Hey!

Last year Square experienced a two-day outage, which affected small business owners' ability to accept customer payments. Jack Dorsey, the company’s co-founder, decided that it was time for him to come back and fix things at Square.

There was a lot of excitement about Dorsey’s return, and many were quick to throw the previous Square’s leader, Alyssa Henry, under the bus for “mismanaging” the company. Jack Dorsey dismissed the company’s priorities, announced just a year earlier at Block’s Investor Day, and set a new direction.

Unfortunately, almost a year after his return, things are still looking pretty ugly. In the second quarter of 2024, Toast and Clover delivered 27% YoY and 28% YoY revenue growth respectively. Square’s revenue grew just 9% YoY. So today, I decided to take a look at the company’s progress under Dorsey’s leadership…and if he made the right call to change the company’s priorities.

Enjoy and, as always, happy to hear your feedback!

Jevgenijs

p.s. if you have feedback just reply to this email or ping me on X/Twitter

In September 2023, Square experienced a two-day outage that disrupted its services and affected small business owners' ability to process payments. A few days later, Block announced that Alyssa Henry, then the CEO of Square, would step down from her role, and the company’s founder, Jack Dorsey would take over her responsibilities.

In Q3 2023 Shareholder Letter (the first letter published since the leadership change), Jack Dorsey wrote that there had been “a number of things holding the company back”, but he still believed that Square would prove to be Block’s “superpower, with major unlocks arriving in 2024”.

“I believe there have been a number of things holding Square back, some structural, some cultural, all of which can be addressed through stronger and more opinionated prioritization and week-on-week fast iteration.”

