Hey!

Business rivalries are always fascinating and insightful. Think of Microsoft and Apple rivalry in the 1980s and 90s, or Google’s battle with Apple in mobile in the 2010s, or, more recently, Nvidia outcompeting Intel in the AI chips race. These rivalries share one key outcome: they drive innovation, benefiting both consumers and businesses.

There are exciting rivalries in the Fintech industry too. Visa and Mastercard is an obvious one, but there are more. So today I decided to write about five fintech rivalries that I believe are worth watching in 2025. Each of these rivalries has a “plot twist” coming up in 2025, which might completely change the narrative and eventual outcome.

In the meantime, thank you for reading Popular Fintech in 2024, and wishing you an amazing year ahead!

Jevgenijs

p.s. if you have feedback just reply to this email or ping me on X/Twitter

Square vs. Clover

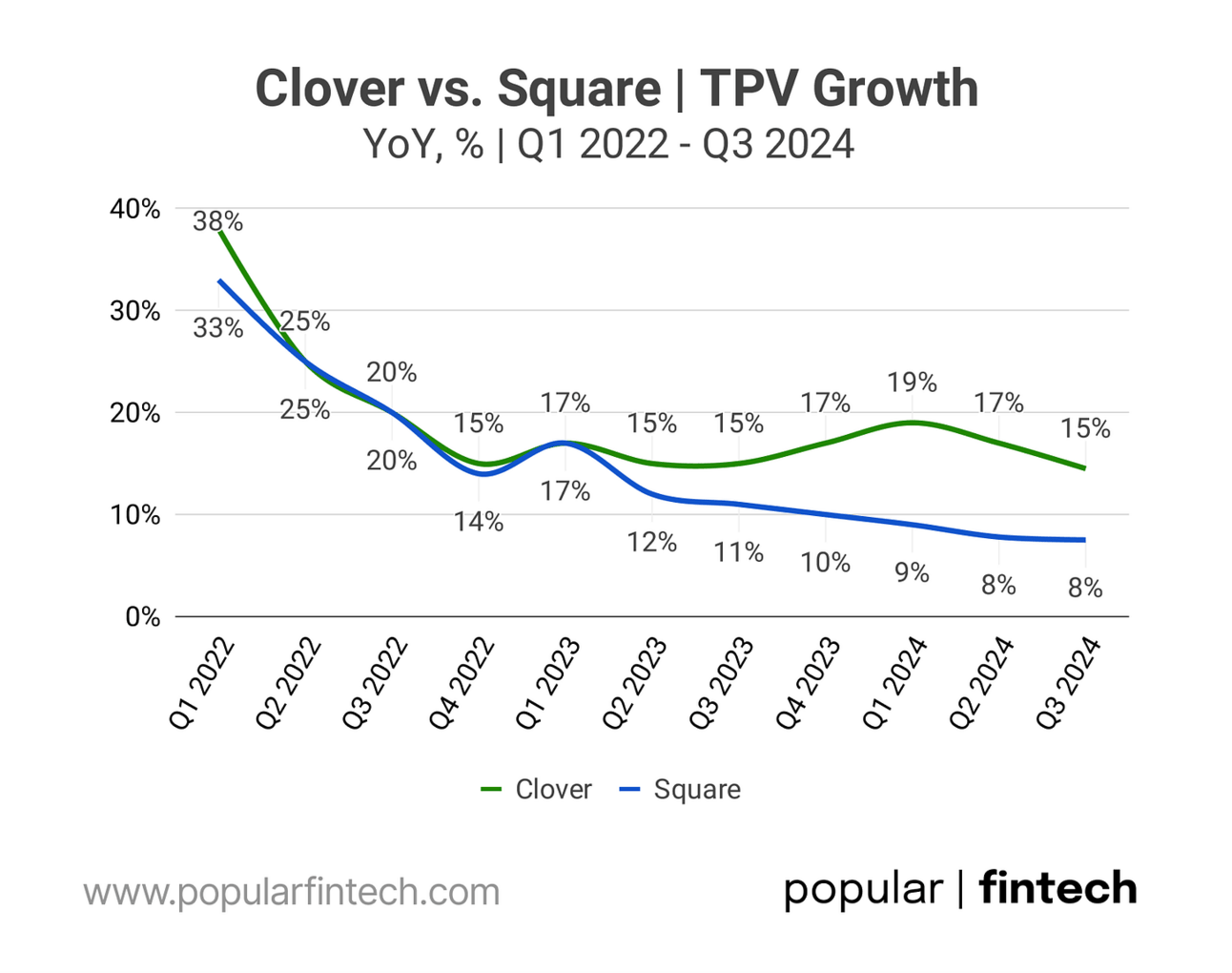

Fiserv has had an excellent year, with the company’s stock up 56% YTD, largely driven by the success of Clover. In Q3 2024, Clover’s payment volume increased 15% YoY, while revenue increased 28% YoY. Back in 2023, during the company’s Investor Day, Fiserv guided for $4.5 billion in Clover’s revenue in 2026 (representing a 28.5% CAGR), and so far they have been successfully using their distribution power to deliver on this promise.

Things at Block’s Square are not so great. In Q3 2024, both payment volume and revenue growth decelerated to 8% YoY. Jack Dorsey took over leadership of Square over a year ago and undertook a number of major infrastructure projects, including uniting Square’s mobile properties into a single application and developing a new platform for merchants. The ambition behind these initiatives was to increase the stability of the system and the speed of development.

