Last week Robinhood ( ) reported its Q1 2022 results. I guess investors’ expectations were super low going into the earnings call, as the stock price didn’t crash despite the decreasing revenues and increasing losses. Nevertheless, I think it is too early to write this company off. It is difficult for the company to report any meaningful growth this year given the “outlier” Q1 and Q2 of last year and consequently difficult comps. Last year, Robinhood customers were going wild trading meme stocks and chasing skyrocketing crypto prices. This year should tell what the company’s “normal” year could be (and let’s omit for a moment that 2022 didn’t start as a normal year). Let’s try to objectively decompose what Robinhood reported last week!

If you are new to Robinhood, I suggest reading my profile of the company titled “Robinhood: a brokerage that aimed to "democratize finance for all".

Funded Accounts and MAUs

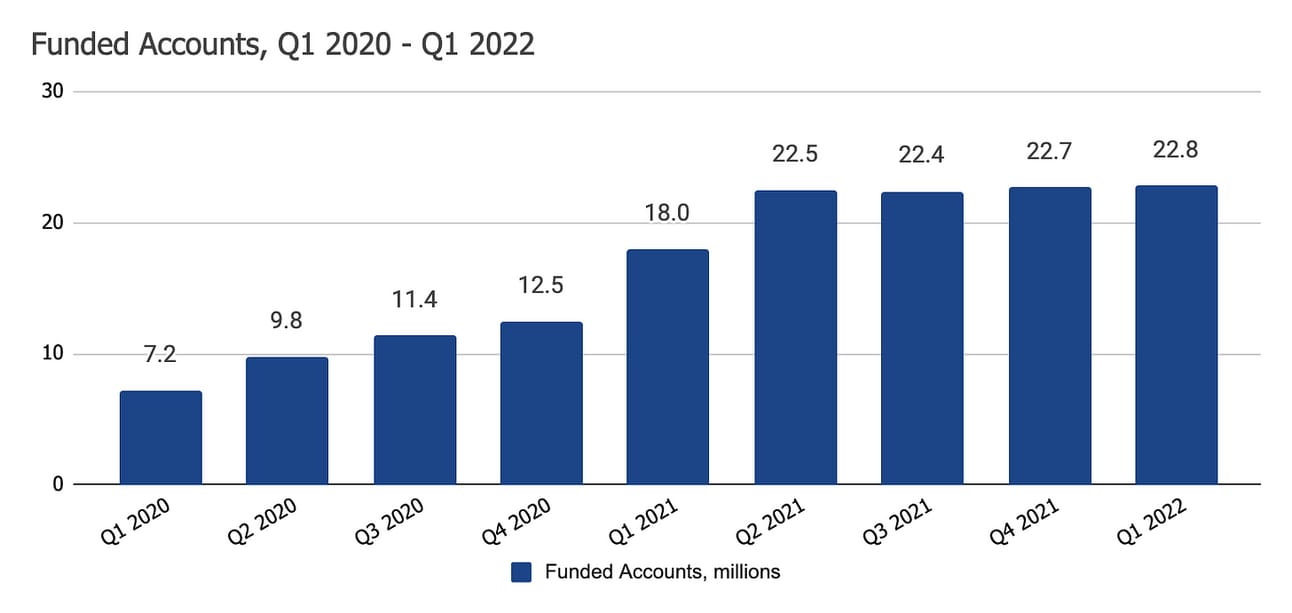

Robinhood reported 22.8 million Cumulative Funded Accounts at the end of Q1 2022, a 27% YoY growth, and a small increase from 22.7 million at the end of 2021. The company provides a breakdown of the changes in the Funded Accounts; thus, the quarter brought 0.5 million new accounts, 0.1 million customers resurrected their accounts, and 0.5 million customers churned.

