Last week PayPal ( ) reported Q2 2022 results. The company finally managed to beat its earnings guidance, and even raised the guidance for the full year. However, I believe the most promising aspect of this earnings report was the management’s commitment to reignite the revenue growth and cut costs aggressively. I guess it is not a coincidence that these commitments came right after Elliott Investment Management, an activist investor, disclosed a $2 billion stake in the company.

We’ve seen PayPal’s management guiding for revenue growth and then missing their guidance many times, so I remain skeptical about this promise (but hope to be proven wrong). However, I believe the aggressive cost cuts are not negotiable. Moreover, it was great to hear the company committing to focus on its core offerings, namely, Paypal Checkout, Venmo, and Braintree, as I believe they got distracted with their pursuit of the latest and greatest fintech trends and acquisitions.

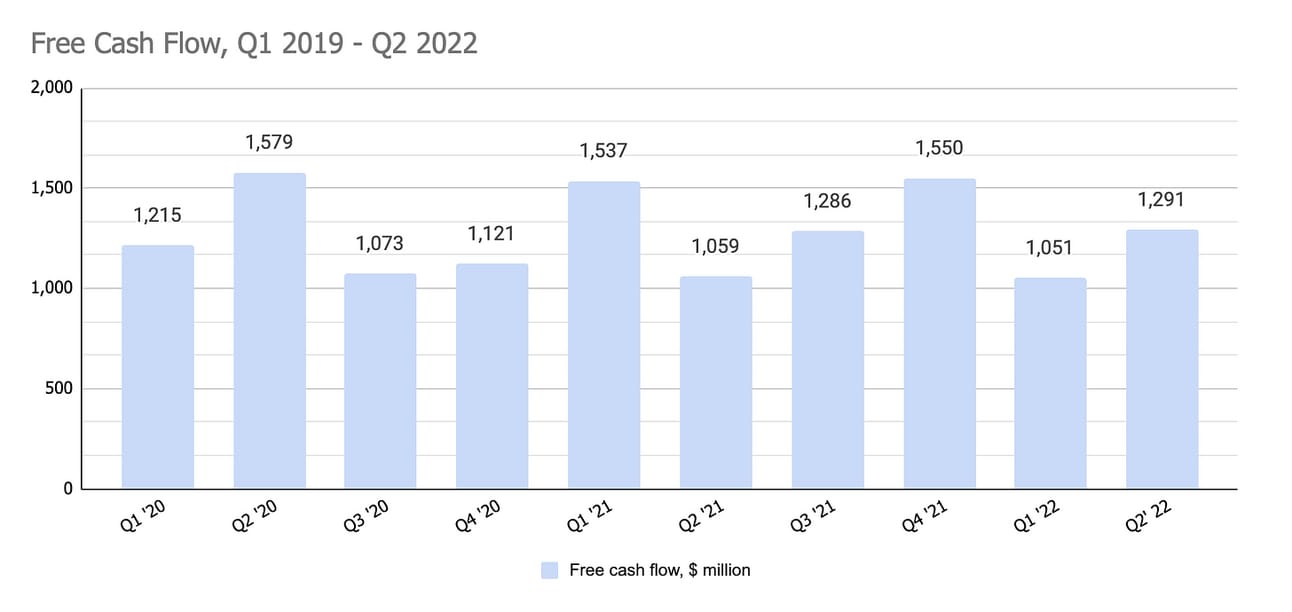

Finally, the company’s board authorized an additional $15 billion in share repurchases and the company’s management mentioned the plan to “return 75% to 80% of free cash flow to shareholders in the form of share repurchases.” I guess I am becoming more optimistic about the company’s prospects, so let’s dive into its Q2 2022 results!

If you are new to PayPal, I suggest reading my previous reviews:

If you are new to Popular Fintech, subscribe to receive upcoming reviews:

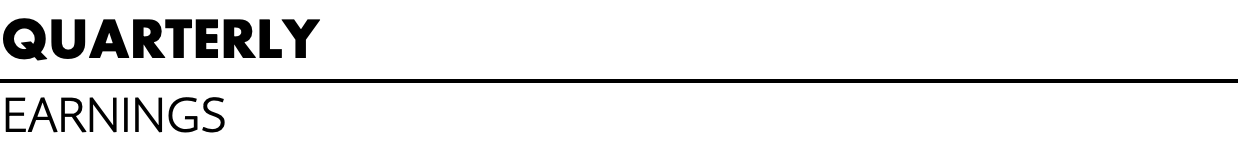

Active Accounts

PayPal reported 0.4 million net new active accounts, finishing the quarter with 429 million active accounts, of which 35 million were merchants. This represents a 6.5% increase in active accounts compared to Q2 2021, and the number was pretty much flat compared to the previous quarter. In Q1 2022 PayPal added 2.4 million net new active accounts.

