Hey!

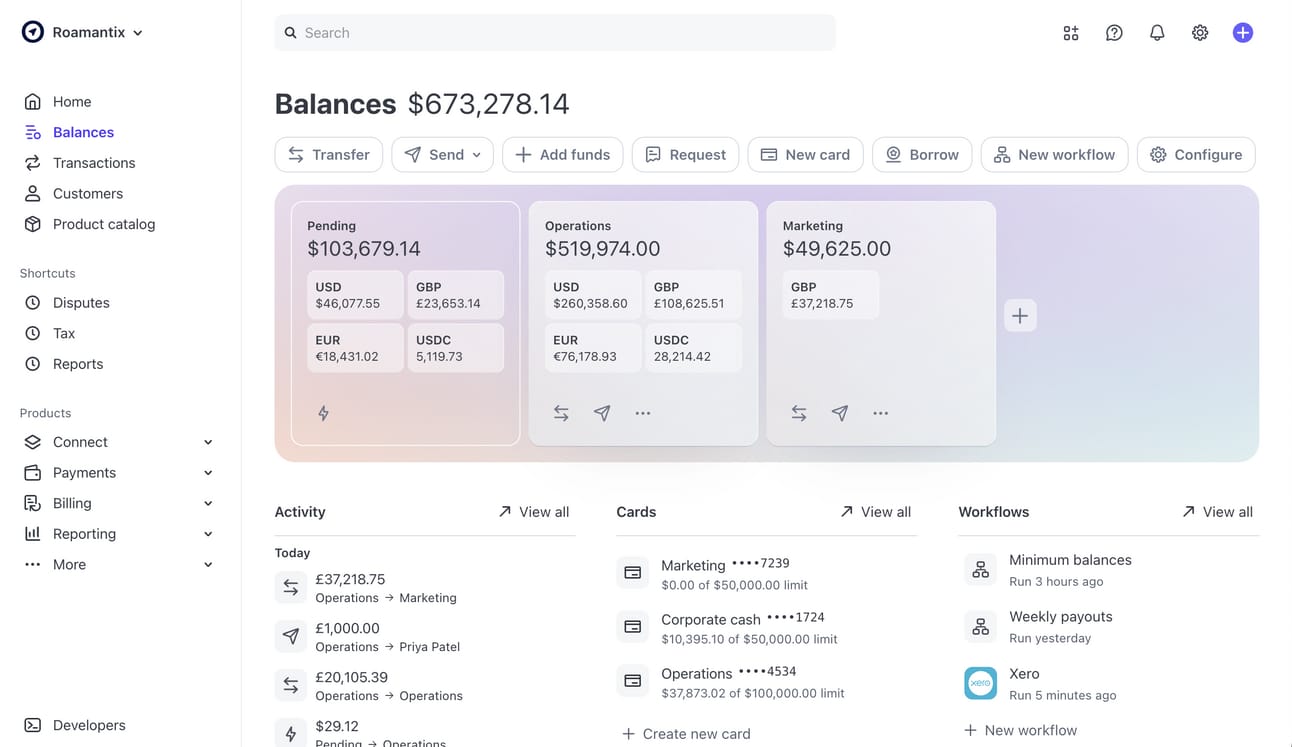

Small business banking is quietly changing. Square and Shopify now offer small businesses everything from payment acceptance to corporate cards and savings accounts. Spend management platforms like Ramp and Brex are taking a similar path, with offerings like Brex Banking and Ramp Treasury.

What began as payment processing or expense management has evolved into a push to become the primary banking partner for small businesses. The main goal behind these expansions is to capture operational deposits, the day-to-day business cash that represents the most valuable part of small business banking.

So, where will small businesses bank in the future?

Let’s dive in!

