Hey!

I continue to explore companies that aren’t traditionally seen as Fintechs, but have quietly built sizeable Fintech businesses along the way. This week, it’s Sea Limited. Headquartered in Singapore, Sea operates three major platforms across Southeast Asia: Garena (gaming), Shopee (e-commerce), and Monee (financial services).

Sea started as a gaming company and used profits from Garena to fund its push into commerce and financial services. The result? One of the largest e-commerce platforms in Southeast Asia, and one of the region’s biggest Fintech players.

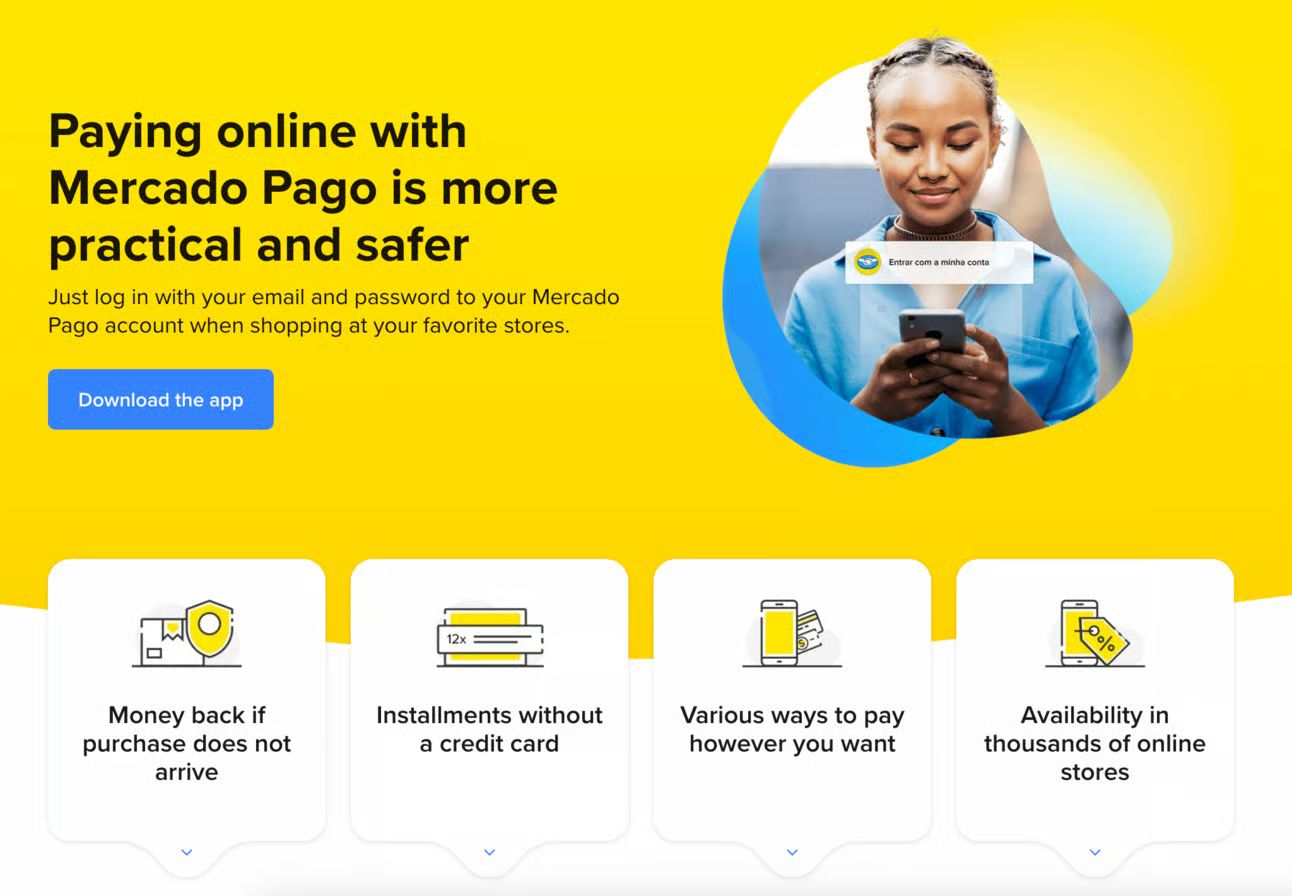

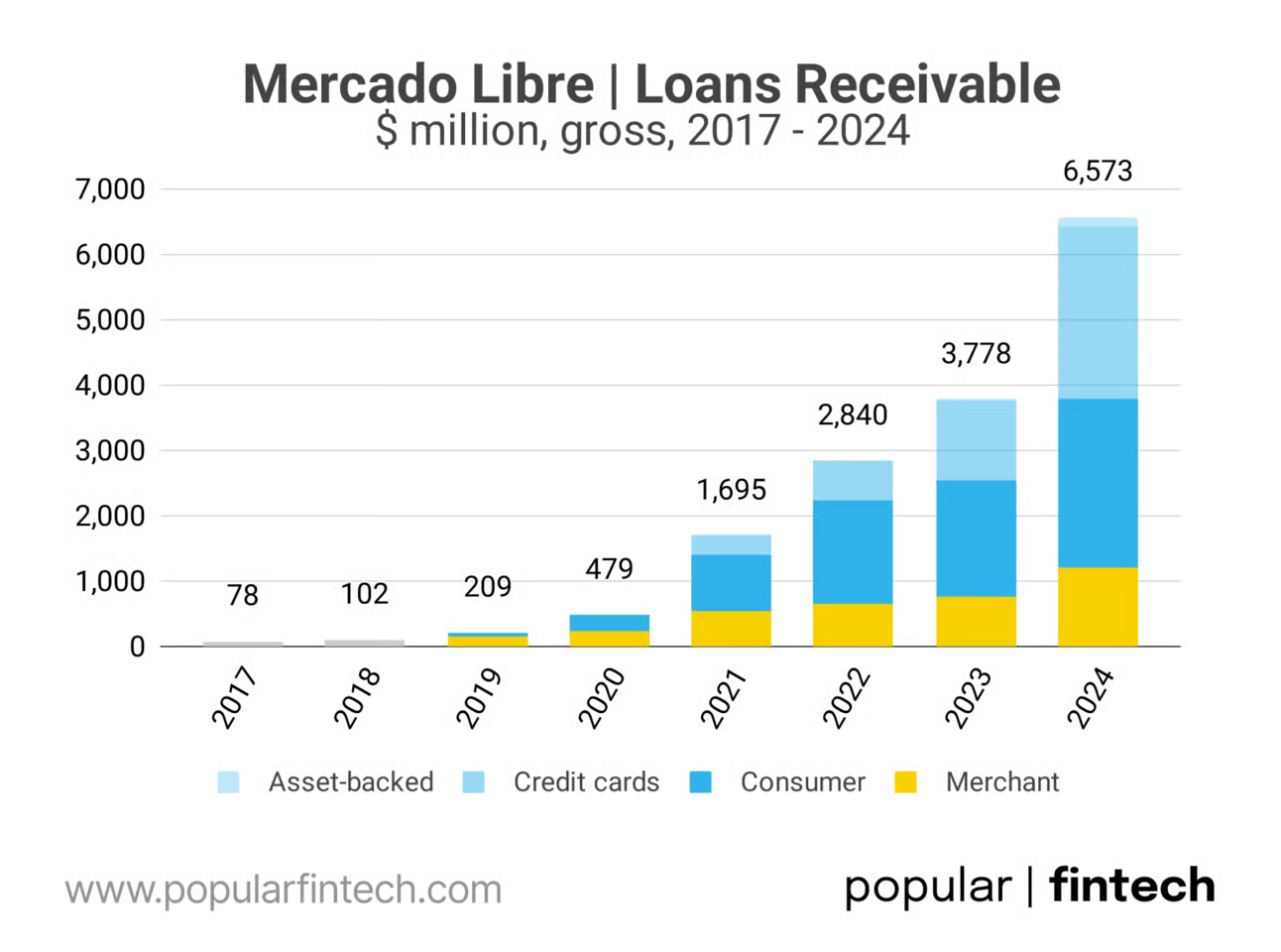

Like Mercado Libre, Sea’s Fintech journey began with a wallet to support online purchases. And like Mercado Pago, it’s consumer credit that’s now driving the next wave of growth. The synergy between e-commerce and financial services is real, and both Sea and Mercado Libre are proof of that.

Let’s dive in!

Jevgenijs

p.s. if you have feedback, just reply to this email or ping me on X/Twitter

In today’s article, I continue to explore companies that aren’t traditionally seen as Fintechs, but have built serious Fintech businesses along the way.

This week it is Sea Limited $SE ( ▼ 2.13% ) (and if you missed Mercado Libre $MELI ( ▼ 0.93% ), you can check it here). Headquartered in Singapore, Sea operates three major platforms (primarily) across Southeast Asia: Garena (gaming), Shopee (e-commerce), and Monee (financial services).

Image source: Free Vector Maps

To avoid any confusion: in early 2025, Sea rebranded its Digital Financial Services business from SeaMoney to Monee. So, when you see SeaMoney or Monee in the text below, they refer to the same business.

Sea started as a gaming company back in 2009, when it launched Garena, its digital entertainment arm that licensed and published global hits like League of Legends and Call of Duty: Mobile across Southeast Asia.

But it was Garena’s own title, Free Fire, launched in 2017, that turned the company into a regional gaming powerhouse. Free Fire became one of the world’s most downloaded mobile games, especially popular in emerging markets like Indonesia, India and Brazil.

Image source: Garena

“We began our digital entertainment business, Garena, at our inception in 2009, and have since expanded our game operations globally with the launch of our self-developed game, Free Fire.”

Garena remains one of the largest mobile gaming platforms in the world. In Q1 2025, 662 million people played Garena games (reported as “Quarterly Active Users”), and nearly 65 million of them made in-app purchases (reported as “Paying Active Users”).

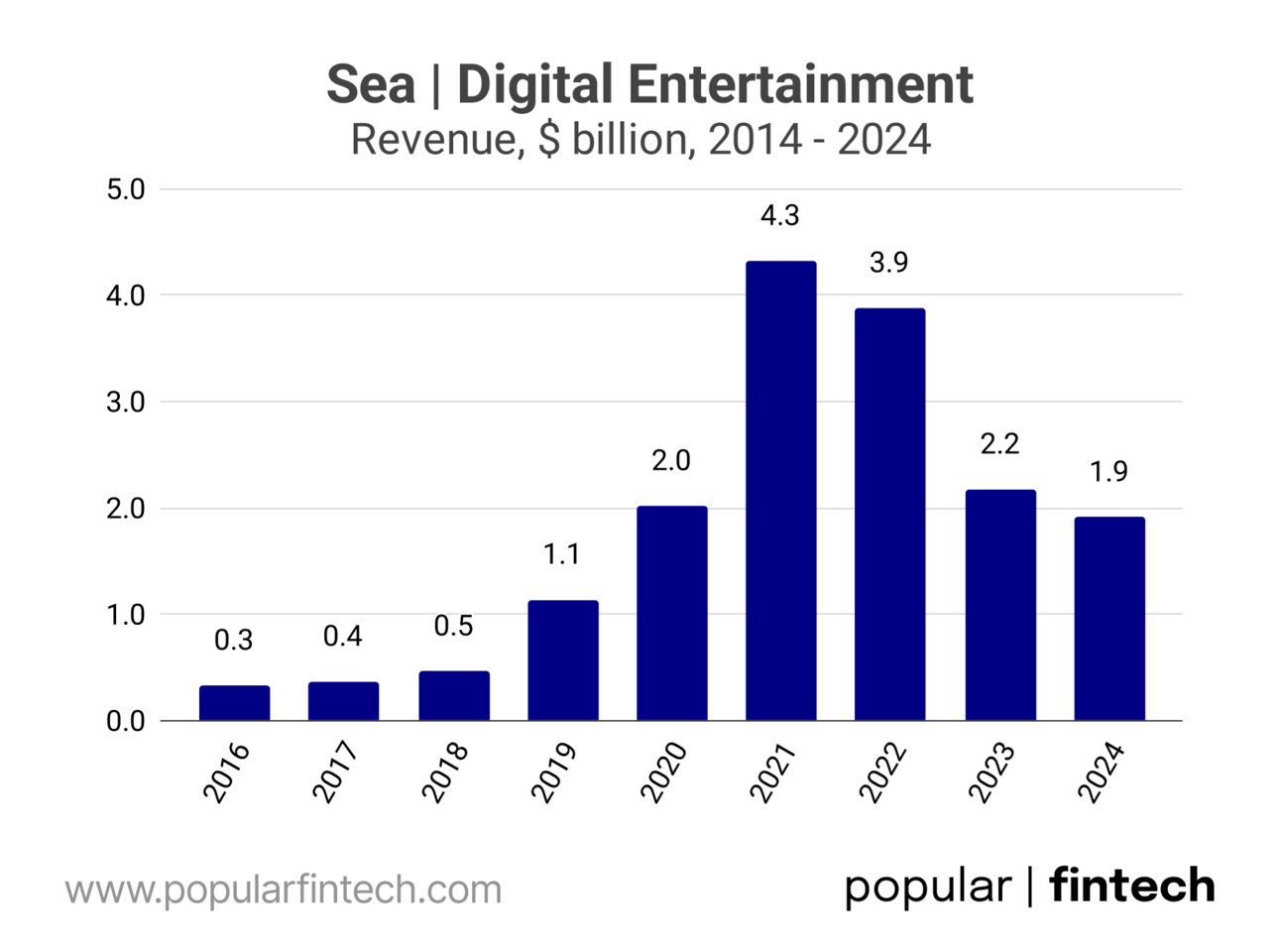

In 2024, Garena generated $1.9 billion in revenue, down sharply from its pandemic peak of $4.3 billion, but still a massive cash engine for Sea. Sea’s gaming business has been highly profitable, helping fund the company’s expansion into new verticals.

