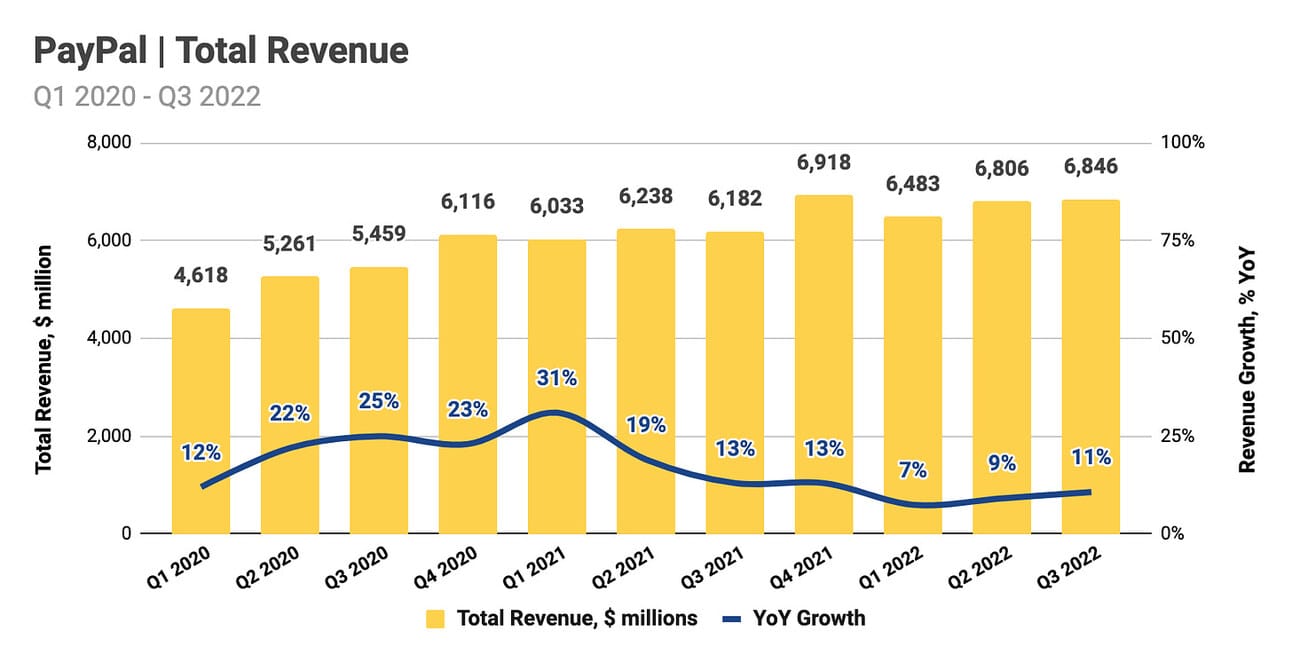

Investopedia defines “growth stock” as “any share in a company that is anticipated to grow at a rate significantly above the average growth for the market.” PayPal reported $6.85 billion in revenue in Q3 2022, which represents a 10.7% YoY growth, and the company’s management guided for $7.38 billion in revenue in Q4 2022, which would represent a 6.6% YoY growth. U.S. e-commerce retail sales grew 10.8% YoY in Q3 2022, so I believe it would be fair to say that, at least in terms of revenue growth, PayPal is hardly growing “at a rate significantly above the average growth of the market.”

Nevertheless, the company’s scale allows it to find meaningful cost-optimization opportunities, and the pressure from activist investors provides an additional incentive to do so. Thus, in Q3 2022 PayPal improved both the transaction and operating margins by cutting expenses. The company’s management also believes that they have room to improve the margins further in Q4 2022 and in 2023. Better margins improve profitability and increase free cash flow, which the company intends to return to investors through share buybacks.

I understand that investor sentiment has changed, and free cash flow today is valued higher than growth prospects in the future. However, I am not sure that the company’s competitors, like Block and Shopify, pivoted their strategy as hard as PayPal and stopped investing in future growth. So would you bet on PayPal after the sentiment changes again? (and it will at some point)

If you are new to PayPal, I suggest reading my previous reviews:

Active Accounts

PayPal reported adding 2.9 million net new active accounts during Q3 2022, bringing the total number of active accounts to 432 million, of which 35 million were active merchant accounts. This represents a 3.8% growth in active accounts compared to Q3 2021, and a 0.7% growth compared to the previous quarter. A year ago, PayPal reported servicing 33 million active merchant accounts, but due to rounding, it is hard to understand the growth rate in merchant accounts. The company also reported “almost 90 million” Venmo accounts, of which 57 million were monthly active accounts.

If you recall from my previous reviews, PayPal kicked off the year by setting an ambition to add 15-20 million net new active accounts during 2022 (February 2022), but then lowered this target to 10 million net new active accounts (April 2022). Apparently, the company’s management believes that the latter goal is achievable, as during the Q3 2022 earnings call they guided for “3 million to 4 million net new active accounts” in Q4 2022 (which would bring the total for the year to 9-10 million net new active accounts).

