Hi!

Hope you had a great weekend! Brazil is the home to some of the coolest Fintech companies out there (and probably, the most innovative Central Bank in the world). If you follow Brazil’s booming Fintech scene, you will like this letter:

Brazil’s Nubank, Stone, and XP will report earnings this week,

Inter&Co receives a US brokerage license, and

Truist analysts call SoFi “the future of US banking”

Thank you for reading and see you tomorrow!

Jevgenijs

Brazil’s Nubank, Stone, and XP to Report First Quarter Results

This week, Brazil’s top publicly traded Fintech companies will report their first quarter 2023 results. The world’s largest neobank Nubank (NYSE: NU), will report its results today (May 15), Brazil’s largest digital brokerage XP Investimentos (NASDAQ: XP), will report tomorrow (May 16), and, the country’s leading merchant acquirer Stone (NASDAQ: STNE) will report on Wednesday (May 17). All three companies will report their results after the market close. If you are not following these companies, then you are totally missing out, as Brazil is clearly at the forefront of innovation in financial services. For instance, the country’s instant payment scheme, PIX, recorded 24 billion transactions in 2022, surpassing all other payment methods.

Nubank pre-announced reaching 79.1 million customers in the quarter, suggesting continued growth despite an already massive scale (the company serves more than 45% of the country’s adult population). However, investors will be focusing on the company’s progress in its new markets, Mexico and Colombia, as well as the performance of its loan book. The company raised $330 million for expanding its operations in Mexico, and $150 million to support growth in Colombia. In addition, last quarter, the company started aggressively scaling its loan originations in Brazil despite rising delinquencies. The management argued that Net Interest Margins had sufficient safety buffers to enable this strategy.

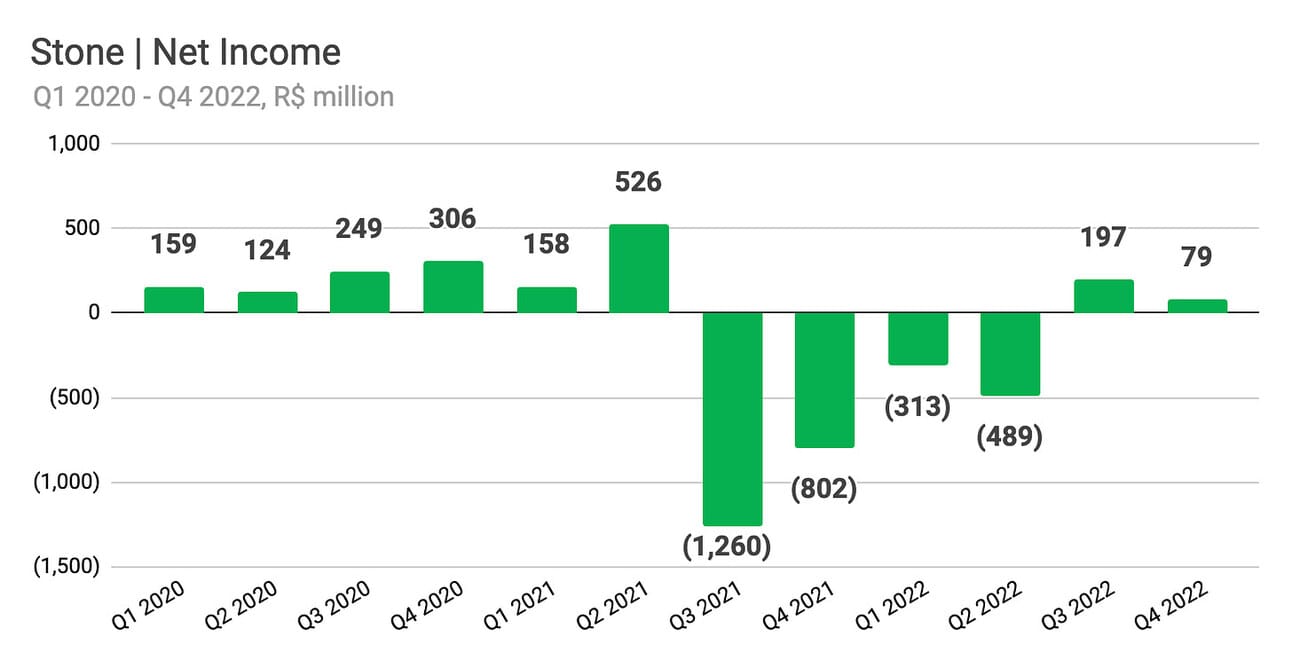

Stone finished 2022 with another profitable quarter, reporting an Operating Income of R$254.3 million (approx. $52 million), and a Net Income of R$78.8 million (approx. $16 million). Stone was profitable in 2018, 2019, and 2020, achieving net income margins of 19.3%, 31.2%, and 25.2% respectively. However, the company’s fortunes turned in 2021 as it started facing mounting losses in its lending business and had to mark down the value of its stake in Banco Inter. In February 2023, the company sold its remaining stake in Banco Inter for R$218 million (approx. $45 million) and announced its plans to return to growth in its lending business in the second half of 2023. Investors will be looking for more information on that.