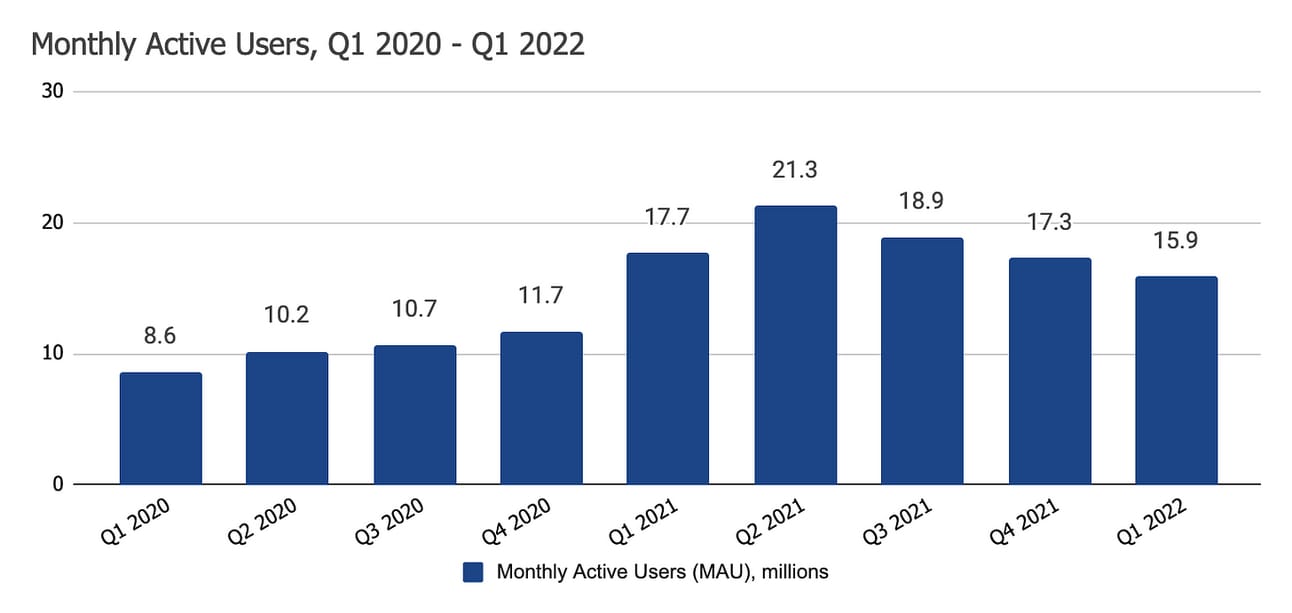

As I wrote in my Robinhood profile, the concerning part is the decreasing engagement of customers, as measured by the Monthly Active Users. The company reported 15.9 million Monthly Active Users in Q1 2022, which represents a 10% decline YoY, and an 8% decline from the previous quarter. When reporting quarterly data, Robinhood presents MAUs for the last month in the quarter (i.e. March 2022).

Robinhood defines a “Monthly Unique User” as “a unique user who makes a debit card transaction, or who transitions between two different screens on a mobile device or loads a page in a web browser while logged into their account, at any point during the relevant month.” As you can see from the definition, this is quite a vague metric, so treat it with caution.

During the earnings call, the company announced that it will be publishing monthly metrics going forward (the first one should be published in mid-May, 2022). I hope that they will start reporting Daily Average Revenue Trades, which should be a better measure of customer activity than MAUs. Thus, in its annual report, the company reported that “daily average revenue trades for equities increased from 2.2 million [in 2020] to 3.1 million [in 2021]”, and “daily average revenue trades for cryptocurrencies increased from 0.1 million to 1.2 million.”

