Hey!

Coupang, the “Amazon of South Korea”, controls close to 40% of the country’s e-commerce market and serves almost half the population. Even with its dominant position, Coupang continues to grow, with analysts projecting $45 billion in revenue by 2027. That made me think Coupang must have a strong Fintech arm, just like Mercado Libre with Mercado Pago or Sea with Shopee.

But I was wrong. Coupang’s Fintech business is limited to a wallet, Coupang Pay, and a co-branded credit card, WOW card. Limited disclosures suggest that these products have a marginal contribution to the company’s top line. So what happened? My conclusion is that Coupang lost the wallet war.

South Korea experienced a major shift from card payments to mobile wallets, and Coupang was late to respond. Coupang’s wallet came too late, Samsung, Naver, KakaoPay, and Toss had already built strong footholds. And in Fintech, payments come first. If you control payments, you earn the right to offer loans, insurance, and investments.

Coupang missed that chance.

Let’s dive in!

Jevgenijs

p.s. if you have feedback, just reply to this email or ping me on X/Twitter

Today’s write-up is about Coupang, the “Amazon of South Korea”. You can find my write-ups about Mercado Pago, the “Amazon of Latin America”, here, and Sea, the “Amazon of Southeast Asia”, here.

Founded in 2010 as a Groupon clone, the company pivoted into commerce around 2012-2014, and went public in 2021 at a $60 billion valuation, making it the largest U.S. IPO by a foreign company since Alibaba. As of this writing, Coupang $CPNG ( ▼ 1.24% ) has a market capitalization of around $55 billion.

Image source: Coupang

“Coupang is one of the fastest-growing technology and commerce companies in the world, providing retail, restaurant delivery, video streaming, and fintech services to customers around the world under brands that include Coupang, Coupang Eats, Coupang Play and Farfetch.”

Coupang’s core business is e-commerce in South Korea, but over the years it has expanded geographically into Taiwan (an earlier attempt to enter Japan was unsuccessful) and broadened its offerings to include restaurant delivery and video streaming. In 2024, it also acquired the global luxury marketplace Farfetch.

“In January 2024 we acquired the business and assets of Farfetch Holdings plc (“Farfetch”), a leading global marketplace for the luxury fashion industry which connects customers in more than 190 countries and territories with some of the world’s best boutiques and brands.”

