IPO of Robinhood ( ), a company known for offering commission-free stocks and options trading via a mobile app, was one of the most anticipated IPOs of 2021. The company prices its initial public offering at $38 per share, raising over $2 billion in capital and securing a valuation in excess of $32 billion. Yet, the stock lost 70% of its value since the IPO, and investors are wondering what’s next for the company.

Investors that remain bullish about Robinhood’s prospects operate with two investment theses: a) they either expect the company to be the main beneficiary of the wealth transfer from the retiring baby boomers to the younger generations (read, Robinhood customers), or b) they expect that the company will be able to monetize its highly engaged customer base through non-trading services (such as payment cards).

There were a few publicly-traded brokerages in the United States before 2020, but then Charles Schwab bought TD Ameritrade (at the point of acquisition, the company had 14.5 million accounts and $1.6 trillion in Assets Under Custody), and Morgan Stanley bought E*TRADE (5.2 million accounts, $360 billion in AUC). A similar consolidation happened in the robo-advisory industry with J.P. Morgan acquiring Nutmeg, and UBS acquiring Wealthfront. Therefore, the third investment thesis would be that Robinhood will eventually cease to exist as an independent company and will be acquired by a bigger legacy player.

I believe that betting on the acquisition is gambling, so below I try to understand Robinhood’s prospects to become profitable as an independent company.

Business Overview

Robinhood was founded in 2013 by Vladimir Tenev and Baiju Bhatt with the goal of “democratizing finance for all” and went public on July 28, 2021. The company is known for offering commission-free trading of stocks, options, ETFs, and, as of lately, cryptocurrencies through its user-friendly and nicely-designed mobile app. The company was a major beneficiary of the pandemic and the subsequent increase in retail investor’s participation in the stock market. The company boasts that it became the first brokerage account for half of its customers.

The company aims to achieve its mission of “democratizing finance for all” by introducing and popularizing commission-free and fractional share trading. Thus, instead of charging its customers a commission for trading shares or options, it relies on “Payment for Order Flow” (PFOF) to generate income. PFOF essentially means that Robinhood routes its customer trades to market makers (like Citadel Securities) rather than exchanges, and charges these market makers a small fee for every trade. Robinhood uses a similar model for cryptocurrency trading; thus, providing commission-free trading for its customers, which is a compelling offering.

I believe it would be fair to say that the company has already achieved its mission (at least in the United States) as commission-free and fractional share trading became the norm, and all major brokerages had to revert to this model. Moreover, the company onboarded over 10 million people to stock trading, which is a remarkable outcome. However, what the shareholders of Robinhood are wondering is whether such a noble mission can lead to a sustainable and profitable business.

The company recently started expanding its product offering with the launch of the Robinhood Cash Card and Robinhood Crypto Wallet, but at its core, the company remains a brokerage offering options, stocks, and cryptocurrency trading. Thus, the company makes money by charging marker makers transaction-based fees, as well as charging its retail customers interest on margin accounts and securities lending.

Customers

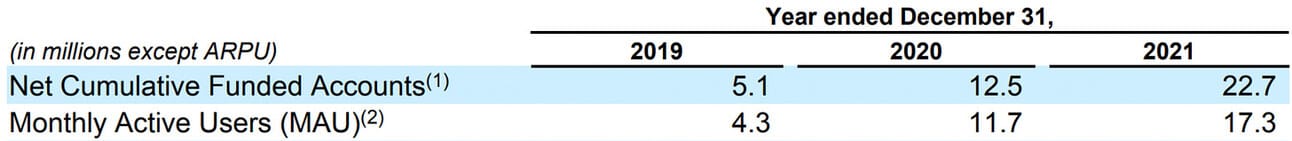

Robinhood reported 22.7 million funded accounts and 17.3 million monthly active users at the end of 2021. Robinhood was one of the beneficiaries of the pandemic and the increased retail investor activity that followed. Thus, the number of funded accounts grew 145% YoY in 2020, and then 81% YoY in 2021.

To put this into perspective, 22.7 million accounts would make Robinhood the third-largest brokerage in the United States, just behind Charles Schwab and Fidelity Investments. Robinhood has more customers than Charles Schwab and TD Ameritrade separately, and considerably more customers than Morgan Stanley and E*Trade combined. It should be noted that the chart below does not include the numbers for Vanguard, J.P. Morgan Self-Directed Investing, and Merrill Edge, but the main point remains the same - Robinhood has managed to become one of the largest brokerages in a very short time frame.

Despite the impressive customer growth on an annual basis, what concerns Robinhood shareholders and Wall Street analysts is the stagnation of user growth in the latest quarters. Thus, as can be seen from the chart below, Robinhood’s customer base remained almost flat during Q2-Q4, 2021. Moreover, Monthly Active Users spiked to 21.3 million in Q2 2021, and decreased to 17.3 million in Q4 2021.