Total Payment Volume

PayPal reported $337 billion in Total Payment Volume in the quarter, which represents an 8.7% growth compared to Q3 2021, and a 0.8% decline compared to Q2 2022. I believe this was the last quarter, in which eBay had a material impact on the company’s performance. Thus, excluding eBay Total Payment Volume grew 10% YoY. Venmo processed $63.6 billion in TPV, which represents a 6% growth compared to Q3 2021, and a 4% growth compared to Q2 2022.

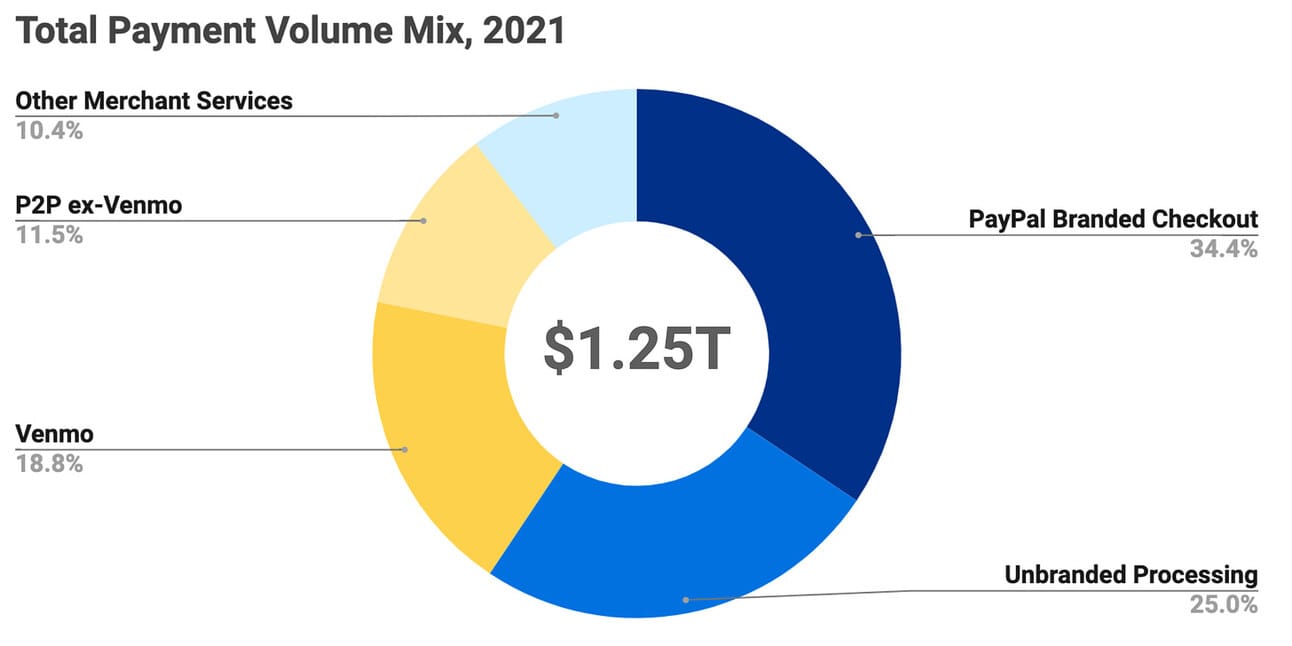

In its Q3 2022 Investor Update, PayPal shared a breakdown of 2018 and 2021 Total Payment Volume by its key services. Thus, as you can see on the chart below, PayPal Branded Checkout, Unbranded Processing (Braintree), and Venmo were the largest contributors to Total Payment Volume in 2021, with 34.4%, 25.0%, and 18.8% share in the total volume respectively. Venmo’s TPV grew at 52.4% CAGR, Braintree’s TPV grew at 39.8% CAGR, and PayPal’s Branded Checkout TPV grew at 25.6% CAGR during the 2018-2021 period.

The management guided for 8.5% YoY growth, or $1.35 trillion, in Total Payment Volume for the full year 2022, down from the 12% YoY growth, or $1.40 trillion, that they guided for in Q2 2022. This guidance implies $352 billion in TPV in Q4 2022, which represents a 3.7% growth compared to Q4 2021.

I believe the main question that occupies PayPal’s investors’ minds is what will fuel further growth. TPV is the key driver of PayPal’s revenue and TPV growth is decelerating to single digits with no obvious levers to pull. Inflation helped TPV growth in Q3 2022, but at some point, the Central Banks around the globe will either slow inflation down or it will start destroying consumer demand.

On Partnership with Apple

PayPal announced reaching an agreement with Apple on several initiatives, including integrating “Tap to Pay” technology into PayPal and Venmo iOS applications, which will allow merchants to accept card payments without using their iPhones (without a need for any extra hardware such as a payment terminal). The functionality is nothing new (i.e. both Square and Shopify already support the “Tap to Pay” functionality in their applications), but should strengthen PayPal’s value proposition in offline and omnichannel commerce.

In addition, next year, the company’s U.S. clients will be able to add their Venmo and PayPal debit and credit cards to Apple Pay, and PayPal will integrate Apple Pay as a payment option in unbranded checkout flows. This is definitely a win for PayPal’s customers given the popularity of Apple Pay; however, I am not sure this is a win for PayPal. There is nothing novel in this either (i.e. Cash App supports Apple Pay), and Apple charges issuers (in this case PayPal) for every transaction made with Apple Pay. Thus, this “partnership” will cut into PayPal’s transaction margin.

