Coinbase and Robinhood went through explosive growth in 2020 and 2021, and now both face the challenges of a bear market. Both companies face declining metrics across the board: active users, assets under custody, trading volumes, and revenue. Coincidentally, both companies have the same amount of cash reserves on their balance sheets, around $6 billion. However, you see two completely different approaches to navigating this downturn.

Vlad Tenev, CEO and co-founder of Robinhood, is steering the company towards profitability by year-end, while Brian Armstrong, CEO and co-founder of Coinbase, is ready to suffer through the losses until the market returns to growth. This could be a difference in the management style or risk tolerance, but, perhaps, Brian Armstrong is just more bullish on the crypto market and its ability to return to growth faster than anyone expects.

Let’s review Coinbase Q2 2022 financials!

If you are new to Coinbase, I suggest reading my previous reviews:

👉🏻 Coinbase Q1 2022 Earnings Review: did the company print enough cash to survive the crypto winter?

…and if you are new to Popular Fintech, subscribe to receive upcoming updates:

Customers

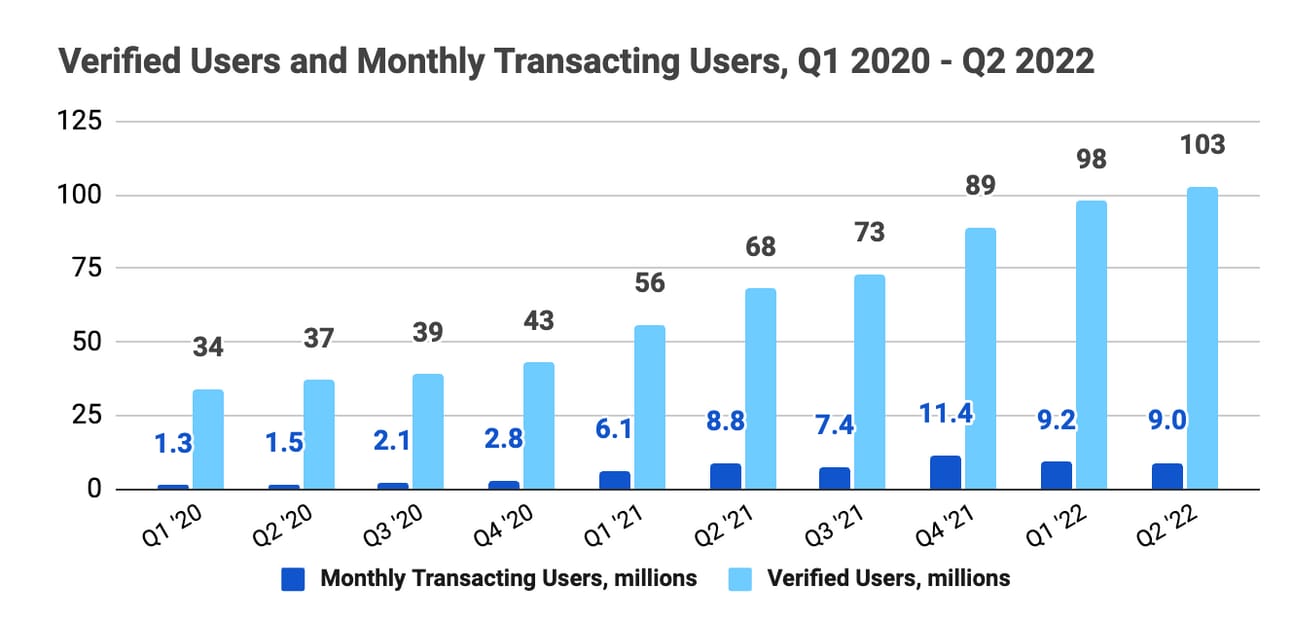

Coinbase reported 103 million Verified Users and 9.0 million transacting users at the end of Q2 2022. This represents a 51% YoY and 5% QoQ growth in Verified Users, as well as a 2% YoY growth, and a 2% QoQ decline in Monthly Active Users. During the earnings call the company’s management reported that MAUs declined to 8.0 million users in July 2022, and guided for a lower MAU number for Q3 2022.

