Hey!

Originally built to support a snowboard shop, Shopify has grown into a leading global commerce platform. It now powers millions of merchants across 175 countries, processes hundreds of billions in GMV, and has become one of the most important companies in global commerce.

But here's what makes Shopify's story remarkable: while many companies plateau after finding their niche and reaching scale, Shopify keeps expanding its TAM. It’s going after the enterprise segment, expanding into offline retail, and pushing aggressively into international markets.

This puts Shopify on a collision course with some of tech's biggest names, Adobe, Salesforce, and SAP, but with one decisive advantage: speed. Shopify and its Fintech partners, Stripe, Affirm, and Global-E, can ship faster, iterate more quickly, and serve customers with less friction.

And in a world where commerce is increasingly software-defined, that might be the most powerful edge of all. Let’s dive in!

Jevgenijs

p.s. if you have feedback, just reply to this email or ping me on X/Twitter

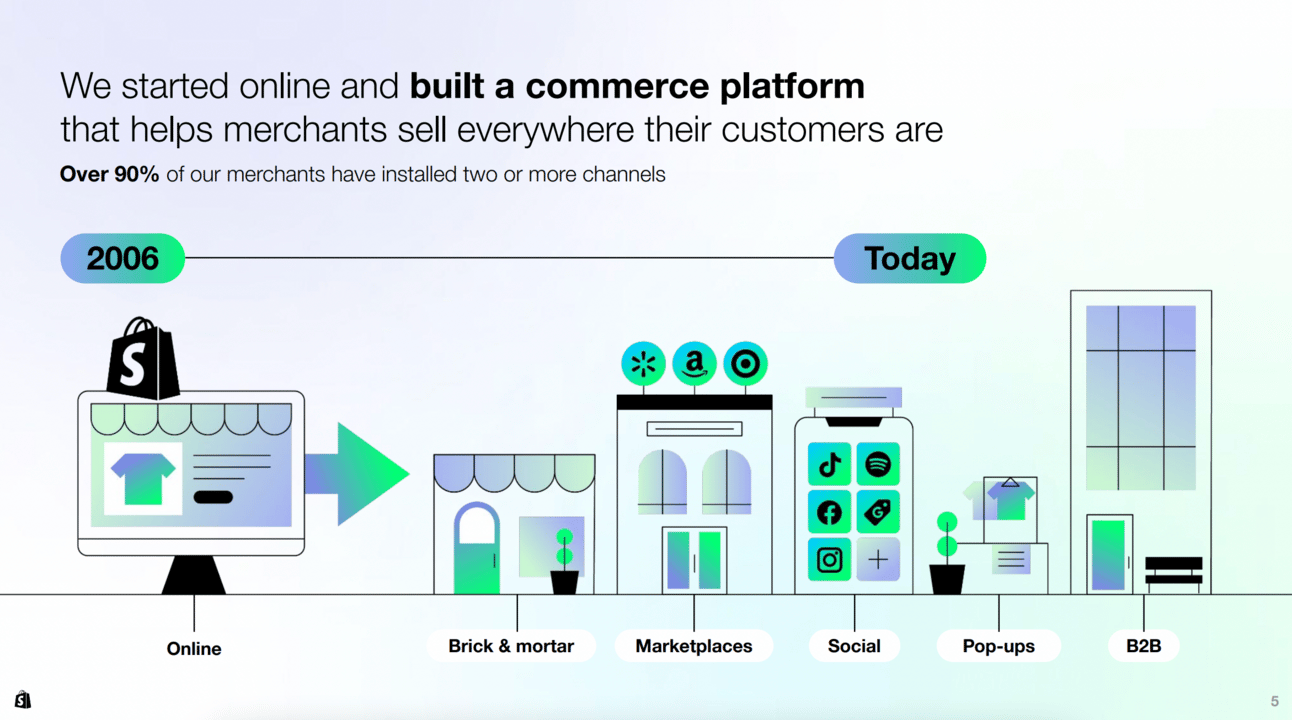

Shopify is a Canadian e-commerce platform founded in 2006 in Ottawa by Tobias Lütke, Daniel Weinand, and Scott Lake. Originally built to support their own snowboard shop, Shopify has grown into a leading global commerce solution for online and in-store retailers. The company $SHOP ( ▼ 3.34% ) went public in 2015, and its stock is up 4,075% (yes, four thousand percent) since the IPO.

Image source: Investor Overview - Q4 2024

“From local start-ups landing their very first sale to global brands pushing billions in GMV, merchants everywhere are choosing Shopify. I'm especially proud to share that in the U.S. alone, Shopify is now over 12% of the e-commerce market share. And we continue to grow rapidly in places like Europe and Japan.”

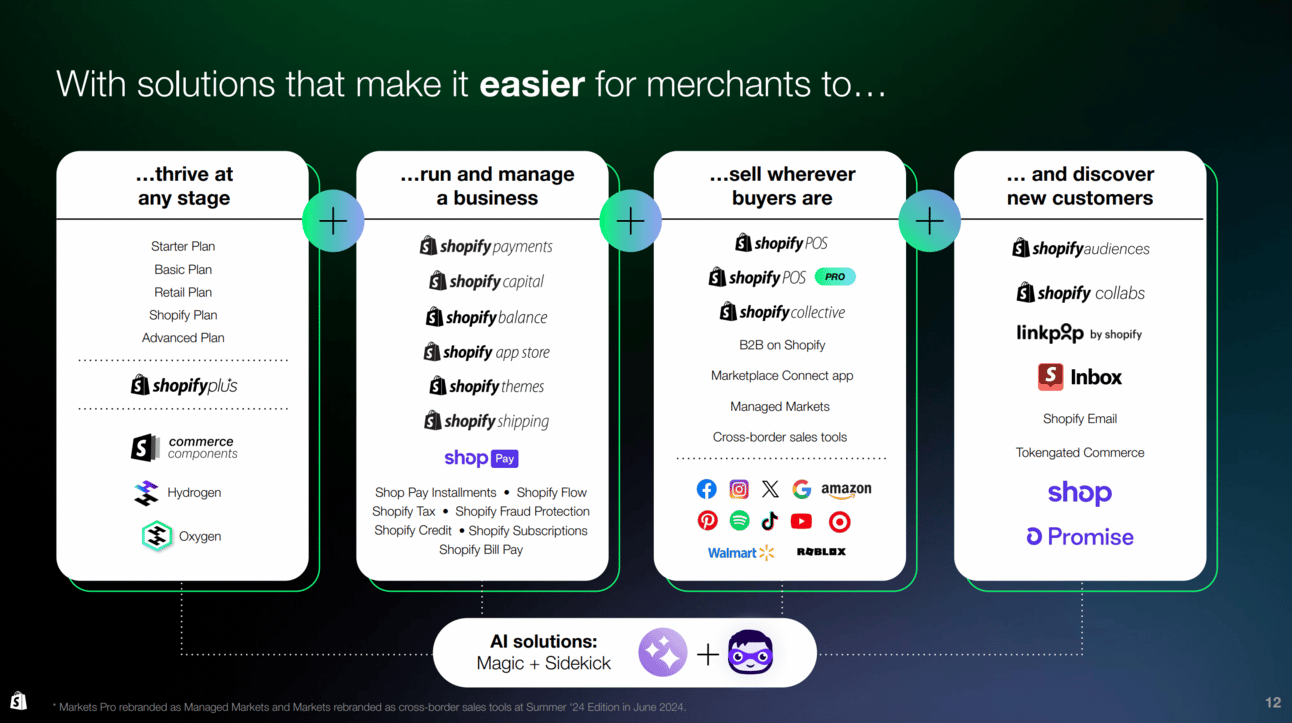

Shopify has evolved from a basic online store builder into a full-featured commerce platform, offering everything from multi-channel marketing and payments to consumer and merchant lending, as well as point-of-sale tools. Its regular Shopify Editions updates showcase the company’s continuous product innovation across all merchant segments.

Image source: Shopify Investor Overview - Q1 2025

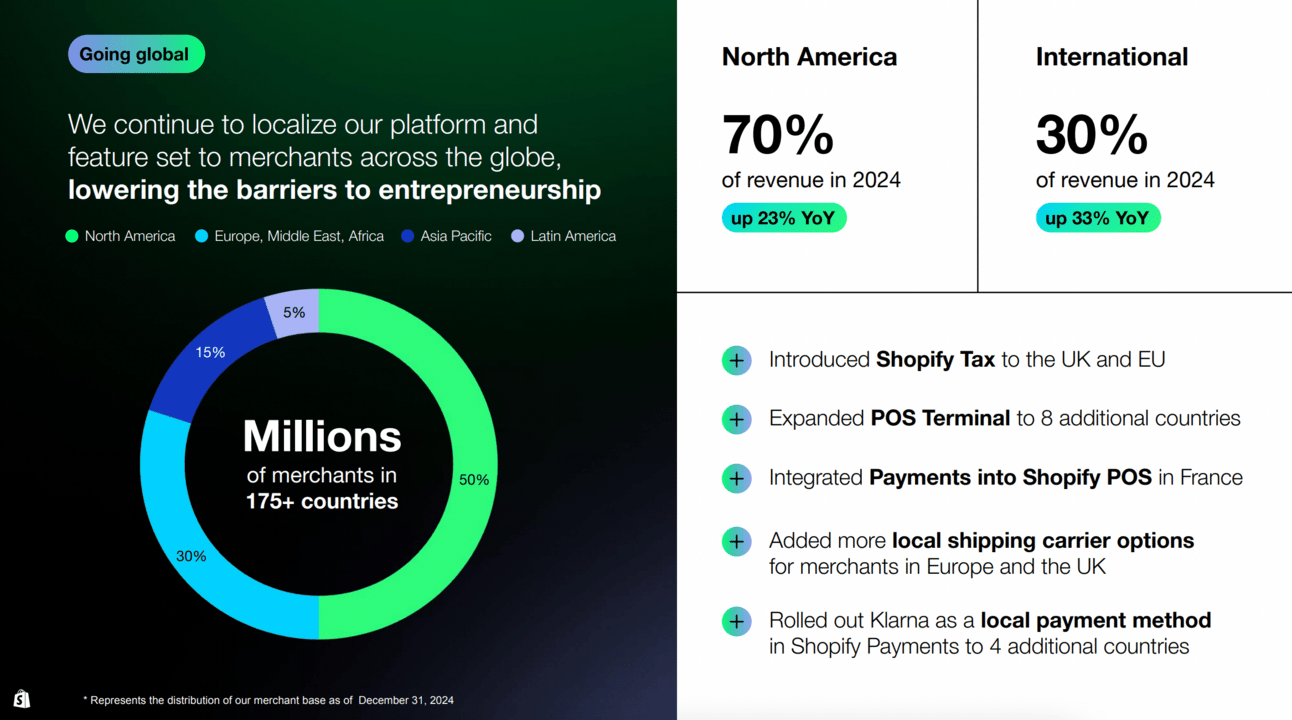

Shopify now serves “millions of merchants” in 175 countries. The company last disclosed its exact merchant count in 2021, reporting 2.06 million. However, based on its Gross Merchandise Volume (GMV) growth since then, the current number of merchants is likely approaching 3 million. Half of those merchants are based in North America, 30% in Europe, and the remaining 20% are spread across other regions.