Jack Dorsey, Block’s Q3 2023 Shareholder Letter

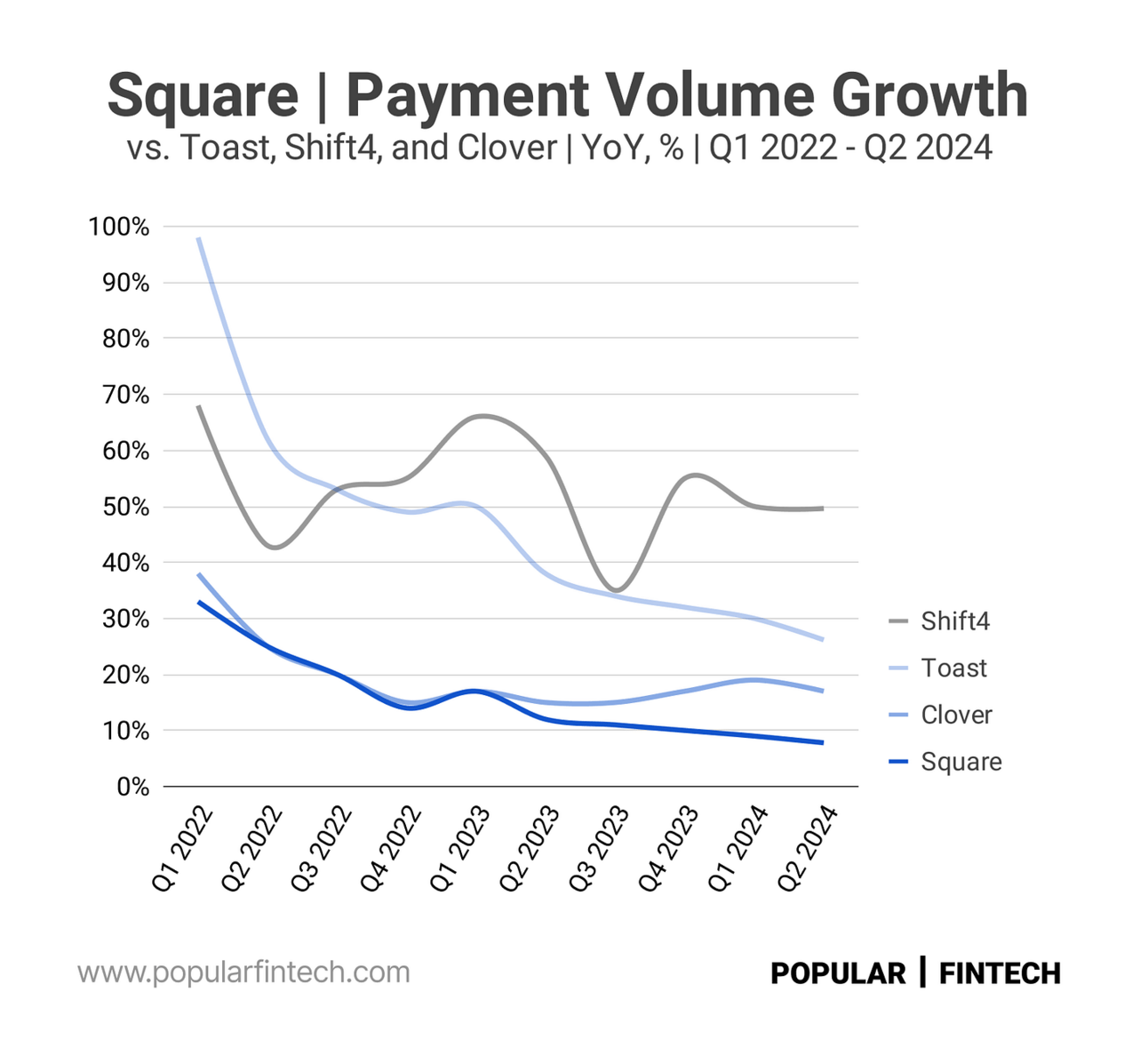

It is August 2024 as I write this, and almost a year has passed since Jack Dorsey took over Square. Unfortunately, Square performance continues to deteriorate. Thus, in Q2 2024, the company’s Gross Payment Volume increased 7.8% YoY, while revenue increased 9.3% YoY. As you can see from the chart below, the trend is not pretty.

What’s even more painful to watch, is Square performance compared to its competitors. Thus, in Q2 2024, Shift4, Toast, and Clover delivered 50% YoY, 26% YoY, and 17% YoY payment volume growth respectively. The difference in growth rates is not related to a difference in scale. In Q2 2023, Clover processed more payments than Square ($78 billion vs. $58 billion), while Toast and Shift4 are approaching Square’s scale ($41 billion and $40 billion respectively).

Square competitors have also reported 30%-ish YoY revenue growth for the quarter (x3 Square’s growth rate). I can also add a chart on gross profit growth, but I hope you get the point. Square is growing much slower than its competitors, and its growth is decelerating.

But back to Jack Dorsey’s return…. During the company’s 2022 Investor Day, Alyssa Henry defined Square’s priorities as omnichannel software (meaning growing with sellers that have both, in-person and online, footprints), going global, and growing upmarket.

“We are focused on 3 strategic priorities. First, omnichannel software. We want to help sellers make the sale no matter where their buyers are. Second, global expansion. While commerce is different around the globe, all sellers face similar challenges. Third, growing upmarket. We already serve a growing number of larger sellers and expect that growth to continue.”

Alyssa Henry, Block’s 2022 Investor Day

Jack Dorsey threw away the priorities discussed at the Investor Day and defined new four areas of focus for Square: a rock solid and flexible multi-vertical platform, providing a “local” experience to sellers of all sizes, growing with AI, and banking on Square.”

I started thinking, that perhaps, the leadership change and the change in priorities might have contributed to Square’s continued underperformance. Let’s take a look at how the company progressed in these new priorities.

