The third quarter of 2022 might have felt uneventful for Marqeta (NASDAQ: ): Block is still its largest client, the company’s board has not found a new CEO to replace the founder, and the company keeps reporting “due diligence costs related to potential acquisitions”, but has not pursued one. Nevertheless, the company reported a 53.9% YoY growth in Total Processing Volume, and a 45.7% YoY growth in revenue, as well as launched “Marqeta for Banking”, a portfolio of banking products that expands capabilities of the company’s card issuing platform… all while burning very little of its $1.2 billion cash and cash equivalents balance.

Marqeta’s management is also going against the tide by not reducing the company’s workforce or pursuing profitability at the cost of future growth. Instead, the company is buying back its stock, which, I believe, is the management’s way of signaling the confidence that the best is yet to come.

If you are new to Marqeta, I suggest reading my previous reviews:

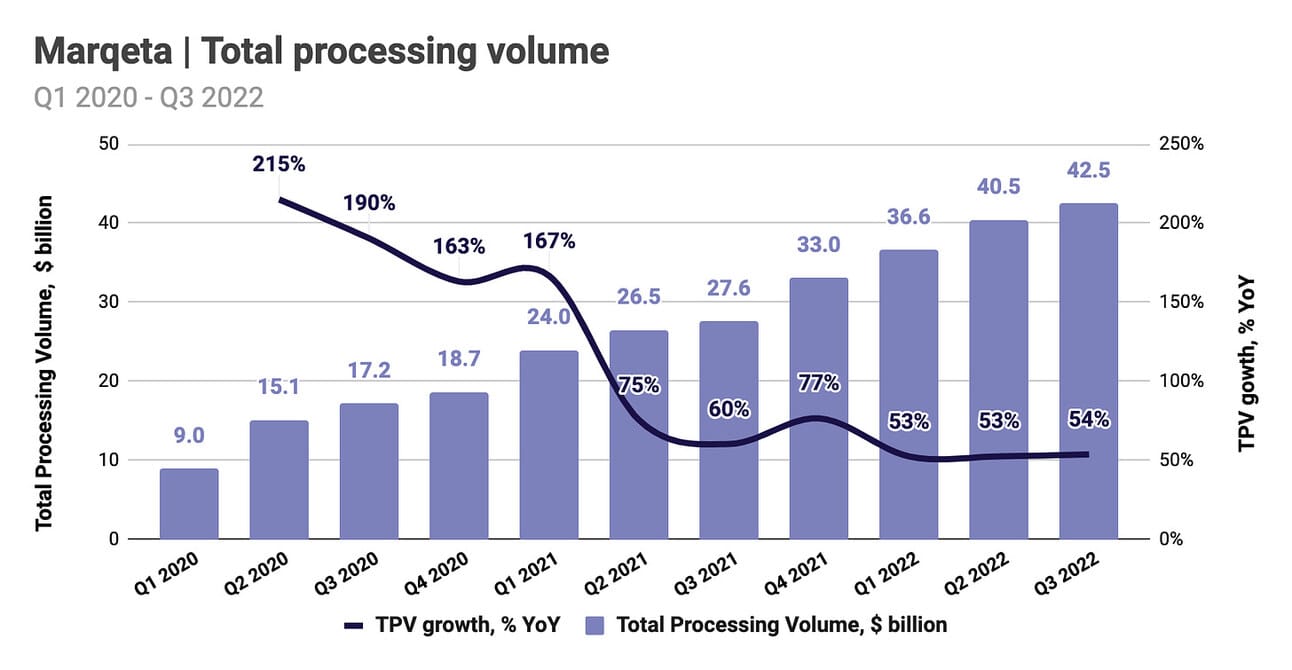

Total Processing Volume

Marqeta reported Total Processing Volume (TPV) of $42.5 billion in Q3 2022, which represents an increase of 53.9% compared to Q3 2021, and a 5.0% increase compared to Q2 2022. The company attributes the increase in TPV to “growth across all our major verticals, particularly financial services, and “Powered by Marqeta” customers” (customers, for which Marqeta acts only as a processor). During the earnings call, the company’s management called out growth in expense management and lending (including buy-now-pay-later) sub-verticals.

