Yesterday Nubank ( ), the largest neobank in the world, held its first earnings call as a public company. However, the company made news before the call as Warren Buffett’s Berkshire Hathaway disclosed a $1 billion investment in the company (Buffett started investing in the company before it went public, investing $500 million in the company’s latest private round). Fortune tried to make the news bigger than they were by calling Nubank a “crypto-friendly bank” (and reminding that Warren Buffett once called crypto a “rat poison”).

However, calling Nubank a “crypto bank” is a stretch, and crypto was clearly not a reason why Mr. Buffett invested in this company. Moreover, as of this writing, Nubank’s market cap was $40.6 billion, while the most valuable bank in Latin America, Itaú Unibanco, traded at $49.3 billion. I wouldn’t expect Warren Buffet to take such a sizable position for a short-term gain, so he sees appreciation of Nubank shares for the years to come. Let’s try to understand, why Buffett is so bullish about this company (and I’ll say it again, it is not crypto!).

Source: Earnings release Q4 2021

Customers

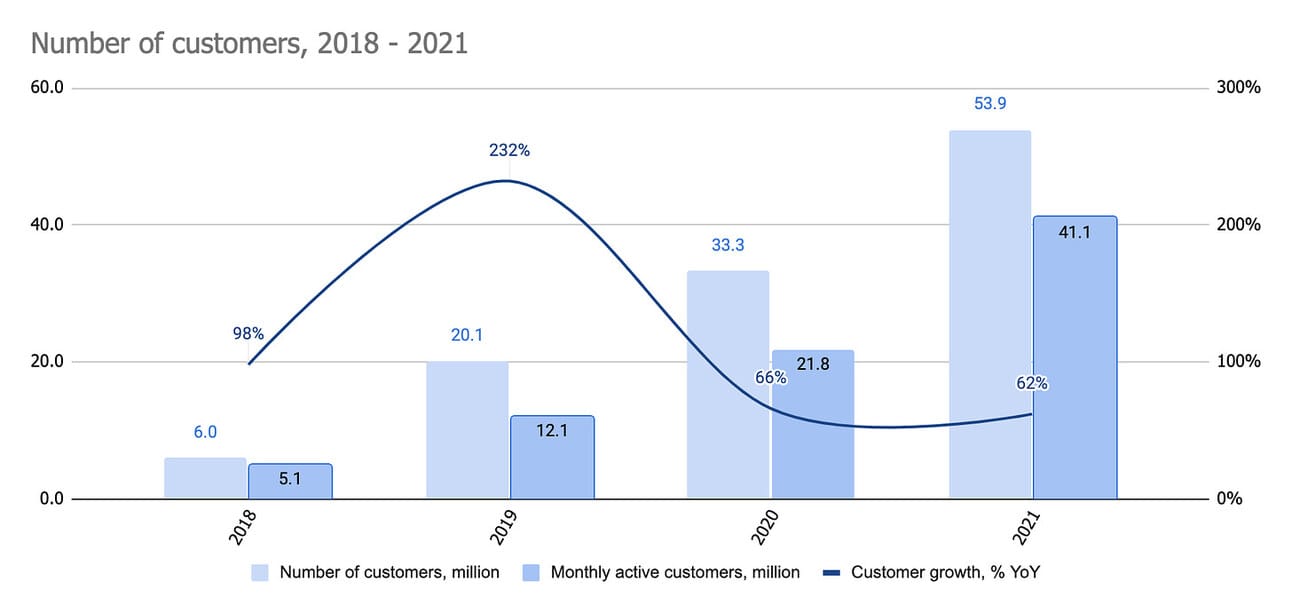

Nubank acquired 5.8 million new customers during Q4 2021 and finished 2021 with 53.9 million customers, of which 1.4 million were SME customers and the rest were private individuals. The company also grew its active customer base from 21.8 million in 2020 to 41.1 million in 2021, delivering 88% YoY growth (active customers are defined as customers that generated revenue in the last 30 days).