Assets Under Custody

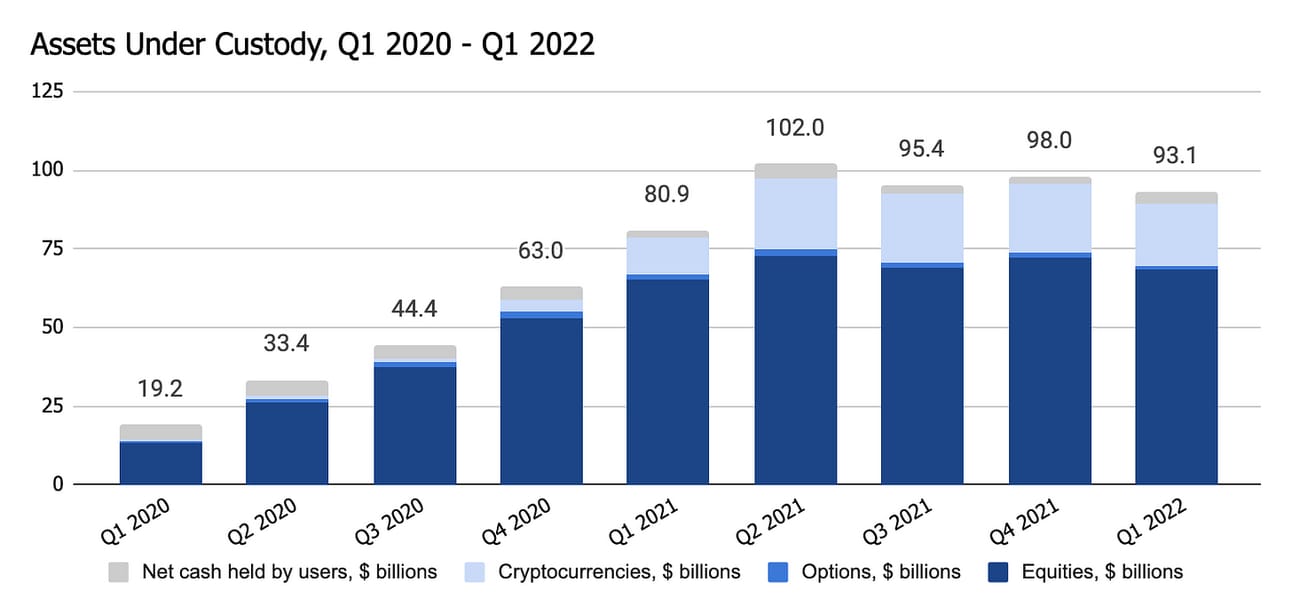

Robinhood reported $93.1 billion in Assets Under Custody at the end of Q1 2022, which represents a 15% increase YoY, and a 5% decrease from the previous quarter. Equities represented 73.6% ($68.5 billion), Cryptocurrencies represented 21.2% ($19.7 billion), and Options represented 1.2% (1.1 billion) of the total Assets Under Custody. Robinhood customers ended the quarter with $3.8 billion (or 4.1% of AUC) in cash on their accounts.

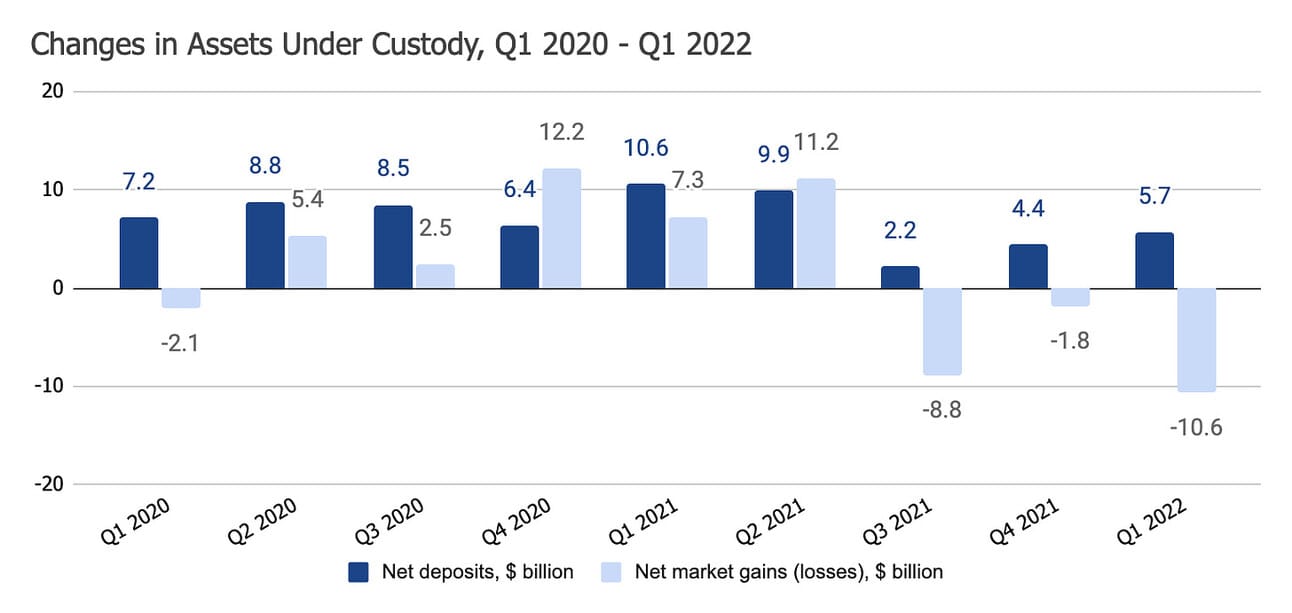

One of the few positive highlights from this earnings release was the growing net deposits. Thus, you can see from the chart below that Robinhood customers deposited $5.7 billion to the platform during the quarter. It is also important to note that the above-mentioned decrease in the Assets Under Custody was driven by the decrease in the asset value of Robinhood customers’ portfolios, rather than cash outflows. Q1 2022 was a terrible quarter for the market, and Robinhood customers’ portfolios experienced a $10.6 billion net market loss during the period.

Overall, the situation doesn’t look very tragic: the number of funded accounts remains quite stable, and Robinhood customers keep depositing more cash to the platform. The company went through two extraordinary events last year (the meme stock craziness of Q1 2021, and the crypto boom of Q2 2021), as well as just went through a historic market turmoil in the first quarter of 2022. Therefore, I wouldn’t measure the company’s performance against these exceptional periods.