In Q3 2022, TPV for Marqeta’s top five customers (measured by TPV volume) grew 56%, while TPV from all other customers, grew by 46% compared to Q3 2021. This represents a major change from Q2 2022, when TPV for the company’s top five customers grew 48% YoY, while TPV from all other customers, grew 81% YoY, as well as Q1 2022, when TPV for the top five customers grew 39% YoY, while TPV from all other customers, grew 168% YoY. The top five customers can be different in each quarter, but it is still fair to conclude that, as the year progressed, the growth of the company’s largest clients accelerated, while the growth of the company’s smaller clients decelerated.

The company’s management did not provide TPV guidance for Q4 2022; however, given the provided revenue guidance (and assuming a stable Take Rate), we should expect $44-45 billion in TPV in Q4, 2022. This would represent a 34-37% growth compared to Q4 2021, which was a very strong quarter for Marqeta.

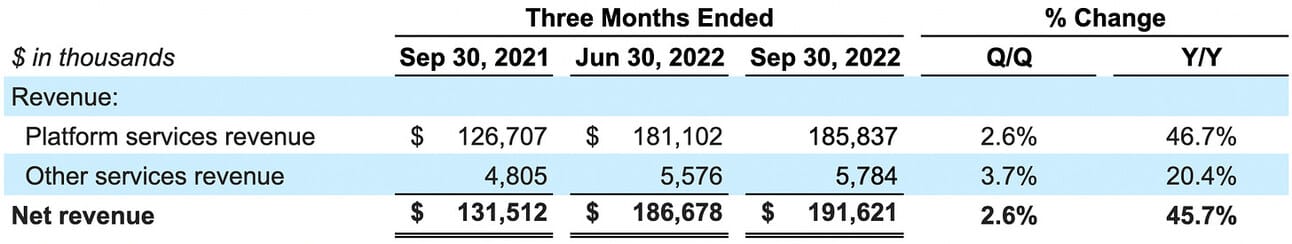

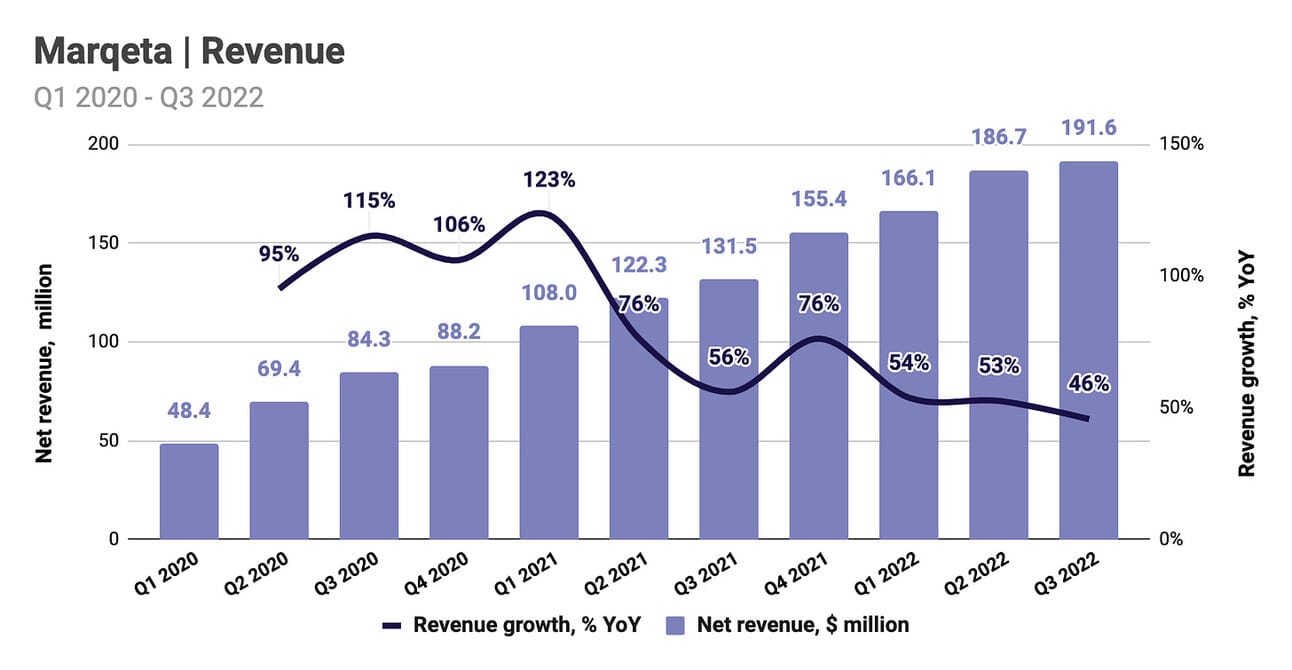

Revenue and Take Rate

Marqeta reported $191.6 million in net revenue for the quarter, which represents a 45.7% increase compared to Q3 2021, and a 2.6% increase compared to Q2 2022. Block, Inc, Marqeta’s largest customer, generated 73% of net revenue in the quarter, compared to 68% in Q3 2021, and 69% in Q2 2022. The increase in concentration compared to Q3 2021 is related to Block’s acquisition of Afterpay, which was also Marqeta’s client, while the increase in concentration compared to Q2 2022 is related to the growth of Block’s Cash App businesses.