During the Q1 2022 earnings call, the management guided for 10 million in net new active accounts in 2022 and reiterated this target on the Q2 2022 call. Let’s see how this goes, but I truly don’t understand what changed exactly since the first half of the year, and how, out of a sudden, PayPal plans to add over 7 million new accounts during the remainder of the year, while they added just 0.4 million in the second quarter.

A skeptic in me also does not exclude the possibility of PayPal finishing 2022 with fewer active accounts than they had at the end of 2021. PayPal defines an active account as an account that completed a transaction on one of the company’s properties within the last 12 months, and we are yet to see if the customer cohorts of Q3 2021 and Q4 2021 remain active (some 23 million accounts).

Total Payment Volume

PayPal reported $339.8 billion in Total Payment Volume, which represents a 9.3% growth compared to Q2 2021 and a 5.2% growth sequentially (I will use “spot” metrics throughout the text, which is the volume expressed in USD). Excluding eBay, the TPV grew 11% YoY (as I understand there should be no more “excluding eBay” metrics going forward, as eBay volumes in Q3 and Q4 will not be material).

The investor presentation mentions that P2P volume (peer-to-peer payment between users of PayPal Wallet, Venmo, and Xoom) increased 3% YoY and reached $93 billion (of which $61 billion came from Venmo). This suggests that non-P2P volume (PayPal Checkout and Braintree) grew at the rate of 11.8% YoY, and my read of the management’s comments is that this growth was primarily driven by Braintree (“unbranded processing”).

The company’s management expects the TPV to grow 12% in 2022. This implies that the company expects TPV growth acceleration in the year's second half. Similar to the company’s guidance on net new account growth, there was very little information provided as to how they will do it, and what levers they will pull to achieve this guidance. My only guess is that they hope for a very strong Q4 2022 (see below).

