Hey!

In December 2015, Bessemer Venture Partners wrote a $17.5 million check to a “company selling restaurant point of sale software”. The company was going after the incumbents, Micros and NCR, each controlling “roughly 25% market share”. At the time, the funding round valued it at $122 million.

That company was Toast $TOST ( ▲ 2.51% ). A decade later, Toast is a public company with a market cap of over $20 billion, but…the same incumbents still dominate the market. Toast is expanding internationally and pursuing new customer segments, and I believe, finally, it has the muscle to dethrone these incumbents.

Toast is not a startup, and its stock is far from cheap, but the growth opportunity in front of it is still massive. Let’s dig in!

Jevgenijs

p.s. if you have feedback, just reply to this email or ping me on X/Twitter

In December 2015, Kent Bennett and Eric Ahlgren wrote an investment memo recommending that Bessemer Venture Partners invest $17.5 million in a “company selling restaurant point of sale (POS) software”. The investment would give BVP a 14.3% ownership, implying a $122 million valuation of the company.

They argued that “the POS market [ was ] extremely fragmented, with two large incumbents, Micros and NCR, each accounting for roughly 25% market share.” Nevertheless, the company was “consistently [ winning ] based on the quality of product and reasonable pricing.”

As you might have guessed, that company was Toast $TOST ( ▲ 2.51% ). In September 2021, Toast went public and, as of this writing, its market capitalization is around $20.8 billion.

Toast started with POS software, but over time has expanded its software offering. Today, it offers software solutions for nearly every aspect of restaurant operations, including payroll and HR, marketing, and kitchen management.

Image source: Toast Investor Day 2024

“Toast is a cloud-based, all-in-one digital technology platform purpose-built for the entire restaurant community. Toast provides a single platform of software as a service, or SaaS, products and financial technology solutions that give restaurants everything they need to run their business across point of sale, operations, digital ordering and delivery, marketing and loyalty, and team management.”

The number of restaurant locations that the company serves increased fivefold over the last 5 years, and Toast finished 2024 serving 134,000 restaurant locations.

Toast charges its customers a software subscription fee and finished 2024 with $832 million in annual recurring revenue (ARR). In 2024, the company generated $706 million in subscription revenue, earning a gross profit margin of approximately 70%.

However, they also “attach” payment processing (and lately, lending) to their software offering. Thus, in 2024, Toast processed $159 billion in payments, generating $4.1 billion in revenue and earning a 22% gross profit margin.

“Some of our competitors offer specific point solutions without the requirement to use related payment processing services. While we believe that our integrated software and payments platform offers significant advantages over such point solutions, customers who have specific needs, and customers who do not want to change from an existing payment processing relationship, may believe that products and services offered by competitors better address their needs.”

As is common for vertically integrated software providers, Toast earns more money from payments than it does from selling software. Thus, in 2024, the company earned $1.2 billion in gross profit on $4.96 billion in revenue. Subscription services brought in $487 million in gross profit, while financial technology services brought in $877 million in gross profit (the company has a negative margin on hardware).

In 2023, Toast reached profitability on an adjusted basis (as in delivering positive Adjusted EBITDA for the year), which was followed by reaching GAAP profitability in 2024. The company expects to remain GAAP-profitable going forward.