I understand that Robinhood’s plans to grow its customer base rely on international expansion rather than further growth in the United States. At the latest earnings call, the company’s management hinted that the first country Robinhood could expand to would be the United Kingdom and the initial offering would be cryptocurrency trading. A few months later, Robinhood announced the acquisition of Ziglu, a UK payment institution, and crypto asset brokerage company.

Assets Under Custody

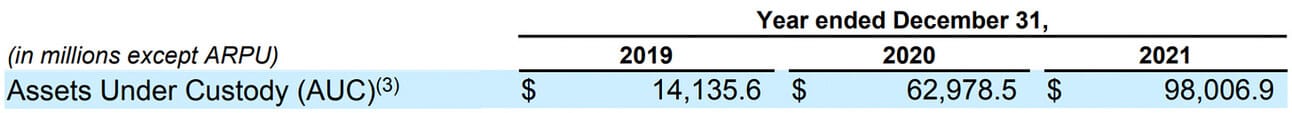

Robinhood finished 2021 with $98 billion in Assets Under Custody, which the company defines as “the fair value of all equities, options, cryptocurrency and cash held by users in their accounts”. Similar to the user base, Assets Under Custody grew rapidly during 2020-2021, with 345% YoY growth in 2020, and another 55% YoY growth in 2021.

Again, to put this number into perspective…$98 billion in Assets Under Custody is nothing compared to the company’s peers. One can argue that comparing Robinhood to Fidelity and Charles Schwab is not fair, as Robinhood doesn’t provide advisor-led accounts or mutual funds and works only with retail customers, but I believe the chart below provides some hints on why Charles Schwab's market cap (as of this writing) was $145.8 billion, and Robinhood’s market cap was $8.7 billion.

Moreover, AUC plateaued in 2021, peaking at $102 billion at the end of Q2 2021 and dropping to $98 billion by the end of the year. In an attempt to increase AUC, Robinhood introduced stock transfer functionality allowing their customer to bring their portfolios from other brokerages, as well as allegedly working on launching tax-advantaged retirement accounts. Nevertheless, it doesn’t feel like Robinhood’s management has a strong story to tell their shareholders on how they plan to grow AUC.

Revenue

Robinhood reported $1.82 billion in net revenue in 2021, which represented an 89% YoY growth. As can be seen from the breakdown below, “Transaction-based revenues” represented 77% of the total net revenue, “Net interest revenue” (securities and margin lending) represented 14% of the total net revenue, and the rest came from such services as “Robinhood Gold” subscription and fees for securities transfer to other brokerages.

Transaction-based revenue almost doubled in 2021; however, the growth had two “one-off” drivers: a) the meme stock mania of Q1 2021 (remember the GameStop saga?), and b) increased activity in cryptocurrency trading in Q2 2021, as the prices soared to all-time highs. Thus, in Q1 2021 Robinhood generated $133 million in transaction-based revenue from equities trading (out of $287 million for the full year). And in Q2 2021 the company generated $233 million in transaction-based revenue from cryptocurrency trading (out of $419 million for the full year).

The impact of the two events is better illustrated by the quarterly revenue breakdown (please see the chart below). As can be seen, the revenue jumped in Q1 and Q2 2021, but then quickly reverted to more “normalized” levels. Thus, in Q4 2021 revenue grew only 14% YoY, and was almost flat sequentially.

Robinhood is regularly introducing new cryptocurrencies on its platform, as well as launched a Crypto Wallet, aiming to increase customer activity and transaction-based revenues. In addition, they recently launched Robinhood Cash Card. Robinhood Gold, a monthly subscription service, and Robinhood Cash Card are the company’s attempts to monetize its customer base outside of trading. With the customer base and AUC hitting the growth ceilings, growing non-trading revenue will most likely be high on the management’s priority list.

