Hey!

Shift4 and Toast represent one of the most fascinating rivalries in the payments industry. They recently started diversifying their businesses, but in the beginning, both provided POS software, payment terminals, and payment processing for restaurants. Both did a fantastic job at this as their growth trajectory suggests.

However, as Shift4 and Toast went public (Shift4 went public in June 2020, and Toast in September 2021) a notable difference emerged. Shift4 has consistently been more profitable than Toast, but the market would give Toast a much higher valuation. That didn’t change even when investors started demanding “profitable growth.”

I have seen numerous theories trying to explain why Toast is valued higher than Shift4. Some seemed reasonable and grounded on facts, while many appeared to be baseless opinions. So, I have finally decided to explore whether there is a fundamental reason for the difference in valuation.

Enjoy and let me know if I got something wrong!

Jevgenijs

p.s. if you have feedback, just reply to this email or find me on Twitter/X

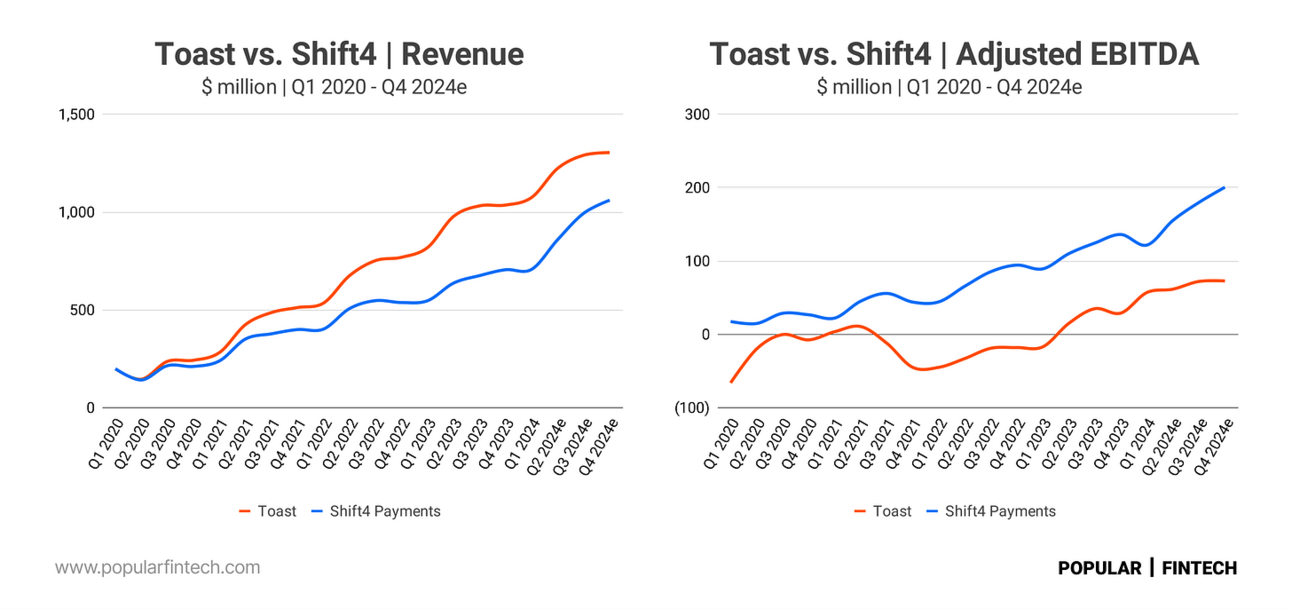

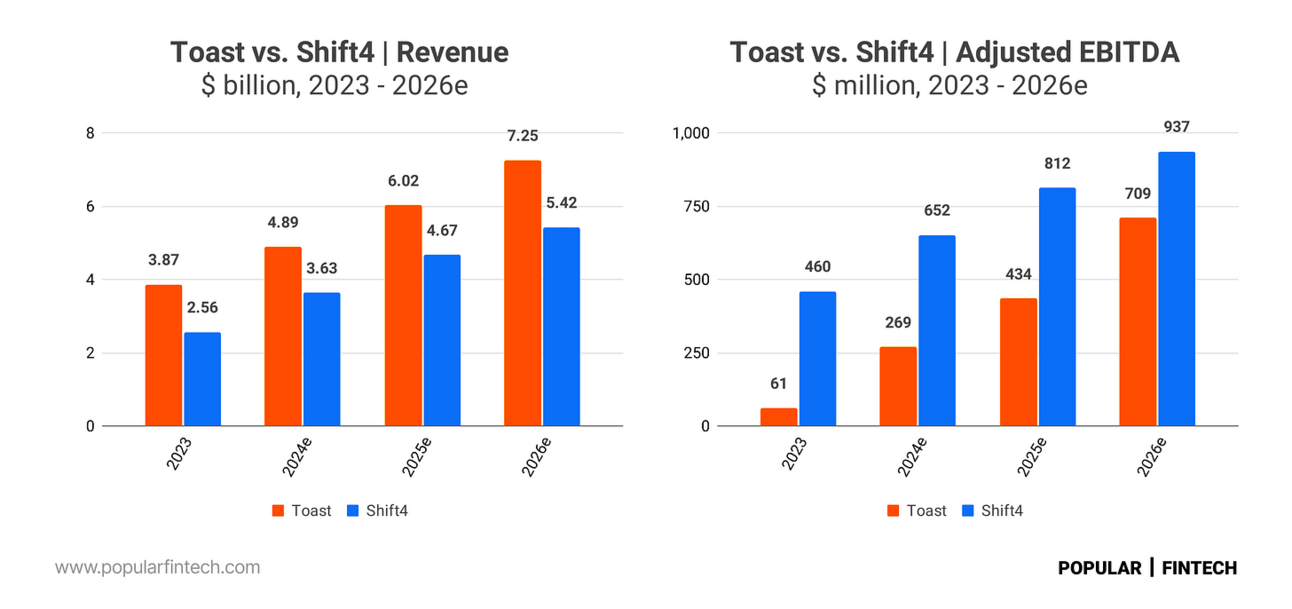

If I looked at the revenue and Adjusted EBITDA charts for Toast and Shift4 Payments, I would expect Shift4 Payments to be valued much higher than Toast. Toast generates higher revenue, but Shift4 is so much more profitable. Thus, in 2023, Toast reported Adjusted EBITDA of $62 million on a total revenue of $3.87 billion, while Shift4 reported Adjusted EBITDA of $460 million on a total revenue of $2.57 billion.