Image source: Investor Overview - Q4 2024

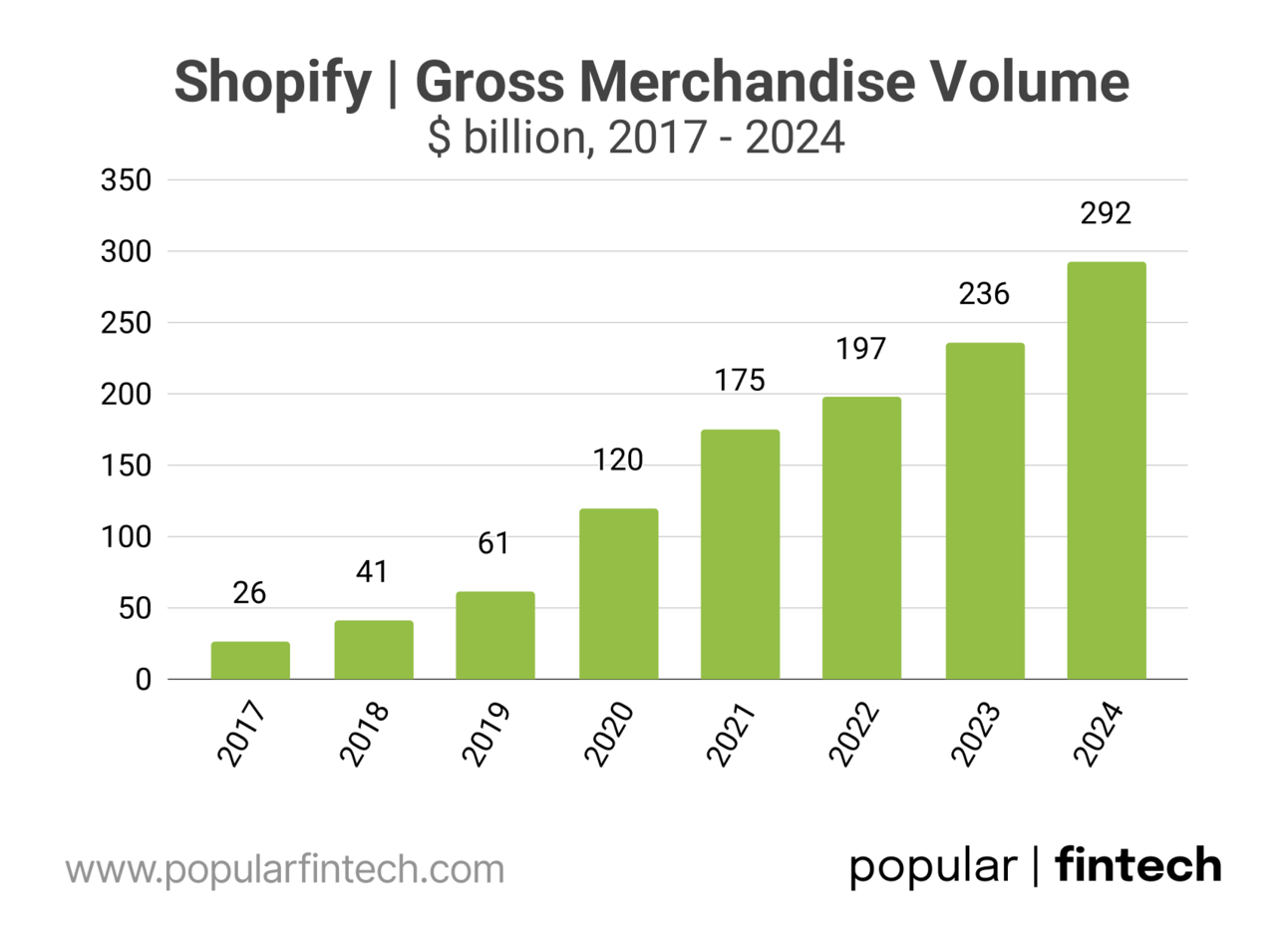

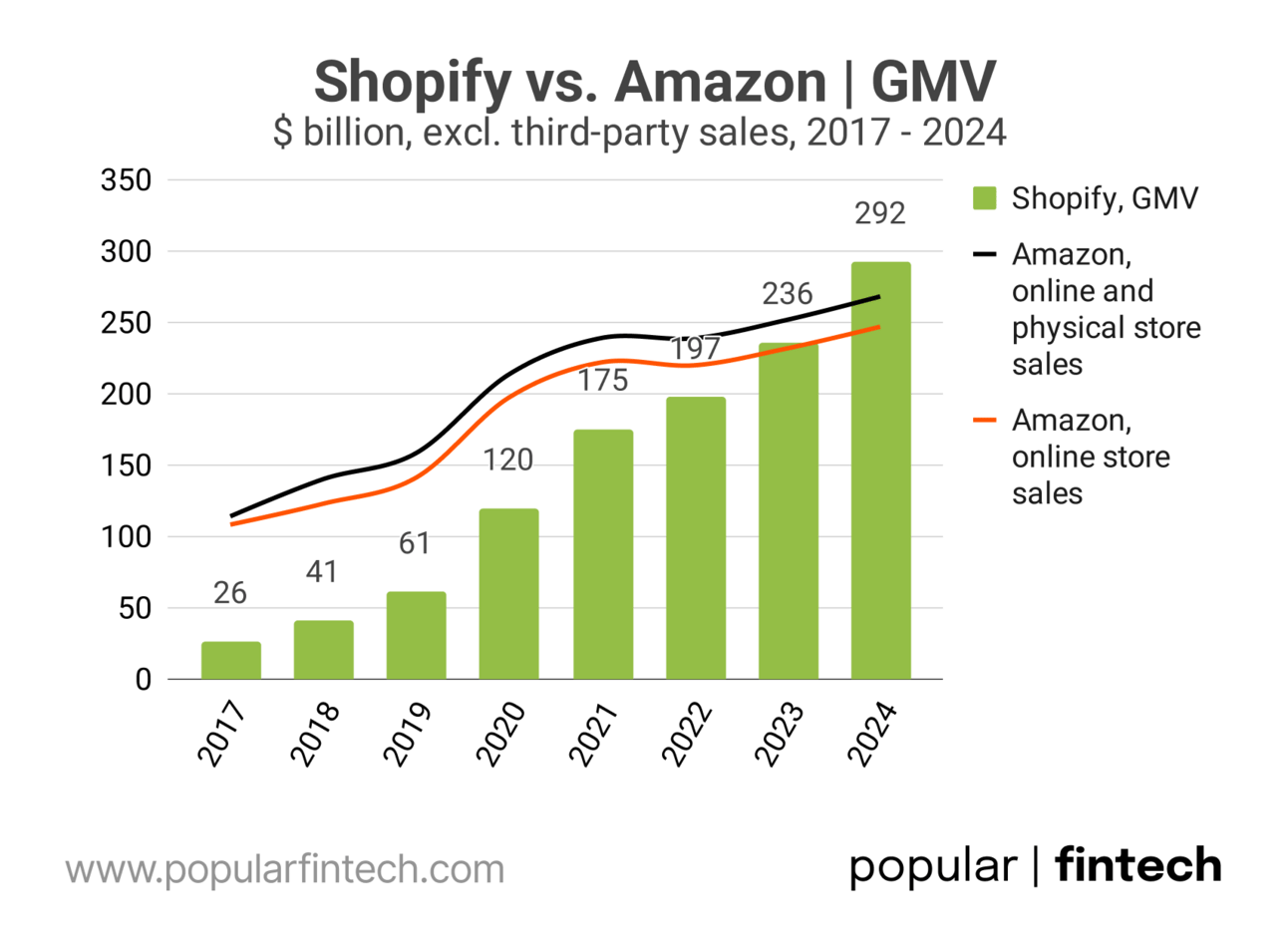

In 2024, Shopify reported $292 billion in GMV (the value of goods and services sold by merchants using the Shopify platform), up 24% from a year ago. GMV grew at a 37% CAGR over the past 5 years, from 2019 to 2024, and a 55% CAGR over the past 10 years, from 2014 to 2024.