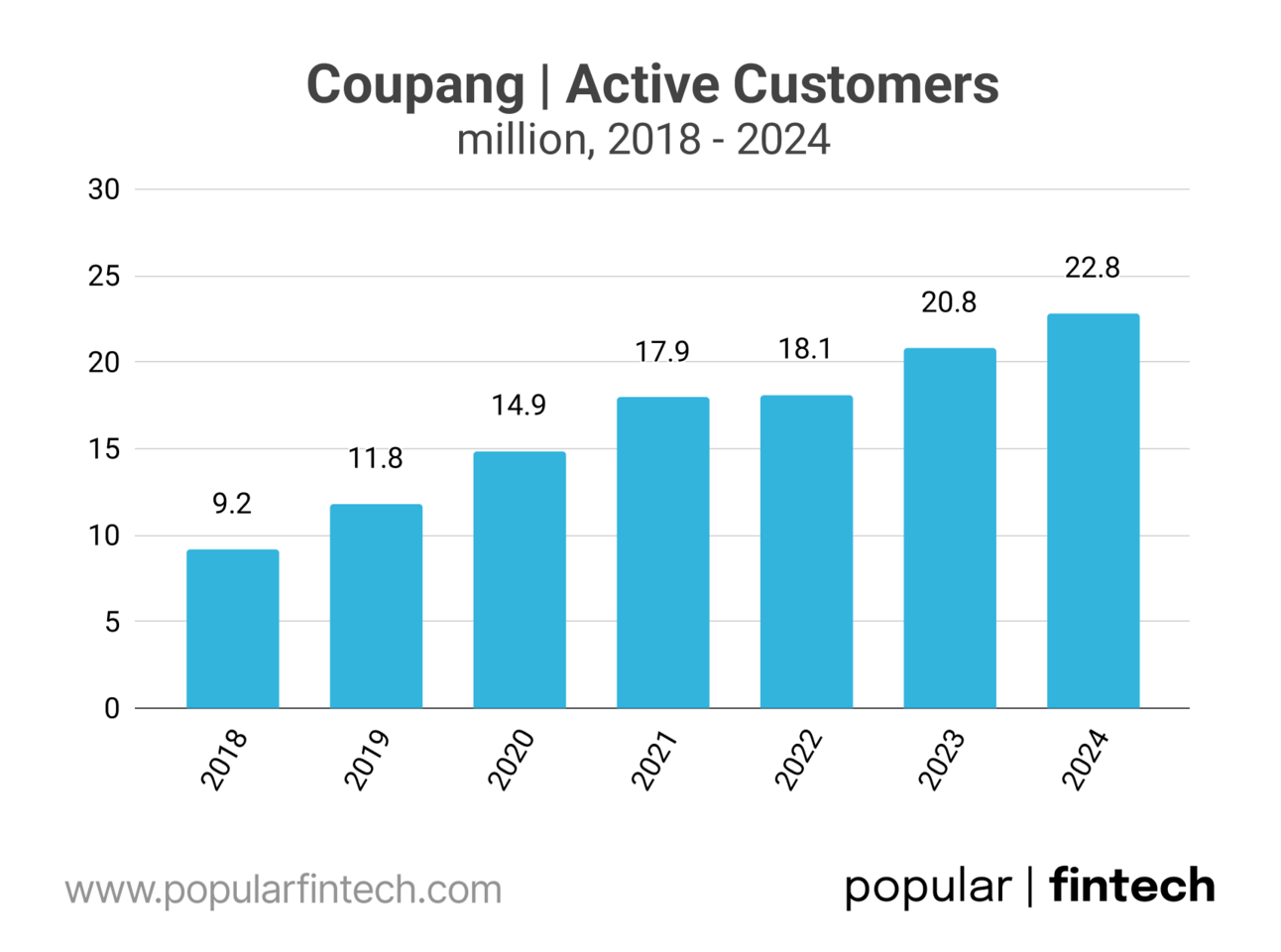

It’s worth noting that South Korea has a population of 51 million and 23 million of them use Coupang. The company is the undisputed leader in South Korean e-commerce, with nearly 40% market share, followed by Naver (often called the “Google of South Korea”) and Gmarket (the “eBay of South Korea”).

Image source: South Korea Online Retail Forecast 2023-28

“Top three players accounted for 67.4% of market share in 2023. Coupang is the largest player with 39.7% market share due to its strong brand presence and customer-centric services, followed by Naver leveraging its search capabilities and Gmarket offering diverse products and competitive pricing.“