Revenue

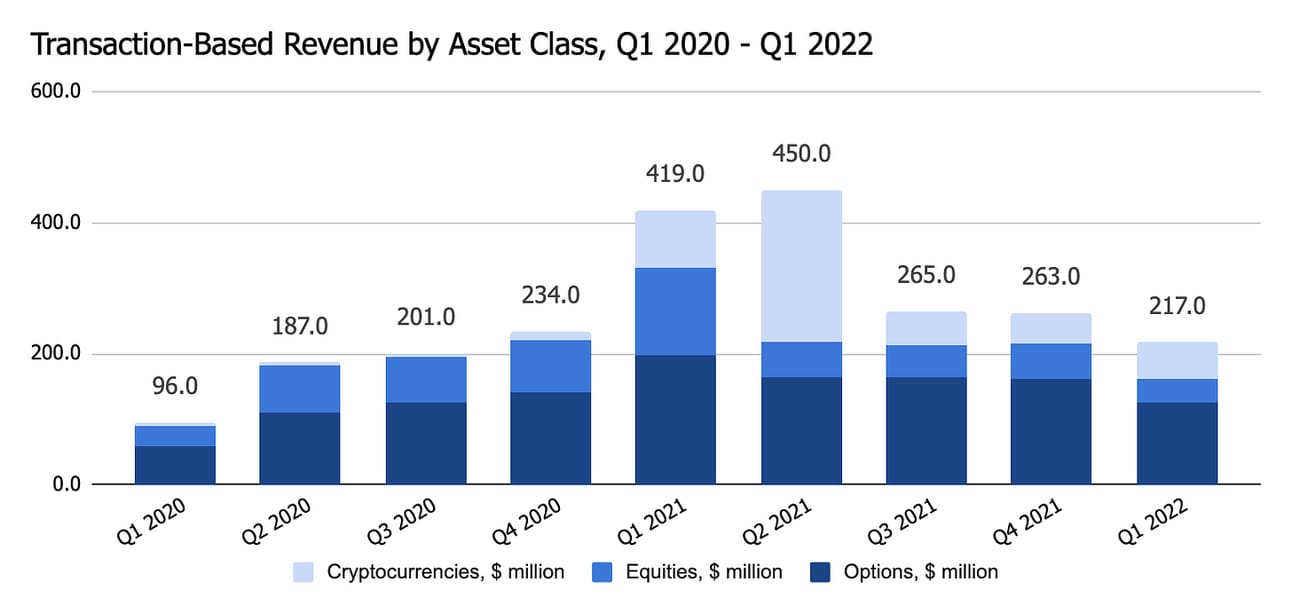

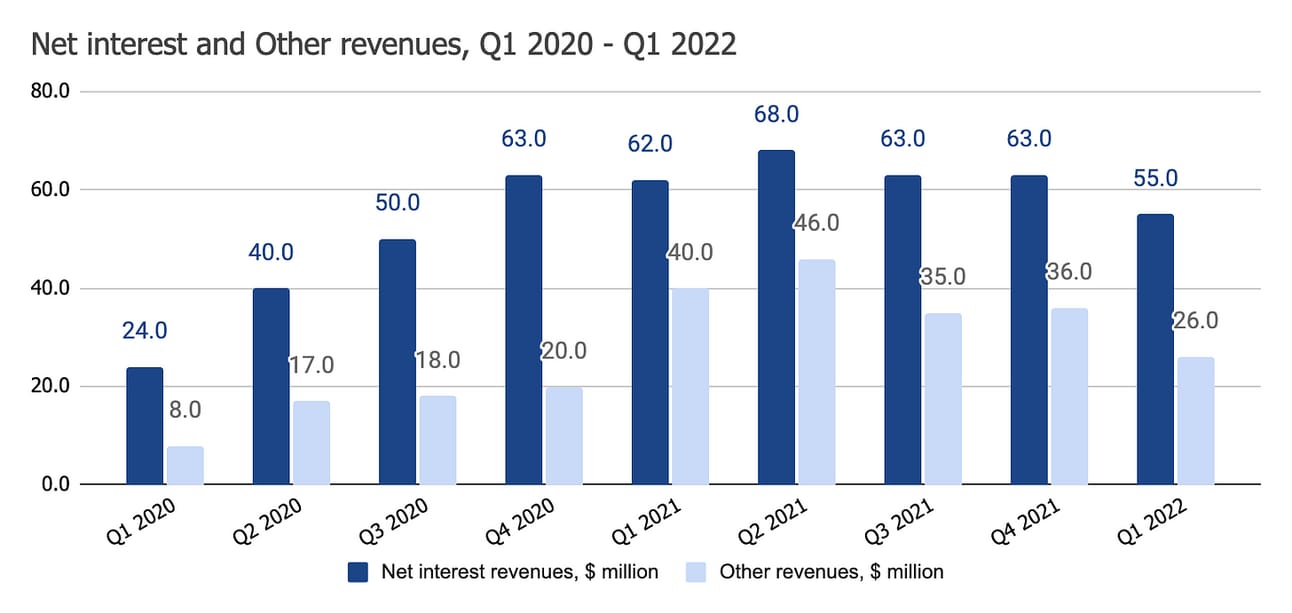

The company reported $299 million in Net Revenue in Q1 2022, which represents a 42.7% decline from Q1 2021, and a 17.6% decline sequentially. Transaction-based revenue stood at $218 million (72.9% of Net Revenue), Net interest revenue stood at $55 million (18.4%), and Other revenue, which primarily includes Robinhood Gold subscription and account transfer (ACATS) fees, contributed the remaining $26 million (8.7%).

As mentioned earlier, the company went through two exceptional quarters last year, and the chart below illustrates that. Thus, you can see “abnormal” activity in equities and options trading in Q1 2021 and cryptocurrencies trading in Q2 2021. Respectively, the 42.7% YoY decline in Net revenue was primarily driven by the decline in Transaction-based revenue from equities and options trading (73% and 36% YoY decline respectively).

This year I will be watching the “normalized” level of transaction-based revenues (meaning revenue level excluding extraordinary market events), as well as the development of Net interest and Other revenues. Thus, Robinhood is heavily investing in its product offering and started rolling out the Fully Paid Securities Lending program, as well as launched the Cash Card, which should start contributing to Net interest and Other revenues at some point. So far the trend in both Net interest and Other revenues has been negative; let’s see if Robinhood’s efforts will reverse it.

During the earnings call the company’s management said that they will not be providing revenue guidance going forward, and expect the monthly operational metrics, that the company will start publishing in May, to provide meaningful guidance to investors.