In short, PayPal tried to spin this as great news, but my take is that they had to partner with Apple not to lose merchants (i.e. to Shopify) and cardholders (i.e. to Cash App).

Revenue and Take Rates

PayPal reported $6.85 billion in revenue for the quarter, which represents a 10.7% growth compared to Q3 2021, and a 0.6% growth compared to Q2 2022. Transaction revenue grew 11.2%, and revenue from other value-added services grew 6.4% compared to Q3 2021. Revenue from other value-added services includes revenue share earned from Synchrony Bank (Synchrony Bank is the lender behind PayPal Credit in the U.S., which includes the Buy Now Pay Later product), interest earned on customer account balances, as well as interest earned on merchant loans.

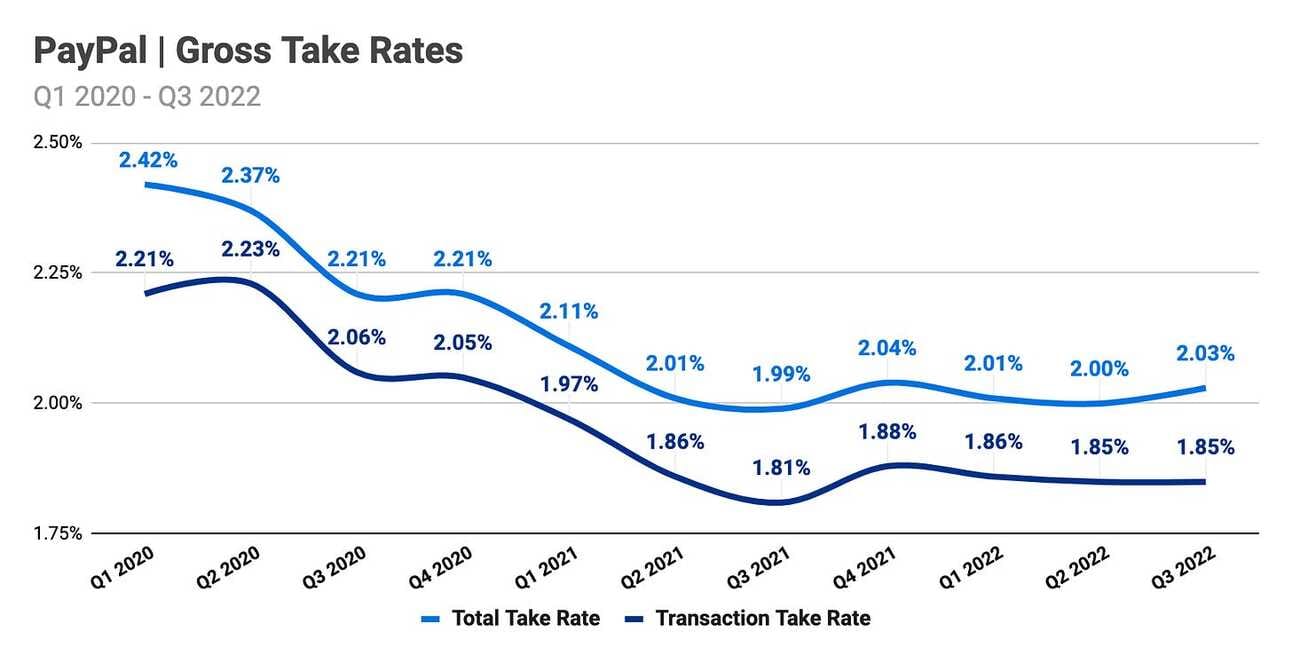

Transaction revenue, which represented 91.1% of the total revenue, is a function of TPV and Transaction Take Rate. As discussed above, in Q3 2022, TPV increased by 8.7% compared to Q3 2021, which was in line with the inflation rate in the U.S. (U.S. revenue represented 58.1% of the total revenue in the quarter). The Transaction Take Rate increased from 1.81% in Q3 2021 to 1.85% in Q3 2022, which resulted in transaction revenue outpacing TPV growth. The management guidance suggests further improvement in the Transaction Take Rate in Q4 2022 (more on that below), which will allow revenue growth to continue outpacing growth in TPV.

The second component of the revenue, revenues from other value-added services, represented 8.9% of the total revenue. As you might have noted, the growth rate of this revenue component accelerated lately (it grew 6.4% YoY and 14.6% QoQ). The reason is twofold: 1) Q3 2021 number included $93 million in revenue for servicing a Paycheck Protection Program loan portfolio, which became non-material in Q3 2022 (hence, single-digit YoY growth), and 2) PayPal earns interest on its customer account balances, and the rising interest rates became a strong tailwind for the company in Q3 2022 (hence, double-digit QoQ growth).

As noted earlier, the Transaction Take Rate (transaction revenue over TPV) improved from 1.81% in Q3 2021 to 1.85% in Q3 2022; however, remained unchanged compared to Q2 2022. Total Take Rate (total revenue over TPV) improved from 1.99% in Q3 2021 and 2.00% in Q2 2022 to 2.03% in Q3 2022, as the growth in revenue from other value-added services outpaced the growth in TPV). The revenue and TPV guidance for Q4 2022 suggests that the management expects the Total Take Rate to be 2.095%, a take rate that the company has not delivered since early 2021.