We're also rolling out our single app experience to new sellers now and expect to launch that more broadly in 2025. We've seen tangible momentum in partnerships and early signs of success in sales. We grew our Square brand and performance marketing investments and began ramping sales hiring, including field sales. We will be scaling these and other go-to-market efforts more meaningfully into next year.

Amrita Ahuja, Block Q3 2024 earnings call

With the infrastructure project mostly complete, Square is refocusing its efforts on sales. In Q3 2024, the company already increased its marketing budget by 20% YoY, and plans further increase in 2025. Jack Dorsey also reorganized the company and assigned the task of building sales to Nick Molnar, the founder of Afterpay. Will Dorsey and Molnar be able to turn things around? We’ll see in 2025.

Fiserv (NYSE: FI) stock price: $207.95* (+56% YTD)

Block (NYSE: SQ) stock price: $88.97* (+15% YTD)

* as of December 27, 2024

Affirm vs. Klarna

In November, Klarna, one of the leading BNPL lenders globally, confidentially filed IPO documents with the SEC (despite having a European origin, Klarna decided to list in the U.S.). The rivalry between Affirm and Klarna is not new. Thus, the U.S., Affirm’s home market, is the fastest-growing geography for Klarna, so they have been competing head-to-head for some time. However, this rivalry will get more of the spotlight as Klarna becomes a publicly traded company.

