Marqeta delivered another strong quarter: Net revenue was up 53% YoY, Gross profit was up 66% YoY, the Operating loss was considerably down from a year ago, and the company was cash flow positive for the quarter. Marqeta has $1.7 billion in cash and cash equivalents, so it is actively hiring the best talent, pursuing acquisitions, and using the weakness of its private competitors to strengthen its market position.

However, Jason Gardner’s decision to step down from his role as the CEO of the company cast a huge shadow on all of the above. Jason Gardner is the founder of the company and one of its largest shareholders, so his decision will definitely have an impact on the future of Marqeta. He will remain with the company in the role of its chairman and will serve as the CEO until a replacement is found.

I should say that the optimist in me sees this as an opportunity. Marqeta has amazing technology, but is, kind of, stuck in the world of Fintech and technology companies. I believe this company has a huge potential in serving established card issuers that are just starting their journey to cloud-based software. Perhaps, the new CEO will help Marqeta with making this leap. In the meantime, let’s review the company’s Q2 2022 financials!

If you are new to Marqeta, I suggest reading my previous reviews:

…and if you are new to Popular Fintech, subscribe to receive upcoming updates:

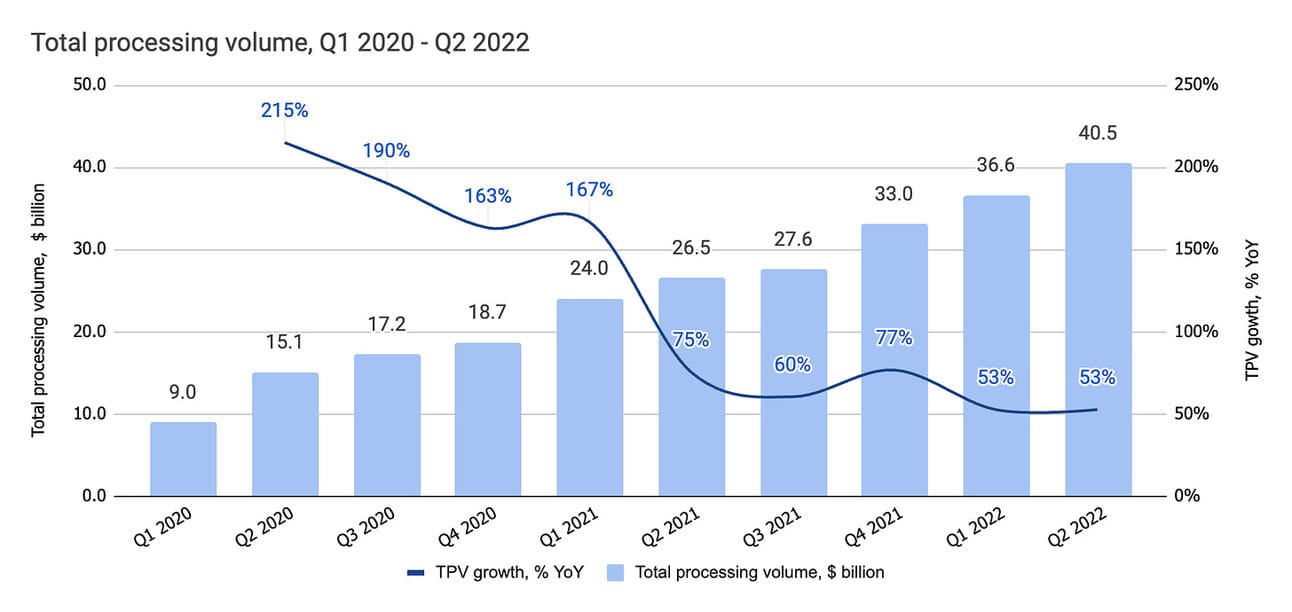

Total Processing Volume

Marqeta reported $40.5 billion in Total Processing Volume for the quarter, which represents a 53% increase compared to Q2 2021, and a 10% increase sequentially. Marqeta offers two services: “Managed by Marqeta” and “Powered by Marqeta”, and the difference between the two is the scope of the end-to-end process handled by the company. Thus, in the case of “Powered by Marqeta”, the company only processes the transactions for the issuer, while in the case of “Managed by Marqeta”, the company does card fulfillment, KYC/KYB, dispute management, and transaction processing.

