If you follow Fintech or crypto industries, then you have definitely heard of Coinbase ( ). The company went public through a direct listing on April 14, 2021, which almost perfectly timed the peak of the first crypto cycles of the year. The company started trading at $381 per share, and closed its first trading day at $328 per share, valuing the company at $85.8 billion. As of this writing, the company traded at $135 per share and had a market capitalization of $35.4 billion.

Like many other high-growth companies, Coinbase was decimated by the rising interest rates despite improving fundamentals. However, as Warren Buffett said, “be greedy when others are fearful”, so perhaps, this market drawdown represents an opportunity to invest in a great company at a “reasonable price”. Let’s break down Coinbase's financials!

Business Overview

Coinbase is one of the largest cryptocurrency exchanges in the world and a leader in the United States. Coinbase allows retail and institutional customers from over 100 countries to trade in a variety of cryptocurrencies via its web and mobile applications, as well as a set of APIs. In the company’s words, Coinbase builds “safe, trusted, easy-to-use technology and financial infrastructure products and services that enable any person or business with an internet connection to discover, transact, and engage with crypto assets and decentralized applications.”

If you follow the company, then you might get a feeling that it is just unstoppable and manages to tap into every area of innovation in the crypto and Web3 space. For example, in addition to crypto and staking trading capabilities, the company launched a crypto wallet, a crypto-based payment card, an NFT marketplace, and even announced plans to produce a movie based on the Bored Ape Yacht Club NFT collection. Moreover, through its venture arm, Coinbase Ventures, the company made investments in over 200 companies in the crypto/Web3 industry.

However, despite all the innovative products that the company brings to the market, it remains a crypto brokerage and an exchange at its core, and generates most of its revenues from trading fees (87% of the total revenue in 2021). Sometimes it also acts as a market maker and sells crypto assets from its balance sheet to its customers (6.5% of the total revenue in 2021). The non-trading services, such as staking, custodial services, and the above-mentioned payment card, generated only 6.5% of the total revenue in 2021.

Thus, before jumping into the company’s financials, it is worth going through the drivers behind its revenues, such as customers, customer assets, and trading activity.