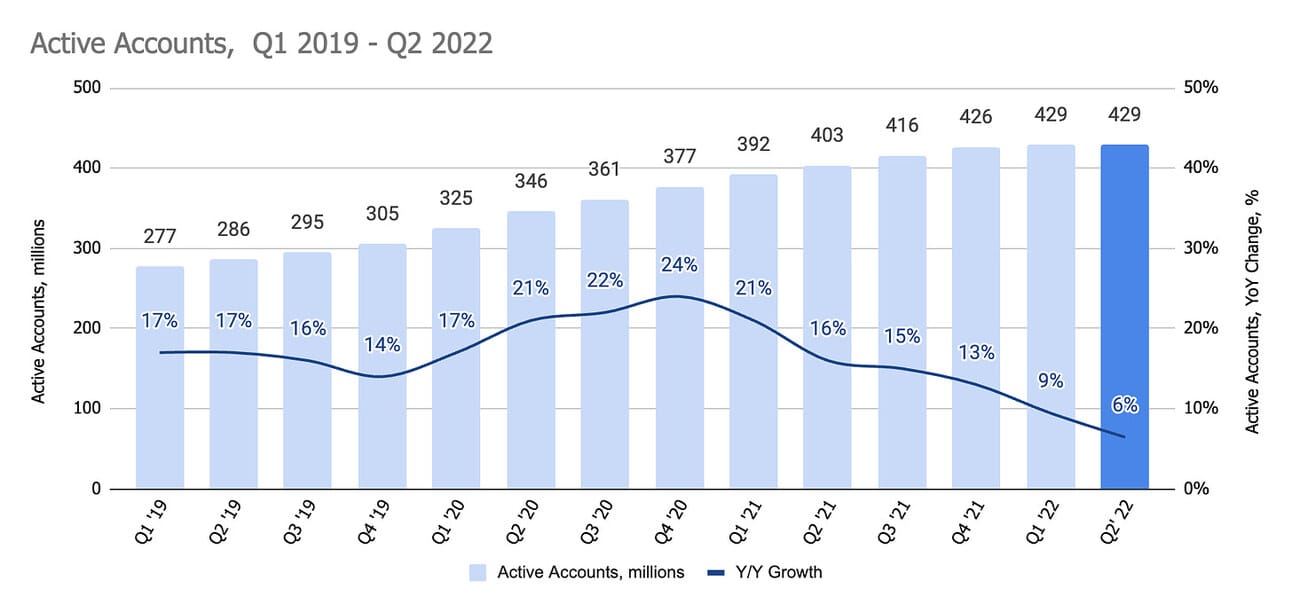

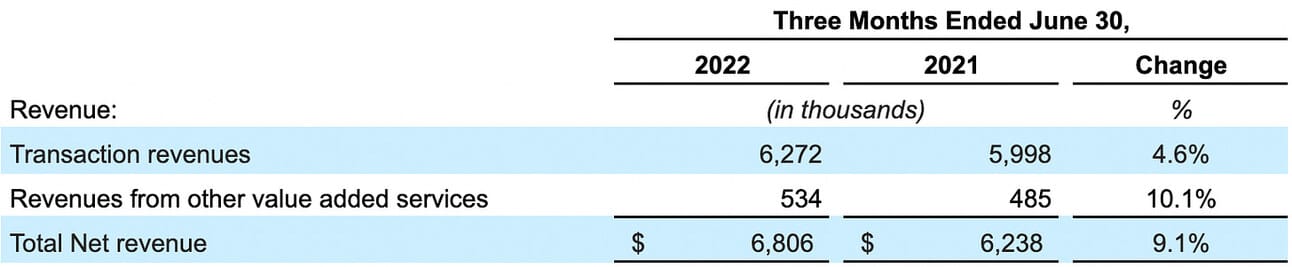

Revenue and Take Rate

PayPal reported $6.8 billion in total net revenue, which represents a 9.1% growth compared to Q2 2022, and a 5% growth sequentially. Transaction revenue grew 4.6% YoY, and revenue from value-added services grew 10.1% YoY. As per the company’s 10Q filling, the Transaction revenue was “driven primarily by growth in our unbranded card processing volume, which consists of our Braintree products and services, and to a lesser extent, Venmo.”

PayPal delivered another quarter of single-digit revenue growth, but I believe the small uptick in revenue growth rate (from 7% YoY in Q1 2022 to 9% YoY in Q1 2022) positively surprised investors. I guess, PayPal reminded everyone that they are still a massive player in the space and have multiple businesses to support growth even at this scale (Checkout, Venmo, and Braintree).