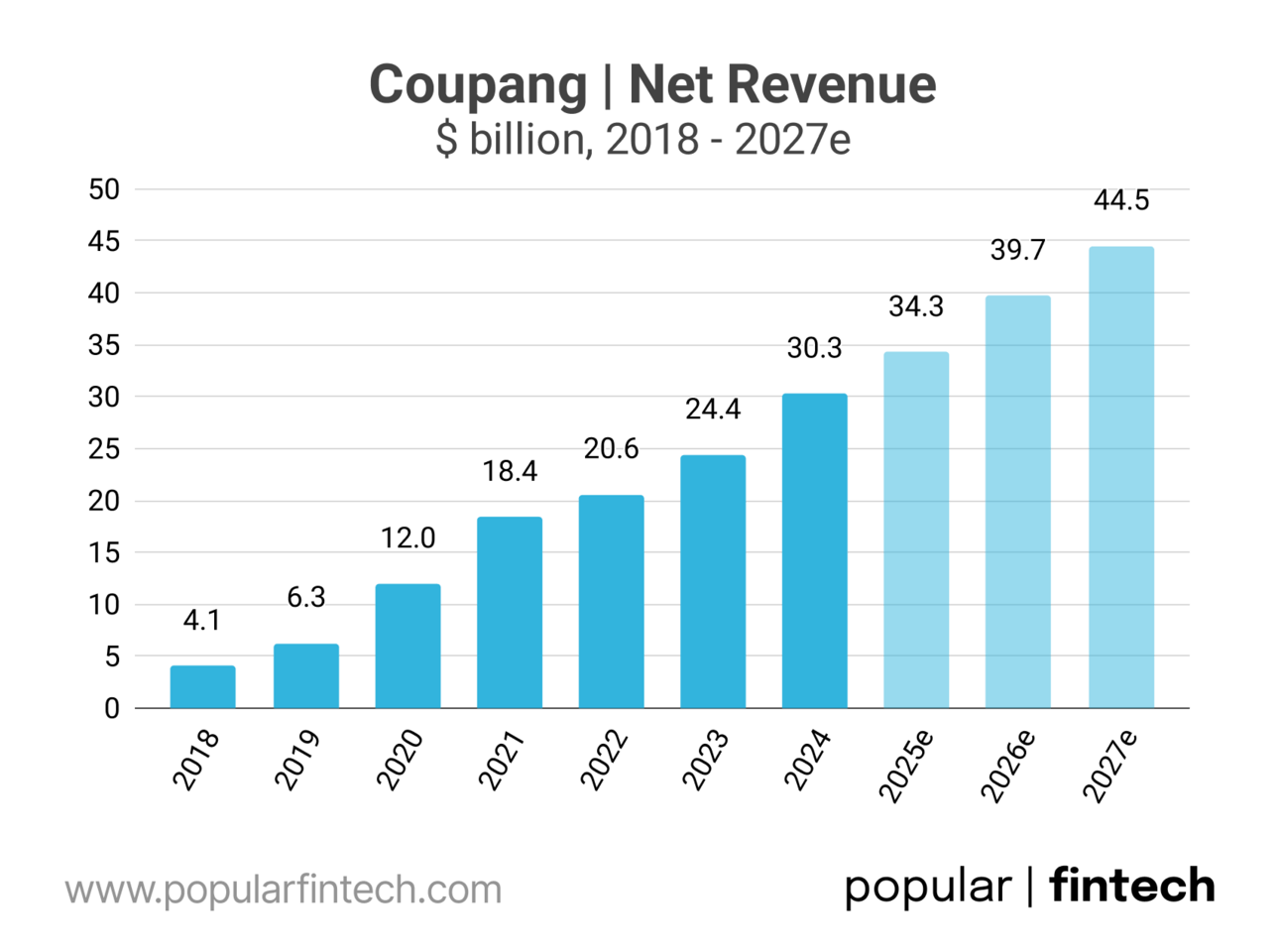

In 2024, Coupang reported total revenue of $30.3 billion, almost five times higher than the $6.3 billion it generated in 2019. Despite its already large market share, Wall Street analysts expect Coupang’s growth to continue, projecting its revenue to reach nearly $45 billion by 2027.