The interest rates increased further since Q3 2022 (the Federal Reserve executed two hikes of the fed funds rate in Q4 2022), so it is reasonable to expect further growth in the non-transactional component of the Total Take Rate (meaning, growth in revenue from other value-added services outpacing growth in TPV). However, the guidance suggests improvement in the Transaction Take Rate as well (contribution from revenue from other value-added services is not large enough to drive such a meaningful improvement to the Total Take Rate).

The company’s management lowered their revenue guidance for the remainder of the year and guided for $7.38 billion in revenue in Q4 2022, and $27.51 billion in revenue for the full year 2022. This guidance would represent a 6.6% YoY growth on a quarterly basis, and an 8.4% YoY growth on an annual basis.

During Q2 2022 earnings call (August 2022), PayPal’s management guided for $27.85 billion in revenue for the full year 2022, and if we go back even further to Q4 2021 earnings call (February 2022), the company guided for 15-17% revenue growth in 2022, which would imply $29.18 - 29.68 billion in revenue. This year’s guidance was clearly not helpful, and the company has not yet provided 2023 guidance.

The company’s management is aiming to outpace the U.S. e-commerce growth rate in 2023 (which they did in the U.S. in Q3 2022, as U.S. e-commerce retail sales grew 10.8% YoY, and PayPal’s U.S. net revenue grew 14.4% YoY), but this, most likely, means single-digit growth, at best, in a down cycle.

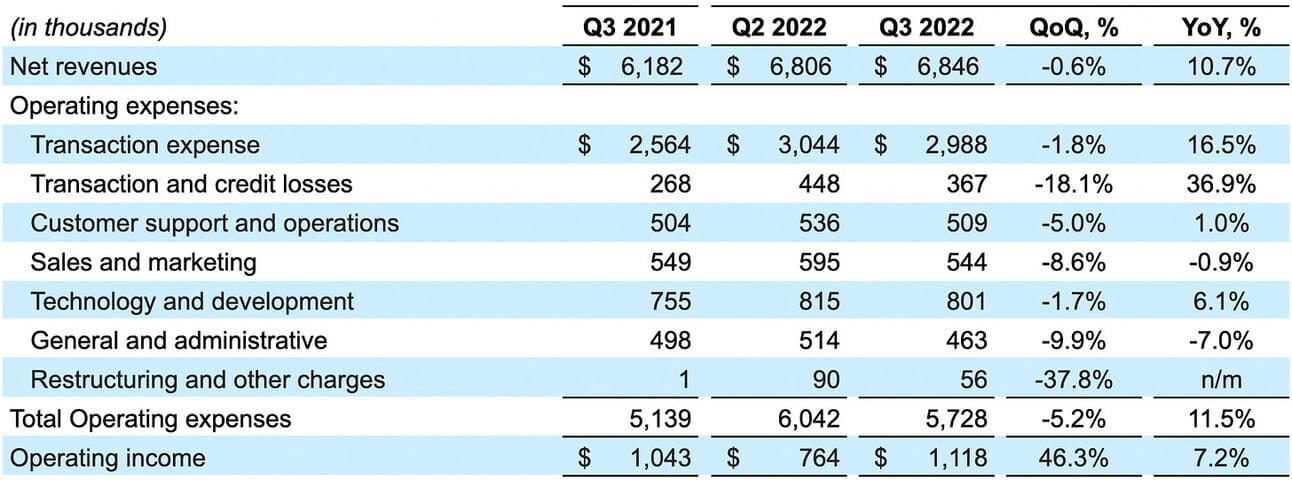

Operating Expenses

PayPal reported $5.73 billion in total operating expenses in Q3 2022, which represents an 11.5% increase compared to Q3 2021, and a 5.2% decrease compared to Q2 2022. Transaction expense and transaction and credit losses increased 18.5% compared to Q3 2021, and decreased 3.9% compared to Q2 2022, while non-transaction expenses (support, sales and marketing, technology, and G&A) increased 2.9% compared to Q3 2021 and decreased 6.9% compared to Q2 2022.