Data source: Shopify IR website

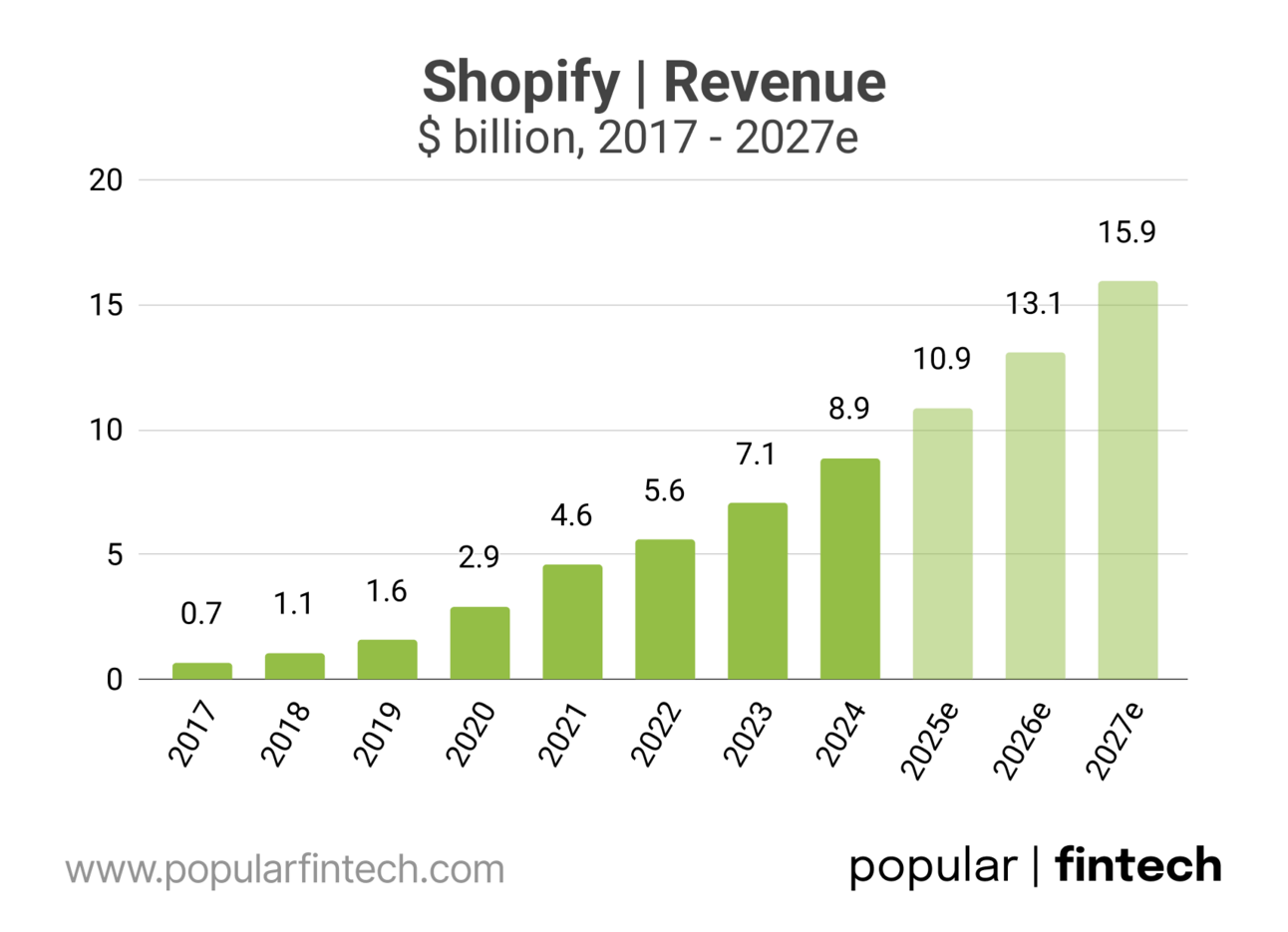

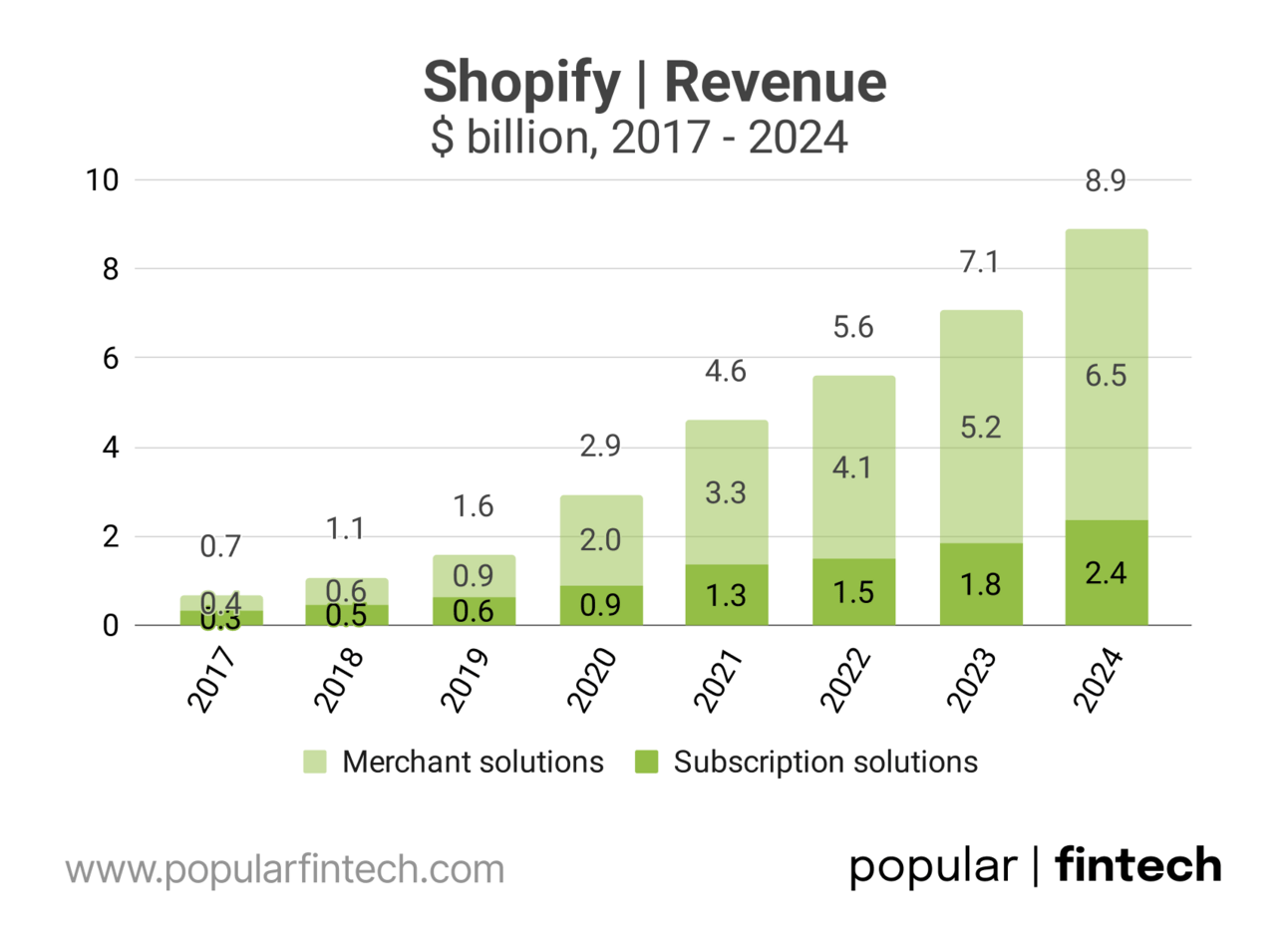

Growth in merchants and GMV has driven revenue expansion, with the company reporting $8.9 billion in revenue in 2024, up 26% from 2023. If analysts’ projections for 2025–2027 materialize, Shopify is on track to achieve a 23x increase in revenue over the decade (2017-2027).

Data source: Shopify IR website + Koyfin (estimates)

“On this very call 1 year ago, we laid out very clear goals, and then we set out, and we absolutely crushed them. We delivered 24% GMV growth, 26% revenue growth and an 18% free cash flow margin. This is not just Shopify doing well, this is Shopify operating as a growth company at peak performance.”

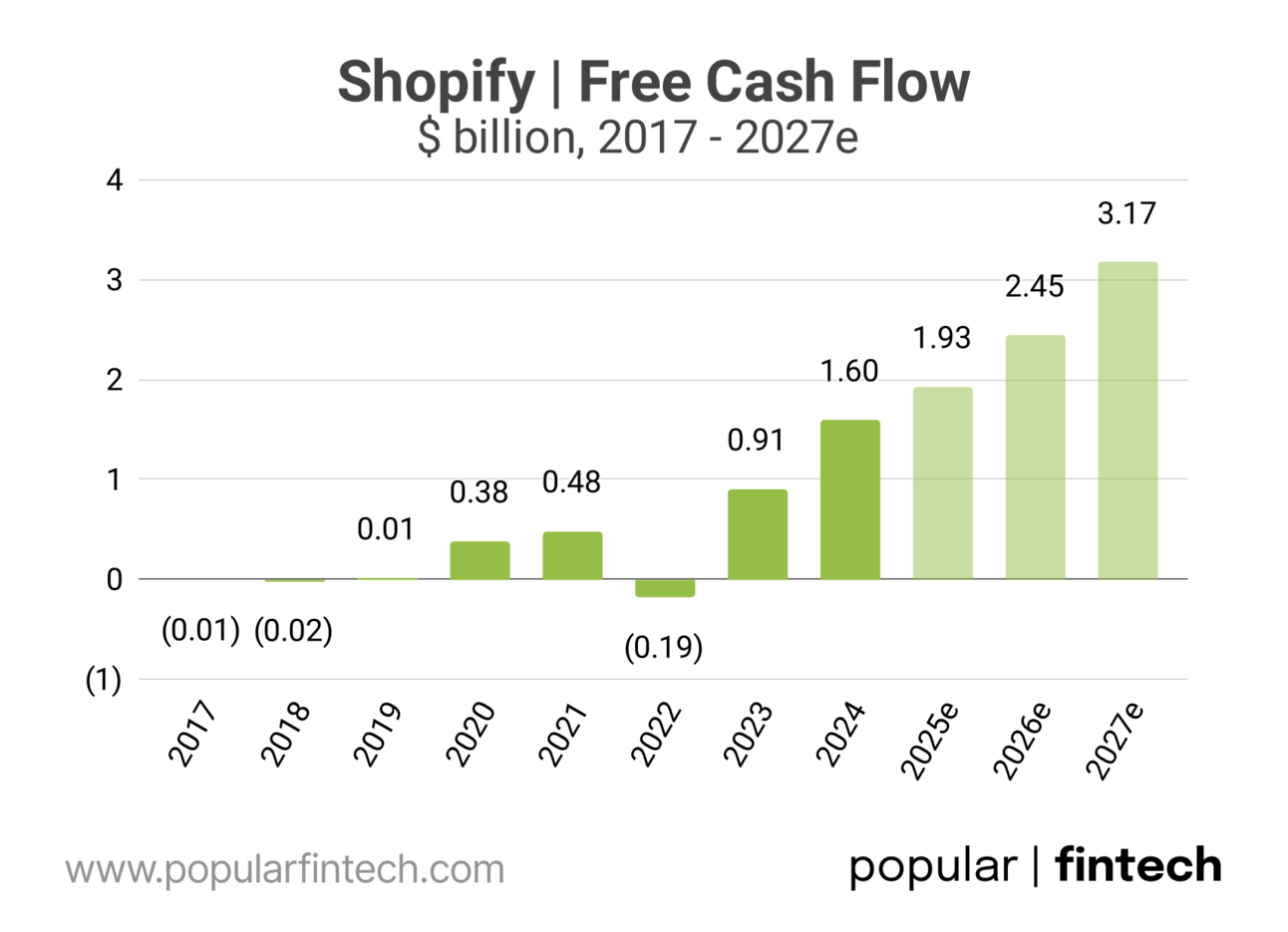

In May 2023, Shopify abandoned its plan to build a fulfillment network, which was a drag on the company’s free cash flow as it required heavy investments in building warehouse facilities. Since then, the company has demonstrated its ability to achieve both growth and profitability. In 2024, Shopify reported an 18% free cash flow margin and expects to maintain this level going forward.

Data source: Shopify IR website + Koyfin (estimates)

“As we move into 2025, and as I mentioned on our last call, we believe the free cash flow margin profile that we have achieved in 2024 strikes the right balance between profitability and investing in building the best products for our merchants today and into the future.”

