Coinbase ( ) reported its Q1 2022 results on May 10, 2022, but it already feels like it was a very long time ago. Since then Terra collapsed, Three Arrow Capital filed for bankruptcy, and FTX had to bail out BlockFi. Investors didn’t take the news lightly and the price of Bitcoin fell below the $20,000 level, while other cryptocurrencies experienced even bigger drawdowns. Coinbase, in the meantime, pivoted from planning to hire 6,000 people during the year to laying off 18% of its staff. It also went from printing cash to barely keeping the Adjusted EBITDA positive.

In Q1 2022, Coinbase delivered its first quarterly loss in more than 2 years, and Q2 2022 looks even worse (like much worse). I think that the hardest part is that, at this point, it is even hard to estimate the losses that the company will be making in the coming quarters and if its $6.1 billion cash reserve will suffice to see the better times. We are clearly in a “crypto winter”, and one has to truly believe in the bright future of blockchain to stay invested in Coinbase.

Customers

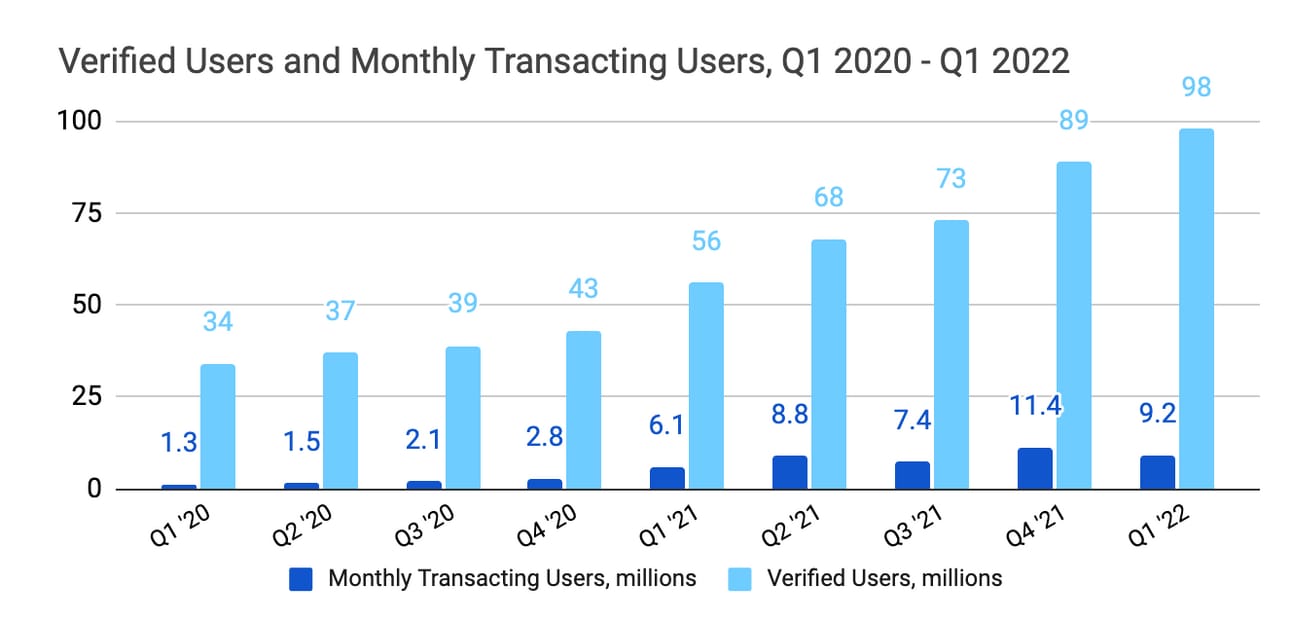

Coinbase finished the quarter with 98 million Verified Users and 9.2 million Monthly Transacting Users, representing 75% and 51% YoY growth respectively. Sequentially, the number of Monthly Transacting Users declined 19%, and, during the earnings call, the management mentioned a further decline in April 2022 (8.9 million).

As a reminder, Coinbase defines a Monthly Transacting User as “a retail user who actively [i.e. buying or selling crypto assets] or passively [i.e. earning a staking reward] transacts in one or more products on our platform at least once during the rolling 28-day period ending on the date of measurement.”

Assets on Platform

The company finished the quarter with $257 billion in assets on the platform, representing a 15% growth YoY, and an 8% decline sequentially. Assets of institutional clients comprised $134 billion, or 52% of the total assets on the platform, and assets of retail clients comprised $123 billion, or 48% of the total assets on the platform.

At the end of the quarter, 96% of the assets on the platform were crypto assets (42% Bitcoin, 24% Ether, and 31% other crypto assets), meaning that we can expect a major decline in this metric given the collapse of crypto assets prices in Q2 2022. Thus, Bitcoin price declined 58% and Ether price declined 69% during Q2 2022. Moreover, given the price decline, some users might have decided to fully exit their crypto-asset positions and withdraw funds from Coinbase, or move their funds to non-custodial wallets (and other exchanges).

