Hello!

The bear thesis for Square is that it has fallen behind the competition (think Clover, Toast, and Shift4) on pretty much every metric, including payment volume, revenue, and gross profit growth. However, there is a bright spot in Square’s story - banking.

Thus, according to the latest Shareholder Letter, “gross profit from our banking products, which primarily include Square Loans, Instant Transfer, and Square Debit Card, grew 36% year over year.” For what it’s worth, Square issues more small business loans than Chase!

Intrigued by this opportunity, I decided to research business banking in the U.S. Today’s letter is my attempt to understand and size the opportunity in servicing small businesses. Square is competing with the giants, namely, Chase and American Express. It won’t be easy, but…wasn’t it the whole premise of Fintech, to replace the incumbents?

Hope you enjoy today’s letter (which certainly won’t be my last on the topic)!

Jevgenijsp.s. have feedback? reply to this email and find me on Twitter/X

Square has fallen behind the competition on both TPV, revenue, and gross profit growth. Thus, In Q1 2024, the company reported a 9% YoY growth in TPV…

…and an 11% growth in revenue, which is considerably lower than the growth numbers reported by Clover, Toast, and Shift4.

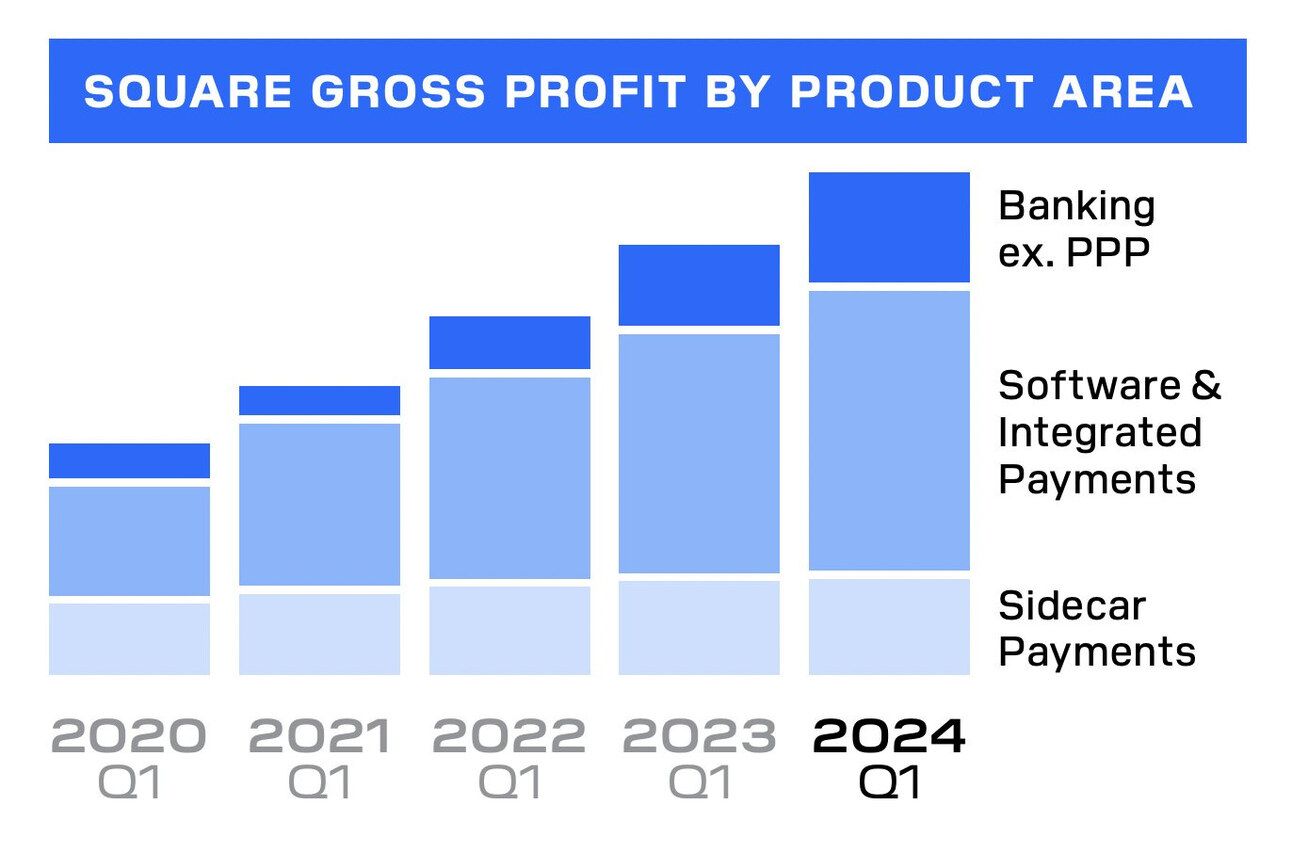

Gross profit grew 19% YoY to $820 million, compared to 25% YoY for Shift4 and 43% for Toast (Fiserv does not disclose gross profit numbers for Clover). However, inside of it, gross profit from Square’s banking products, increased 36% YoY to $190 million.

"Gross profit from our banking products, which primarily include Square Loans, Instant Transfer, and Square Debit Card, [ was $190 million and ] grew 36% year over year.

Block’s Q1 2024 Shareholder Letter

In Q1 2024, Banking products contributed 23% to the company’s total gross profit, up from 17% in Q1 2020 and 11% in Q1 2021. Banking products have a similar contribution to Square’s gross profit outside of the U.S. Thus, in Q4 2023 banking products represented 20% of the international gross profit pool.

So what is Square Banking? Square offers checking accounts (provided by Sutton Bank), high-yield savings accounts (provided by Block’s industrial loan company, Square Financial Services), debit cards (Mastercard), credit cards (American Express), small business loans, instant transfers, and Bill Pay.

“We see a growing opportunity for banking with and on Square, and are surfacing it as one of our top priorities. We’ve come a long way since introducing Square Capital. We now have a number of financial tools in the market to help sellers with cash flow and purchasing, including Loans, Debit Card, Credit Card, Checking, Savings, and Bill Pay.”