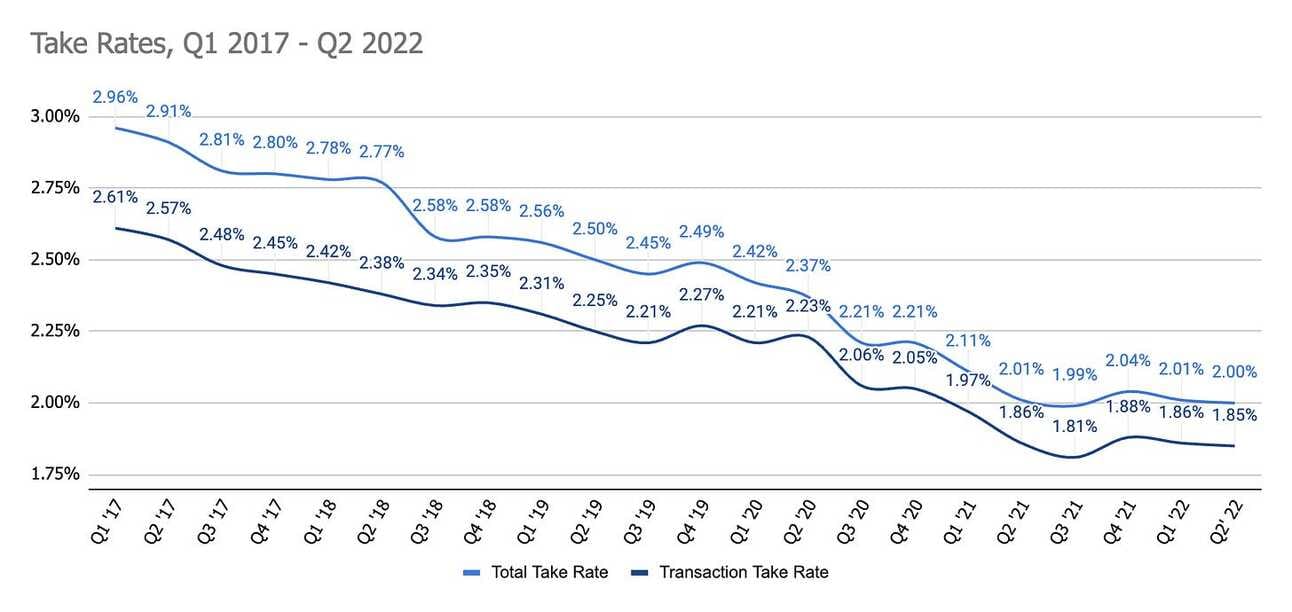

Another positive aspect was that both, the Transaction Take Rate and the Total Take Rate, stopped declining. As you can see from the chart below, the take rates declined sharply during the 2017 - 2020 period, but now seem to remain flat at around 2.00% (Total Take Rate) and 1.85% (Transaction Take Rate).

The company’s management guided for $6.8 billion in revenue in Q3 2022, and $27.85 billion for the full year 2022 (which would represent a 10% YoY growth). This guidance implies 10% YoY revenue growth in Q3 2022 and 12.2% YoY revenue growth in Q4 2022. As you can see, the company’s management guided for an acceleration of the revenue growth in the second half of the year (Q1: 7%, Q2: 9%, Q3: 10%, and Q4: 12%).

Operating Expenses

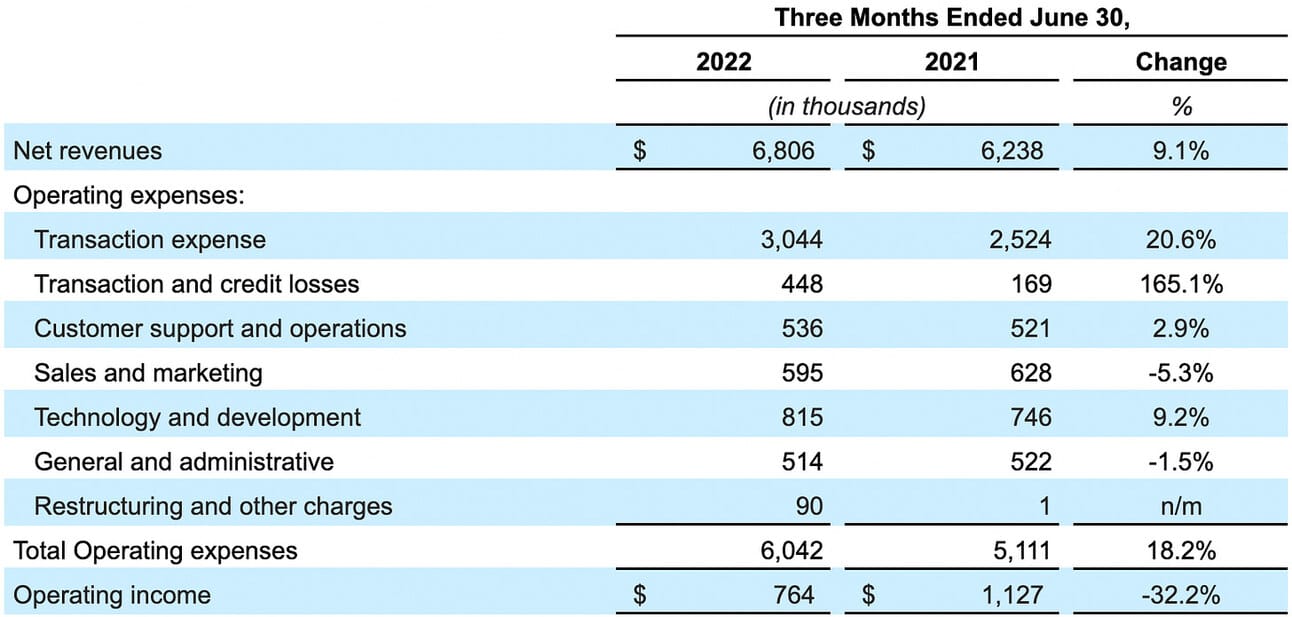

The company reported $6.04 billion in operating expenses, which resulted in an Operating income of $764 million for the quarter (a decline from an Operating income of $1.13 billion in Q2 2021). Total operating expenses increased 18.2% compared to Q2 2021. Transaction expenses and Transaction and credit losses increased 38% YoY and totaled $3.5 billion. Operating expenses excluding transaction-related expenses grew 5.5% YoY and totaled $2.55 billion.