Nubank’s 52.4 million private customers account for approximately 25% of the country’s total population, 30% of the country’s adult population, and 50% of the country’s population of the working age. For reference, the largest bank in Brazil (and the whole of Latin America), Itaú Unibanco, claims to serve 60 million retail customers. Given Nubank’s track record, I believe it is safe to assume that in 2022 it will overtake Itaú Unibanco, as the largest consumer bank in Brazil.

As I wrote earlier, Nubank’s growth is nothing short of impressive. However, you cannot expect the company to continue double-digit customer growth for a prolonged period given the market share it has already gained in Brazil. I believe that Warren Buffett made a bet that Nubank will not only grow its revenue and profits in Brazil, but will also be able to repeat its success in Mexico and Colombia.

Thus, the company reported having 1.4 million customers in Mexico (up 1,243% YoY), and 114 thousand customers in Colombia (Nubank operated in Colombia for only 15 months, so the YoY comparison does not make sense). For reference, the population of Mexico and Colombia is 127 million and 48 million people respectively. The largest bank in Mexico, BBVA Bancomer boasts having over 23 million customers, and the largest bank in Colombia, Bancolombia, boasts having over 6 million customers.

Nubank produced a nice illustration of the market opportunity they are going after:

On the final note, I wouldn’t exclude that Nubank will use the capital that it raised during the IPO ($2.6 billion) to expedite its growth in both Mexico and Colombia.

Revenue and Gross Profit

Nubank reported $635 million in revenue for Q4 2021 and $1.7 billion for the full year 2021, which represents 214% YoY growth for the quarter, and 130% YoY growth for the full year. The company also reported $226.9 million in Gross Profit for the quarter (197% YoY growth) and $732.9 million for the full year (124% YoY growth).

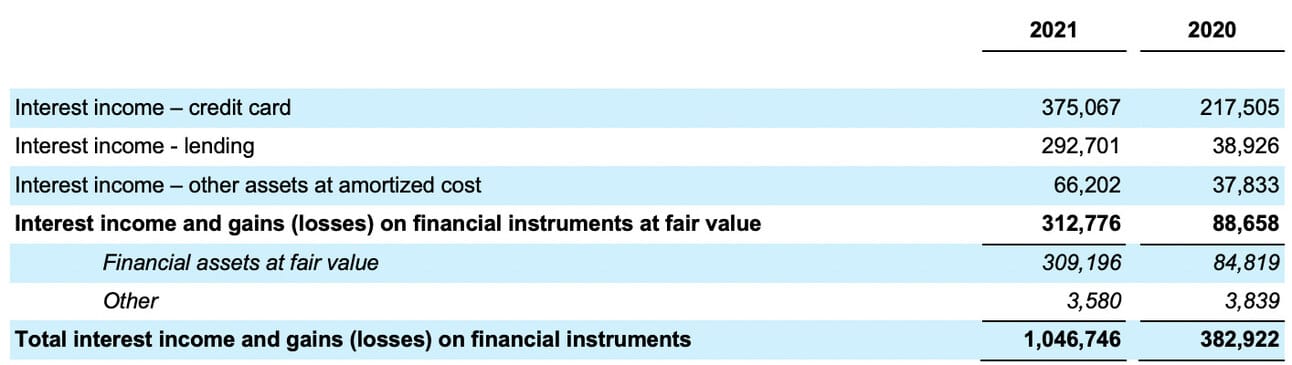

Over the last three years, the company managed to maintain gross profit margins in excess of 40%, and, as can be seen from the chart above, in 2021 revenue grew at a much higher rate than the customer base. Looking inside the revenue, we can see that the “Fee and Commission Income” grew 84% YoY, and the “Interest Income and Gain (Losses) on Financial Instruments” grew 173% YoY.

Nubank is a bank; thus, it is able to attract cheap deposits, issue loans, and earn interest income. In 2021, Nubank’s interest income constituted only 62% of the total income, and thus, is expected to grow once the bank builds up its loan book. For example, if we try to draw parallels with Capital One then we can expect the interest income to reach 80% of the total income over time. It is important to highlight, that Nubank started with credit cards and later started offering personal loans. Thus, over time one can expect the company to also offer auto loans and mortgages, essentially, providing almost unlimited growth potential for the years to come.