Customers

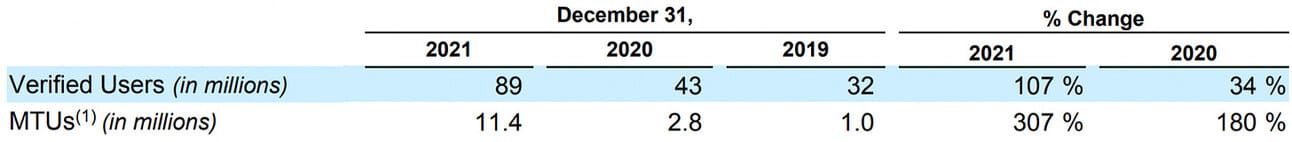

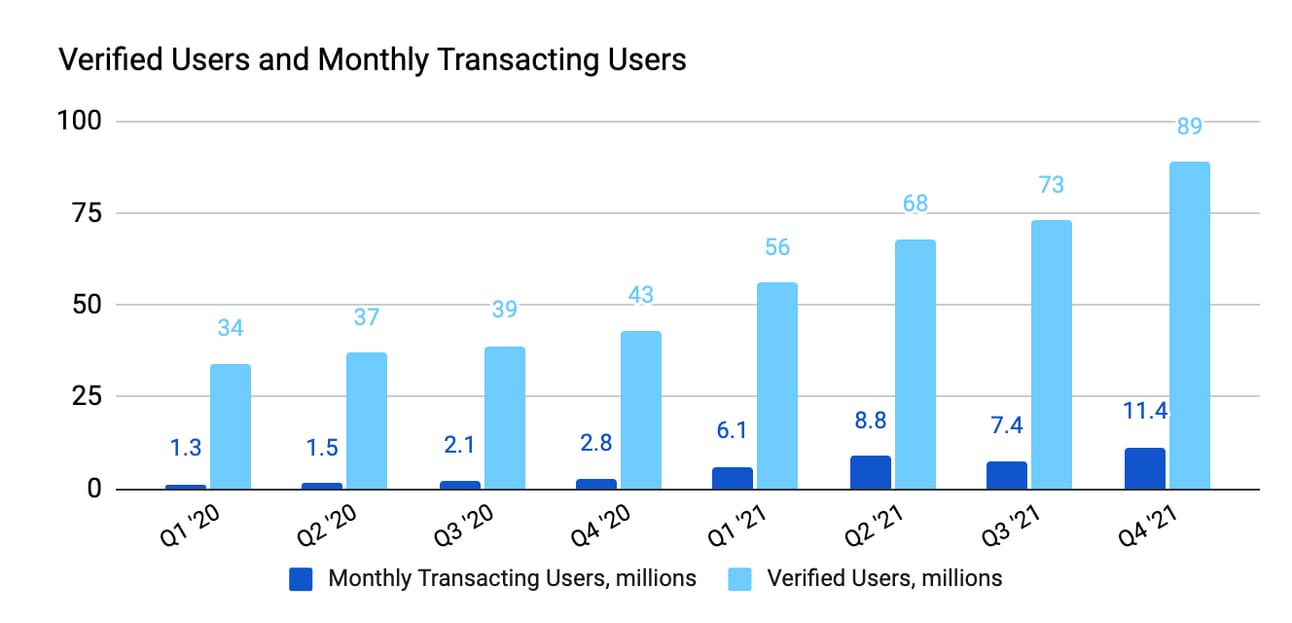

At the end of 2021, Coinbase reported 89 million Verified Users, of which 11.4 million were Monthly Transacting Users (MTUs). Coinbase defines “Monthly Transacting Users” as “a retail user who actively or passively transacts in one or more products on our platform at least once during the rolling 28-day period ending on the date of measurement.”

Coinbase almost tripled its customer base, growing the number of Verified Users from 32 million at the end of 2019 to 89 million Verified Users at the end of 2021. However, a more relevant metric is the Monthly Transacting Users, as the company makes money on transaction fees (“active transaction”), as well as subscription fees, such as staking (“passive transaction”), and does not charge users, who just hold their assets on the platform.

As the company notes in its quarterly shareholder letter, there are many factors impacting the Monthly Transacting Users metric, and it is extremely difficult to forecast. Thus, the company guided for a wide range of 5-15 million MTUs on an average annual basis in 2022.

Coinbase also reported 11,000 institutional customers at the end of 2021, up from 7,000 at the end of 2020. Growth in the number of institutional customers on the platform exemplified increasing interest from institutions in the crypto ecosystems. The institutional customer segment is already a meaningful contributor for Coinbase in terms of the Assets on the Platform and Trading Volume, but so far provides a marginal contribution to the company’s revenues (due to lower fees).