Jevgenijs

p.s. if you have feedback, just reply to this email or ping me on X/Twitter

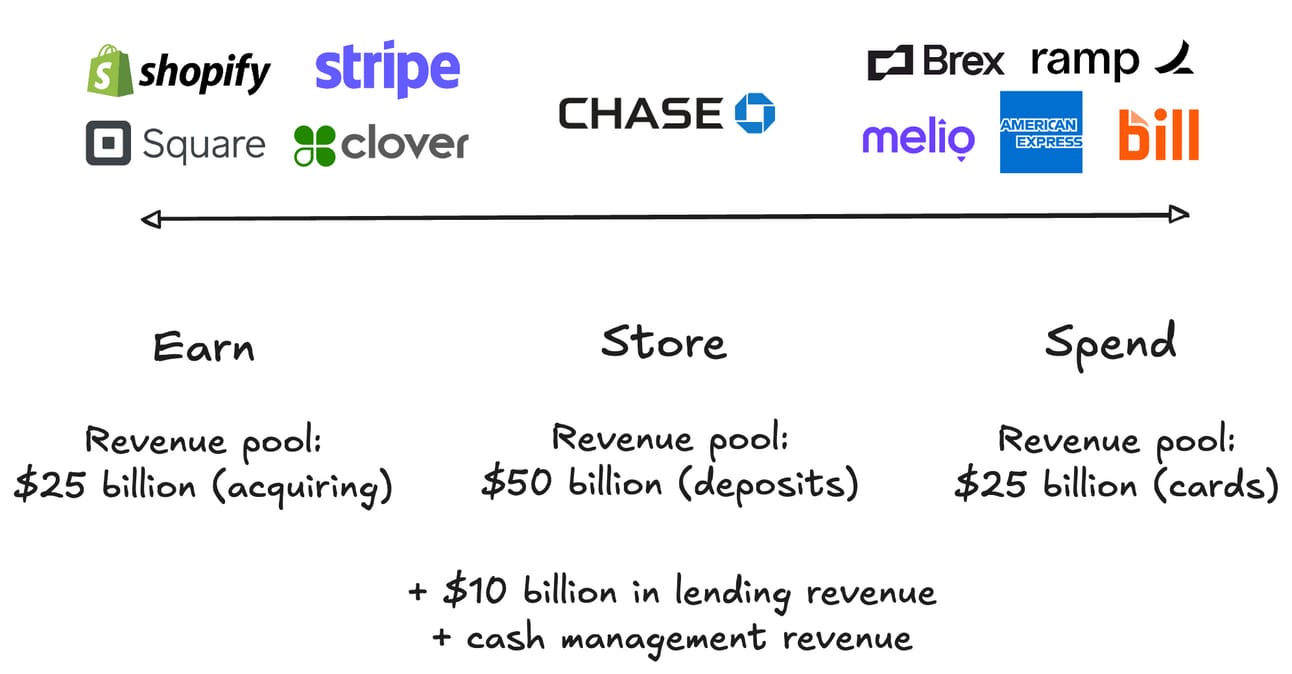

Last year, I wrote about the opportunity in Square banking. The setup used to be simple: a merchant would use Square to accept payments, transfer funds to their Chase accounts, and use an Amex card to pay suppliers. Square earns a merchant discount rate, Chase gets the deposits, and Amex earns the interchange.

However, at some point, Square realized that merchants might be underserved when it comes to lending. Banks are typically not super excited about lending to small businesses, and credit cards are an expensive way to borrow. So they started offering fast and flexible financing to small businesses, with repayments automatically taken as a percentage of daily sales.

Image source: Square

“In 2013, we began offering capital to sellers because we saw a meaningful gap in the market: small businesses were often denied access to credit, in the same way they were once denied access to accepting credit cards.”

In 2023, Square also launched a credit card for merchants. They used the same logic in how they underwrite the credit limit and collect repayments, but expanded where merchants can spend the borrowed funds. Interestingly, they chose to launch an Amex card instead of a Visa or Mastercard.

Image source: Square

“With no late fees or annual fees, the Square Credit Card features a credit limit determined by the sales a seller processes through Square, growing as their business grows, and rewards them with free card processing every time they spend.”

However, as of today, Square Banking includes checking accounts (provided by Sutton Bank), savings accounts (provided by Square Financial Services), bill pay, and budgeting tools. So, if we go back to the diagram above, there is no need for a Square merchant to become a customer of Chase or American Express. They can bank with Square. Pretty cool, right?

Image source: Square

I wrote about the opportunity in Square Banking, and, kind of, forgot about it. But then, earlier this year, Ramp, a corporate card and spend management platform, launched Ramp Treasury. Ramp Treasury is a cash management solution that enables businesses to earn interest on their operating cash (by putting it into an FDIC-insured high-yield savings account or a money market fund).

Image source: Ramp

“With Ramp Treasury, you can store operating cash in a free, FDIC-insured Ramp Business Account, where it earns 2.5% (that’s 35x more than the national average). Invest excess cash in a money market fund via the Ramp Investment Account, with rates currently as high as 4.38%. No fees. No minimum deposits. No transfer limits.”

..and then Stripe announced that it is expanding its money management tools to let businesses store and convert multiple currencies, send and receive funds globally via fiat and crypto rails, issue virtual and physical cards, and make payouts in 58 countries - all from the Stripe Dashboard.

Image source: Stripe

“With money management on Stripe, you can store funds, send and receive money, convert currencies, and spend from cards directly in the Dashboard in multiple currencies.”