Operating Expenses

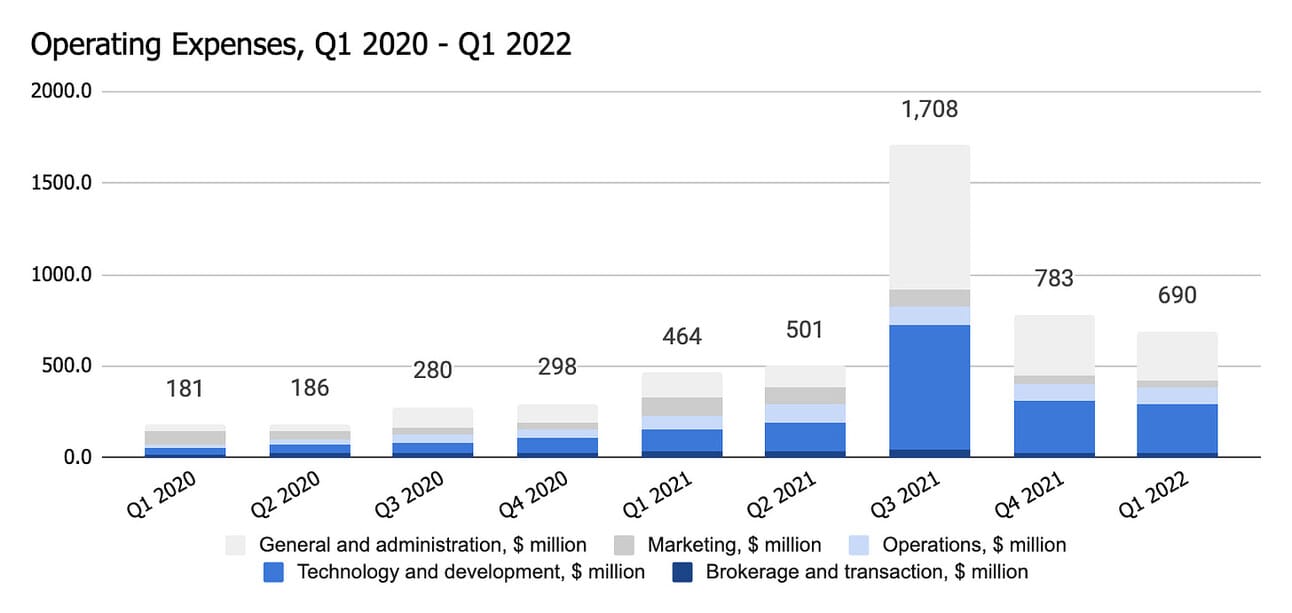

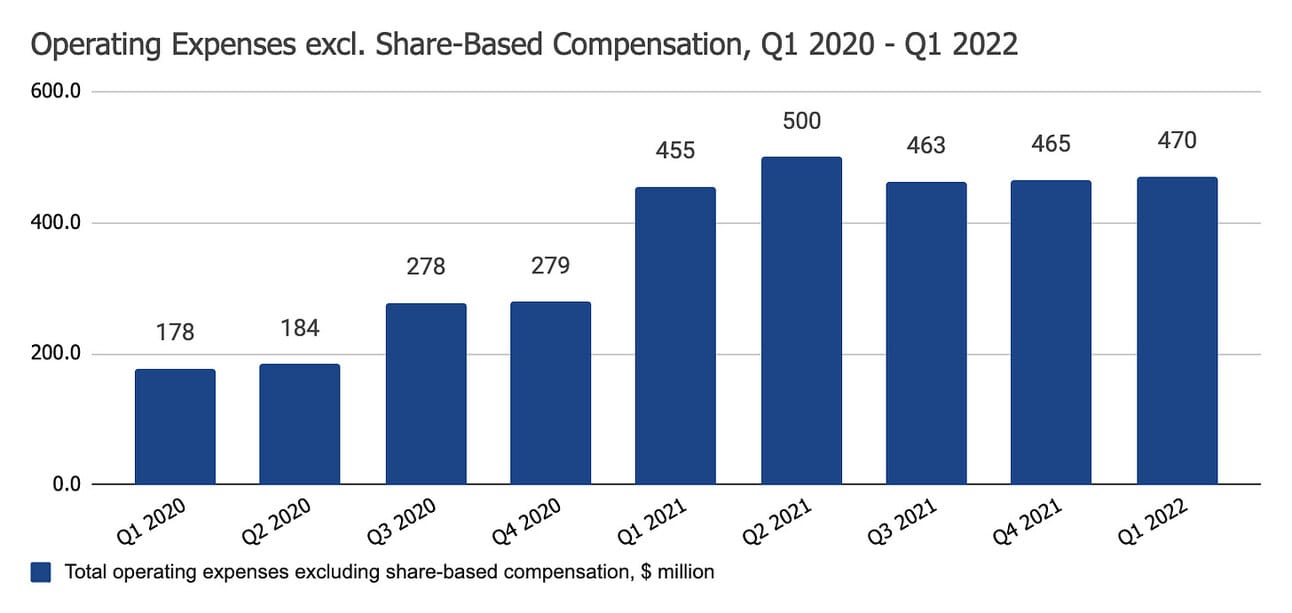

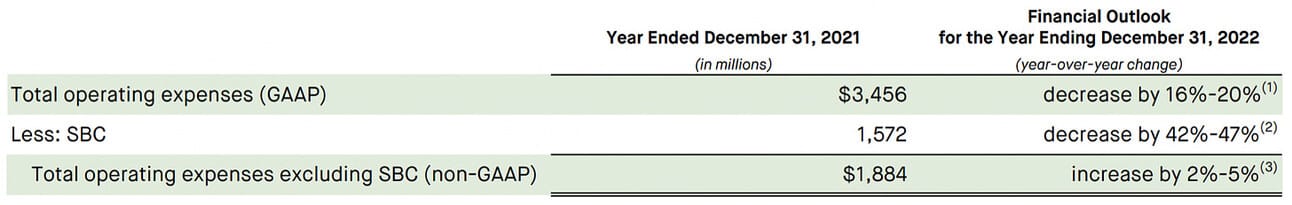

The company reported $690 million in Operating expenses for the quarter, which represents a 48.7% increase from Q1 2021. Excluding share-based compensation, the operating expenses totaled $470 million, up 3.3% from Q1 2021. The key components include “General and administration” expenses ($268 million, or 38.8%), “Technology and development” expenses ($266 million, or 38.6%), and “Operations” expenses ($91 million or 13.1% of the total Operating expenses).