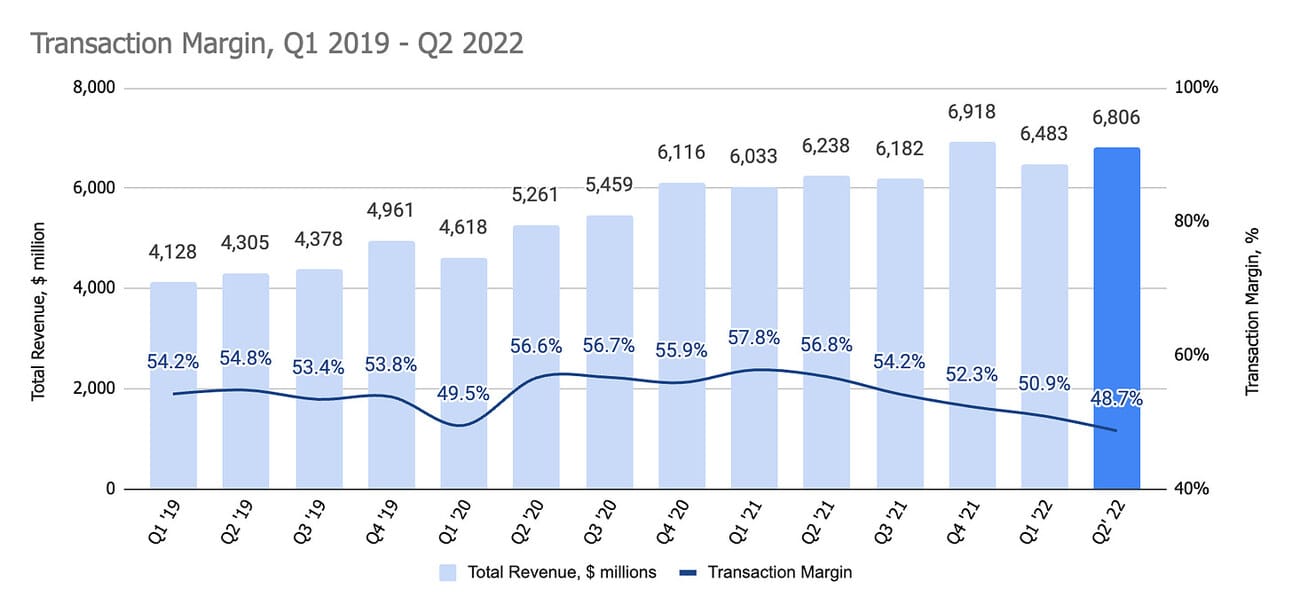

Transaction margin, the company’s measure of gross profitability, continued to decline (both sequentially and compared to Q2 2022). Thus, the Transaction margin in Q2 2022 stood at 48.7% compared to 56.8% in Q2 2021 and 50.9% in Q1 2022. As per the 10Q filing, the Transaction margin was negatively impacted by the growing share of Braintree and Venmo payments, as “unbranded card processing, generally has higher expense rates.”

During the earnings call, the company’s management emphasized the cost optimization initiatives (which, are apparently the result of Elliott Management's “activism”). Thus, Dan Schulman, the company’s CEO, mentioned $900 million in OpEx savings in 2022 and $1.3 billion in OpEx savings in 2023. Further, Gabs Rabinovich, the company’s interim CFO, mentioned that “of the $900 million of identified savings this year and the $1.3 billion next year, nearly 50% of that really comes from transaction-related expenses.”

First, I have little doubt that PayPal, given its scale, can find these savings (i.e. renegotiate deals with processors, optimize the organizational structure, etc.). Second, the company’s ability to cut its transaction-related expenses, means that the Transaction margin might stop compressing further. Back of the envelope calculation: 50% of $1.3 billion = $163 million per quarter, or 2.4% margin improvement on the Q2 2022 revenue of $6.8 billion.