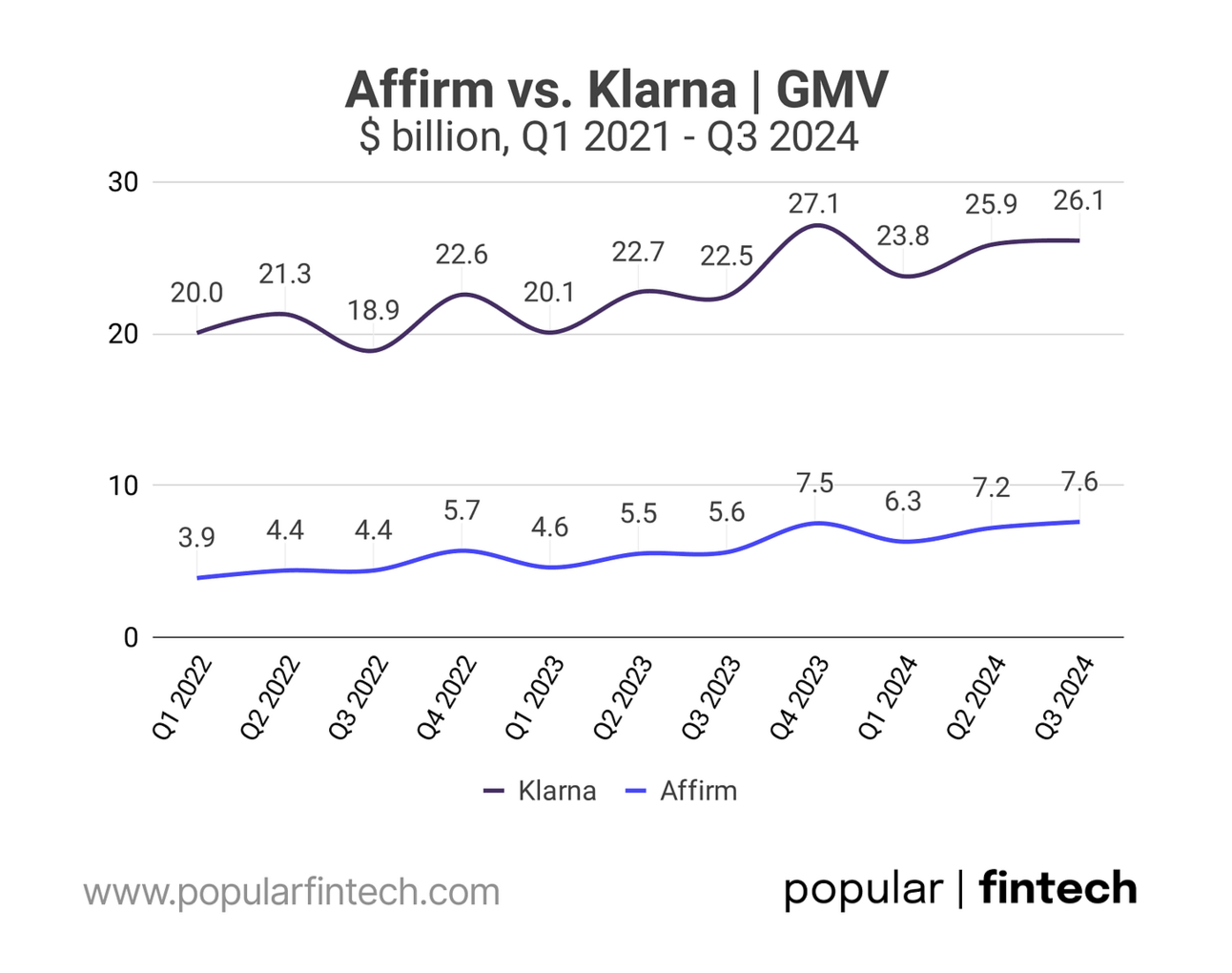

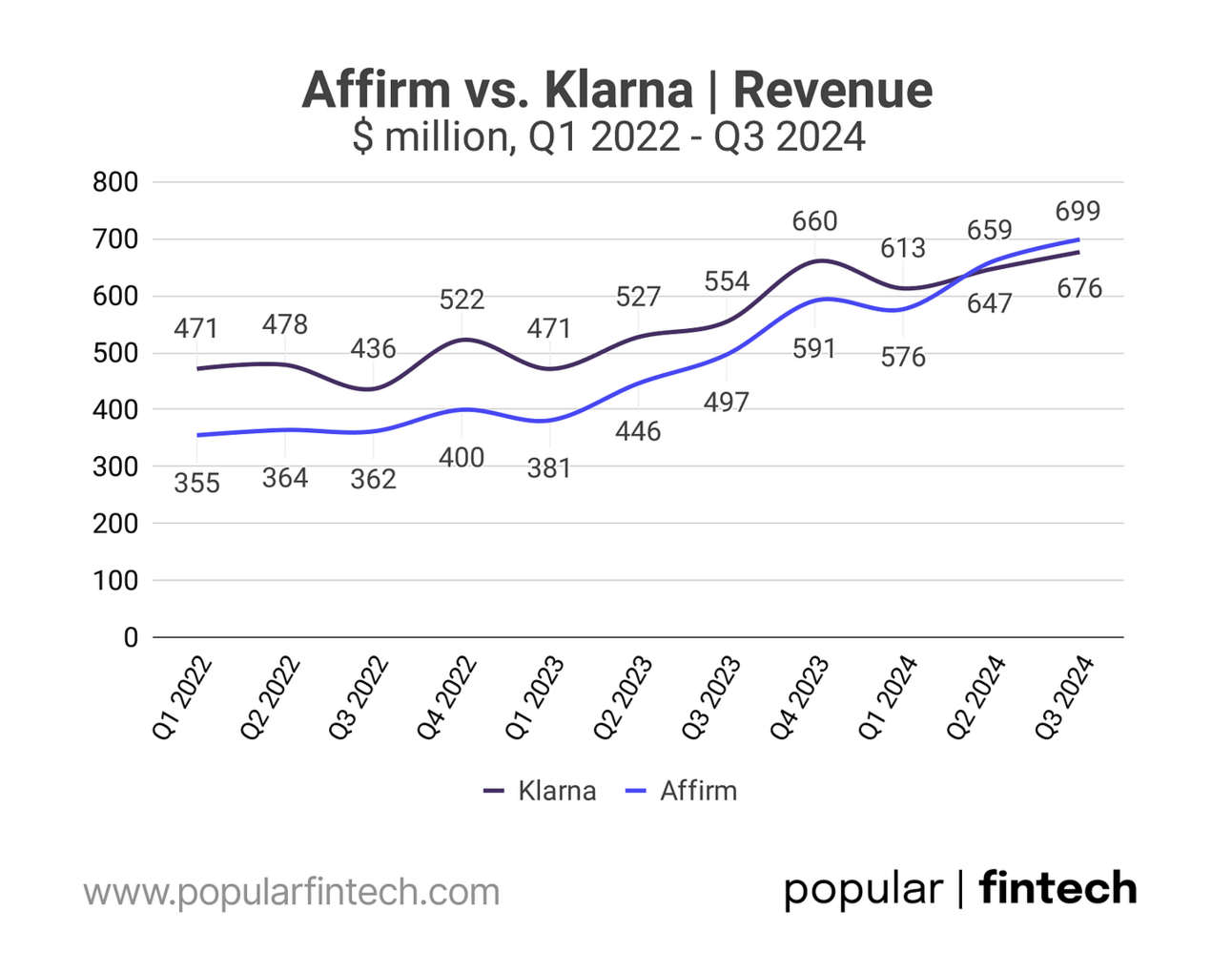

Klarna dwarfs Affirm (and Afterpay) in terms of Gross Merchandise Volume (see the chart above); however, Affirm commands a higher take rate, and in Q2 2024, overtook Klarna in terms of revenue. The key difference between the two is Affirm's ability to originate longer-duration, higher-amount, interest-bearing loans. Thus, in Q3 2024, only 14% of Affirm’s GMV came from “Pay in 4” loans (typically 0% APR loans funded by merchants), while for Klarna, this is the key offering.

The battle has been brought to us in the U.S., we held off the onslaught better than I think anybody expected and continue to do so. We're bringing the battle to them in Europe in the U.K., not the other way around.

Max Levchin, Affirm Fiscal Q1 2025 earnings call

Klarna got lots of media attention in 2024 for its use of AI. Through the use of AI, the company claims to have stopped hiring, and even terminated its agreements with Salesforce and Workday. In the meantime, Affirm finally started scaling its Affirm Card and even expanded to the UK, bringing the competition to Klarna’s turf. Will Affirm succeed in Europe? Or will Klarna be able to defend its market dominance? That will be something to closely watch in 2025.

Affirm (NASDAQ: AFRM) stock price: $64.64* (+31% YTD)

* as of December 27, 2024

Coinbase vs. Robinhood

The crypto industry is expected to have an exciting year ahead, as the new administration takes office. It will, hopefully, mark the end of lawsuits, enforcement actions, and consent orders. Not surprisingly, Robinhood is doubling down on its crypto business. During the company’s Investor Day, Vlad Tenev, Robinhood co-founder and CEO, highlighted that Robinhood is already one of the leading crypto marketplaces in the U.S., successfully competing with Coinbase.

In 2024, Robinhood launched Robinhood Crypto in the EU; thus, expanding the competition with Coinbase to Europe. It also agreed to acquire crypto exchange Bitstamp, giving it more flexibility to list new tokens, and even partnered with other Fintech companies to launch a new stablecoin, USDG. The company already offers staking service in Europe, and floated the ambition to bring this service to the United States, once there is regulatory clarity.