Per the company’s disclosures, the increase in the TPV was mainly driven by the increase in the processing volume of the company’s customers in financial services and buy-now-pay-later sectors, as well as the customers that engage with Marqeta “solely as an Issuer Processor” (“Powered by Marqeta”). Additionally, the TPV for the company’s top five customers (in terms of the TPV during the quarter), grew by 48% compared to Q2 2021, while the TPV from all other Customers, grew by 81% compared to Q2 2021.

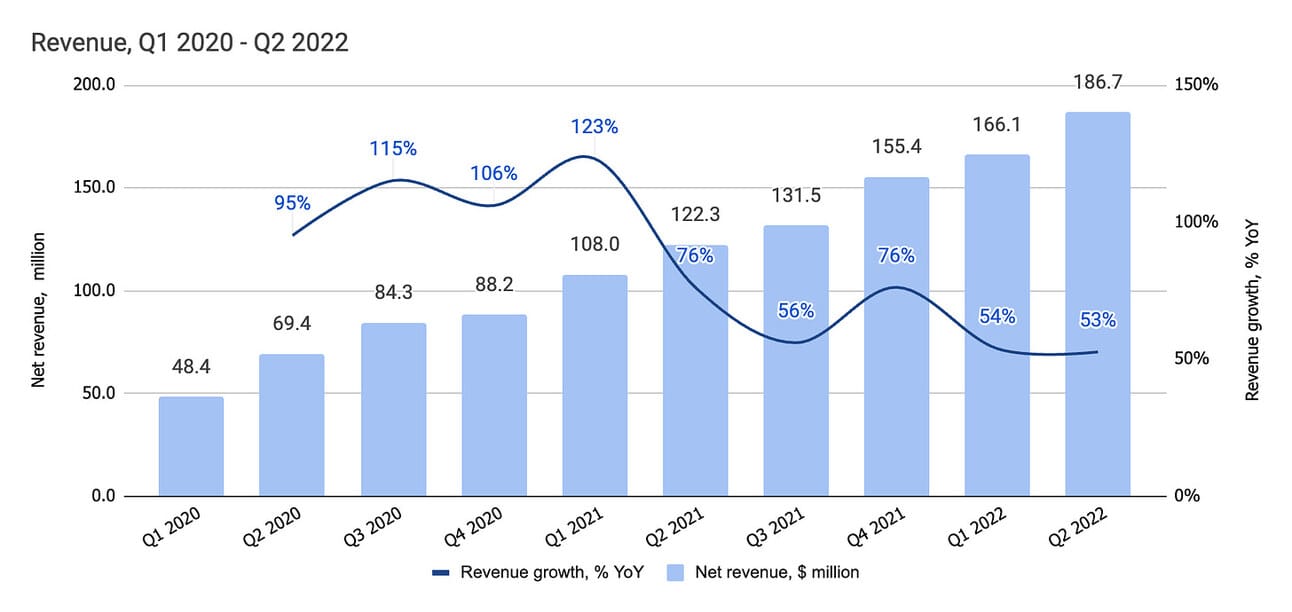

Revenue and Take Rate

The company reported $186.7 million in revenue for the quarter, which represents a 53% growth compared to Q2 2021, and a 12% growth sequentially. “Platform services revenue, net” includes the interchange fees earned on processed card transactions (net of Revenue Share), as well as processing fees. “Other services revenue” includes revenue earned for providing card fulfillment services, KYC/KYB, etc. (“Managed by Marqeta”).

A significant portion of the Company's revenue is still derived from one Customer (Block, Inc). Marqeta co-operates with Block on Cash App, Square Business, and Afterpay cards. Thus, for “the three months ended June 30, 2022 and 2021, Block, Inc. accounted for 69% and 72% of the Company’s net revenue, respectively.” The company experienced an increase in the concentration after Block acquired Afterpay at the beginning of 2022, but this concentration was offset by the growth of the revenue generated by other customers.