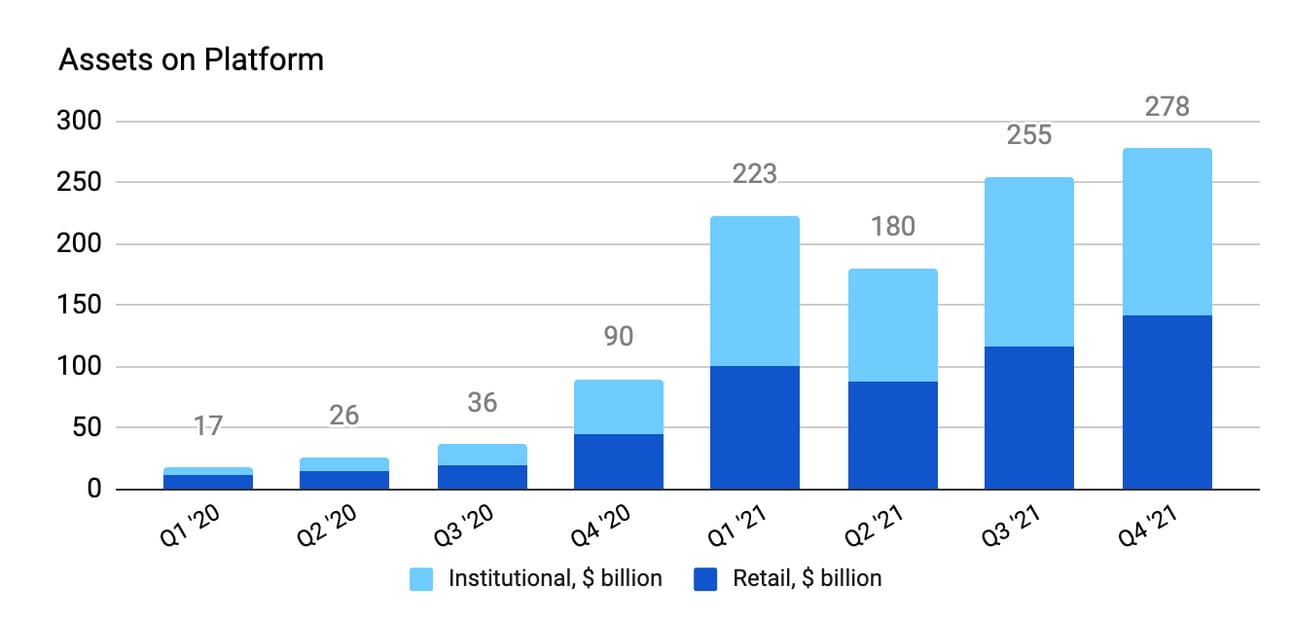

Assets on Platform

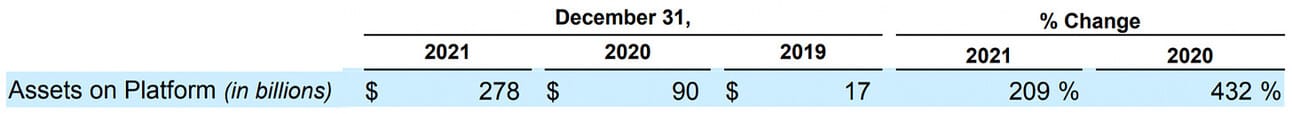

Coinbase reported $278 billion in Assets on Platform at the end of 2021. Coinbase defines “Assets on Platform” as “the total U.S. dollar equivalent value of both fiat currency and crypto assets held or managed in digital wallets on our platform, including our custody services, calculated based on the market price on the date of measurement.”

As mentioned above, institutional investors contribute a sizeable portion of assets on the Coinbase platform. Thus, assets held by institutional investors stood at $137 billion at the end of 2021 (up from $45 billion at the end of 2020, and $6.5 billion at the end of 2019), which represented 49% of the total assets on the platform (50% in 2020, and 38% in 2019).

It should be noted that in 2021, retail investors didn’t seem to be less bullish on the prospects of cryptocurrencies, and managed to keep up with institutional investors, increasing their assets on the Coinbase platform at a similar pace (from $45 billion at the end of 2020 to $141 billion at the end of 2021).

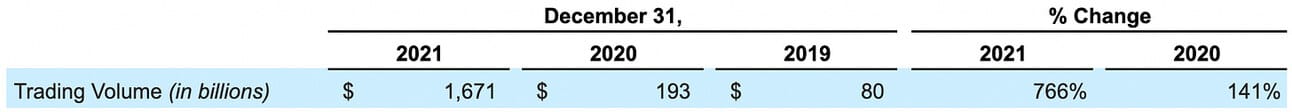

Trading volume

Probably the most impressive metric for Coinbase was Trading Volume. Thus, in 2021 Coinbase reported a Trading Volume of $1.67 trillion, which represented a 766% YoY growth. Coinbase defines Trading Volume as “U.S. dollar equivalent value of matched trades transacted between a buyer and seller through our platform during the period of measurement.

The activity of institutional investors kept increasing over the last couple of years; thus, 68% of the trading volume in 2021 was generated by institutional investors, up from 62% in 2020 and 56% in 2019. In 2021, trading volume by retail customers grew 632% YoY (from $73 billion in 2020 to $535 billion in 2021), and trading volume by institutional investors grew 846% YoY (from $120 billion in 2020 to $1.14 trillion in 2021).

In 2021, trading in Bitcoin contributed 24% of the total Trading Volume on the Coinbase platform (down from 41% in 2020), trading in Ethereum contributed 21% (up from 15% in 2020), and trading in other currencies contributed the remaining 55% (up from 44% in 2020). The decreasing share of Bitcoin trading suggests increasing interest in alternative cryptocurrencies, and per management comments, adding new cryptocurrencies has an immediate impact on the company’s revenue.