Glassnode, an analytics platform, tracks balances on various exchanges using on-chain data. They try to identify custodial wallet addresses used by the exchanges; thus, the data does not fully reconcile (i.e. according to Coinbase filing, total Bitcoin assets on the platform stood at $107.5 billion, while Glassnode only captured approximately $30 billion). Nevertheless, Glassnode data suggests that the value of Bitcoin held on Coinbase wallets declined 60%, and the value of Ether held on Coinbase wallets declined 73% during the quarter.

Trading Volumes

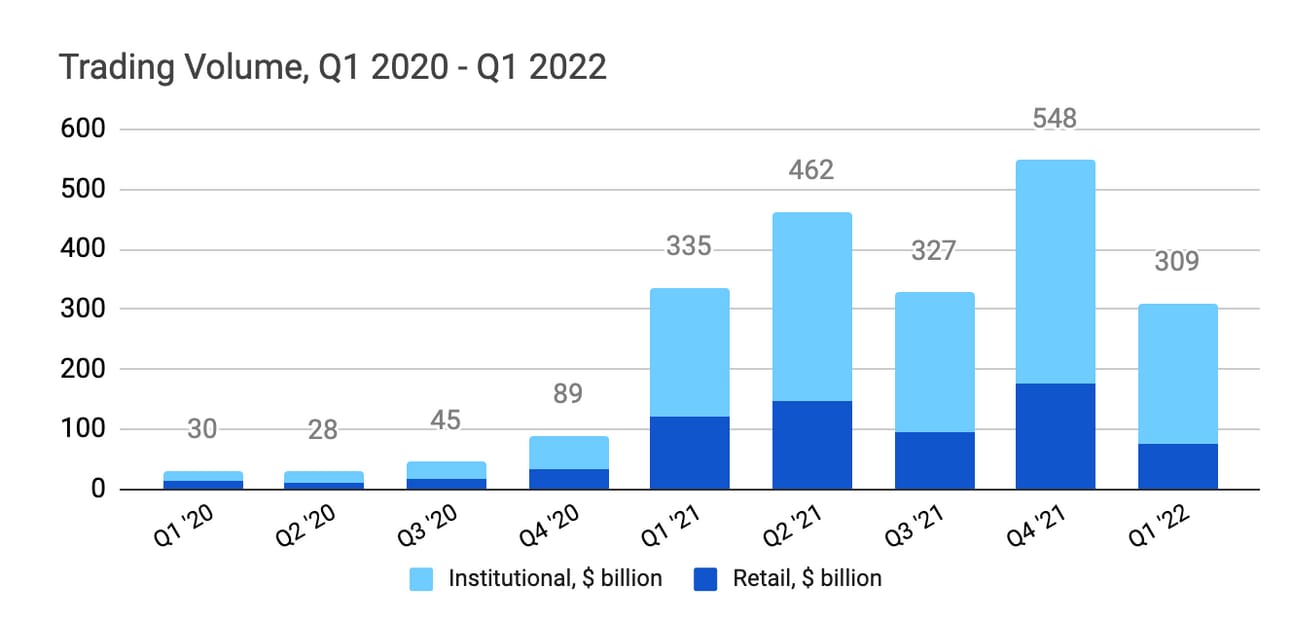

The company reported $309 billion in trading volume on the platform, which represents an 8% decline YoY, and a 44% decline sequentially. Retail customers generated $74 billion in trading volumes (24% of the total) and institutional clients generated $235 in trading volumes (76% of the total). Notably, retail trading volumes declined 38% YoY (and 58% sequentially), while institutional volumes grew 9.3% YoY (and declined 37% sequentially).