This made me realize that Square expanding beyond payment acceptance into banking products isn’t unique - it’s part of a broader trend. Square, Shopify, and Stripe offer their merchants lending products, current and savings accounts, bill pay, and cards.

Image source: Shopify Balance

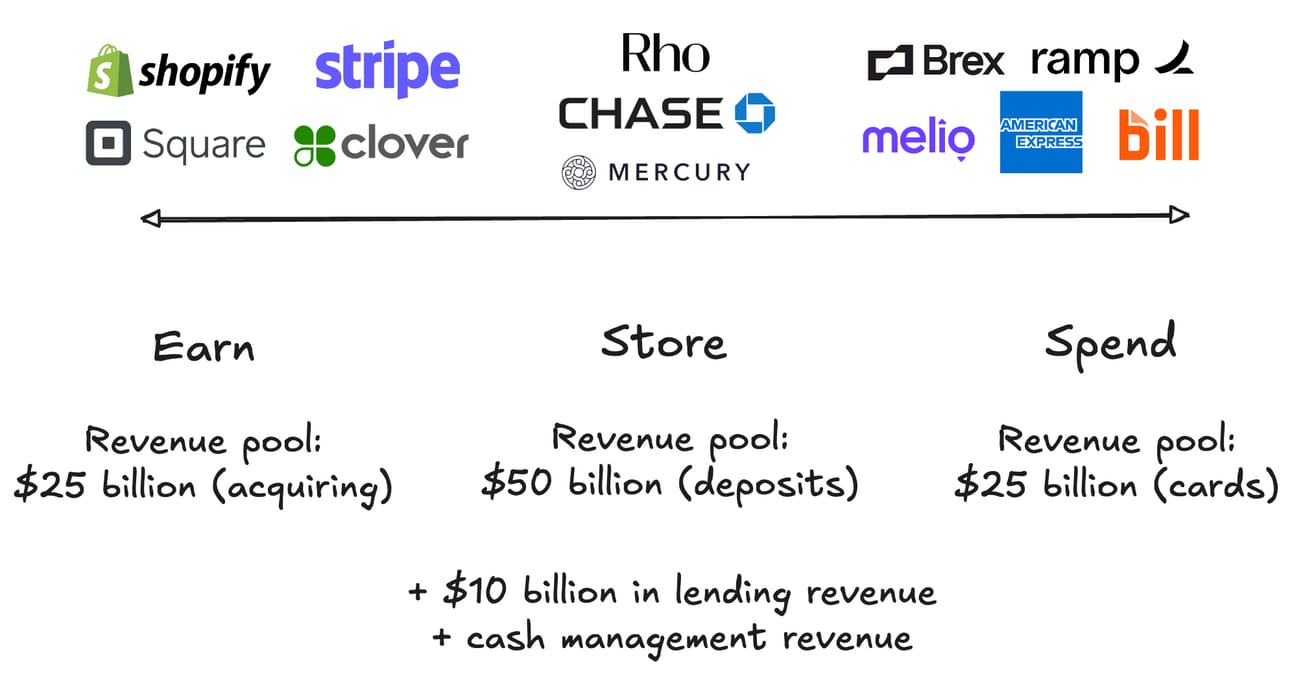

However, the companies in the spend management category are also expanding beyond corporate cards and bill pay. There is Ramp Treasury and Brex Banking, and Bill and Melio started offering working capital solutions to their clients (and I wouldn’t be surprised if accounts come next).

So when you think about it, Chase and other banks are being challenged from all sides by Fintech companies competing to become the primary place where small businesses keep their money. And that’s because the biggest revenue opportunity is in operational deposits. Let’s unpack that.

McKinsey estimates that “the United States is home to more than 30 million SMEs, representing 99 percent of the nation’s enterprises.” Small business banking generates $150 billion in annual revenue for the U.S. banking industry.

“We estimate that small-business banking represents about $150 billion in annual revenue for the US banking industry across all products - deposits, loans, cards, cash management, and merchant services. That is about 17 percent of the US banking industry as a whole.”

Chase is the biggest player in small business banking, with 4.4 million clients, of whom 70% consider Chase their primary bank. Including small businesses without a checking or savings account, Chase serves a total of 7 million small businesses. Given the estimated 30 million SMEs in the U.S., Chase's share suggests it’s a very fragmented market.