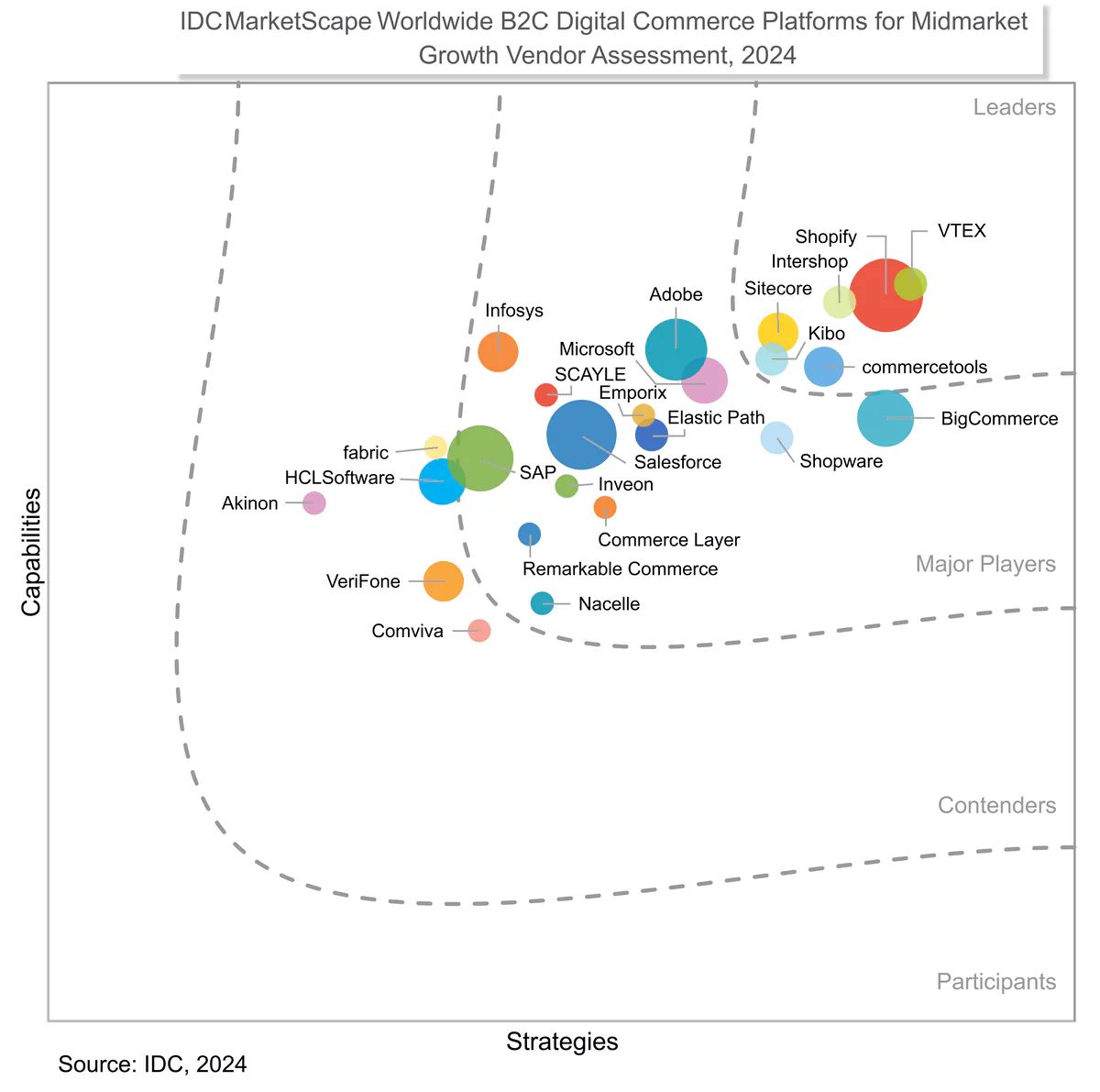

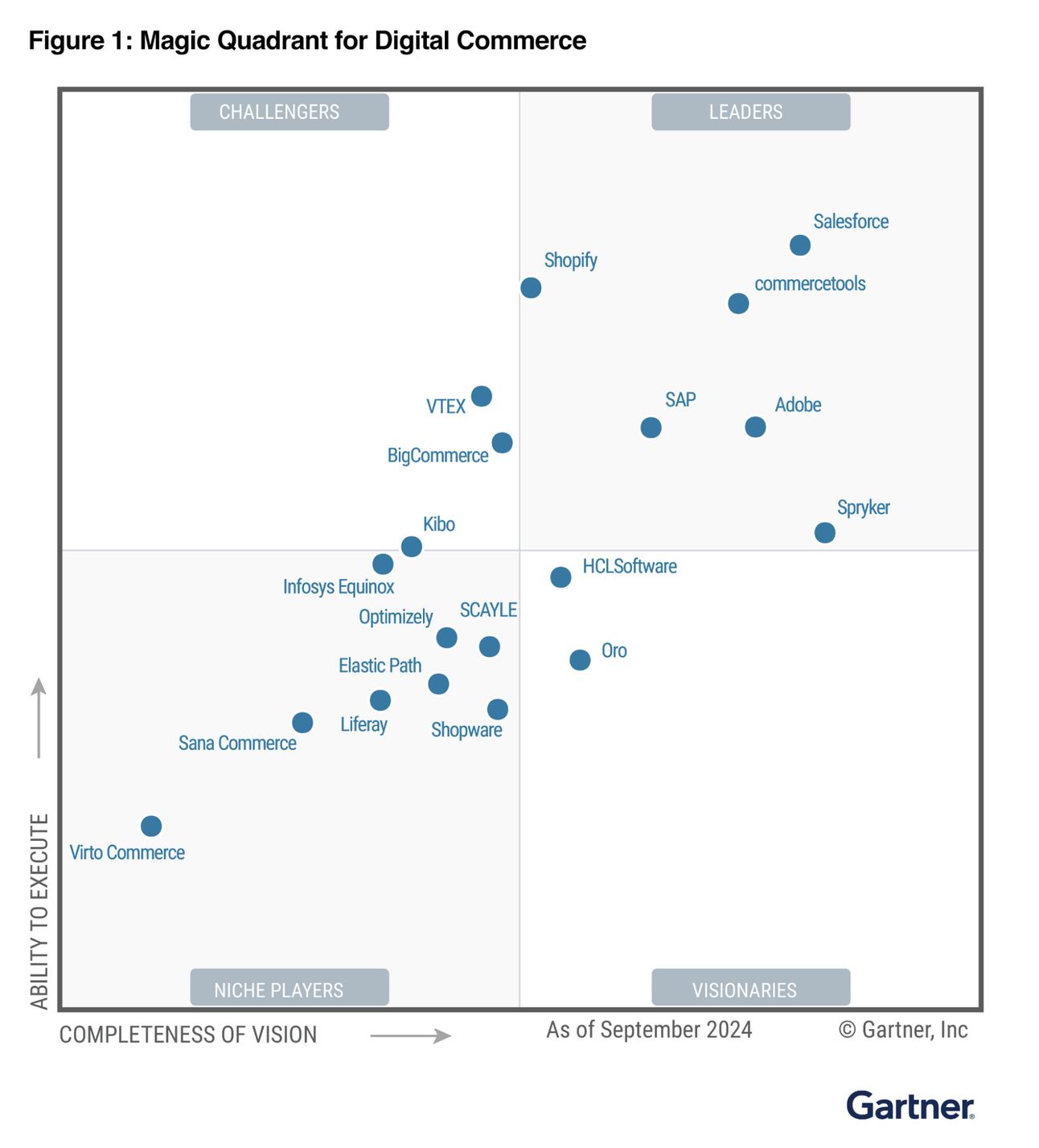

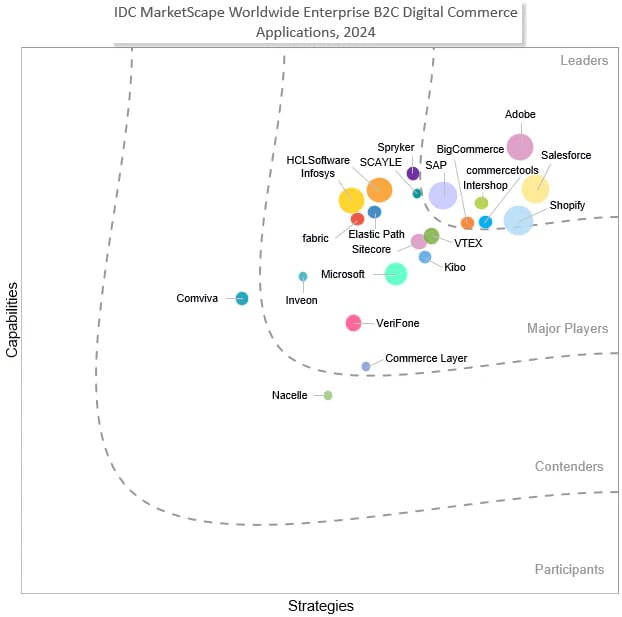

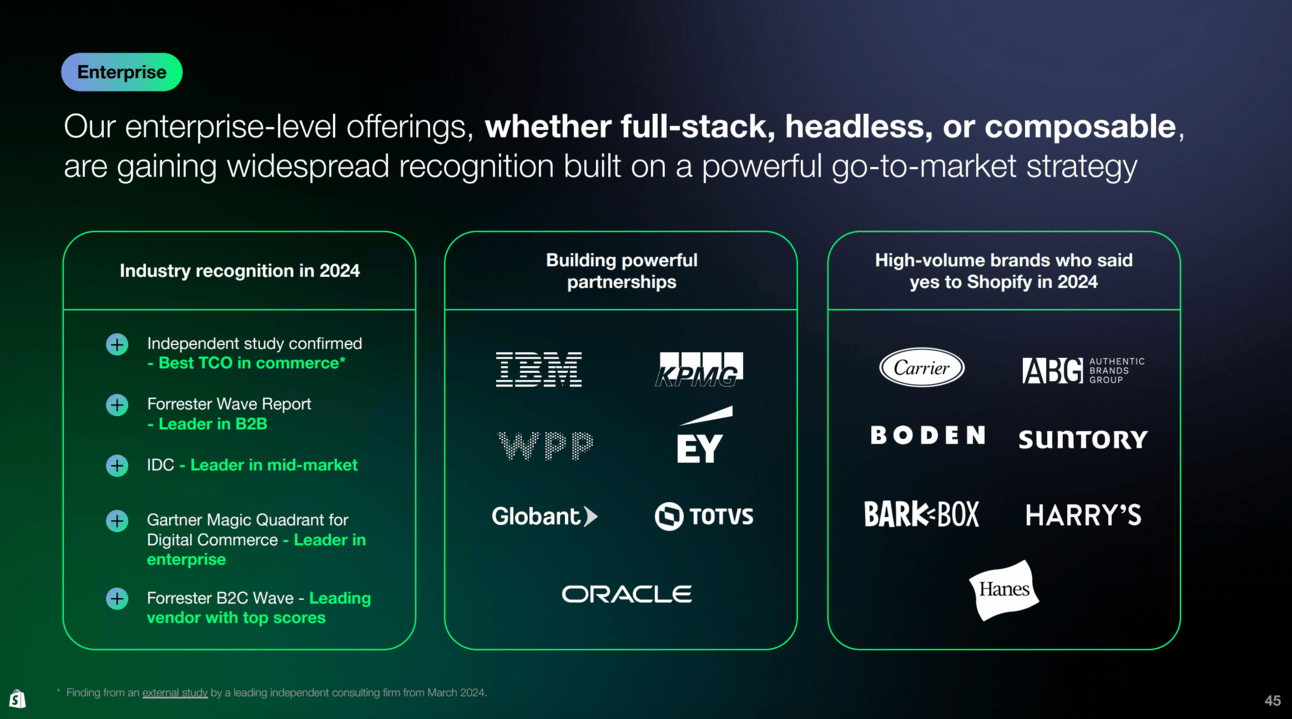

IDC, Gartner, and Forrester all rank Shopify as a leading commerce platform, with the company standing out particularly in the mid-market merchant segment. Rankings vary by customer segment (B2C vs. B2B) and company size (mid-market vs. enterprise), but Shopify consistently ranks among the top across most categories.

Image source: Shopify

Regardless of which ranking you look at, you'll find Adobe, SAP, and Salesforce, which all entered the commerce platform market through acquisitions. Adobe acquired Magento for $1.7 billion, SAP acquired Hybris for an estimated $1.2–1.5 billion, and Salesforce acquired Demandware for $2.8 billion.

✔️ Adobe Commerce (Magento)

Founded: Magento in 2008, acquired by Adobe in 2018

HQ: United States

Target: Mid-market to enterprise B2C and B2B businesses

Differentiation: Open-source roots with robust extensibility and a large developer ecosystem; integrates deeply with Adobe Experience Cloud.

✔️ SAP Commerce Cloud (Hybris)

Founded: Hybris in 1997, acquired by SAP in 2013

HQ: Germany

Target: Large enterprises, especially in B2B, B2C, and telco sectors

Differentiation: Strong in complex B2B use cases and integration with SAP's ERP and CRM suites.

✔️ Salesforce Commerce Cloud (Demandware)

Founded: Demandware in 2004, acquired by Salesforce in 2016

HQ: United States

Target: Enterprise B2C brands and retailers

Differentiation: Cloud-native SaaS with built-in AI (Einstein) and tight integration with the broader Salesforce ecosystem.

Image source: Salesforce

You will also find a few independent, but smaller, companies, such as BigCommerce $BIGC ( 0.0% ), VTEX $VTEX ( ▼ 1.12% ), commercetools, and Spryker, that rank close to, or in some cases even ahead of, Shopify. Website builders, like Wix $WIX ( ▼ 0.51% ) and Squarespace, also offer e-commerce functionality, but their offerings are primarily geared toward smaller merchants with less complex needs.

✔️ BigCommerce

Founded: 2009 | HQ: United States

Target: SMBs to mid-market B2C and B2B merchants

Differentiation: Open SaaS model with strong headless and B2B features, appealing to merchants seeking flexibility without full custom builds.

✔️ VTEX

Founded: 1999 | HQ: Brazil

Target: Mid-market to enterprise B2C and omnichannel retailers

Differentiation: Unified commerce platform with native marketplace and order management capabilities.

✔️ commercetools

Founded: 2006 | HQ: Germany

Target: Large enterprises with advanced digital commerce needs

Differentiation: Pioneer of headless, MACH-certified (Microservices, API-first, Cloud-native, Headless) commerce architecture.

✔️ Spryker

Founded: 2014 | HQ: Germany

Target: Enterprise B2B, B2C, and marketplace businesses

Differentiation: Modular and composable platform tailored for complex business models and fast time-to-market.