Date source: Coupang, Koyfin

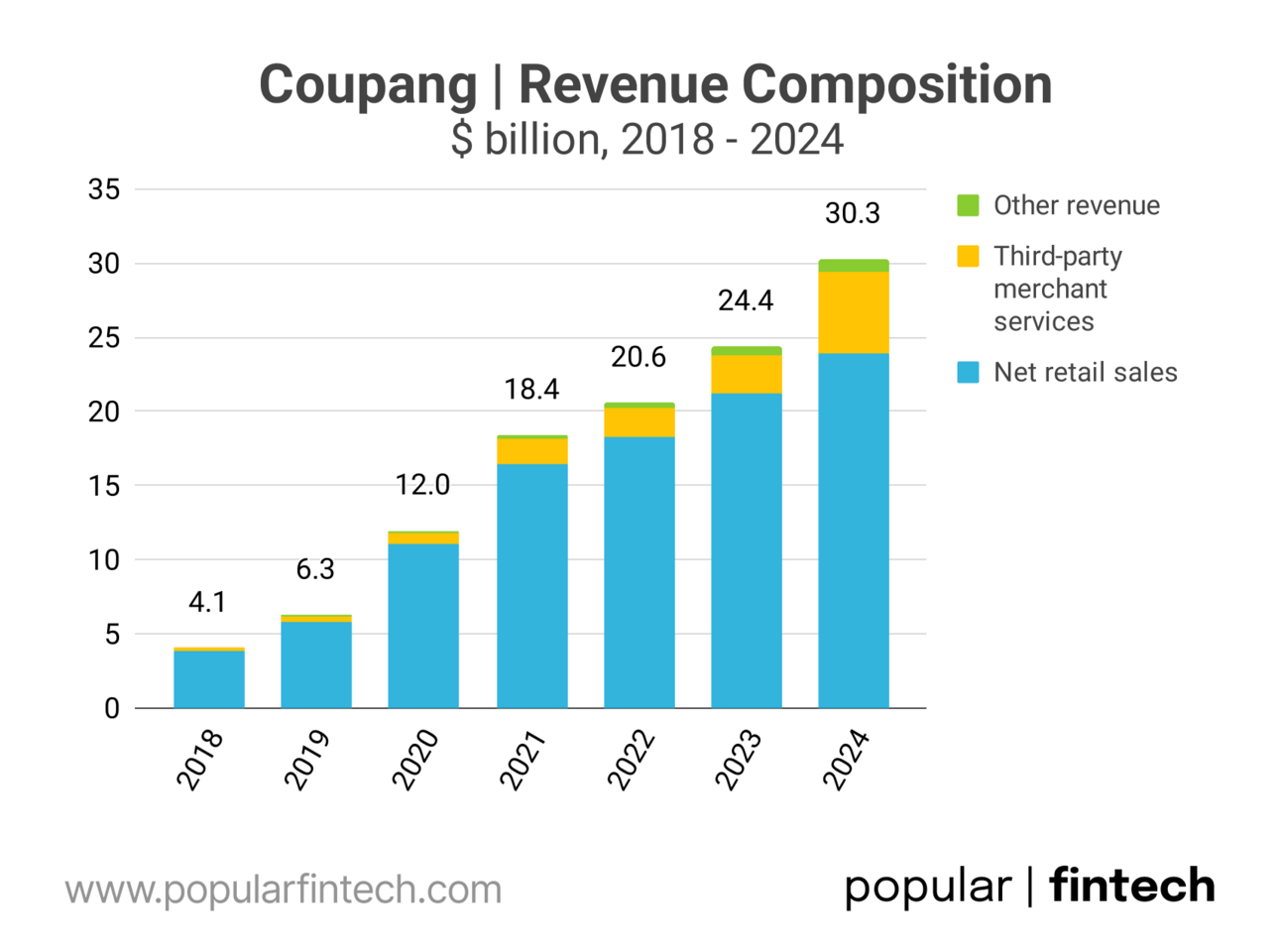

A key difference between Coupang and companies like Mercado Libre and Sea is that Coupang primarily sells products itself (known as “first-party” or “1P”), whereas Mercado Libre and Shopee mainly operate as marketplaces for third-party (“3P”) sellers. However, third-party sales are growing faster than first-party sales.

Coupang, like Amazon, does not disclose Gross Merchandise Volume. However, its financials show growing revenue from “third-party merchant services.” In 2024, the company generated $5.6 billion in “third-party merchant services”, including $1.7 billion contributed by Farfetch.

