Hi!

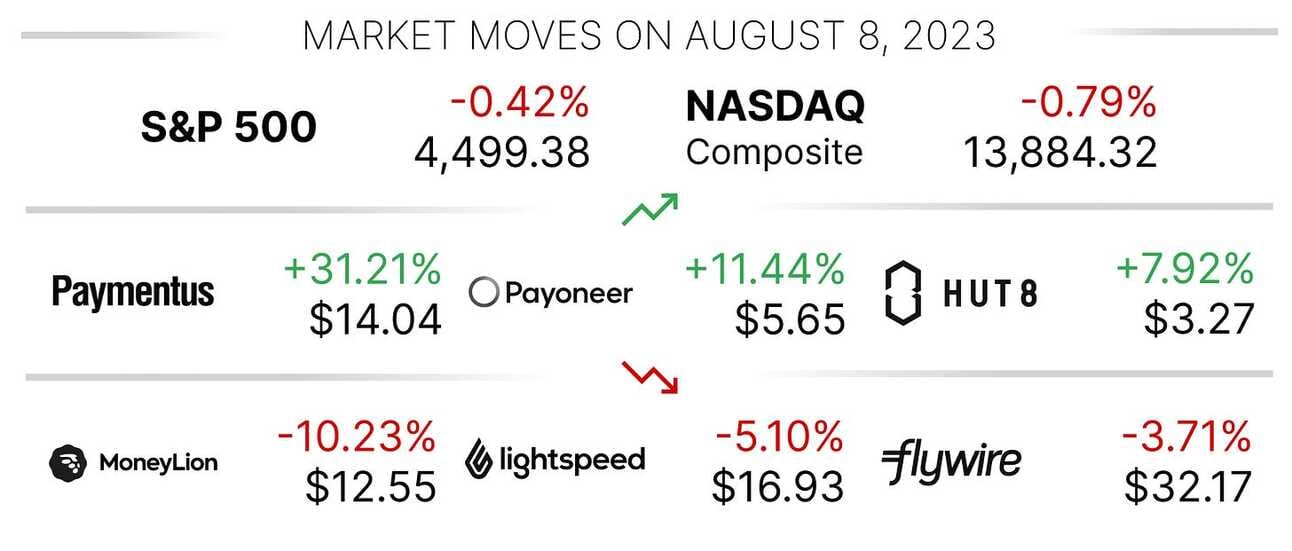

Lots of positive news from Fintech companies this week (and hopefully, more to come, as the companies continue to report their second quarter results):

Marqeta secures a four-year extension with Block for Cash App card,

Toast reaches Adjusted EBITDA profitability, and

PayPal launches a U.S. dollar stablecoin

Thank you for reading and have a great day!

Jevgenijs

p.s. have feedback? DM me on Twitter

Marqeta Secures Four-Year Extension with Block for Cash App Card

As part of its second-quarter earnings release, Marqeta (NASDAQ: MQ) announced that it had signed a four-year extension with Block (NYSE: SQ) to continue powering the company’s Cash App card product. This extended deal will become effective on July 1, 2023, and will continue through June 30, 2027. The new agreement includes reduced pricing, as well as a transfer of responsibility for managing the card network relationship, including financial terms and choice of card brand, from Marqeta to Block. The company expects the renewal to “reduce reported net revenue and decrease gross profit.”

Marqeta powers both Cash App and Square cards and generated 78% of its net revenue from managing Block’s card programs in the second quarter. The company’s second agreement with Block, which covers Square Card, expires in December 2024 and was not subject to the announced renewal. Interestingly, when launching a credit card for merchants, Square chose to go with American Express and a different processor. Square disclosed that its sellers “spent more than $1 billion using their debit cards” in the first five months of 2023, which suggests a limited contribution to Marqeta’s total processing volumes.