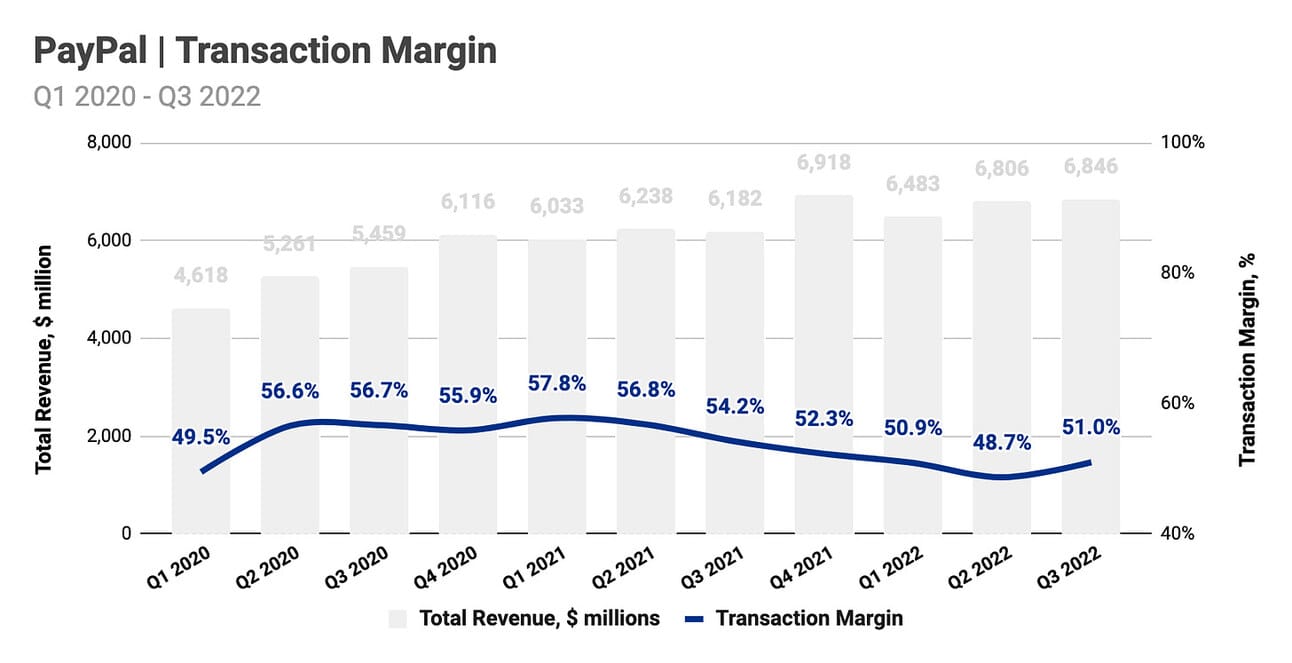

PayPal’s transaction margin (total revenue less transaction expense and transaction and credit losses, divided by the total revenue), which is the company’s measure of gross profitability, decreased from 54.2% in Q3 2021 to 51.0% in Q3 2022. Sequentially the margin improved from 48.7% in Q2 2022. As a reminder, in July 2022, activist investor Elliott Management announced acquiring a $2 billion stake in the company, forcing the management to embark on a cost-cutting journey. Thus, PayPal committed to cutting $900 million in total operating costs in 2022, and $1.3 billion in 2023, of which “nearly half coming on the transaction expense.”

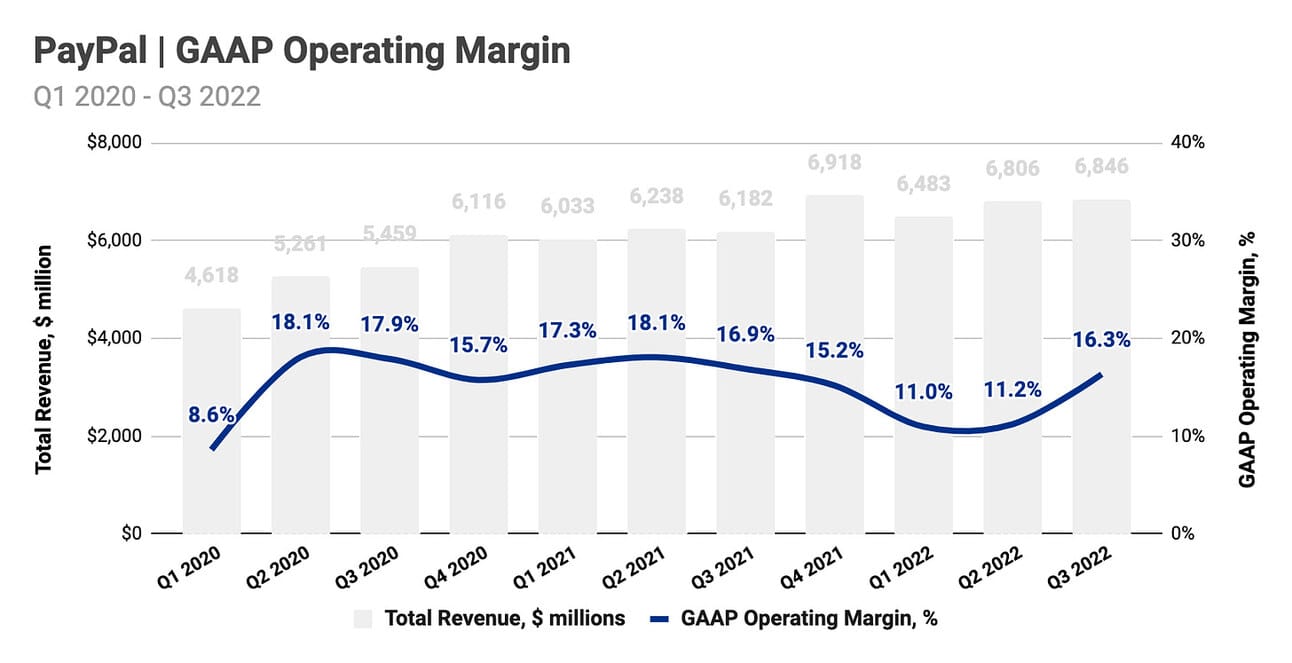

PayPal’s operating margin (total revenue less total operating expenses, divided by the total revenue), decreased from 16.9% in Q3 2021 to 16.3% in Q3 2022; however, the margin increased sequentially from 11.2% in Q2 2022. “We now expect that non-transaction-related operating expenses for Q4 will be flat to slightly negative year-over-year and we are planning similar levels in 2023,” said Dan Schulman, the company’s CEO during the Q3 2022 earnings call. The company’s chief referred to the non-GAAP operating costs (GAAP operating costs adjusted for stock-based compensation, amortization of acquired intangible assets, as well as restructuring and other one-time costs).