Operating Expenses

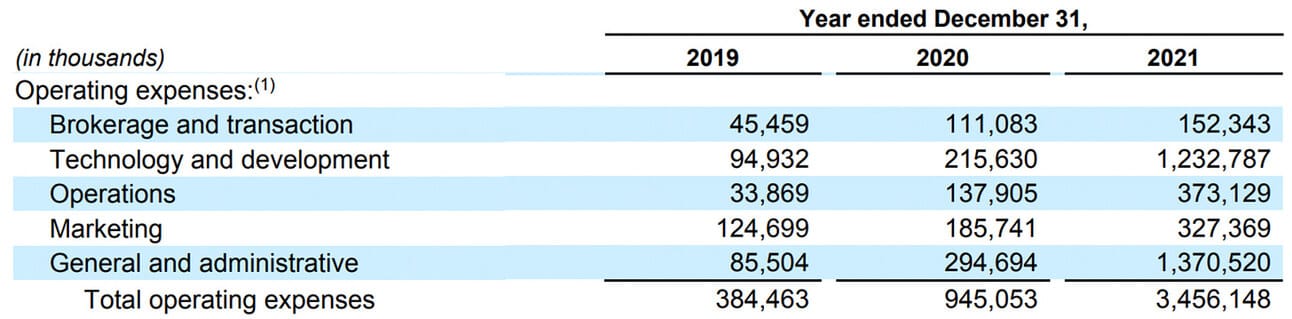

Customer and trading volume growth lead to a rapid escalation of the company’s operating expenses. Thus, Robinhood reported $3.5 billion in operating expenses in 2021, which represented a 265% YoY growth. The company’s operating expenses grew 145% YoY in 2020. Operating expenses grew across the board with “Technology and development” and “General and administrative” positions standing out (growing 471% and 365% YoY respectively).

It should be noted that the company went public on July 28, 2021, so it had to recognize and book large stock-based compensation costs in its P&L. Quarterly operating expenses breakdown illustrates that really well, and you can see the impact of $1.25 billion and $0.38 billion in stock-based compensation booked in Q3 and Q4 2021 respectively. Excluding stock-based compensation, operating expenses for 2021 totaled $1.88 billion, which represents 99% YoY growth.

During its latest earnings call, the company guided on how operating expenses can evolve in 2022. Thus, the company’s management expects a reduction of 35-40% in stock-based compensation and a 15-20% increase in operating expenses excluding stock-based compensation. The management is saying that they will continue growing the staff of the company, and consequently the operating costs.

Net Income and Adjusted EBITDA

Robinhood reported a GAAP Net Loss of $3.7 billion for 2021, which was driven by the higher operating expenses discussed above, as well as the change in the fair value of convertible notes and warrants. The company managed to deliver a Net Income of $7.5 million in 2020.

In its annual filing, the company explains that the “change in fair value of convertible notes and warrant liability was due to the mark-to-market adjustment of the convertible notes and warrants we issued in February 2021.” Long story short, during the memo stock boom of early 2021, Robinhood had to quickly raise capital and used convertible notes and warrants as an incentive for the financiers. The company notes that this was a one-off initiative and that “there will be no additional mark-to-market adjustments related to the convertible notes or warrant liability”.

The quarterly Net Income chart illustrates the impact of a) changes in the fair value of convertible notes and warrants (Q1 and Q2 of 2021), as well as recognition of stock-based compensation expenses following the IPO (Q3 and Q4 2021).

As per the earnings calls, the company’s management uses Adjusted EBITDA, a non-GAAP metric, as a measure of the company’s profitability. As can be seen from the table below, the adjustments primarily include stock-based compensation and the one-off change in the fair value of convertible notes and warrants mentioned above. The company finished 2021 with an Adjusted EBITDA of $34.1 million.

The company turned to negative Adjusted EBITDA in the last two quarters of 2021, as the revenues decreased (memo stock mania and crypto boom faded away), while the costs kept escalating. During their latest earnings call, the company’s management mentioned that might return to positive Adjusted EBITDA in 2022 if the market conditions permit, but most likely this will happen in 2023.

Things to Watch in 2022

Normalized revenue levels. As mentioned above, last year Robinhood experienced two artificial “boosts” to its revenues; namely, the meme stock mania of Q1 2021 and the cryptocurrency trading boom of Q2 2021. In 2021, I will be watching for the “normalized” level of trading activity and the revenues that the company can generate from it.

International expansion. International expansion (with cryptocurrency trading) is the main company’s bet on the growth of the customer base. The company has already announced its first acquisition in the UK, and I believe it will be looking for more acquisitions to broaden its geographic coverage, as fast as possible.

Assets Under Custody. One of the investment theses for Robinhood rests on baby boomers retiring and transferring their wealth to younger generations. Robinhood is introducing tools to facilitate the process (stock transfer from other brokerages, tax-advantaged retirement accounts), so it will be interesting to see if this investment thesis plays out.

Diversification of revenue. Subscription service Robinhood Gold, Crypto Wallet, and Cash Card are expected to help Robinhood diversify its revenue stream with non-trading income. I am especially interested if Robinhood will succeed in the rollout of the Cash Card, as this product would provide revenue that is not directly impacted by the direction of the stock market or cryptocurrency prices.

Robinhood will report Q1 2022 earnings on April 28, 2022, so subscribe to Popular Fintech newsletter below, and let’s follow the progress of the company together!

Source of the data used above: Investor Relations websites of Robinhood, Charles Schwab, Morgan Stanley, Interactive Brokers, and Fidelity Investments.

Disclosure & Disclaimer: despite rocky performance in 2021 and early 2022, I have open positions in most of the companies covered in this newsletter, as I am extremely bullish on the transformation in the financial services industry. However, none of the above is financial advice, and you should do your research.