Marqeta ( ) reported Q4 2021 and full year 2021 results earlier this week. The company went public in June 2021, so this was the first time they reported full-year results as a public company. I love the company because of its simplicity: the company tapped into an existing (and very large) market of card issuing and card payment processing, they compete with known legacy vendors and their outdated solutions built for the mainframe computer world, and their revenue is simply a product of the volume of processed transactions and the take rate. They might have a fancy website with a lot of industry-specific jargon, but underneath, they just process card transactions, and apparently, do it much better than their competition.

It looks like I am not alone, and Marqeta’s modern cloud-based card issuing solution is winning the hearts (and budgets) of customers: their revenue grew 78% YoY in 2021. Let’s go through the numbers to understand what’s ahead for the company.

How Marqeta makes money

Marqeta provides a modern card issuing and card payment processing platform to numerous clients, which are primarily fast-growing technology companies. For instance, it boasts serving such customers as Block, Inc. (Cash App), Affirm, Klarna, DoorDash, Uber, and many others. Marqeta’s platform also powers cards issued by Goldman Sachs’ Marcus, as well as virtual cards issued by J.P Morgan. In a nutshell, when a company, such as Block or Affirm, decides to offer debit or credit cards to their customers, they turn to Marqeta, and Marqeta handles the process of card issuing and card payment processing end-to-end providing their clients with a SaaS solution and a set of APIs.

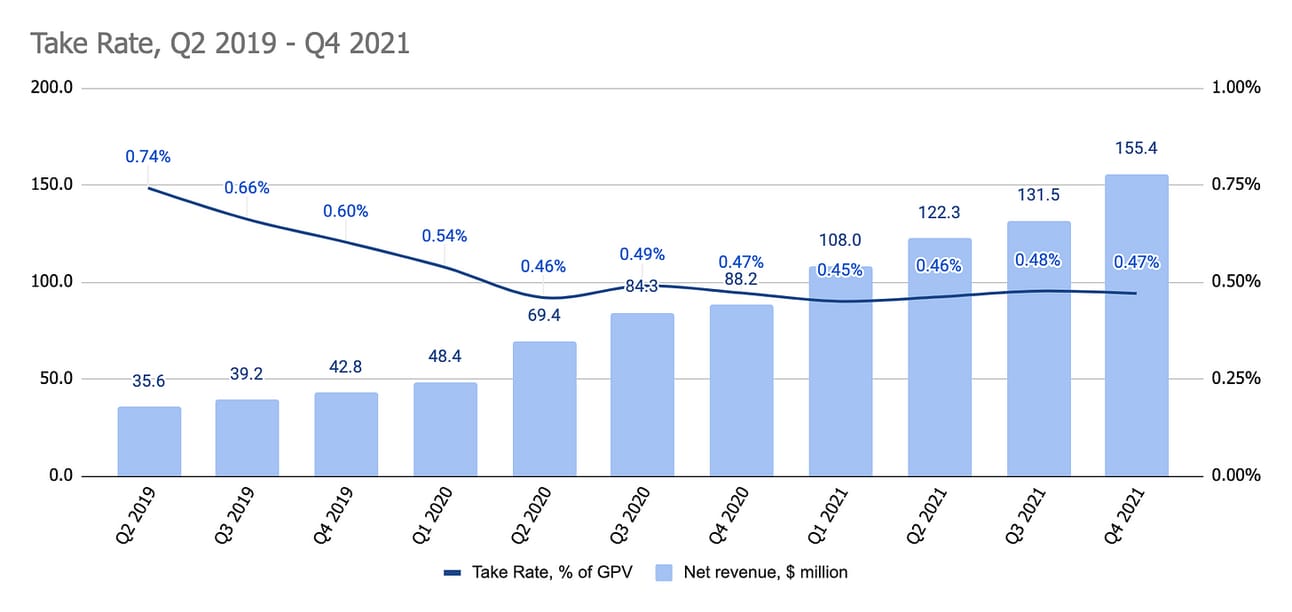

Marqeta charges their clients the transaction fees (as well as shares the “interchange fees” - these are the fees that card issuers are receiving from the merchants) for all card transactions going through their platform; thus, the volume of payments by Marqeta-powered cards (called “Total Processing Volume”), as well as the Take Rate (% of the TPV changed as a fee) are the two key drivers of the company’s revenue. Logically, powering more and bigger card issuers increases the Total Processing Volume and thus, the revenue of the company. In addition, as Marqeta works primarily with fast-growing Fintechs, the growth of its clients drives Total Processing Volume as well.