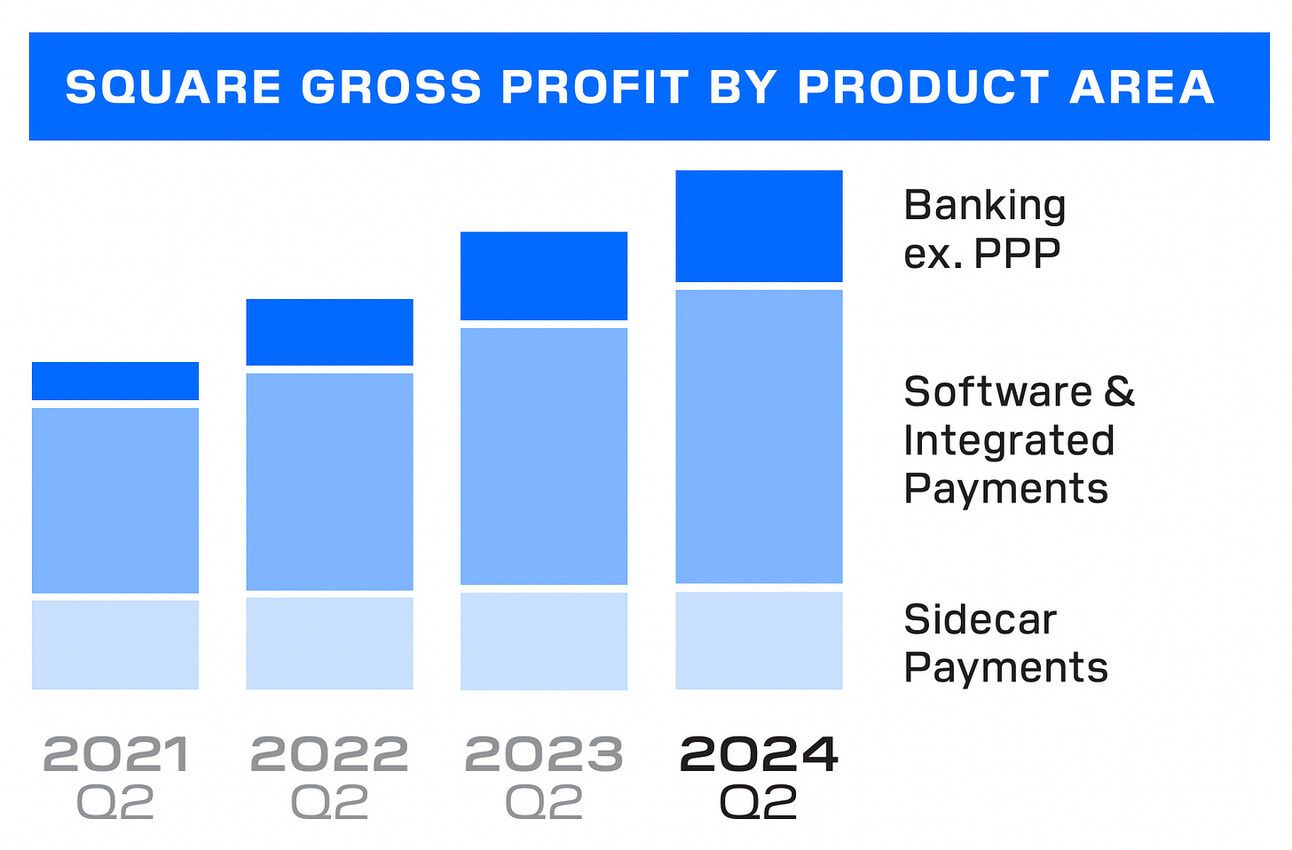

I wrote about “banking on Square”, earlier this year, but, in short, it indeed, as Jack Dorsey envisioned back in 2023, turned into a growth driver for Square. Thus, in Q2 2024, gross profit from Square’s banking products grew 27% YoY. Square originated more small business loans than Chase ($1.45 billion vs. $1.31 billion), and banking now contributes 23% of Square’s gross profit.

“Strength in banking gross profit was driven by continued strong demand for loans and our ability to find opportunities to deliver lending solutions to our customers while maintaining underwriting discipline.”

Block Q2 2024 Shareholder Letter

The “growing with AI” priority meant using AI to increase Square’s developer productivity, as well as to give merchants new tools. Since then, Square has launched a set of new AI-powered features every quarter, ranging from generating product descriptions and menus to building custom websites. Did it help with payment volume or revenue growth? Probably not (at least not directly), but it was 2023, and you just had to launch something with AI.