Finally, XP Investimentos has already published its operating results for the first quarter. The number of active clients grew 2% QoQ and 13% YoY to 4.0 million. Nevertheless, net inflows in the quarter were down 48% QoQ and 65% YoY and totaled R$16.2 billion (approx. $3.3 billion). Retail Daily Average Trades totaled 2.3 million, up 2% YoY and down 13% QoQ, reflecting “a weak equity market in the first quarter of 2023”. The company finished the quarter with R$954 billion in client assets (approx. $194 billion), representing a 9% YoY and 1% QoQ increase. In the fourth quarter of 2022, the company reported a 21% YoY decline in net income, and embarked on a “comprehensive adjustment of cost structure.”

✔️ Nubank reaches the milestone of 80 million customers in Latin America

✔️ Brazil's StoneCo swings to profit on surging finance services

✔️ StoneCo announces completion of CEO transition

✔️ XP Inc. Reports 1Q23 KPIs

Inter&Co Receives a US Brokerage License

Inter&Co Securities, a subsidiary of Brazilian financial services group Inter&Co (NASDAQ: INTR), was granted a license to operate as an investment broker in the United States. The license will enable Inter’s users to invest directly in the companies listed on The New York Stock Exchange and Nasdaq. The company also received a Registered Investment Adviser (RIA) registration and plans to establish a dedicated wealth management division in the United States. “We were the first Brazilian company to enable direct international investments, seamlessly integrated within our Super App used in Brazil, and now wish to grow our successful platform in the United States,” commented the company’s CEO João Vitor Menin.

Image source: Inter&Co Investor Day Presentation

Last week, Inter&Co reported its first quarter results disclosing 26.3 million customers of which 51.5% were active. This number included 3.3 million active customers using Inter Invest. Inter&Co started its expansion into the United States by acquiring a money remittance service USEND in early 2022 with the idea of serving Brazilians living abroad. It doubled down on its US expansion ambition last quarter by acquiring a mortgage originator and fund manager, YellowFi. In its home market, Brazil, Inter&Co offers a wide range of financial services for consumers and SMBs through its Super App. The offering includes digital accounts, payments, FX, cards, loans, investments, and insurance services.

✔️ FINRA Approved Inter&Co Securities LLC to Operate as a US Broker

✔️ Inter&Co Rings the Opening Bell

✔️ Inter&Co, Inc Reports First Quarter 2023 Financial Results

✔️ Inter&Co Acquires YellowFi to Expand its Product Offering in the US

✔️ Inter announces closing of USEND acquisition

Truist Analysts Call SoFi “The Future of U.S. Banking”

SoFi (NASDAQ: SOFI) received a “Buy” rating and an $8 price target from Truist Securities analysts who see it as “the future of US banking” due to its digital, nimble, and always-on capabilities. The report argues that millennials and Gen Z are increasingly becoming the dominant market segment for financial services, and SoFi's digital platform and user-friendly interface make it a prime candidate to capture this growing market. In addition, the report pointed out the competitive advantages that SoFi got from securing a banking charter and strong growth in deposits on the company’s balance sheet. Thus, deposits increased to $10.1 billion in the first quarter of this year, compared to just $1.2 billion a year ago.

SoFi stock is down almost 20% after reporting its first quarter 2023 results. The company originated $3.6 billion in loans and finished the quarter with $16.2 billion in loans on its balance sheet. Net revenue increased 43% YoY to $472.2 million, driven by the 149% YoY growth in interest income. SoFI reported a Net loss of $34.4 million and an Adjusted EBITDA of $75.7 million, reiterating its plans to reach GAAP profitability by the end of the year. However, some analysts, including David Chiaverini of Wedbush, pointed out the lack of actual loan sales during the first quarter and raised a concern that when SoFi does begin selling loans again, there could be a significant negative impact on the fair value of its loans.

✔️ SoFi Gains a Bull. Analyst Calls It ‘The Future of U.S. Banking.’

✔️ SoFi’s stock is poised to benefit from ‘powerful demographic shift,’ a new bull says

✔️ SoFi's stock selloff builds as lull in loan sales sparks continue

✔️ SoFi Technologies, Inc. Reports First Quarter 2023 Results

✔️ SoFi Saw Personal Loans Soar This Quarter. Why That Might Not Be A Good Thing

Warren Buffett’s Berkshire Hathaway invested in two Brazilian Fintech companies, Stone (NASDAQ: STNE) and Nubank (NYSE: NU). Berkshire invested in Stone in 2018 at their IPO and in Nubank’s last private round in 2021. Stone’s IPO was priced at $24 a share, and Nubank’s last private round valued the company at $30 billion. As of this writing, Stone shares traded at $13.81, and Nubank’s market cap was $27.3 billion.

Senior Director - Member Experience Business Lead

@ SoFi

🇺🇸 Seattle, WA, or San Francisco, CA, United StatesDirector, Software Engineering

@ SoFi

🇺🇸 Seattle, WA, or Remote, United StatesSenior Manager, Data Science

@ SoFi

🇺🇸 Multiple locations, United StatesTech Manager

@ Nubank

🇧🇷 Sao Paulo, BrazilSenior Product Manager

@ Stone

🇧🇷 Remote, Brazil

Cover image: Nubank

Disclaimer: Information contained in this newsletter is intended for educational and informational purposes only and should not be considered financial advice. You should do your own research or seek professional advice before making any investment decisions.