The “Cost of revenue” for Marqeta comprises primarily of “Card Network fees” (fees paid to VISA and Mastercard), and the “Issuing Bank fees” (in most cases, Marqeta’s clients are not banks; thus, “legally” their cards are issued by a partner bank, which is Sutton Bank). Deducting “Cost of revenue” from the “Revenue number”, we are getting to the “Gross Profit”, which can be thought of as the money left for covering the costs that are not directly related to card issuing or card payment processing (i.e. salaries, servers, marketing, etc.).

Total Processing Volume

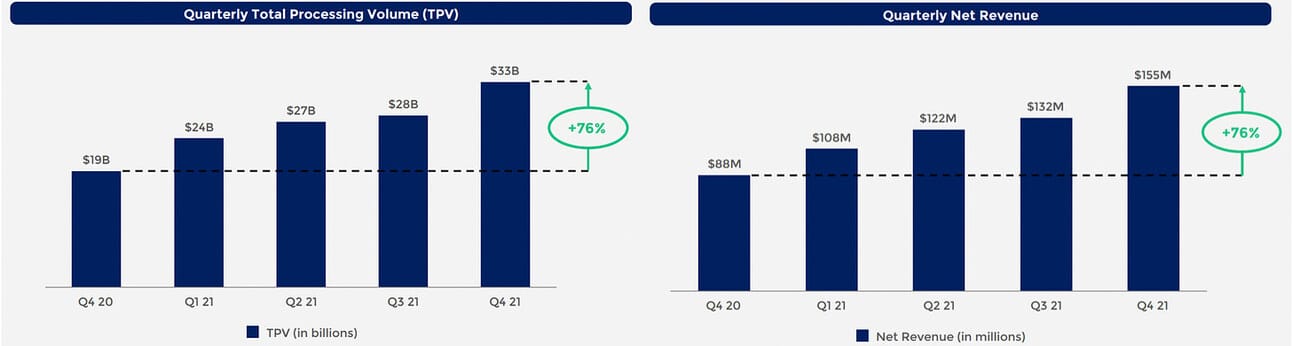

Marqeta reported $33 billion in Total Processing Volume in Q4 2021, and $111.1 billion for the full year 2021. This represents 77% YoY growth for the quarter and 85% YoY growth for the full year. Q4 2021 also showed an acceleration of the YoY growth compared to Q3 2021 (77% vs 60%, see the chart below).

Marqeta went through a triple-digit growth in 2020 and early 2021, as it served the customers that benefited from the pandemic (Block’s cash app, Affirm, DoorDash, etc.), and the consumers got their stimulus checks. However, the company can grow TPV also in the post-COVID environment, and the last couple of quarters are strong proof of that.

As mentioned above, Marqeta’s volume growth comes from two factors: a) growth of their existing customers (i.e. Cash App adding 12 million new customers during 2021), b) partnerships with new customers. In 2021, the management expects the growth to come primarily from the existing customers; however, in my opinion, the main potential unlock for Marqeta should come from the onboarding of large established card issuers (think of the largest banks), as those start moving away from their legacy card systems to the modern cloud solutions.