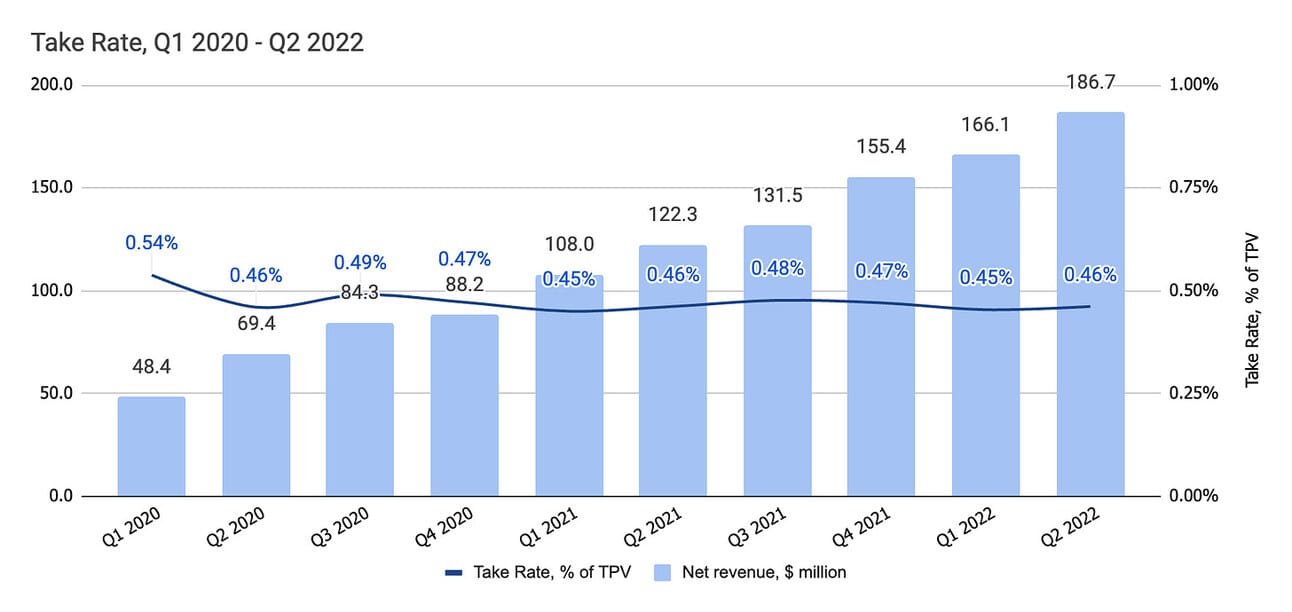

As you can see from the chart below, the Take Rate (revenues divided by the Total Processing Volume) has been quite stable for the last couple of years. As a result, Marqeta’s revenue growth closely follows the Total Processing Volume growth. For now, Marqeta’s growth is heavily impacted by the growth of Block's business, but, as mentioned above, other company clients grow at a much faster pace and the concentration with Block should decrease over time.

In addition, I see a lot of potential in Marqeta partnering with incumbent card issuers that are moving away from their legacy processing partners. During the quarter Marqeta announced its platform’s expanded capabilities to power credit cards (such as instant decisioning and rewards engine). While the existing Marqeta customers, such as fintech and technology companies, primarily rely on debit and prepaid cards, the credit card capabilities of Marqeta’s platform should open doors to the world of established financial institutions.

The company’s management guided for a 36-38% YoY revenue growth in Q3 2022, which suggest a sequential decline. Thus, the revenue guidance implies $178.8 - 181.5 million in revenue in Q3 2022 vs. $186.7 million in revenue in Q2 2022. In addition, the management guided for a 39-40% revenue growth for the full year of 2022.