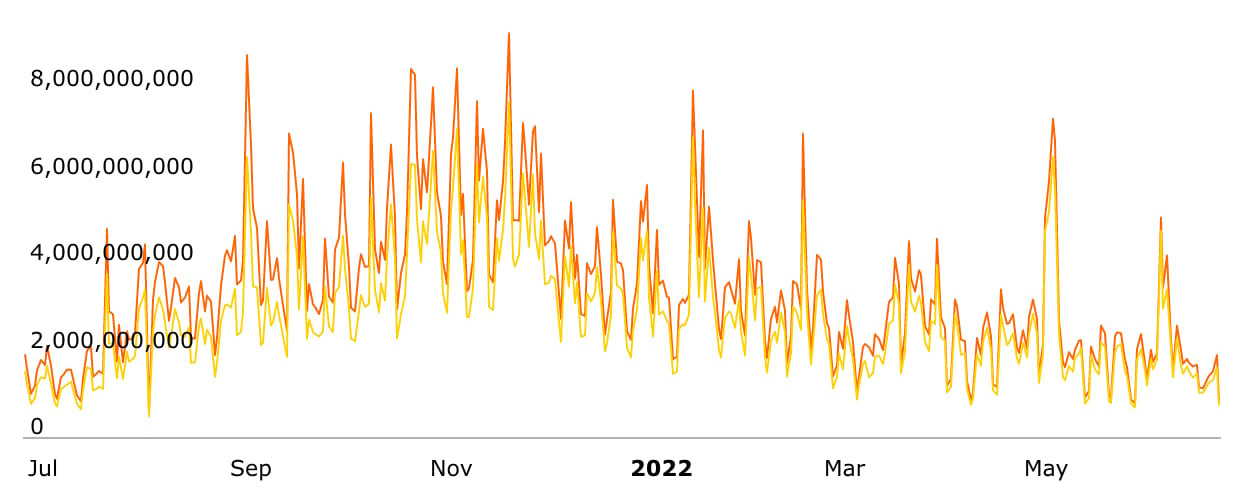

During the earnings call, the company’s management mentioned $74 billion in trading volume in April 2022 (less than the average monthly volume in Q1 2022), and the data from CryptoCompare (see chart below) suggests a further downward trend (with an exception of a couple of spikes during the Luna and Three Arrow Capital collapses in May and June 2022).

However, we should treat the data from CryptoCompare (and similar providers relying on public API data) with caution, as it excludes OTC trades from institutional clients. Overall, it looks like Coinbase will report another sequential decline in trading volume, this decline will be material, but not dramatic. Of course, the key question is what happens next (Q3 2022 and onwards).