Revenue and Take Rate

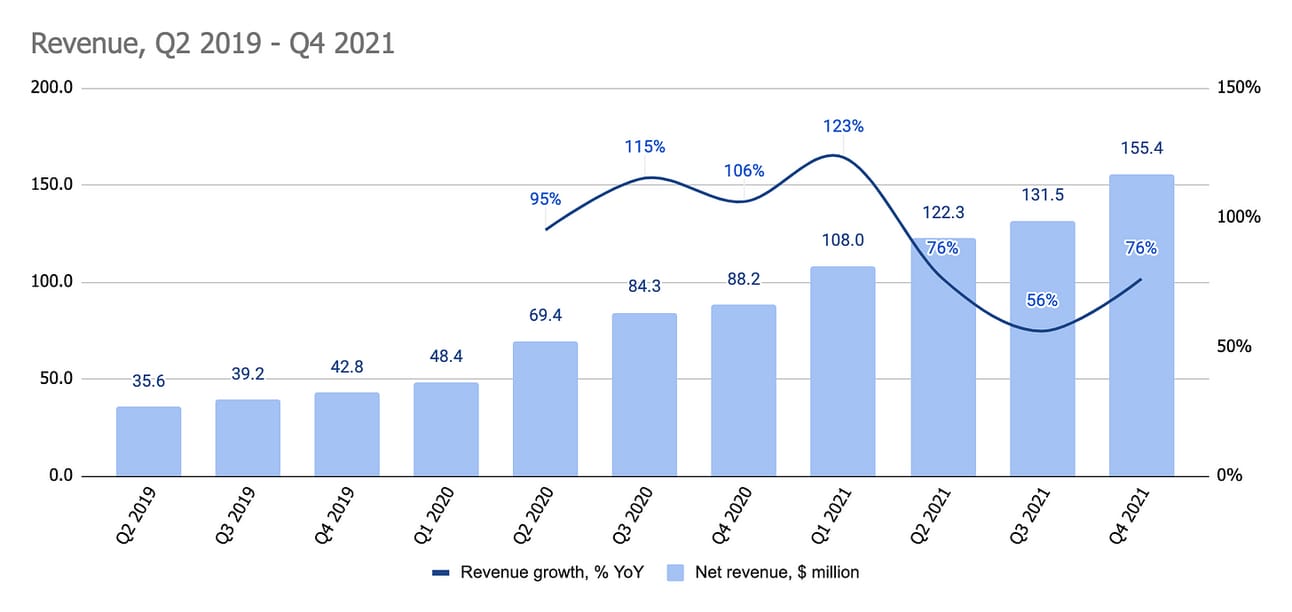

Marqeta reported $155.4 million in revenue in Q4, 2021, and $517.2 million for the full year 2021, which represents 76% YoY growth for the quarter and 78% for the full year.

Revenue growth was proportionate to the growth in Total Processing Volume, as the Take Rate (Revenue as % of Total Processing Volume) stayed almost unchanged through the last 3 quarters. As per the management comments, minor fluctuation of the Take Rate in the last quarters was the result of the transaction mix changes.

It should be noted that Marqeta has a high client concentration in Block’s Cash App. Cash App concentration (percentage of revenues) went from 68% in Q3 2021 to 63% in Q4 2021. However, as Block has acquired Afterpay, its concentration with Marqeta will increase again in 2022, without meaningful reduction expected in 2022.

The company did not guide for the full year 2022 and only guided for the 48-50% YoY growth in Net revenue in Q1 2022 (or $160-162 million). As the management does not expect a meaningful change in the Take Rate, we can assume that the Total Processing Volume will grow at a similar rate, resulting in $35.5 - 36 billion in TPV for the quarter.