Block’s Q3 2023 Shareholder Letter

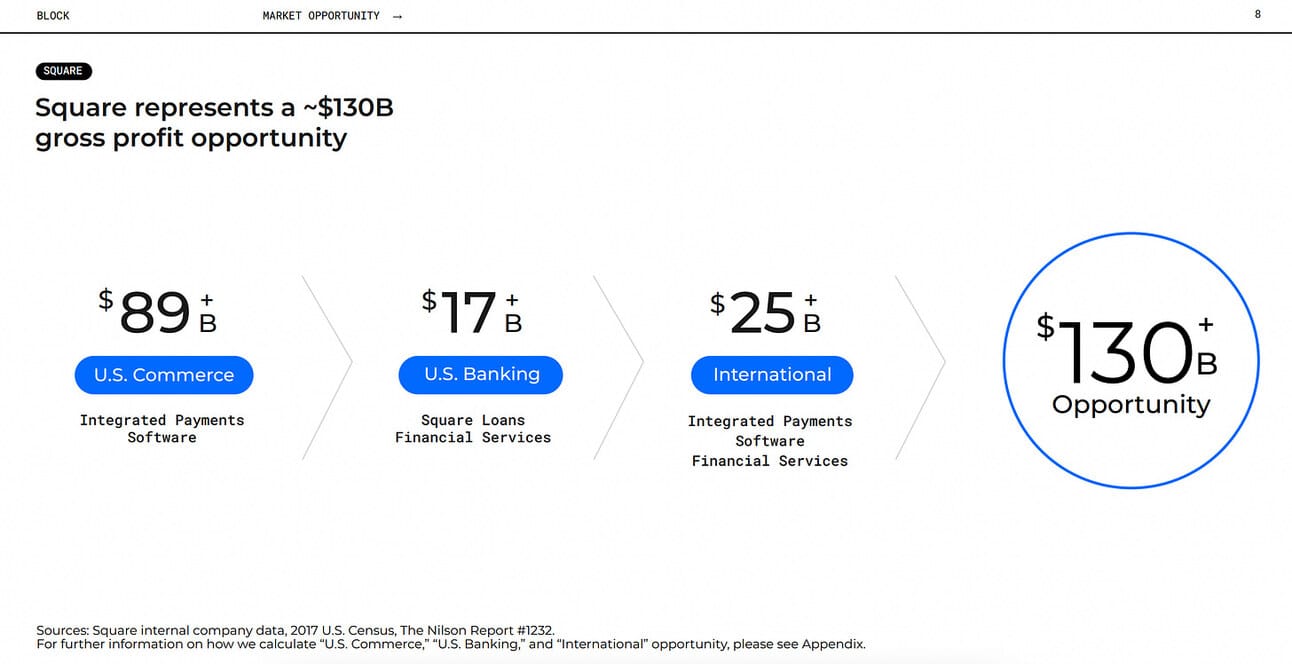

How big is this opportunity? Square estimates that banking represents a $17 billion gross profit opportunity in the U.S. alone, which compares to the $89 billion gross profit opportunity from integrated payments and software. In addition, the company estimates a $25 billion gross profit pool in its international markets (the number includes payments, software, and banking).

McKinsey, in turn, estimates that small business banking in the U.S. represents a $150 billion revenue opportunity. This is about 17% of the total U.S. banking revenue pool.

We estimate that small-business banking represents about $150 billion in annual revenue for the US banking industry across all products - deposits, loans, cards, cash management, and merchant services. That is about 17% of the US banking industry as a whole.

I would assume that McKinsey operates with net revenue (e.g. net interest income), which is comparable to the gross profit that Square uses in its estimate. Square’s estimate of the opportunity is smaller ($89 billion + $17 billion = $106 billion) because it excludes a number of products that McKinsey does include (e.g. deposits), as well as narrows the estimate to the industries that it serves.