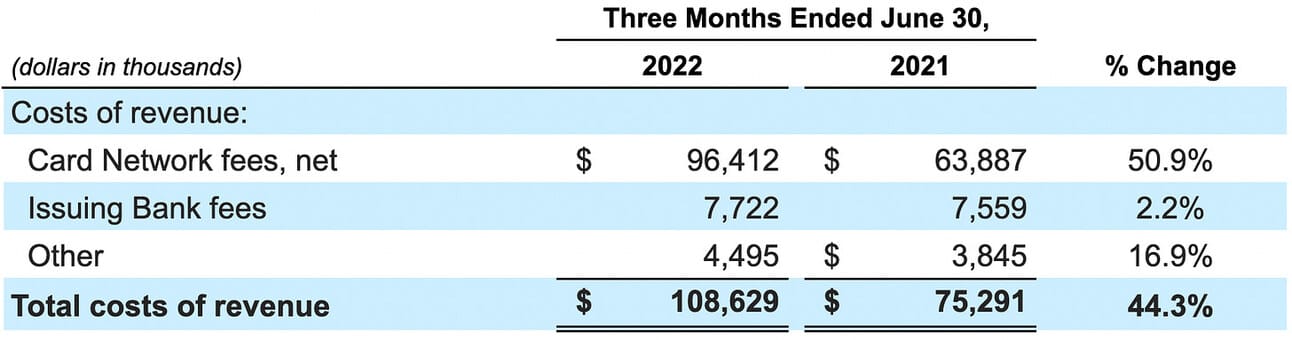

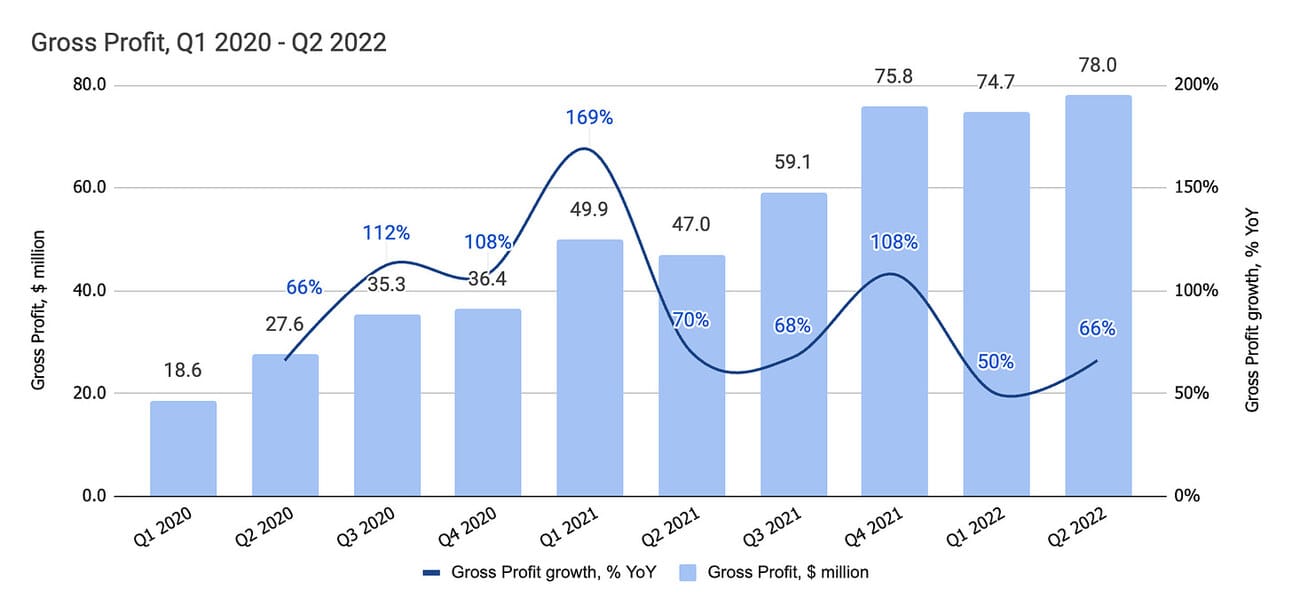

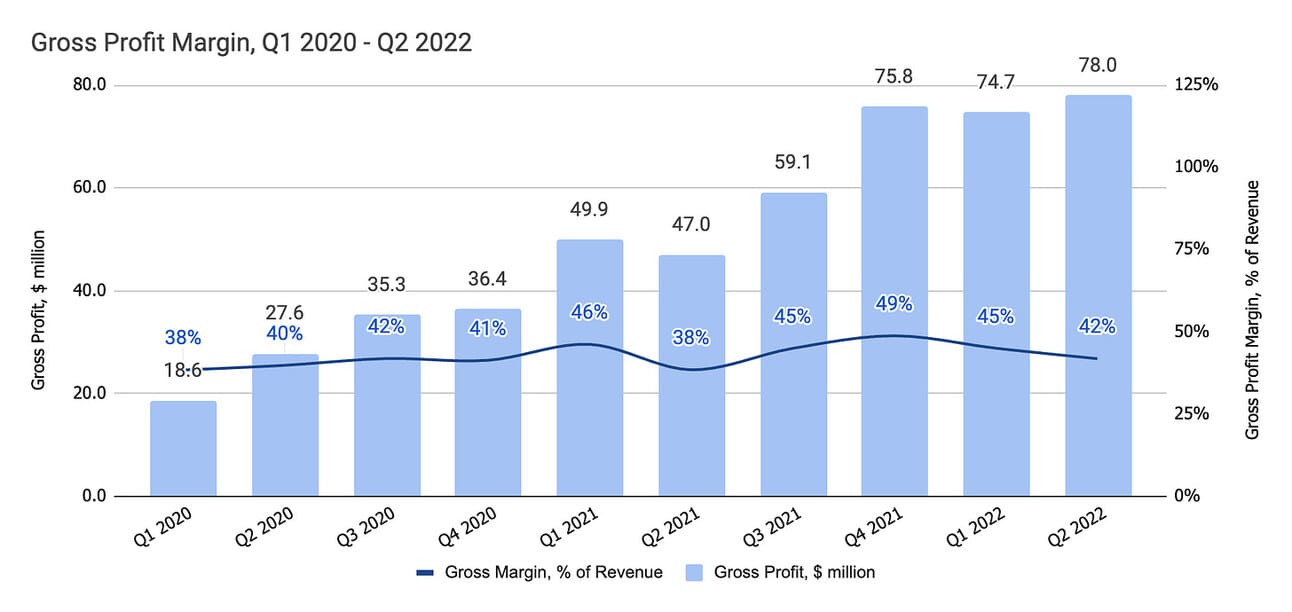

Gross Profit

Marqeta reported $78.1 million in gross profit for the quarter, which represents a 66.2% growth compared to Q2 2021, and a 4.5% growth sequentially. “Costs of revenue” consist of Card Network fees (89% of the total costs of revenue), Issuing Bank fees (7%), and card fulfillment costs (4%). The growth in the card network fees was in line with the growth in the Total Processing Volume.

As I wrote previously, Marqeta has seasonality in its network costs due to the way its card network incentive agreements are structured (card networks reimburse issuers part of the paid fees to “incentivize” growth in transaction volumes). Thus, as Marqeta’s incentive targets run from April to March of each year, the company’s gross profit is negatively impacted in the second quarter of each year.

Despite the seasonality throughout the year, Marqeta has consistently managed to operate with a gross profit margin above 40% on an annual basis. The company delivered gross profit margins of 42% in 2019, 41% in 2020, and 45% in 2021.

The management guided for Q3 2022 and full year gross profit margin of 43-44%. The guidance implies a gross profit of $77-79 million in Q3 2022, and $309-318 for the full year.