Gross Profit and Gross Profit Margin

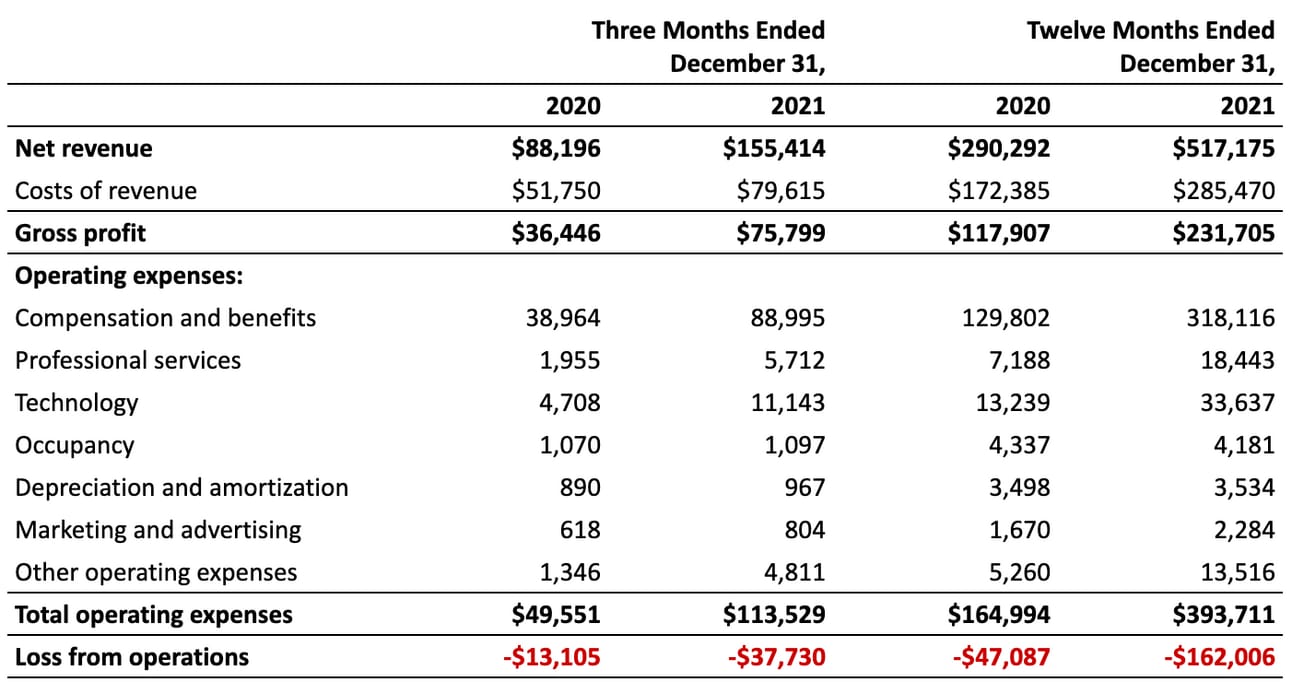

Marqeta reported $75.8 million in Gross Profit (which is the revenue net of directly attributable costs, such as the card network and issuing bank fees) in Q4 2021, and $231.7 million for the full year 2021. This represented 108% YoY growth for the quarter and 97% YoY growth for the full year.

Marqeta has been able to consistently deliver a gross profit margin in access of 40% (with the exceptions in Q1 2020 and Q2 2021). Don’t read much into the improving Gross Profit Margin in Q4 2021 (49% in Q4 2021 vs 45% in Q3 2021): as per the management’s comments on the earnings call, the improvement came from the higher than expect card scheme incentives that were booked in one quarter. Incentives are a form of performance-based reimbursement of the costs that card scheme offer their partners, and in this case, Marqeta outperformed their planned volumes, thus, receiving additional incentives in Q4 2021.

As noted above, the costs that impact the gross profit margin are primarily the card network and issuing bank fees; thus, increasing processing volumes will have a positive impact on the gross profit margin (for instance, through higher card scheme incentives mentioned above). However, as the company onboards bigger clients, it might collect lower fees (through a lower Take Rate) while occurring the same direct cost level.

Similar to the Net Revenue, the company’s management provided guidance only for Q1 2022. Thus, they guided for a 43-44% gross margin in Q1 2022, which, assuming the Net revenue growth of 48-50%, would result in $68.7 - 71.3 million in Gross Profit in Q1 2022.

Operating Expenses

Marqeta's Operating expenses stood at $113.5 million for Q4 2021, and $393.7 million for the full year 2021, leading to a Loss from operations of $37.7 million for Q4 2021 (an increase from $13.1 million in Q4 2020), and $162 million for the full year 2021 (an increase from $47.1 million in 2020).