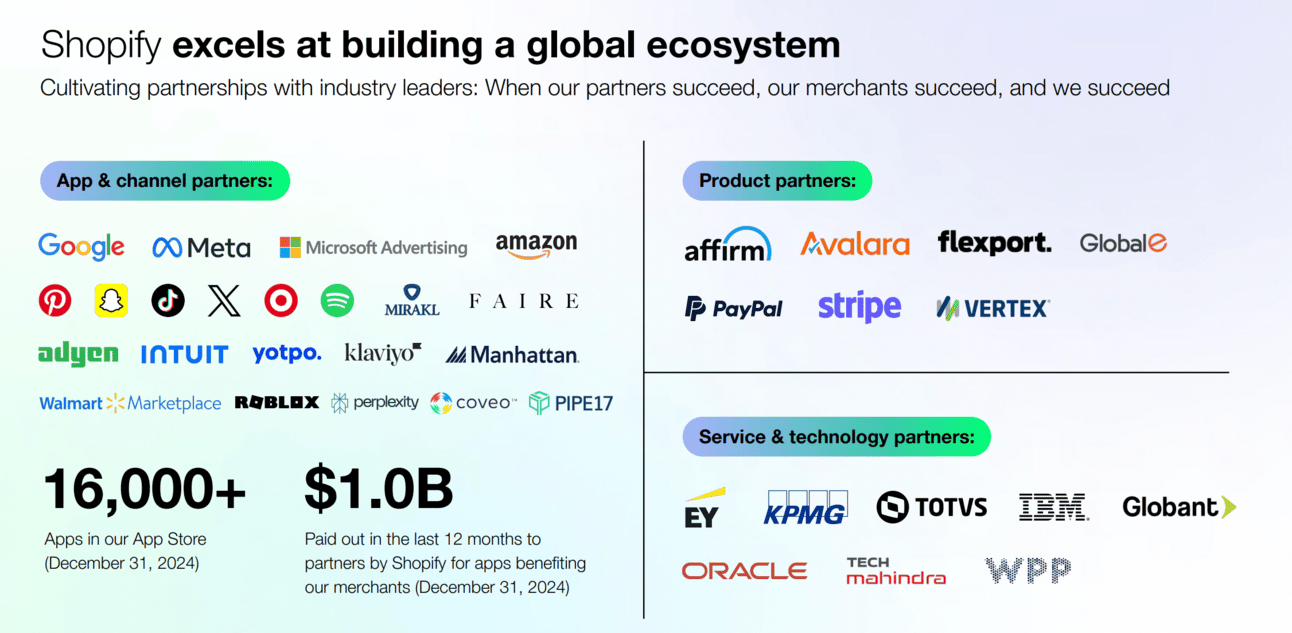

Where Shopify’s scale matters most is in its ability to rapidly ship new features and support a vast ecosystem of app developers. At the end of 2024, the Shopify App Store offered 16,000 apps that extended the platform’s functionality.

Image source: Shopify Investor Overview - Q1 2025

“Over the past year, we have paid out $1 billion to partners for apps benefiting our merchants. We also added over 3,000 new apps to our App Store, bringing our total to more than 16,000 apps by the end of 2024”

Even more importantly, Shopify has partnered with leading Fintech companies to expand into financial services, collaborating with Stripe on payments, Affirm on consumer lending, and Global-E on currency exchange. Through these partnerships, Shopify extended its offering to merchants and unlocked new sources of income.

Image source: Shopify Investor Overview - Q1 2025

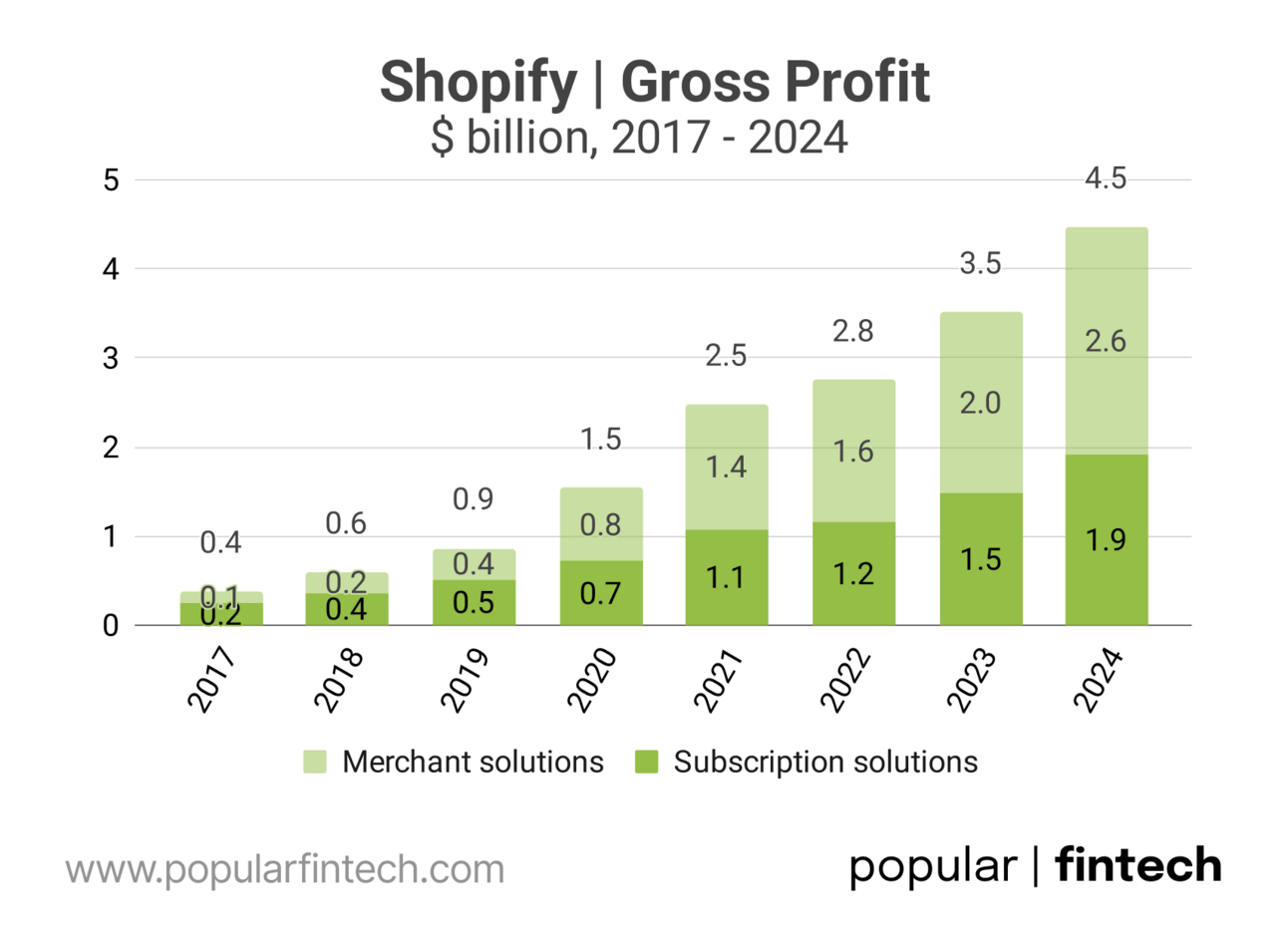

Thus, in 2024, “Merchant Solutions” revenue, which primarily consists of revenue from financial services, contributed $6.5 billion, or 74% of the company’s revenue. The importance of financial services in Shopify’s revenue mix makes me classify Shopify as a Fintech company (which many people still object to).

Data source: Shopify IR website

”Merchant Solutions” also contributed $2.6 billion, or 57% of Shopify’s gross profit (financial services have a lower gross profit margin than subscription services).

Data source: Shopify IR website

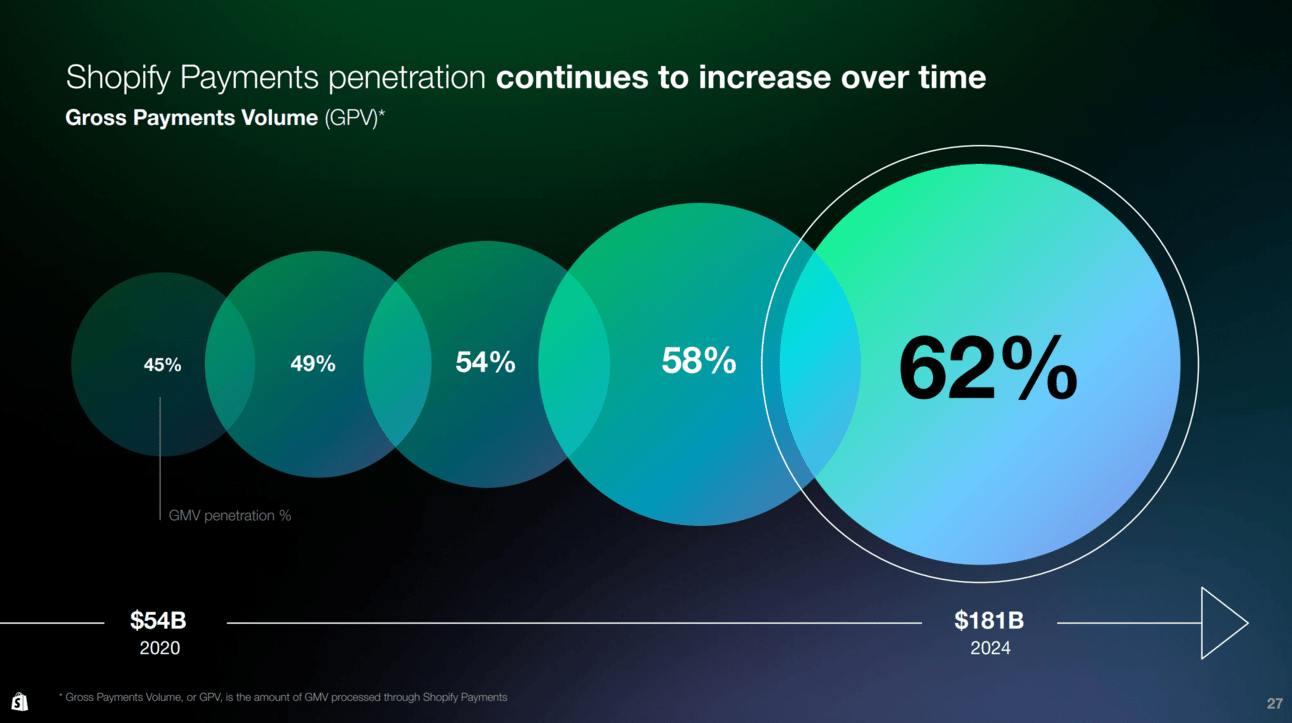

Shopify Payments is the company’s most mature financial services product. Launched in 2013, it processed $181 billion, or 62% of GMV, in 2024. As of Q1 2025, Shopify Payments was available in 39 countries.

Image source: Shopify Investor Overview - Q1 2025

“We made great progress in Q1 with Payments GMV penetration hitting 64%. We launched Shopify Payments in 16 new markets. At the end of 2024 and after a decade of offering Payments, it was in 23 countries. With our Q1 expansion, we nearly doubled that, bringing the total to 39 countries now supported by Shopify Payments.”

However, Shopify also offers Shopify Capital (merchant financing), consumer financing (Shop Pay Installments powered by Affirm), FX (powered by Global-E), and has a full banking offering for small businesses, including bill pay and savings accounts.

Image source: Shopify

“We continued to grow our capital business and have recently introduced several product innovations that give merchants more choice for how they manage their loans and how they choose among various loan options.”