Image source: JPMorgan Investor Day 2025

Image source: JPMorgan Form 10-K 2024

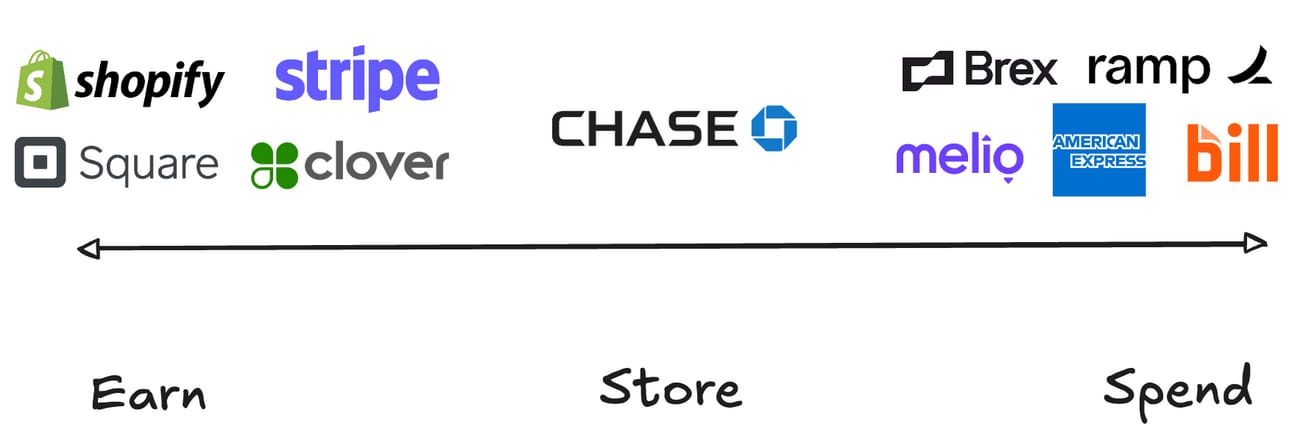

According to the FDIC, small business loans totaled $284 billion in 2022, with $162 billion in loans under $250,000. I would use the $162 billion as the TAM for Fintech companies, given the maximum loan amounts they offer (as I understand, larger loans typically require collateral or state guarantees).

Image source: FDIC

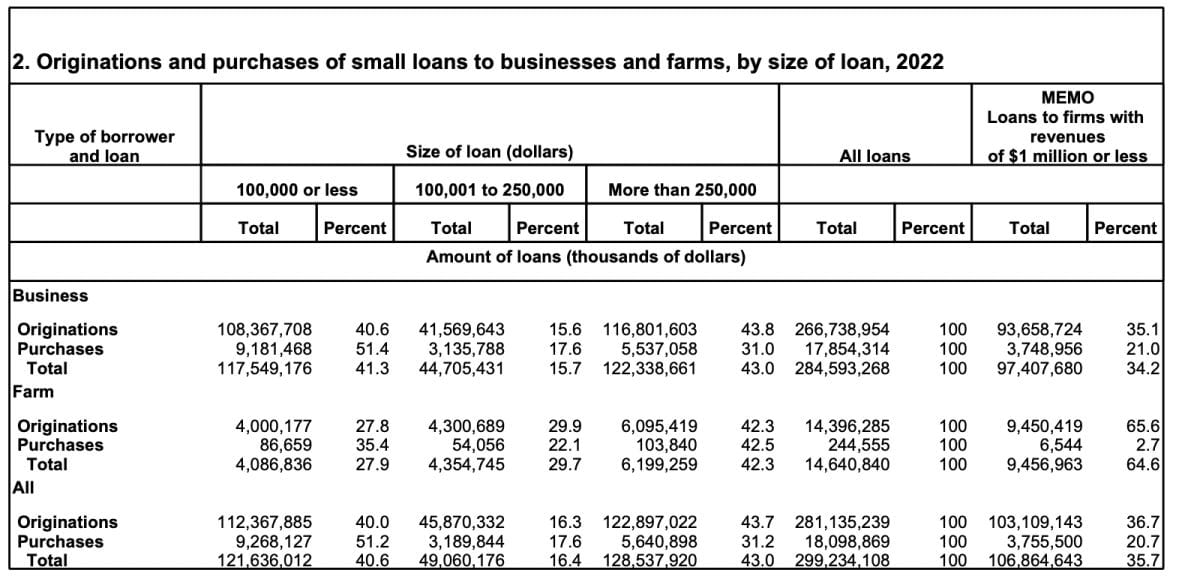

The small business lending market is also highly fragmented, with the largest lender, Bank of America, holding only $20.8 billion in small business loans on its balance sheet (less than 8% of the total loans).