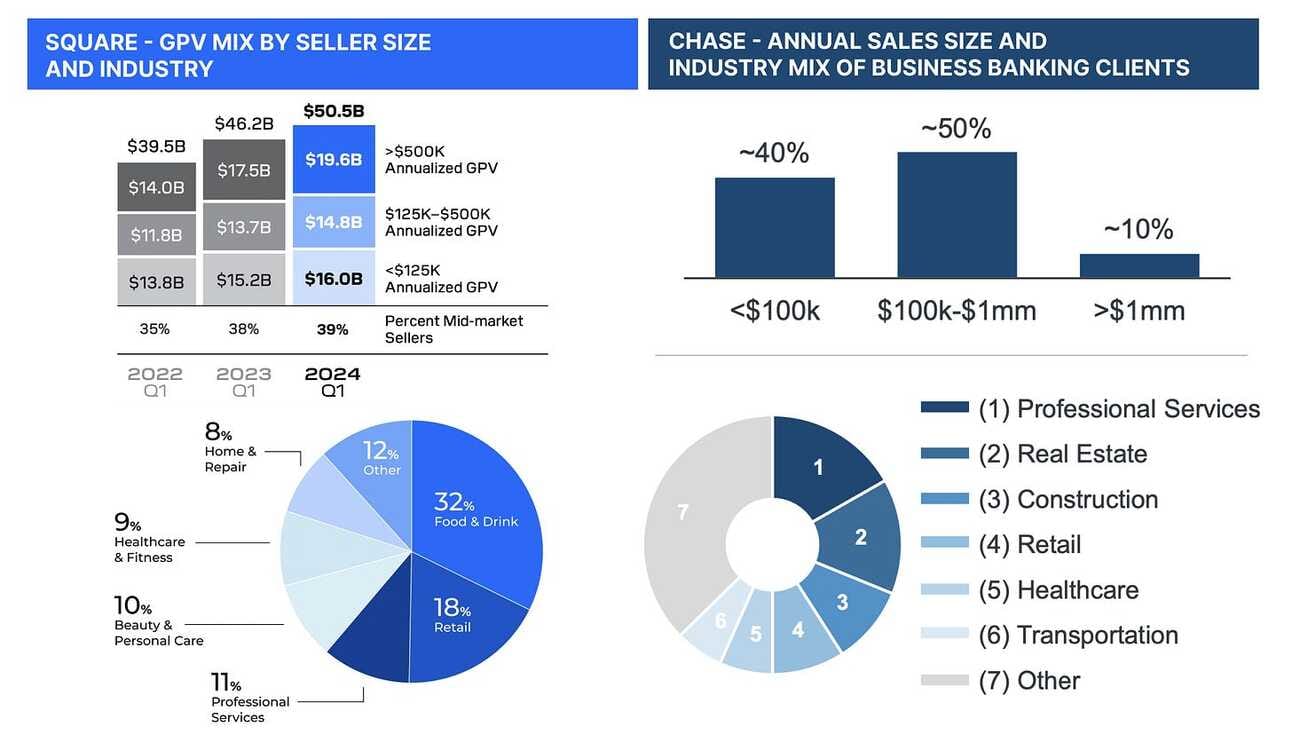

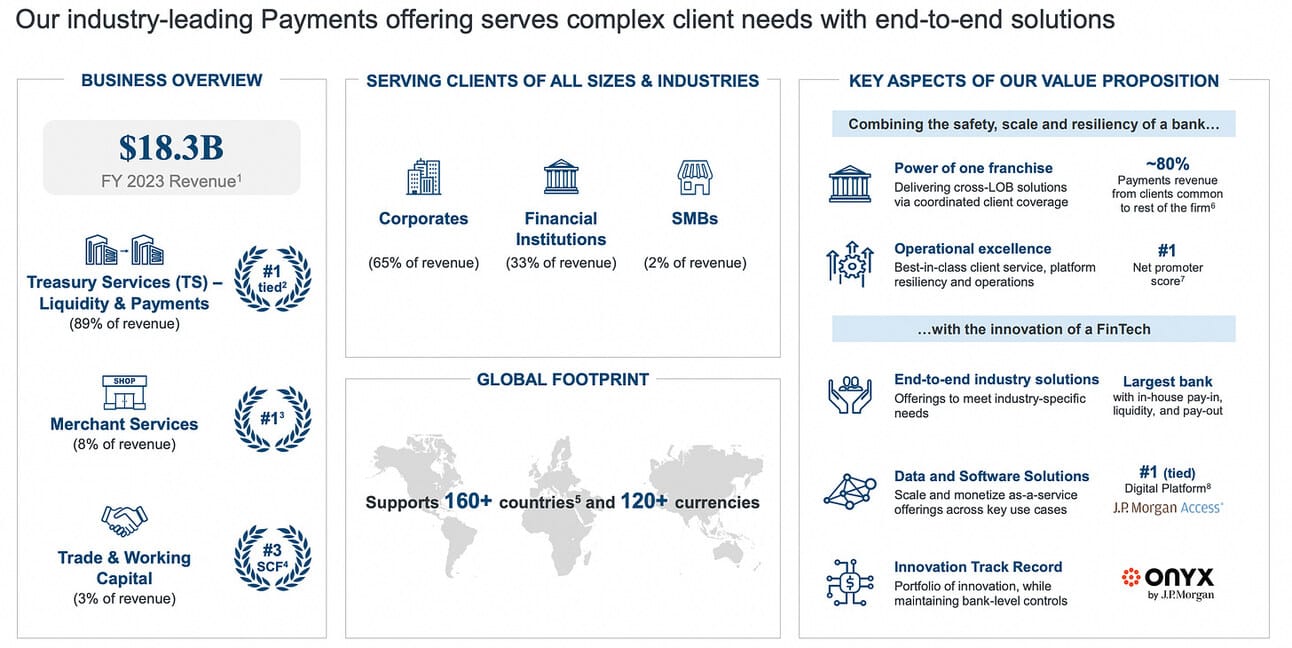

Who’s currently serving this customer segment? Not surprisingly, the leader in the market is Chase. Thus, Chase claims to be “the #1 in small business primary bank share with 9.5% of a fragmented market.” The company also boasts of being #1 in merchant services for small businesses and #2 in small business card spend (see the slide below from JPMorgan Investor Day 2023).

While presenting Chase for Business at the Investor Day 2023, JPMorgan grouped its products into three categories: banking and cash management (accounts, Bill Pay, Zelle), credit cards and lending, and merchant services. Square’s checking accounts are provided by Sutton Bank; however, from the clients’ perspective Square offering is very similar (almost identical?) to Chase’s.