Data source: Sea

“ Garena is a global game developer and publisher. Garena provides users with access to popular and engaging mobile and PC online games that we develop, curate, license and localize for each market.”

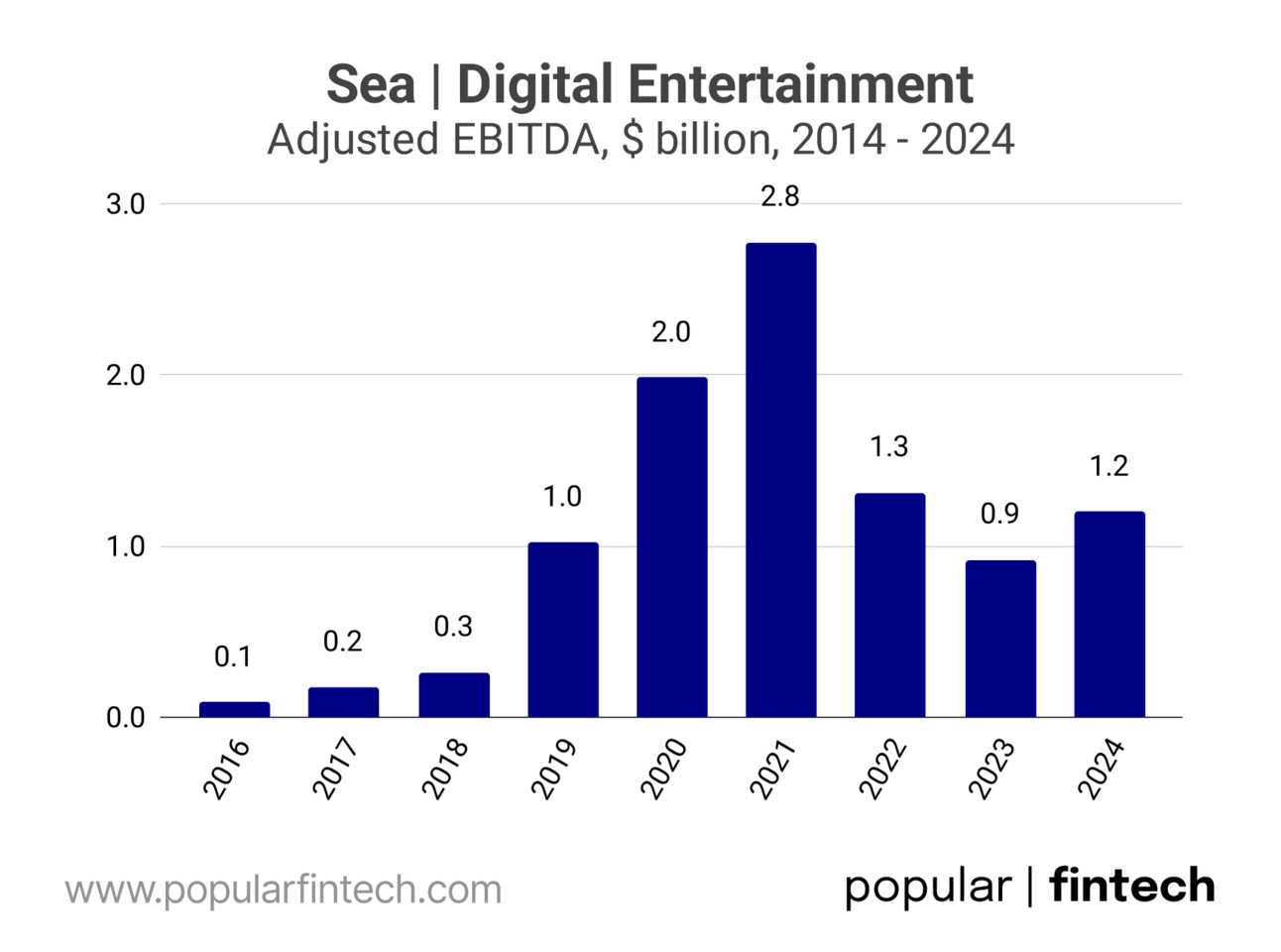

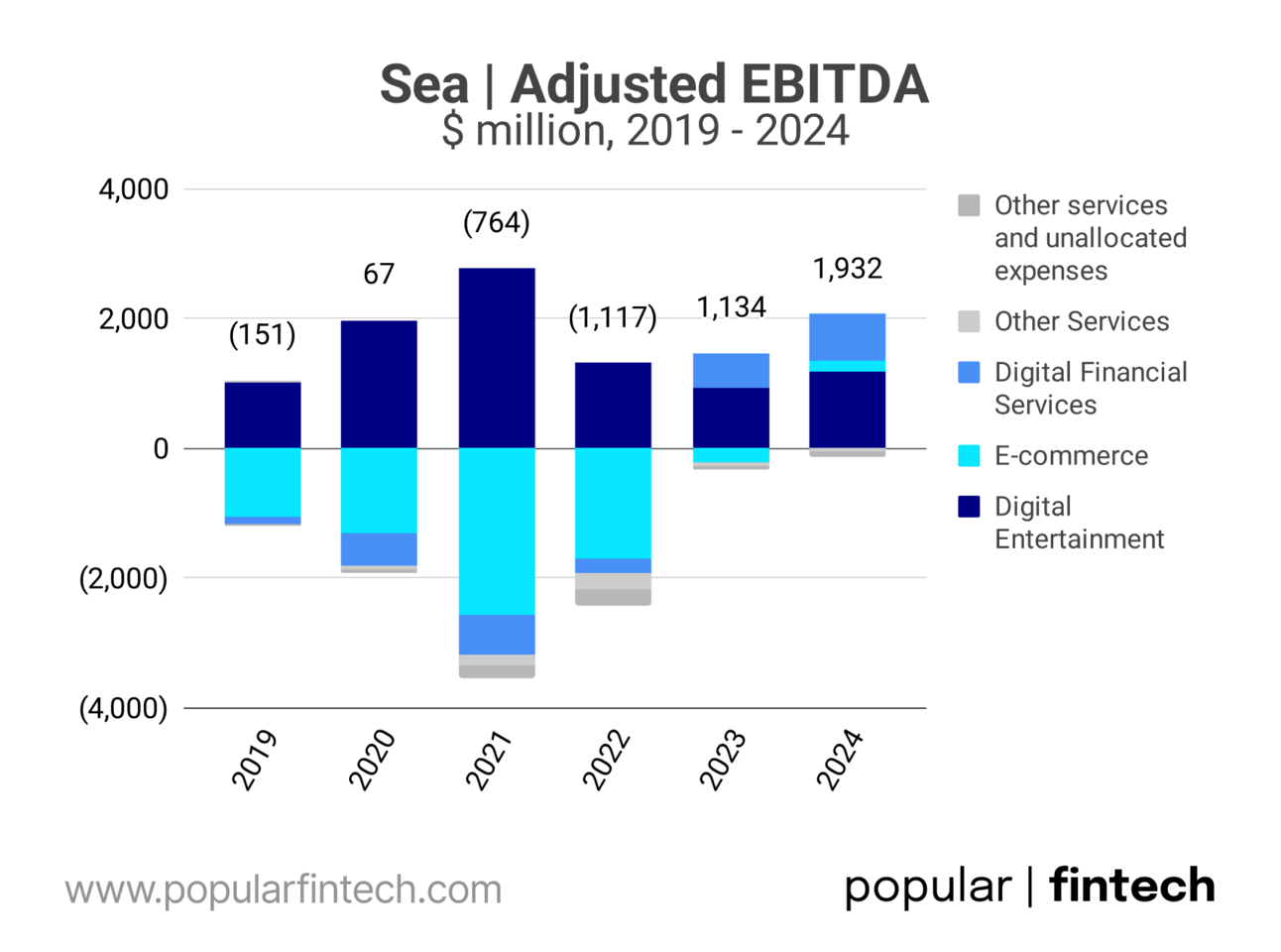

At its peak in 2021, Garena delivered $2.8 billion in adjusted EBITDA, making it one of the most profitable mobile gaming operations globally. In 2024, Garena generated $1.2 billion in adjusted EBITDA, up from $0.9 billion in 2023, a clear sign that the company has adjusted to the post-pandemic reality and returned to growth.

Data source: Sea

“2024 was a great year for Garena, marking Free Fire's remarkable comeback. After the post-pandemic headwinds, in 2022 and 2023, Free Fire responded with annual bookings growing at 34% year-on-year in 2024, and we expect continued growth in 2025.”