To be honest, the “local experience to sellers of all sizes” priority wasn’t really clear to me at the time (and still isn’t). Jack Dorsey mentioned that the company was going to “better prioritize its vertical outreach to sellers that are inherently local, such as restaurants and services.” I believe this meant a focus on two verticals, restaurants and services, which was a major deviation from the previous focus on omnichannel merchants.

I believe it is fair to conclude that Square's vertical (and “local”) outreach didn’t improve the trajectory. And thus, Jack Dorsey dedicated the Q2 2024 Shareholder Letter to Square’s go-to-market strategy. The company doubled down on distribution partnerships, as well as appointed Nick Molnar, co-founder and CEO of Afterpay, “to lead a centralized sales function across Block, inclusive of Square.”

“Nick will focus immediately on raising the performance bar of the Square team, continuing to hire across inbound and outbound sales, building out our field sales strategy and team, strengthening our sales motion.”

Jack Dorsey, Block’s Q2 2024 Shareholder Letter

Finally, given the outage incident, it was logical to highlight the focus on building “a rock solid platform”. However, I think Jack Dorsey meant more than “fix the platform to avoid further outages.” Thus, he highlighted that increasing the reliability of the platform would increase Square's “overall agility and development speed”, and benefit both, internal teams and the ecosystem of third-party developers building on top of Square’s platform.

In Q4 2023 Shareholder Letter, Jack Dorsey announced a reorganization of Square around functions, with the ambition to elevate engineering and design. The company also brought back Robert Andersen, Square’s first designer, to make “design at Square world-class again.”

“We’re reorganizing the people in Square back to a simple Engineering/ Product/ Design/ Sales structure. The past organizational structure was holding us back, slowing us down, and weakening our skills. I want Square to be a leader in engineering and design again.