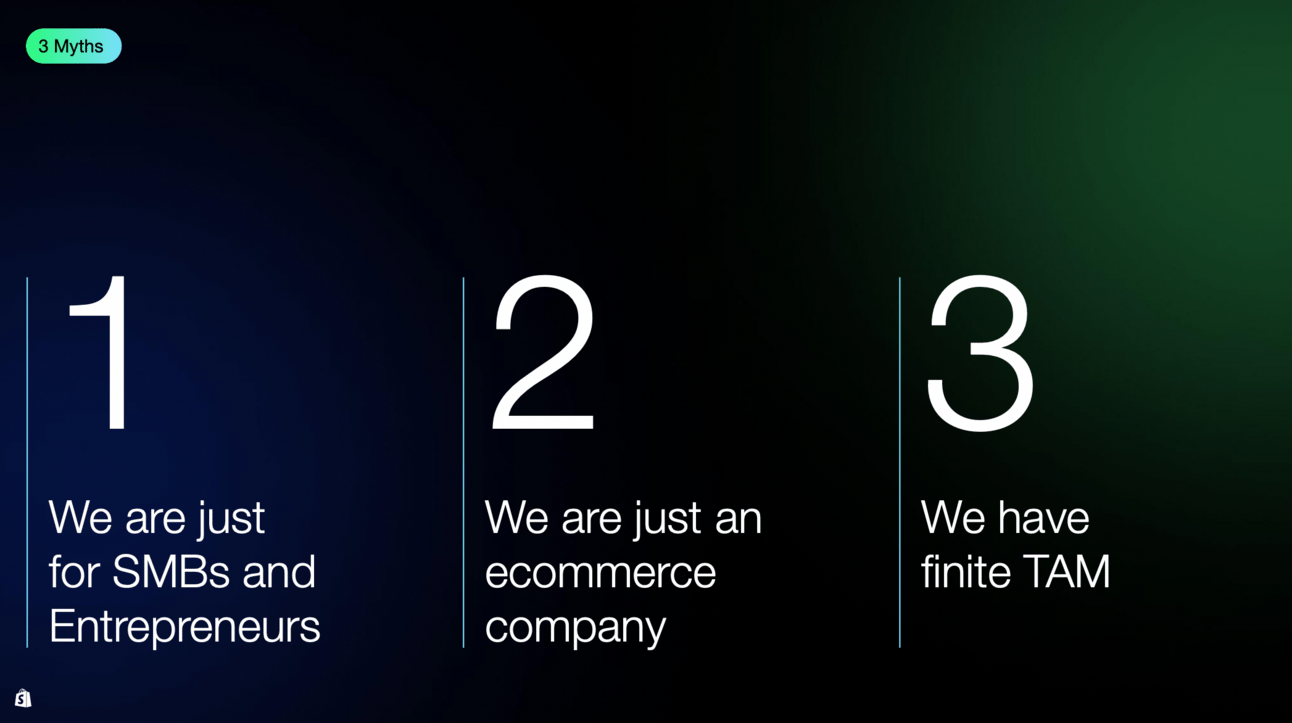

While researching Shopify, I noticed striking similarities to Toast. Like Toast, Shopify operates in a massive market dominated by incumbents, has outgrown its original focus, and is expanding into the enterprise segment. It’s also broadening its product offering (moving into offline commerce) and entering new geographies to grow its total addressable market.

Image source: Investor Day 2023 Presentation

“In 2025, we will continue to invest in our core platform and in key areas like enterprise, offline and international markets as these key growth drivers are helping to fuel our top line growth and laying the groundwork for ongoing success and innovation. As the commerce landscape evolves, we firmly believe Shopify is best positioned to thrive, thanks to our proven track record, agile platform, relentless focus on product innovation and the success of our merchants.”

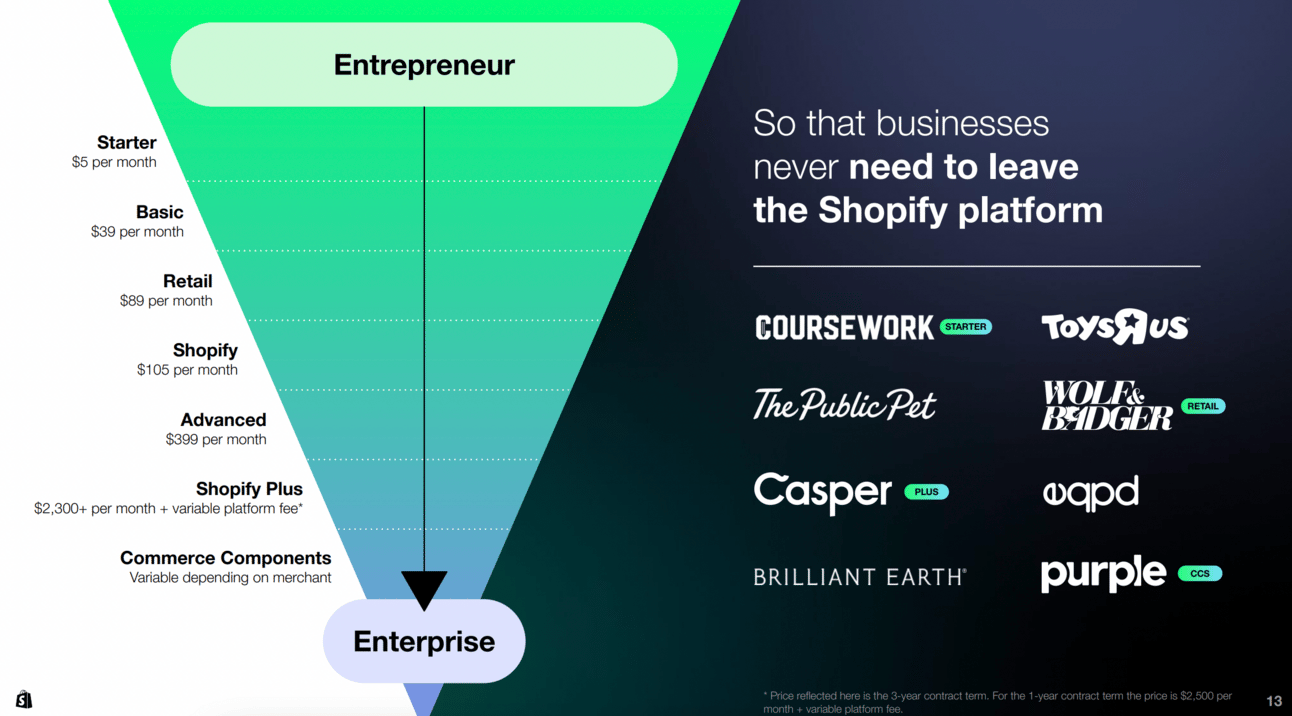

As noted earlier, the enterprise space is dominated by the incumbents (Adobe, Salesforce, and SAP). However, Shopify is using its development muscle to catch up with the incumbents on functionality, and offers enterprise customers unprecedented implementation speed (months instead of years).

Image source: Shopify Investor Overview - Q1 2025

“Once [ enterprise merchants ] see brands like Westwing, or BarkBox, or Reebok launch at this record speed where it doesn't take 12 to 18 months to launch, where it takes 3 months to launch, it's becoming incredibly compelling. But I think at the high level, the enterprise is migrating to Shopify.”

IDC still ranks Adobe and Salesforce as the leaders in enterprise commerce. Enterprise merchants have more sophisticated needs (such as integrations with the rest of the IT stack), and Shopify is yet to catch up with the incumbents. However, succeeding in the enterprise segment is Shopify’s top priority, so assuming it will never catch up with incumbents is an increasingly unreasonable bet.

Image source: Shopify

Shopify is also onboarding system integrators and consultants in its pursuit of enterprise merchants. Winning enterprise customers requires navigating lengthy RFP processes and ensuring seamless integration with complex IT systems, and Shopify is prepared to play that game.

Image source: Shopify Investor Overview - Q1 2025

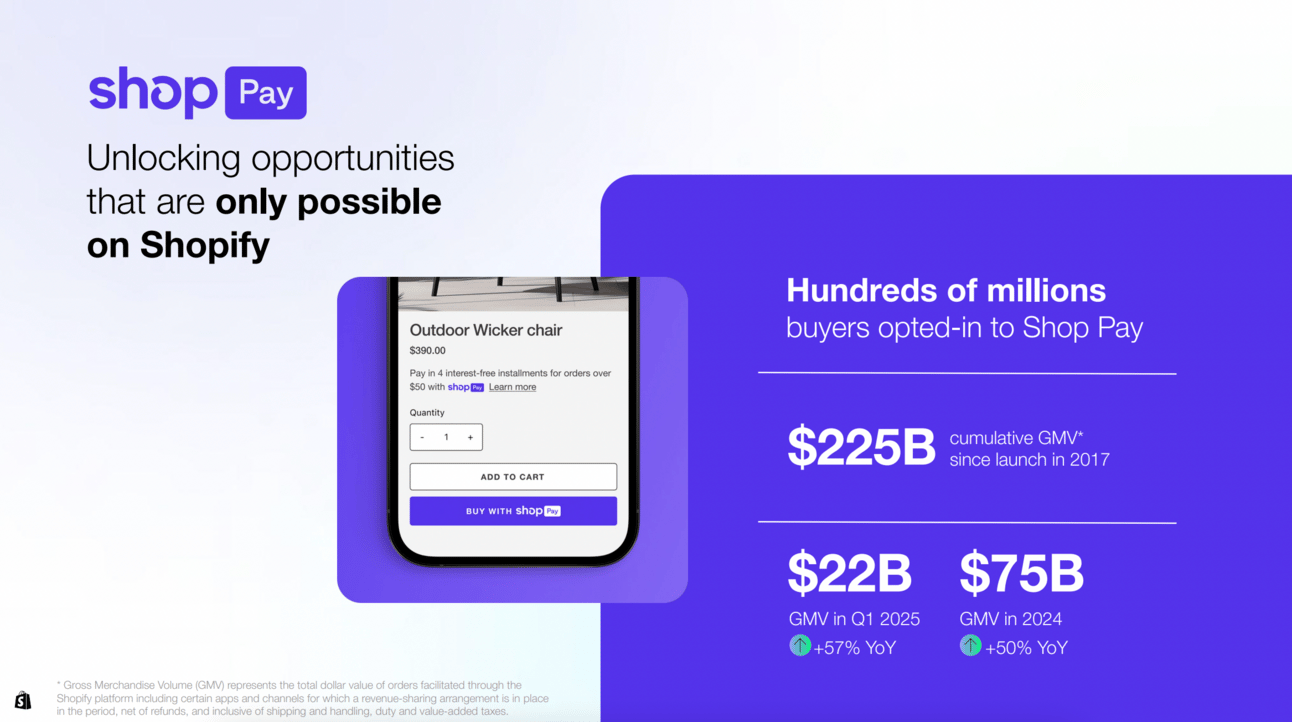

Shopify also launched Shopify Components, allowing enterprise merchants to try individual components, such as the company’s accelerated checkout solution, Shop Pay, without committing to the full platform. This reminds me of Adyen’s “land and expand” strategy, where it initially captures a portion of the payment flow and gradually increases its share of wallet over time.

Image source: Shopify Investor Overview - Q1 2025

“One of the biggest advantages to our merchants is access to Shop Pay. And in Q1, Shop Pay GMV was up 57% from last year, processing over $22 billion in GMV. Within our core pillars of Shop, the Shop Pay component continues to be a key product offering that is working to drive upmarket enterprise-level growth opportunities.”

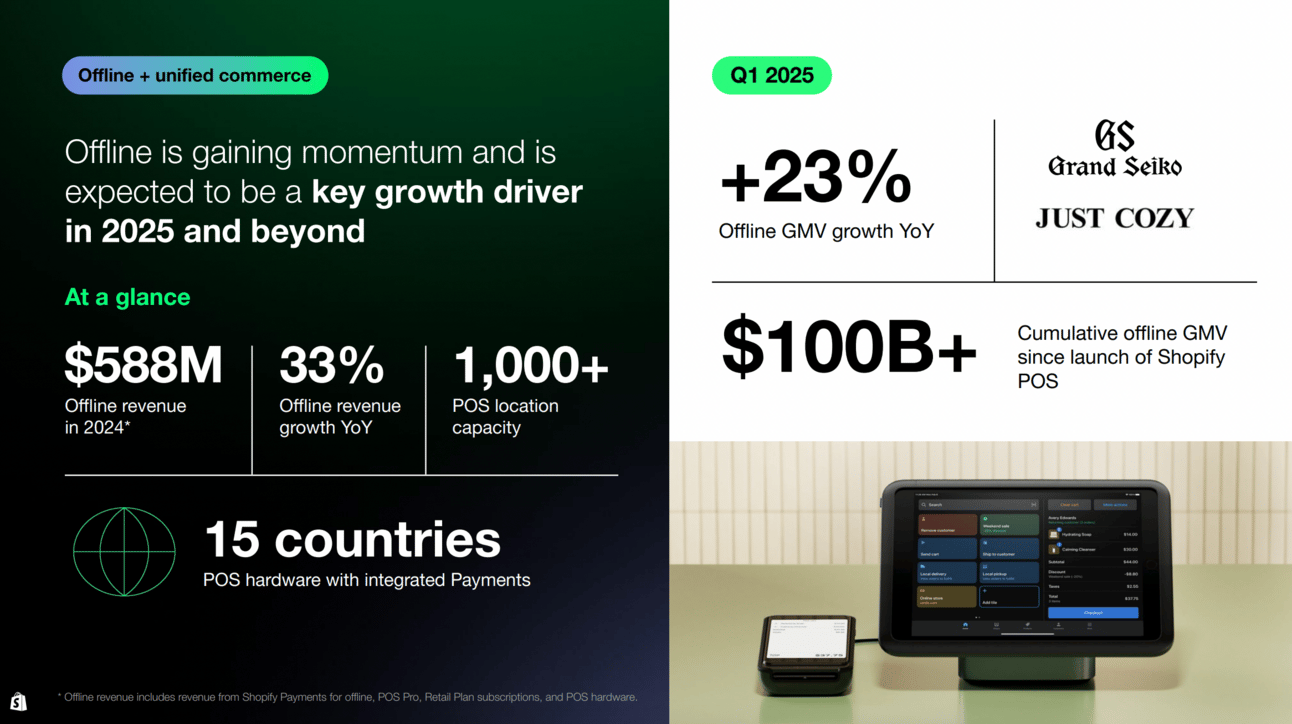

Shopify is also expanding beyond e-commerce. Thus, the company offers POS software and hardware targeting merchants with a physical footprint. The key value proposition is in offering a single solution to power in-store and online sales; however, the solution can be also used on a stand-alone basis.

