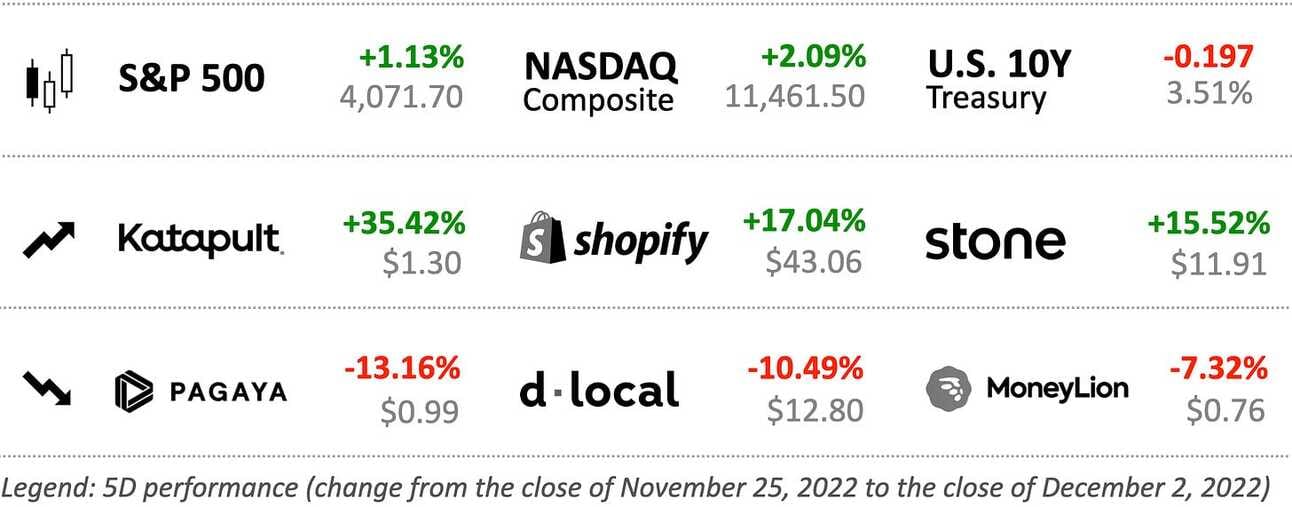

This Week in the Markets

That was an eventful week. On Wednesday, the Federal Reserve Chairman, Jerome Powell, held a press conference and triggered a market rally by signalling a smaller rate hike at the next FOMC meeting that will take place on December 14-15, 2022. CME FedWatch Tool now estimates a 78.2% probability of a 50 basis points rate increase, and 21.8% probability of a 75 basis point rate increase in December.

On Thursday, the U.S. Department of Commerce reported that U.S. consumer spending rose 0.5% MoM in October, which was the largest increase since January. At the same time, the Federal Reserve’s preferred inflation measure, Personal Consumption Expenditures (PCE) Price Index increased 6.0% YoY in October, compared to the increase of 6.3% YoY in September. Consumers remain resilient, while the inflation is slowing.

Finally, the Jobs Report released on Friday by the U.S. Department of Labor confirmed that the U.S. job market remains strong, as employers added more jobs than expected. Thus, employers added 263,000 jobs in November, and the unemployment rate remained unchanged at 3.7%. Apparently, investors decided that good news for the economy (resilient consumers, and strong jobs market), is also good news for the market, and the main indices finished the week in the green.

🟢 Shopify (NYSE: ): shares of the Canadian e-commerce company advanced 17.04% during the week, most likely on strong Black Friday Cyber Monday weekend results. Thus, Shopify reported a record $7.5 billion in Gross Merchandise Sales during the weekend, which represents a 19% increase from the previous record of $6.3 billion set in 2021.

🔴 dLocal (NASDAQ: ): shares of the Uruguay-based payments processor declined 10.49%, as the short seller Muddy Waters doubled down on its allegations of fraudulent accounting at the company. A couple of week ago, Muddy Waters published a research that revealed multiple accounting discrepancies in dLocal’s reporting, which (per Muddy Waters) suggested fraud.

Shares of lenders Katapult (NASDAQ: ) and Pagaya (NASDAQ: ) moved on no particular company news. Both companies went public through SPAC mergers: Katapult in June 2021 and Pagaya in June 2022. Shares of Katapult are down 86.6%, and shares of Pagaya are down 90.1% since their IPOs.