Finally, the company’s “Fee and Commission Income” primarily consists of card fees (interchange, rewards, etc). Therefore, over time Nubank can grow its revenue by introducing additional services and upselling its private and SME customers. For instance, in 2020 the company acquired a brokerage company Easynvest, and in 2021 it acquired e-commerce payments company Spin Pay. By the way, Easynvest supports crypto trading, hence all the noise about Nubank being a “crypto-friendly bank”.

In summary, the company grew its revenue at the rate of 130% while maintaining a healthy gross profit margin of 43%, and has multiple areas for further growth ranging from lending to investments, to e-commerce acquiring, to insurance to name a few. Therefore, one can conclude that besides the growth opportunities in Mexico and Colombia, Warren Buffett might be making a bet on the strong potential for the company to monetize its customer base in Brazil.

Deposits and Loan Portfolio

Nubank finished 2021 with $9.7 in deposits, which represented 73% YoY growth. The size of the deposit base represents the bank’s capacity to originate loans, and as of now, deposits do not seem to present a bottleneck in Nubank’s lending ambitions.

Thus, at the end of 2021, Nubank’s credit portfolio stood at $6.6 billion, of which $1.4 billion were personal (installment) loans, and $5.2 billion were credit card receivables (used credit card limits due for repayment). The total credit portfolio grew 97% YoY, but the balance of personal loans grew 592%.

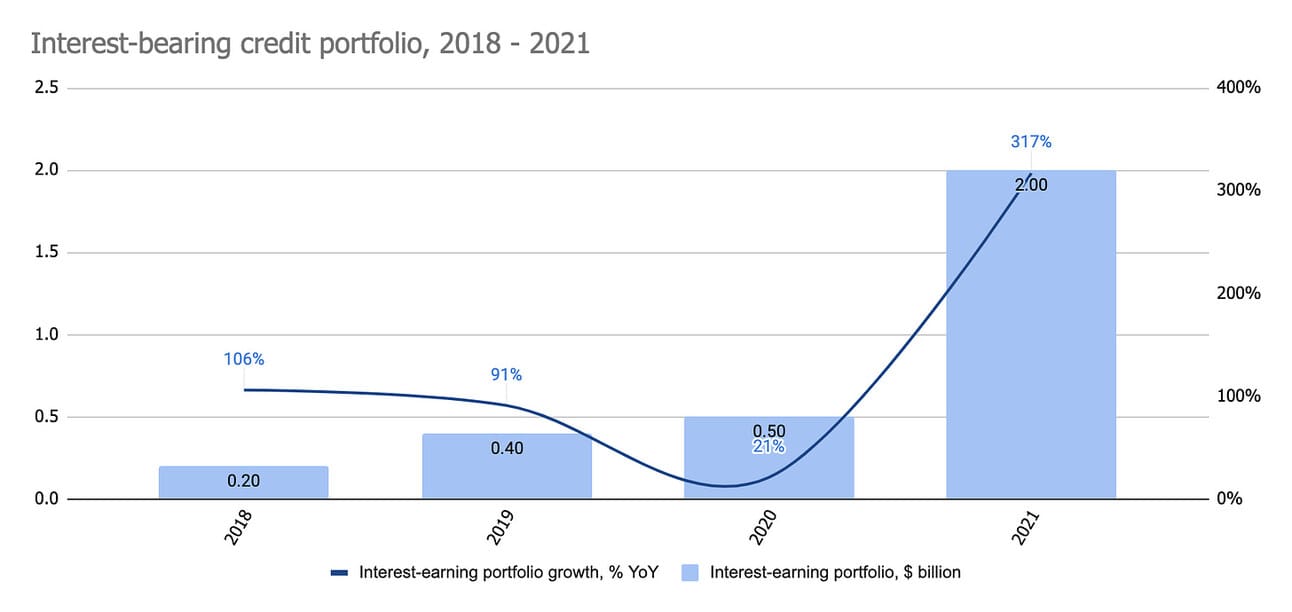

In its registration statement, the company indicated that it tightened credit policies during the early days of the pandemic in 2020 (most lenders did). Thus, the growth of the portfolio in 2020 was quite moderate and is not indicative of the company’s capacity to grow its loan book.