This was a wild quarter in crypto that was marked by the collapse of the stablecoin Luna and the bankruptcies of crypto hedge fund Three Arrow Arrows Capital and lender Voyager. Therefore, continued growth in Verified Users, as well as just a minor decline in MAUs speaks to the strength of the company’s position in the crypto ecosystem.

As a reminder, Coinbase defines a Monthly Transacting User as “a retail user who actively [i.e. buying or selling crypto assets] or passively [i.e. earning a staking reward] transacts in one or more products on our platform at least once during the rolling 28-day period ending on the date of measurement.”

Assets on Platform

The company reported $96 billion in Assets on the Platform, which represents a 47% decline compared to Q2 2021, and a 62% decline sequentially. The split between Retail and Institutional assets remained almost unchanged, with retail customers holding 49% of the total Assets on the Platform.

As I noted in my previous review, Ether and Bitcoin contributed more than 60% of the total assets on the platform; thus, we could use price changes in these two cryptocurrencies, as a proxy for the change in the Assets on Platform metric. Thus, the 62% sequential decline in Assets on the Platform was proportional to the decline in Ether and Bitcoin prices during the quarter, with Bitcoin declining 59% and Ether declining 70%.

Bitcoin’s price is almost unchanged and Ether appreciated 25% in the current quarter to date (July 1 - September 22, 2022); thus, we can expect Coinbase to report a single to low-double-digit increase in Assets on the Platform at the end of Q3 2022 (unless a major price move takes place in the last two weeks of the quarter).

Trading Volumes

Coinbase reported $217 billion in Trading Volume for the quarter, which represented a 53% decline compared to Q2 2021 and a 30% decline compared to Q1 2022. Retail trading volumes declined 68% compared to Q2 2022, and 38% sequentially, and Institutional trading volumes declined 46% compared to Q2 2022, and 27% sequentially.

In the last review, I used the data from CryptoCompare as a proxy for the trading volumes. As a reminder, CryptoCompare uses Coinbase’s public APIs to collect the data on trading volumes; however, this data does not include over-the-counter transactions. As can be seen from the chart below, daily trading volumes on Coinbase were stable throughout Q3 2022, but approximately 25% lower than in Q2 2022 (partially due to meaningful spikes in trading activity in May and June).

Source: CryptoCompare

During the earnings call, the company reported $51 billion in trading volume in July 2022; and thus, guided for lower trading volumes for the quarter. The chart above suggests that July volumes were the lowest in the current quarter, and things got a bit better since then.

Revenue

The company reported $803 million in net revenue for the quarter, which represented a 61% decline compared to Q2 2021, and a 31% decline compared to Q1 2022. Similarly to the previous quarter, the decline in revenue was driven by the lower retail trading volumes; and thus, lower transaction revenue.

Transaction revenue contributed $655 million, or 82% of the total net revenue, while subscription and services revenue contributed $147 million, or 18% of the total net revenue. Notably, subscription and services revenue declined merely 3% compared to the previous quarter; thus, the total revenue decline came primarily from the transaction revenue.

In his interview with CNBC, Brian Armstrong, the company’s founder and CEO, expressed an ambition for subscriptions and services revenue to eventually reach 50% of the company’s revenue. As for now, the company expects subscription and services revenue to contribute “more than $600 million” in revenue in 2022 (meaning, it will remain flat or grow modestly during the remaining quarters).

The sequential decline in total transaction revenue (-35% QoQ) was in line with the decline in retail trading volumes (-38% QoQ), as retail customers continue to generate most of the company’s revenues (94%). The company reiterated that Coinbase Prime, the company’s offering to institutional clients, is one of the top priorities. During the quarter Coinbase also announced a notable institutional win in BlackRock. However, we are yet to see a meaningful contribution from this segment.