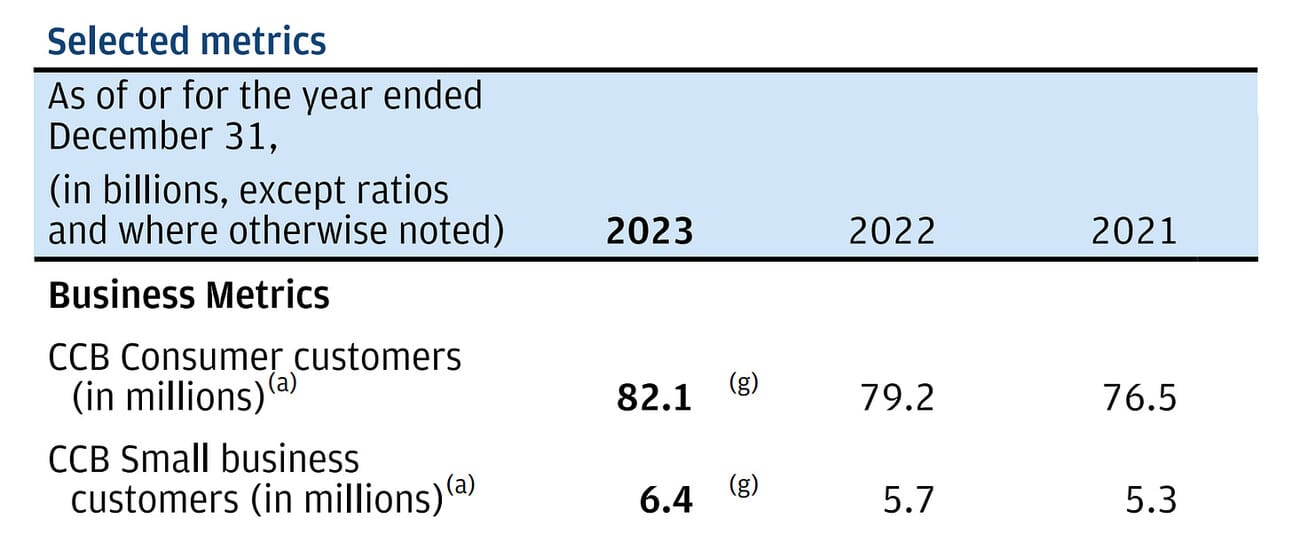

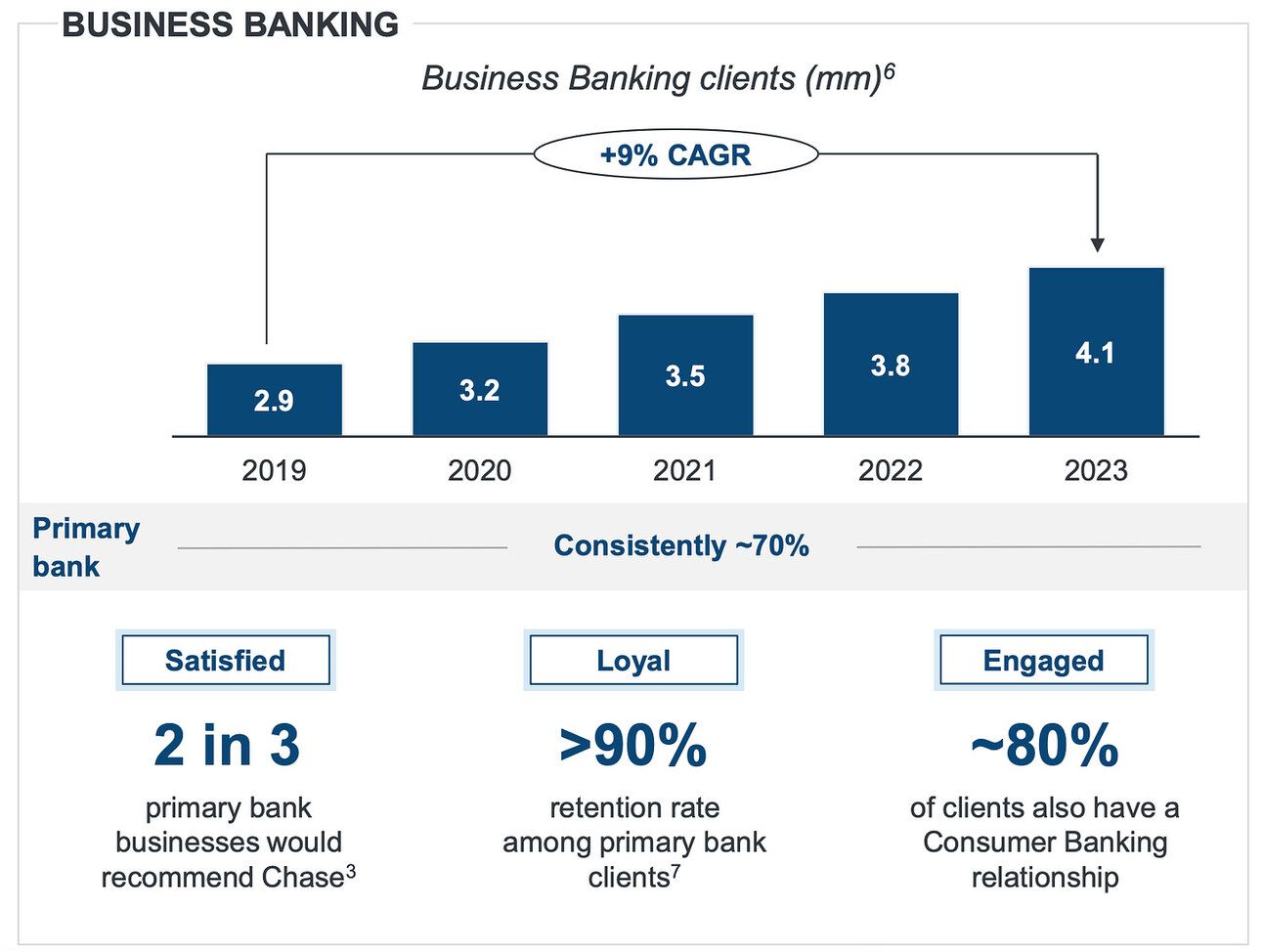

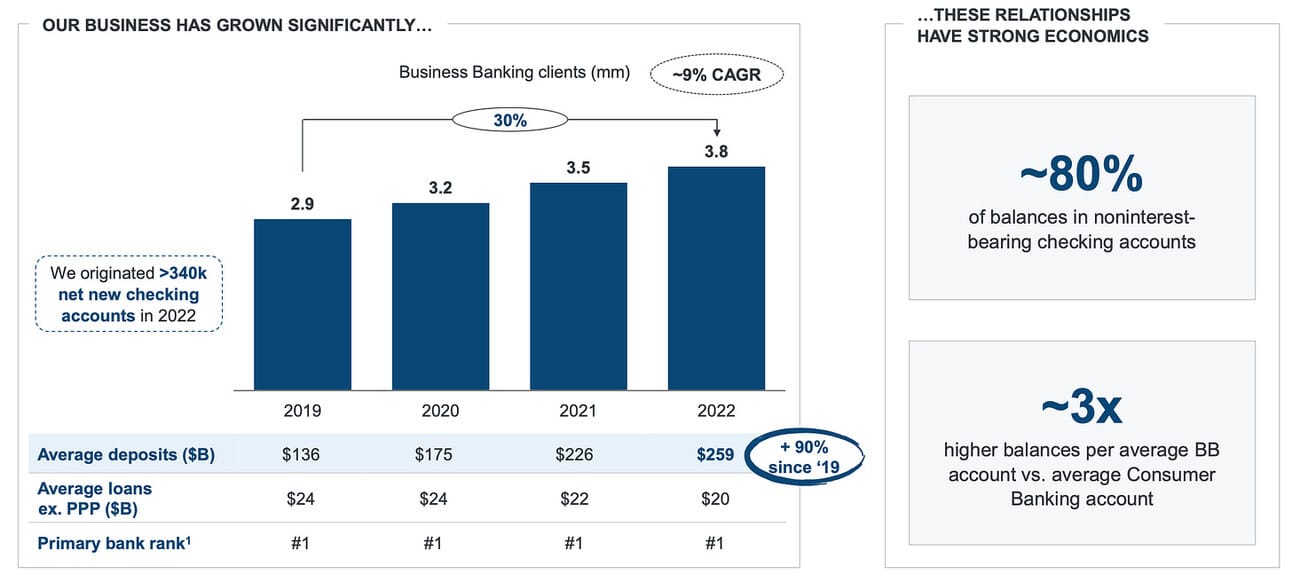

McKinsey estimates that “the United States is home to more than 30 million SMEs, representing 99% of the nation’s enterprises”. JPMorgan’s annual report discloses that the company had 6.4 million small business customers, a 13% YoY increase from 5.7% in 2022. JPMorgan also claims that it delivered a 9% annual growth in the number of small business customers since 2019.

When it comes to having checking and savings accounts (“Business Banking clients” on the chart below), Chase reported 4.1 million customers, suggesting that about 2.3 million customers use other bank’s products (e.g. merchant services) without having checking or savings account with the bank. Chase also claims that it is a primary bank for 70% of its account holders.

Square does not provide disclosures about the percentage of its clients using banking services, but its annual report states the company served “more than 4 million sellers in 2023”. Chase serves industries that Square doesn’t serve, such as real estate, construction, and transportation. If we exclude those, I would expect Square to have a comparable customer base to Chase.