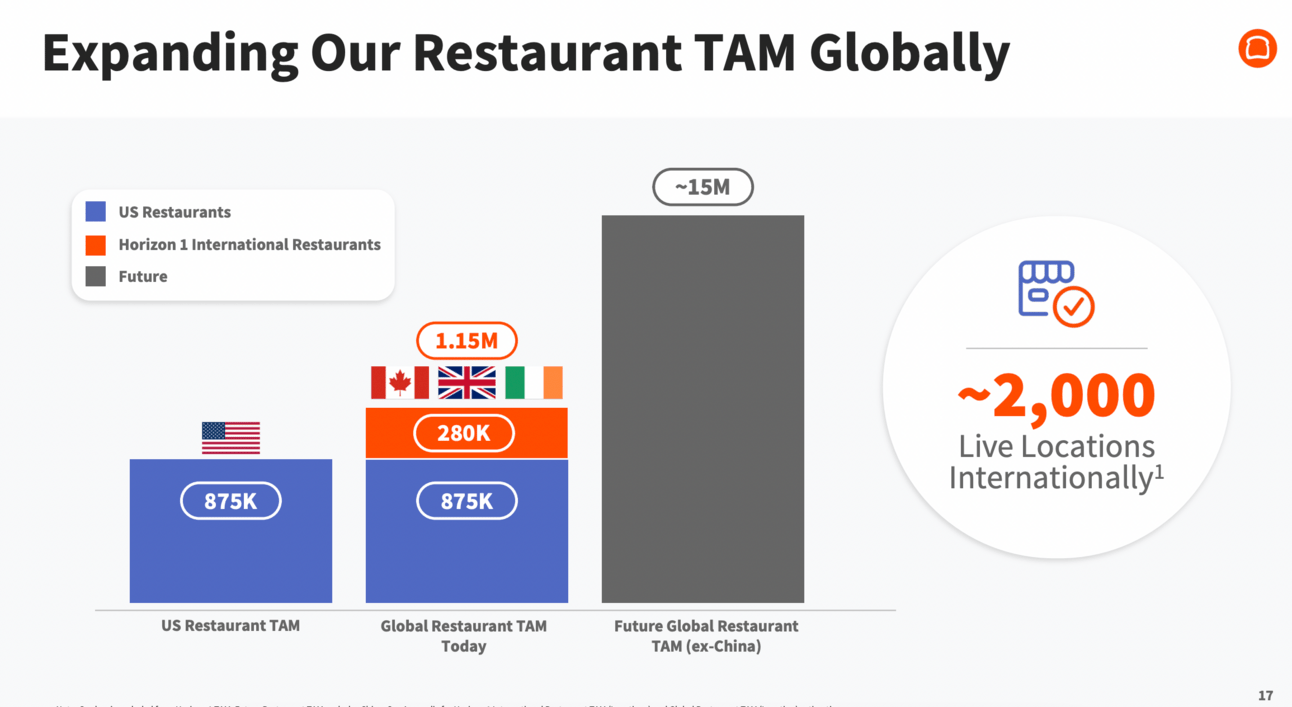

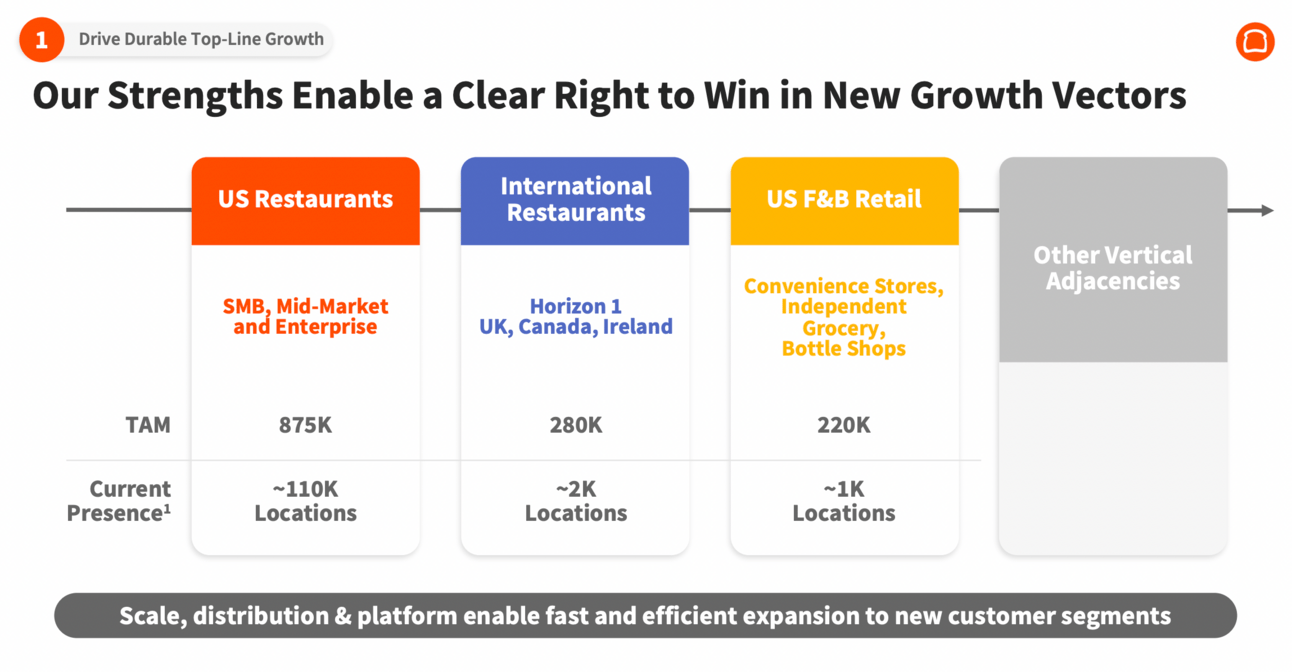

Nevertheless, despite what’s already an obvious success, Toast is still early in its journey. Thus, the company estimates that there are 875 thousand restaurant locations in the US, which means that it still serves just around 15% of its TAM.

Image source: Toast Investor Day 2024

“Despite our strong growth at just 15% market share in the U.S. restaurant market, we have tremendous headroom to scale. In 2024, we increased market share and location count in all of our top 100 markets in the SMB segment.”

So, who serves the rest of the market? The same incumbents who were mentioned in the Bessemer Venture Partners memo. Almost ten years passed, but the industry is still fragmented, and NCR and Oracle (the company behind the MICROS POS) are still the largest players in the space.

Image source: Toast Investor Day 2024

“…the industry sort of remains fragmented, with a significant portion of restaurants still on legacy platforms. And Toast is leading the way, across all cloud platforms. And we have conviction that just as a decade ago, you saw the industry consolidate across a few vendors. We have conviction that the same thing will happen as this transition happens to the cloud as well.”

NCR’s story is super fascinating. Thus, while Toast was evolving from a startup into one of the market leaders, NCR split into two companies, one keeping the software business, NCR Voyix $VYX ( ▲ 4.01% ), and the other one, NCR Atleos $NATL ( ▲ 4.91% ), keeping the ATM business.

Following the split, NCR Voyix also sold its banking unit to focus solely on the software for restaurants and retail merchants, and is now in the process of selling its hardware manufacturing (the company did manufacture its payment terminals). What’s left is a company that provides software and payment services for restaurants and retailers.

Image source: NCR Voyix Investor Day 2023

“…in retail, we are honored to be the global leading point-of-sale software provider and call 67% of the largest 400 retailers by revenue customers…in our restaurant business, we are honored to be the #2 point-of-sale software provider globally and boast 8 of the top 10 global restaurant chains as customers”

NCR Voyix still serves more restaurant locations than Toast. The company’s client roster includes Starbucks, Chipotle, and McDonald’s. NCR Voyix also serves retail merchants, and its POS solutions support even more retail locations than restaurant locations.

Image source: NCR Voyix Investor Day 2023

“While the sales cycle for enterprise point-of-sale is very competitive, once committed, we generally maintain these relationships for over 10 years, sometimes as long as 30 years.”