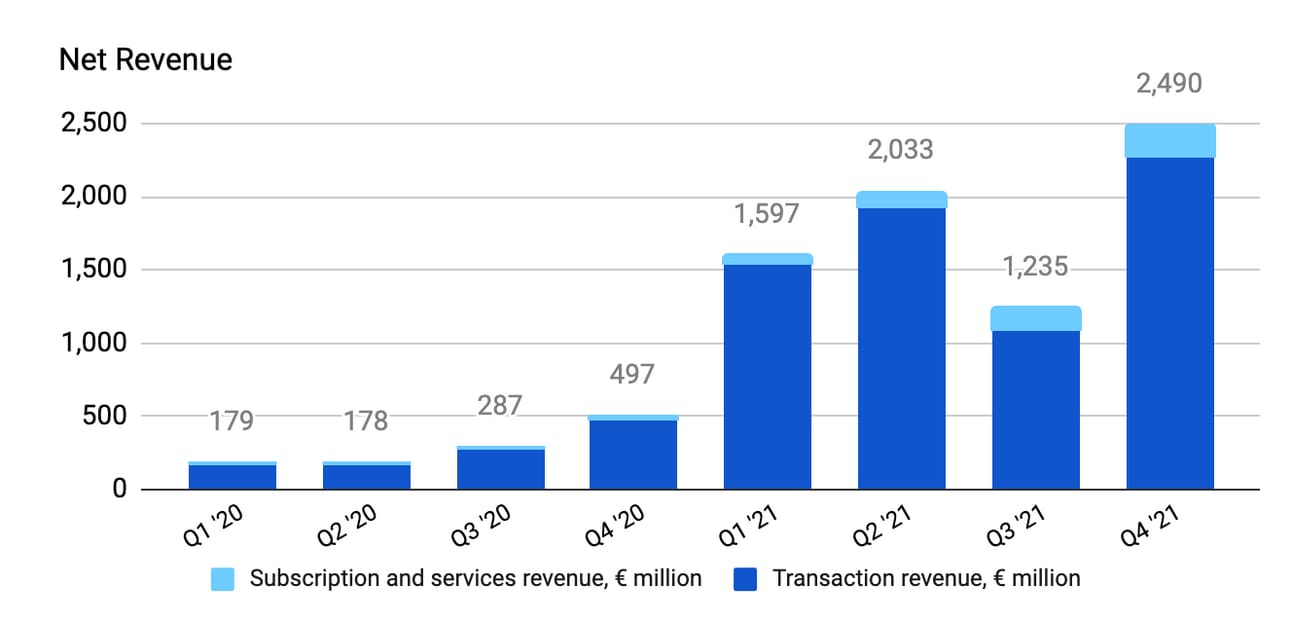

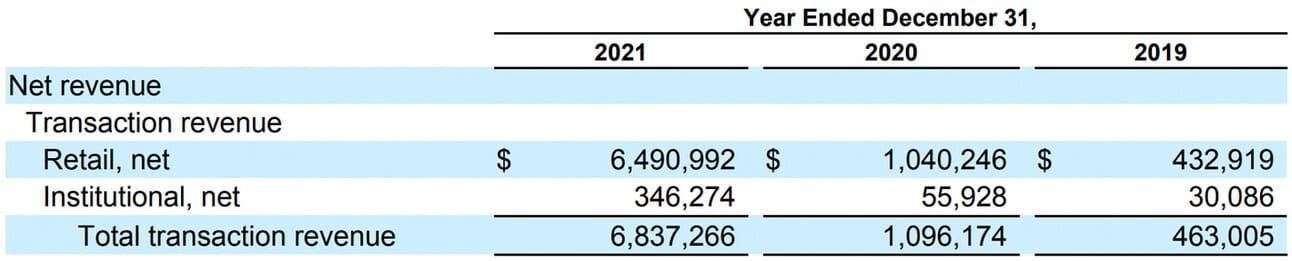

Revenue and Take Rate

Coinbase reported $7.35 billion in revenue in 2021, which represented a 514% YoY growth. Coinbase splits its revenue into three categories: a) Transaction revenue (fees for executing customer trades), b) Subscription and services revenue (staking fees, custodial fees, and interest income that the company earns by investing fiat balances) and c) Other revenue (revenue that Coinbase makes on trades, where it acts as principal - meaning, it sells a crypto asset to its customer from its balance sheet). “Transaction revenue” and “Subscription and services revenue” are grouped into “Net Revenue” in the company’s reporting.