It is important to keep in mind that Nubank earns interest income only from the revolving part of the credit card portfolio (meaning that the customers can pay down their used credit card balance at the end of the month without paying any interest). As per the legislation in Brazil, “customers may revolve for a maximum of two months, after which any revolved balances must be transferred to an installment plan”.

Nubank finished 2021 with a $2 billion interest-bearing credit portfolio (or 317% YoY growth), which included revolving and refinanced credit card balances, as well as personal loans. Similarly, interest-bearing credit portfolio growth in 2020 was limited during the first year of the pandemic due to tightened credit policies.

A loan portfolio is a leading indicator of a company’s potential to earn interest income, as the expected losses are front-loaded at the moment of origination, while the income is recognized during the duration of the loan. It is seen that Nubank was well prepared to scale its lending operations coming out of pandemic, and can grow the deposit base proportionally to support lending growth. Thus, the growth of the loan book supports my earlier argument that Nubank is still early in maximizing its potential to earn interest income, and one can expect strong interest income growth in the coming years.

Net Income

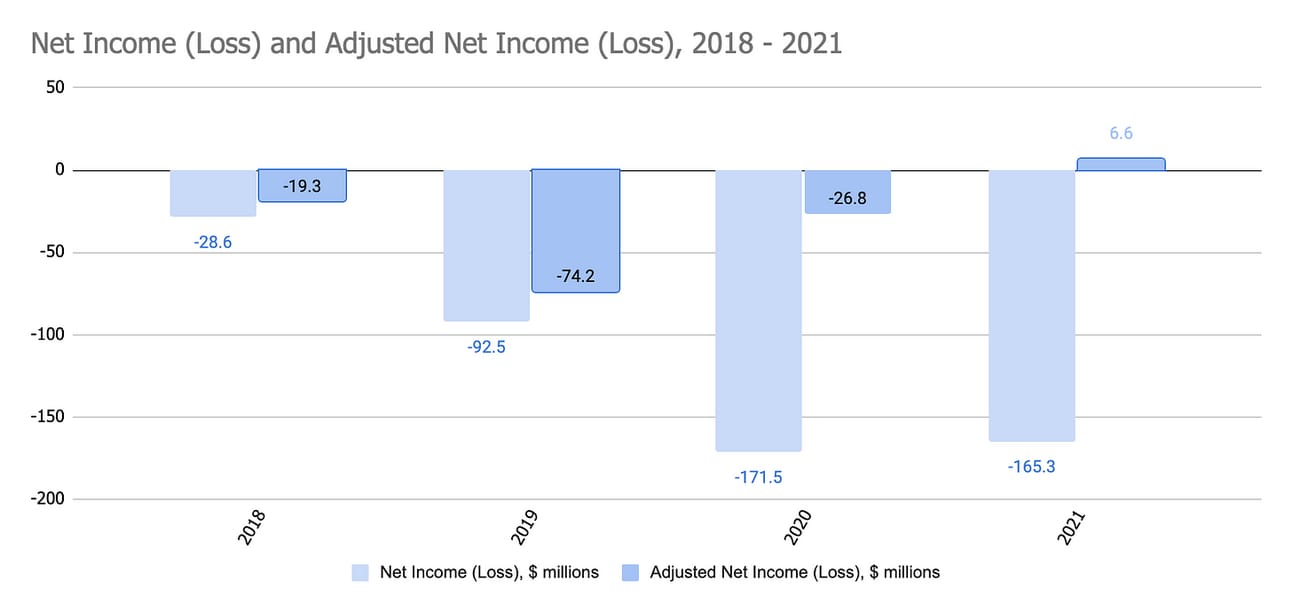

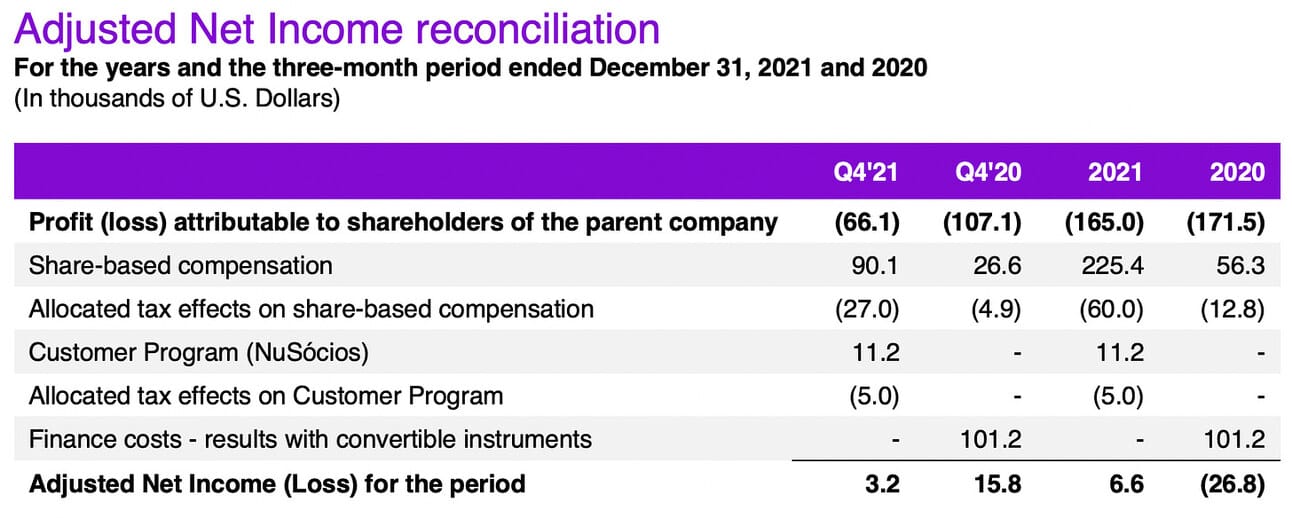