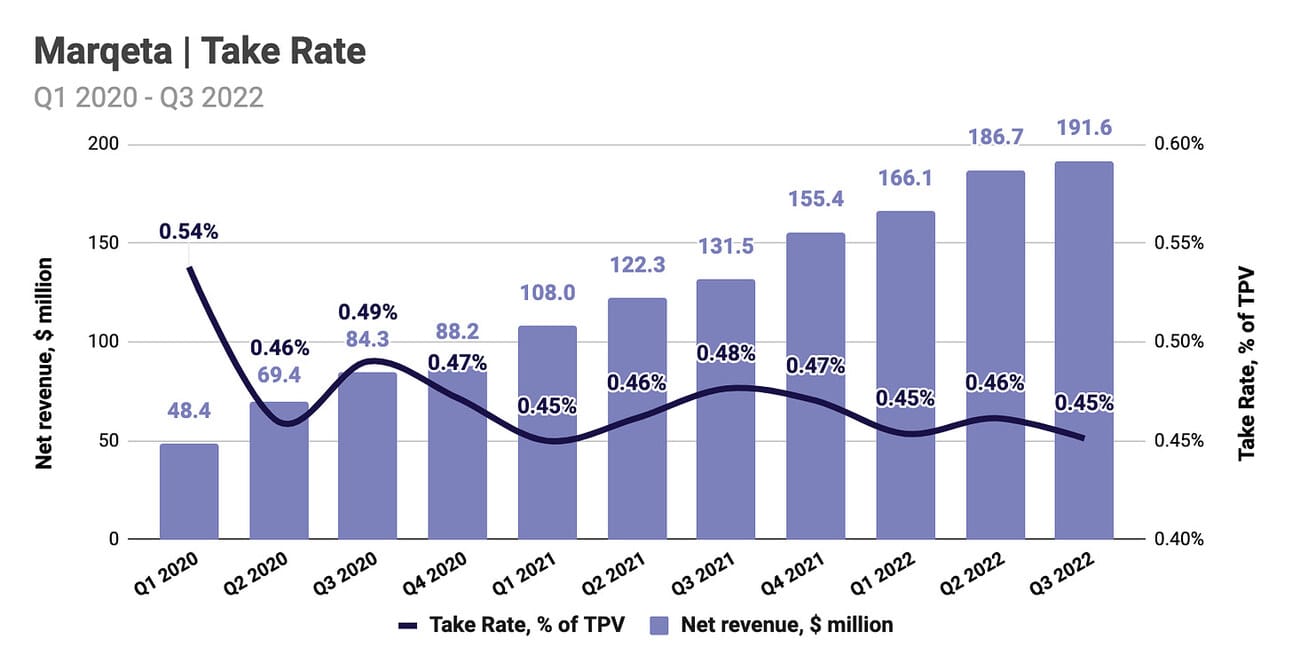

Marqeta’s revenue growth is a function of TPV growth and change in the Take Rate. In Q3 2022, year-over-year TPV growth outpaced revenue growth by 8.2% (53.9% vs. 45.7%), which the management attributed to the growth of the company’s “Powered by Marqeta” business that has a lower take rate than the “Managed by Marqeta” business. In Q3 2022, revenue from Block increased by 54.5% compared to Q3 2021, while revenue from all other clients increased by 26.8% compared to Q3 2021 (though this calculation might be slightly distorted as revenue from Afterpay moved from “all other clients” to Block).

The company’s Take Rate (Net revenue divided by Total Processing Volume) declined from 0.47% in Q3 2021 to 0.45% in Q3 2022, as mentioned above, due to the growth of “Powered by Marqeta” volumes outpacing the growth of “Managed by Marqeta” volumes. During the earnings call, Mike Milotich, the company’s CFO, said that although the take rate for the “Powered by Marqeta” business is lower, its gross profit margin is similar to several verticals in the “Managed by Marqeta” business. We should expect the take rate to decline further, should the growth of the “Powered by Marqeta” business continues.