The chart below summarizes the impact of the growth in MTUs, Assets on Platform, and Trading Volumes discussed above, on the company’s revenues. As you can see, Coinbase revenues exploded in 2021. The company’s management is openly saying that they do not have sufficient visibility into the market to give guidance on revenues in 2022, and the chart provides a good illustration of the reasons for that. Thus, you can see explosive growth in revenue in Q1-Q2, 2021, as the result of the first crypto boom run. It was followed by a quiet Q3 2021, and another run in Q4, 2021. Q1 2022 has been quite slow so far, and I believe no one knows how things evolve later in the year.

Two components of the revenue, that are worth watching closely, are the Subscription and services revenue and revenue generated by Institutional clients. Thus, Coinbase earned $213 million in Subscription and services revenue in Q4 2021, which represented 8.6% of the total Net revenue in the quarter (up from $20.7 million and 4.16% share in Q4 2020). This is a more stable revenue, which makes the company less dependable on the boom cycles.

Institutional investors generated $90.8 million or 4% of the total Transaction Revenue in Q4 2021 (up from $24.6 million and 5.1% share in Q4 2020). There have been a lot of talks on the increasing adoption of crypto by institutional investors in 2021, and as we saw, it indeed translated into high volumes of trading activity and assets on the platform, but yet to translate into a meaningful revenue stream for the company.

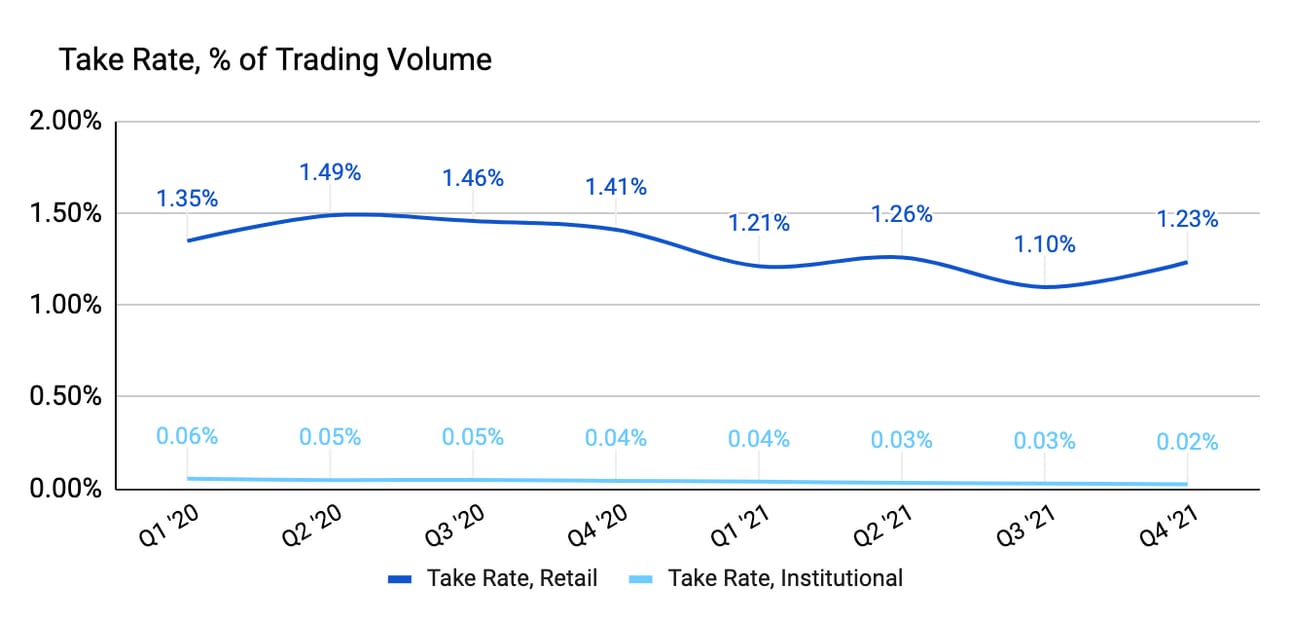

Finally, it is worth watching the Take Rates (Transaction revenue expressed as % of Trading Volume), which represents the fee level that the company charges its customers. Coinbase is notorious for charging retail customers higher rates than its competitors, so it is important if they manage to keep Take Rates at this level. Thus, in 2021, Coinbase achieved a Take Rate of 1.21% (down from 1.42% in 2020) on the trading volumes of its retail customers, 0.03% (down from 0.047%) on the trading volume of its institutional customers.