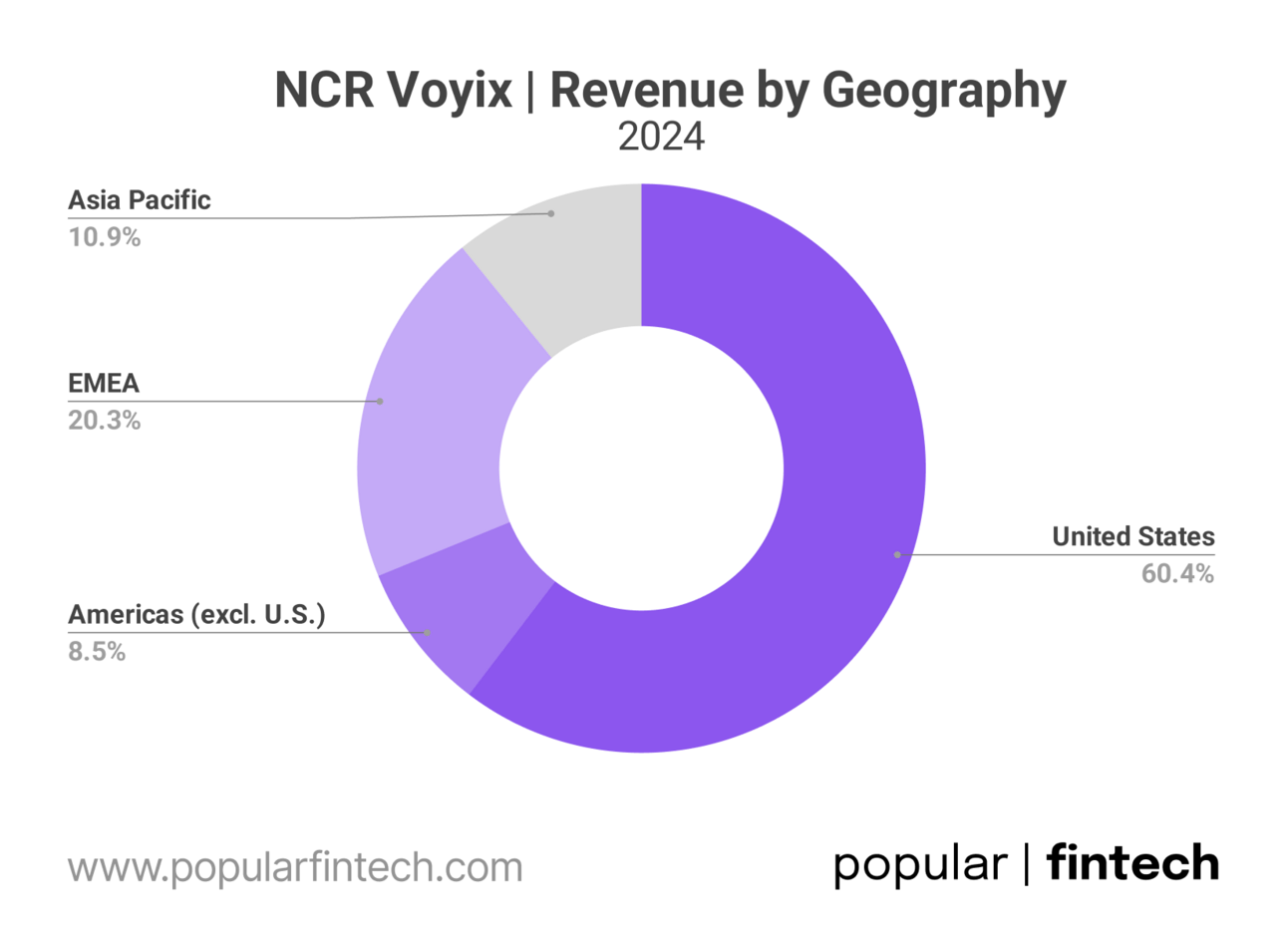

NCR Voyix is a global player with almost 40% of its revenue coming from outside the U.S. For instance, the company’s solutions are used by British retail chains Sainsbury’s and Tesco.

“While the sales cycle for enterprise point-of-sale is very competitive, once committed, we generally maintain these relationships for over 10 years, sometimes as long as 30 years.”

IDC even ranked NCR Voyix ahead of Toast in the POS software market for quick-service and full-service restaurants, with Oracle receiving the highest score overall in both categories (though I would expect, this rating might not hold the ultimate truth).

Image source: IDC via Oracle

NCR Voyix is also not sitting still. Thus, it has developed a cloud-based solution, Aloha Cloud, and is actively working on moving its customers to this platform. The company aims to migrate 40% of client locations to its cloud platform by 2027 (referred to in the company’s financial disclosures as “Platform sites”).