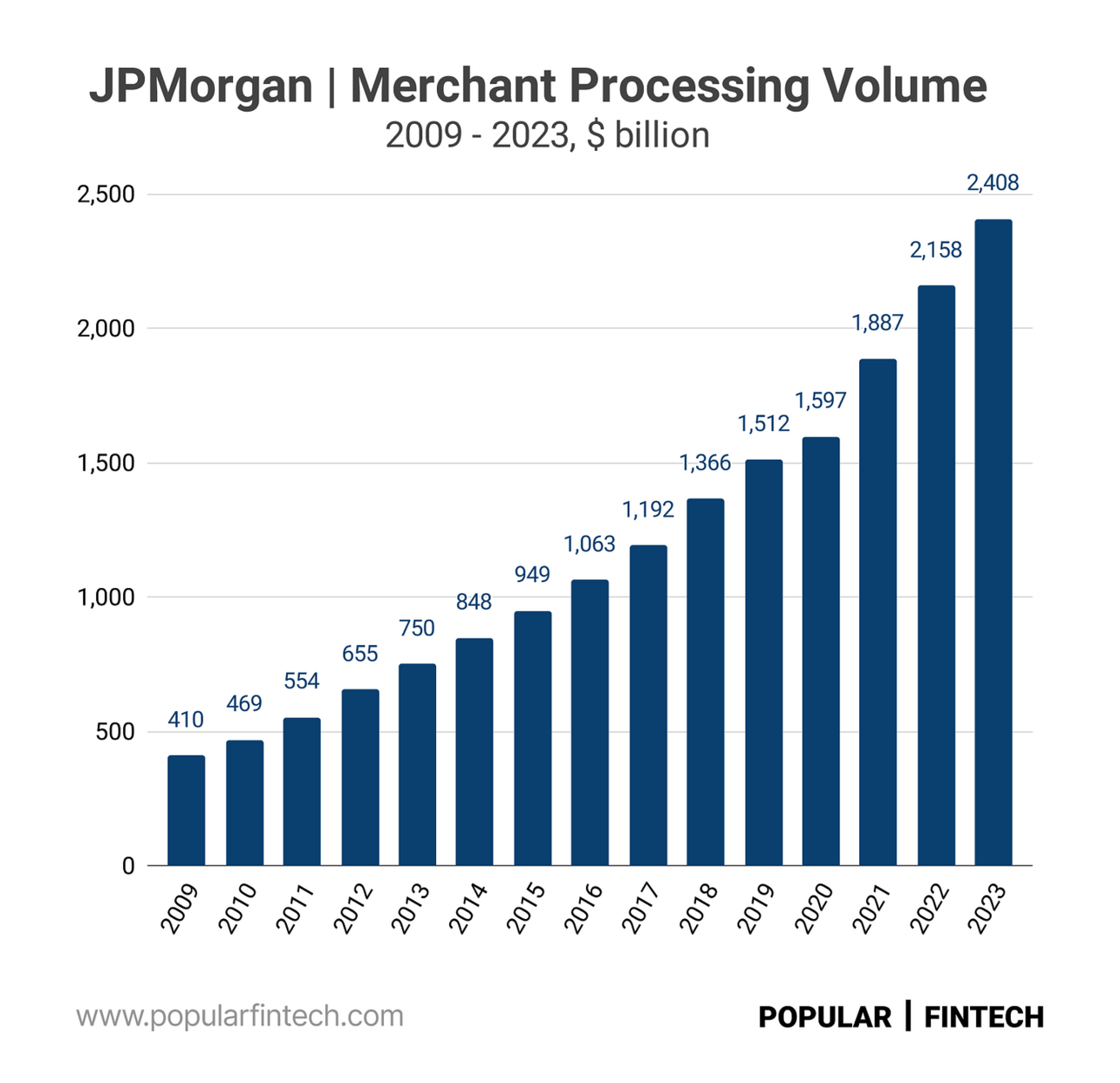

JPMorgan is one of the largest merchant acquirers in the United States. Thus, the company processed more than $1.4 trillion in merchant payments in 2023. Moreover, merchant acquiring is only a small part of JPMorgan’s payments franchise, as the bank provides a wide range of payment services for companies, other financial institutions, as well as governments, and claims to move $10 trillion a day.

Nevertheless, in 2023, small businesses generated only 2% (or $366 million) of JPMorgan’s total payments revenue (see the slide below). This includes merchant services, domestic and cross-border payments, and other cash management services. Square’s revenue in 2023 was $7.03 billion, and gross profit (which would be more comparable to JMorgan’s “net revenue”) was $3.13 billion.

Thus, I would conclude that when it comes to merchant services, Square is not really competing with Chase, and instead is competing with Toast, Clover, Shift4, and other non-bank players. The difference in revenue (given the comparable customer base) suggests that small businesses prefer specialized players over their primary bank. Not even sure why JPMorgan claimed to be the #1 payment provider for Business Banking clients.