Operating Expenses

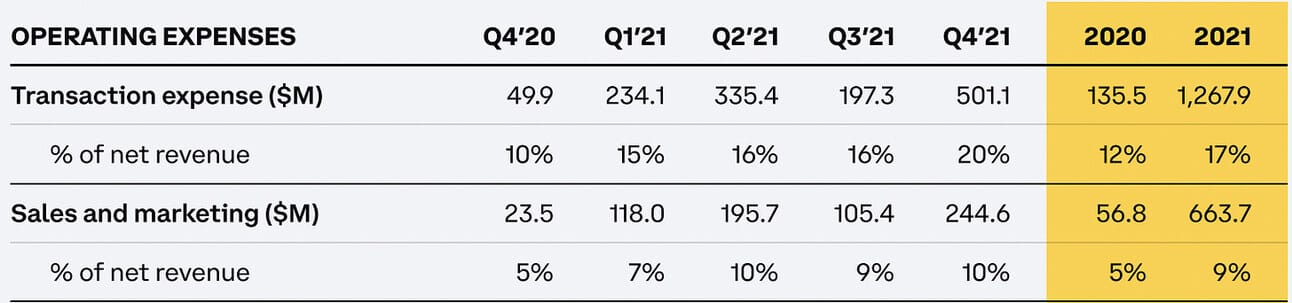

Coinbase reported $4.76 billion in Operating expenses in 2021, which represented a 448% YoY growth (which despite looking like a terribly high increase was lower than the revenue growth rate of 514%). “Transaction expense”, and, to some degree, “Sales and marketing” expenses are driven by the customer activity (and hence experience the highest growth in 2021), while the rest of the expenses, such as “Technology and development” and “General and administrative”, are mostly fixed overhead costs.

As can be seen from the table below (generously provided by Coinbase), Transaction expenses as % of net revenue grew from 12% in 2020 to 17% in 2021, while Sales and marketing expenses as % of net revenue from 5% in 2020 to 9% in 2021. It might seem like a negative trend, but if you think about the gross margins that Coinbase earns on its revenue then you can find a lot of positives in these numbers. Just think about it, Coinbase earned a 74% margin on its Net revenue of $7.4 billion (100% minus 17% in Transaction expenses minus 9% in Sales and marketing expenses).

Coinbase guided for $4.25 - $5.25 billion in “Technology and development” and “General and administrative” expenses in 2022 (these two positions contributed $2.2 billion in expenses in 2021). The growth in the expenses is driven by the company’s plans to “hire 6,000 employees in 2022, largely technology & development teams to execute on product innovation, international expansion, platform scaling, and reliability”.

Coinbase management is delivering on their pre-IPO promise to invest heavily in the development during the down and up markets. Again, a reminder that these types of expenses are not driven by customer activity and are driven by the company’s hiring plans. Thus, the company is guiding for considerably higher expenses even if the trading volume, and thus, revenues, will be much lower than in 2021.