Date source: Coupang

“Third-party merchant services represent commissions, advertising, and delivery fees earned from merchants and restaurants that sell their products through our online businesses. Other revenue includes revenue earned from our Rocket WOW membership program and various other offerings.”

To put Coupang’s scale into perspective, I compared its estimated GMV with that of Mercado Libre and Sea (see chart below). Despite operating in a market of just 51 million people, Coupang generates a GMV comparable to Mercado Libre, which serves a region of over 600 million.

Date source: Coupang

That got me thinking that Coupang should have a massive Fintech business. As I explained in my write-ups on Mercado Libre and Sea, e-commerce creates a strong foundation for payments, as well as consumer and merchant lending.

…and I was wrong.

Coupang’s Fintech business is limited to its wallet Coupang Pay (which is primarily used with the Coupang ecosystem) and a co-branded credit card. I would also argue that the opportunity for scaling this business might be limited given fierce competition. It looks like Coupang missed the Fintech train.

Image source: Coupang

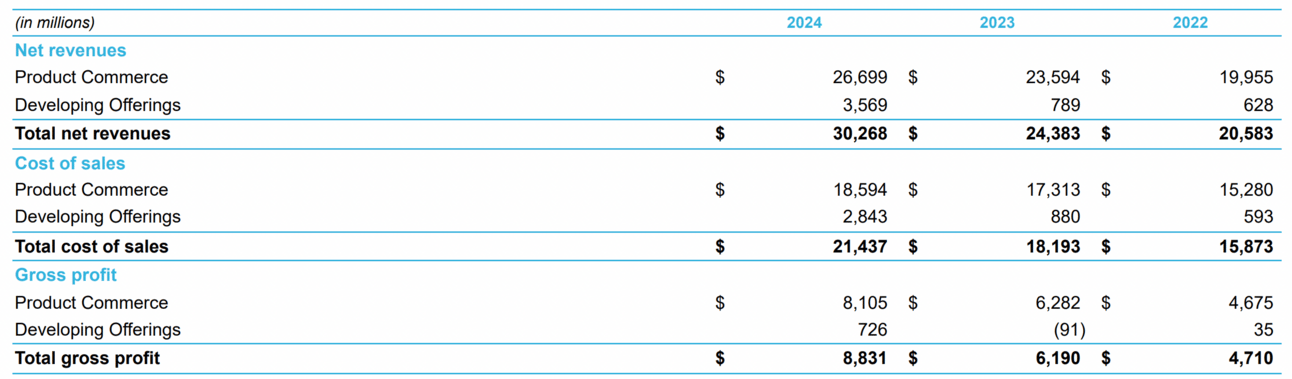

Coupang doesn’t report revenue from its Fintech ventures separately. Instead, it includes them under “Developing Offerings”, alongside Coupang Eats, its Taiwan operations, the streaming business, and Farfetch. Excluding Farfetch, the “Developing Offerings” generated $1.9 billion in revenue in 2024.

Image source: Coupang, Form 10-K, 2024

“Developing Offerings includes our more nascent offerings and services, including Coupang Eats, our restaurant ordering and delivery service in Korea, Coupang Play, our online content streaming service in Korea, fintech, our retail operations in Taiwan, as well as advertising products associated with these offerings, and also includes Farfetch, our newly acquired global luxury fashion marketplace.”

As I understand it, Coupang monetizes Coupang Pay primarily by charging fees to third-party sellers. Any additional fintech revenue is likely included in “Other revenue,” alongside Rocket WOW membership fees. With around 14 million WOW members paying approximately $70 per year, there doesn’t appear to be significant Fintech revenue in that line item.

Coupang, Form 10-K, 2024

So what happened? Why wasn’t Coupang able to leverage its platform to build a successful Fintech business? As you remember from my earlier write-ups, Mercado Libre and Sea began building their Fintech businesses with digital wallets, Mercado Pago and AirPay, because low card and banking penetration in their markets made it necessary to enable online payments.