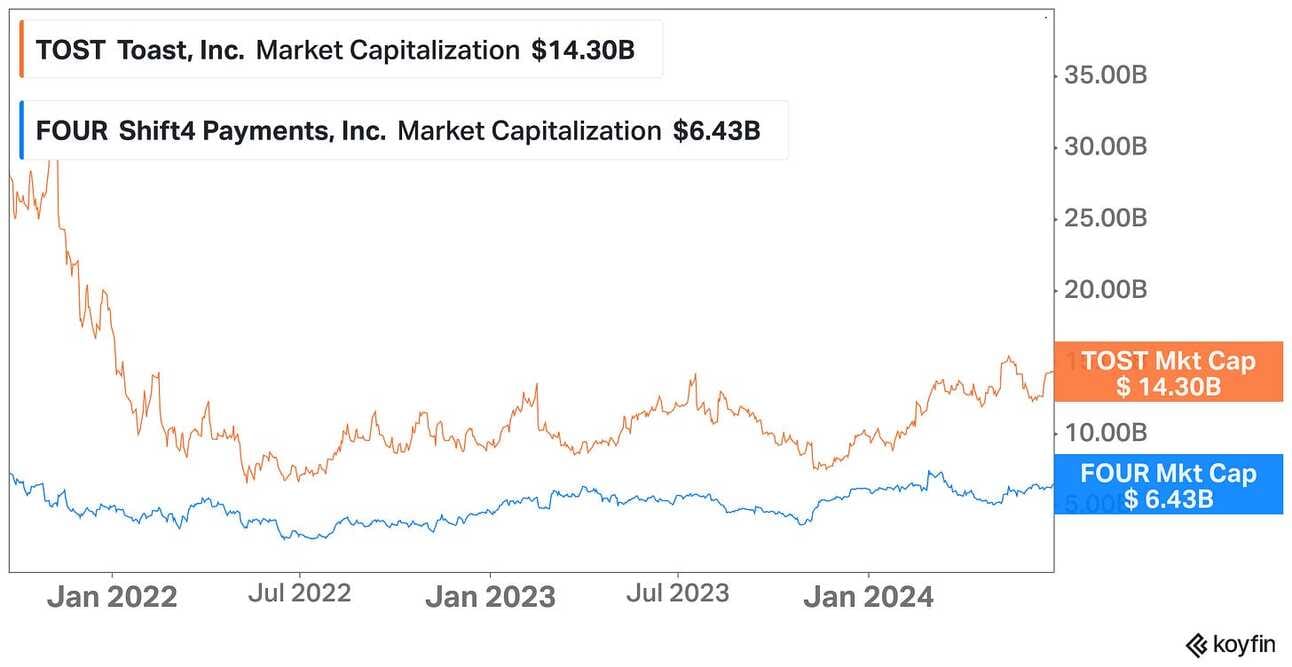

In reality, as of this writing, Toast has a market cap of $14.3 billion, while Shift4’s market cap is just $6.43 billion (enterprise value of $13.2 billion and $7.7 billion for Toast and Shift4 respectively). And as you can see from the charts above and below, through their short history of being public companies, Shift4 