The company’s management guided for net revenue growth of 29-31% YoY in Q4 2022, which implies net revenue of $200-204 million in Q4 2022, and net revenue of $745 - 748 million for the full year. Q4 2022 guidance implies a deceleration of growth, but as I mentioned above, Q4 2021 was a strong quarter for the company, making for difficult comparables.

Gross Profit

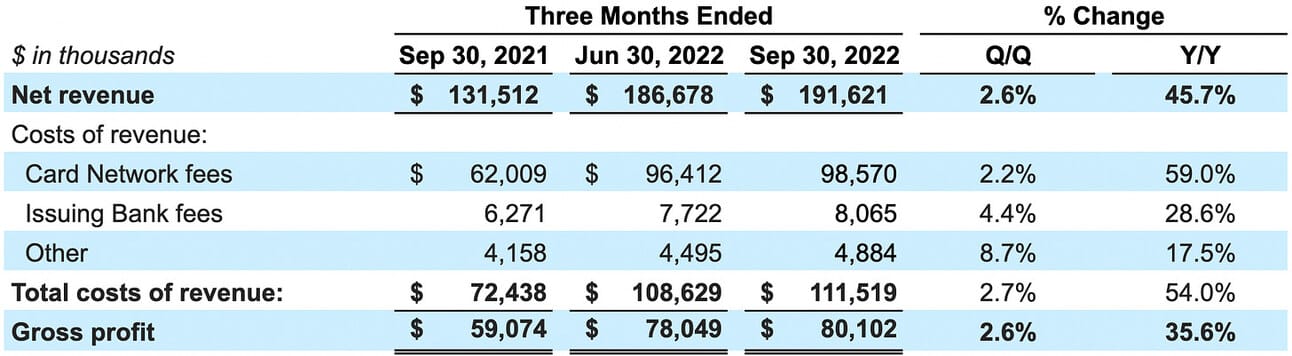

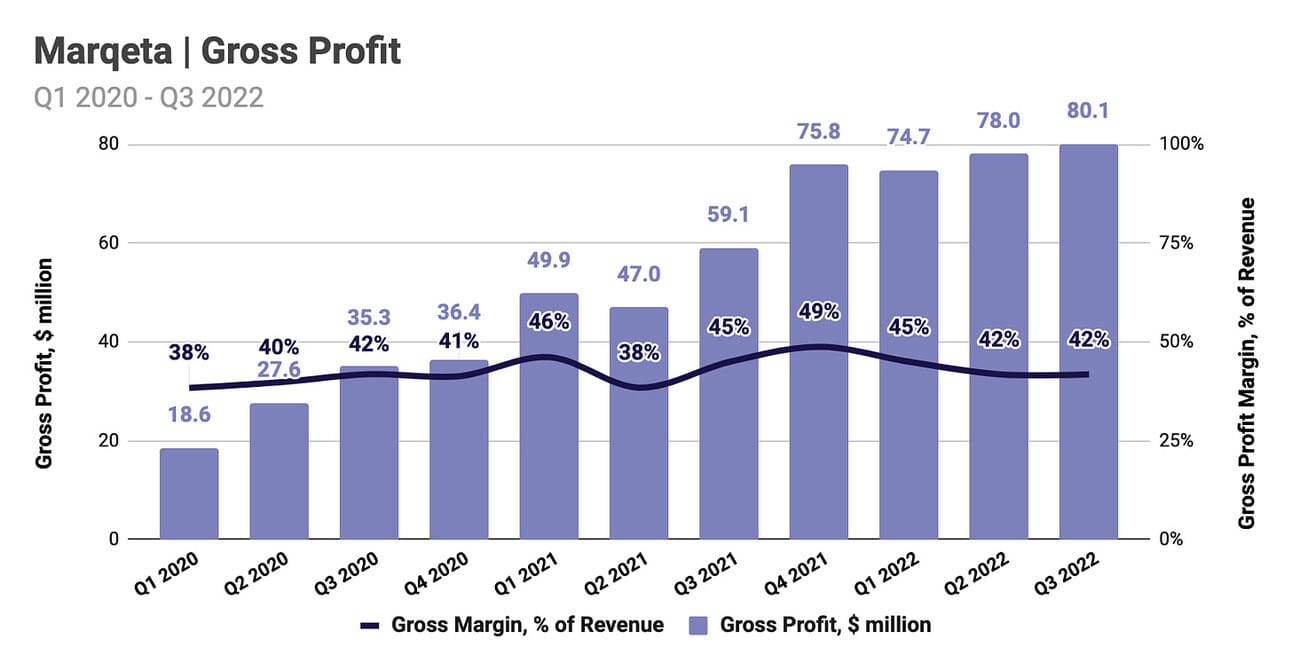

Marqeta reported $80.1 million in Gross profit for the quarter, which represents a 35.6% growth compared to Q3 2021, and a 2.6% increase compared to Q2 2022. Gross profit margin decreased from 44.9% in Q3 2021 to 41.8% in Q3 2022, as the increase in the costs of revenue outpaced the increase in revenue (54.0% YoY vs 45.7% YoY). The increase in the costs of revenue was primarily driven by “Card network fees” (59.0% YoY increase), and “reflects the increase in TPV as well as unfavorable changes in [the] card program mix.”

The company’s CFO mentioned during the earnings call that while Block contributed 72.5% of Marqeta’s net revenue in the quarter, “their share in the gross profit was more than 15 [percentage] points lower than their share of net revenue.” This implies that Block contributed approximately $46 million in gross profit at a 33% gross profit margin. This suggests that the growth of Block’s Cash App was one of the factors contributing to the gross profit margin compression. Nevertheless, as the chart below illustrates, Marqeta has been consistently operating at a 40%+ gross profit margin with a few deviations to the positive side (i.e. Q1 2021 and Q4 2021).

The company’s management expects the gross profit margin to remain in the range of 42 - 43% in Q4 2022, which implies (given the revenue guidance discussed above) $84 - 88 million in gross profit in Q4 2022, and $317 - 320 million in gross profit for the full year 2022.