Finally, a regular look at the Take Rates. The company’s management admits that eventually, retail take rates will compress, but for now, Coinbase continues commanding above-the-market rates despite aggressive competition (i.e. Binance announcing zero-fee Bitcoin trading). Thus, the retail Take Rate increased during the quarter to 1.34%, which the management attributed to lower trading volumes (Coinbase has a tiered pricing model for some of its users).

Given the further decline in trading volumes, we should expect a sequential decrease in revenue. It is hard (or impossible?) to forecast what happens next in the crypto market, so I am waiting for the revenues to stabilize to understand a normalized revenue level in a bear market (kind of revenue “bottom”). This revenue level would hint at the level of operating expenses that the company can support without burning its cash reserves.

Operating Expenses

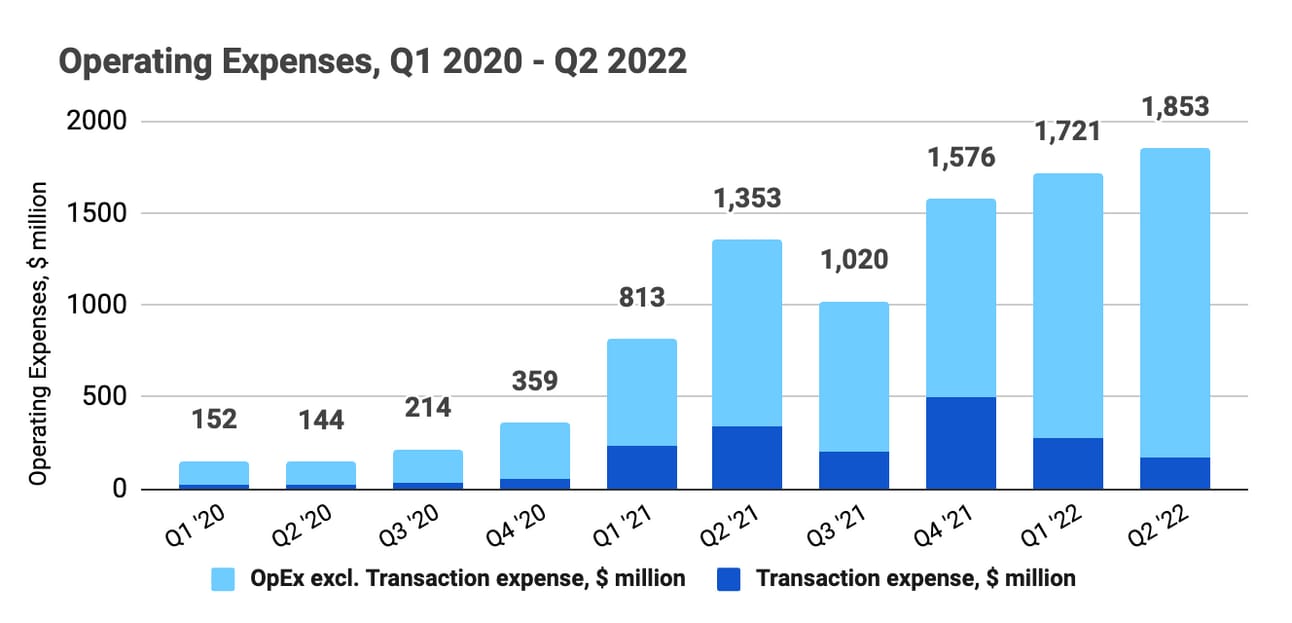

The company reported $1.85 billion in total operating expenses, which represents a 37% increase compared to Q2 2021, and a 7% increase compared to Q1 2022. If you recall from the previous review, Coinbase announced layoffs impacting 18% of the company’s workforce. However, the layoffs took place at the end of the quarter (late June 2022); and thus, had little impact on Q2 2022 operating expenses.