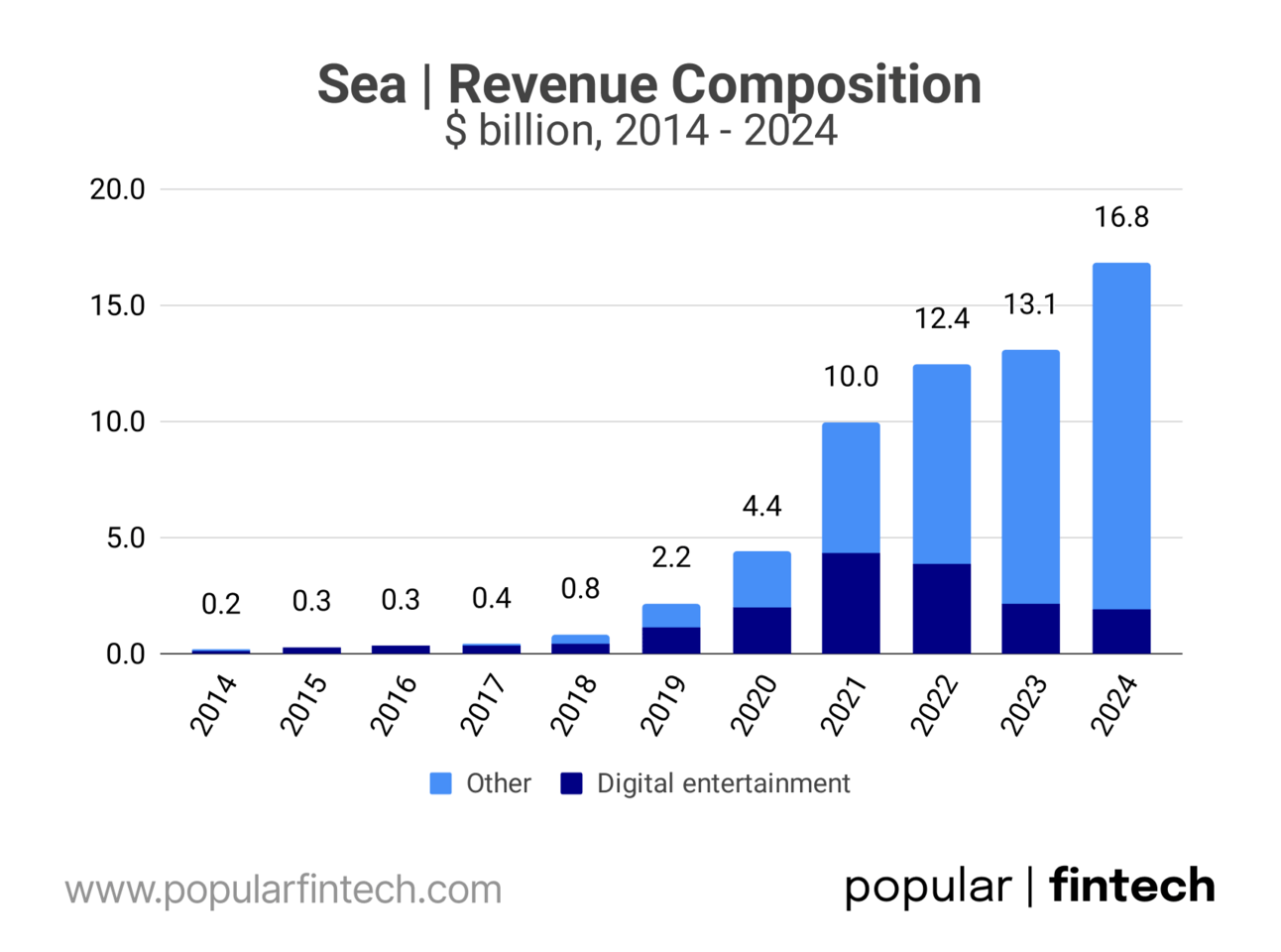

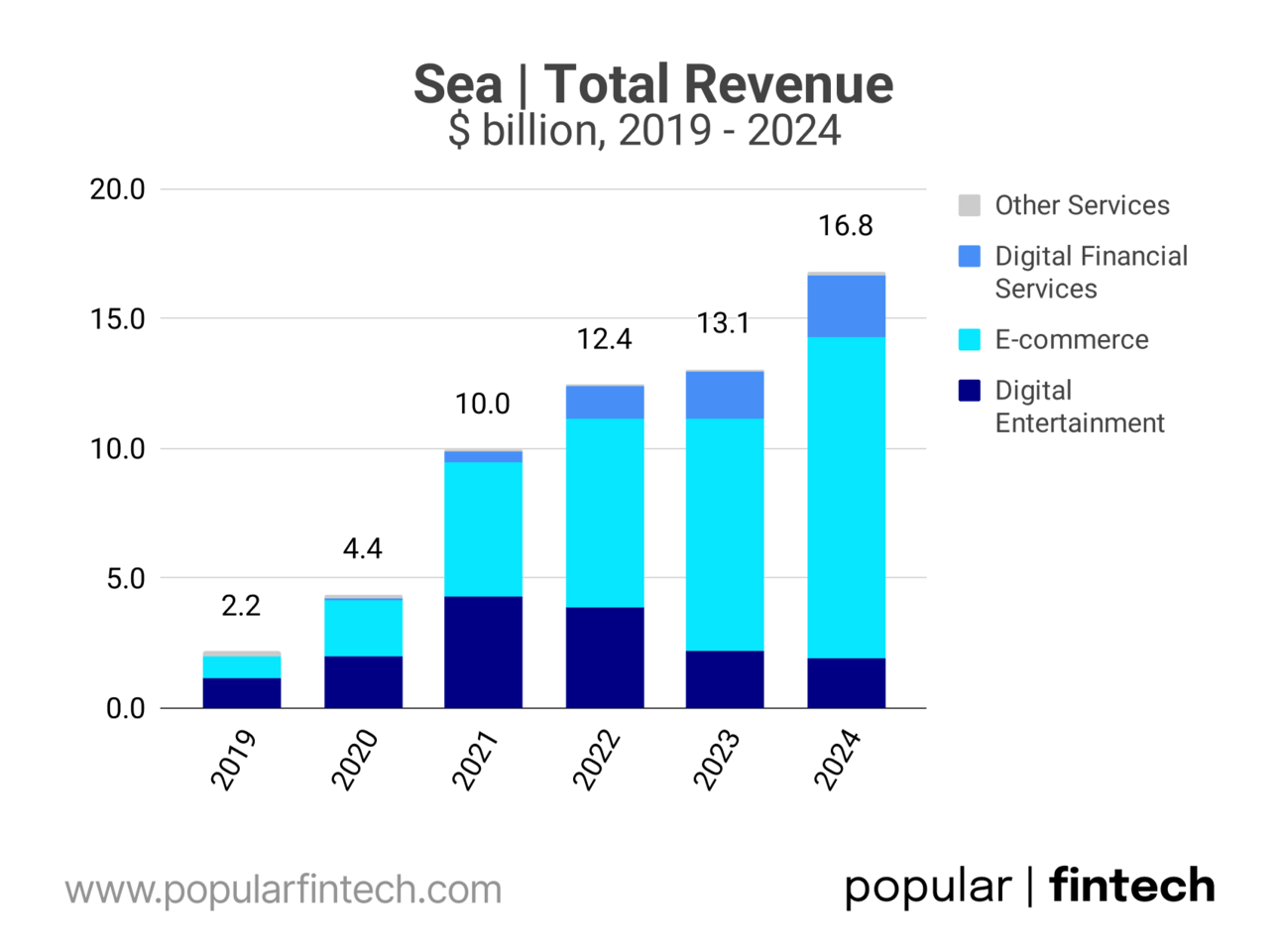

Garena’s profitability gave Sea the financial power to invest aggressively in building its commerce and Fintech businesses. And it would be a completely different story if Sea had remained just a gaming company. In 2014, digital entertainment made up 96% of the company’s total revenue. A decade later, in 2024, that figure dropped to just 11%.

Data source: Sea

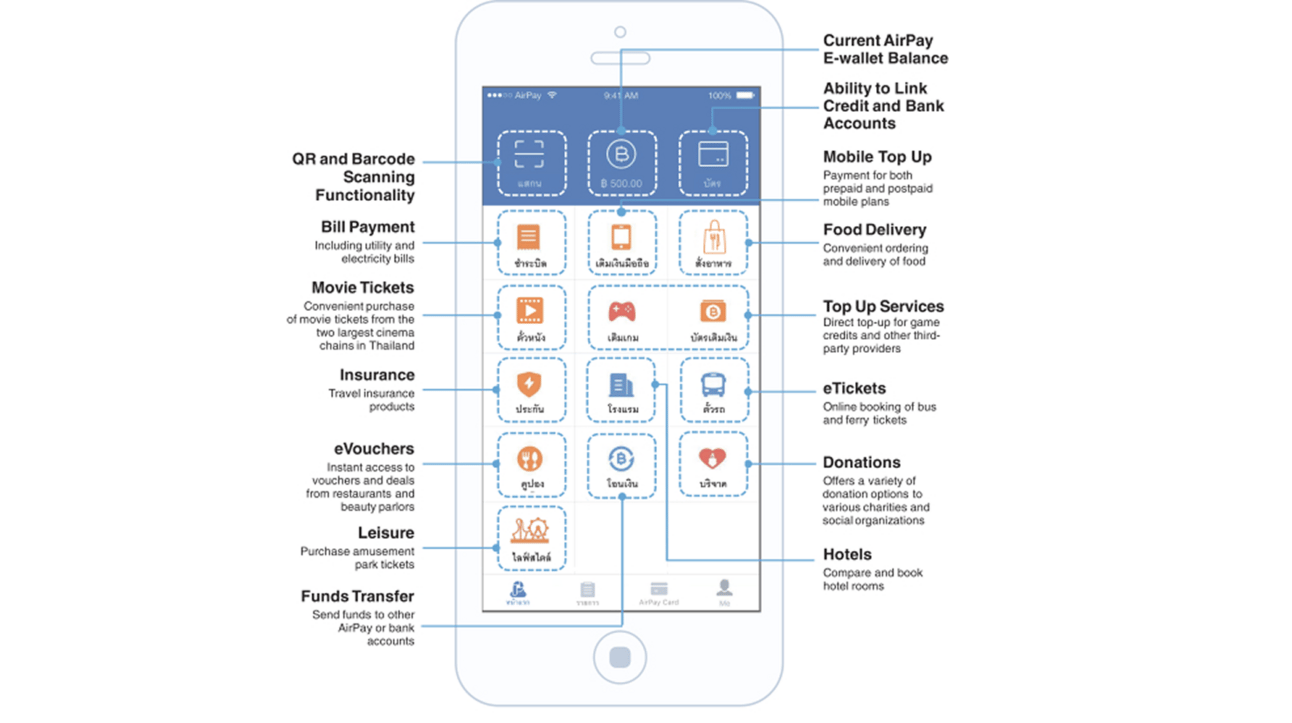

In 2014, Sea launched a digital wallet called AirPay, originally designed to support in-game purchases on Garena. Credit card penetration in Southeast Asia was low, and many Garena users were unbanked. AirPay provided a way for these users to buy virtual goods and top up game credits, enabling Sea to better monetize its gaming audience.

Image source: Sea, Form F-1

“We started to offer digital payment services in Southeast Asia in 2014. Since then, we have further expanded our digital financial service offerings across credit, banking and insurtech.”

To enable AirPay top-ups for users without bank accounts and credit cards, Sea built a physical payment network across Southeast Asia. Users could visit authorized AirPay agents, typically convenience stores, internet cafes, and mom-and-pop shops, to deposit cash into their wallets. This network was critical in enabling AirPay’s early adoption, especially in countries like Vietnam, Thailand, and Indonesia.

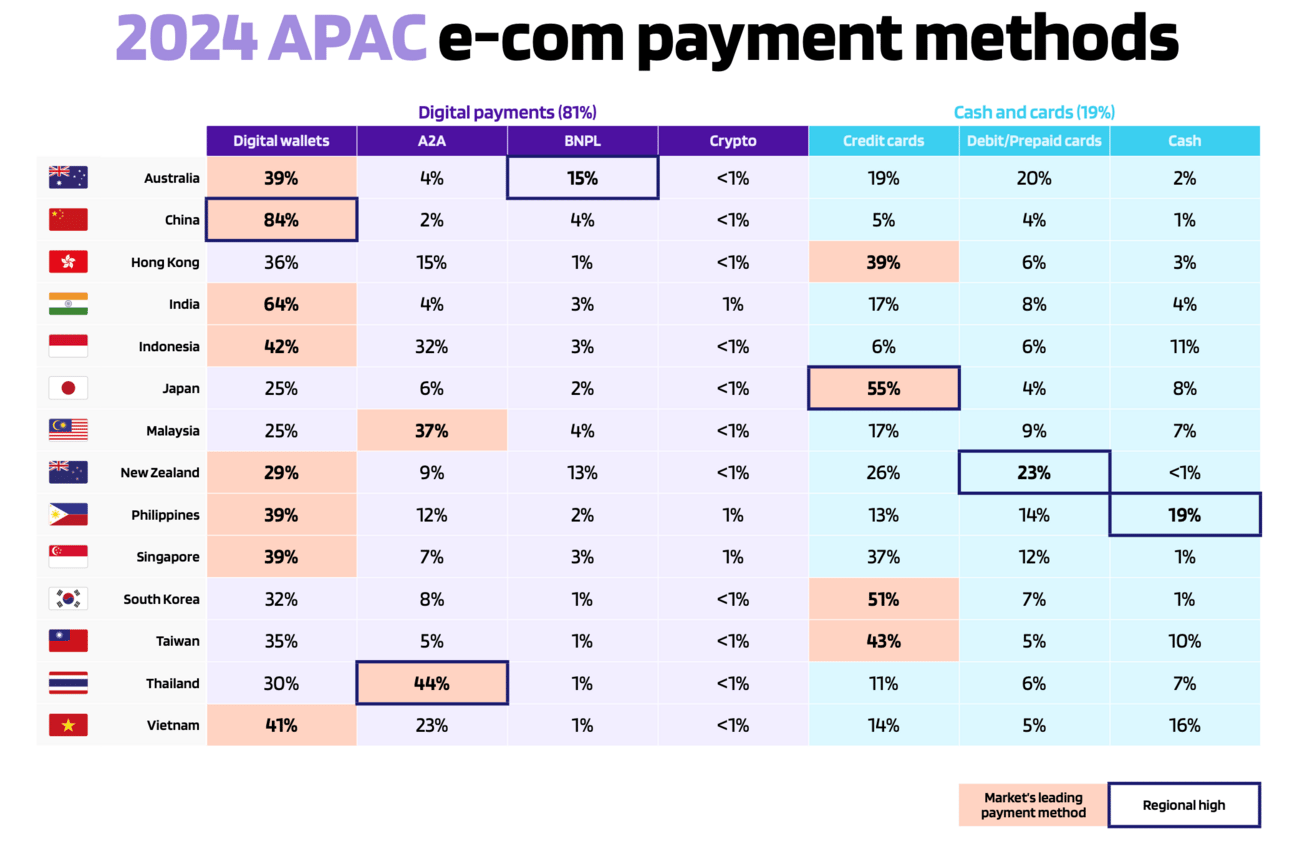

Image source: Worldpay Global Payments Report 2025

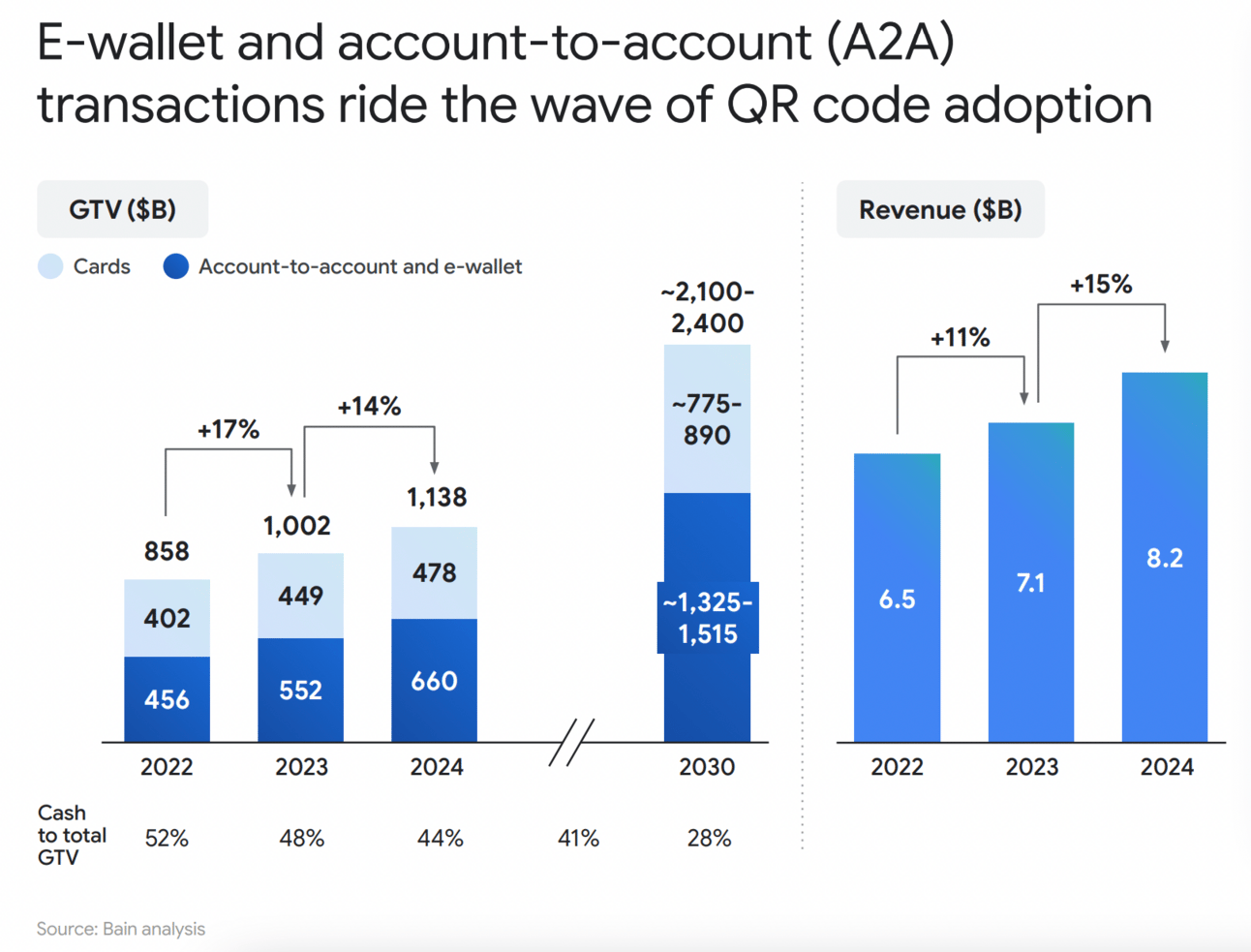

Cash still makes up around 40% of all payments in Southeast Asia, so there’s plenty of room for digital wallets to grow. According to Bain & Company, digital payments in the region grew 14% YoY in 2024, driven by more smartphones, better internet, and more people moving their spending online.