Operating Expenses

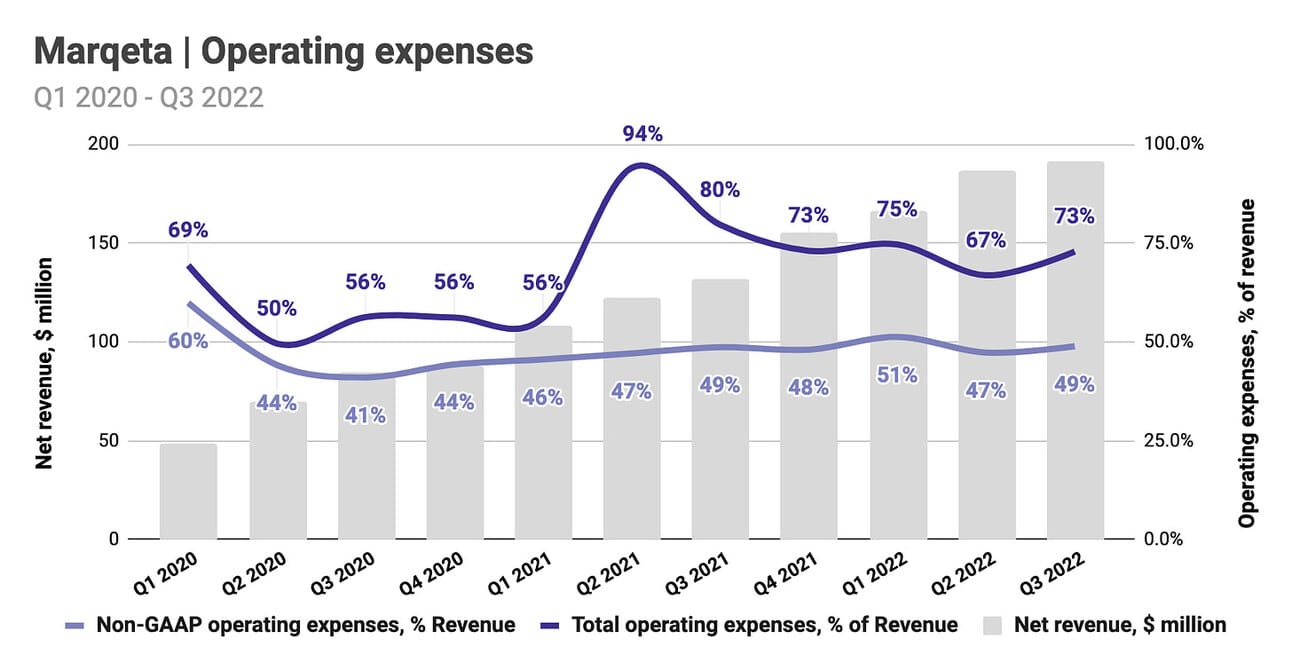

Marqeta reported $139.6 million in Operating expenses for the quarter, which represents a 33.3% increase compared to Q3 2021, and an 11.9% increase compared to Q2 2022. “Compensation and benefits” expenses were the largest cost category and contributed 75.9% of total operating expenses, followed by “Technology” expenses (9.6%), “Professional services” (4.7%), and “Other” expenses (7.8%). “Other” expenses include an irregularly high indemnification cost of $5.9 million (the company typically agrees to indemnify its clients, partners, and issuing banks from non-compliance with regulatory requirements).

Operating expenses expressed as a percentage of revenue (see the chart below) present a mixed picture. Thus, you can see that the Operating Expenses / Net revenue ratio decreased from 79.6% in Q3 2021 to 72.9% in Q3 2021, but increased from 66.8% in Q2 2022. Overall, it is hard to see that increased scale (as measured by the increase in revenue) translates into meaningful improvement in operating efficiency (as measured by the decreasing OpEx / Net revenue ratio).

Moreover, the operating efficiency has not been improving even on an adjusted level (as measured by the non-GAAP Operating expenses / Net revenue ratio). The company calculates Non-GAAP operating expenses by excluding share-based compensation and related taxes, as well as depreciation and amortization. The company reported share-based compensation of $43.5 million for the quarter, compared to $39.0 million in Q3 2021 and $35.2 in Q2 2022.