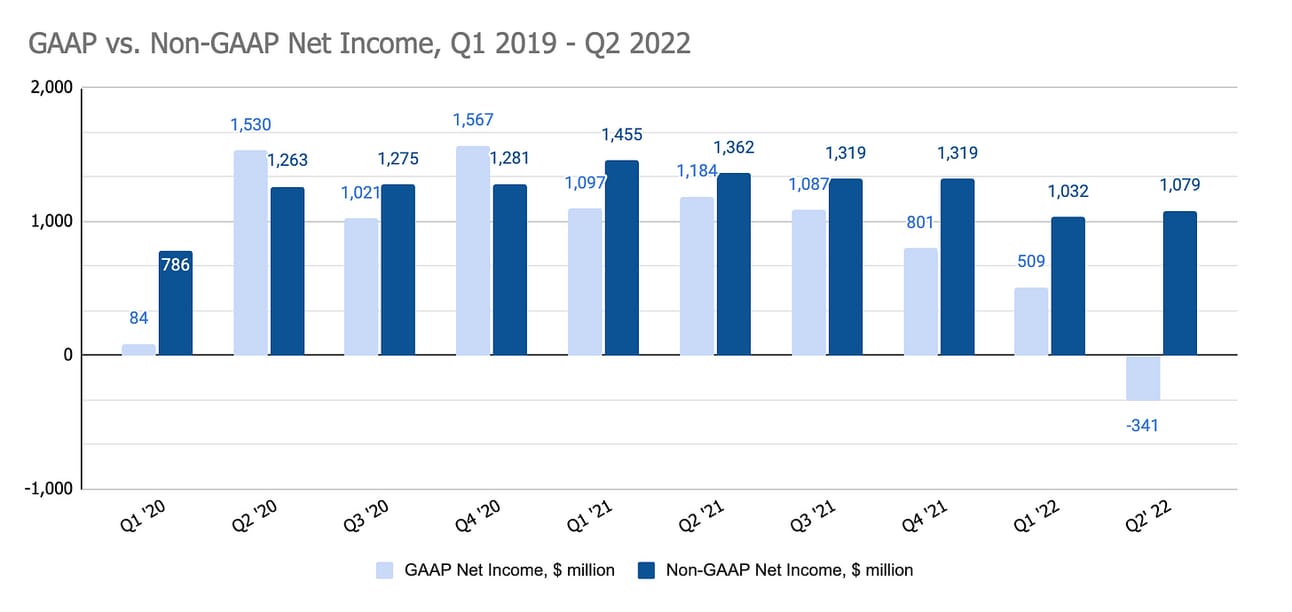

Net Income

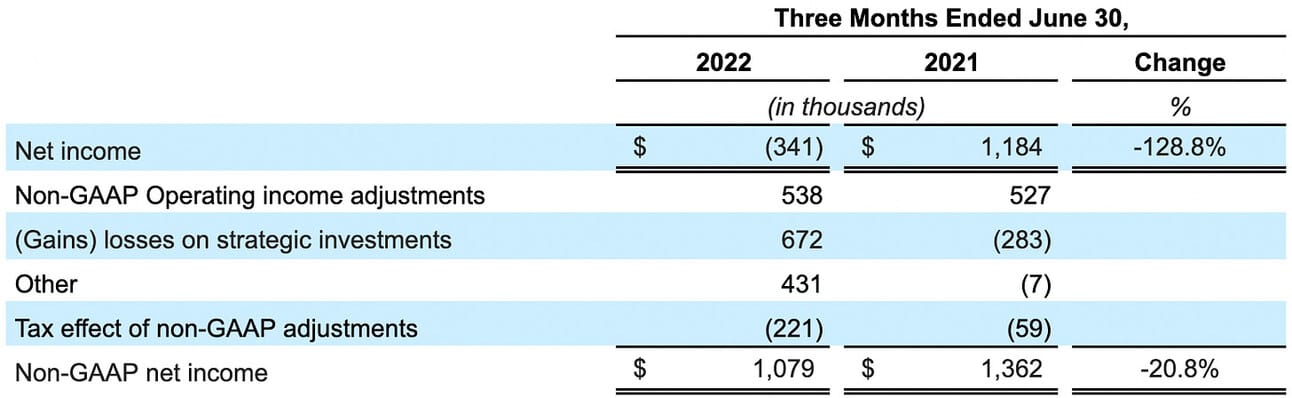

PayPal reported a Net loss of $341 million for the quarter, down from a Net Income of $1.18 billion in Q2 2021. This is the first company’s quarterly Net loss in a very long time (if I am not mistaken, this is the first quarterly loss since the spin-off from eBay). To be fair, the company incurred a sizeable loss on its strategic investments, as well as an “income tax expense of $218 million driven primarily by higher tax expense related to the intra-group transfer of intellectual property.”