It should be noted that the company had to book $377 million in crypto asset impairment. As per the accounting standards, the company had to book an impairment when the value of the crypto assets fell (despite continuing to hold those), but cannot realize the gain until the assets are sold.

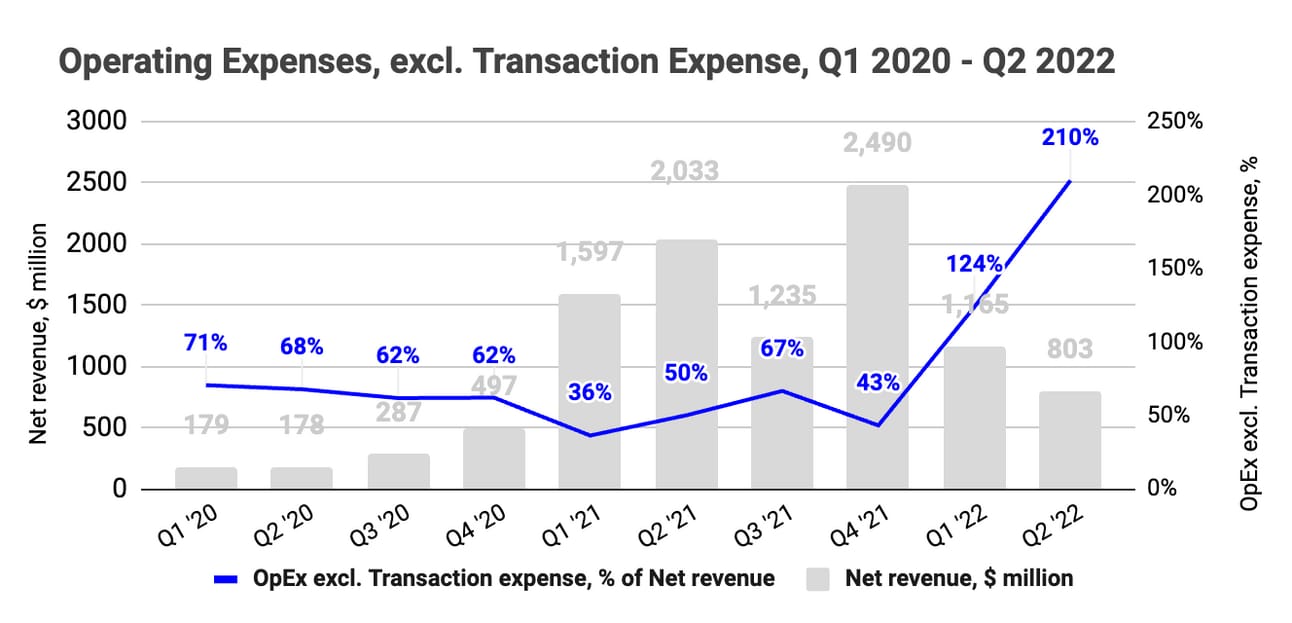

When analyzing operating expenses, which should separate between transaction expenses, which are driven by the trading volumes, and the rest of the expenses, such as sales and marketing, and staff compensation. Thus, transaction expenses contributed $167.2 million, or 9% of the total operating expenses, and can be expressed as 21% of the total revenue. As can be seen from the chart below, the transaction expenses have been increasing relative to the revenue for over a year reaching 24% in Q1 2022. The company’s management expects transaction expenses to remain in “the low 20% range” in Q3 2022.

Operating expenses excluding transaction expenses contributed $1.68 billion, or 91% of the total operating expenses, and can be expressed as 210% of the total net revenue. As can be seen from the chart below, Coinbase used to operate with OpEx excluding transaction expenses in the range of 60-70% of the revenue prior to 2021. Clearly, there is a long way to go for the company to return to these levels (and the announced layoffs only marginally help).

The company’s management guided for the operating expenses (excluding transaction and “other” expenses) to amount to $1.1 billion in Q3 2022 ($100 million in sales and marketing, and $1 billion in technology and development, as well as general and administrative). This will be an improvement compared to Q2 2022 results ($1.2 billion), but is clearly short of bringing the company back to profitability (more on that in the next section).

