Hi!

I once worked for a bank, which was a member of an international banking group. But then the group sold the bank, and we had to establish our own relationship with Visa, which, in turn, required posting millions in collateral. Card schemes require issuers to post collateral to protect themselves from the settlement risk.

I remembered this experience recently and decided to research the topic. What I have found is that Visa and Mastercard require card issuers to post billions in collateral for what seems to be no reason at all! That settlement risk rarely materializes into losses for the scheme. Let’s dive into that in today’s newsletter.

Let’s start with why Visa and Mastercard require issuers to post collateral. Card schemes are exposed to settlement risk. That is when an issuer cannot settle authorized transactions, while the scheme still needs to settle payments with acquirers.

“The Company indemnifies its clients for settlement losses suffered due to failure of any other client to fund its settlement obligations in accordance with the Visa operating rules. This indemnification creates settlement risk for the Company due to the difference in timing between the date of a payment transaction and the date of subsequent settlement.”

Typically, schemes are exposed to that risk for just one day, but in some cases, settlement can take longer. During the day issuers authorize card payments, and typically the next morning, the scheme would credit the total amount of authorized transactions from issuers’ accounts (that’s called settlement).

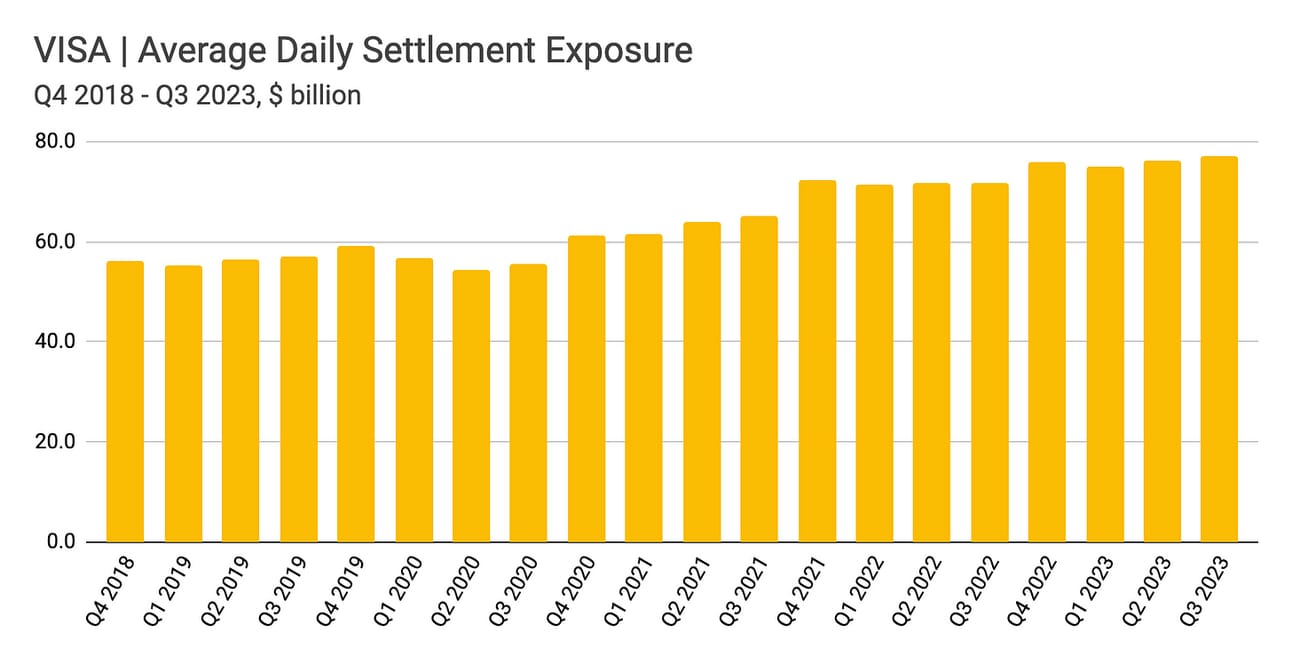

Visa reports the average and maximum daily settlement exposure. For instance, in Fiscal 2023 (Q4 2022 - Q3 2023), Visa’s “maximum daily settlement exposure was $126.9 billion and the average daily settlement exposure was $77.1 billion.” The easiest way to think about settlement exposure is that if all Visa’s issuers defaulted on the same (average) day, Visa would have to settle $77.1 billion out of its own pockets.