Image source: E-Conomy SEA 2024

For those of you who read my deep dive into Mercado Libre, this story will sound familiar. Mercado Pago, the company’s Fintech arm, also started as a wallet to enable e-commerce transactions.

Image source: Mercado Libre

However, lending presented a much bigger opportunity than payments. According to Bain & Company, digital lending in Southeast Asia generated $22 billion in revenue in 2024, almost three times more than payments, which brought in $8 billion.

Image source: E-Conomy SEA 2024

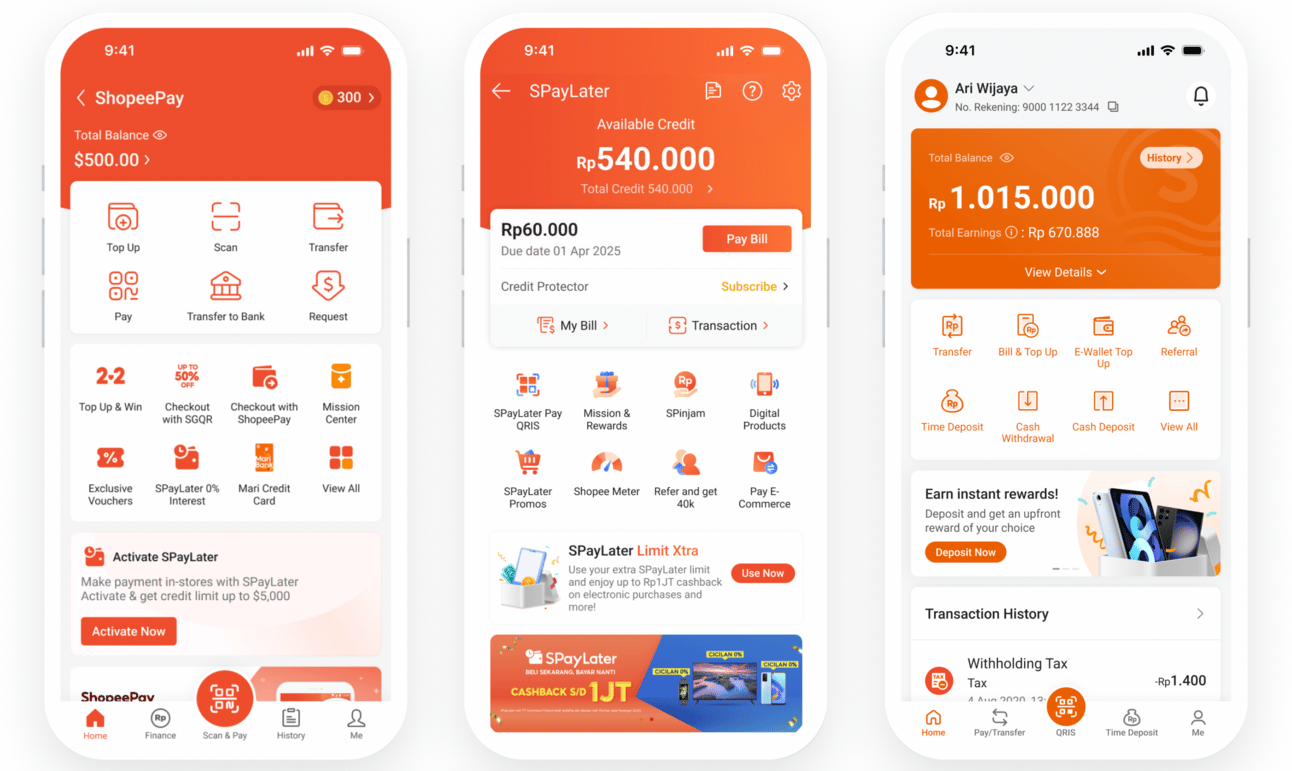

So around 2019-2020, Sea rebranded AirPay into ShopeePay and started expanding beyond payments under the SeaMoney brand. Over time, Sea added lending, insurance, and other financial services. What started as a way to top up game credits is now a full-fledged Fintech platform, serving both consumers and merchants within the Shopee ecosystem.

Image source: Monee

“Monee is already one of the largest unsecured consumer lending businesses in Southeast Asia, and I believe we are only at the start of realizing its full potential. We have expanded beyond Southeast Asia to Brazil and we are moving beyond payments and credit to every aspect of people’s lives relating to money, such as banking, investment and insurance.”

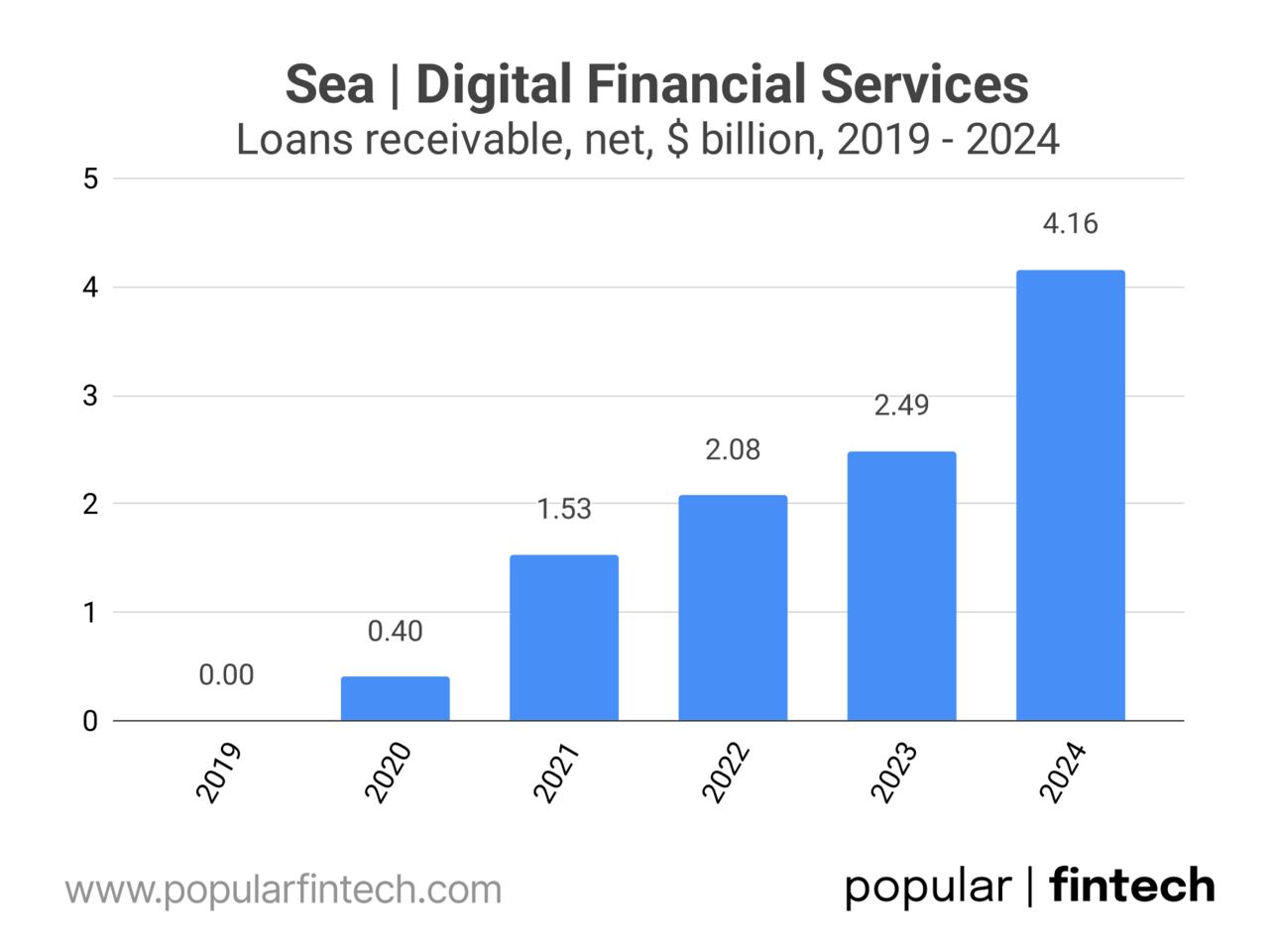

Sea’s lending business has scaled in a straight line since launch. The company had no loan book in 2019, but by the end of 2024, its total outstanding loans reached $4.16 billion. Most of that growth came from consumer lending within the Shopee ecosystem, where Sea can leverage its own data to underwrite risk and enforce repayment.

Data source: Sea

“On the buyer side, we offer consumption loans (SPayLater) which gives users the ability to complete their purchase first and make the payment later or in instalments, and cash loans which allows users to meet their short-term borrowing needs. The tenure of such loans is short, generally in the range of 3 to 12 months.”

Sea no longer discloses the size of its merchant loan book, but it appears the company has scaled down this part of the business. Early on, Monee offered working capital loans to Shopee sellers, but recent updates suggest the focus has shifted toward consumer lending.

Image source: E-Conomy SEA 2024

“In our Digital Financial Services business, there are a few main products that we have. The SPL, or Shopee PayLater, the BCL, or buy cash loans, and the off-line product …at this point in time, the SPL in terms of outstanding, is still the biggest product.”

Mercado Libre did a better job building a merchant lending business, but for both companies, the real driver is consumer lending. That’s where the demand is, and where they can grow faster and make more money. Whether it’s Mercado Pago or Monee, lending to buyers is what’s powering Fintech growth.

Data source: Mercado Libre

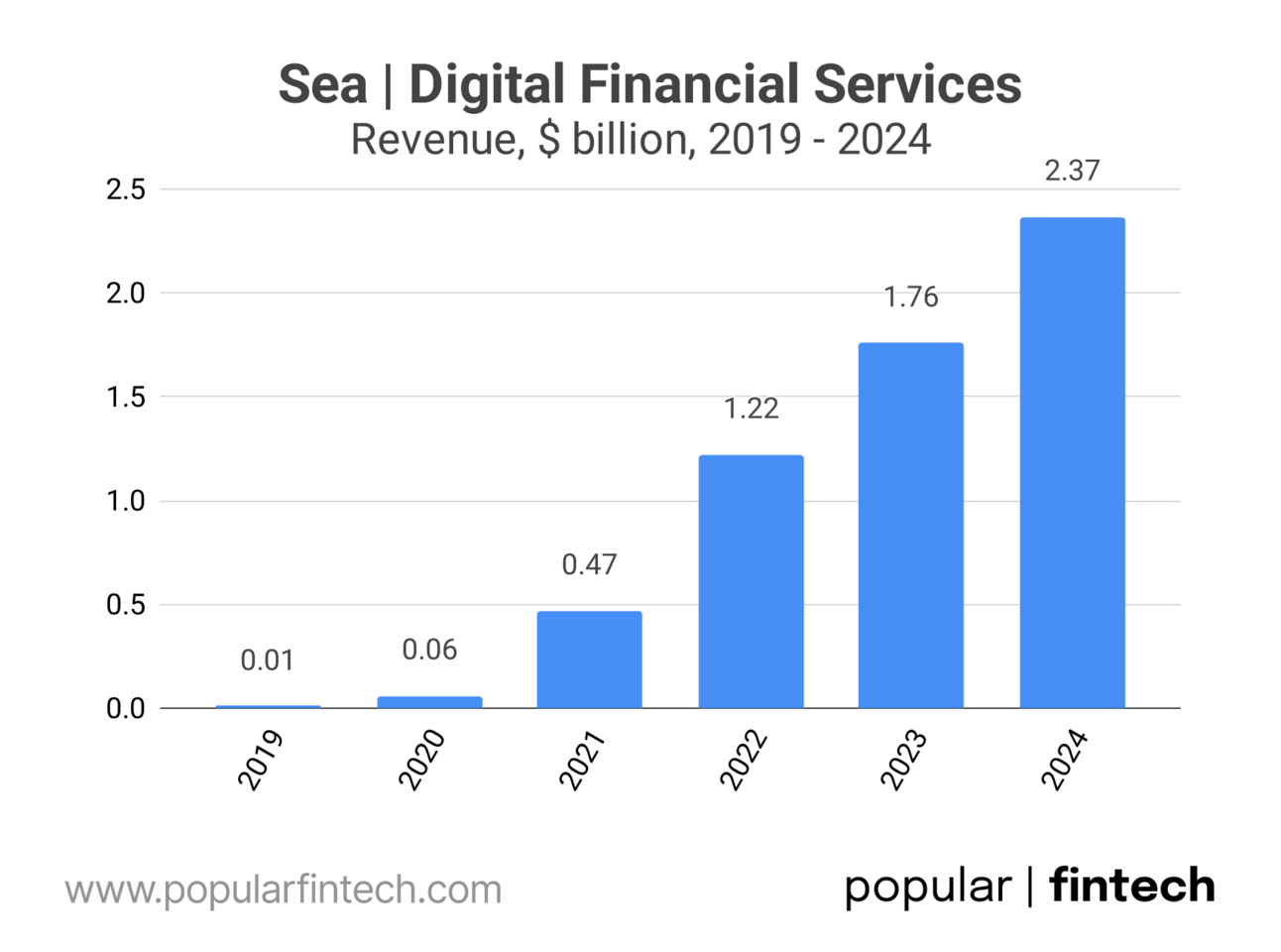

As a result, Sea’s Digital Financial Services revenue grew from almost nothing to a meaningful business in just a few years. In 2019, the segment brought in just $9.2 million. By 2024, that number had grown 257x to $2.4 billion, driven primarily by lending and the rising adoption of ShopeePay across its core markets.