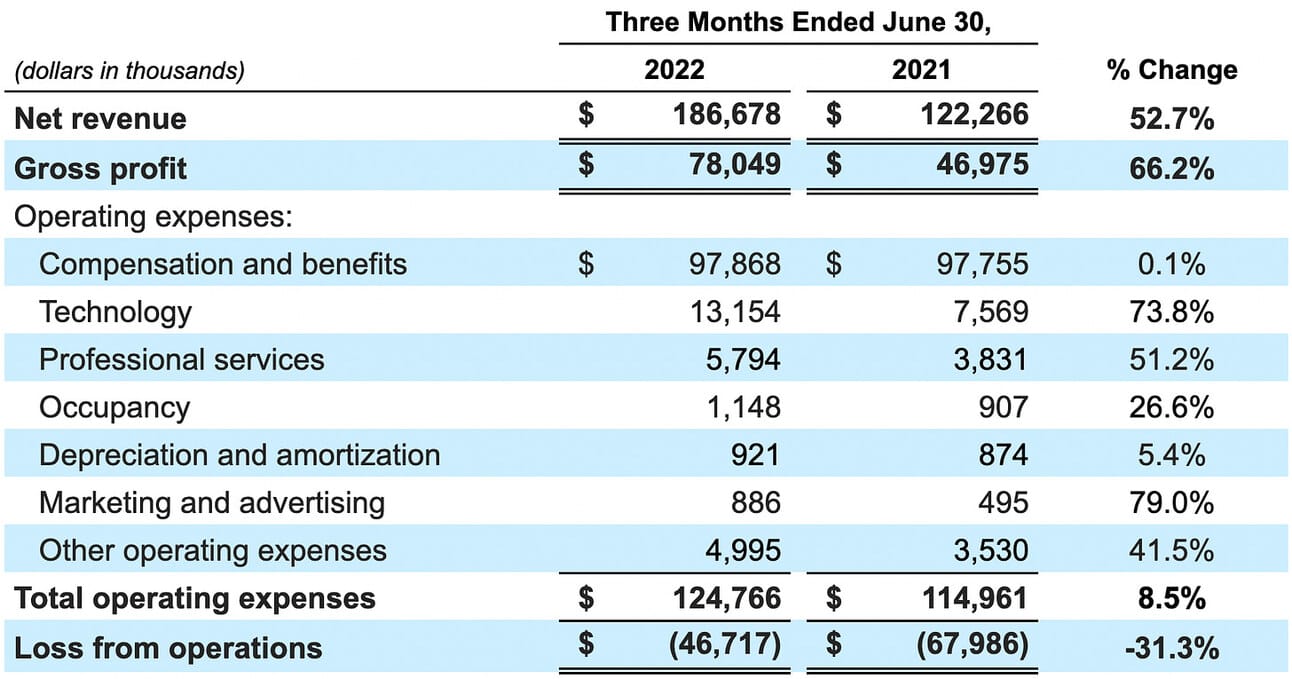

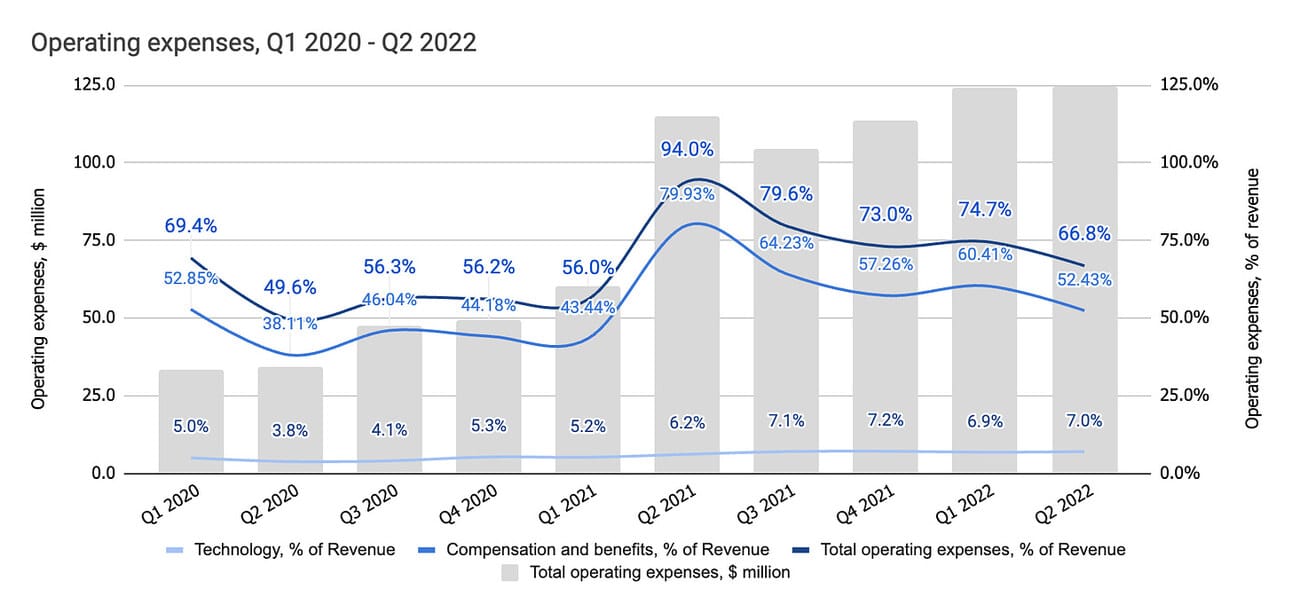

Operating Expenses

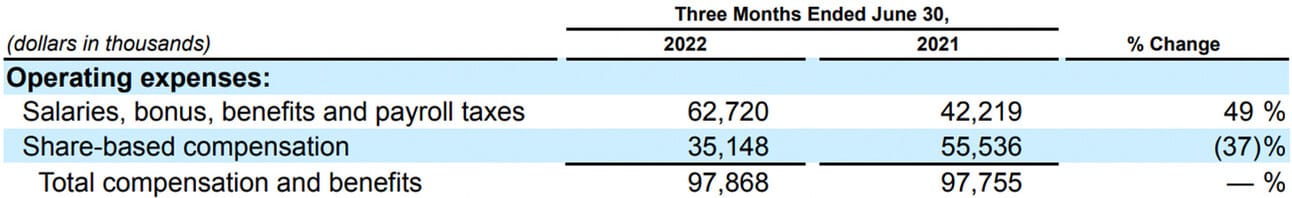

Marqeta reported $124.8 million in operating expenses for the quarter, which lead to an Operating loss of $46.7 million. Notably, the operating expenses increased just 8.5% compared to Q2 2021. “Compensation and benefits”, the largest component of the company’s operating expenses, was almost flat YoY despite Marqeta actively hiring (the trick is in the decreasing share-based compensation).