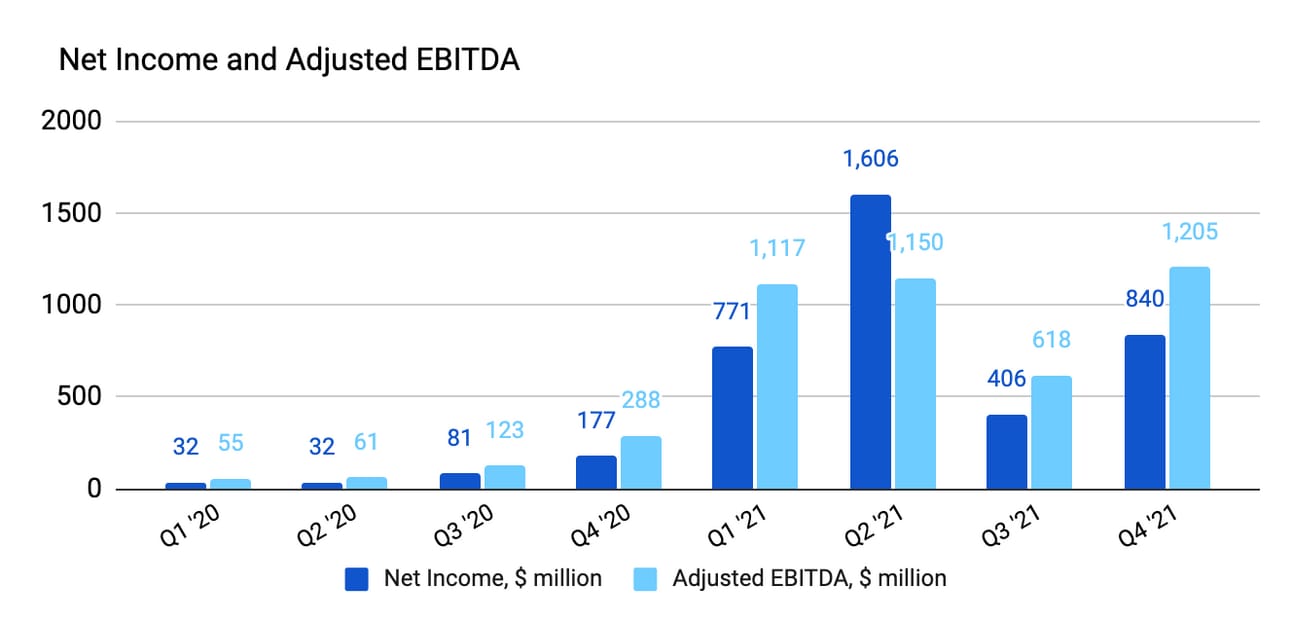

Net Income and Adjusted EBITDA

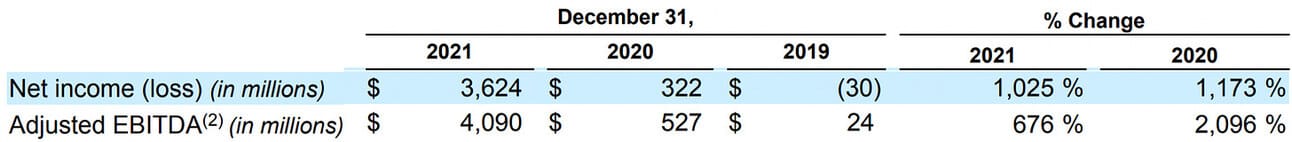

Coinbase reported a Net Income of $3.6 billion for the full year of 2021, up from $322 million in 2020. The management is using Adjusted EBITDA, a non-GAAP metric, as a measure of the company’s profitability. Thus, the company reported an Adjusted EBITDA of $4.1 billion for the full year of 2021, up from $527 million in 2020.