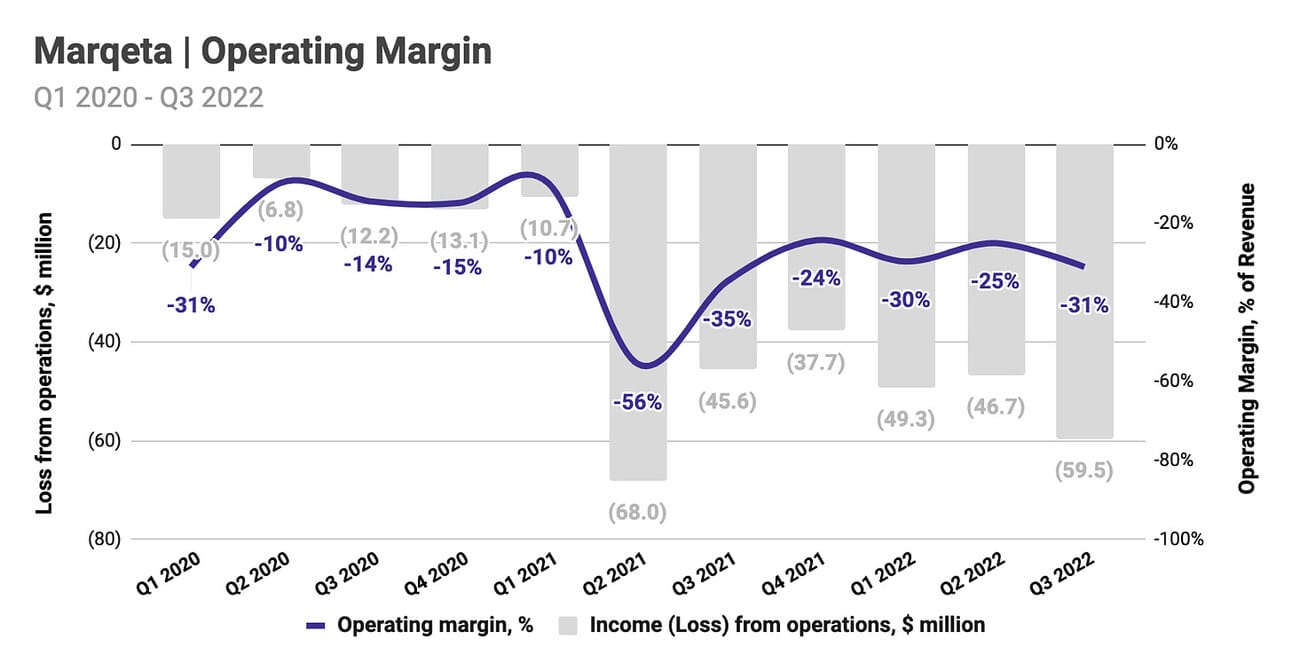

Marqeta reported a Loss from operations of $59.5 million for the quarter, compared to a Loss from operations of $45.6 million in Q3 2021, and $46.7 million in Q2 2021. As mentioned above, the company incurred an irregularly high indemnification cost of $5.9 million this quarter. As I will argue in the next section, Marqeta is not optimizing for profitability; however, should it decide to do that, the company would have to reduce its workforce (as “Compensation and benefits” expenses represent more than 75% of total operating expenses). Marqeta is one of the few technology companies that has not executed layoffs in this cycle.