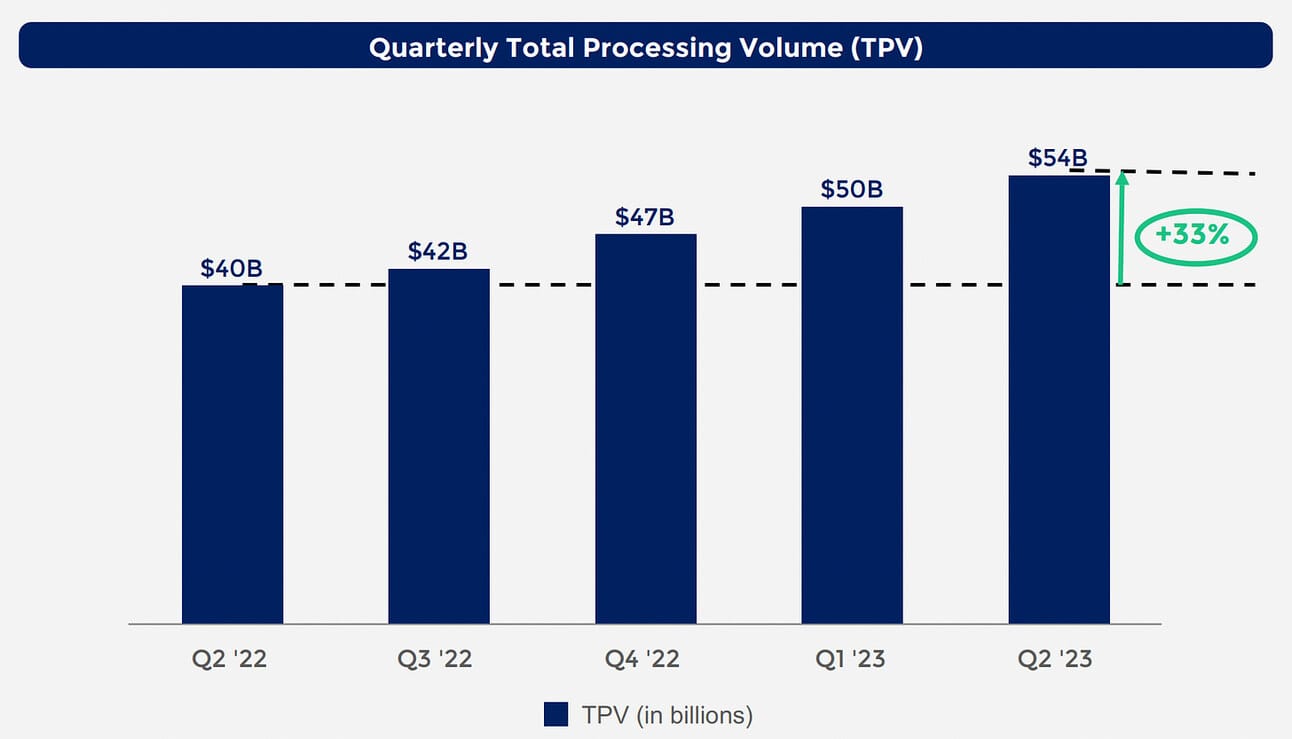

Marqeta also reported a 33% YoY growth in Total Processing Volume to $54 billion, and a 24% YoY growth in net revenue to $231 million. Net loss increased to $59 million largely due to restructuring expenses (the company executed a round of layoffs) and post-acquisition compensation related to the acquisition of Power Finance. Adjusted EBITDA for the quarter was $1 million, compared to an Adjusted EBITDA loss of $10 million in the second quarter of 2022. During the quarter the company shuttered its operations in Australia but expanded to Brazil through a partnership with Fitbank.