The company reported a Net Loss of $66.2 million for Q4 2021 (38% improvement from Net Loss of $107.1 million in Q4 2020), and $165.3 million for the full year 2021 (4% improvement from Net Loss of $171.5 million in 2020). On the Adjusted Basis (non-GAAP metric), the company reported an Adjusted Net Income of $3.2 million for Q4 2021 (down from $15.8 million in Q4 2020) and $6.6 million for the full year 2021 (up from a loss of $26.8 million in 2020).

As any high-growth company, Nubank uses extensively stock-based compensation to recruit the top talent. As can be seen in Adjusted Net Income reconciliation, stock-based compensation amounted to $225.4 million in 2021. And, as any high-growth company, Nubank uses Adjusted Net Income to illustrate its profitability (excluding stock-based compensation from the calculation).

Back in the day, Warren Buffett argued: “If options aren’t a form of compensation, what are they? If compensation isn’t an expense, what is it? And, if expenses shouldn’t go into the calculation of earnings, where in the world should they go?” I am not aware if Mr. Buffett has changed his stance on stock-based compensation, but I would guess he believes that, as Nubank scales, it will be able to report income on both an adjusted and non-adjusted basis.

Customer Acquisition Cost and Cost to Serve

In order to support this belief (that Nubank can become profitable also on a non-adjusted basis), I will throw in two metrics: a) Customer Acquisition Cost (CAC), and b) Monthly Average Cost to Serve per Active Customer.