Image source: Shopify

Shopify is early in its pursuit of offline commerce. Thus, in 2024, solutions for offline commerce contributed $588 million, or less than 7% of the company’s total revenue. However, the company expects offline commerce to be one of the key growth drivers going forward.

Image source: Shopify Investor Overview - Q1 2025

“In offline, we grew revenue 33% to $588 million for the year while also crossing $100 billion in cumulative offline GMV processed on Shopify.”

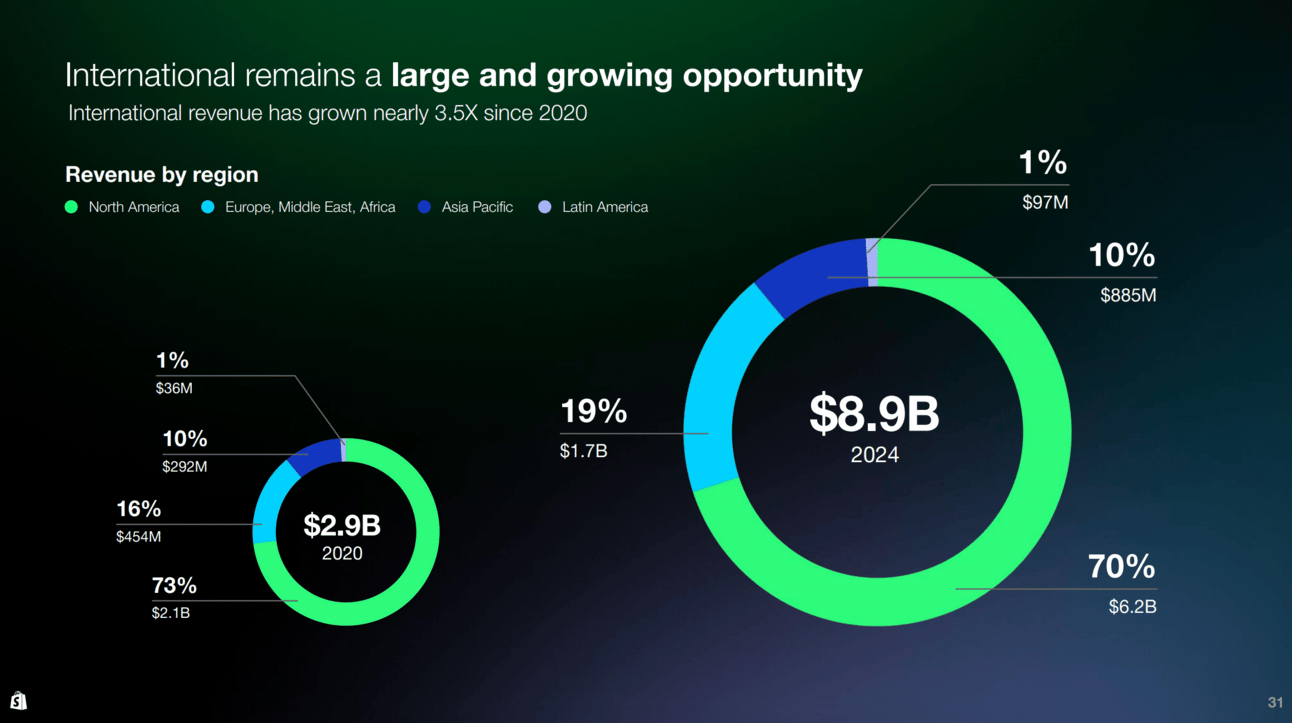

Finally, Shopify continues to expand geographically by winning more international merchants and expanding its product availability. In 2024, North America accounted for 70% of Shopify’s revenue, but international markets are growing at a significantly faster rate.

Image source: Shopify Investor Overview - Q1 2025

“Our international regions continued to outperform North America, achieving a 33% growth rate for the year. With 2 consecutive years of international growth exceeding 30%, we are driving rapid growth at scale as we continue to expand our global presence.”

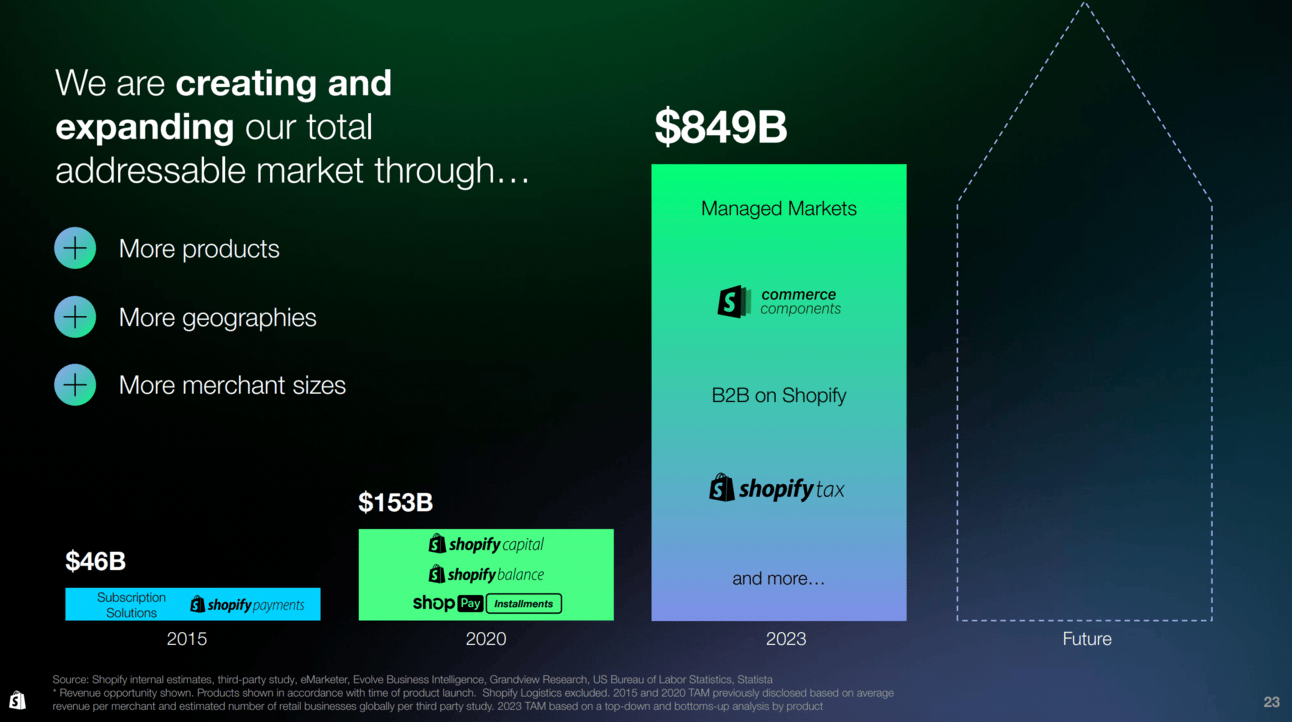

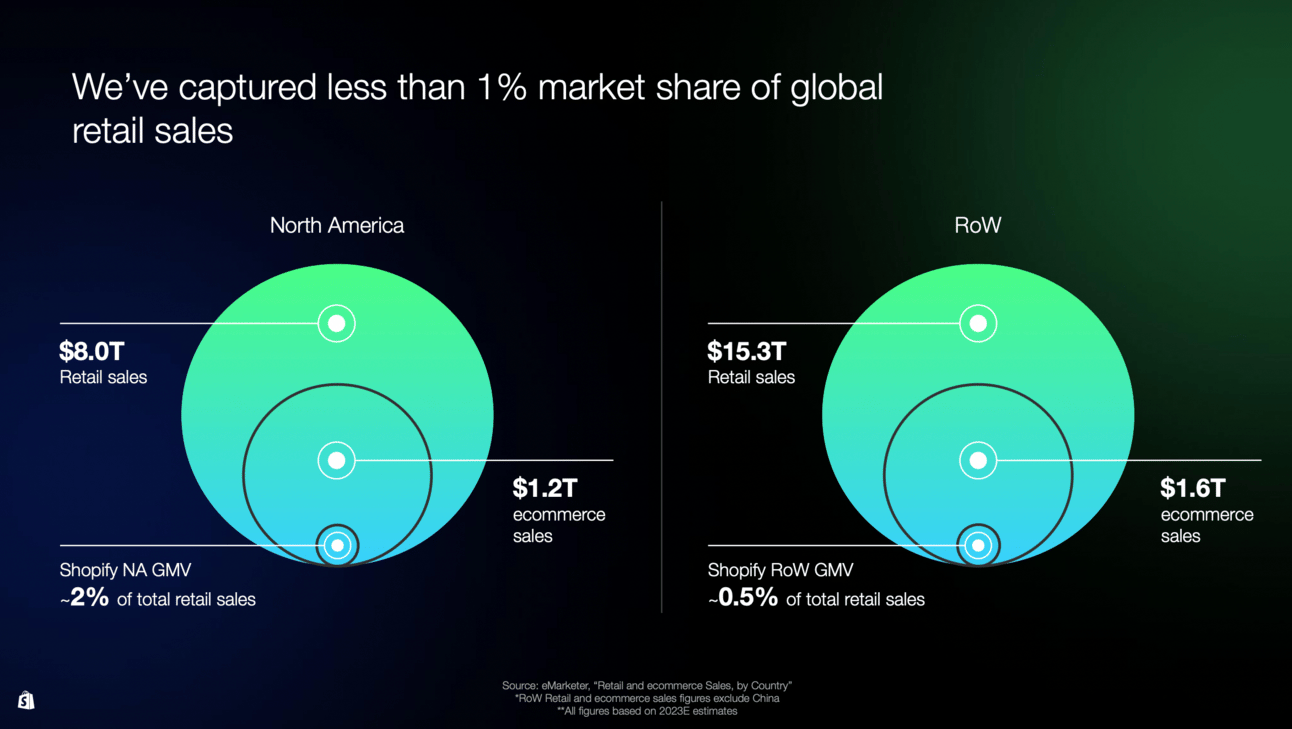

The combination of new customer segments (e.g., enterprise), an expanded product offering (e.g., offline commerce), and international growth is driving an increase in Shopify’s TAM. Thus, the company estimates that it has expanded its TAM (potential revenue) from $46 billion in 2015 to $859 billion in 2024.