has always been more profitable, and Toast has always enjoyed a much higher market cap.

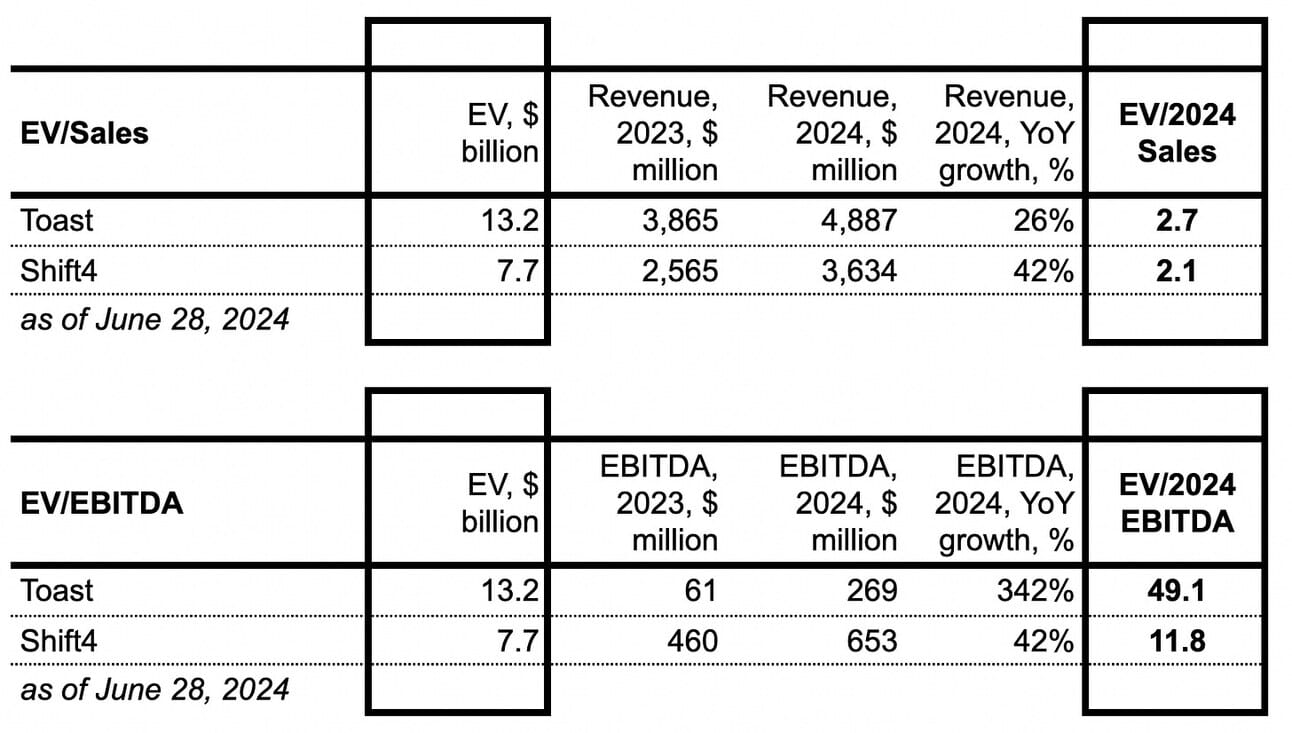

For some reason, Toast trades at much higher multiples than Shift4 (see the Enterprise Value/Sales and Enterprise Value / EBITDA multiples below). I’ve been curious as to why for a long time, so decided to finally take a closer look.

