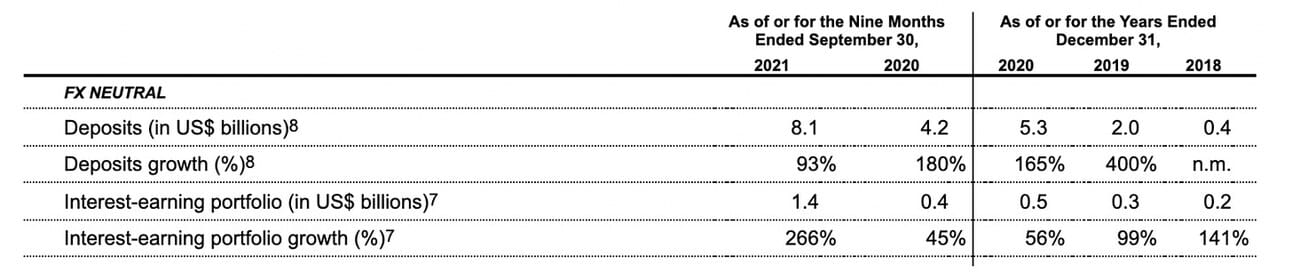

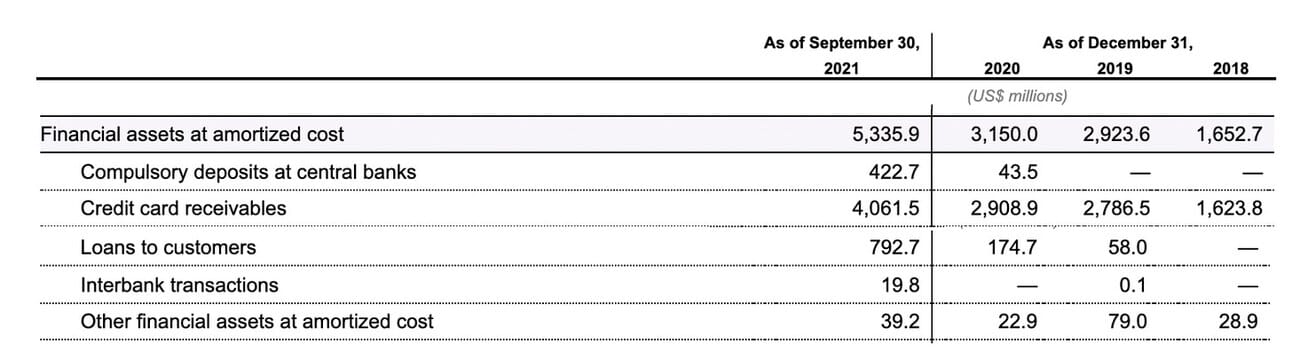

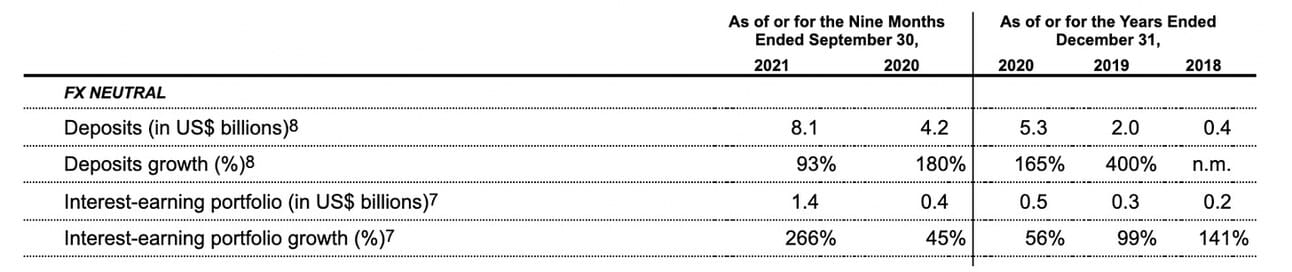

At the end of September 2021, Nubank had $8.1B in deposits, and $4.85B in its lending portfolio (of which $4,061.5M in Credit card receivables, and $792.7M in Loans to customers); $1.4B were interest-bearing assets. The difference between the lending and deposit portfolio indicates that the company does not have capital constraints in its lending business. Nevertheless, scaling the lending business will require time and, perhaps, a wider product range (i.e. car leasing, mortgages).

There is no comment in the filing on the “Interest income and gains (losses) on financial instruments at fair value” position ($159.4M or 15% of total revenue), but the company held $4.78B in financial assets (securities, derivatives) at the end of September 2021, which yielded interest and fluctuated in fair value.