Net Income (Loss) and Adjusted EBITDA

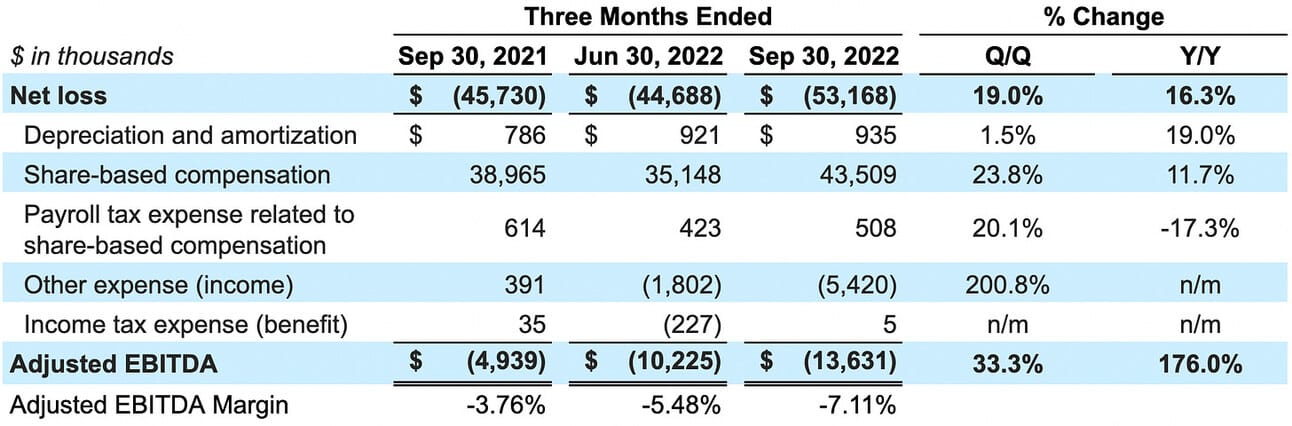

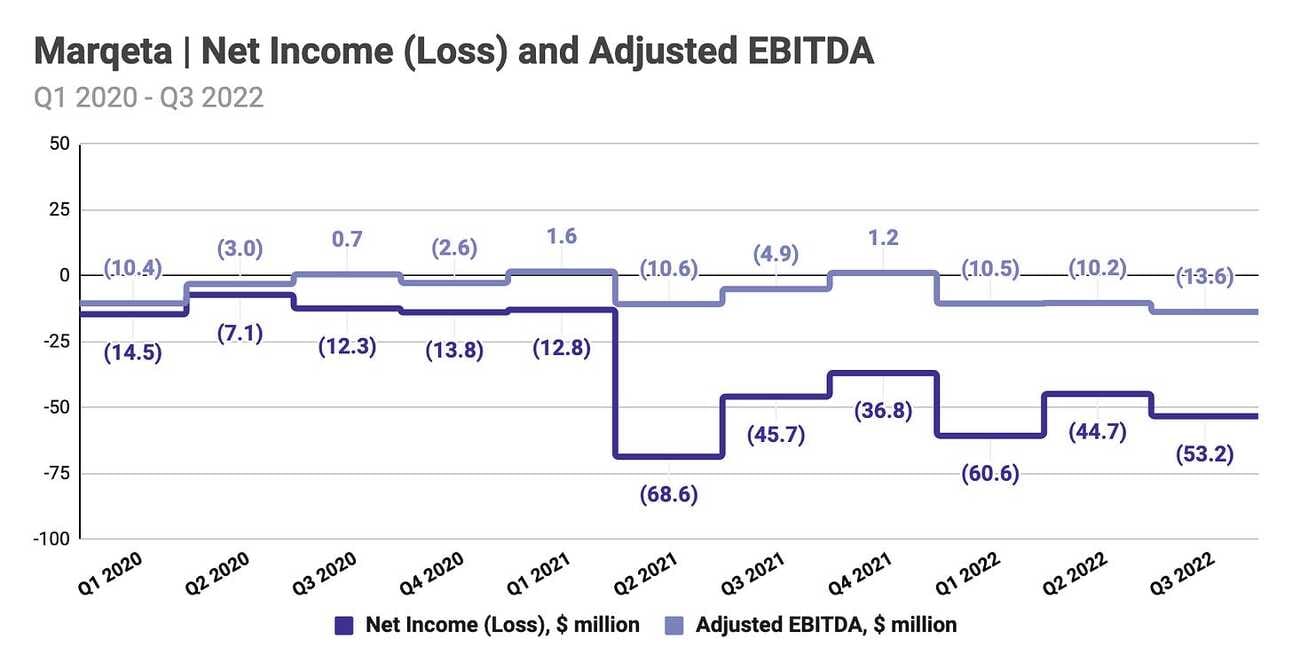

The company reported a Net loss of $53.2 million for the quarter, compared to a Net loss of $45.7 million in Q3 2021, and $44.7 million in Q2 2022. Marqeta also reported a negative Adjusted EBITDA of $13.6 million, compared to a negative Adjusted EBITDA of $4.9 million in Q3 2021, and $10.2 million in Q2 2022. The largest adjustment that the company makes in calculating Adjusted EBITDA is share-based compensation and related payroll tax expense.

On one of the earlier earnings calls, the company’s CFO guided for a target to operate at a “20%-plus Adjusted EBITDA margin” once the company captures “more of the market opportunity.” The company had $1.2 billion in cash and cash equivalents, as well as $0.44 billion in marketable securities at the end of Q3 2022. Thus, the company’s management does not have an urgency to optimize costs and is pursuing this “market opportunity”, which results in Marqeta operating at a negative single-digit Adjusted EBITDA margin, despite quadrupling revenue since Q1 2020. Moreover, in Q3 2022 the company “repurchased 1.96 million shares for $13.9 million at an average price of $7.05 per share.”

Marqeta’s management expects a negative Adjusted EBITDA margin of 5-6% in Q4 2022, which (given the revenue guidance) implies a negative Adjusted EBITDA of $10 - 12 million in Q4 2022, and a negative Adjusted EBITDA of $44 - 47 million for the full year. Thus, the company plans to continue “capturing market opportunity” in Q4 2022.

Things to Watch in 2023

CEO succession. In August 2022, the company’s founder, Jason Gardner, announced his plan to step down from the CEO role (he intends to remain actively involved with the company in the executive chairman capacity), and, as of this writing, the search for a new CEO is still ongoing. My bet would be that the Board is looking to hire an industry veteran that would help Marqeta with opening doors to the established card issuers.