Plotting operating expenses as a percentage of revenue shows a very positive trend. Thus, as you can see from the chart below, Marqeta’s operating expenses (relative to revenue) skyrocketed following the IPO, and are consistently coming down since then. At the moment, the operating expenses exceed the gross profit (hence, the operating loss); however, on an adjusted basis (excluding stock-based compensation of $35 million), the company is not that far from profitability.

On the company’s earnings call, the management reiterated that the company continues to hire people, as it sees the opportunity to pursue opportunities while the competition is weakened by market conditions (and has a ton of cash to pursue those opportunities). However, as the company’s financials suggest, the company is being prudent about operating expenses and its growth managed to accommodate larger payroll.

Net Income (Loss) and Adjusted EBITDA

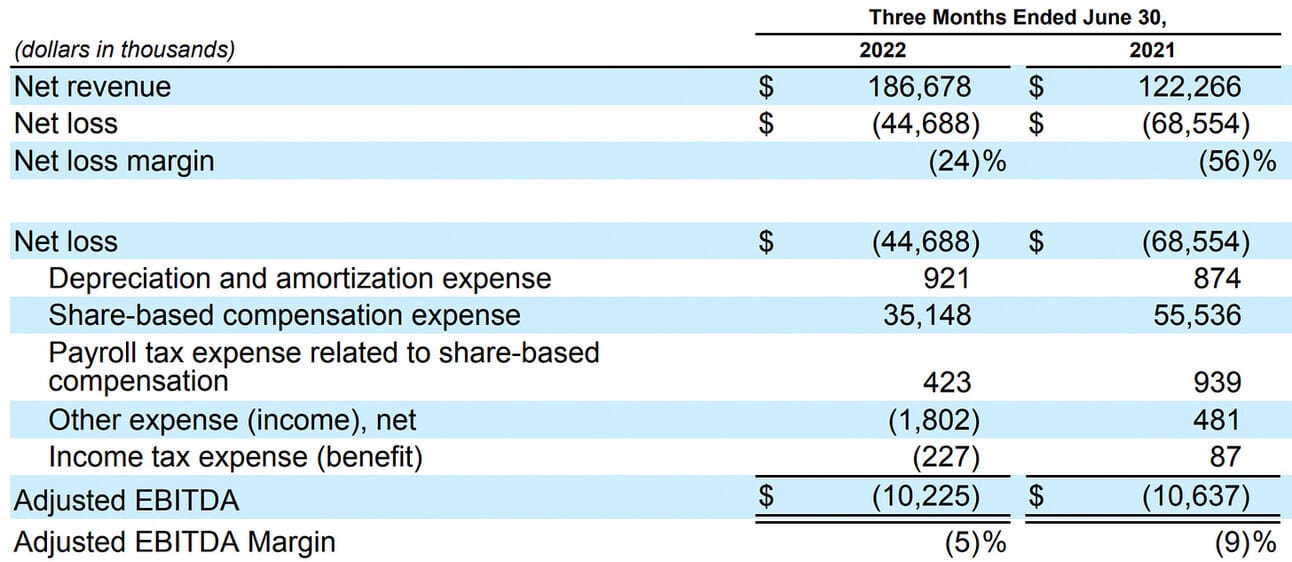

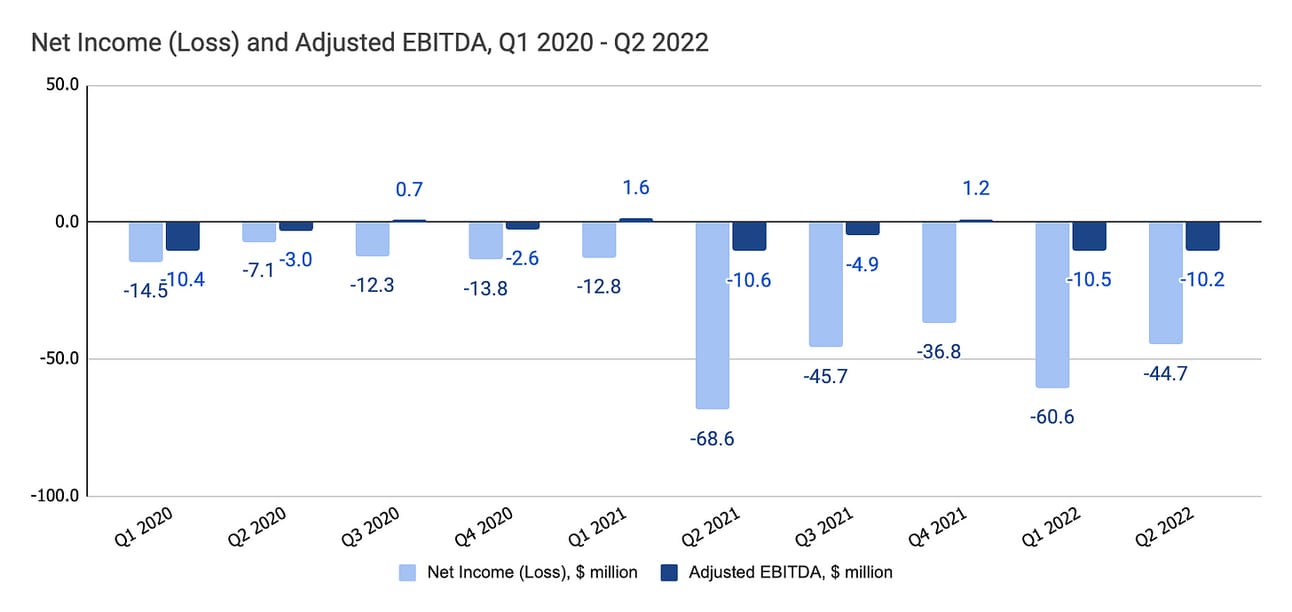

Marqeta reported $44.7 million in a Net loss for the quarter (an improvement from a Net loss of $68.6 million in Q2 2021), and an Adjusted EBITDA of $10.2 million (almost unchanged compared to an Adjusted EBITDA of $10.6 million in Q2 2021). The company calculates Adjusted EBITDA by deducting share-based compensation, depreciation and amortization, and income tax expenses from the Net loss figure. As you can from the breakdown below, share-based compensation was the key adjustment.

The company’s management guided a negative Adjusted EBITDA margin of 8-9% in Q3, 2022, and a negative Adjusted EBITDA of 7-8% for the full year. The guidance implies a negative Adjusted EBITDA of $14-16 million for Q3 2022, and a negative adjusted EBITDA of $50-57 million for the full year.

The company’s management reiterated the target of operating “at a 20%-plus adjusted EBITDA margin once we have captured more of the market opportunity.”

Marqeta was cash flow positive for the quarter, and as of June 30, 2022 had cash, cash equivalents, and marketable securities totaling $1.7 billion on its balance sheet.