Both Toast and Shift4 started by providing POS software, payment terminals, and payment processing for restaurants in the United States. Since then Toast expanded beyond POS software (they now offer multiple software solutions for restaurants) and more than just payments (they also offer merchant financing), while Shift4 expanded into hotels, stadiums, and a few other merchant categories. Both companies also started expanding internationally.

“We are in table service restaurants in the United States and hopefully the rest of the world pretty soon. In that environment, it's ourselves and Toast. If you're winning a new location for that new restaurant coming online, it's using one of the two of us. When you get into things like coffee shops and bakeries, you're suddenly in Square and Clover territory.”

Taylor Lauber, Head of Strategy at Shift4

Mizuho Technology Conference 2024

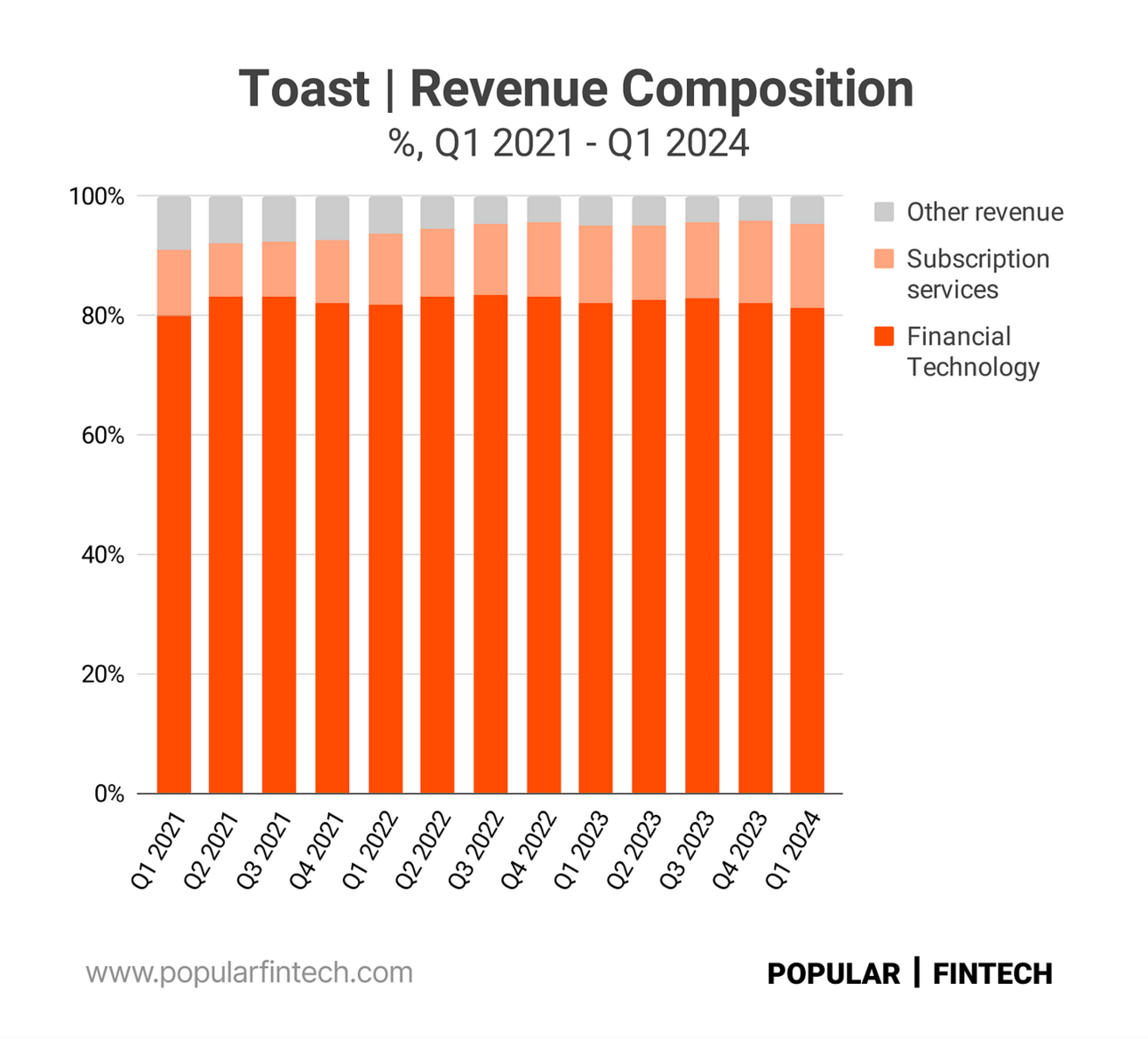