Data source: Sea

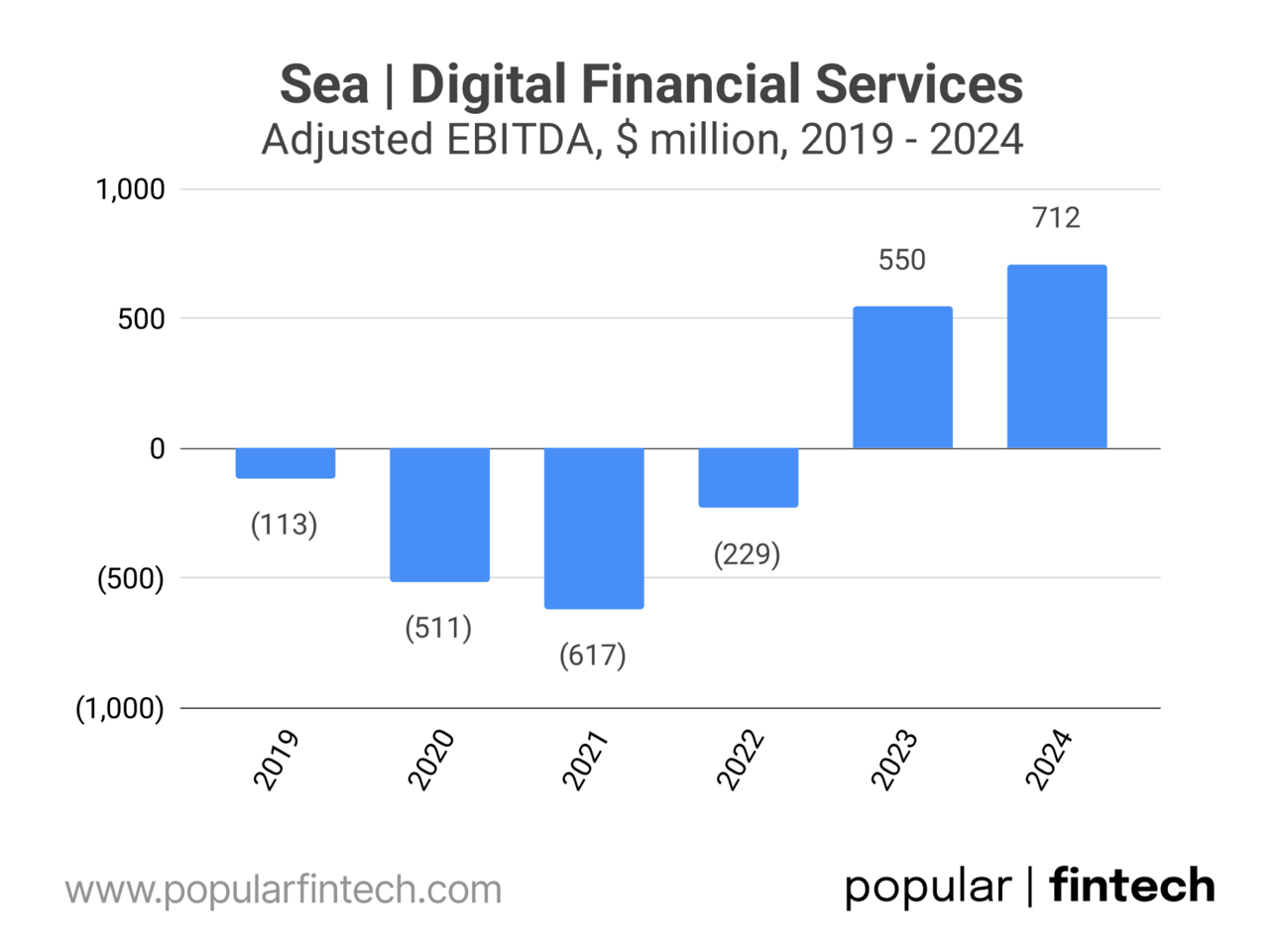

Sea’s Digital Financial Services segment didn’t just scale, it also turned profitable. In 2024, the business generated $712 million in adjusted EBITDA, a sharp turnaround from years of heavy investment and losses. With both lending and payments now contributing to the bottom line, Monee has become a key part of the company’s growth story.

Data source: Sea

“Moreover, Monee offers other digital financial services to its users through technology, such as payment processing in Southeast Asia and Brazil, banking services in Singapore, Indonesia and the Philippines.

We also offer insurance products through our SeaInsure business. SeaInsure acts as an underwriter for selective types of life and non-life insurance products in certain of our markets.”

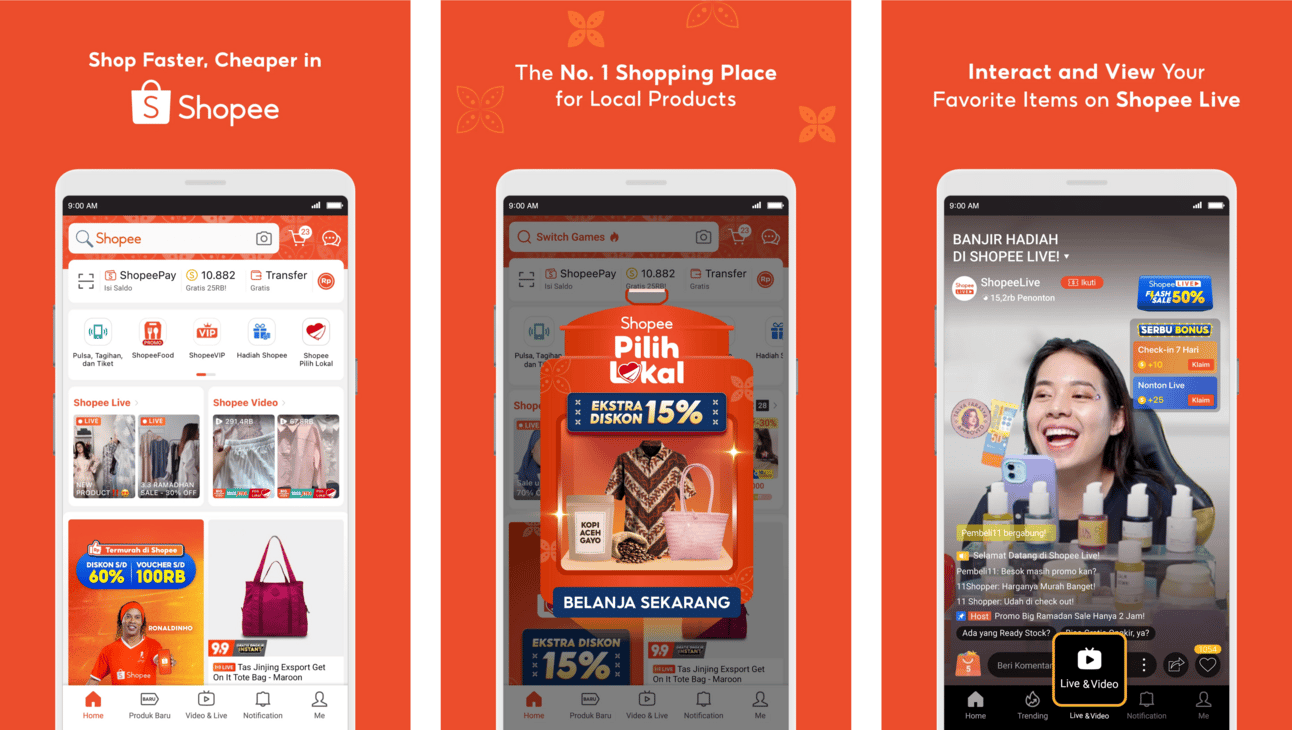

But this isn’t the whole story. Just a year after launching AirPay, Sea entered the e-commerce space with the launch of Shopee in 2015. What started as a mobile-first marketplace aimed at helping individuals sell to one another quickly evolved into one of the largest online commerce platforms in Southeast Asia and Taiwan.

Image source: Shopee

“We launched our e-commerce business, Shopee, in Southeast Asia and Taiwan in 2015. Since its inception, Shopee has adopted a mobile-first approach and is a highly scalable marketplace platform that connects buyers and sellers.”

Shopee faces strong competition across the region, including from Lazada (backed by Alibaba), Tokopedia, and TikTok Shop (TikTok owns 75% of Tokopedia). Despite this, Shopee has maintained a leadership position in most of its core markets, including Indonesia, Thailand, and the Philippines.

Image source: Momentum Works

“While we primarily operate as a marketplace, we also purchase some products from manufacturers or third parties directly and sell on our Shopee platform under our official store to meet buyers’ demand. Bulk purchasing and direct product sales for specific product categories also enable us to offer a more diversified product assortment to our buyers.”

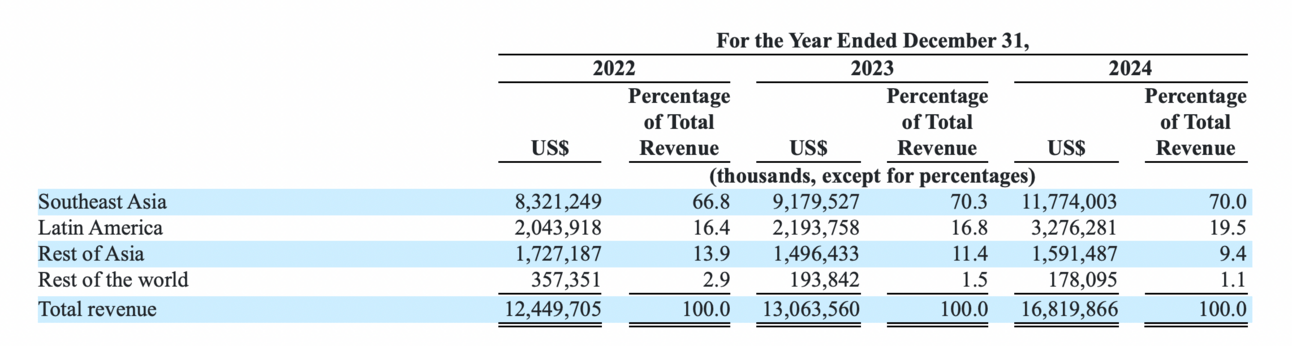

Shopee tried to expand beyond Southeast Asia, launching in Latin America (Brazil, Mexico, Argentina), Europe (Spain, France, Poland), and India between 2019 and 2021. But the company quickly ran into challenges and by late 2022, had shut down most of its operations outside Southeast Asia, exiting Europe and India entirely and scaling back in Latin America.

Today, Brazil is the only non-Asian market where Shopee still operates, and it's now one of the company’s largest markets in terms of revenue.

Image source: Sea Annual Report 2024

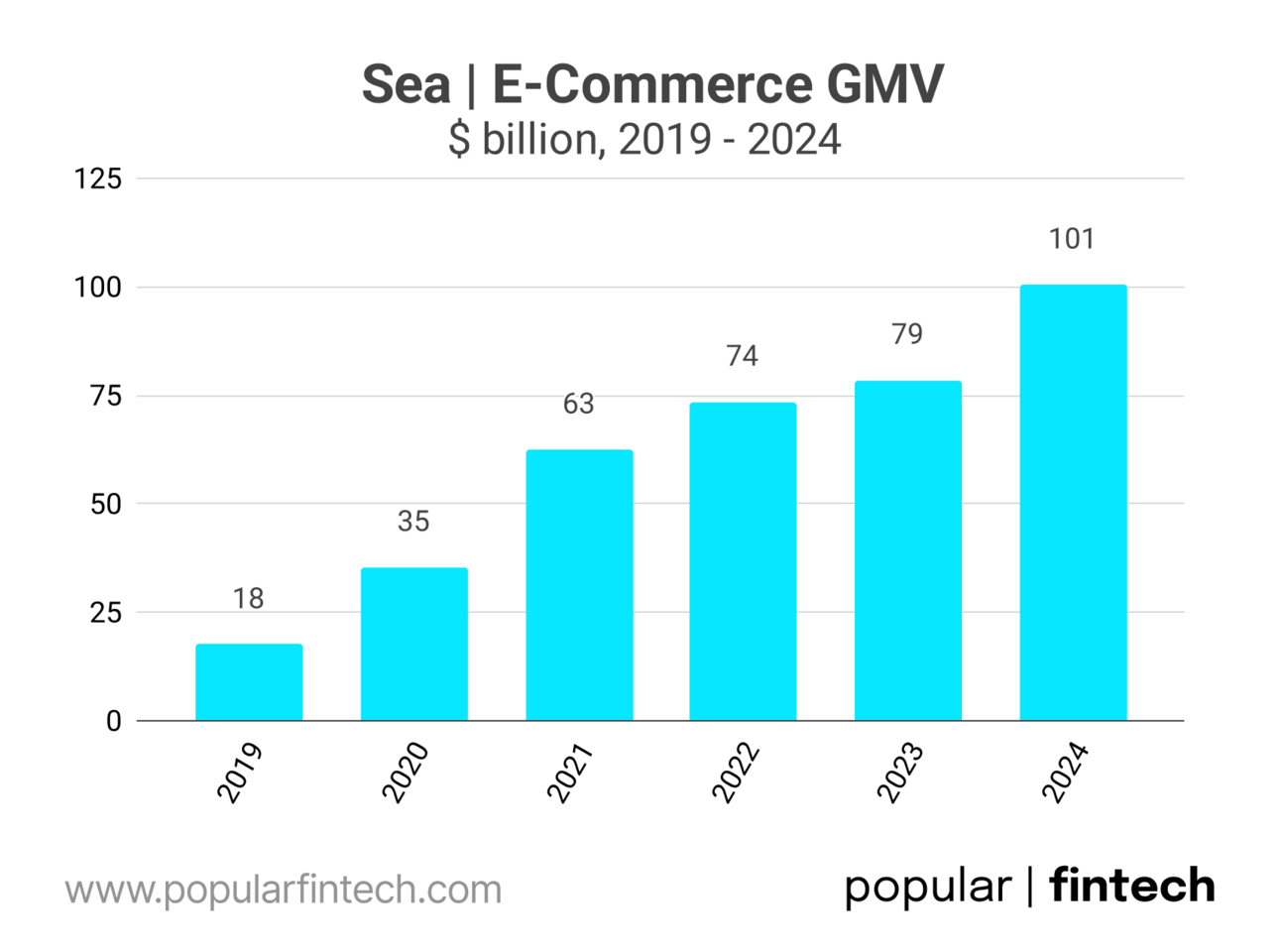

Shopee’s growth over the past five years has been impressive. Its gross merchandise volume grew from $18 billion in 2019 to $101 billion in 2024, more than 5x in five years.