Obviously, as the transaction volumes on the networks increase over time, so does the absolute amounts of the settlement exposure. As you can see on the chart below, Visa’s daily average settlement exposure increased from $56.1 billion in Fiscal 2018 to $77.1 billion in Fiscal 2023.

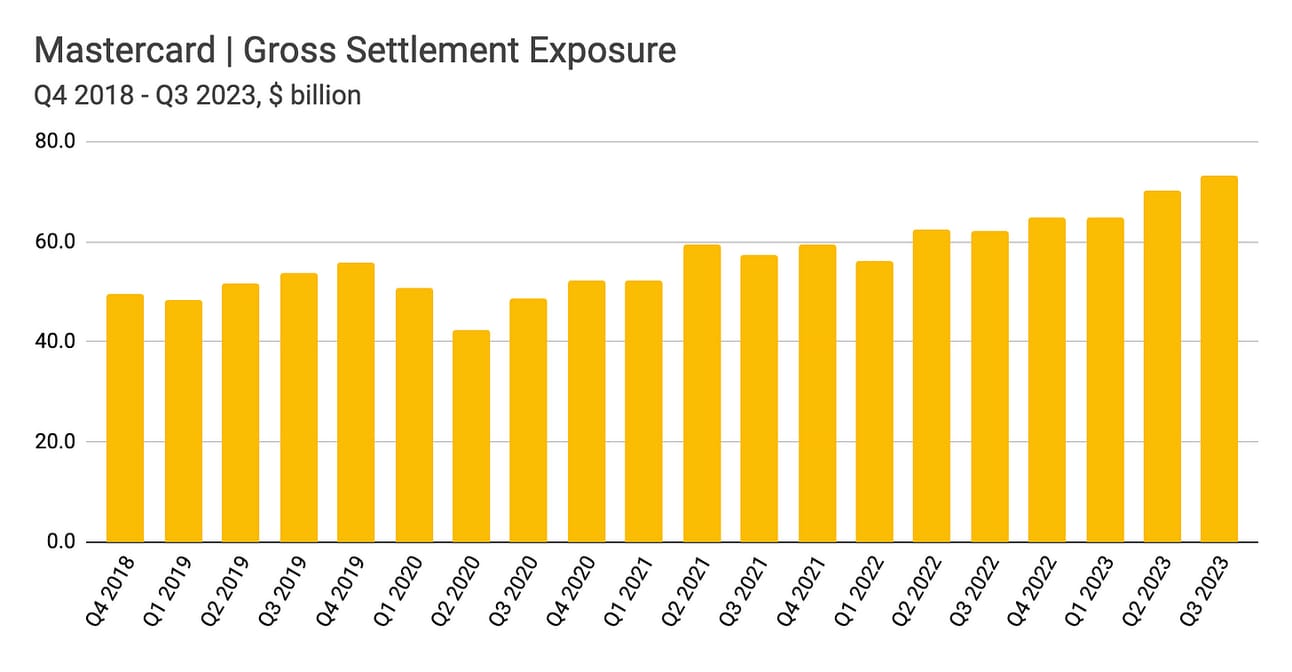

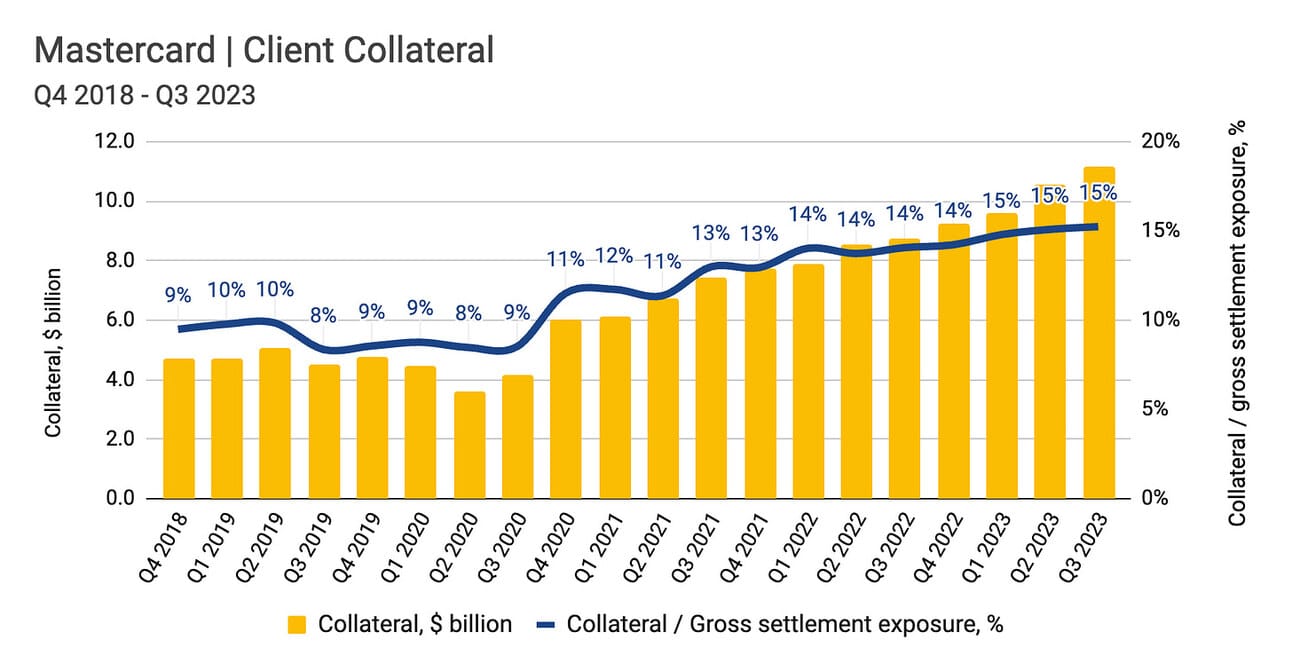

Mastercard reports a metric called “Gross settlement exposure”, which is the average daily payment volume multiplied by the estimated number of days of exposure (as mentioned above, in some cases settlement takes a few days). Mastercard’s Gross settlement exposure increased from $49.7 billion in Q4 2018 to $73.1 billion in Q3 2023.

In short, the amounts are meaningful and the risk seems to be real. So let’s look into how Visa and Mastercard mitigate this risk. That is asking issuers to post collateral.