Diversification of revenue. Concentration with a single client, Block, remains a key concern for the company and its investors (the existing agreement with Block expires in Q2 2024, and at this point, the company cannot provide any assurance that it will be prolonged). Thus, I would expect the company to continue attempts to diversify its revenue stream either through the onboarding of new clients that match Block in size (i.e. established card issuer), expansion of the product offering beyond card processing (i.e. “Marqeta for Banking”), or acquisitions.

Path to profitability. As I argued above, the company has the financial resources to pursue market opportunity without worrying about reaching profitability on an adjusted or non-adjusted basis. However, I am eager to see if the company’s management attempts to at least indicate that reaching profitability is on the horizon (i.e. by improving the operating margin). I doubt Marqeta will provide the full year 2023 guidance during the next earnings call, but I will be listening carefully for any discussion about reaching profitability.

Acquisitions. The company is actively pursuing M&A opportunities, and the company’s chief, in particular, mentioned potential acquisitions in the credit space. The company continues to build its Credit Platform, and acquisitions can fast-track the process. Moreover, if the Venture Capital funding drought continues, I would expect Marqeta to have ample opportunities to pursue acquisitions of client portfolios and talent.

Source of the data used above: Investor Relations

Disclosure & Disclaimer: I own shares in several companies that I write about in this newsletter, as I am bullish on the transformation in the financial services industry. However, the information contained in this newsletter is intended for informational purposes only and should not be considered financial advice. You should do your own research or seek professional advice before making any investment decisions.