Data source: Sea

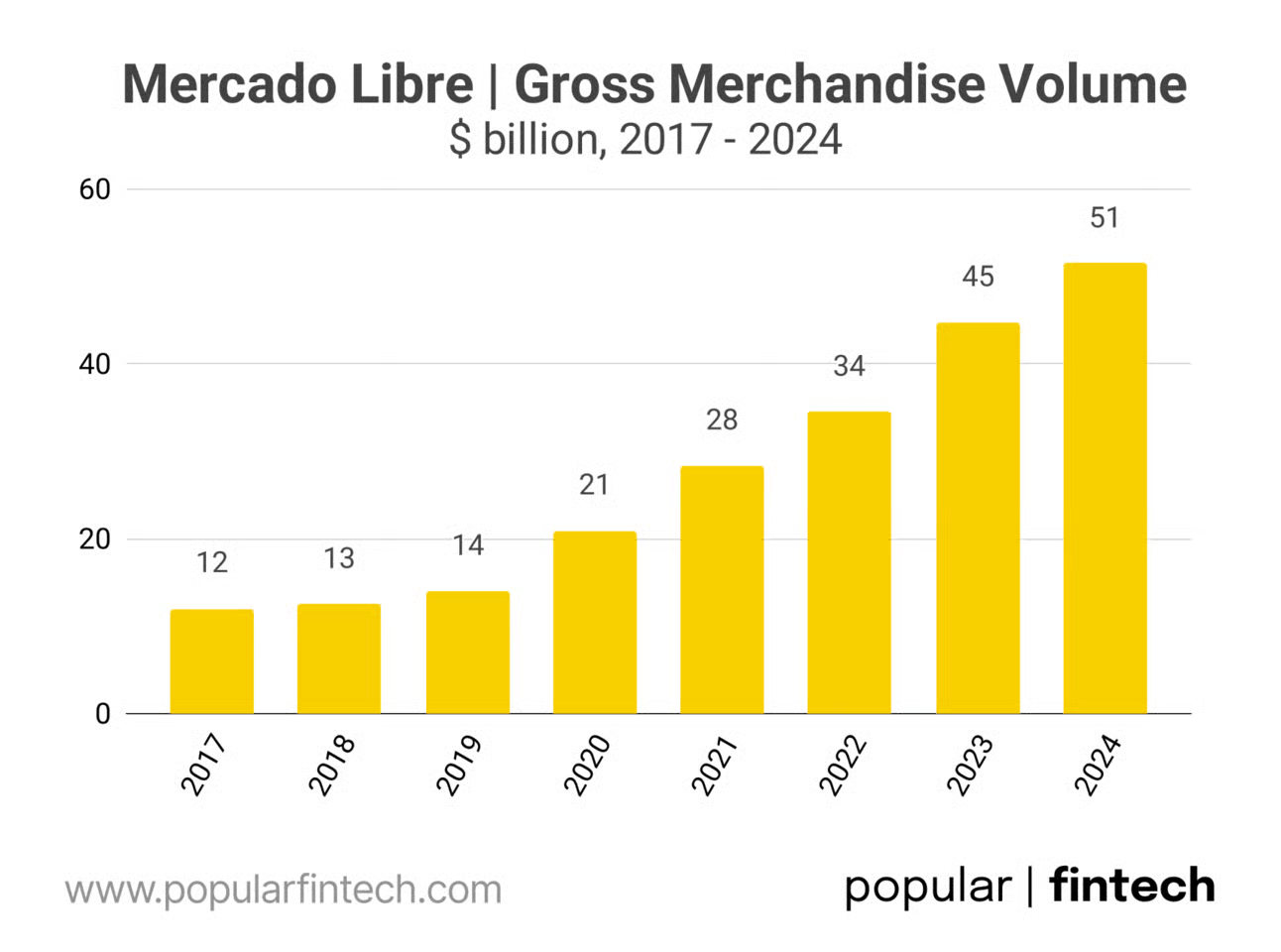

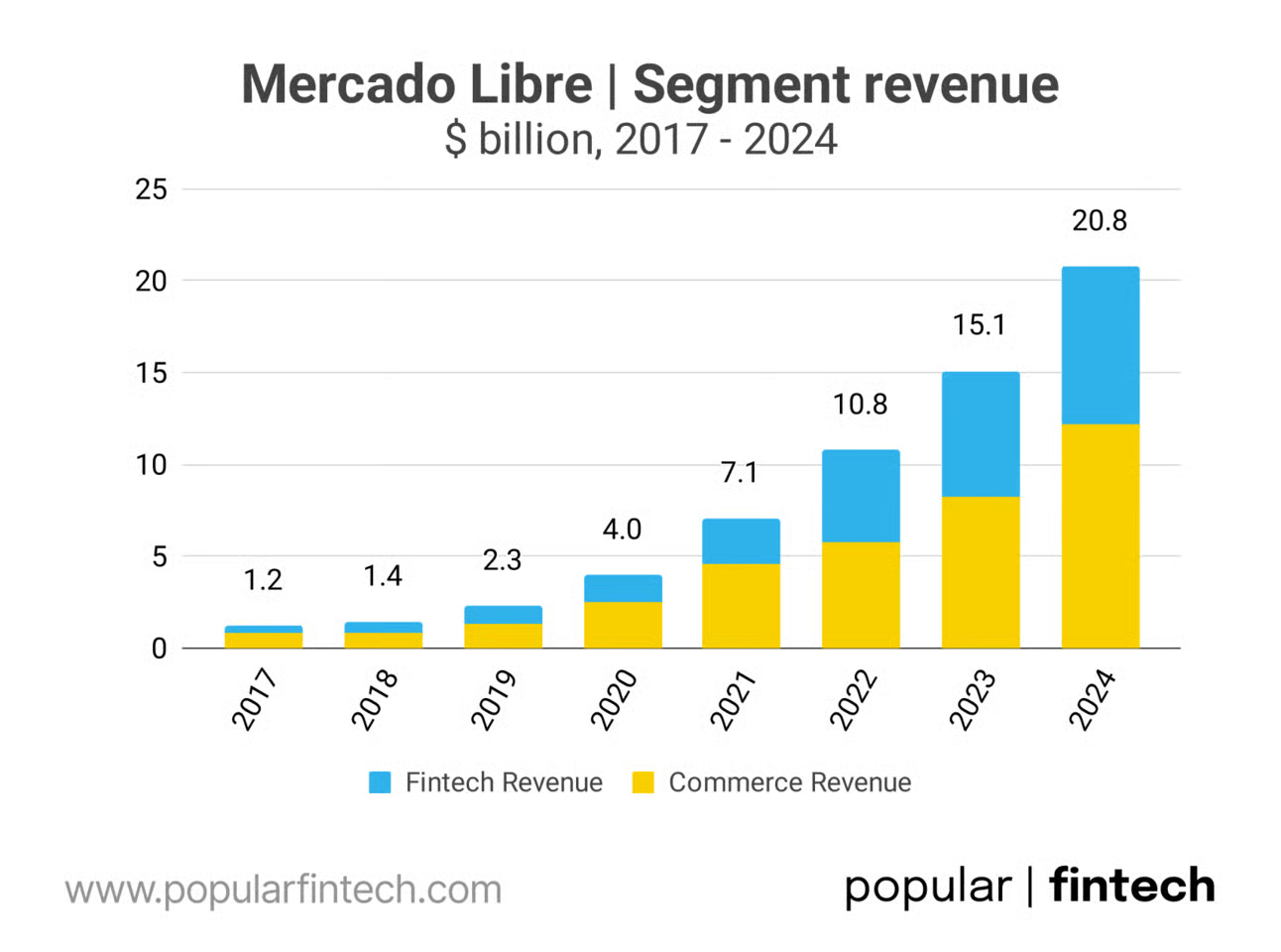

For comparison, Mercado Libre’s GMV grew from $14 billion to $51 billion over the same period. Despite pulling out of several international markets, Shopee has cemented its position as one of the largest e-commerce platforms in the world.

Data source: Mercado Libre

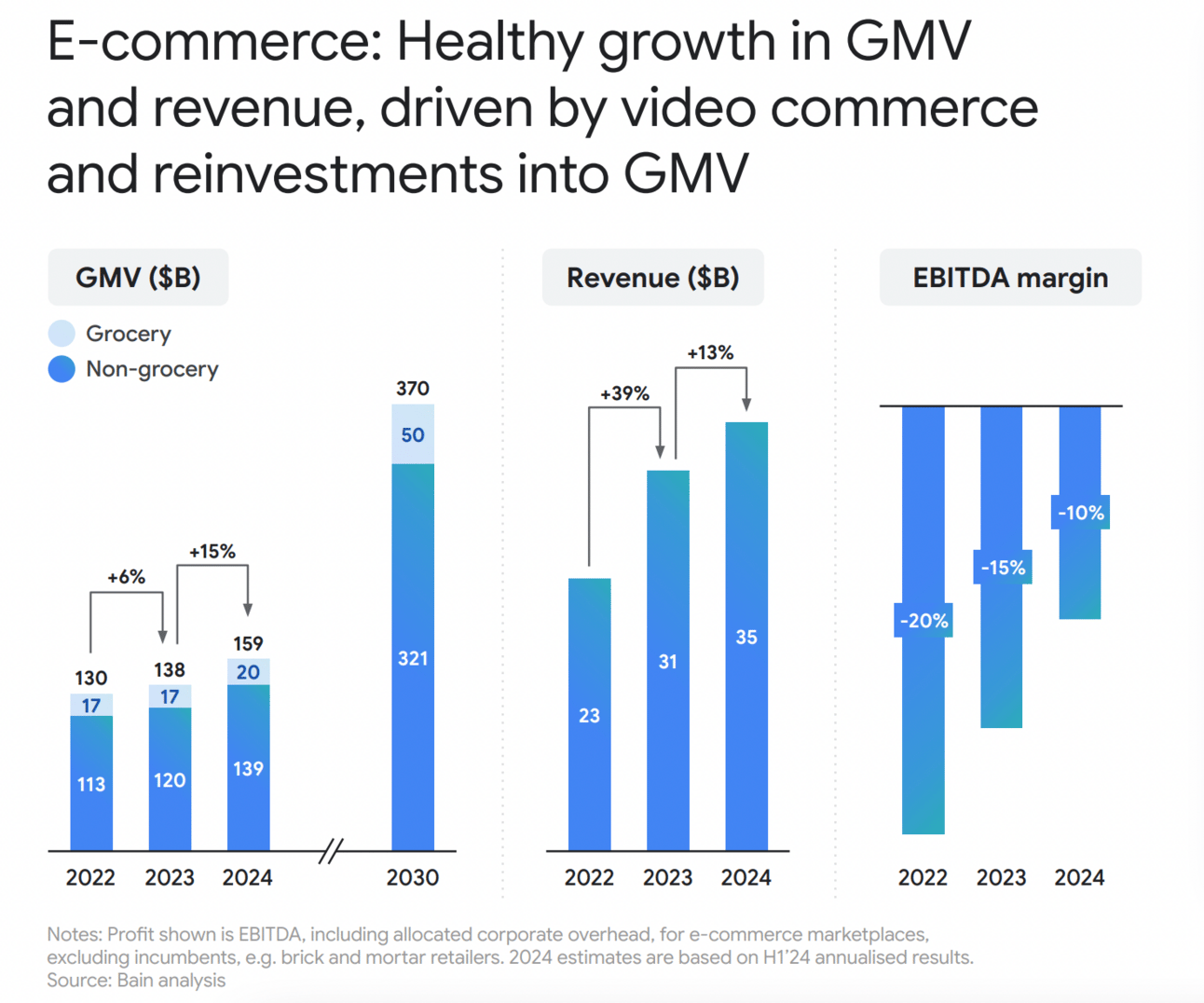

E-commerce in Southeast Asia is growing fast, but there’s still a lot more to come. In 2024, GMV reached $159 billion, and Bain & Company expects it to more than double to $370 billion by 2030. Most of that growth will come from non-grocery categories, driven by rising internet use, video commerce, and better logistics.

Image source: E-Conomy SEA 2024

“Currently, the average e-commerce penetration rate (excluding food and beverage) in Southeast Asia is 20 percent, which suggests a long growth runway before it matches China’s penetration rate of 47 percent.”