✔️ Jerome Powell Signals Fed Prepared to Slow Rate-Rise Pace in December✔️ Powell Says the Fed Is Prepared to Slow the Pace of Rate Hikes in December✔️ US Inflation Indicator Rises by Less Than Forecast as Spending Increases✔️ Powell’s ‘Most Important’ Inflation Indicator Is Cooling Down✔️ Consumer Spending Jumped in October as Inflation Eased✔️ November Employment Report Shows U.S. Economy Added 263,000 Jobs✔️ US Hiring and Wages Extend Strong Gains, Keeping Pressure on Fed✔️ Payrolls and wages blow past expectations, flying in the face of Fed rate hikes✔️ Home Prices Drop for Third Straight Month as US Market Cools✔️ Wells Fargo Cuts Hundreds More Mortgage Employees on Industry Slowdown✔️ Shopify Merchants Set New Black Friday Cyber Monday Record✔️ Shopify Stock Could Be Cyber Monday’s Biggest Winner✔️ Muddy Waters doubles down on allegations of dLocal balance sheet discrepancies

Klarna Aims for Profitability in 2023

Klarna, the Swedish Buy Now Pay Later lender, published its Q3 2022 results, reporting a Net Loss for the quarter of SEK 2.13 billion (~$205.92 million at the current exchange rate) on Total net operating income of SEK 4.06 billion (~$392.62 million). Klarna is not a public company, but it is securing financing through bond placements, and has to disclose its financials. In Q3 2021, the company reported a Net Loss of SEK 1.12 billion (~$108.19 million) on Total net operating income of SEK 3.42 billion (~$330.87 million). Thus, the company’s total net operating income grew by 18.7% compared to Q3 2021, while the Net Loss almost doubled.

It has been a difficult year for the company. In July, 2022 Klarna raised $800 million in additional capital, but had to accept an 85% cut to its valuation from $46 billion to $6.7 billion. The company also had to execute two rounds of layoffs, cutting its workforce by 10% in May and doing an additional cut in September. However, the company’s CEO, Sebastian Siemiatkowski, remains optimistic, and expressed an ambition to return to profitability by the summer of 2023 an interview to CNBC. Affirm, Klarna’s most prominent U.S. competitor, also reported an increase in its Operating Loss from $166.1 million in Q3 2021 to $287.5 million in Q3 2022.

✔️ Klarna aims to return to monthly profitability in 2023 as losses double✔️ Klarna CEO says firm was ‘lucky’ to cut jobs when it did, targets profitability in 2023✔️ Klarna eyes profitability in 2023 despite losses doubling✔️ Klarna confirms $800M raise as valuation drops 85% to $6.7B✔️ Klarna to lay off 10% of its workforce as souring economy hits BNPL space✔️ Klarna cuts more jobs just months after laying off 10% of global workforce