On the adjusted basis, the company reported a Non-GAAP Net Income of $1.1 billion for the quarter (GAAP Net Income adjusted for stock-based compensation, amortization of acquisitions, gains and losses on strategic investments, and one-time expenses), down from $1.4 billion in Q2 2021.

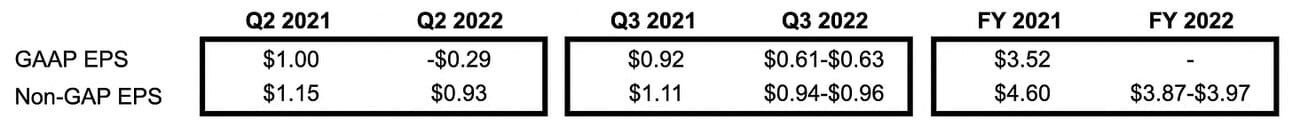

The company’s management guided for a GAAP EPS in the range of ~$0.61-$0.63 and a Non-GAAP EPS of $0.94-$0.96 in Q3 2022, as well as a Non-GAAP EPS of $3.87-$3.97 for the full year 2022. They did not guide for a full-year GAAP EPS.

To be honest, these GAAP/non-GAAP EPS guidances are super confusing, and I genuinely don’t understand why PayPal’s management cannot just guide for GAAP and Non-GAAP Net Income. Let’s try to summarize their guidance:

EPS is a function of the Net Income and the shares outstanding, and as the company is buying back its shares, it is hard to recalculate EPS guidance to Net Income guidance. Based on the number of shares used in the Q2 EPS calculation, the company is expecting Q3 2022 GAAP Net Income of $706-730 million, and Q3 2022 Non-GAAP Net Income of $1.09-1.11 billion.

On the final note, the company’s Board has authorized an additional $15 billion share repurchase program (increasing the total authorization to almost $18 billion). As per the CEO's comment, the company plans to “return 75% to 80% of free cash flow to shareholders in the form of share repurchases.” The company generated $1.29 billion in free cash flow in Q2 2022 and guided for $5.0+ billion in free cash flow for the full year 2022.

Things to Watch in 2022

TPV and Revenue growth. The company’s guidance implies a return to double-digit growth in the second half of the year, which is a positive sign. However, for now, this remains just management guidance, and PayPal management destroyed its credibility by continuously missing its own guidance. With the Take Rate being flat, the revenue growth comes down to the growth in TPV, so let’s see if the company can deliver that.

Transaction and Operating Margins. The company’s focus on the costs side is clearly a great outcome of Elliott’s activism. The announced cost optimization initiatives should improve both, the Transaction and the Operating Margins. Personally, I am most interested in the company stopping its Transaction margin compression (which went below the 50% mark in Q2 2022). Revenue growth paired with improved transaction margin will translate into higher profit eventually, even if non-transactional expenses remain flat.

Further improvements. I don’t think that return to revenue growth and $1.3 billion in savings in 2023 were the only things that Elliott Management expects from PayPal. The company promised to “provide details related to the review of capital return alternatives” at Investor Day to be held in early 2023. Super curious to see what they come up with (divestitures, exits from some geographies, further cost cuts - I mean, PayPal is a huge company, so there should be plenty of inefficiencies).

In summary, Elliott Management taking a stake in PayPal, and getting commitments from the management to restore the revenue growth and cut costs, is perhaps, a turning point for the company. Let’s not forget that PayPal is a household name, and focus can do miracles for the performance of the company. For what it’s worth, I am definitely becoming more optimistic about the company’s prospects!

Source of the data used above: Investor Relations

Disclosure & Disclaimer: despite rocky performance in 2021 and the first half of 2022, I have open positions in most of the companies covered in this newsletter, as I am extremely bullish on the transformation in the financial services industry. However, none of the above is financial advice, and you should do your research.