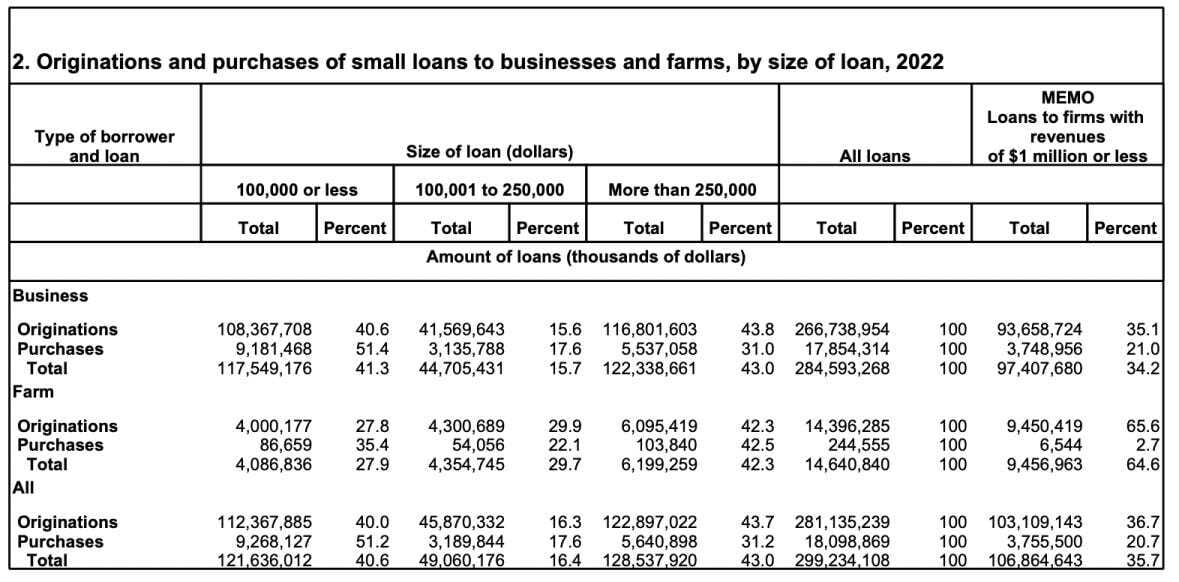

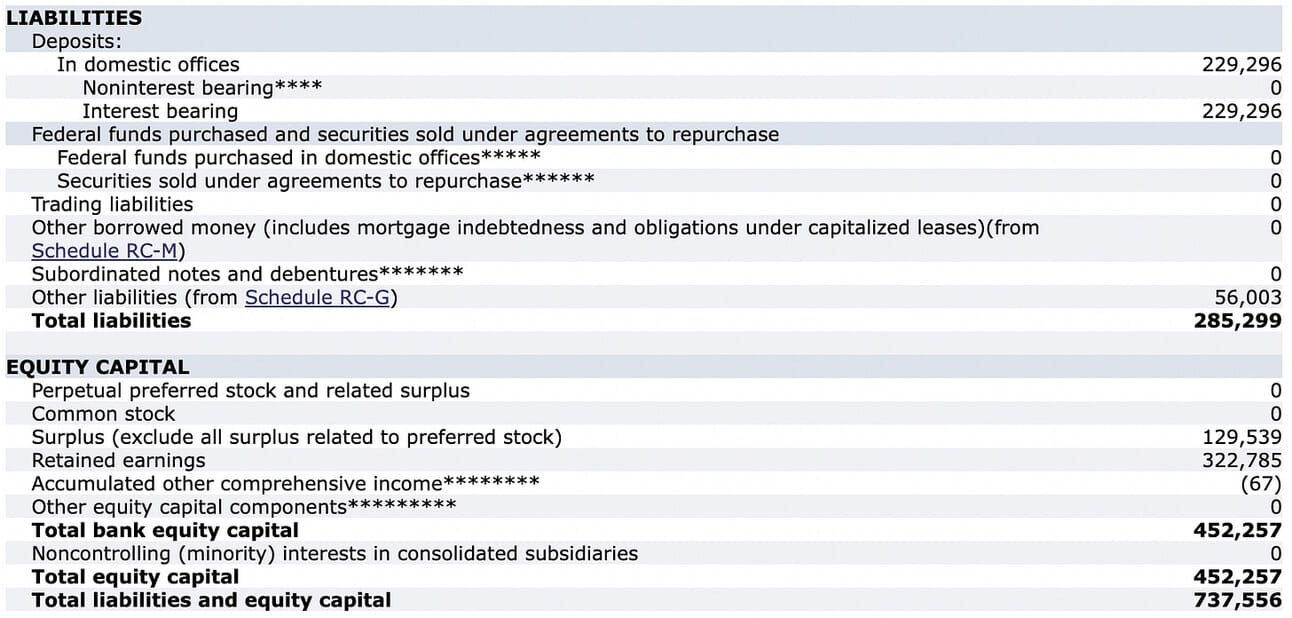

Let’s discuss small business lending. According to the FDIC data, in 2022, financial institutions issued $284.6 billion in “small loans” (loans of $1 million or less), of which $97.4 billion were issued to businesses with an annual revenue of $1 million or less (see the table below).

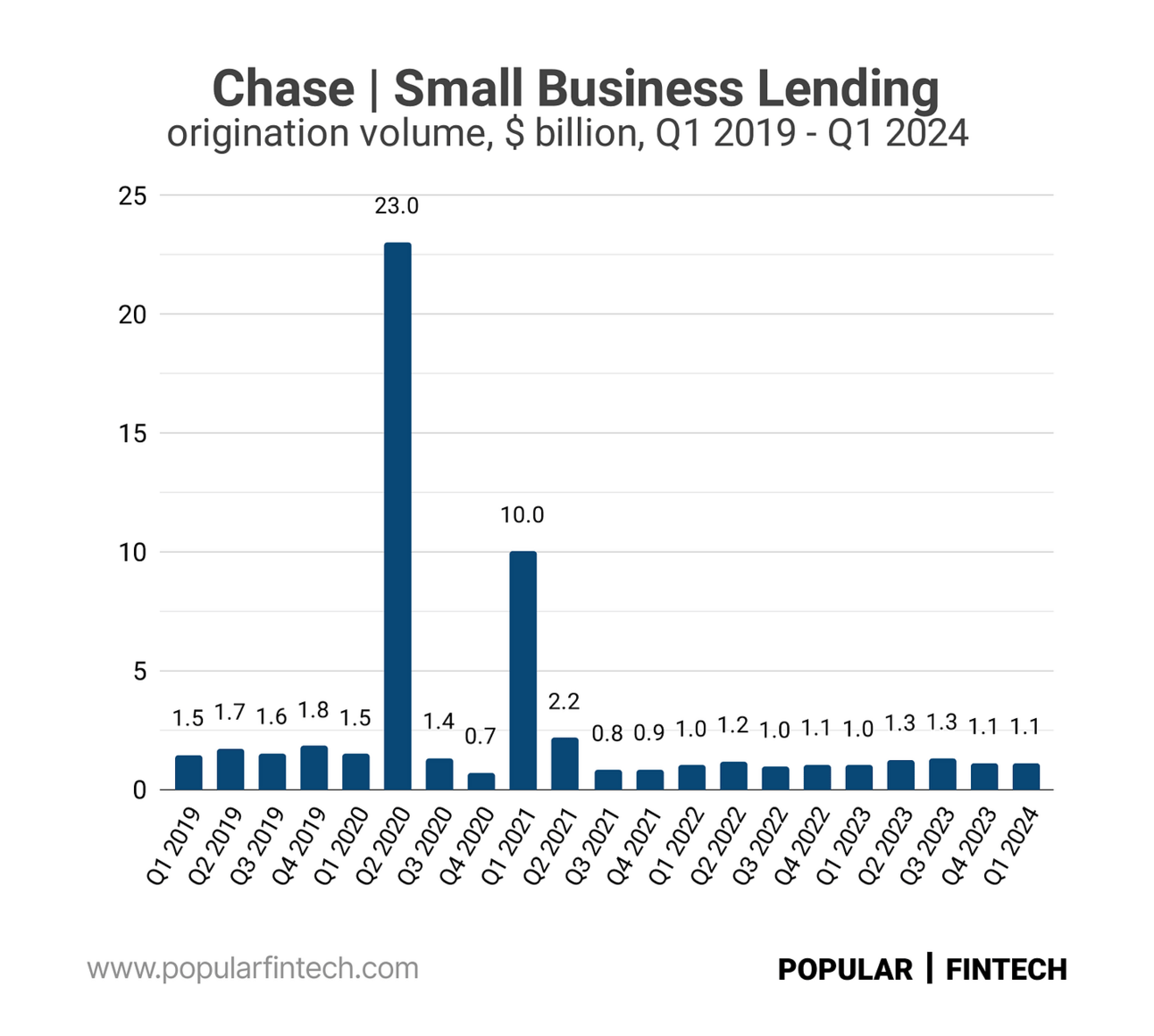

In 2023, Chase originated $4.7 billion in small business loans (around $1.2 billion per quarter) and had an average outstanding loan balance of $19.6 billion. Chase’s origination volume and the average loan balance, have been consistently declining for the past 5 years (please ignore Q2 2020 and Q1 2021 on the chart below - these are loans issued under the Paycheck Protection Program).

In Q1 2024, Square originated $1.32 billion in loans, up 17% from $1.13 billion a year ago. So Square is already originating more small business loans than Chase. and, apparently, has been originating more loans than Chase for at least a year.

We continue to find incremental opportunities to deliver lending solutions to our customers while maintaining underwriting discipline. Square Loans facilitated approximately 129,000 loans totaling $1.32 billion in originations, up 17% year over year."

Block’s Q1 2024 Shareholder Letter

In estimating its market opportunity in banking, Square’s management used loans of $250,000 or less (with $250,000 being the maximum loan amount for Square loans). Such loans represented $44.7 billion of originations in 2022 (as per the FDIC data above).

This means that Square has a meaningful runway in small business lending given its current annual run rate of $5.3 billion in originations. This is even more the case if large banks, such as Chase, continue to scale down lending, forcing small business owners to seek financing out of their primary bank.

“Since its public launch in May 2014, Square Loans has facilitated more than 2.2 million loans and advances, representing more than $16.2 billion in principal amount loaned or advanced. This includes approximately 150,000 loans to small businesses representing more than $1.5 billion of Paycheck Protection Program (“PPP”) loans facilitated in 2020 and 2021.”

Block’s 2023 Form 10-K

Now let’s discuss the opportunity behind Square cards. Thus, the Nilson Report estimates that “small business credit and debit, prepaid, purchasing, fleet and corporate commercial card products from the 95 largest US issuers generated a combined $1.269 trillion in purchase volume in 2023.”

The purchase volume with small business credit cards was $413 billion, and the purchase volume with small business debit cards was $246 billion.

The largest issuers were JPMorgan Chase ($229.21 billion), Bank of America ($193.00 billion), U.S. Bank ($104.92 billion), Wells Fargo ($104.09 billion), and Capital One ($89.87 billion).