Toast Reaches Adjusted EBITDA Profitability

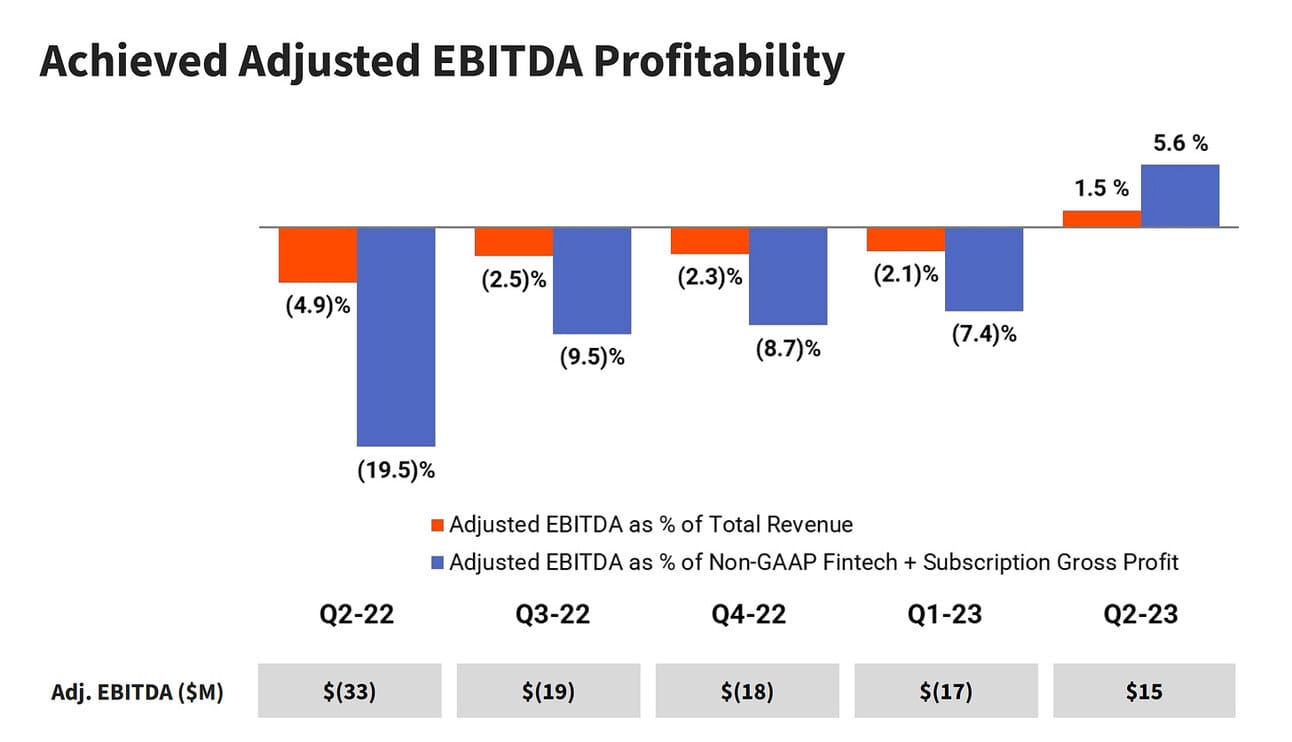

Toast (NYSE: TOST) reported its second quarter 2023 results yesterday. Total serviced restaurant locations rose by 35% YoY to 93,000 locations. Gross Payment Volume increased by 38% YoY to $32.1 billion driving a 45% YoY growth in revenue to $978 million. Despite reporting a GAAP net loss of $98 million, Toast posted a positive Adjusted EBITDA of $15 million, reaching profitability on an adjusted basis ahead of schedule. The company raised its revenue guidance to $3.81 - $3.87 billion (up from $3.71 - $3.80 billion) and expects to report Adjusted EBITDA of $15 million to $35 million for the full year.

The company’s second quarter was marked by the controversy related to an introduction of a 99-cent fee on online orders over $10, which was intended to fund software improvements. Faced with a widespread backlash from restaurant operators and customers alike, the company announced that it will remove the fee just days after its nationwide implementation. Many criticized Toast for charging customers without offering restaurants the option to waive or offset the fee. The negative response prompted the CEO, Chris Comparato, to acknowledge the mistake and announce the fee's removal.

✔️ Toast Announces First Quarter 2023 Financial Results

✔️ Toast to remove 99-cent fee after widespread backlash

PayPal Launches U.S. Dollar Stablecoin

PayPal (NASDAQ: PYPL) introduced a new stablecoin called PayPal USD (PYUSD), which is backed by deposits and short-term treasuries and can be redeemed 1:1 for U.S. dollars. Eligible U.S. PayPal customers can use PYUSD for various purposes, including transferring between PayPal and external wallets, making person-to-person payments, funding purchases, and converting between supported cryptocurrencies. The stablecoin aims to bridge the gap between fiat and digital currencies within the PayPal network and the broader Web3 ecosystem. The stablecoin is issued by Paxos Trust Company as an ERC-20 token on the Ethereum blockchain.

Stablecoins are digital tokens designed to maintain a consistent value, unlike volatile cryptocurrencies such as Bitcoin and Ethereum. They are usually pegged to another currency, most commonly the U.S. dollar, and are backed by cash reserves, treasuries, and other liquid financial instruments. CoinMarketCap estimates the total circulation of stablecoins to be around $125 billion with the largest of them being Tether and USD Coin. The U.S. Federal Reserve is exploring regulatory measures to supervise stablecoin issuers, following the collapse of TerraUSD, which set off a broader crypto asset selloff and multiple prominent bankruptcies last year.

✔️ PayPal Launches U.S. Dollar Stablecoin

✔️ What Are Stablecoins and Why is PayPal Getting Involved?

✔️ US Fed clarifies process for banks to transact in stablecoins

Last week, I suggested revisiting valuation multiples for major payments companies, once they all report their second-quarter 2023 results. Shopify, PayPal, Block, and FIS reported their results since then and the Enterprise Value / NTM Sales multiples declined slightly across the board. Shopify (NYSE: SHOP) and Block (NYSE: SQ) saw the biggest declines from 11.9x to 9.1x and from 2.2x to 1.7x respectively.

Director, Enterprise Sales

@ Marqeta

🇺🇸 Remote, United StatesSenior Director, Product Management

@ Marqeta

🇺🇸 Remote, United StatesChief of Staff, Fintech

@ Toast

🇺🇸 Boston, MA, United StatesAssociate Director of Product Design

@ Toast🇮🇪 Dublin, IrelandSenior Director, Deputy to the GM of Venmo

@ PayPal

🇺🇸 San Jose, CA, United States

Cover image source: Cash App

Disclaimer: Information contained in this newsletter is intended for educational and informational purposes only and should not be considered financial advice. You should do your own research or seek professional advice before making any investment decisions.