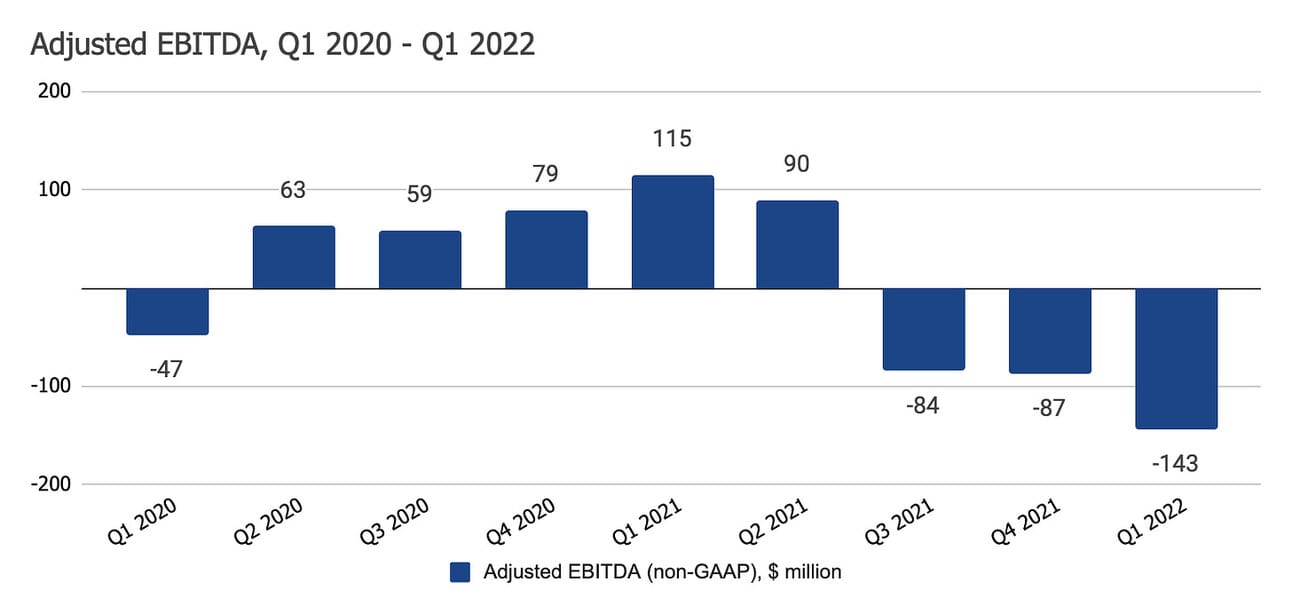

As the company went public in July 2021, it started realizing share-based compensation; hence, the huge spike in operating expenses in Q3 2021 on the chart above. However, if we exclude share-based compensation, we can still see two major increases in the cost basis: one in Q3 2020, and the second in Q1 2021. In the short term, the goal of the company is to reach profitability on the Adjusted EBITDA level (excluding share-based compensation), but in the longer term, Robinhood will need to achieve GAAP profitability (meaning, the company’s revenues should exceed the operating expenses including the share-based compensation).

Before the earnings call the company announced the planned layoff of approximately 9% of its 3,800 employees, and during the earnings call, the management stated the ambition to reach a positive Adjusted EBITDA run-rate by the end of the year. Thus, as per the company’s guidance, the operating expenses including the share-based compensation should decrease by 16-20%, and the operating expenses excluding share-based compensation should increase only marginally by 2-5% in 2022. See the next section on my thoughts on how this guidance aligns with the ambition to reach positive Adjusted EBITDA.