South Korea’s story is different. By the time Coupang began building its e-commerce empire, card adoption was already widespread. Even today, cards remain the dominant payment method for both online and offline transactions.

Image source: Worldpay Global Payments Report 2025

However, in 2014, the country introduced “simple payment service”, a mobile-native alternative to cards, offering one-click, app-based payments using cards or bank accounts. Think of it as Apple Pay but with a much deeper integration into mobile apps, greater adoption in offline commerce, and open banking capabilities.

This innovation spurred the rise of mobile wallets, which started replacing card payments in both online and in-person commerce. First, Samsung Pay, followed by Kakao Pay, Naver, and Toss Pay. Coupang was one of the last players to join this trend with the launch of Coupang Pay.

Image source: Bank of Korea

There are over 40 providers of “easy payment services”, yet just four players, Samsung Pay, Naver Pay, Kakao Pay, and Toss Pay, control the majority of the market. Coupang has essentially lost the wallet war.

“Currently, there are a total of 40 electronic financial companies, of which the big three, Naver Pay, Kakao Pay, and Toss Pay, have a 90% share.”

In a recent article, Alex Johnson quoted a banker saying, “primacy is payments.” Mercado Libre and Sea are perfect examples of that. By becoming the primary wallet for consumers, they earned the right to offer more financial services. So did all wallet players in South Korea.

Thus, Coupang’s biggest competitor in commerce, Naver, boasts over 30 million users of its Naver Pay wallet. They have expanded beyond payments, offering loans, credit cards, and stock trading. In 2024, Fintech business brought $1.1 billion in revenue.

Image source: Naver

“NAVER Pay is a comprehensive financial platform that helps users live a smart consumption, finance, and investment life, from simple payment services to financial product search and comparison, securities, and real estate, in one app.”

Kakao Pay, mentioned earlier, was launched by Kakao Talk (Kakao Corp), a messenger app used by 94% of the South Korean population. Kakao Corp actually launched two Fintech businesses: Kakao Pay and Kakao Bank.

Image source: Kakao Corporation

KakaoPay serves over 24 million active users and offers a wide range of financial services, including mobile payments, debit and credit cards, peer-to-peer transfers, savings products, insurance, loans, investments, and bill payments. In 2024, the company generated $766 million in revenue.