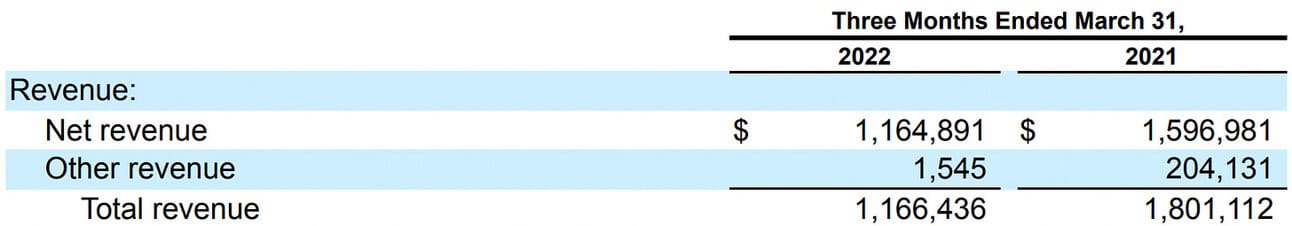

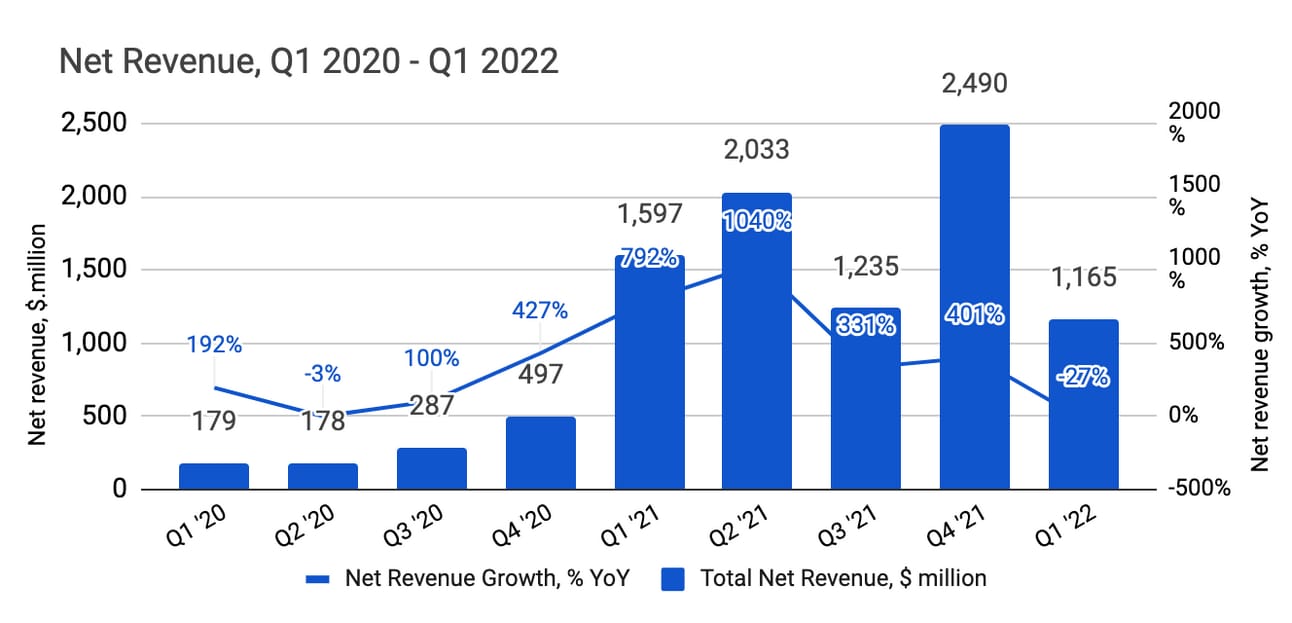

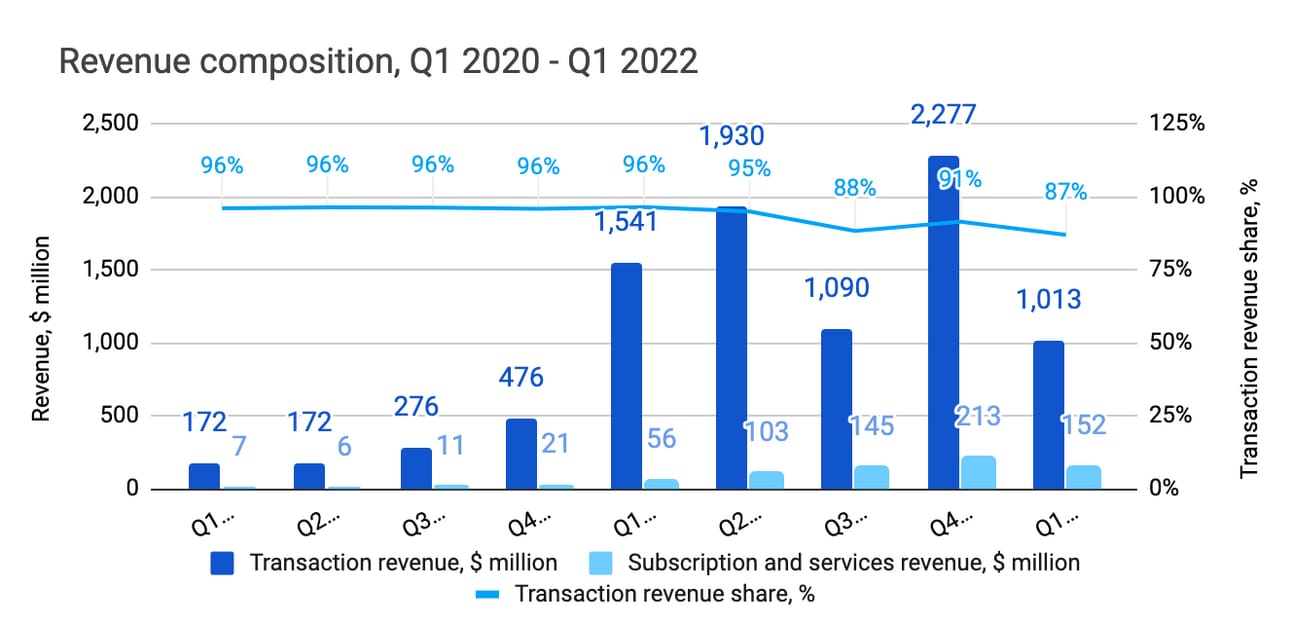

Revenue and Take Rate

Coinbase reported $1.17 billion in total revenue in Q1 2022, which represents a 27% decline YoY, and a 53% decline sequentially. The total revenue number includes $1.01 billion in “Transaction revenue” (87% of total revenue), $0.15 billion ( in “Subscription and services revenue” (13% of total revenue), and $1.55 million in “Other revenue” (<1% of total revenue), which is the revenue generated from the “sale of crypto assets and Corporate interest and other income”. “Transaction revenue” and “Subscription and services revenue” are grouped into “Net revenue” in the table below.

Given that Coinbase generates the majority of its revenue from trading (“Transaction revenue”), the company’s revenue (at least for now) is primarily a function of the Trading Volume and the Take Rate. As illustrated above, the trading volumes in Q1 2022 were similar to the volumes in Q1 2021 and Q3 2021. Consequently, you can see from the chart below that the revenue in Q1 2022 was similar to the revenue in Q3 2021, but is considerably lower than in Q1 2022. The reason for that is a combination of lower trading volumes by Coinbase retail clients and the lower Take Rate for the trading of Coinbase institutional clients.