Image source: Bank of America

Assuming a 4-6% interest yield and the $162 billion loan balance, we arrive at $7-10 billion in annual revenue. Fintech companies are extending eligibility, so most likely the TAM is larger. So, it's reasonable to say the revenue opportunity is likely closer to the high end of the estimate, or around $10 billion annually.

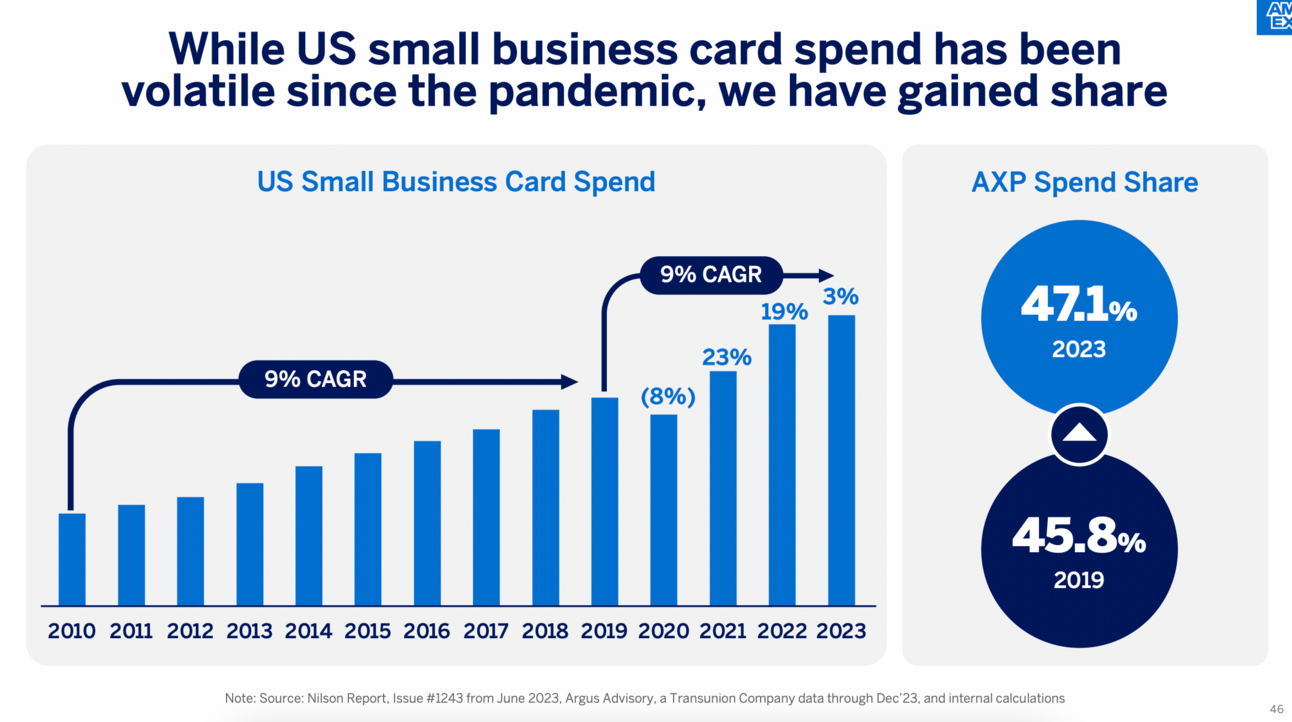

Moving on to commercial cards. American Express claims to control 47% of the small business card spend (3x the closest competitor). The company has 3.9 million small business cardholders who spend over $400 billion annually on those cards.

Image source: American Express Investor Day 2024

“We're the undisputed leader in small business cards. We have over $400 billion in annual SME billings. We have 3.9 million small business card members. We have a leadership position in small business that's 3x larger than the next competitor.”