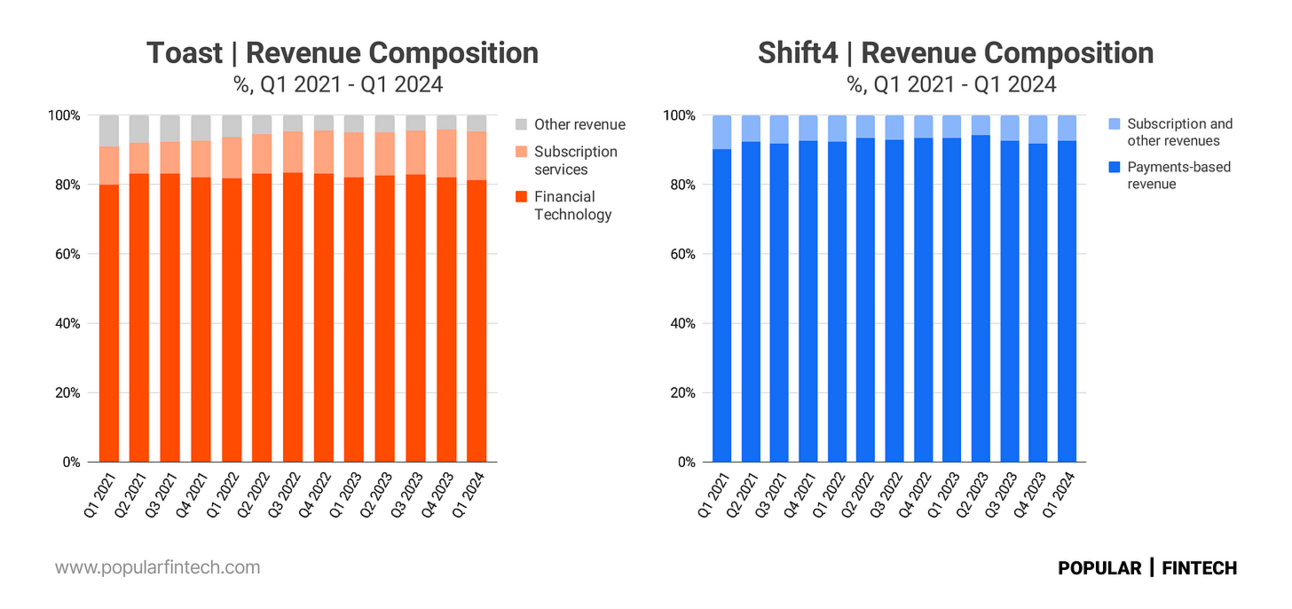

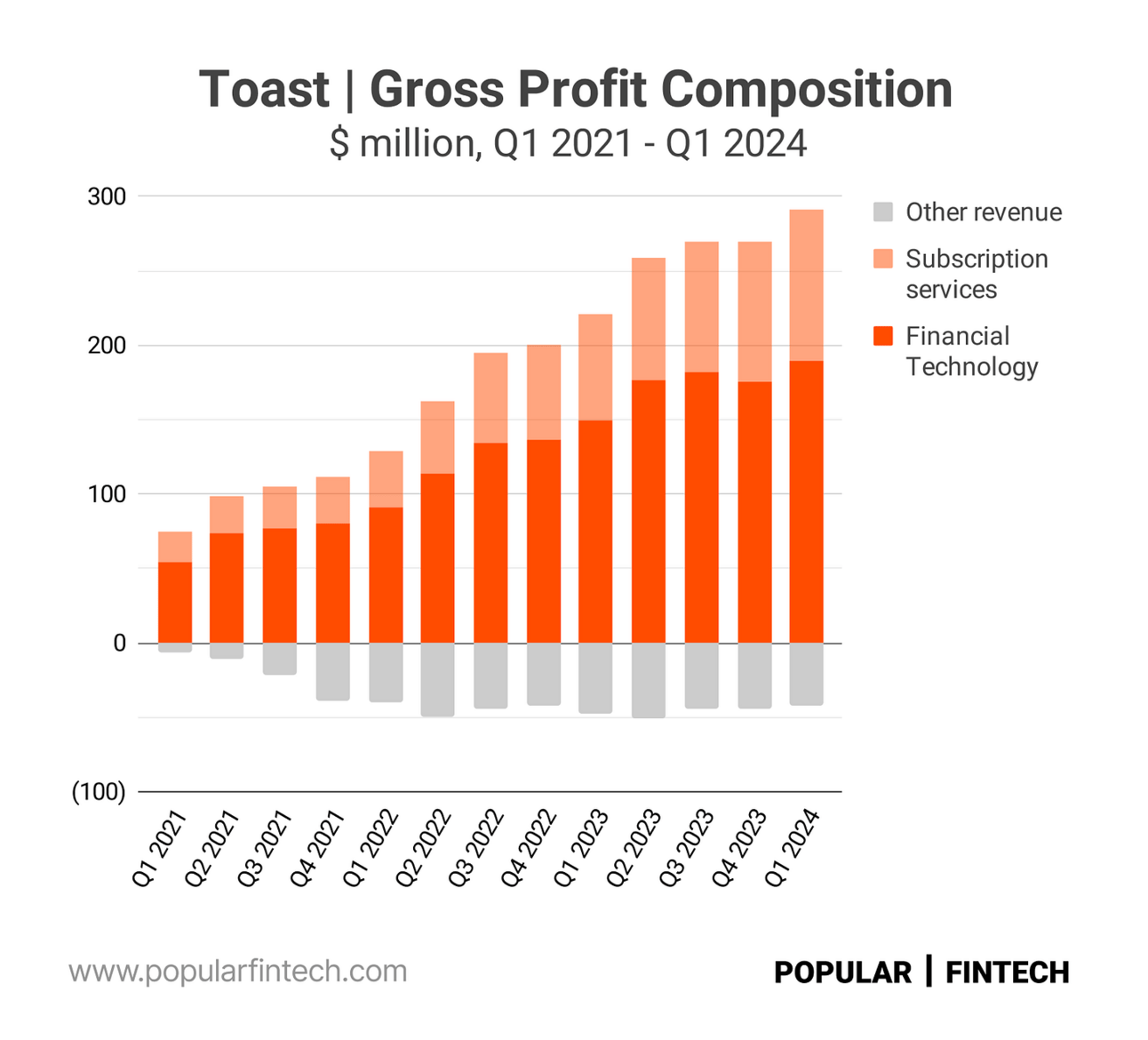

Nevertheless, restaurants remain the core segment for both companies. What’s also common between these two companies is that, similarly to other vertically integrated software providers, both companies generate most of their revenue from payment processing. Thus, as you can see from the chart below, over 80% of Toast's revenue comes from “Financial Technology”, which primarily comprises payment processing.