Jack Dorsey, Block’s Q4 2023 Shareholder Letter

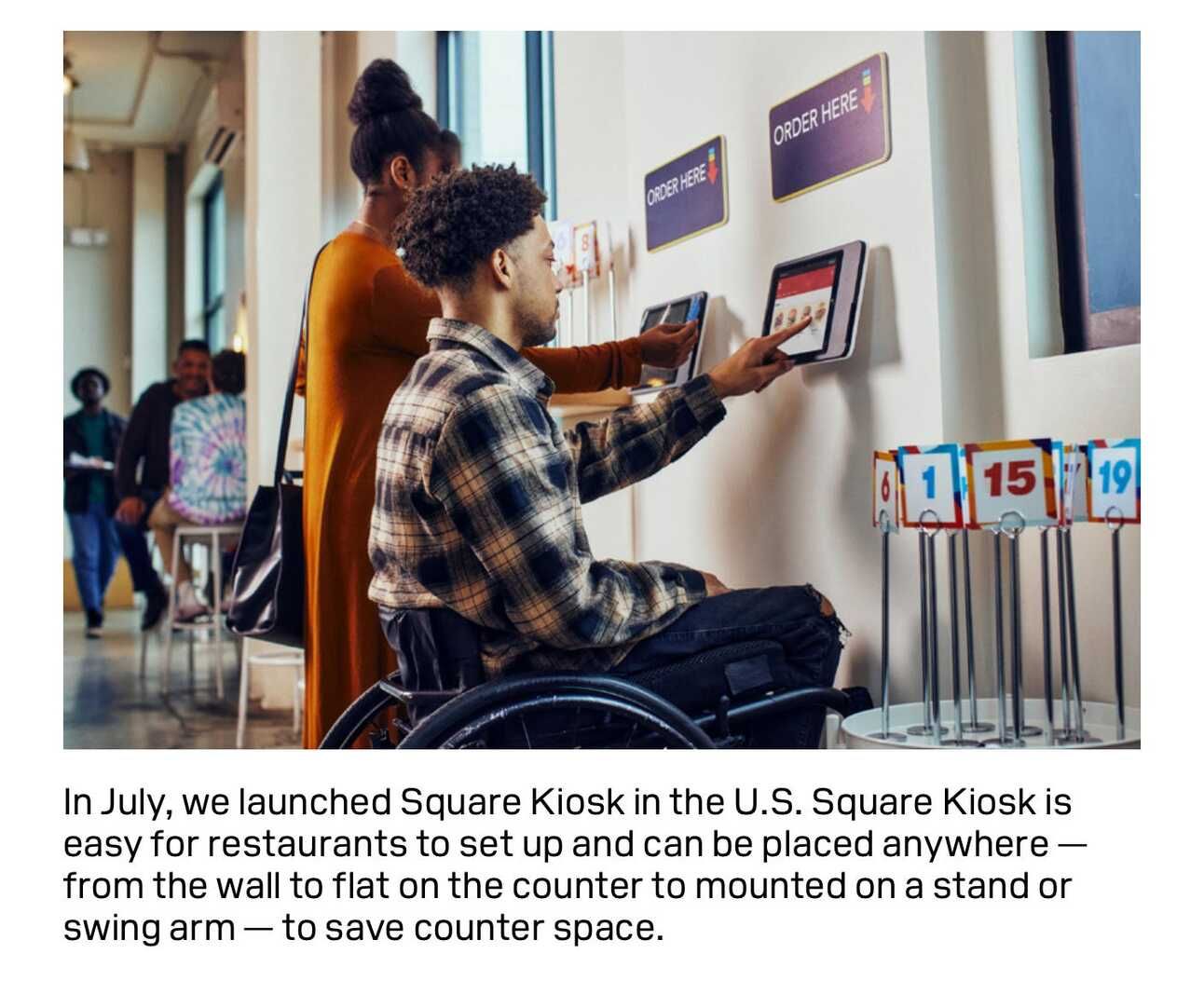

He also set an ambition to consolidate all Square apps into a single app (Square has multiple apps, such as Square Point of Sale, Square Restaurants, Square Kiosk, etc.), as well as improve the self-service onboarding of merchants. The ambition was to simplify the discovery and onboarding of merchants to Square’s ecosystem.

“Our new onboarding platform was completed in July and is now rolling out to eligible sellers in the US. The new onboarding process is simpler, reducing the number of steps required to onboard onto Square from more than 30 to only 4.”

Jack Dorsey, Block’s Q2 2024 Shareholder Letter

A lot has been done since Jack Dorsey took over to simplify Square’s platform and increase “agility and development speed.” The company is shipping new products (e.g. Square Kiosk), and continues to improve the existing ones (e.g. integrating Square Kitchen Display System with the Retail Point of Sale). I want to trust the process, but still, so far the promised “unlocks” are difficult to see (at least in the revenue or payment volume growth rates).

In summary, out of the 4 priorities, that Jack Dorsey announced after his return, only one contributed to growth acceleration. In the meantime… In Q2 2024, Square’s payment volume in international markets increased 19% YoY (compared to 6% YoY in the U.S.). Gross profit in markets outside the U.S. increased 34% YoY (compared to 12% YoY in the U.S.).

“Square GPV in our U.S. market grew 6% year over year, and Square GPV in our international markets grew 19% year over year, or 22% year over year on a constant currency basis.”