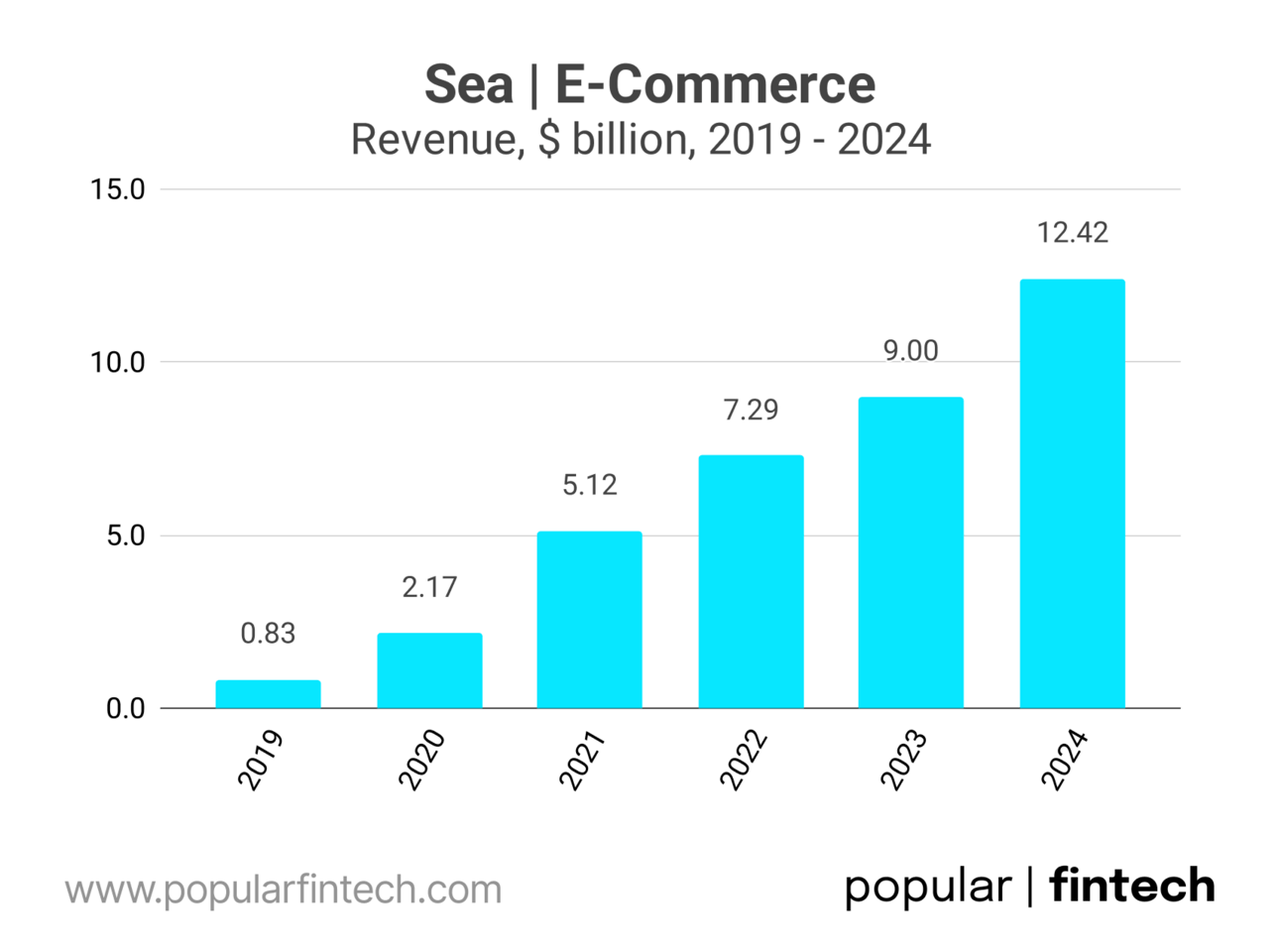

Shopee has gone from a fast-growing cash burner to a profitable e-commerce business in just a few years. In 2019, Shopee generated $0.8 billion in revenue. By 2024, that number had reached $12.4 billion, a 15x increase, driven by rising order volumes, improved monetization, and deeper market penetration across Southeast Asia and Brazil.

Data source: Sea

“Shopee is the largest e-commerce platform in Southeast Asia and Taiwan. It also has a significant presence in Latin America. We monetize Shopee mainly by offering sellers paid advertising services, charging transaction-based fees, and charging for certain value-added services, including logistics.”

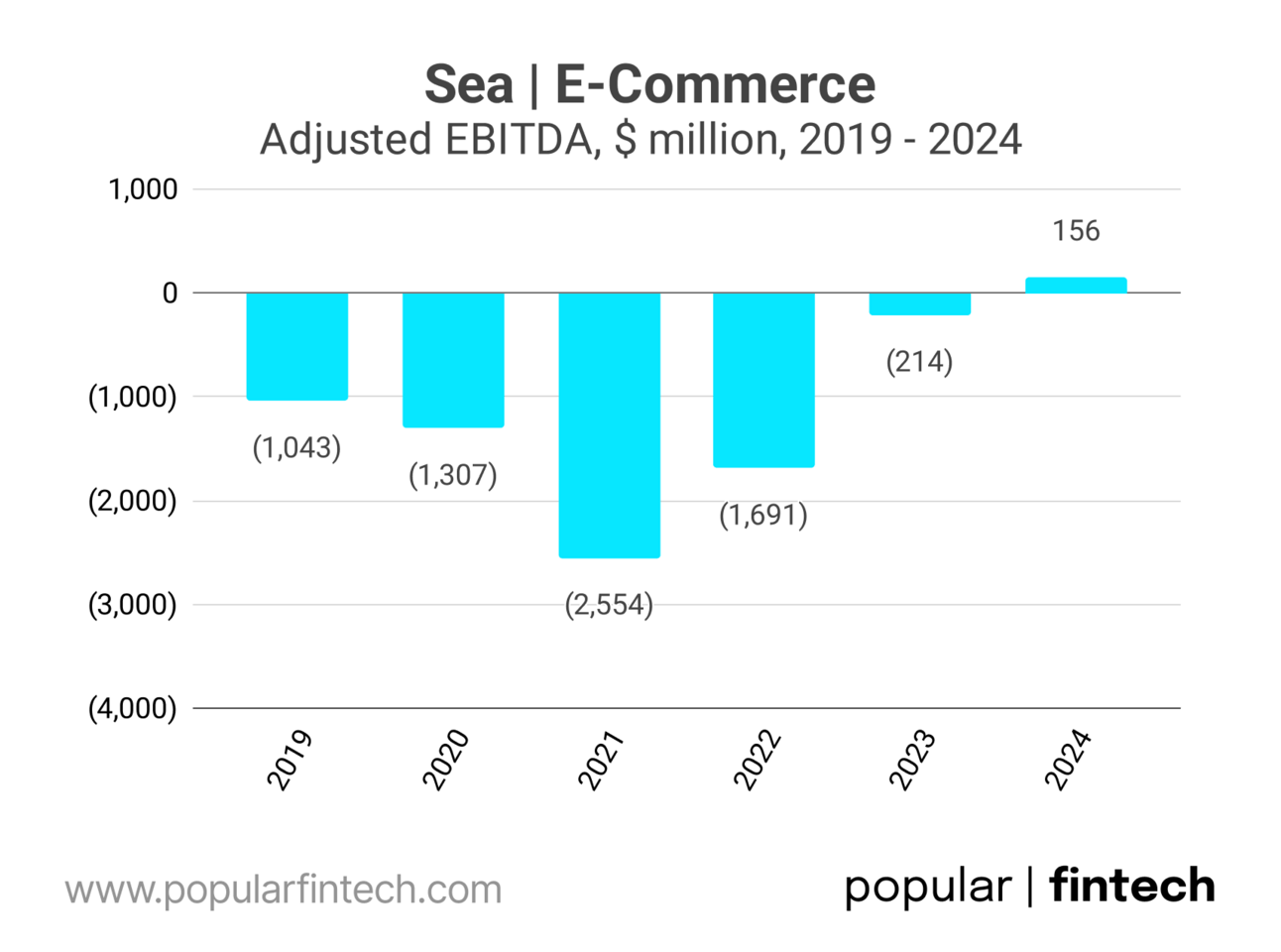

Even more importantly, Shopee turned a profit. After peaking at $2.5 billion in adjusted EBITDA losses in 2021, the platform posted a positive adjusted EBITDA of $156 million in 2024. That turnaround came from cost discipline, improved take rates, and pulling back from unprofitable international expansion.

Data source: Sea

Similar to Mercado Libre and Mercado Pago, Shopee and Sea’s financial services business have reinforced each other. Thus, Shopee gave Monee access to millions of users and a use case beyond gaming, paying at checkout. Shopee's growth helped Sea scale its wallet and later expand into lending, insurance, and other services. Shopee also generated a rich stream of transaction data, which Monee used to build credit models and underwrite loans with better risk controls.

In return, Monee helped Shopee grow by offering wallet payments and Buy Now Pay Later lending, which made it easier for users to shop. It improved checkout conversion, boosted average order value, and kept more of the customer journey within Sea’s ecosystem. Financial services became one more tool to drive engagement and monetization across the Shopee platform.

“Depending on the market, sellers and buyers can choose from a number of payment options to complete transactions on Shopee, including our own mobile wallet and consumption loan services, credit cards, bank transfers through ATM or over the internet, and cash payments upon delivery or at designated convenience stores.”

Going forward, the growth potential for Monee’s wallet isn’t limited to the Sea’s ecosystem. In markets like Indonesia, Vietnam, and the Philippines, cash still accounts for over a third of all point-of-sale transactions. Digital wallet usage is growing, but far from saturated, unlike in markets like China or India, and Sea is expanding ShopeePay’s presence in physical stores, transit, and bill payments.

Image source: Worldpay Global Payments Report 2025

“We have integrated the mobile wallet services of Monee with our Shopee platform across different markets, to promote efficient growth of Monee and to reduce payment friction for Shopee users. Moreover, we have use cases of our mobile wallet services outside of Sea’s platforms, including other online and offline merchants, along with a variety of third-party use cases.”

By 2024, Sea looked nothing like the gaming company it started as. That year, e-commerce brought in $12.4 billion, making up 74% of total revenue. Digital financial services added another $2.4 billion, or 14%. Gaming, once the core of the business, accounted for just 11% of revenue. Sea has clearly become a commerce and Fintech company, with Garena now playing a supporting role.

Data source: Sea

Sea used profits from its gaming business to build Shopee and Monee. Between 2019 and 2023, Garena generated over $8 billion in adjusted EBITDA, while e-commerce and Fintech burned through nearly the same amount. But the bet worked. By 2024, Shopee turned profitable with $156 million in adjusted EBITDA, and Monee reached $712 million. Gaming paid the bills, until the others could stand on their own.

Data source: Sea

Unlike Sea, Mercado Libre didn’t have a gaming business to fund its expansion. It had to grow using the profits from its own commerce and Fintech operations. As a result, Fintech plays a much bigger role in Mercado Libre’s business today, contributing 41% of total revenue in 2024, compared to just 14% for Sea.

Southeast Asia’s digital economy still has plenty of room to grow. Most people are already online, but only about half shop digitally, and those who do are just getting started. As spending increases and new services take off, platforms like Shopee and Monee are well-positioned to benefit.

Image source: E-Conomy SEA 2024

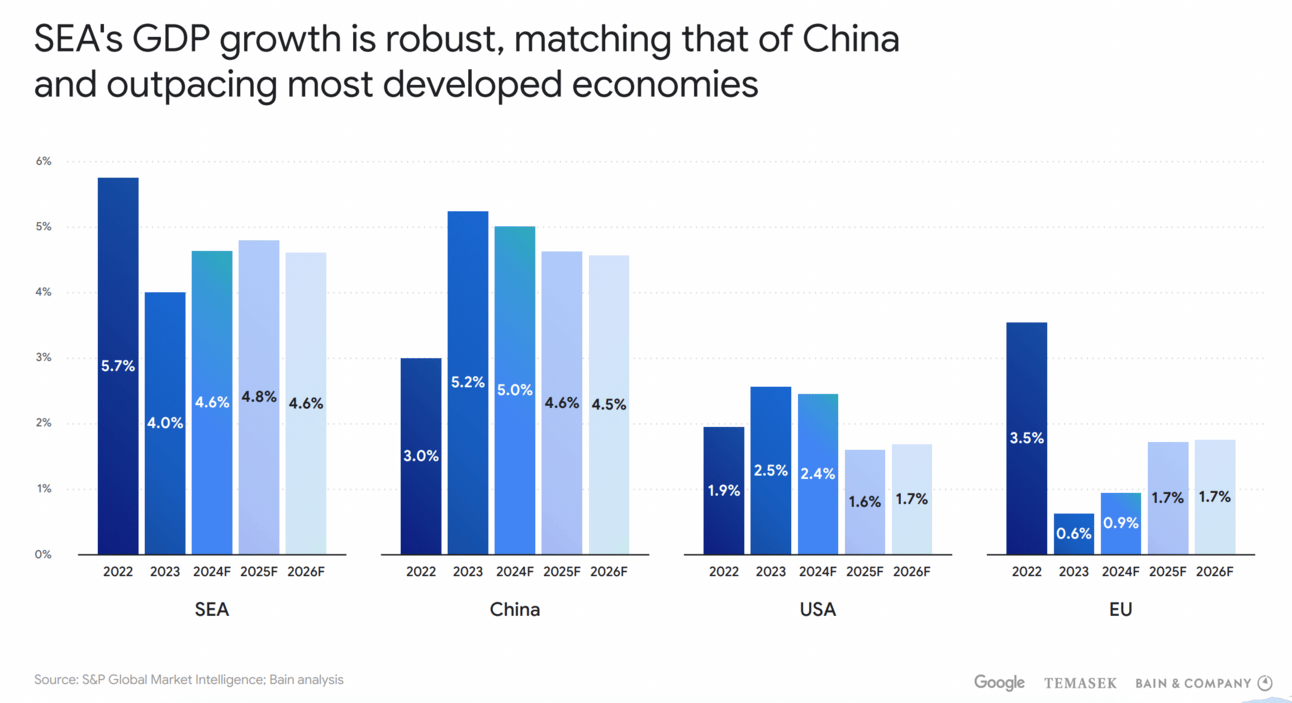

Southeast Asia isn’t just growing digitally, it’s growing economically. The region’s GDP is expected to expand at around 4.6–4.8% annually through 2026, outpacing both the U.S. and Europe by a wide margin. That macro tailwind adds another layer to Sea’s long-term opportunity, as rising incomes and consumption will continue to drive demand for e-commerce and financial services.