70% of the non-interest income, or $321.5M came from the Interchange fees (fees paid by the merchants on each card transaction to the issuers of the card, in this case, Nubank), and the rest came from other services such as phone recharge service, rewards, late fees and commission fees on life insurance and brokerage.

Nubank notoriously does not charge monthly or annual card fees, and its cards reward program is voluntary, but customers transacting with their cards still generate interchange revenue for the bank and I would expect it to continue growing with the customer base. Nevertheless, bigger potential in growing revenue, most likely, lies in cross-selling non-card products (like life insurance and brokerage) to the existing customer base.

Finally, there is little mentioned about the revenue generated by the company’s 1.1 million SME customers. SME banking was launched in late 2019; therefore, the company might be early in monetizing this customer segment.

In summary, out of $1,062.1M in total revenue, $406.4M (38%) in revenue was generated by the consumer lending portfolio, $321.5M (30%) came from the card-issuing business (interchange fees), and $133.3M was contributed by other products (13%).

Losses are growing, but are not concerning if the company can scale lending business

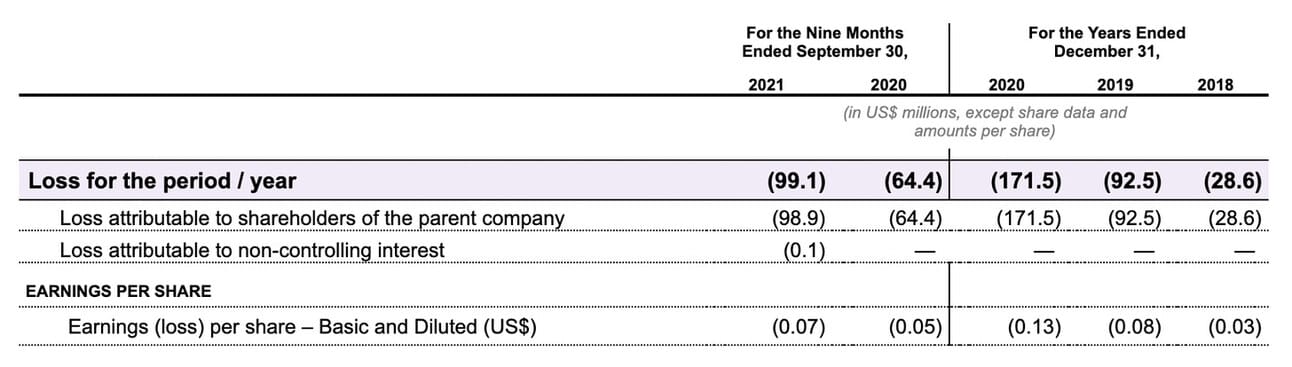

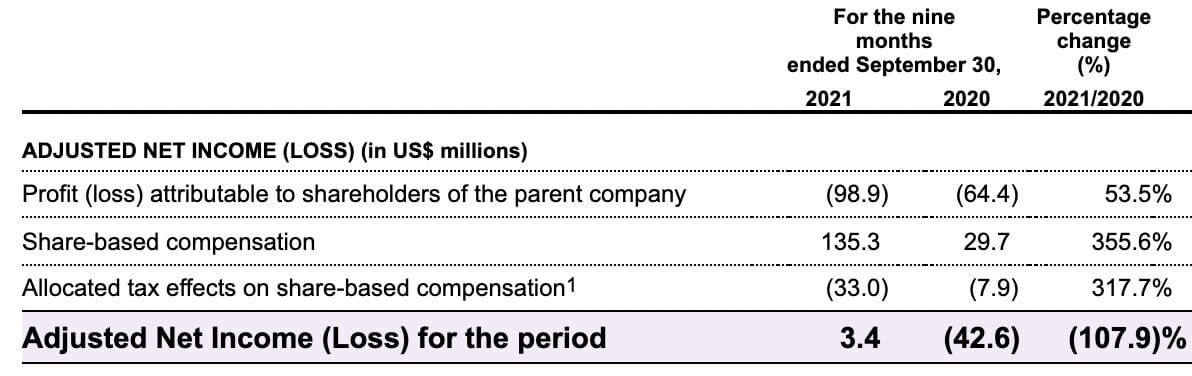

The company made losses in all three full reported years (2018-2020), as well as the first nine months of 2021. Thus, the company lost $99.1M in 9M 2021 and $206.2M over the last 12M (Q4 2020 - Q3 2021).

Nubank separates the costs into two large categories: “Cost of financial and transactional services provided” and “Operating expenses”. Deducting “Cost of financial transactional services provided” (the costs that can be directly attributed to the provision of the services) from the Total revenue results in “Gross profit”.