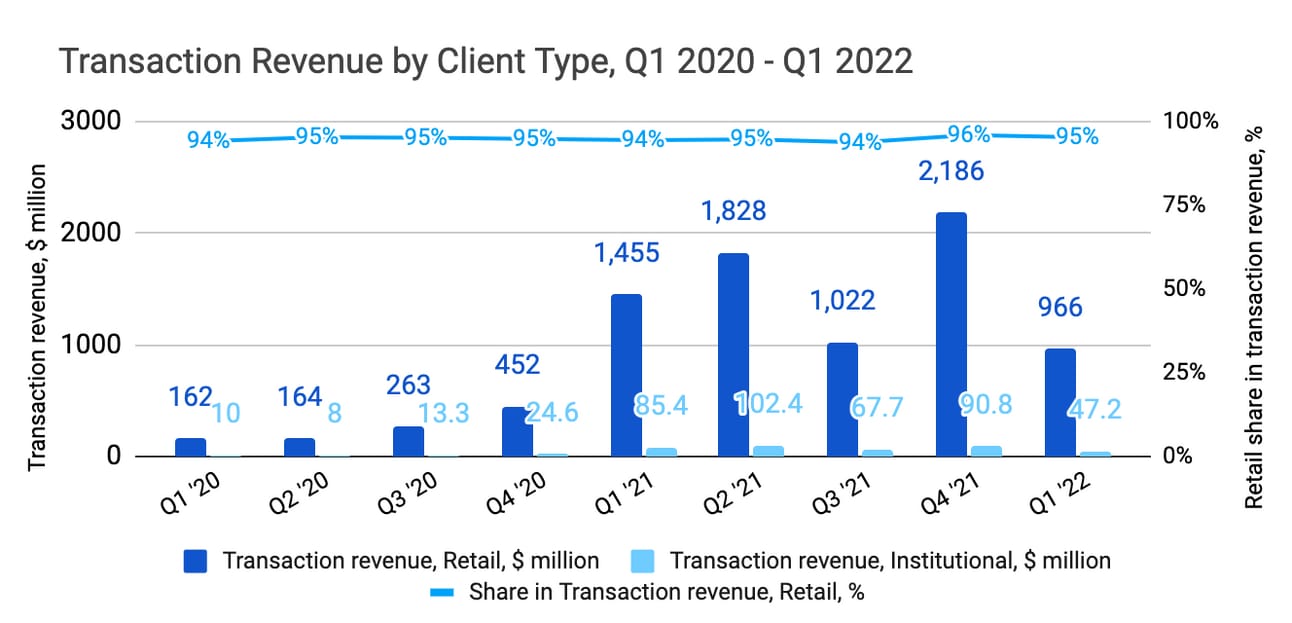

Thus, as the chart below illustrates, the transaction revenue generated by retail customers declined 34% YoY from $1.46 billion in Q1 2021 to $0.97 billion in Q1 2022 (due to a 38% decline in volume, see above). Furthermore, you can see that the transaction revenue generated by institutional clients declined 45% YoY despite a 9.3% growth in trading volume (due to the Take Rate compression, see below). There were a lot of discussions about the adoption of crypto by institutional clients last year, and about Coinbase being well-positioned to serve such clients with its Coinbase Prime product. However, so far, the contribution of institutional clients to the company’s revenue has been marginal.

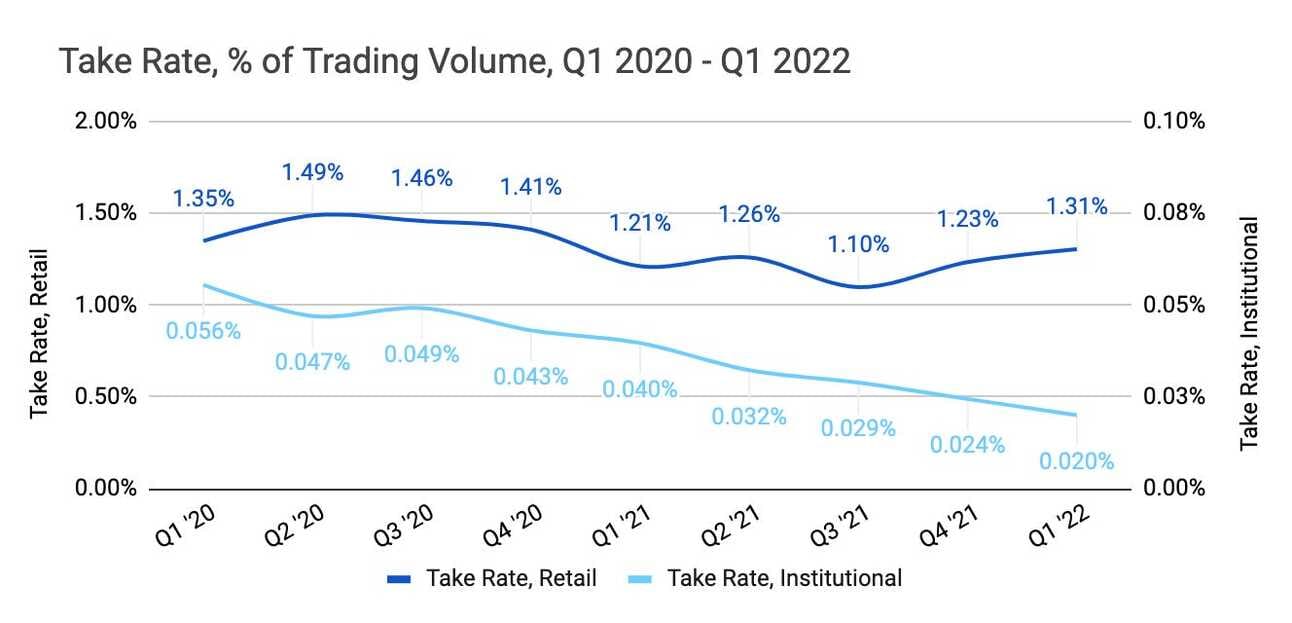

Take Rate for institutional clients decrease from 0.04% in Q1 2021 to 0.02% in Q1 2022, while the Take Rate for retail clients increased from 1.21% in Q1 2021 to 1.31% in Q1 2022. Coinbase is notorious for charging (consumers) above-the-market fees, and there have been a lot of discussions about compressing the Take Rate given the competition from other exchanges (FTX, Kraken, etc.). However, so far this compression is not taking place.