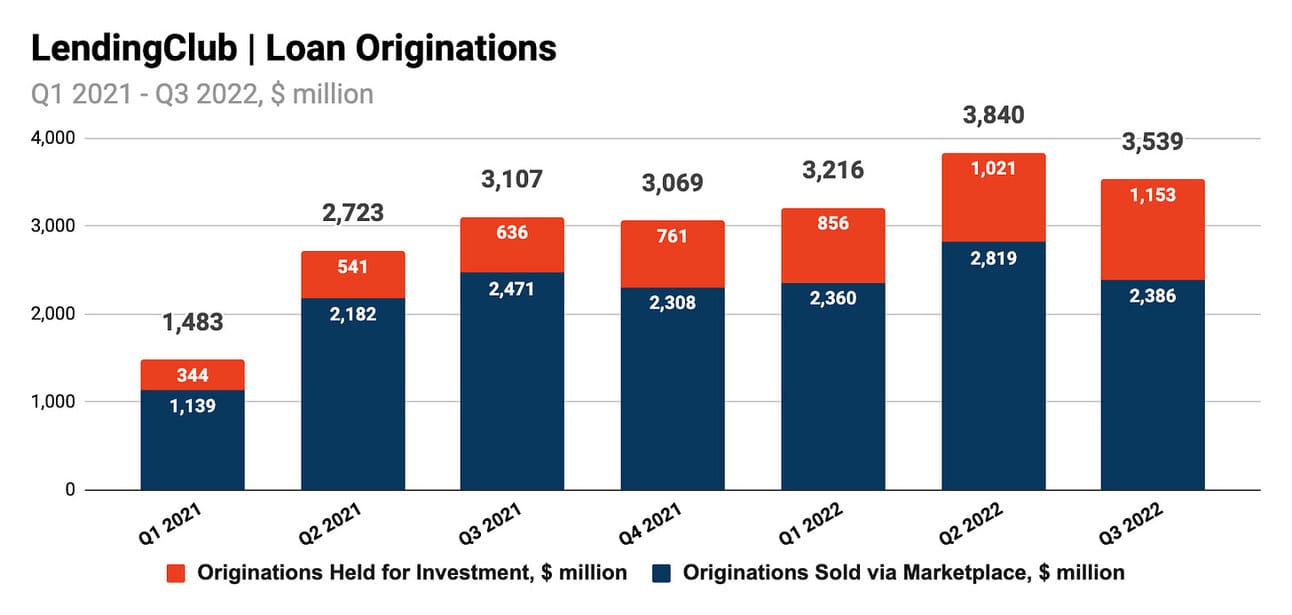

LendingClub Acquires $1 Billion Loan Portfolio

LendingClub announced signing an agreement to acquired $1.05 billion personal loan portfolio from MUFG Union Bank. The loans were originated by LendingClub (and bought by MUFG Union Bank via LendingClub Marketplace) and became available for sale following the acquisition of MUFG Union Bank by U.S. Bancorp. Personal loans in the portfolio are currently being serviced LendingClub and have an “outstanding principal weighted average FICO score of 729.” The company expects to complete the acquisition of the portfolio by the end of 2022.

LendingClub is not the first lender to buy back its loans. In Q3 2022, SoFi bought back $1.28 billion in loans it originated and sold to investors. Neither SoFi nor LendingClub previously communicated an intention to buy loans back, so my understanding is that the Fintech lenders had to step in with their balance sheets and support evaporating demand from institutional loan buyers. "LendingClub utilized its strong balance sheet to support marketplace liquidity while mitigating a slowdown in marketplace revenue," said Scott Sanborn, LendingClub's CEO.

Read LendingClub’s Q3 2022 Earnings Review 👉🏻 “LendingClub Q3 2022 Earnings Review: getting a banking charter was a smart decision”

Read SoFi’s Q3 2022 Earnings Review 👉🏻 “SoFi Q3 2022 Earnings Review: the last lender standing”

✔️ LendingClub Acquires $1 Billion Personal Loan Portfolio✔️ LendingClub to buy $1 billion loan book from MUFG's parent company✔️ LendingClub has a warning about the marketplace model✔️ U.S. Bancorp Completes Acquisition of Union Bank

Brazil Legalizes Crypto as Payment Method

This week Brazil’s Congress passed a legislation that will give payments made in cryptocurrencies (and frequent traveler points) a status of a legitimate payment method. The legislation will include payments made in cryptocurrencies and frequent traveler points into the definition of “payment agreements”, which means they will fall under the supervision of the country’s central bank. The proposed legislation is aiming to reduce risks posed by cryptocurrencies to the economy, limit illegal activity and protect consumer rights, and still requires the signature of the president of Brazil.

Image source: Ewan Kennedy on Unsplash

If approved by the president, the proposed law should enable regulated financial institutions, such as banks, to offer payment services in cryptocurrencies. The Congress provided regulated financial institutions with a legal foundation for operating payments in cryptocurrencies, but at the same time made their life easier by including such payments into the existing legal framework that regulates payment services. Brazil is the seventh largest crypto market in the world according to a study by Chainalysis, and the primary uses of cryptocurrencies in the country are store of value and remittances.

✔️ Brazil's Congress Moves to Regulate Crypto Payments✔️ Brazil Lawmakers OK Crypto as Payment Method✔️ Brazil crypto law back on agenda as FTX collapse sends shockwaves✔️ Latin America’s Key Crypto Adoption Drivers: Storing Value, Sending Remittances

In Other News

✔️ Mercado Livre detaches itself from the market and grows 19% on Black Friday✔️ Apple Pay Tops PayPal This Holiday Season. It’s Adding Users at a ‘Rapid’ Pace✔️ JPMorgan, Other Banks in Talks to Reimburse Scammed Zelle Customers✔️ Mastercard, Block Back Group to Lobby for Canada Finance Reforms✔️ Analysis: Australian buy-now, pay-later sector faces fresh hurdle: regulation✔️ Square adds American Express cards for sellers✔️ Max Levchin’s War on Credit Cards✔️ Coinbase Names Four New Executives to Lead Europe Expansion✔️ Coinbase says Apple blocked its last app release on NFTs in wallet✔️ 'Crypto is dead': analyst explains why FTX's collapse won't benefit Coinbase✔️ Crypto Bank Silvergate Has a Defender in Wall Street✔️ BlockFi sues a Bankman-Fried company to recover Robinhood shares✔️ FTX Had Plans For Its Robinhood Shares✔️ Biden Bid to Restore Student Debt Relief Rejected by Court✔️ nCino Reports Third Quarter Fiscal Year 2023 Financial Results✔️ Inter&Co joins Amazon's Payment Service Provider Program✔️ Apollo-Backed Banamex Bidder Seeks $2 Billion From HSBC, BofA

Disclosure & Disclaimer: despite rocky performance in 2021 and 2022, I own shares in several companies that I write about in this newsletter, as I am extremely bullish on the transformation in the financial services industry. However, none of the above is financial advice, and you should do your own research.