Hi!

Hope you’re having a great week! Yesterday’s headlines were all about Fintech lenders (and I love Fintech lenders, as I spent a few years of my career helping build two marketplace lenders):

Nubank remains bullish on opportunities in Mexico and Colombia,

Upstart secured additional funding for its loan marketplace, and

SoFi’s stock was downgraded by Wedbush (again)

Thank you for reading and see you tomorrow!

Jevgenijs

Nubank Remains Bullish on Opportunities in Mexico and Colombia

Nubank (NYSE: NU) reported its first quarter 2023 results, posting a third consecutive quarter of profitable growth. As previously reported, Nubank added 4.5 million customers, finishing the quarter with 79.1 million customers across Brazil, Mexico, and Colombia. 56 million customers used Nubank’s digital accounts, 35 million customers used credit card products, and 6 million customers took a personal loan. Gross revenue increased 85% YoY to $1.62 billion, driven by a 103% YoY growth in interest income, and a 41% YoY growth in commission income. The company’s loan portfolio increased 54% YoY to $12.8 billion, and deposits increased 25% YoY to $15.8 billion. Net income for the quarter was $141.8 million, compared to a net loss of $44.6 million a year ago.

During the earnings call, David Vélez, the company’s co-founder and CEO, pointed out “a tremendous opportunity for growth” that the company sees in its new markets, Mexico and Colombia. So far, Nubank’s experience in Mexico and Colombia has been more positive compared to the first years of the company’s operations in Brazil. Within three years of operating in Brazil, Nubank acquired 1.2 million customers, accounting for less than 1% of the country's population, a lower penetration rate than the company currently enjoys in Mexico and Colombia. He also stressed the importance of the company’s lending capabilities, concluding that “it's virtually impossible to build a large financial services business in the region without having credit underwriting as a core capability.”

✔️ Nubank reaches the milestone of 80 million customers in Latin America

✔️ Nu Holdings Ltd. Reports First Quarter 2023 Financial Results

✔️ Buffett-backed Nubank reports record revenue on steady user growth

Upstart Secures Additional Funding

Castlelake LP, a global alternative investment firm with approximately $20 billion in assets under management, has reached an agreement to acquire consumer installment loans worth up to $4 billion from the Fintech lender Upstart (NASDAQ: UPST). This strategic deal involves Castlelake purchasing an existing portfolio of loans that Upstart has originated, as well as investing in future loan origination through a forward-flow agreement. Castlelake previously provided financing to the Fintech lender LendingPoint. "Upstart is excited to collaborate with a firm that we believe is an experienced and dependable capital provider through economic cycles," commented Upstart’s CFO, Sanjay Datta, in the press release.

Last week, Upstart’s shares surged after the company reported its first quarter 2023 results. Loan originations declined 78% and revenues declined 67% from a year ago. Upstart reported a net loss of $129.3 million, compared to a net income of $32.7 million a year ago. Nevertheless, after executing a series of layoffs, the company guided for improved profitability, as well as announced securing $2 billion in long-term funding commitments from multiple investors. Upstart relies on third-party investors to fund its loans, so the company’s origination volumes plummeted last year, after investors pulled out from subprime lending. At some point, the company even had to step in with its own balance sheet to fund loans.

✔️ Castlelake Reaches Purchase Agreement for up to $4 Billion of Consumer Installment Loans Originated on Upstart's Platform

✔️ Private Credit Shop Castlelake Joins Consumer-Debt Push

✔️ Private Credit Firms Are Muscling Into Consumer Lending

✔️ Upstart stock soars 40% after earnings outlook positively surprises

SoFi’s Stock Gets Another Downgrade from Wedbush

Just yesterday, I wrote about Truist analysts assigning SoFi (NASDAQ: SOFI) a “Buy” rating and calling the company the “future of US banking.” Well, some analysts disagree. Wedbush analysts downgraded the stock from Neutral to Underperform and slashed the price target by half to $2.50 per share. SoFi shares lost 4.98% yesterday, finishing the day at $4.77. In a note to investors, Wedbush analysts raised concerns that the company’s "capital levels may be overstated” because of the use of fair value accounting (SoFi marks its loans as “loans for sale”, and reports them at fair value). Wedbush thinks that SoFi may have to raise capital later this year to support growth. This is the second time that Wedbush downgraded SoFi stock in just two weeks.