On the final note, I would like to highlight the increased weight of the “Subscription and services” revenue, which grew 169% YoY (from $56 million in Q1 2021 to $152 million in Q1 2022). This source of income includes blockchain rewards (staking), custodial fees, interest income (generated by the loans to customers), and revenue from Coinbase Cloud. Q2 2022 guidance from the company: “We anticipate subscription and services revenue will be similar to modestly lower in Q2 [2022] compared to Q1 [2022].”

Nobody knows what will happen with the crypto market going forward and if there will be another growth cycle. However, as I illustrated above, Coinbase revenue is highly dependent on the trading volume of its retail clients. Thus, the trading volumes (as reported by using the CryptoCompare website, for example) can serve as a good proxy for the company’s revenue in between the quarterly earnings.

Operating Expenses

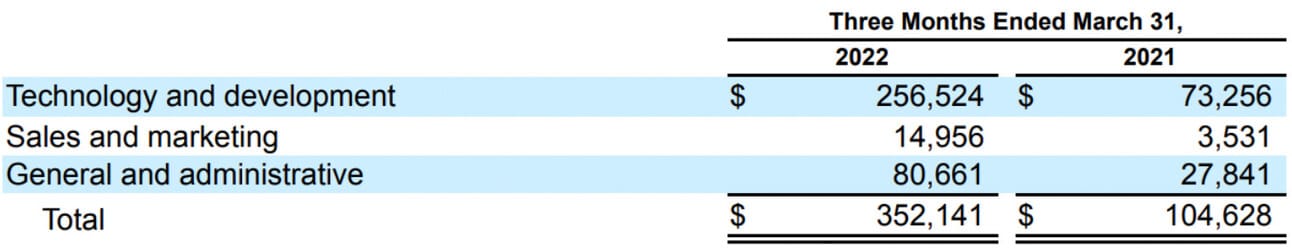

Coinbase reported $1.72 billion in Operating expenses in Q1 2022, representing a 112% increase YoY, which lead to an Operating loss of $0.55 billion. As the table below illustrates, expense increase came primarily from increased spending on “General and administrative” (241% YoY), “Technology and development” (209% YoY), and “Sales and marketing” (70% YoY).

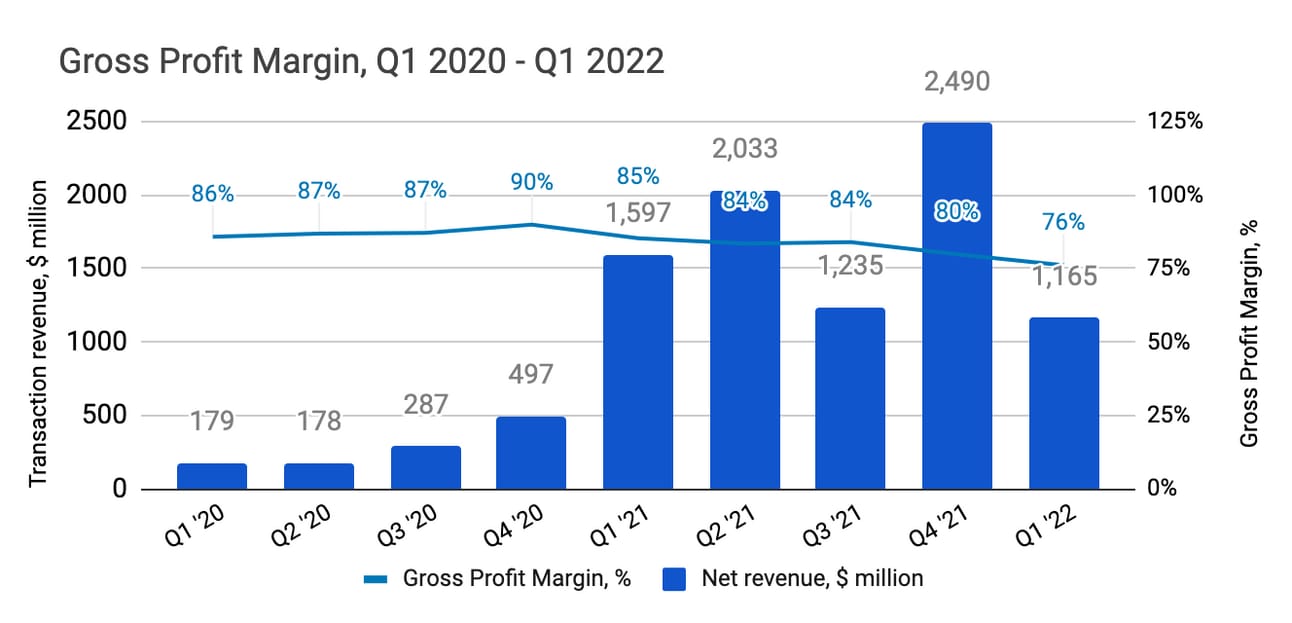

Coinbase does not report explicitly the gross profit or gross profit margin, perhaps, because the gross profit margin (net revenue minus “Transaction expense” divided by the net revenue) is ridiculously high. As can be seen from the chart below, Coinbase commanded 80%+ gross profit margin up until the end of 2021; however, it dropped to a record low of 76% in Q1 2022 (and per the company’s guidance will remain at this level in Q2 2022).