“Transactional expenses” are such costs as card processing fees, fees for processing bank slips, costs of providing card rewards, etc. As we discussed above, in 9M 2021 Nubank made $321.5M in interchange fees alone (and the voluntary card rewards program generated an additional $21M in fees); thus, the cards revenue covers the costs with sufficient buffer. I would even conclude, that Nubank has reached the scale at which the interchange and card reward fees generated by the existing cards portfolio cover both the transactional costs and sizeable marketing investment into new customer acquisition. The trick is most likely in the large share of organically acquired customers (the company attributes 80-90% of new customer acquisition to word of mouth).

“Interest and other financial expenses” (primarily interest paid on deposits) and “Credit loss allowance expenses” (provisions for losses on the outstanding credit balances), which in 9M of 2021 summed to $471.4M. As discussed above, credit card and personal loan portfolios yielded $406.4M in interest in the same period. Therefore, at this point, Nubank’s lending business is not generating sufficient revenue to cover even direct costs and thus, would generate a “gross loss”, if reported separately.

The company managed to scale its interest-earning portfolio to $1.4B in the last 12 months, but the deposits, which are a direct cost for lending operations, also grew from $4.2B at the end of September 2020 to $8.1B at the end of September 2021. Moreover, the company mentions “easing lending policies” that helped scale lending volumes. To account for the higher credit risk, the company had to increase provision levels from 5.5% in 2020 to 5.8% in 2021 (page 136 of F-1 filing), which further decreases the profitability of its lending portfolio.

Therefore, I would conclude that Nubank is yet to prove its ability to profitably scale lending operations. Deposits (and thus, the interest the company is paying to depositors) will continue growing with the customer base; and thus, the company needs to figure out how to deploy this capital profitably and at scale. Nubank’s focus on the previously unbanked population might fire back when it comes to lending, but let’s see.

As per the other large cost positions: $124.7M in “Customer support and operations” is ridiculously low given the size of the customer base. Nubank has proven that it can build a huge competitive cost advantage over incumbent banks (no physical branch network, fewer employees, automation, etc). In their filing, the company indicates that incumbent banks spend on average $15.7 per month to serve each of their customers (Customer support + General and administrative costs).

General and administrative expenses, which amounted to $404.7M in the first nine months of 2021, include “research and development, certain back-office activities, indirect relations with our customers and overhead”. In particular, this position includes share-based compensation of $135.3M driven by the growing headcount, and for some reason, the cost of issuing the first card to the customer (all next cards are accounted in “Customer support and operations” position).

Summarising the above, it looks that Nubank has figured out how to acquire and service non-lending customer profitably. Marketing and customer support costs are low and the existing cards portfolio already now generates sufficient fees (through interchange and rewards program) to cover the costs. However, Nubank’s lending business (credit card limits, personal loans) is still tiny and loss-making and the company is yet to prove it can scale it profitably. Nubank has large customer base, capital and deposits; however, scaling lending business can take time. Finally, fees generated by recently launched services, such as insurance and brokerage, is non-essential, and monetization of SME customers is in its infancy. This clearly could fuel revenue growth for the years to come, as the company ramps up cross-selling its customer base.

Key things to watch going forward

Nubank’s market share in Brazil is massive, so expecting a double digit growth for a prolonged period of time in company’s home market is unreasonable. Therefore, company’s ability to scale in Mexico and Colombia are critical for further growth.

The interest Nubank’s lending portfolio is generating does not cover the cost of deposits and provisions for credit losses. The company is yet to prove it can scale its lending business profitably. Interest income is the bread and butter of commercials banks after all.

Revenue from recently launched services (insurance, brokerage) and SME customer base is non-essential at the moment, and most of the non-interest income is generated by the card issuing business. Upselling the existing customer base with premium services will clearly be a driver for further revenue growth.

The company closed its first trading week with the market cap of over $54B, so I am curious how far it can go (as mentioned, Nubank is already the largest bank in Latin America by market cap). I have no doubt that Nubank will be able to execute on both, expansion to other geographies and better monetization of the customers in Brazil. However, we are yet to see if this will drive further the market cap, or rather justify the existing price tag.

On the final note, for anyone interested in Nubank’s story, I would recommend listening to Patrick OShaughnessy’’s conversation with David Vélez, the company’s co-founder and CEO. I always find it useful to hear the motivation of the founders and if they still are on the mission to make an impact.

Sources used: company’s F-1 filling, Nubank’s website and Yahoo Finance. Other sources are linked directly in the text.

Disclosure & Disclaimer: I have open positions in most of the FinTech company I write or plan to write about, as I am extremely bullish on the transformation in the financial services industry. However, none of the above is financial advice.