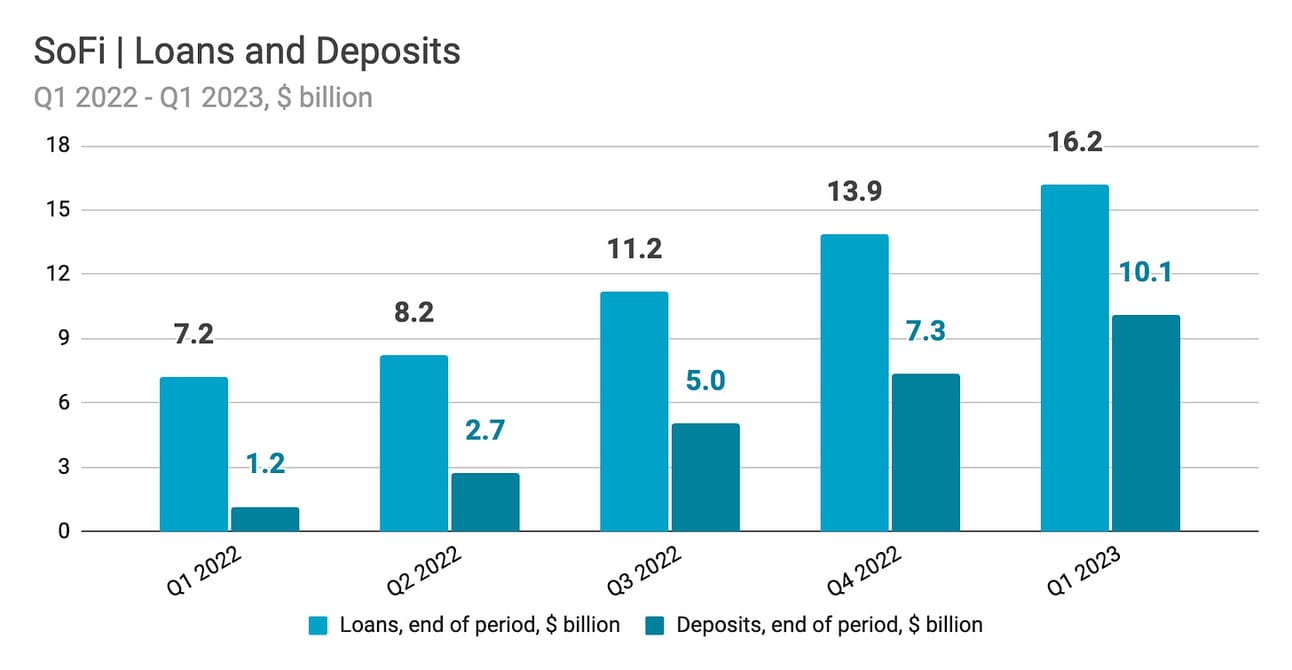

SoFi stock is now down more than 20% after reporting its first quarter 2023 results. The company onboarded 433,000 new members during the quarter, bringing the total to 5.7 million members, as well as originated $3.6 billion in loans. Net revenue increased 43% YoY to $472.2 million, driven by the 149% YoY growth in interest income. SoFI reported a Net loss of $34.4 million and an Adjusted EBITDA of $75.7 million, reiterating its plans to reach GAAP profitability by the end of the year. As a vote of confidence in the company’s bright future, SoFi CEO, Anthony Noto, continues buying the stock. Yesterday, the company also disclosed that Anthony Noto’s wife made multiple purchases in 2021 and 2022.

✔️ SoFi Technologies shares tumble as Wedbush downgrades due to potential headwinds

✔️ SoFi CEO Anthony Noto Discloses Stock Purchases by Wife Dating Back to 2021

✔️ SoFi Technologies, Inc. Reports First Quarter 2023 Results

✔️ SoFi Saw Personal Loans Soar This Quarter. Why That Might Not Be A Good Thing

Last year, investors (including myself) praised SoFi (NASDAQ: SOFI) and LendingClub (NYSE: LC) for timely getting banking charters, which allowed them to fund loan originations with deposits. Upstart (NASDAQ: UPST), decided to stick to its “asset light” model and kept the loans on its balance sheet at a minimum. The price action following first-quarter reports suggests that investors might not be as excited about heavy balance sheets, as they were last year 👇🏻

Vice President of Machine Learning

@ Upstart

🇺🇸 Remote, United StatesPrincipal Product Manager, Lending Partnerships

@ Upstart

🇺🇸 Remote, United StatesSenior Director, Business Lead, Invest

@ SoFi

🇺🇸 UT, CA, NY, or TX, United StatesConsumer Deposits Pricing and Strategy Lead

@ SoFi

🇺🇸 UT, CA, NY, or TX, United StatesSenior Product Designer

@ Nubank

🇲🇽 Mexico City, Mexico

Cover image: Nubank

Disclaimer: Information contained in this newsletter is intended for educational and informational purposes only and should not be considered financial advice. You should do your own research or seek professional advice before making any investment decisions.