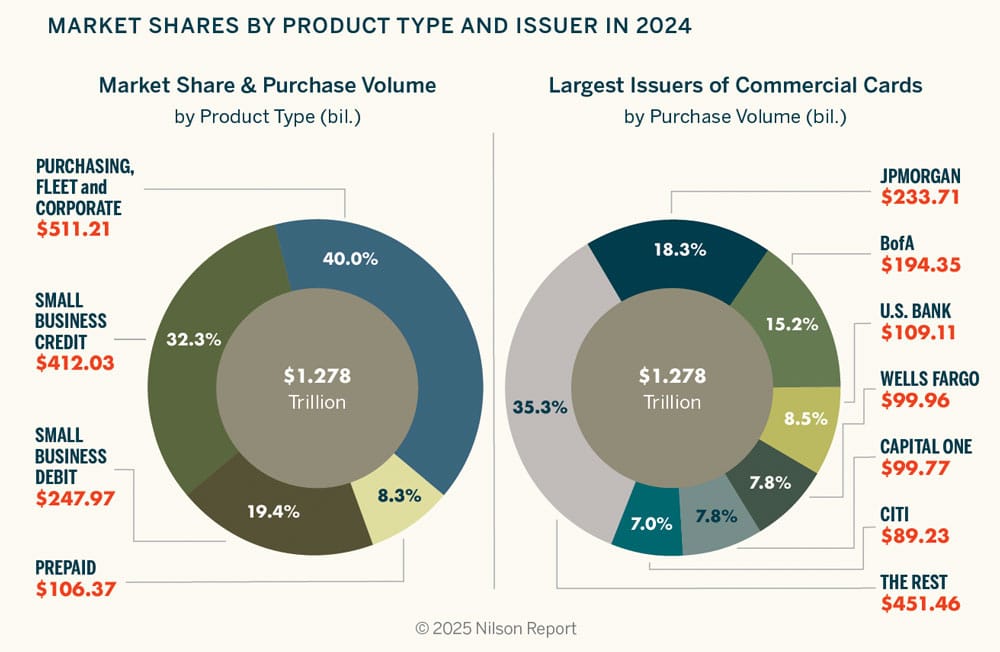

According to The Nilson Report, the total small business card spend (excluding Amex cards) is roughly $660 billion, with the largest players being Chase, Bank of America, U.S. Bank, and Wells Fargo. Again, outside of American Express, it’s a fragmented market.

Image source: The Nilson Rerport

Assuming a 2.5% interchange on roughly $1 trillion in small business card spend (Visa, Mastercard, and American Express), we arrive at the TAM of $25 billion. There is an extra opportunity in non-card payments, which are, in volume, much larger than card payments, and currency exchange (let’s call it “cash management”).

Image source: American Express Investor Day 2022

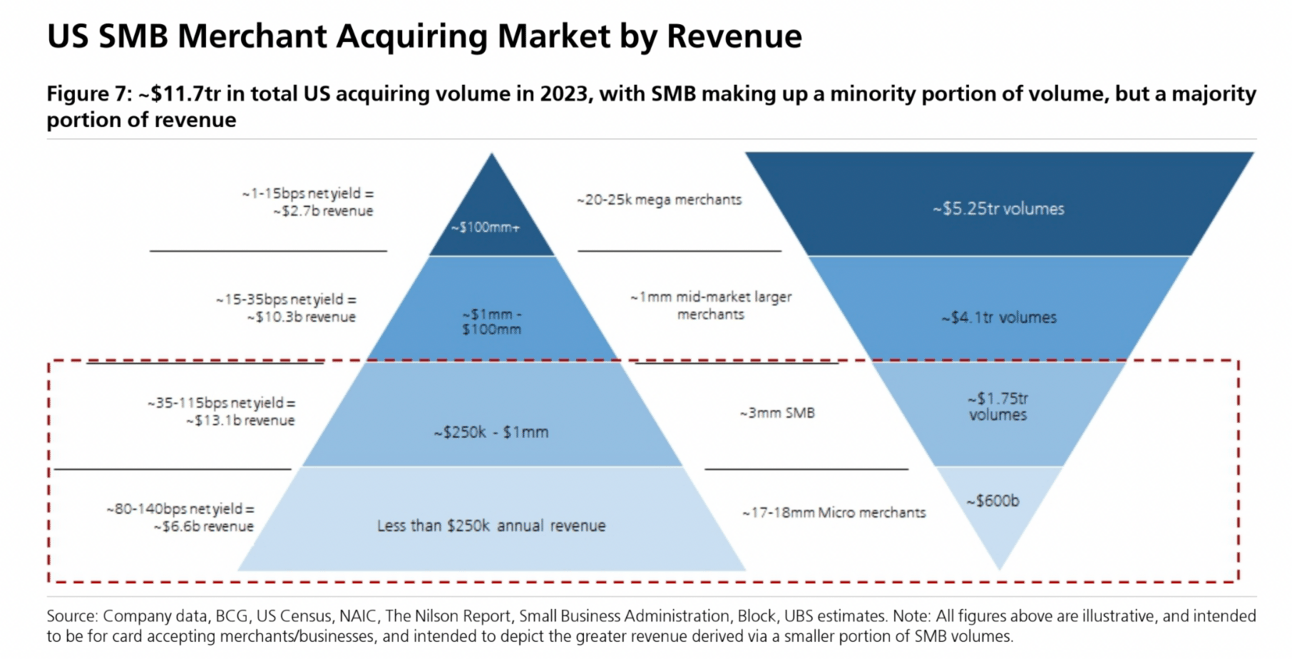

Several companies (McKinsey, Boston Consulting Group, and UBS) estimate that small businesses contribute 65-70% of the merchant acquiring revenue pool in the U.S. Thus, UBS estimates the total merchant acquiring net revenue pool to be $35 billion, of which $24.5 billion comes from small business merchants.