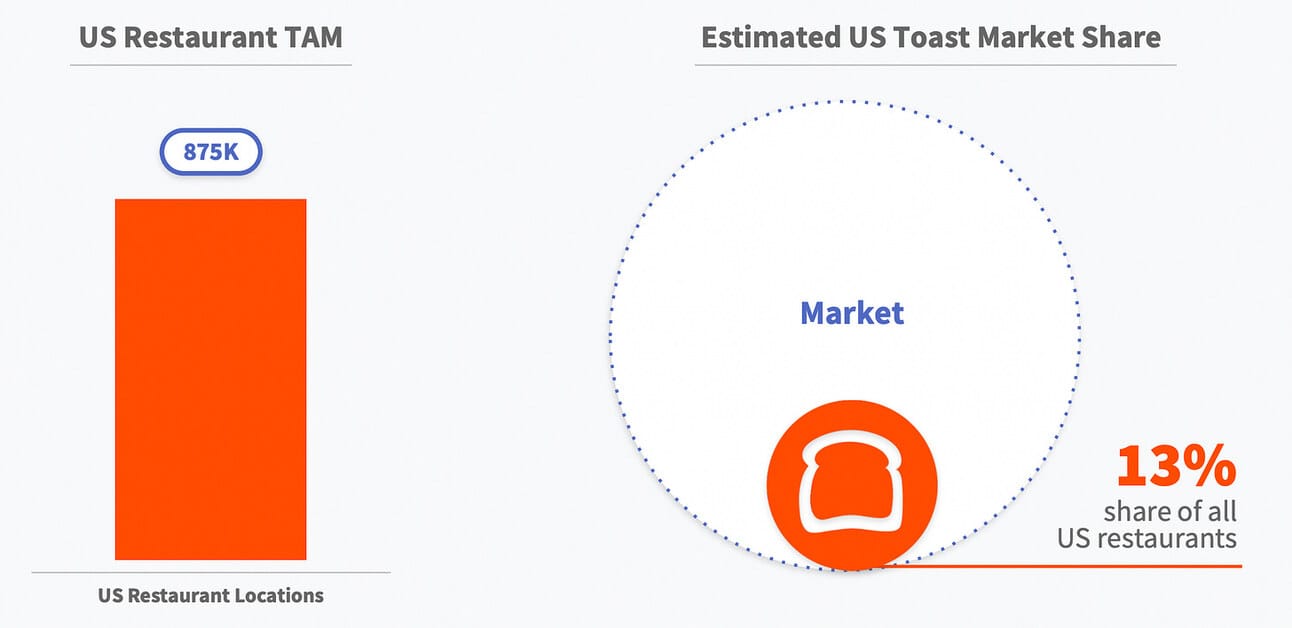

Both companies are also major players in their respective categories. Thus, Toast serves 112,000 restaurant locations, which they estimate to represent 13% of all U.S. restaurants. Shift4 does not disclose the number of served locations, but claims to serve “roughly 1/3 of the table service restaurants (and 40% of the hotels) in the United States.”

“…We're in roughly 1/3 of the table service restaurants in the United States. We are in 40% of the hotels in the United States. And we're in 75% of the stadiums in every sports league in the United States, and…we weren't in a single stadium 4 years ago. We weren't in a single hotel 8 years ago.”