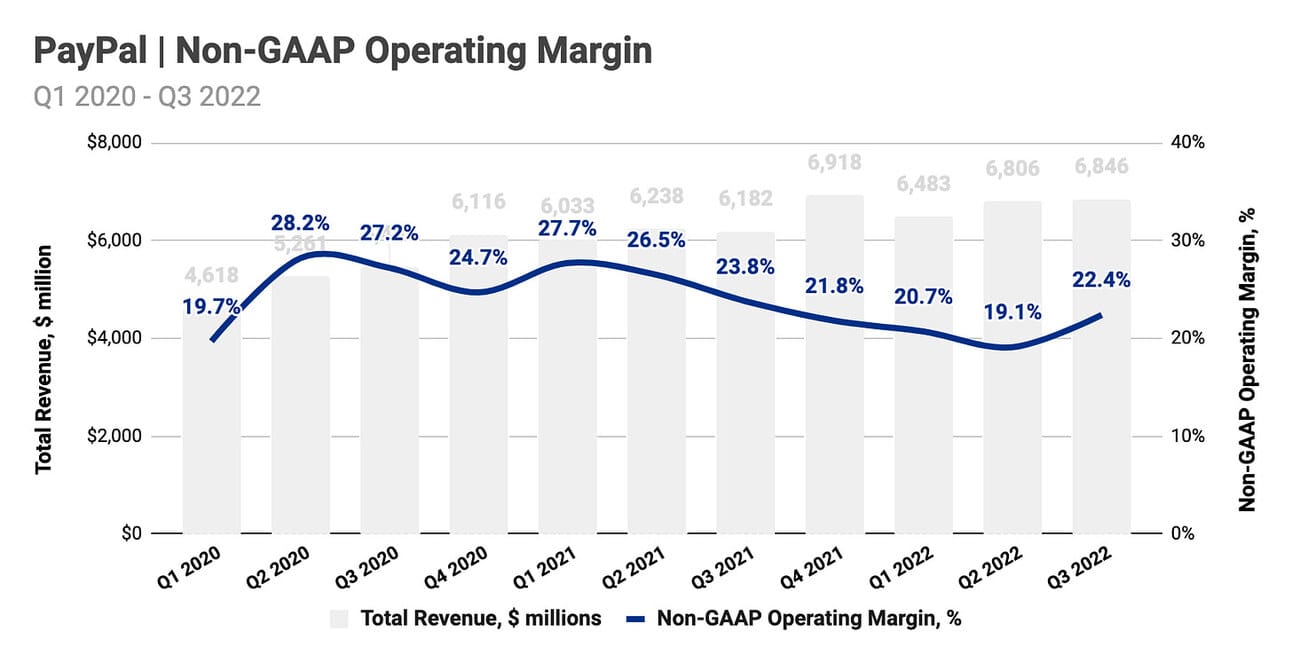

Dan Schulman also commented on the company’s operating margin going forward: “We now expect to grow our year-over-year non-GAAP operating margin in Q4 to approximately 22.5%. We further anticipate that in 2023, we will deliver at least 100 basis points of operating margin expansion [to 23.5%].”

In Q3 2022 non-GAAP operating expenses totaled $5.31 billion and the non-GAAP operating margin was 22.4% (compared to 23.8% in Q3 2021, and 19.1% in Q2 2022). Before the pandemic (2017-2019) PayPal operated with a non-GAAP operating margin of 19.9 - 23.6%; thus, we should not expect any meaningful improvement past the set target of 23.5% in 2023.