Net Income and Adjusted EBITDA

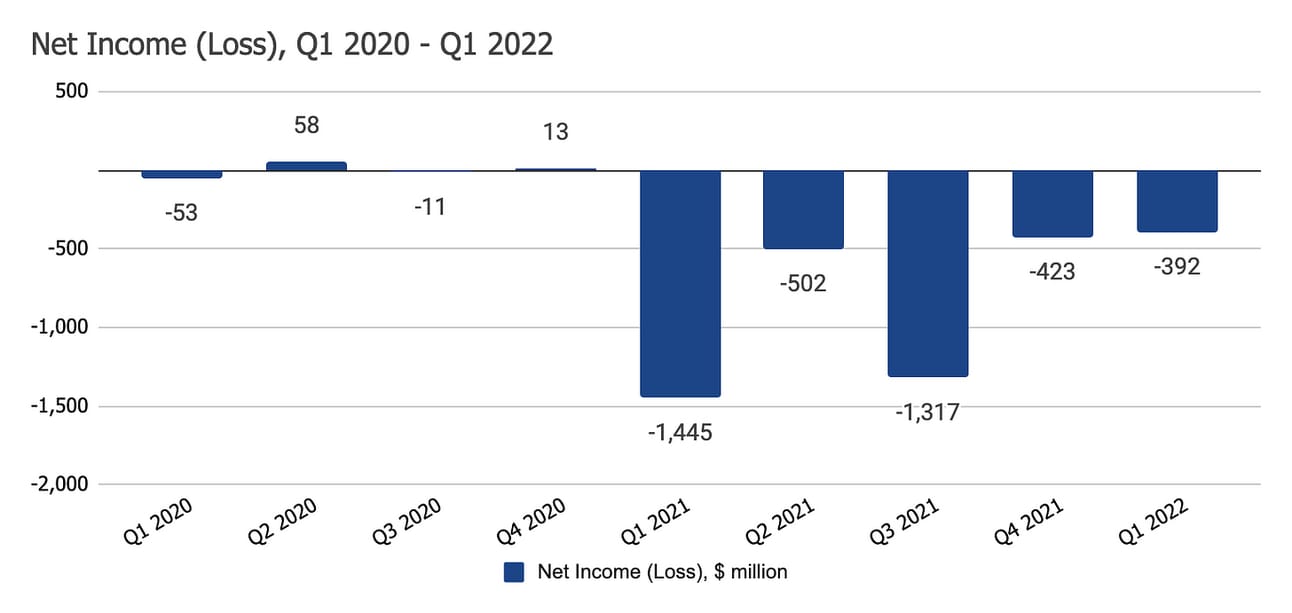

Robinhood reported a Net Loss of $392 million for the quarter, an improvement from a Net Loss of $1.45 billion in Q1 2021. Please note that Q1 2021 results were impacted by the $1.49 billion change in the fair value of convertible notes and warrant liability, which “was due to the mark-to-market adjustment of the convertible notes and warrants we issued in February 2021.” During the peak of the meme stock mania, Robinhood had to quickly raise capital, which it did through convertible notes and warrants.

The company also reported the third consecutive quarter of negative Adjusted EBITDA. Thus, the company finished the quarter with an Adjusted EBITDA of negative $143 million, a decrease from an Adjusted EBITDA of $115 million in Q1 2021. The key adjustments included $220 million in share-based compensation, $12 million in depreciation and amortization, and $10 million in legal and tax settlements and reserves.

As I mentioned above, the company’s management stated its ambition to exit the year with a positive Adjusted EBITDA. I believe they meant either achieving positive Adjusted EBITDA in Q4 2021 or achieving a positive Adjusted EBITDA “run-rate” (i.e. positive Adjusted EBITDA in December 2022).

Some back-of-the-envelope calculation: I guess it is safe to assume $220-270 million in net revenue per quarter at the end of the year. Achieving positive Adjusted EBITDA would require cutting operating expenses (excluding share-based compensation) from $470 million in Q1 2021 to the revenue level of $220-270 million. They guided for $1.92 - 1.98 billion in operating expenses (excluding share-based compensation) for the full year or $483-502 million per the remaining quarter. Therefore, I don’t understand how their ambition to reach positive Adjusted EBITDA fits the operating expenses guidance. Unless the company expects to magically increase its revenue by the end of the year, I would expect further cost cuts (or the ambition of positive Adjusted EBITDA moving into 2023). Let’s see.

Things to Watch in 2022

Normalized transaction-based revenue levels. As mentioned above, last year Robinhood experienced two artificial “boosts” to its revenues; namely, the meme stock mania of Q1 2021 and the cryptocurrency trading boom of Q2 2021. In 2022, I will be watching for the “normalized” level of trading activity and the revenues that the company can generate from it.

Diversification of revenue. Robinhood Gold subscription, Fully Paid Securities Lending, and the Cash Card are expected to help Robinhood diversify its revenue stream with non-trading income. I am especially interested if Robinhood will succeed in the rollout of the Cash Card, as this product would provide revenue that is not directly impacted by the direction of the stock market or cryptocurrency prices.

Assets Under Custody. One of the investment theses for Robinhood rests on baby boomers retiring and transferring their wealth to younger generations. Robinhood customers keep depositing cash to the platform, and the company is introducing tools to further increase the share of wallet (stock transfer from other brokerages, tax-advantaged retirement accounts). I wouldn’t be surprised if Robinhood returns to AUC growth already this year.

International expansion. International expansion (with cryptocurrency trading) is the main company’s bet on the growth of the customer base. The company has already announced its first acquisition in the UK, and I believe it will be looking for more acquisitions to broaden its geographic coverage, as fast as possible.

In summary, I wouldn’t write Robinhood off just yet. Their funded accounts base is not decreasing, customers keep depositing cash at an accelerated rate, and the company has an ambitious roadmap that is expected to drive non-trading revenue. Costs remain an issue, but the management seems to have finally realized that and is taking action. This is definitely an interesting company to follow.

Source of the data used above: Investor Relations.

Disclosure & Disclaimer: despite rocky performance in 2021 and early 2022, I have open positions in most of the companies covered in this newsletter, as I am extremely bullish on the transformation in the financial services industry. However, none of the above is financial advice, and you should do your research.