Image source: NCR Voyix

“…we have approximately 74,000 sites on our platform, an increase of 26% from the prior year. In restaurants, Aloha Cloud point-of-sale has been widely available for fast casual for more than a year with nearly 15,000 locations operating on a platform today, many of which are multisite businesses.”

NCR is also trying to “attach” payments to its offering. Thus, in 2018 it acquired a payment processor JetPay. However, it turned out that JeyPay’s solution wasn’t good enough NCR’s clients, so the company partnered with Worldpay. Interestingly, Toast used Worldpay for a long period of time at its exclusive processor, but now also partners with JPMorgan Payments and Adyen (in Europe).

“…we have entered into a 5-year nonexclusive agreement with Worldpay, a global leader in payment solutions to provide the necessary functionality to meet the needs of our enterprise customers beginning in the United States. For 2024, our U.S. customers processed over $500 billion in payments through their point of sale, the majority of which relates to enterprise customers.”

But you know what? While NCR Voyix is trying to replicate Toast’s capabilities (cloud, integrated payment processing), Toast started expanding into retail. The company recognized that it had already developed many components suitable for retail merchants and would only need to customize or build a few additional pieces to serve this market.

Image source: Toast Investor Day 2024

“That's what led to the beginning of our retail offering. And what we realized is many aspects of our platform are actually horizontal. Think about payment processing, lending, scheduling, payroll, and the parts that are specific, vertical specific, the core point-of-sale experience, or the guest experience.”

Toast has also started expanding geographically. Thus, in 2023, the company entered Canada, Ireland, and the U.K. Its footprint outside of the U.S. is still minuscule, but it claims higher “location productivity” of its sales reps (meaning, sales representatives sign new locations faster than in the U.S.).

Image source: Toast Investor Day 2024

“Over the next decade, we have the opportunity to serve many multiples of our 134,000 customer locations today. Not only can we grow market share and scale locations in our U.S. restaurant segments, we can continue to expand our TAM by building out the platform to support new geographies and new verticals across complex higher GPV merchants where we have a right to win.”

….and, last, but not least, Toast is expanding into the enterprise segment in the U.S. The sole reason why NCR and Oracle still serve so many restaurant locations is their strong foothold in the enterprise segment. A single customer can bring hundreds or even thousands of locations.

Image source: Toast Investor Day 2024

“…our second priority is demonstrating that these new markets can be material drivers of growth. In 2024, we made great progress across enterprise, international and retail, and expect to surpass 10,000 customer locations across these new segments later this year.”

And this business is about locations. Toast’s data shows that both the average payment volume per location and the average take rate have remained stable over time. So the growth in the company’s gross profit from financial services is pretty much a product of the growth in the locations it serves.

In the last five years, Toast managed to double its average software revenue per location by building new software products and upselling more products to its customer base. However, we are probably talking about single-digit growth in average software revenue per location going forward. Thus, the growth in gross profit from software solutions is also pretty much a product of growth in served locations.

So…given that incumbents still serve hundreds of thousands of restaurant and retail locations, and assuming Toast manages to execute on its ambition to expand into new segments and geographies, it’s reasonable to conclude that Toast has a long growth runway and should continue expanding for years to come.

Source: Koyfin

Of course, Toast is not the only company trying to dethrone the incumbents. There are Shift4, PAR, Square, Clover, and many others. And the incumbents themselves are not yet throwing in the towel. Still, Toast has emerged as a frontrunner in this fragmented market, and, based on the estimates, it looks like Wall Street analysts expect it to continue winning.

The stock isn’t cheap, but opportunities with this kind of growth runway don’t come around often.

Cover image source: Toast

Disclaimer: The views expressed here are my own and do not represent the views of my employer. The information contained in this newsletter is intended for educational and informational purposes only and should not be considered financial advice. You should do your own research or seek professional advice before making any investment decisions. Read the full disclaimer here.