The main operating expenses for the company in 2021 were “Compensation and benefits” (81% of total operating expenses, and 62% of the net revenue), “Technology” (9% of total operating expenses, and 7% of the net revenue), and “Professional services” (5% of total operating expenses and 4% of the net revenue). It should be noted that these costs include stock-based compensation (more on this below).

Net Loss and Adjusted EBITDA

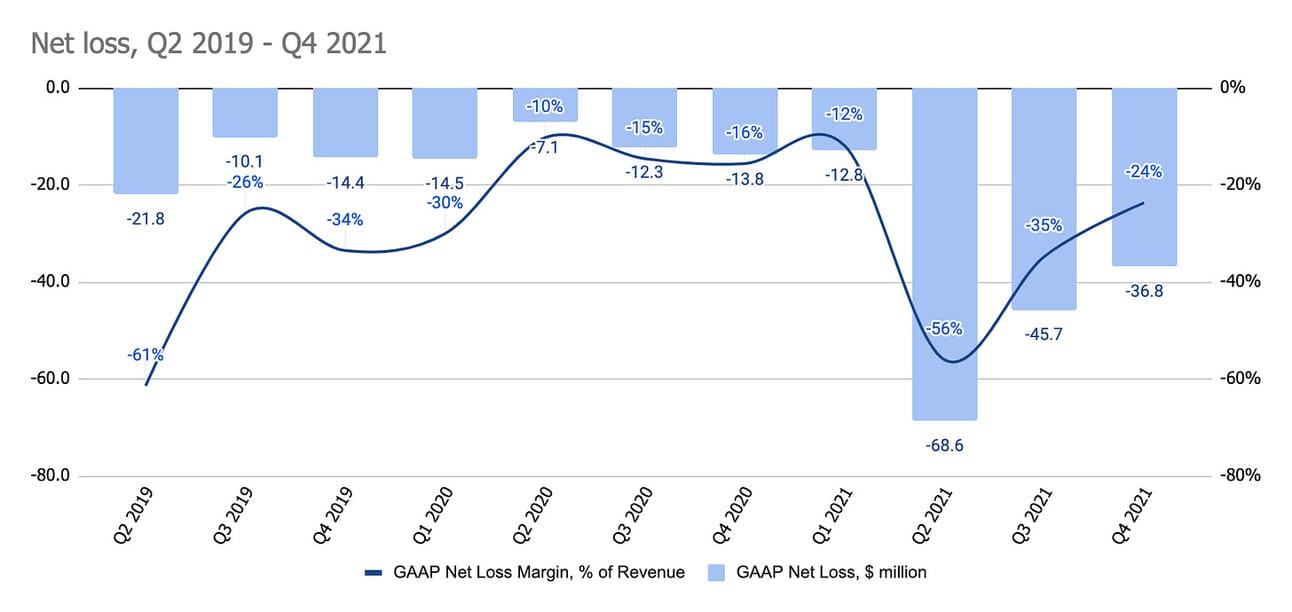

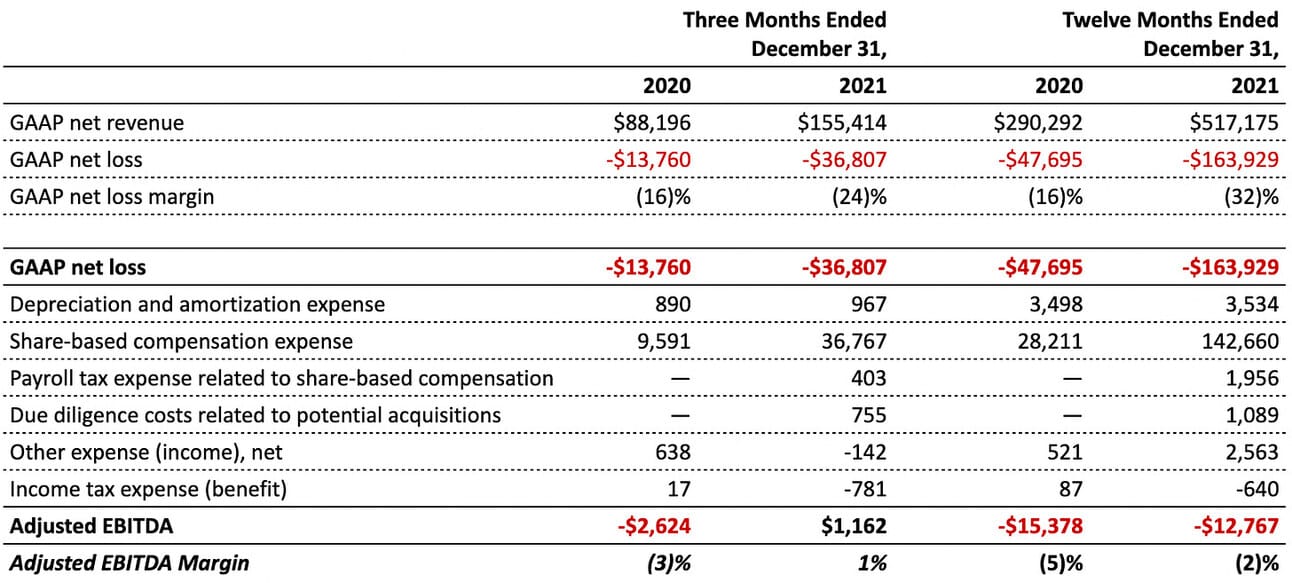

The company reported a $36.8 million GAAP Loss in Q4 2021 (an increase from a $13.8 million loss in Q4 2020), and a $163.9 million GAAP Loss for the full year 2021 (an increase from $47.7 million in 2020).

The chart below clearly illustrates the increased losses since the IPO of the company in June, 2021. However, besides the costs related to the IPO itself, the loss can be attributed to the share-based compensation post the IPO.

Similar to other high-growth companies, Marqeta reports a non-GAAP measure of Adjusted EBITDA, adjusting Net loss for the non-cash items, such as share-based compensation (see below table for the full list of adjustments). Thus, the company reported an Adjusted EBITDA of $1.16 million for Q4 2021 (an improvement from the negative $2.62 million in Q4 2020), and an Adjusted EBITDA of negative 12.77 million for the full year 2022 (an improvement from the negative $15.38 in 2020).

The company guided for negative 8-9% Adjusted EBITDA in Q1 2022, which, assuming expected net revenue of $160-162 million, would imply Adjusted EBITDA of negative $12.8-14.6 million.