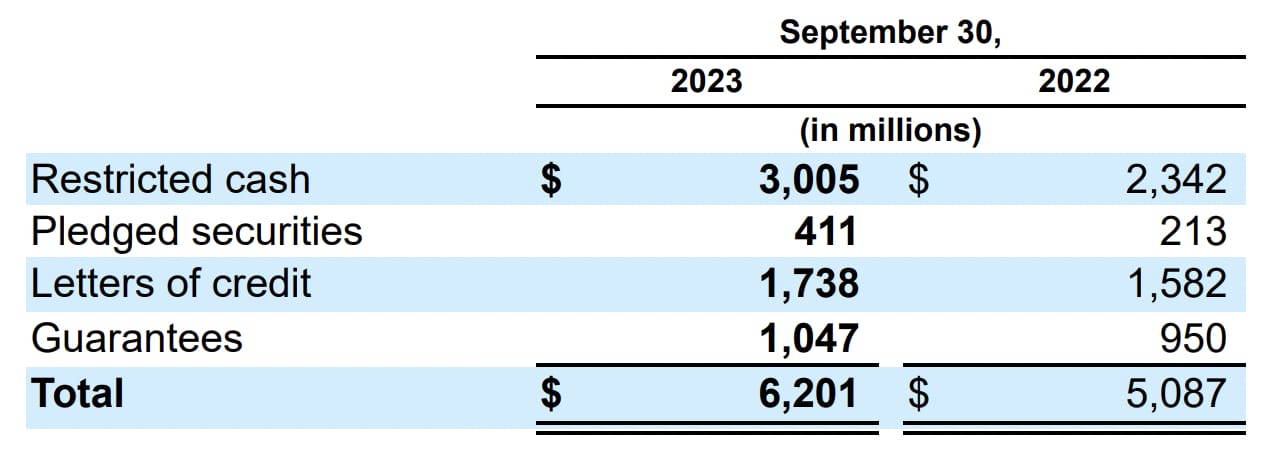

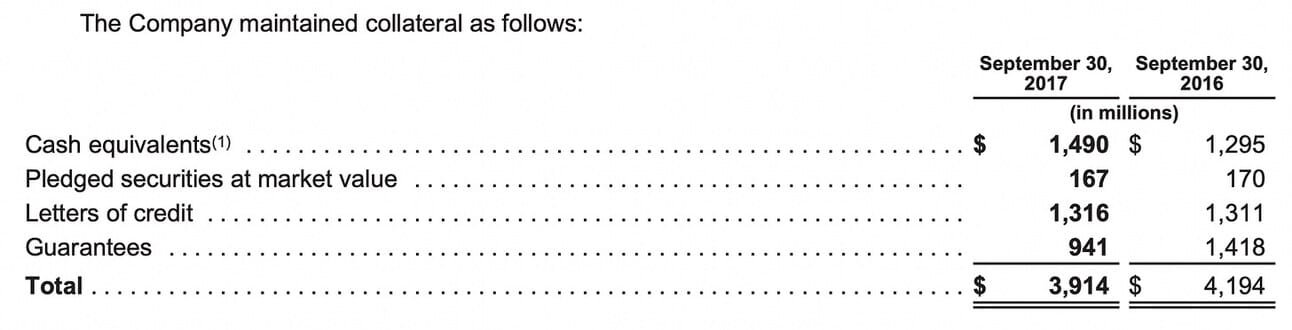

At the end of Q3 2023, Visa had $6.2 billion posted as collateral by the issuers. Issuers can post collateral in cash, or provide letters of credit or guarantees. “Letters of credit are provided primarily by a client’s financial institutions to serve as irrevocable guarantees of payment. Guarantees are provided primarily by a client’s parent to secure the obligations of its subsidiaries,” states Visa’s annual report.

It should be noted that if an issuer is investment-grade (e.g. has a BBB- or above rating from S&P), Visa and Mastercard can forego this requirement. So Chase and Citi are not among those having to post collateral, but an up-and-coming Fintech company is. Nubank received a BB- in September last year. This is a non-investment grade rating.

Mastercard requires certain customers that do not meet the Company’s risk standards to enter into risk mitigation arrangements, including cash collateral and/or forms of credit enhancement such as letters of credit and guarantees.

At the end of Q3 2023, Mastercard had $11.14 billion in posted collateral, which is reported as “Risk mitigation arrangements applied to settlement exposure” in the quarterly and annual filings. Mastercard is a smaller network, but as you might have noticed, the amount of collateral by its issuers is almost double the size of collateral posted by Visa’s issuers.