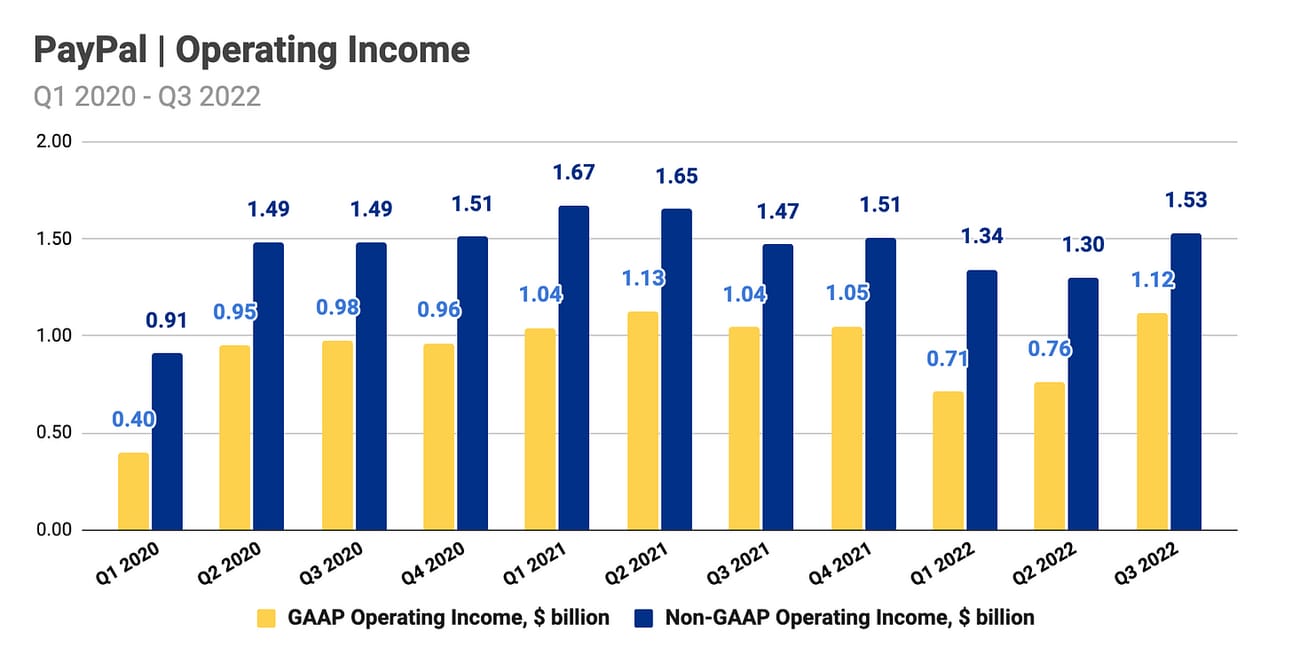

In Q3 2022, the company reported $1.12 billion in GAAP Operating income, a 7.2% increase from $1.04 billion in Q3 2021, and a 46.3% increase from $0.76 billion in Q2 2022. On an adjusted basis, the company reported $1.53 billion in non-GAAP operating income, a 4.2% increase from $1.47 billion in Q3 2021, and a 17.7% increase from $1.30 billion in Q2 2022. Per the management’s guidance ($7.38 billion in revenue, 22.5% non-GAAP operating margin), the company is expected to deliver $1.66 billion in non-GAAP operating income in Q4 2022. This would represent a 10.2% increase from Q4 2021.