The company’s 10Q filing reveals that the increase in transaction expense was driven by the increase in rewards to users for staking (+$59.4 Q1 2021 to Q1 2022), as well as losses on transaction reversal (+$18.5 million), and was partially offset by lower miner fees due to lower gas fees on blockchains (-$37.7 million).

During Q4 2021 earnings call (that took place on February 24, 2022), the company announced ambitious development and expansion plans for 2022, which would lead to $4.25 - $5.25 billion in “Technology and development” and “General and administrative” expenses for the year. They iterated on this ambition also during the Q1 2022 earnings call (that took place on May 10, 2022). However, since then the company announced a hiring freeze (late May), then an extension of the hiring freeze (early June), and eventually, layoffs of 18% of the workforce.

I’d expect the dollar value of the layoffs to be higher than the headcount (i.e. 20-25%), but still, the back-of-the-envelope calculation suggests that the announced layoffs will not suffice to return to the Operating income (i.e. 25% reduction of $984 million in expenses, would only reduce the cost basis by $246 million, while the Operating loss stood at $554 million). In addition, the effect will be realized only in Q3 2022 (they announced layoffs almost at the end of Q2 2022 + will probably have redundancy costs booked in Q2 2022).

The expenses include $352.1 million in share-based compensation, which grew 236% YoY. As you can see, share-based compensation comprised 45% of the “Technology and development” expense, as the company tried to lure engineering talent with stock options. The company guided for $420 million in share-based compensation in Q2 2022; however, the layoffs have impacted this guidance. Share-based compensation is the cost to the company; however, this is a non-cash expense.

The company guided for the “Sales and marketing” expenses of “mid-to-high teens as a percent of net revenue” ($200 million or 17% of the total revenue in Q1 2022). Given the market conditions, it would be unreasonable for the company to stick to this target. In 2021, “Sales and marketing” expenses comprised less than 10% of the total revenue.

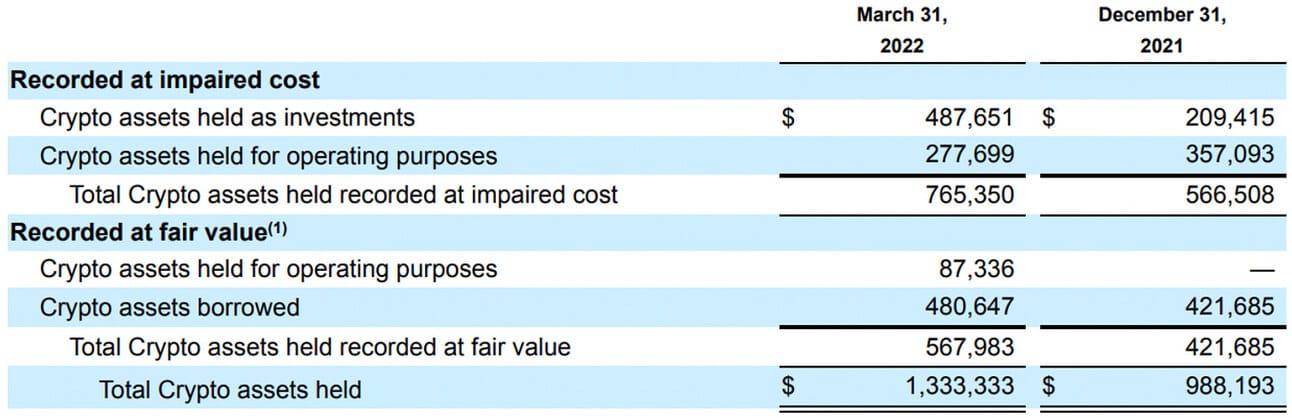

Finally, “Other operating expenses” primarily include “impairment and realized gains on the sale of crypto-assets”. Coinbase held $1.33 billion in crypto assets, and given the price correction that took place in Q2 2022, we can expect impairment expense to be sizeable and also contribute to the operating loss. Similar to stock-based compensation, this is primarily a non-cash expense (impairment of fair value).

In summary, it still looks like Coinbase is entering a period of major operating losses. We will also need to wait for the Q2 2021 earnings results to understand the full impact of the layoffs and the expense level going forward.

