Hi!

Three iconic (IMHO) Fintech companies, PayPal, Block and Shopify, report their second-quarter earnings this week. Are you as excited as I am? More on that in today’s newsletter:

Shopify and PayPal to report second-quarter earnings,

SoFi earnings get mixed reception from analysts, and

Global Payments raises full-year guidance

Thank you for reading and have a great day!

Jevgenijs

p.s. have feedback? DM me on Twitter

PayPal and Shopify to Report Earnings

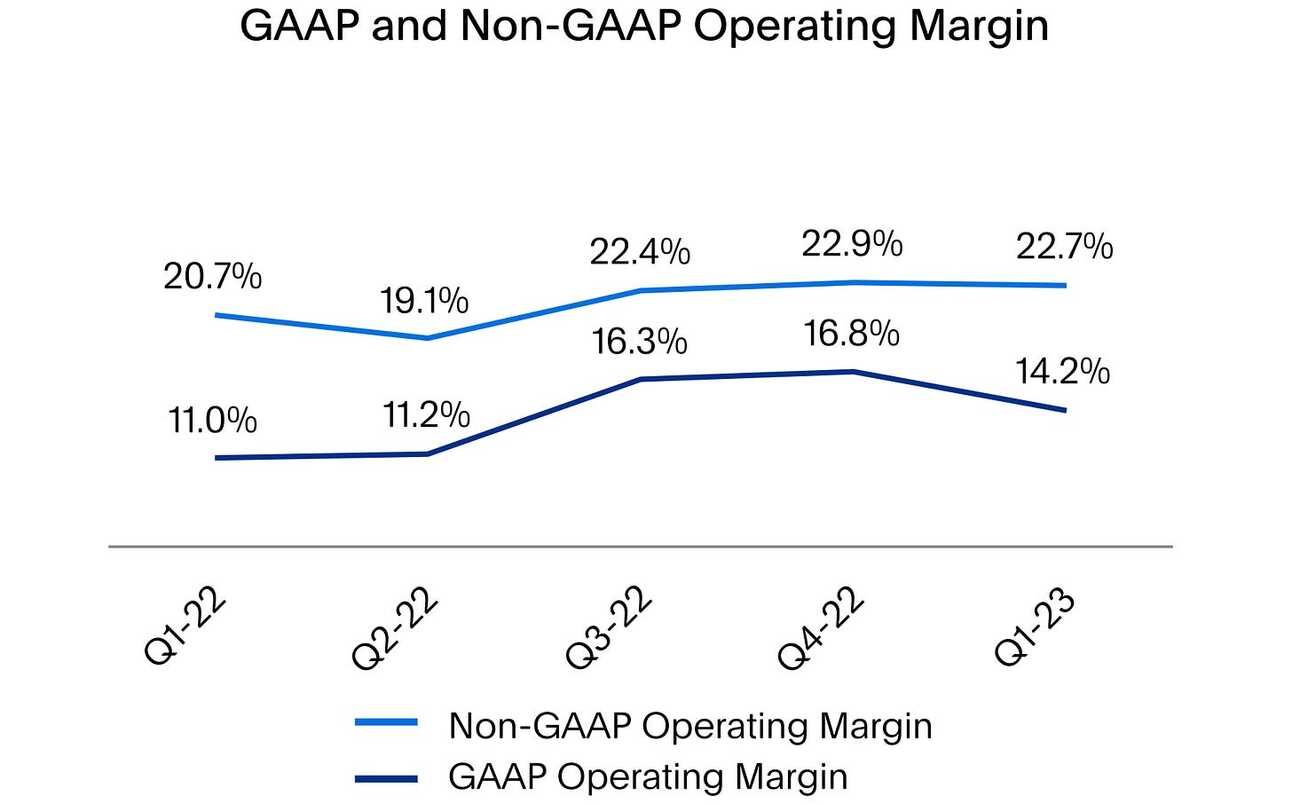

PayPal (NASDAQ: PYPL) and Shopify (NYSE: SHOP) will report their second-quarter earnings today after markets close. In the first quarter, PayPal’s net revenues rose 9% YoY to $7.04 billion, driven by 10% YoY growth in Total Payment Volume. GAAP operating income increased 41% YoY to $1.0 billion, while non-GAAP operating income increased 19% YoY to $1.6 billion. The decline in the operating margin raised many questions from analysts. In response, the management emphasized their focus on improving the company's margins, particularly by targeting the Small and Medium-sized Business segment.

PayPal’s management raised its full-year 2023 guidance expecting revenue growth in the second half of the year to be “relatively in line with” the first half, as well as GAAP EPS of $3.42 and non-GAAP EPS of $4.95. The company expected to generate $5 billion in free cash flow and repurchase $4 billion of its shares. On top of the financial performance (and operating margins), investors will be looking for updates on CEO succession, as Dan Schulman announced his plan to step down at the end of the year. The company has also been operating without a permanent CFO after Blake Jorgensen stepped down just a few months after taking the role.