Block’s Q2 2024 Shareholder Letter

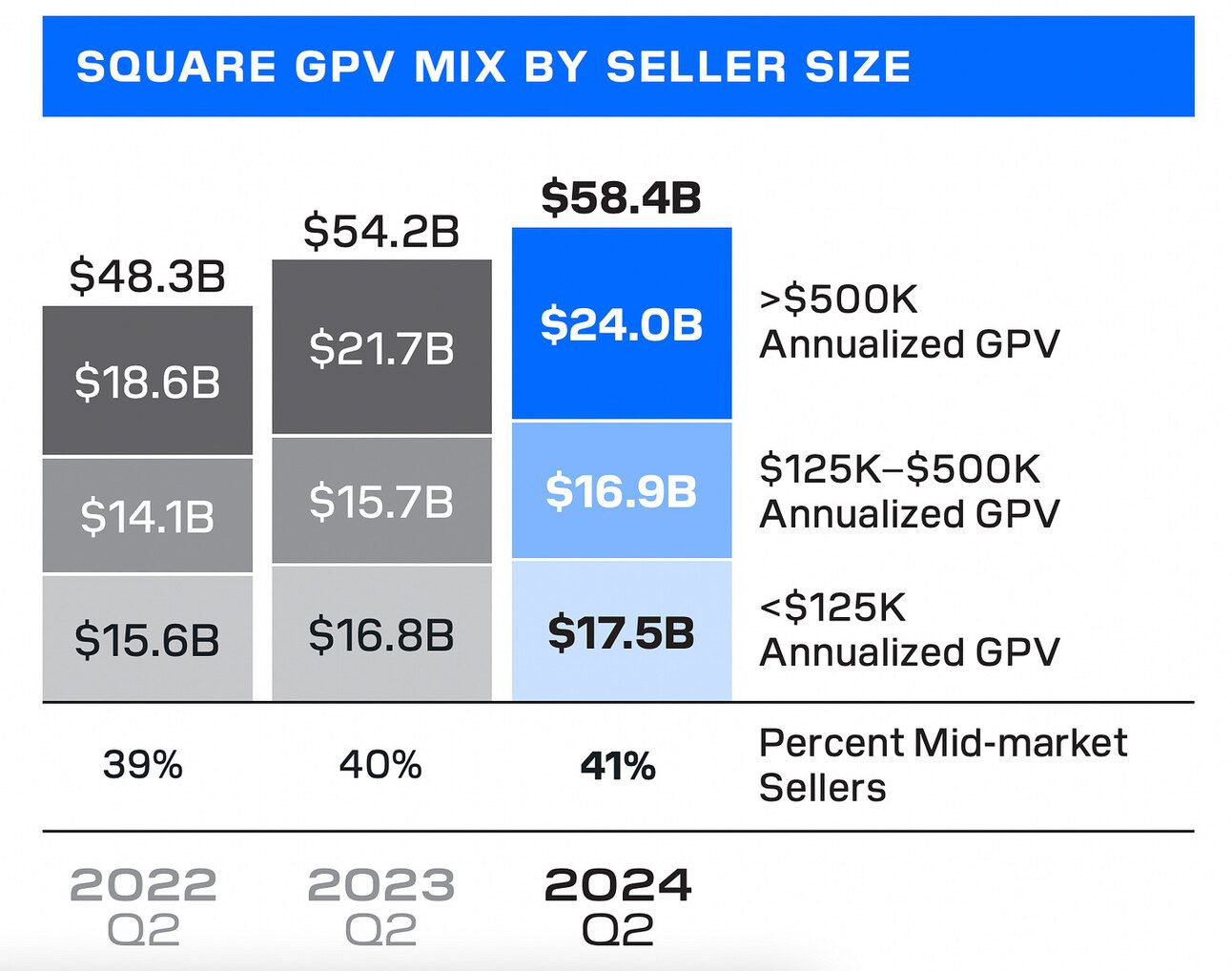

and…payment volume from midmarket sellers increased 10.6% YoY, while payment volume from small merchants (<125K in annualized GPV) increased 4.2% YoY. Also, payment volume from online channels was up 10% YoY.

This made me think, that, perhaps, “omnichannel software, go global, and grow upmarket” were absolutely right priorities for Square. Just imagine if these remained the company’s priorities, instead of “rock solid platform, local experience to sellers, and growing with AI.”…

So…(and please don’t hate me for saying this) could it be that Jack Dorsey brought unnecessary disruption to Square’s direction? Perhaps, he should have just let the team execute on the priorities set during the company’s 2022 Investor Day. He could have added banking to the previous list, “Go Global. Grow Upmarket. Bank Sellers.", and let the team cook.

Or am I just being too impatient in my judgement?

Cover image source: Square

Disclaimer: Information contained in this newsletter is intended for educational and informational purposes only and should not be considered financial advice. You should do your own research or seek professional advice before making any investment decisions.