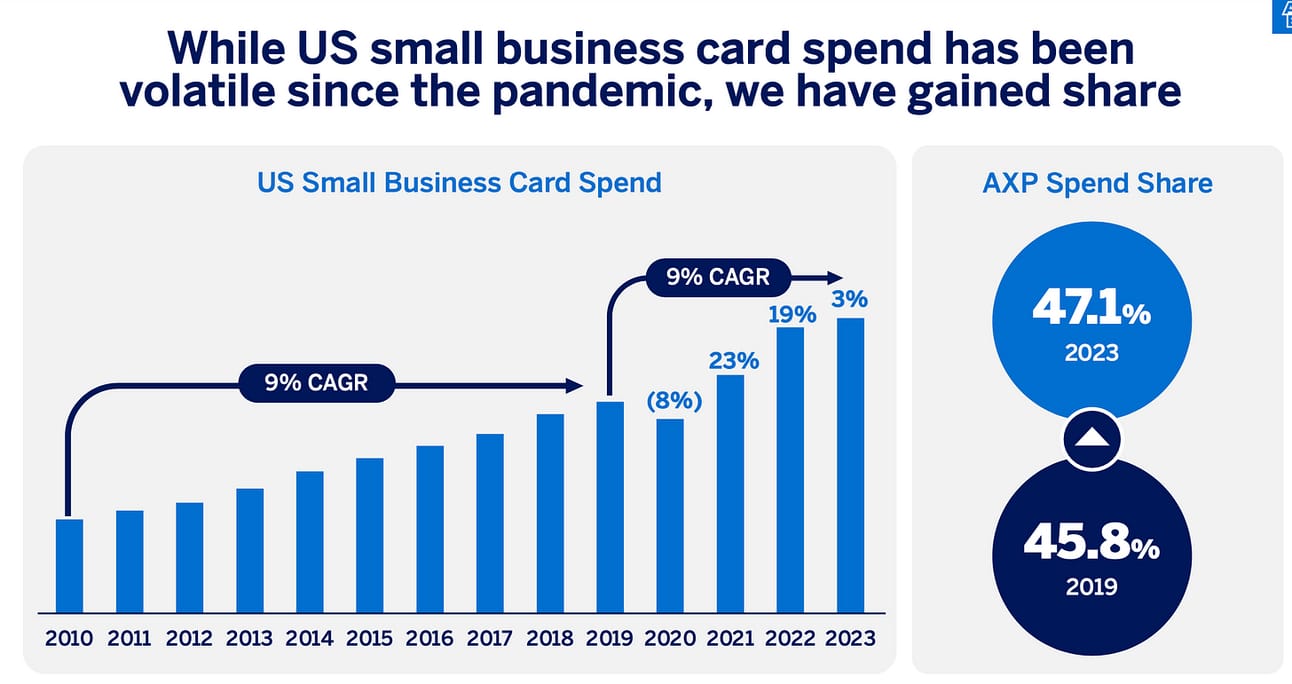

However, the Nilson Report estimates include only Visa and Mastercard-branded cards, and the largest issuer of small business cards is American Express. Thus, American Express claims to have a 47.1% share in overall small business card spend in 2023.

In 2023, American Express had 3.9 million small business customers in the U.S., which spent $427 billion with Amex cards. American Express reports U.S. small businesses within its Commercial Services segment, which in 2023 generated net revenue of $14.8 billion and pretax income of $2.86 billion. Small businesses generated 82% of the segment’s payment volume.

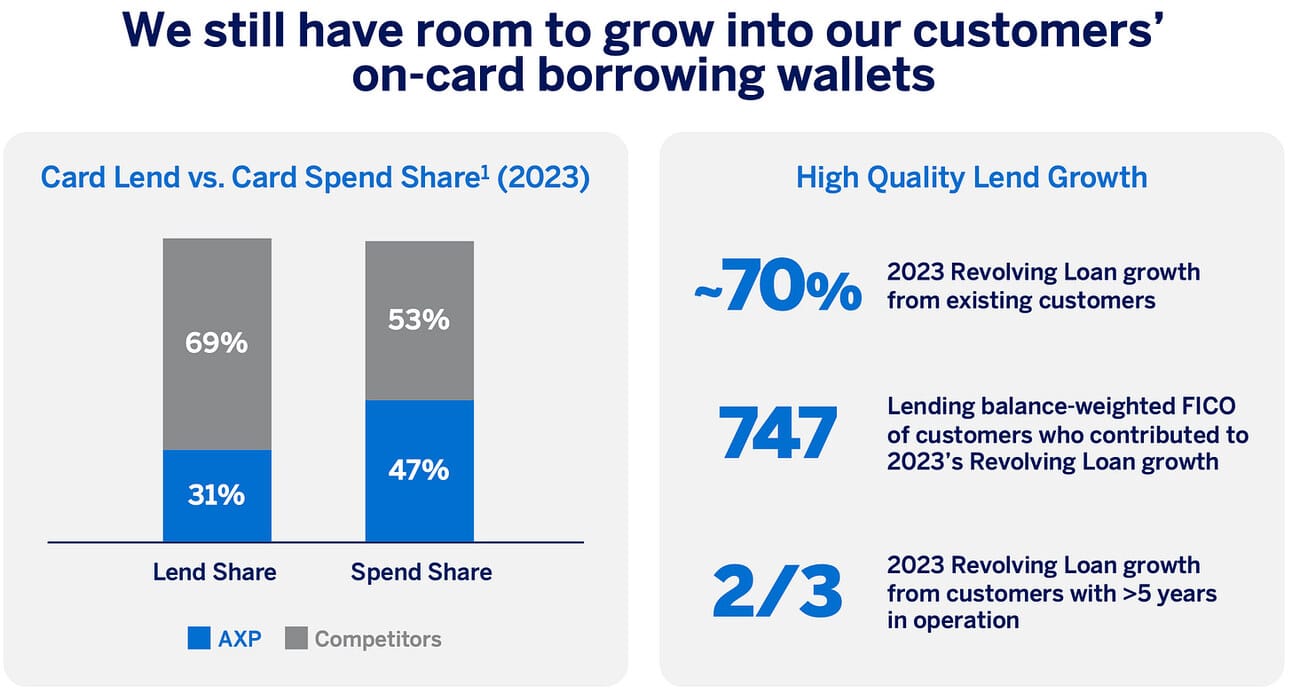

In addition, American Express estimates that, in 2023, they had a 31% share in small business card borrowing. The company’s Commercial Service segment had $23.9 billion in average loans in 2023, earning a 9.9% net interest yield. Based on this disclosure, I would assume that the total market is around $60-70 billion in card borrowing.

As mentioned earlier, Square offers both debit and credit cards, but does not provide disclosures on the number of cards or purchase volume. However, looking at Chase’s and American Express’ numbers, I would suggest that debit and credit cards provide the biggest untapped opportunity for Square banking. Can they compete with Chase and American Express? We’ll see.