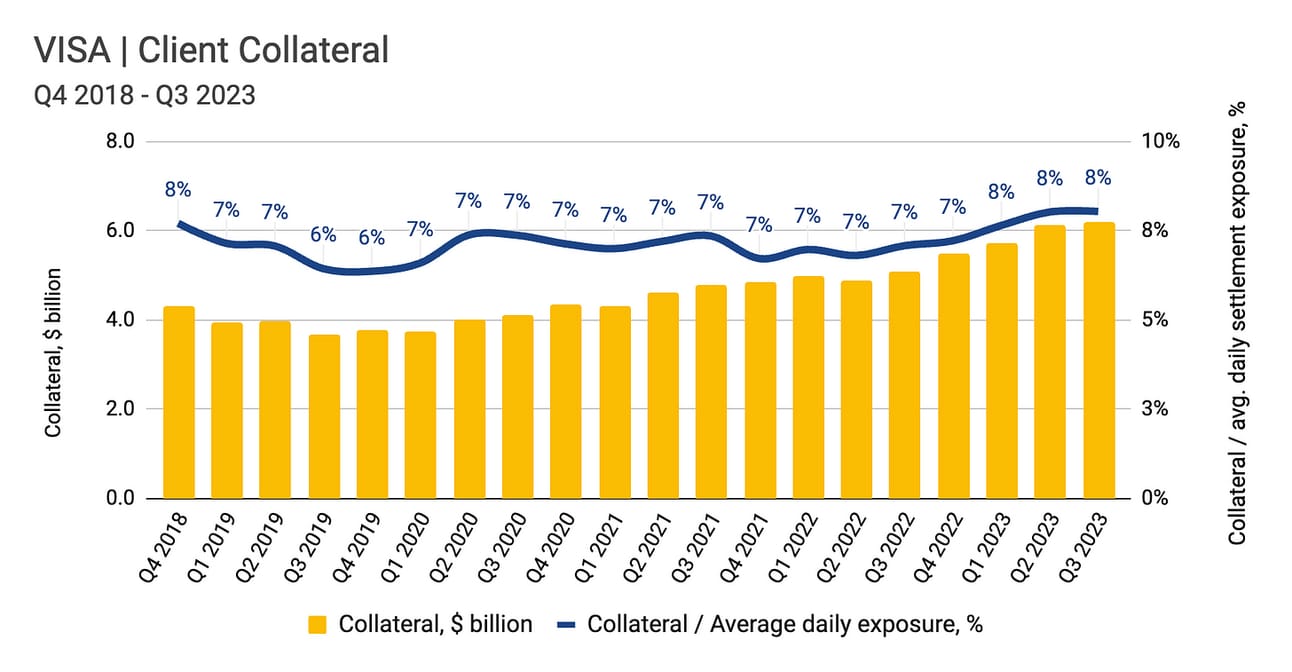

As the settlement exposures increase for both networks, one might expect that the amount of collateral that Visa and Mastercard require their issuers to post to increase as well. And this would be a correct assumption! For instance, in Q4 2018, Visa had $4.3 billion in collateral, compared to $6.2 billion in Q3 2023.

As you can see from the chart above, in the case of Visa, the collateral has remained consistently in the range of 6-8% of the average daily settlement exposure over the past 5 years. What’s interesting, is that starting from Q4 2020, Mastercard started asking for a much higher collateral level (in terms of % of the settlement exposure).

As you can see from the chart below, collateral was 9% of the settlement exposure in Q4 2018, but by Q3 2023 this ratio increased to 15%. I am not sure what changed and was not able to find any explanation of this in the company’s fillings. As a result of this change and the increase in the exposure, collateral posted by Mastercard issuers increased from $4.7 billion in Q4 2018, to $11.1 billion in Q3 2023.

A reasonable question at this point would be “Why is collateral smaller than the exposure?”. As I mentioned above, the largest issuers (those that have an investment-grade credit rating) do not have to post any collateral. If the 80/20 rule applies in this case, then I would expect the largest issuers (20%) to contribute a large share of transaction volumes (80%).

However, another explanation would be that the schemes might be using probabilities (of their issuers defaulting on the settlement obligations) in estimating the amount of required collateral. Similar to credit loss provisions in lending, a lender doesn’t need to provision for the whole loan book, but only for a portion that has a probability of default. So I started looking for data on losses related to credit risk.

…and this is where it got interesting. Apparently, losses related to scheme obligations to settle transactions in case of issuer defaults are so small that they don’t even need to disclose them in the reports. Here is a typical disclosure by Visa:

Historically, the Company has experienced minimal losses as a result of its settlement risk guarantee. However, the Company’s future obligations, which could be material under its guarantees, are not determinable as they are dependent upon future events.

…and a similar note from Mastercard