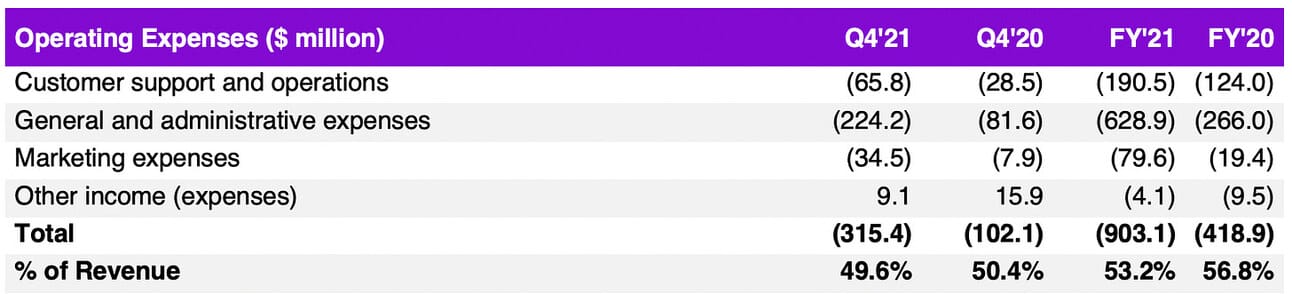

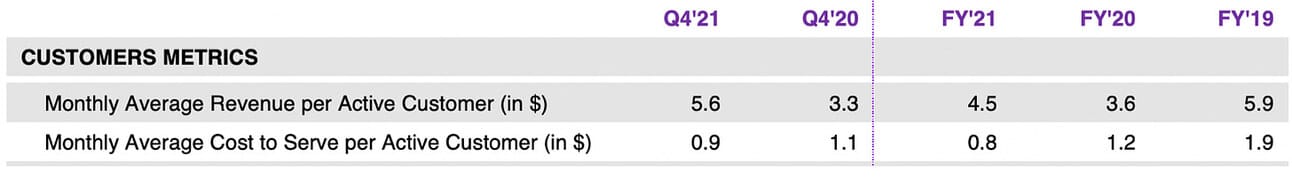

As can be seen from the table below Nubank spend $79.6 million on marketing in 2021 and $19.4 million in 2020. In these two years, Nubank acquired 20.6 million and 13.2 million customers respectively, which means Nubank’s Customer Acquisition Cost was $3.86 per new customer in 2021 and $1.47 per new customer in 2020. This is an insanely low acquisition cost, and I would argue that Nubank is getting their customers pretty much for free. I mean, the company reported Monthly Average Revenue per Active Customer of $4.5 in 2021 and $3.6 in 2020, meaning it gets its marketing money back in less than a month.

The company also reports the Monthly Average Cost to Serve per Active Customer, which stood at $0.8 in 2021, and $1.2 in 2020 (see below). Nubank illustrates the power of a modern digital bank: no branches, not expensive legacy technologies, automated processes, and this results in extremely low cost of serving a customer. Moreover, the cost is falling down as the company scales it customer base.

In short, Nubank’s customer acquisition costs and costs to serve are extremely low already at this scale, so I would guess that Buffett excluded temporarily inflated general and administrative expenses (inflated by hefty stock-based compensation during the growth phase) in his long-term calculations.

Things to Watch in 2022 and Beyond

I like to wrap up earnings reviews with “things to watch” for a given company. Let’s call this one “things that Warren Buffett will be watching before loading up on additional Nubank’s shares”:

Customer growth in Mexico and Colombia. As I illustrated above, Nubank might soon hit the ceiling in terms of customer growth in Brazil; however, company’s first steps in Mexico and Colombia are looking promising.

Loan book and Interest Income growth. Pandemic made Nubank postpone its lending growth plans; however, the company delivered strong numbers in lending origination in 2021 and the growth potential so far does seem to be limited

Fee income growth. As I mentioned above, at this point Nubank mostly earns fees from its card portfolio (i.e. interchange fees), but is aggressively launching additional services that will increase non-interest income (investing, insurance, acquiring, etc.)

Acquisitions. The company raised $2.6 billion through its IPO and (based on the Adjusted Net Income numbers) it didn’t need so much cash to fuel further growth. My guess is that they will be looking at acquiring both product companies, as well as companies that could help them grow their client base in Mexico and Colombia.

Source of the data used above: Nubank’s Investor Relations

Disclosure & Disclaimer: despite rocky performance in 2021 and early 2022, I have open positions in most of the companies covered in this newsletter, as I am extremely bullish on the transformation in the financial services industry. However, none of the above is financial advice, and you should do your research.