What to watch in 2022

Growth through acquisitions. Marqeta is not profitable yet; however, the $1.2 billion that it raised in its IPO gives it a lot of power to grow through acquisitions. Just note the “Due diligence costs related to potential acquisitions” position in Adjusted EBITDA calculation - the company is clearly working on an acquisition.

Growth of Marqeta’s clients. Growth of Marqeta’s clients, such as Block (Marqeta powers cards issued by both Cash App, and Afterpay), Affirm (virtual cards and the upcoming Debit+ card), and others, will be the key current driver for Marqeta’s revenue in 2022.

New client acquisition. As mentioned above, besides growing together with their existing customers, Marqeta will continue growing through acquiring new customers, especially if those are large legacy issuers looking to move away from their outdated solutions.

Global expansion. Most of Marqeta’s revenues come from US-based issuers. However, the company is expanding rapidly into other regions, including Europe and Asia. VISA and Mastercard are global card networks; thus, Marqeta’s product offering (with additional compliance requirements and certifications) should be scalable across the globe.

Source of the data used in the chart above: Investor Relations

Disclosure & Disclaimer: despite rocky performance in 2021 and early 2022, I have open positions in most of the companies covered in this newsletter, as I am extremely bullish on the transformation in the financial services industry. However, none of the above is financial advice, and you should do your research.