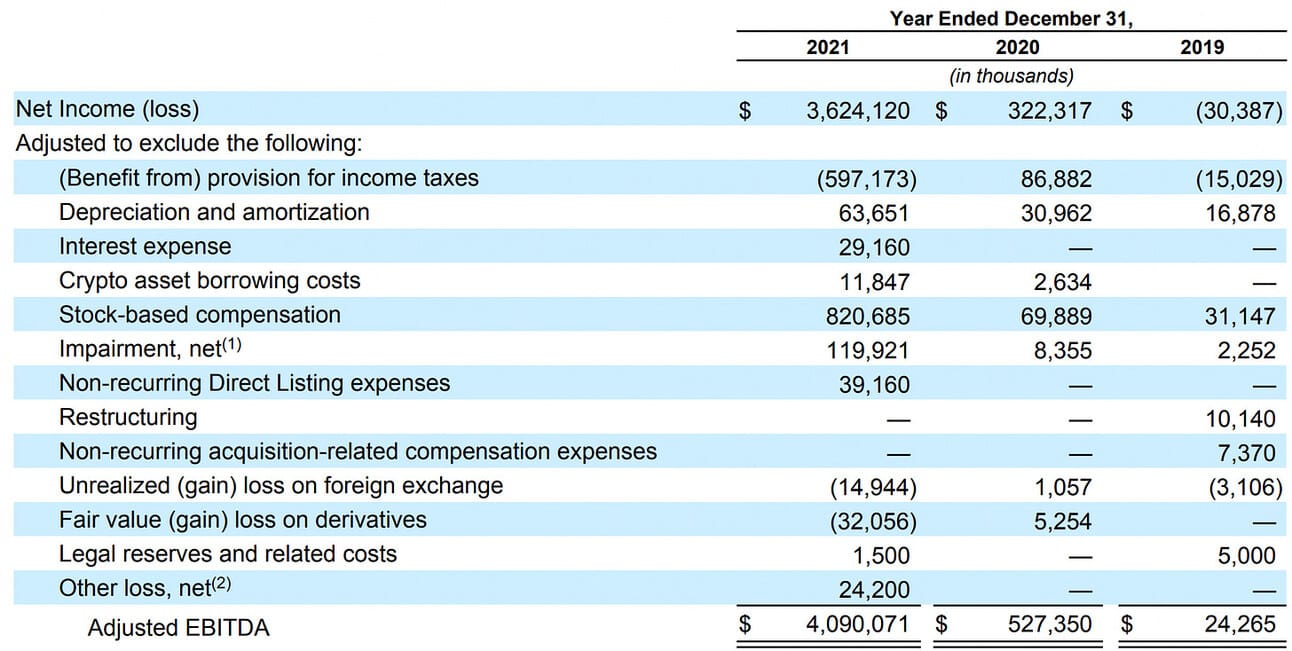

The Profit & Loss statement of Coinbase is quite straightforward, and the only confusing part is the “Benefit from the provision for income taxes” in 2021 (see below). As the company explains in its annual filing, this was a one-off event driven by the company going public in 2021 and becoming “entitled to a tax deduction for certain stock-based compensation equal to the difference between the fair market value of our common stock and the strike price, if any, at the date of inclusion in the grantee’s taxable income. These deductions were higher in 2021 than in prior periods as a result of an elevated amount of exercises and sales post our [IPO]”.

The difference between Net Income and Adjusted EBITDA is primarily driven by the adjustments for the above-mentioned benefit from the provision of income taxes (-$597 million), stock-based compensation (+$820 million), depreciation and amortization (+$63 million), as well as the loss made on the crypto assets held on the company’s balance sheet (+$119 million under “Impairment, net”), and a few one-off items related to the company going public (+$39 million).

As can be seen from the chart below, the company was able to deliver Net Income and positive Adjusted EBITDA in every quarter of both 2020 and 2021.

The company did not provide a 2022 guidance for Net Income or Adjusted EBITDA (again, because it is impossible to forecast customer trading activity and thus, the company’s revenues); however, they mentioned the readiness for “the [maximum] Adjusted EBITDA losses of $500 million on a full-year basis”. This means that the management is ready to stick to 2022 development plans (and $4.25 - $5.25 billion in Technology and G&A spend) even if the company delivers losses on much lower revenue.

Things to watch in 2022

Trading Activity. As mentioned above, even the management of the company is not comfortable forecasting this year’s revenue, which is driven primarily by customer activity. The company set the baseline for its expenses, but without meaningful forecasts of the revenue side, it is impossible to judge the company’s profitability going forward (meaning, don’t read much into the current P/E ratio).

New product launches. As mentioned in the text, Coinbase guided for $4.25-5.25 billion spend on Technology & Development and General & Administrative in 2022. That is a lot of money and a lot of people, so expect a lot of new product launches and experiments. In particular, I am interested if this investment will allow the company to grow its Subscription and service revenues, which are more prone to market cycles.

International expansion. As mentioned above, Coinbase is available for customers in over 100 countries. However, it is yet to prove it can successfully compete outside of the United States. It has a lot of financial and human resources to put up the fight against smaller local players, but will it be able to win customers away from Binance, Kraken and FTX is still a question.

Acquisitions. Coinbase ended last year with over $7 billion in cash and cash equivalents, and, given a highly profitable business, will keep printing more of it in 2022. I’d guess they might put that to work to expedite the growth, especially, internationally.

Coinbase will announce Q1 2022 financial results on May 10, 2022, so subscribe to the Popular Fintech newsletter for updates!

Source of the data used above: Investor Relations

Disclosure & Disclaimer: despite rocky performance in 2021 and early 2022, I have open positions in most of the companies covered in this newsletter, as I am extremely bullish on the transformation in the financial services industry. However, none of the above is financial advice, and you should do your research.