Image source: E-Conomy SEA 2024

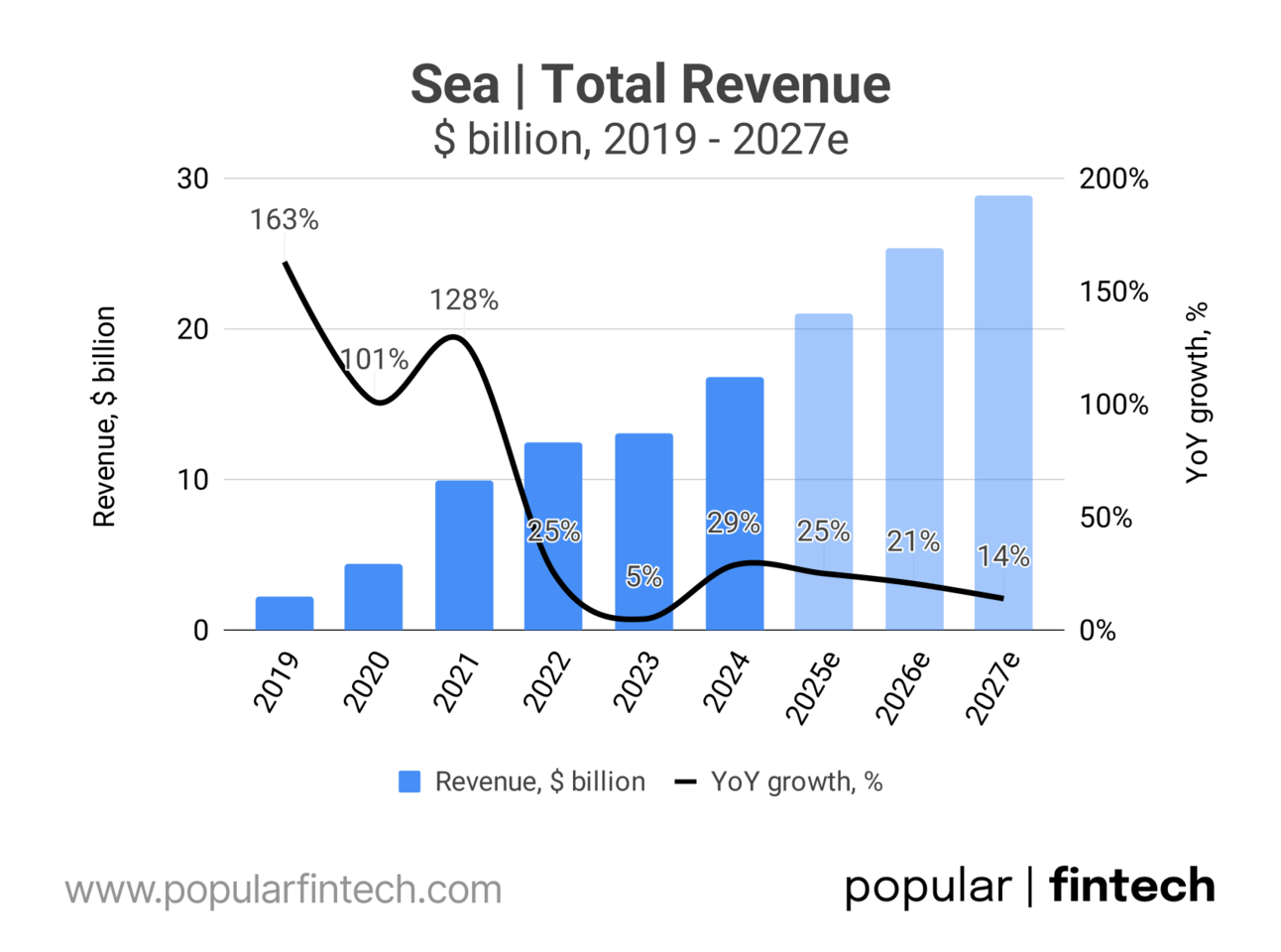

Surprisingly, Wall Street analysts expect Sea’s revenue growth to decelerate to just 14% by 2027. That’s a sharp deceleration from the triple-digit growth seen during the pandemic years, and even below the 21-25% range projected for 2025–2026.

Data source: Sea, Koyfin

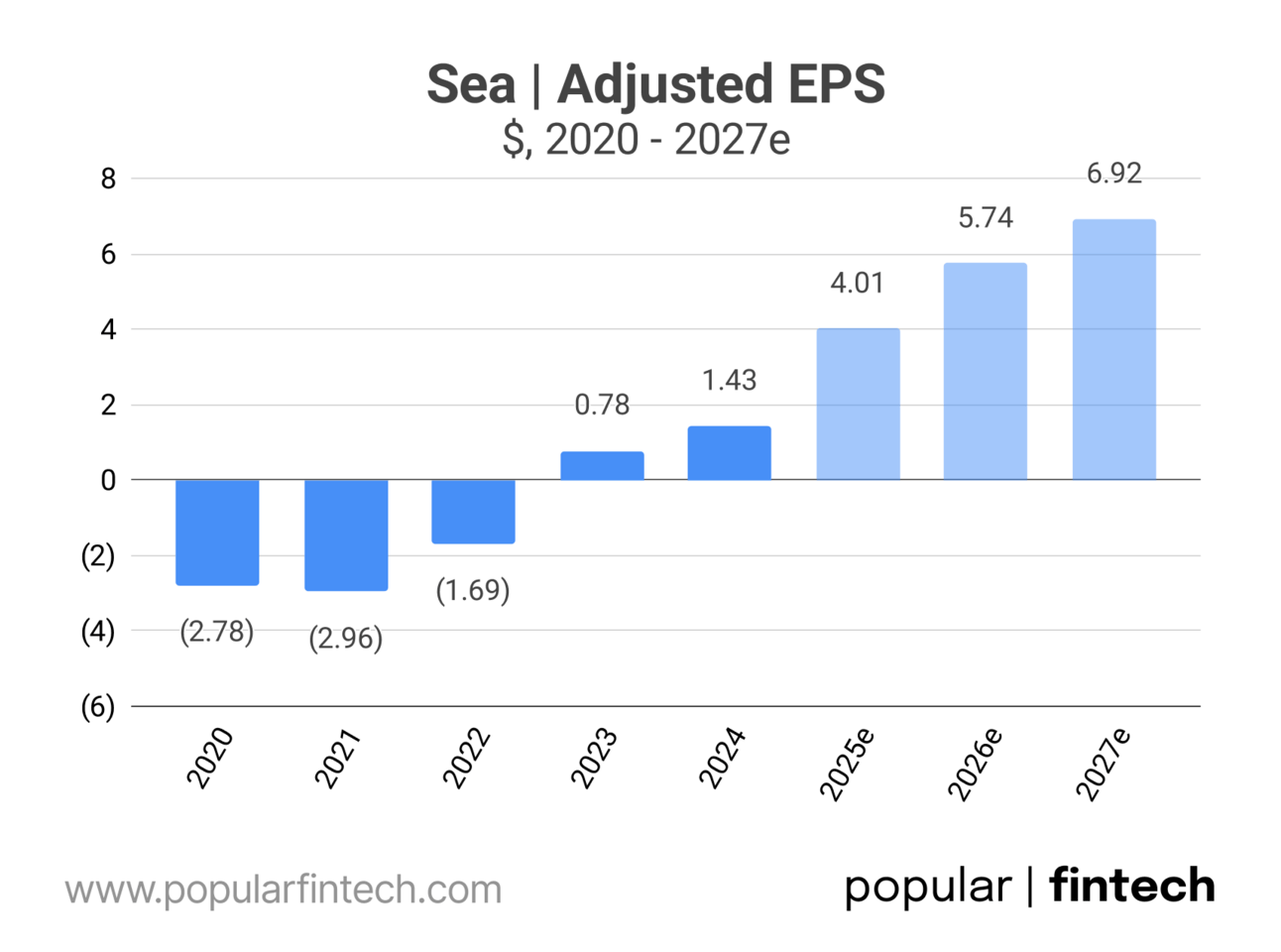

However, while revenue growth is expected to slow, earnings are set to take off. Sea’s adjusted EPS is projected to grow 5x between 2024 and 2027, from $1.43 in 2024 to $6.92 by 2027. That surge reflects a new phase for the company, with all three of its core businesses, e-commerce, Fintech, and gaming, now profitable and contributing to the bottom line.

Data source: Sea, Koyfin

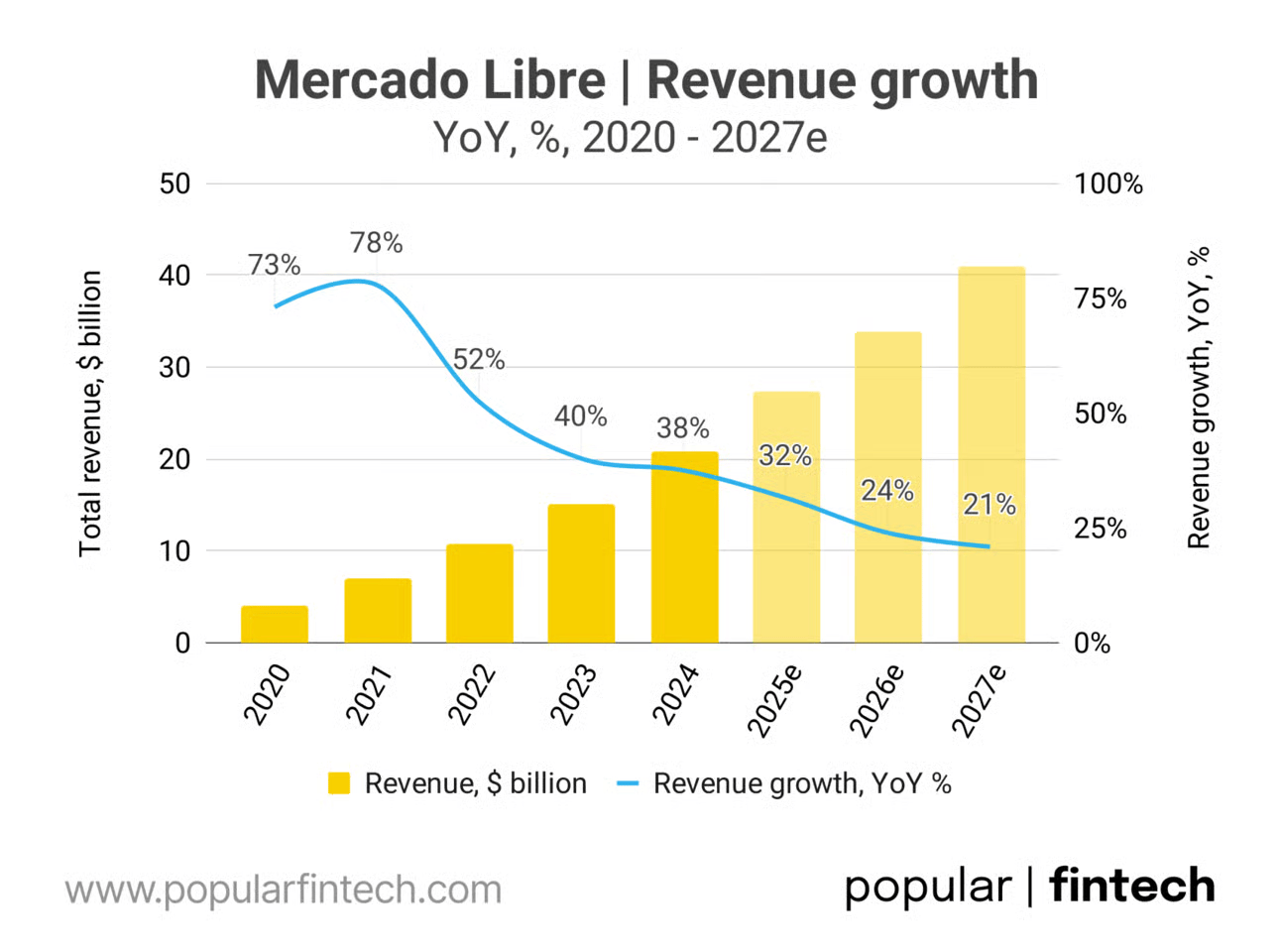

It’s a similar story to Mercado Libre. As the business gets bigger, growth is expected to slow. But both companies are getting more efficient, and that’s driving strong profits after years of heavy investment

Data source: Mercado Libre, Koyfin

Data source: Mercado Libre, Koyfin

There are a lot of similarities between Mercado Libre and Sea. Both used low card and banking penetration in their regions to launch wallets, and later expanded into lending and beyond. Mercado Libre is further ahead, as it has already built a strong merchant lending business and a growing acquiring operation….

…but both companies are building real Fintech ecosystems on top of large commerce platforms, and both remain exciting businesses with plenty of room to grow.

If you want to learn more about Sea check GabGrowth newsletter

Cover image source: Sea

Disclaimer: The views expressed here are my own and do not represent the views of my employer. The information contained in this newsletter is intended for educational and informational purposes only and should not be considered financial advice. You should do your own research or seek professional advice before making any investment decisions. Read the full disclaimer here.