Image source: UBS

“We estimate that total US merchant acquiring net revenue in 2023 was ~$35 billion based on total US acquiring volume of ~$12.3 trillion and an average acquiring take rate of ~29bps.”

This market is also fragmented. Thus, in 2024, the largest player, Square, generated $3.6 billion in gross profit (the equivalent of UBS’s “net revenue”), implying a market share of 15%. It should be noted that a portion of Square's revenue comes from software subscriptions, lending, and international markets.

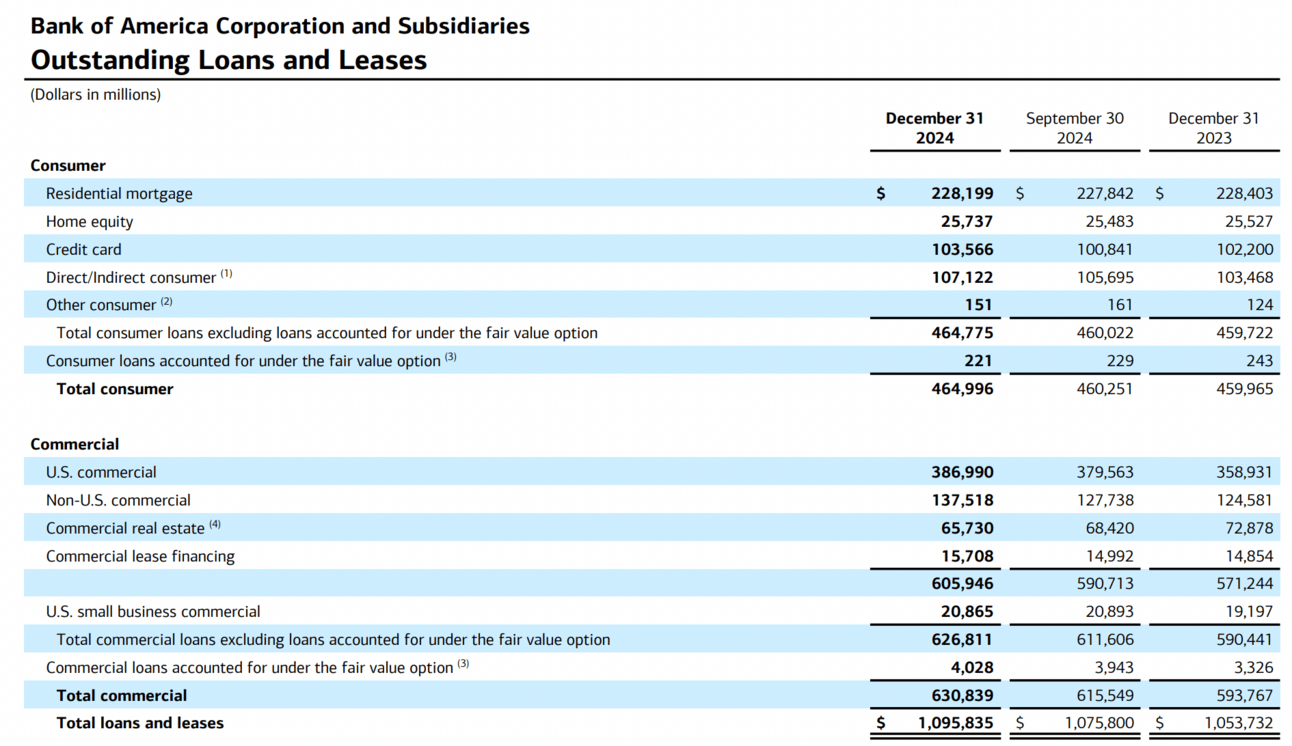

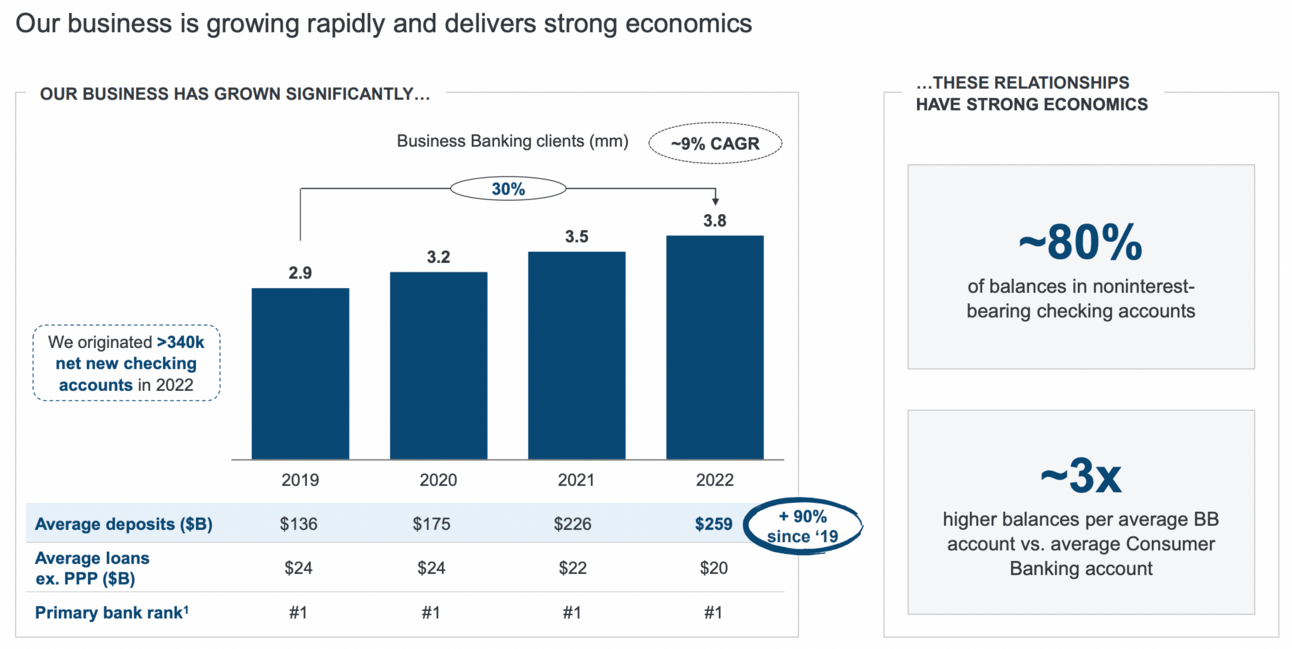

Finally, let’s discuss deposits. In 2024, Chase had $234 billion in average business banking deposits. Using Chase’s 9.7% share of primary small business accounts as a proxy for deposit market share, we can estimate the total small business deposits at $2.4 trillion.

Image source: JPMorgan Investor Day 2025

“We are outgrowing the competition in deposits, with a 7% CAGR in consumer and 12% in Business Banking, driven by the strength and consistency in customer acquisition and contribution from investments in new branches.”

By applying a 2% average long-term Fed Funds rate to $2.4 trillion in deposits, the potential annual revenue opportunity comes out to around $50 billion.

One caveat: business banking deposits are relatively low-cost for banks. For example, Chase reports that 80% of small business deposits are held in non-interest-bearing checking accounts.

In contrast, Fintech companies pay interest on deposits, which reduces their net revenue. Finally, none of them are banks (with the exception of Square, which has an industrial loans company charter), so they have to share interest income with their partner banks.