Image source: Shopify Investor Overview - Q1 2025

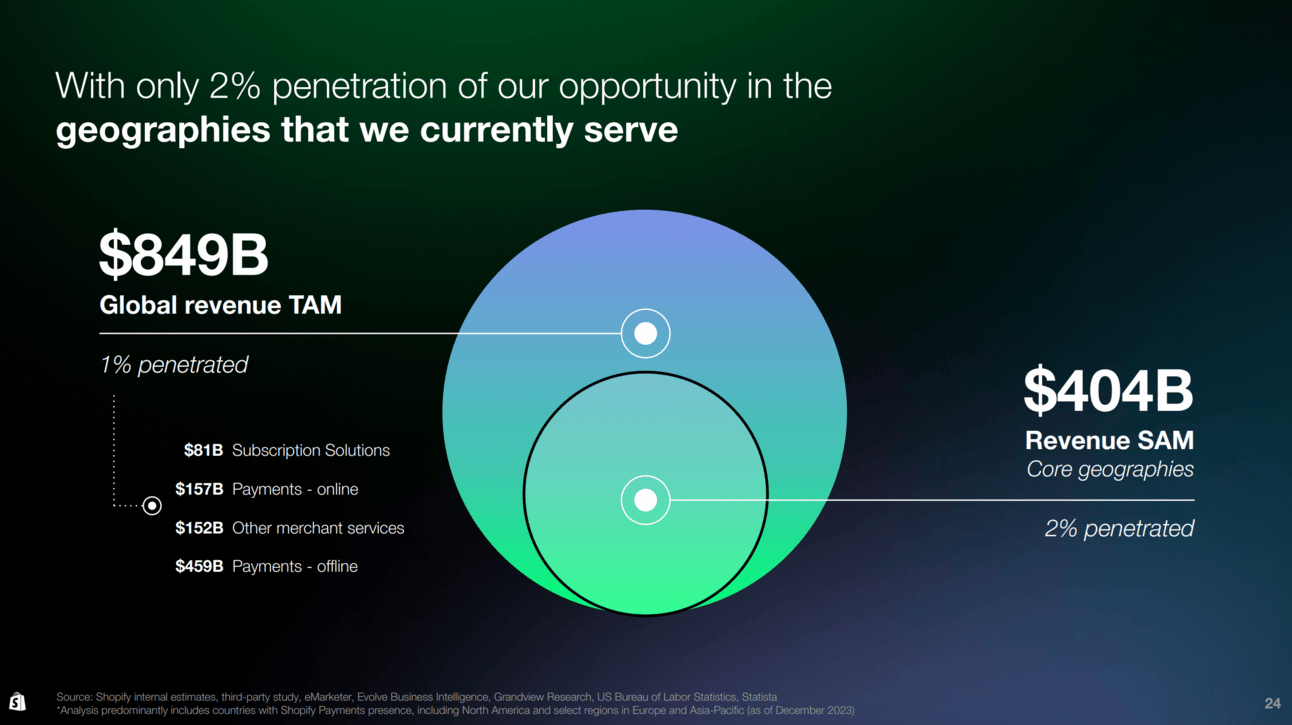

Based on the 2024 revenue of $8.9 billion, Shopify has so far captured slightly over 1% of TAM and 2% of SAM (Serviceable Available Market, or the opportunity within the company’s core geographies).

Image source: Shopify Investor Overview - Q1 2025

It should be noted that the largest component of Shopify’s TAM estimate is in-person commerce. As noted earlier, Shopify is still in the early stages of pursuing the offline retail opportunity, and success is not guaranteed, so the TAM estimate should be viewed with caution.

Image source: Shopify Investor Day 2023

Finally, let’s touch on AI. Shopify offers two AI products to its merchants: Sidekick, an AI assistant that helps merchants run their business by answering questions, offering suggestions, and automating tasks, and Magic, a suite of AI-powered features that help merchants generate product descriptions, emails, and other store content."

Image source: Shopify

“AI is being built into the culture, and frankly, built into the DNA of how we operate. It is now a reflex that is expected of our 8,000 people that work with us. So we're really leaning into this.”

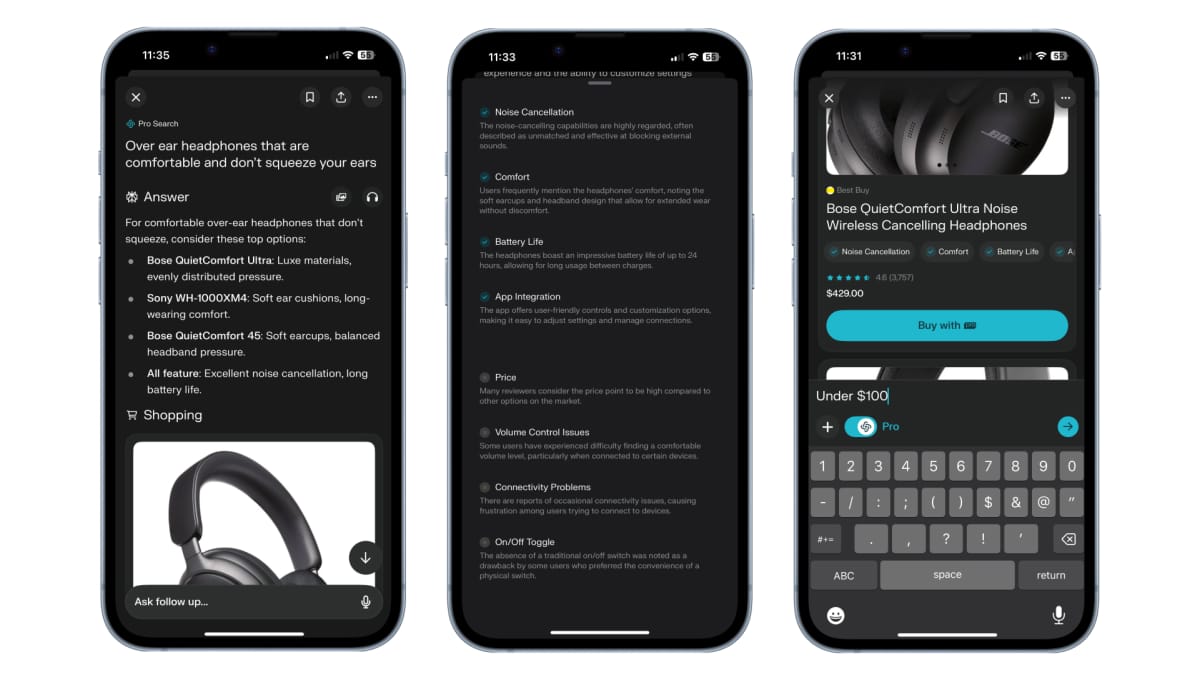

Shopify is integrated into Perplexity’s shopping functionality and is rumored to be powering the upcoming shopping features in ChatGPT. While it’s still early to tell how agentic commerce will evolve, I believe Shopify will be at the forefront of this trend. Shopify has figured out how to partner with the best Fintech companies to extend its platform. It will surely figure out how to partner with the best AI companies.

Image source: Techcrunch

“We've talked about some of the partnerships in the past. You've seen what we've done with Perplexity and OpenAI. We will continue doing that. We're not going to front run our product road map when it comes to anything, frankly. But we do think though that AI shopping, in particular, is a huge opportunity. And you can expect that Shopify will be wherever consumers are looking to find incredible products.”

So, who could stop Shopify from continuing to gain market share? I don’t think these would be the incumbents mentioned above (though they will put up a fight). If anyone is capable of disrupting Shopify’s growth, it’s Amazon. In 2024, Shopify’s GMV actually surpassed Amazon's sales in its online and physical stores.

Data source: Data source: Shopify and Amazon IR websites

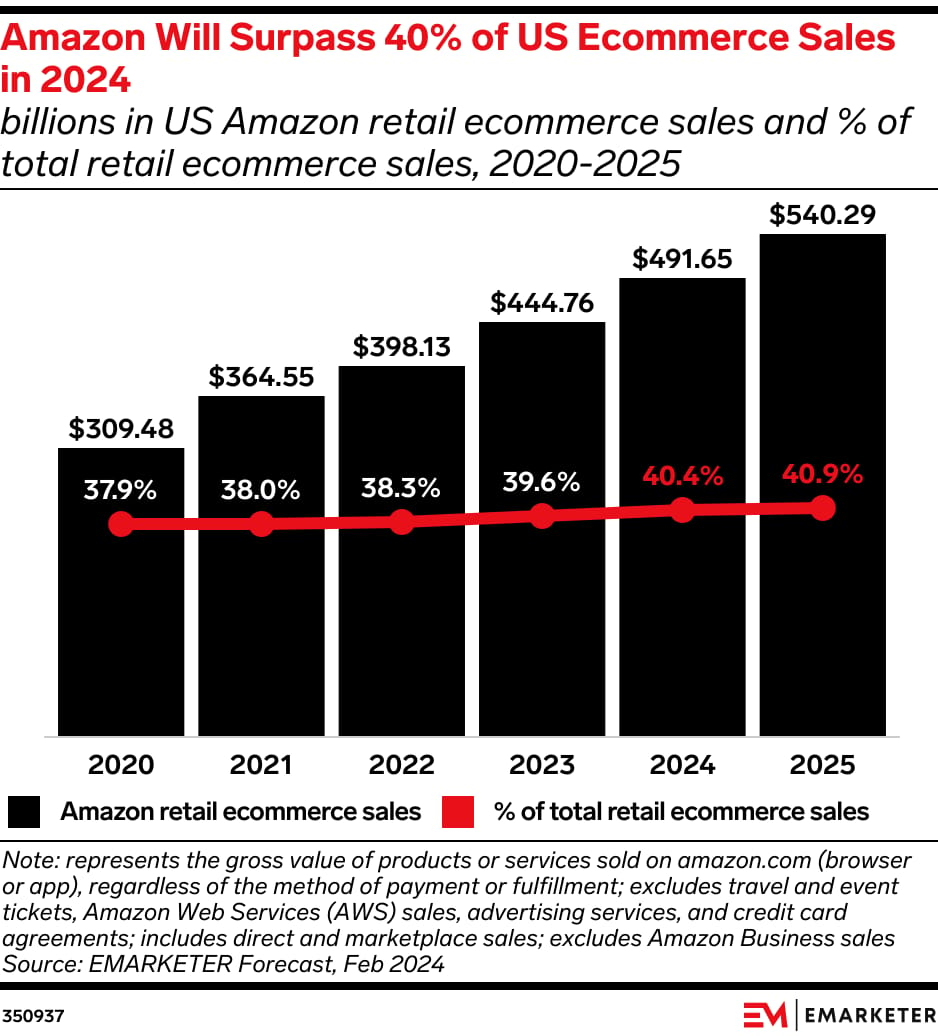

However, Amazon also offers a third-party seller platform, enabling merchants to sell directly through its marketplace (which is an alternative to running your own store powered by Shopify). While Amazon does not disclose third-party GMV, eMarketer estimates suggest it exceeds the GMV of Amazon’s own retail sales.

Image source: eMarketer

Amazon’s key advantage over Shopify is its distribution network. While Shopify once aimed to build its own fulfillment network, it eventually abandoned those plans. Amazon’s fulfillment network and logistics expertise give it a key advantage: faster delivery times.

However, it is unrealistic to expect Amazon to capture 100% of online (or offline) commerce, or that merchants, especially enterprise ones, will forgo their own storefronts in favor of selling exclusively through Amazon. And someone will need to power those independent storefronts…

…and I believe this will be Shopify (with some help from its amazing Fintech partners).

“Our vision goes way beyond just the next quarter. We are committed to building a durable 100-year company that doesn't just meet the needs of our merchants but anticipates what they'll need in the next 5, 10, even 20 years.”

Cover image source: Shopify

Disclaimer: The views expressed here are my own and do not represent the views of my employer. The information contained in this newsletter is intended for educational and informational purposes only and should not be considered financial advice. You should do your own research or seek professional advice before making any investment decisions. Read the full disclaimer here.