As the extent of the Company’s obligations under these agreements depends entirely upon the occurrence of future events, the Company’s potential future liability under these agreements is not determinable. Historically, payments made by the Company under these types of contractual arrangements have not been material.

After not finding any data on losses related to settlement risk, I thought that the scheme obligations (to settle transactions in case of issuer defaults) might be reflected as liabilities on their balance sheets. I had to go back to 2017 to find any disclosures on this. Here is what Visa said in their Fiscal 2017 report:

The fair value of the settlement risk guarantee is estimated using a proprietary model which considers statistically derived loss factors based on historical experience, estimated settlement exposures at period end and a standardized grading process for clients.

Historically, the Company experienced minimal losses, which has contributed to an estimated probability weighted value of the guarantee of approximately $3 million and $2 million at September 30, 2017 and 2016, respectively. These amounts were reflected in accrued liabilities on the consolidated balance sheets.

What Visa is saying is that the amount of potential losses (based on data from the past) multiplied by the probability of those losses equaled $3 million at the end of fiscal year 2017. Visa had $3.9 billion posted as collateral at the end of the fiscal year 2017.

So….In theory, settlement risk is a real deal given the volumes and daily exposures. However, in practice, as suggested by the disclosures on losses related to the settlement obligations, this risk rarely materializes. Perhaps, there is a regulation (that I am not aware of) that defines collateral requirements and obliges schemes to demand collateral. But seems to be more of a “the way things are done around here” type of requirement that costs issuers a lot of money.

Thank you for reading and subscribe if you haven’t done so yet!

Jevgenijs

p.s. I am a huge fan of what Visa did for the digitalization of payments. So please don’t treat this post as a dunk on Visa.

Cover image source: Visa

Disclaimer: Information contained in this newsletter is intended for educational and informational purposes only and should not be considered financial advice. You should do your own research or seek professional advice before making any investment decisions.