Image source: JPMorgan Investor Day 2023

Putting it all together: a) there is a $25 billion annual revenue opportunity in “Earn” (merchant acquiring), b) a $25 billion opportunity in “Spend” (commercial cards), c) a $10+ billion opportunity in lending and cash management, and d) a $50 billion revenue opportunity in “Store” (deposits). This is less than McKinsey’s $150 billion estimate, so I have missed something, but I believe directionally it is correct.

You might have noticed that my illustrations also miss a couple of logos. Notably, Mercury and Rho. Mercury and Rho went after the deposits directly, rather than starting on the merchant acquiring or spend management side like others.

So, where will small businesses bank in the future? Will they bank with their acquirer (Square, Shopify, or Stripe)? Or will they bank with their spend management platform (Brex, Ramp, or Bill)? Or, will they continue banking with traditional banks?

Let’s see how this trend plays out!

p.s. I have used Chase in my illustrations, but, as you might have noticed from my comments above, every part of this market is fragmented. So while Chase might be safe, there are weaker banks in this market. Not every bank serving small business banking can invest $18 billion in technology annually and operate close to 5,000 branches.

Cover image source: Ramp

Disclaimer: The views expressed here are my own and do not represent the views of my employer. The information contained in this newsletter is intended for educational and informational purposes only and should not be considered financial advice. You should do your own research or seek professional advice before making any investment decisions. Read the full disclaimer here.