Net Income (Loss) and Adjusted EBITDA

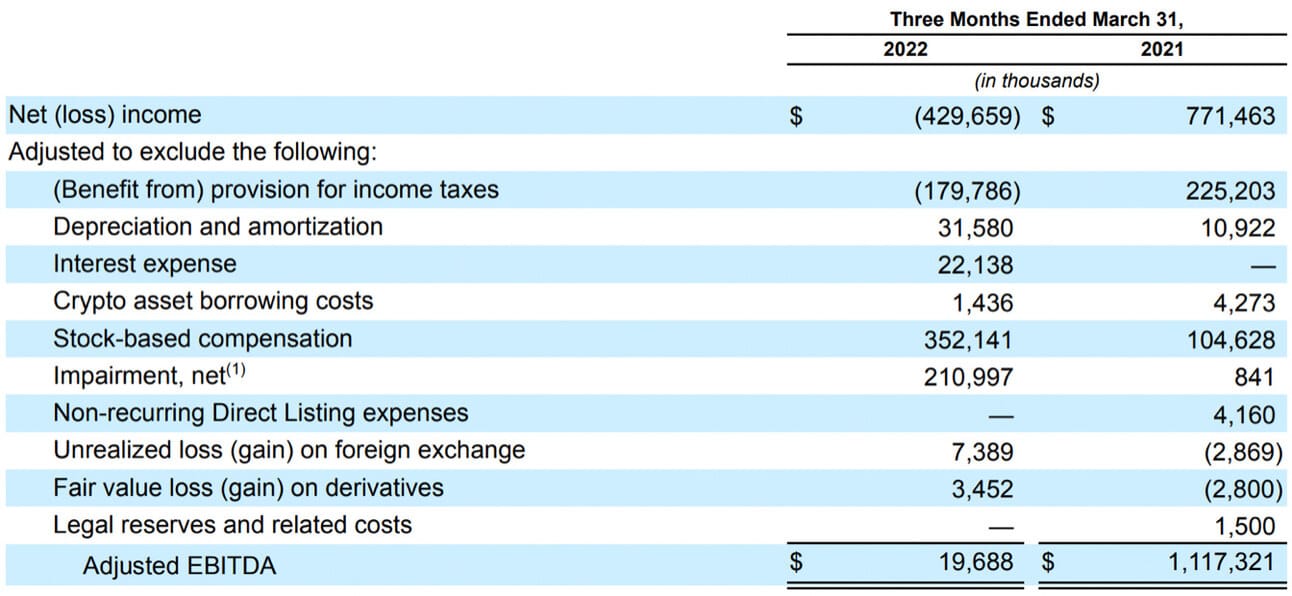

The company reported a Net Loss of $429.7 million for the quarter, a decline from $771.5 million in Net Income a year ago. The Adjusted EBITDA decreased from $1.12 billion in Q1 2021 to $19.6 million in Q1 2022. The last time Coinbase reported Net Loss for the quarter was in Q4 2019, before the company became public. The company finished Q4 2019 with a Net Loss of $27.9 million.

The key adjustments that the company makes to derive the Adjusted EBITDA, are the stock-based compensation (and respective tax benefit) and impairment of the crypto assets held by the company. Adjusted EBITDA can be used as a proxy for the cash burn. The company finished the quarter with $6.1 billion in cash and equivalents, and I believe it is already burning through this cash.

Things to Watch in 2022

Trading Volume (by retail clients). As illustrated above, the key driver of Coinbase revenues is the trading volume of its retail customers. So far the company managed to keep its above-the-market Take Rate, and the revenue is driven primarily by the trading volume.

Expense levels post layoffs. I argue that the announced layoffs will not be sufficient to bring the company back to operating profit, even if the dollar impact of layoffs is higher than the reduction in the headcount (18%). Let’s wait for the Q2 2022 earnings call to hear management’s guidance concerning expenses going forward.

Cash reserves and cash burn. Evaporating revenue already drove the company into net losses, and I would expect the company to deliver negative Adjusted EBITDA in Q2 2022. This means that the company will start (most likely already started) tapping into its cash reserves. I guess the key question is for how long its cash reserves will last if the trading activity does not improve.

Product development and international expansion. They say that crypto winters are “the time to build”, and Coinbase is clearly building. Thus, they keep shipping improvements to the Coinbase platform and Coinbase wallet. Moreover, they remain ambitious about expansion in Europe. This is probably the only positive aspect of the current situation, but who knows, perhaps, it will have a huge payoff down the road.

In summary, Q1 2022 was difficult, but Q2 2022 will be brutal. We will most likely see a 60-70% reduction in assets on the platform, a 20-30% sequential decrease in revenue, and a sizeable impairment to the crypto assets held by the company, while the cost reduction measures will have a limited impact, as they were announced only in late June. Cash reserves and burn rate are the key metrics to watch until the next crypto spring.

Source of the data used above: Investor Relations

Disclosure & Disclaimer: despite rocky performance in 2021 and the first half of 2022, I have open positions in most of the companies covered in this newsletter, as I am extremely bullish on the long-term transformation in financial services industry. However, none of the above is financial advice, and you should do your research.