On its first quarter earnings call, Shopify (NYSE: SHOP) announced selling its logistics business, ”including the people, technology, and related services” to Flexport. As per the terms of the transaction, Shopify will receive an equity stake in the company, and Flexport will become the official logistics partner for Shopify. The deal closed during the second quarter. Shopify invested agressively in its logistics business, including spending $450 million to acquire a warehouse robotics company 6 River Systems in 2019, and $2.1 billion to acquire a fulfillment technology provider Deliverr for in 2022.

The company’s stock rallied after the announcement, as the decision to divest from the logistics is expected to narrow the operating loss. Shopify never disclosed the revenue or expenses related to its logistics business, reporting its results under the “Merchant Solutions” segment, which also includes financial services. In the first quarter, the company reported a 25% YoY increase in revenue to $1.5 billion, driven by a 31% YoY growth in “Merchant Solutions” revenue, and an 11% YoY growth in “Subscription Solutions” revenue. The company reported an operating loss of $193 million, compared to an operating loss of $98 million in the first quarter of 2022.

✔️ PayPal adjusted margin forecast cut eclipses higher profit expectations

✔️ PayPal First Quarter 2023 Earnings Release

✔️ Shopify to Lay Off 20% of Its Workforce as It Sells Logistics Business to Flexport

✔️ Shopify Announces First-Quarter 2023 Financial Results

SoFi Earnings Get Mixed Reception from Analysts

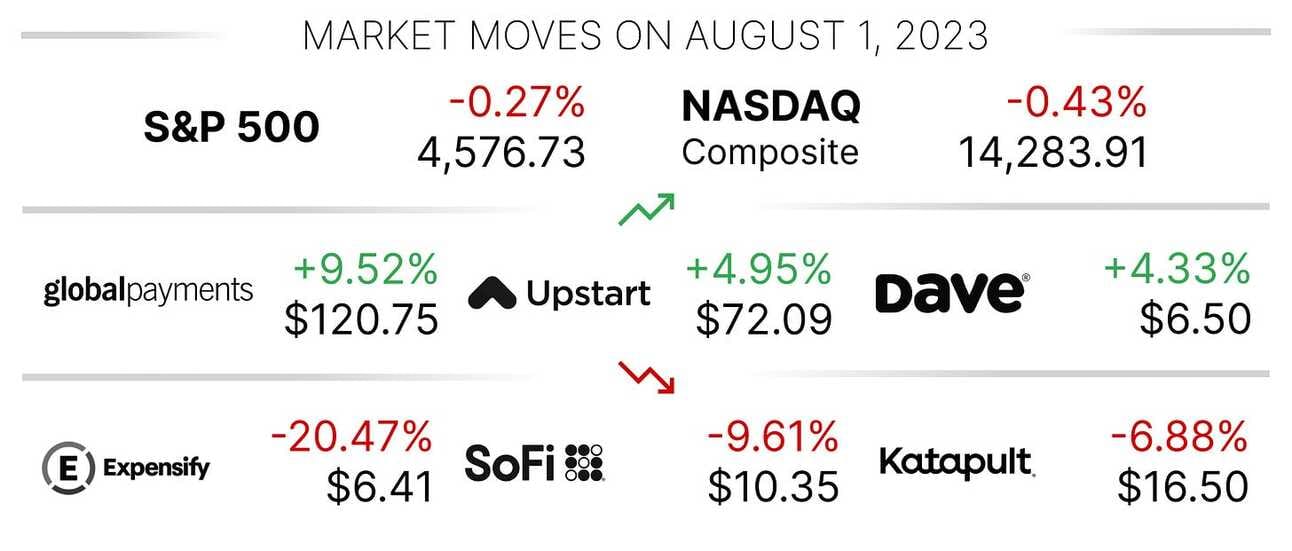

SoFi (NASDAQ: SOFI) reported its second quarter results on Monday. The company did what it usually does, beating the estimates and raising the guidance. Total revenue for the quarter increased 37% YoY to $498 million, driven by a 103% YoY growth in Net interest income, and a 30% decline in non-interest income. The company reported a record personal loan originations of $3.7 billion, representing a 51% increase from $1.3 billion in the second quarter of 2022. Net loss was $47.6 million and Adjusted EBITDA was $76.8 million, compared to a net loss of $95.8 million and Adjusted EBITDA of $20.3 million a year ago.

SoFi raised its full-year adjusted EBITDA guidance to $333 to $343 million, up from the prior guidance of $268 to $288 million. The company’s results received a mixed reception from analysts, as some of them downgraded the stock citing concerns about future growth and valuation. Keefe Bruyette downgraded the shares to “Underperform”, citing an overshooting of the fundamental earnings outlook. They expect SoFi's growth rates to moderate, and profitability to be “modest at best” in 2024. Wedbush analysts also expressed similar concerns, anticipating a potential slowdown in revenue growth and credit quality weakening in the face of a recession.