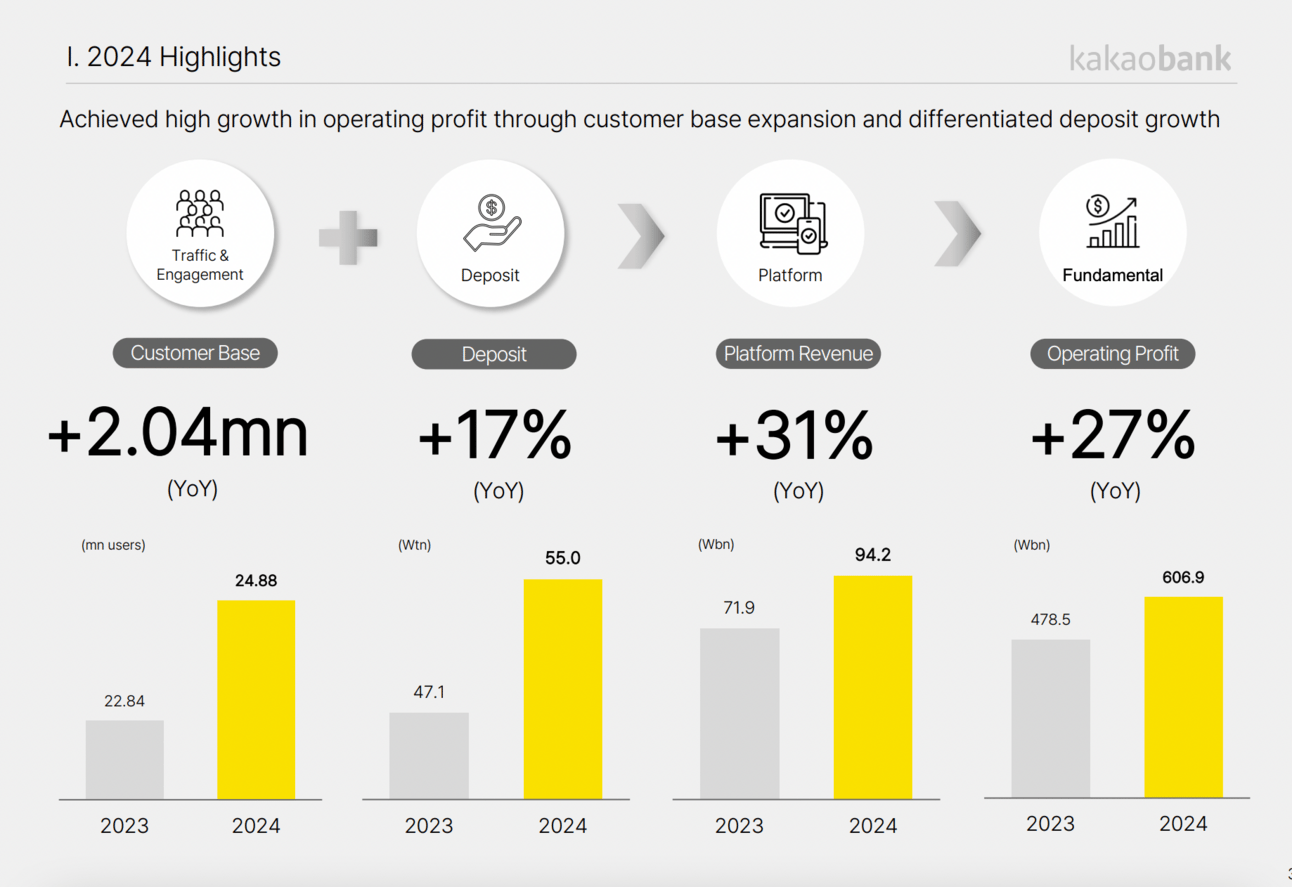

Its sister company, KakaoBank, has become one of South Korea’s leading digital banks, with over 20 million users and a broad suite of services including savings and checking accounts, personal loans, mortgage lending, debit cards, and stock trading. In 2024, the bank generated over $1.5 billion in revenue.

Image source: KakaoBank

Toss, developed by Viva Republica, is one of South Korea’s leading fintech super-apps, serving over 20 million users. It offers a wide range of services, including digital banking, payments, personal loans, insurance, investing, credit scoring, and financial management tools. In 2024, Toss generated nearly $1.3 billion in revenue.

Image source: Toss

Oh, and Samsung Pay in South Korea is much more than Apple Pay in the U.S. It’s not just for tap-to-pay, it also supports QR payments, transit cards, online shopping, and even money transfers. It’s deeply connected to local banks, rewards programs, and Samsung’s other financial services, making it a core part of everyday spending in Korea.

In summary, Coupang has succeeded in building an e-commerce leader, but has missed the opportunity to build a meaningful Fintech business. While it has a wallet, competitors have already moved beyond that, offering a broad range of financial services. Can Coupang catch up? I wouldn’t bet on it.

My takeaway from Coupang’s story is that having a successful e-commerce business isn’t enough to build a thriving ecosystem of financial services. You still have to outcompete everyone else. Like Amazon, Coupang couldn’t.

Cover image source: Coupang

Disclaimer: The views expressed here are my own and do not represent the views of my employer. The information contained in this newsletter is intended for educational and informational purposes only and should not be considered financial advice. You should do your own research or seek professional advice before making any investment decisions. Read the full disclaimer here.