Net Income (Loss) and Adjusted EBITDA

Coinbase reported $1.1 billion in Net Loss, down from $1.6 billion Net Income in Q2 2021, and $430 million Net Loss in Q1 2022. The company also reported a negative Adjusted EBITDA of $151 million, down from Adjusted EBITDA of $1.15 billion in Q2 2021, and Adjusted EBITDA of $20 million in Q1 2022. It is really staggering, how quickly the company’s fortune changed.

Some notable adjustments that the company made in calculating the Adjusted EBITDA include $391 million in stock-based compensation, $377 million impairment to crypto assets (described above), $107 million in unrealized loss on FX due to dollar appreciation, $69 million in impairment on Coinbase Venture investments, and $42 million in restructuring costs related to June layoffs.

The company’s management set a “guardrail” (the limit to Adjusted EBITDA losses) of $500 million for the year, meaning they aim for a maximum negative Adjusted EBITDA of $369 million in H2 2022 (or $184.5 per quarter on average).

Some back of the envelope calculation for Q3 2022:+ $500 million in transaction revenue+ $150 million in subscriptions and services revenue- $115 million in transaction expenses- $1,100 million in sales & marketing, development, and G&A expenses+ adjustment for $400 million in stock-based compensation+ adjustment for $65 million in depreciation and interest expenses= -$100 million in Adjusted EBITDA

Looks like they should be able to remain within the “guardrail”, assuming there are no major shocks to the crypto market during the last few months of the year. However, as we start approaching the year-end, it is worth looking at the “run rate” (i.e. negative Adjusted EBITDA levels in a scenario that the bear market continues into 2023).

The company exited Q2 2022 “with $6,154 million in total available $USD resources which we define as cash & cash equivalents, USDC, and custodial account overfunding.” So Coinbase is not going anywhere and should be able to survive this “winter”.

Things to Watch in 2022

Normalization of transaction revenue. Trading volumes, and consequently transaction revenue keep declining. Without normalization of the transaction revenue in sight, it is difficult to forecast the expense level that the company can sustain without tapping into its cash reserve. We have seen revenue upside in a bull market, what I am looking for is the revenue downside in a bear market.

Cost optimization. For now, the company’s management is ready to lose up to $500 million this year (negative Adjusted EBITDA “guardrail”). However, as we are entering the fourth quarter, investors would expect some guidance for the next year, and I don’t think Coinbase can guide for a similar loss in 2023. Therefore, if the crypto market does not return to growth by year-end, we should expect further cost optimization initiatives.

Product development. Coinbase is using this downturn to focus on product development. Thus, they indicated five priority areas: Coinbase Retail App, Coinbase Prime, Staking, Developer Products, and Web3. I am curious whether they will manage to build a product that could majorly contribute to the revenue in the next bull run (Coinbase Prime, Staking, Developer Products?).

Acquisitions. Finally, as I noted above, the company has over $6 billion in cash, cash equivalents, and stablecoins. This reserve is sufficient to sustain a prolonged bear market and leaves some dry powder for acquisitions. International expansion in large geographies is clearly something to watch for, but I wouldn’t exclude the scenario, in which Coinbase acquires some of the companies from its Coinbase Ventures portfolio.

It was a difficult quarter for Coinbase, and the short-term prospects don’t look much brighter. The company has sufficient cash buffer to survive a lengthy crypto winter, but we should be honest with ourselves that Coinbase, as a company, is a bet on the crypto economy. And Coinbase desperately needs this economy to return to growth to ever shine again.

Source of the data used above: Investor Relations

Disclosure & Disclaimer: despite rocky performance in 2021 and the first half of 2022, I own shares in most of the companies covered in this newsletter (including Coinbase), as I am extremely bullish on the long-term transformation in the financial services industry. However, none of the above is or should be considered financial advice, and you should do your own research.