Finally, let’s talk about deposits. Thus, in 2022, Chase’s business banking clients held $259 billion in deposits with the bank. Moreover, 80% of those deposits (account balances) were in non-interest-bearing checking accounts, meaning Chase paid nothing in interest.

I could not find how much Square’s clients held in their checking accounts (not even sure if this amount is reflected in Block’s financials since Sutton Bank provides the accounts). However, I would assume that the amount was modest, as otherwise, they would disclose it as a driver for banking gross profit.

I would expect Square to share the interest income that Sutton Bank earns on these funds. For example, Robinhood earned an annualized yield of 0.89% on the off-balance sheet cash sweep. As Square doesn’t pay interest on the funds held at checking accounts, they should earn more than Robinhood (which also pays 5% to their customers).

With respect to Square savings accounts, Square Financial Services financials suggest that at the end of Q1 2024, the company’s clients held $229 million in savings accounts. Not much.

Square sells most of the loans that it originates, so, at least until it decides to retain loans on its balance sheet, the company doesn’t need deposits for lending. However, Square could earn a yield by investing those deposits into short-term treasuries (as of this writing Square paid 1.75% APY, while 1-month treasury bills yielded 5.37%).

“We currently fund a majority of these loans from arrangements with institutional third-party investors who purchase these loans on a forward-flow basis, which mitigates our balance sheet and liquidity risk.”

Block’s 2023 Form 10-K

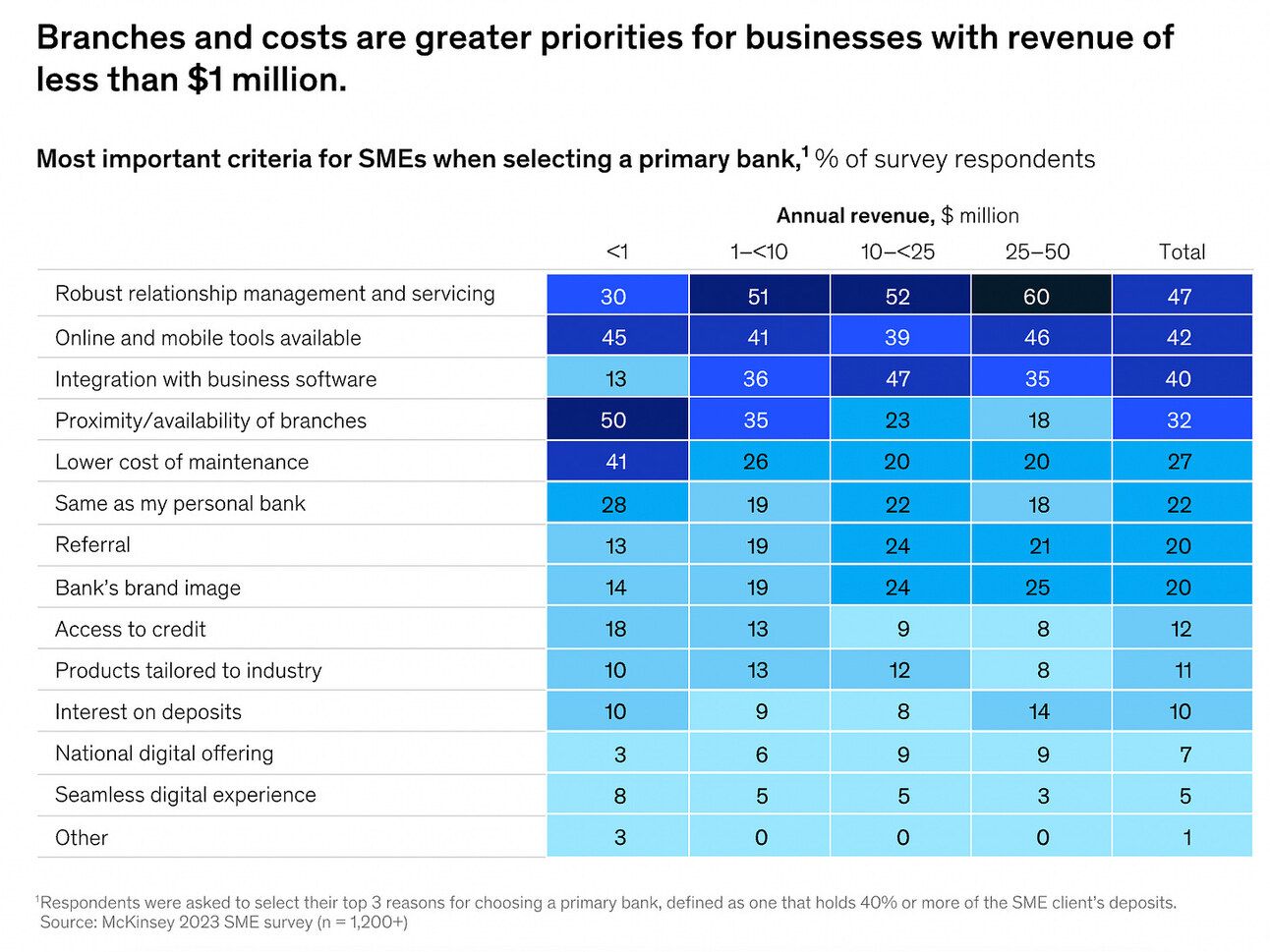

However, I would not be very optimistic about small businesses moving their checking account balances from Chase to Square. According to a survey done by McKinsey, when selecting a primary bank, branches continue to be “a top factor considered by micro businesses, those with annual revenue of less than $1 million” (see the chart below). At the same time, “relationship management and servicing” continues to be the main factor for businesses with annual revenue of $1-10 million.

Competing with Chase (or Bank of America for that matter) on branch coverage (around 4,800 branches with 65% national population coverage) and the number of relationship managers (2,300 business relationship managers with 1,000 to be hired by 2025) does not seem like a strategy that Square would pursue. Thus, I would expect the hundreds of billions in non-interest-bearing deposits to remain with the largest banks.

I will stop here. Square's pursuit of banking opportunity is certainly an exciting journey, and I will certainly keep learning (and writing) more about it.

In summary, Square is already originating more small business loans than Chase, which is the leading primary bank for small businesses in the U.S. Similar to payment acceptance, Square has proven that small businesses can look beyond their primary bank for funding.

Based on my analysis above, I would say that debit and credit cards for small businesses are Square's next frontier. This is a sizable market, which is currently dominated by American Express and the largest banks, such as Chase, Bank of America, and Wells Fargo. So far, Square has the products, but is early in scaling those.

Finally, I don’t think becoming the primary bank for its sellers is on the short-term or medium-term horizon for Square. The benefit of being a primary bank is free deposits (checking account balances that small businesses hold for operating purposes). However, becoming a primary bank requires having a physical branch network, which I doubt is on Square’s agenda.

Let’s see how this plays out!

Cover image source: Square

Disclaimer: Information contained in this newsletter is intended for educational and informational purposes only and should not be considered financial advice. You should do your own research or seek professional advice before making any investment decisions.