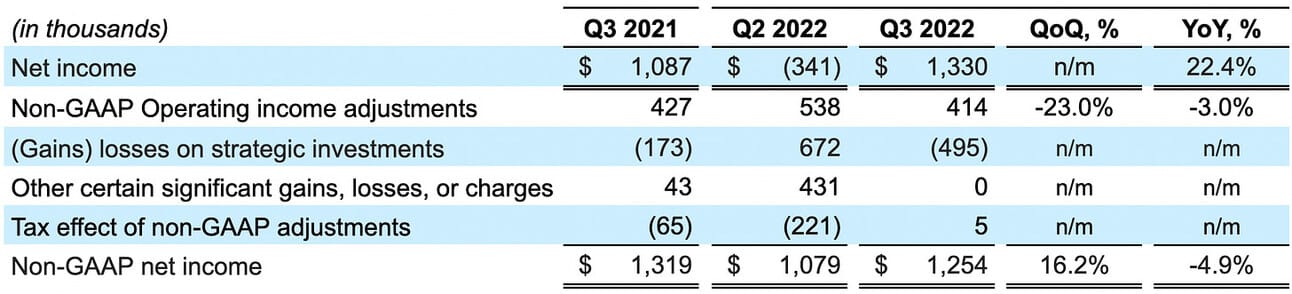

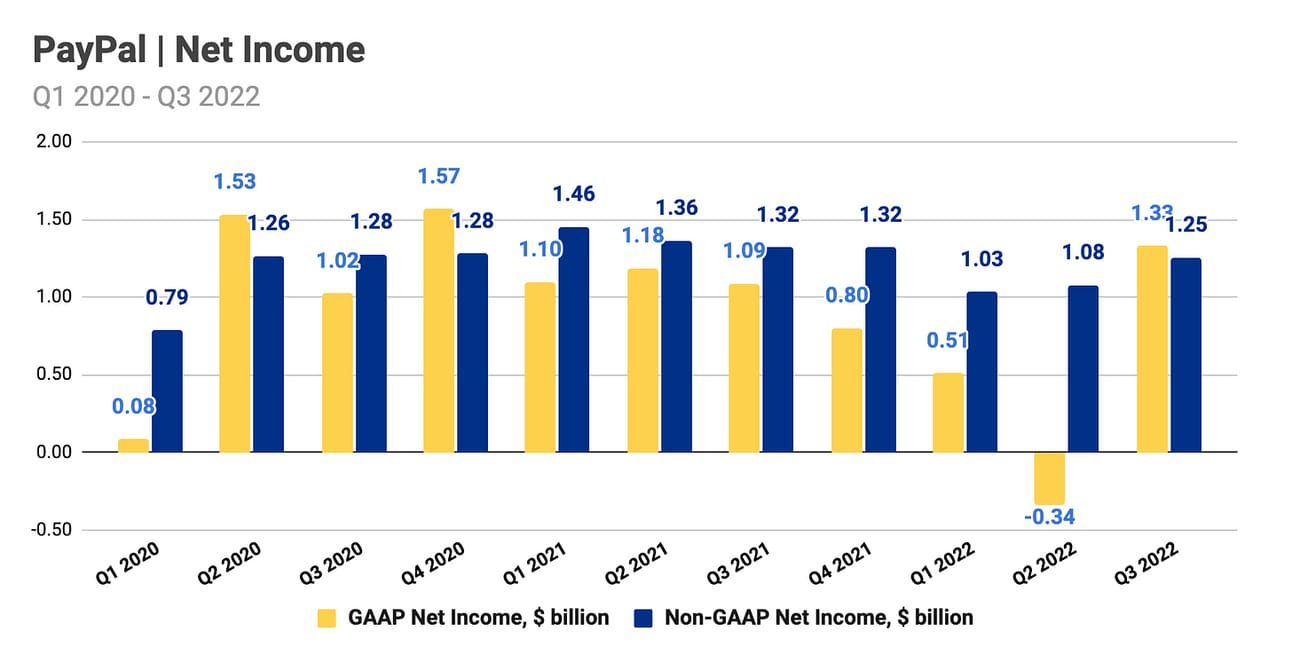

Net Income

PayPal reported $1.33 billion in Net Income for the quarter, up from a Net Income of $1.09 billion in Q3 2021, and a Net Loss of $0.34 billion in Q2 2022. In Q3 2022, the company booked a gain of $495 million on its strategic investments, compared to a $173 million gain in Q3 2021 and a $672 million loss in Q2 2022. Strategic investments are shares owned by PayPal in both publicly traded and privately held companies.

On an adjusted basis, the company reported $1.25 billion in non-GAAP Net Income, down from $1.32 billion in Q3 2021, and up from $1.08 billion in Q2 2022. As can be seen from the table above, the main adjustments include the above-mentioned gains (and losses) on strategic investments, as well as non-GAAP operating income adjustments, such as stock-based compensation, amortization of acquired intangible assets, as well as restructuring and other one-time costs.

The company’s management guided for GAAP EPS of $0.83-$0.85 and non-GAAP EPS of $1.18-$1.20 in Q4 2022, as well as GAAP EPS of ~$2.11-$2.13 and non-GAAP EPS of ~$4.07-$4.09 for the full year 2022. PayPal delivered GAAP EPS of $0.68 and non-GAAP EPS of $1.11 in Q4 2022 (see the chart below). The company’s management also committed to “deliver no less than 15% non-GAAP EPS growth next year.”

Can the company’s management deliver on this “no less than 15% non-GAAP EPS growth” promise? Levers that they can pull are: a) grow revenue (most likely low single digits, just “following” the overall market growth), b) expand operating margin (from 18.3% in 2022 to 23.5% in 2023), c) repurchase shares (in Q1 - Q3 2022 the company used 78% of free cash flow, or $3.2 billion, to repurchase 29 million shares). If my math is correct, then margin expansion alone would suffice to achieve 15% EPS growth, so any growth in revenue or share repurchases would add on top of that.

In Q4 2022 the company intends to spend $1 billion on share buyback, which at the current price of $71 per share would result in a repurchase of approximately 14 million shares, and bring the total for 2022 to 43 million shares.

Things to Watch Ahead

TPV growth. Transaction revenue represents 90%+ of the company’s revenue, and TPV is the main driver of it. PayPal managed to stabilize Take Rates in 2022, so revenue growth should follow closely TPV growth going forward. However, TPV growth is expected to decelerate to low single digits by the end of the year, and there are no obvious levers for the company to pull to reignite growth. The management expects to outpace U.S. e-commerce growth, but that still means that, most likely, we will be looking at low single-digit growth in 2023.

Margins. PayPal achieved an impressive improvement in its Transaction and Operating margins in Q3 2022 and guided for further improvements in Q4 2022 and 2023. The pressure from Elliott Management resulted in cost-optimization initiatives, which in turn, translated into margin expansion. It is surprising (to the point of being suspicious) that PayPal was able to pull through these major improvements so quickly; thus, let’s see if they can sustain the new margin levels.

Further cost cuts. In Q3 2022 the company’s management reiterated on the cost optimization targets ($0.9 billion in 2022 and $1.3 billion in 2022 in transaction and non-transaction expenses). As I argued previously, I have no doubts that years of rapid growth and aggressive M&A activity created inefficiencies. Thus, I wouldn’t be surprised if the company starts cutting deeper, especially if the revenue tanks in 2023 due to the economic recession.

Share buybacks. In 2022 the company is expected to spend approximately $4.2 billion on repurchasing 14 million shares. PayPal is producing healthy cash flow, and the company’s management reiterated that they plan to return the cash to shareholders through share buybacks. Last quarter the company’s board authorized an additional $15 billion share repurchase program, which means that the company’s management has a multi-year run rate.

Source of the data used above: Investor Relations

Disclosure & Disclaimer: I own shares in several companies that I write about in this newsletter, as I am bullish on the transformation in the financial services industry. However, the information contained in this newsletter is intended for informational purposes only and should not be considered financial advice. You should do your own research or seek professional advice before making any investment decisions.