✔️ SoFi Technologies, Inc. Reports Second Quarter 2023 Results

✔️ SoFi Surges Most in a Year After Boosting Revenue Forecast

✔️ SoFi Earnings Sent the Stock Flying. Why Shares Still Got a Downgrade

Global Payments Raises Full-Year Guidance

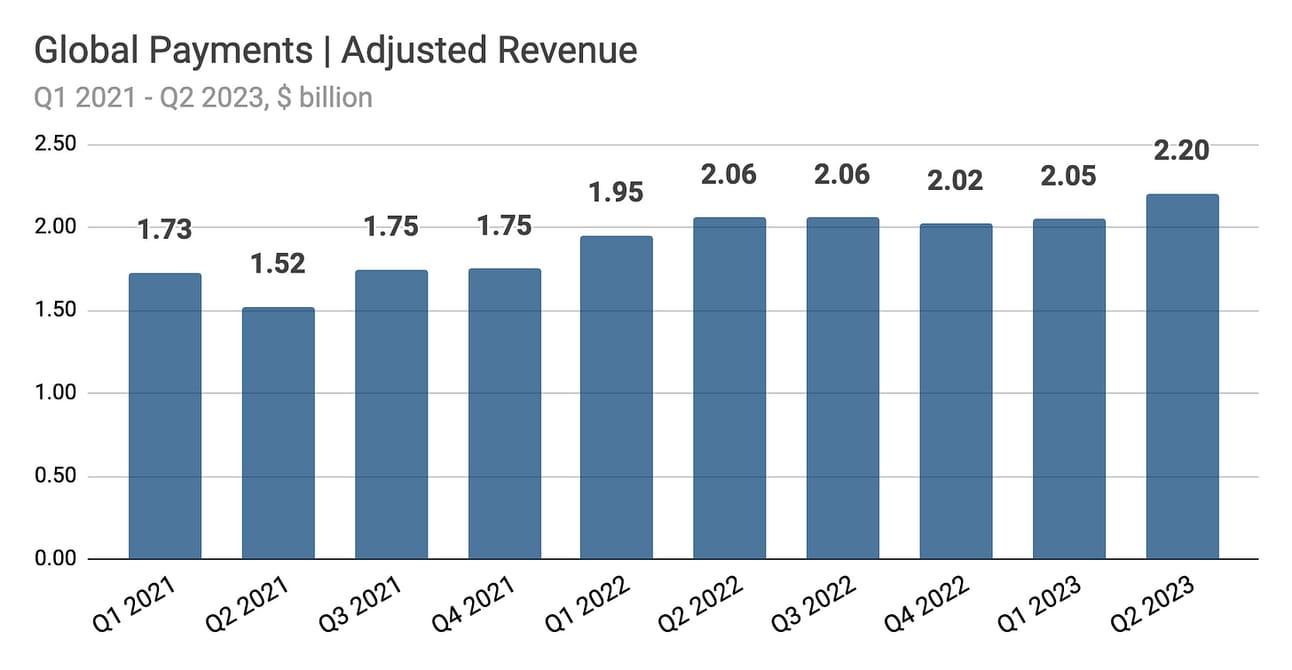

Global Payments (NYSE: GPN) reported strong financial results for the second quarter of 2023, with a 7.5% YoY growth in GAAP revenues to $2.45 billion. Diluted earnings per share were $1.05, an improvement from the loss per share of $2.42 in the prior year. Adjusted net revenues increased by 7.0% YoY to $2.20 billion, and adjusted earnings per share rose by 11% YoY to $2.62. This was the first earnings call for Cameron Bread, who took over as CEO after Jeffrey Sloan stepped down at the beginning of the summer. The CEO succession plan was announced in May 2023.

The company raised its outlook for 2023 to “reflect continued strong and consistent execution across [its] businesses, despite an uncertain macroeconomic environment.” The company’s management is now expecting adjusted net revenue to be in the range of $8.66 billion to $8.74 billion, representing a 7% to 8% growth compared to 2022. Adjusted earnings per share are now expected to be in the range of $10.35 to $10.44, reflecting an 11% to 12% YoY growth. Global Payments' Board approved a dividend of $0.25 per share payable on September 29, 2023.

✔️ Global Payments Reports Second Quarter 2023 Results

✔️ Global Payments Announces CEO Succession Plan

Shopify is trading at premium Enterprise Value / Sales (NTM) multiple compared to its peers (see below). Fiserv and Global Payments have already reported their second quarter results, and Shopify, PayPal, Block and FIS report this week. Worth revisiting this chart once every company has reported.

Senior Director, Deputy to the GM of Venmo

@ PayPal

🇺🇸 San Jose, CA, United StatesDirector, Product Data Science, Venmo

@ PayPal

🇺🇸 San Jose, CA or New York, NY, United StatesSenior Product Manager, Analyze

@ Shopify

🇺🇸 Remote, AmericasDirector of Insurance, SoFi Protect

@ SoFi

🇺🇸 Multiple locations, United StatesSenior Product Manager, SoFi Protect

@ SoFi

🇺🇸 San Francisco, CA, United States

Cover image source: PayPal

Disclaimer: Information contained in this newsletter is intended for educational and informational purposes only and should not be considered financial advice. You should do your own research or seek professional advice before making any investment decisions.