Robinhood has quietly, I'd say, become a major player in retail crypto trading, already doing over half of Coinbase's volume with less than 10% of the number of coins they list and operating exclusively in the U.S. until this year.

Vlad Tenev, Robinhood Investor Day 2024

Robinhood has 24.4 million customers, of which almost half hold crypto in their accounts, and isn’t afraid of making bold statements that trading crypto on Robinhood is much cheaper than on Coinbase. However, Coinbase is years ahead in terms of the scale in the US and in Europe, as well as in terms of its institutional capabilities. Coinbase also is successfully diversifying its revenue away form trading fees, and scaling its L2 chain, Base. Can Robinhood catch up?

Robinhood (NASDAQ: HOOD) stock price : $39.02* (+206% YTD)

Coinbase (NASDAQ: COIN) stock price: $265.71* (+52% YTD)

* as of December 27, 2024

Cash App vs. Venmo

PayPal’s new leadership is pivoting the company to “profitable growth”, which is hurting growth. In Q3 2024, Braintree's payment volume grew by 11% YoY, a slowdown compared to 32% YoY growth in the same quarter last year. Similarly, the company’s international volume growth slowed to 8% YoY, down from 19% YoY in the previous year. PayPal needs to find growth somewhere, and they will attempt to monetize Venmo by borrowing Cash App’s blueprint.

Cash App and Venmo are similar in their scale. In Q3 2024, Cash App had 57 million monthly active users and $70 billion in inflows. Venmo has around 60 million monthly active users and, as the payment volume suggests, similar inflows to Cash App. Cash App is far more effective at monetizing its customer base compared to Venmo, with the Cash App Card being a key driver of success. While 42% of Cash App users (24 million customers) also use the Cash App Card, only 5% of Venmo's active users use the Venmo debit card. Can Venmo replicate Cash App Card’s success?

With Venmo, we're making progress in executing our strategy to shift from solely a P2P service to a central part of consumers' financial lives. We know that we inherited one of the strongest P2P brands and see an opportunity to prioritize innovations that unlock Venmo's value. We believe that Venmo will eventually have multiple monetization levers.

Alex Chriss, PayPal Q3 2024 Earnings Call

Another area of competition will be between Cash App Pay and Pay with Venmo. PayPal seems to be slightly ahead of Cash App with 8% Venmo actives using “Pay with Venmo”, compared to 5% for Cash App and Cash App Pay. I wrote earlier in the year about why Cash App Pay is a big deal for Block. I think Pay with Venmo could also be a big deal for PayPal’s efforts to monetize Venmo. Do merchants really need two extra checkout buttons? TBD.

PayPal (NASDAQ: PYPL) stock price: $86.86* (+41% YTD)

Block (NYSE: SQ) stock price: $88.97* (+15% YTD)

* as of December 27, 2024

Toast vs. Shift4

Finally, a rivalry that is not getting old: Toast vs. Shift4. Shift4’s founder and CEO, Jared Isaacman, was appointed by the Trump administration to lead NASA and will be leaving the company’s CEO post in early 2025 (it is not clear if he will also need to liquidate his stake in the company). However, I don’t think that the rivalry between Toast and Shift4 will be less fun to watch after that happens (though I will miss Isaacman’s regular swings at Toast).