Things to Watch in 2022

CEO succession. The succession of Jason Gardner, the company’s CEO and founder, will definitely be on top of investors’ minds until the role is filled. I would guess that the Board will be looking for someone, who would help the company with opening doors to the established card issuers. This is a natural step in the company’s evolution, and, most likely, requires an “industry veteran”.

Growth of the key customers. Marqeta has a heavy concentration with just a few customers, with the largest of them being Block (Cash App, Square, Afterpay). Until the concentration is there, Block’s success will mean Marqeta’s success, and Block's failures will mean…Oh, and any rumors that Block is not prolonging the agreement will send Marqeta shares down.

Partnerships with established players. I will keep arguing that Marqeta is just getting started and there is a huge potential in serving not only fintech and technology companies, but also the established issuers. Marqeta was successful in getting Block as a customer, but there are way more “Blocks” in the world of “traditional” financial institutions.

Acquisitions. Marqeta finished the quarter with $1.7 billion in cash and cash equivalents. The company doesn’t need much cash to fund its operations, so I would expect them to put this cash to work shortly. International acquisitions probably are on top of my mind, but I wouldn’t exclude Marqeta expanding horizontally (i.e. acquiring processing, digital banking, etc.)

In summary, Jason Gardner’s decision to step down was probably the only unexpected thing that happened this quarter. As for the rest…the company keeps growing, margins are stable, and (IMHO) its best years are still ahead.

Disclosure & Disclaimer: despite rocky performance in 2021 and the first half of 2022, I have open positions in most of the companies covered in this newsletter (including Marqeta), as I am extremely bullish on the transformation in the financial services industry. However, none of the above is financial advice, and you should do your own research.