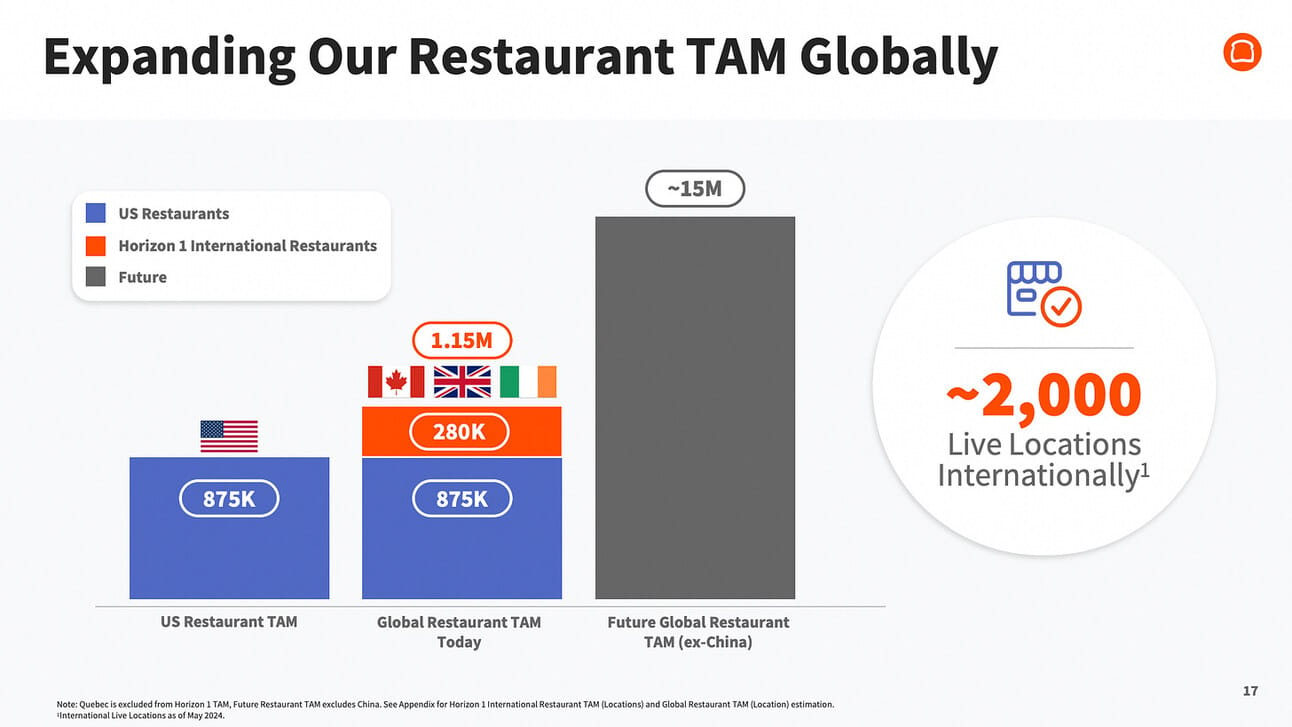

As a reminder, a fundamental difference between these two companies is that Toast grows (almost) exclusively organically, while Shift4 isn’t shy of acquiring companies to accelerate growth. Thus, when Shift4 and Toast decided to expand to Europe in 2023, Shift4 jumpstarted the effort by acquiring a European PSP Finaro. This year, Shift4 followed up with the acquisition of Vectron, “one of the largest European suppliers of POS systems to the restaurant and hospitality verticals”. Vectron serves 65,000 POS locations across Europe.

…with Toast, all their might and everything they've accomplished, they hired like hundreds and hundreds of people and spend like hundreds of million dollars on marketing to share to the world that they have a good product, and it's worked very well for them. From our perspective and just how we evolved in an organization, it's maybe there's a better way.

Jared Isaacman, UBS Global Technology and AI Conference

Will Isaacman’s departure change Shift4’s approach to growth? Probably not. However, as I wrote earlier in the year, public markets are openly saying that they like Toast’s organic growth. Toast has a x2 market cap of Shift4, despite Shift4 growing faster and being way more profitable. So, maybe the company’s board will steer the new leadership towards a different growth avenue. Or, maybe the board will put the company on sale again, once Isaacman gives away his super vote rights. The sale didn’t happen in 2024; perhaps, it will in 2025?

Toast (NYSE: TOST) stock price: $37.50* (+40% YTD)

Shift4 (NYSE: FOUR) stock price: $104.70* (+40% YTD)

* as of December 27, 2024

There are certainly more rivalries in the Fintech industry: Stripe and Adyen, SoFi and LendingClub, Nubank and MercadoLibre, but let’s leave those for another day.

Cover image source: Venmo

Disclaimer: Information contained in this newsletter is intended for educational and informational purposes only and should not be considered financial advice. You should do your own research or seek professional advice before making any investment decisions.