Taylor Lauber, Head of Strategy at Shift4

Mizuho Technology Conference 2024

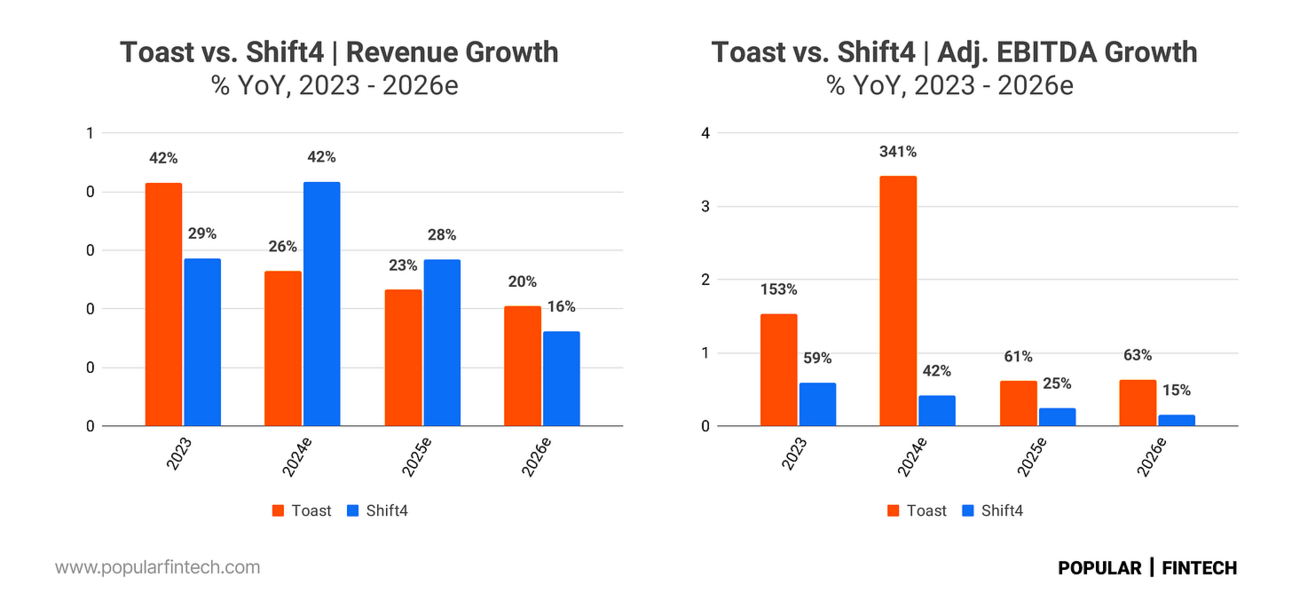

So why does the market value these two companies so differently? My first thought was that Toast’s higher multiple should reflect higher growth prospects. According to analysts’ estimates (as of this writing), Shift4 will grow its revenue faster than Toast in both 2024 and 2025, but its growth will slow down in 2026.

Given Toast’s much lower Adjusted EBITDA base, the company will deliver higher Adjusted EBITDA growth (according to analysts’ estimates) in 2024, 2025, and 2026. However, in 2026, Shift4 is expected to still deliver higher Adjusted EBITDA than Toast (on lower revenue).

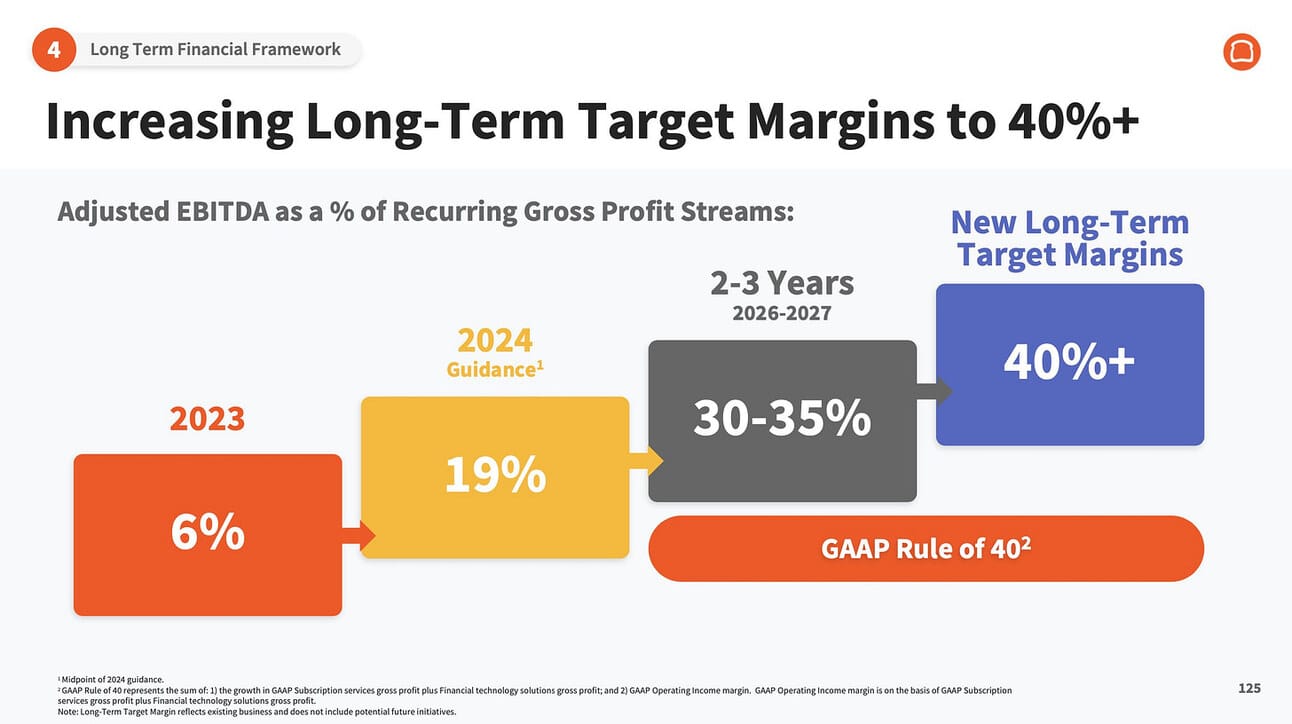

What about the trajectory beyond 2026? During their recent Investor Day (May 2024), Toast’s management laid out a plan to achieve 40%+ Adjusted EBITDA / Gross Profit margin in the long term (with the “long term” defined as “after 2027”).

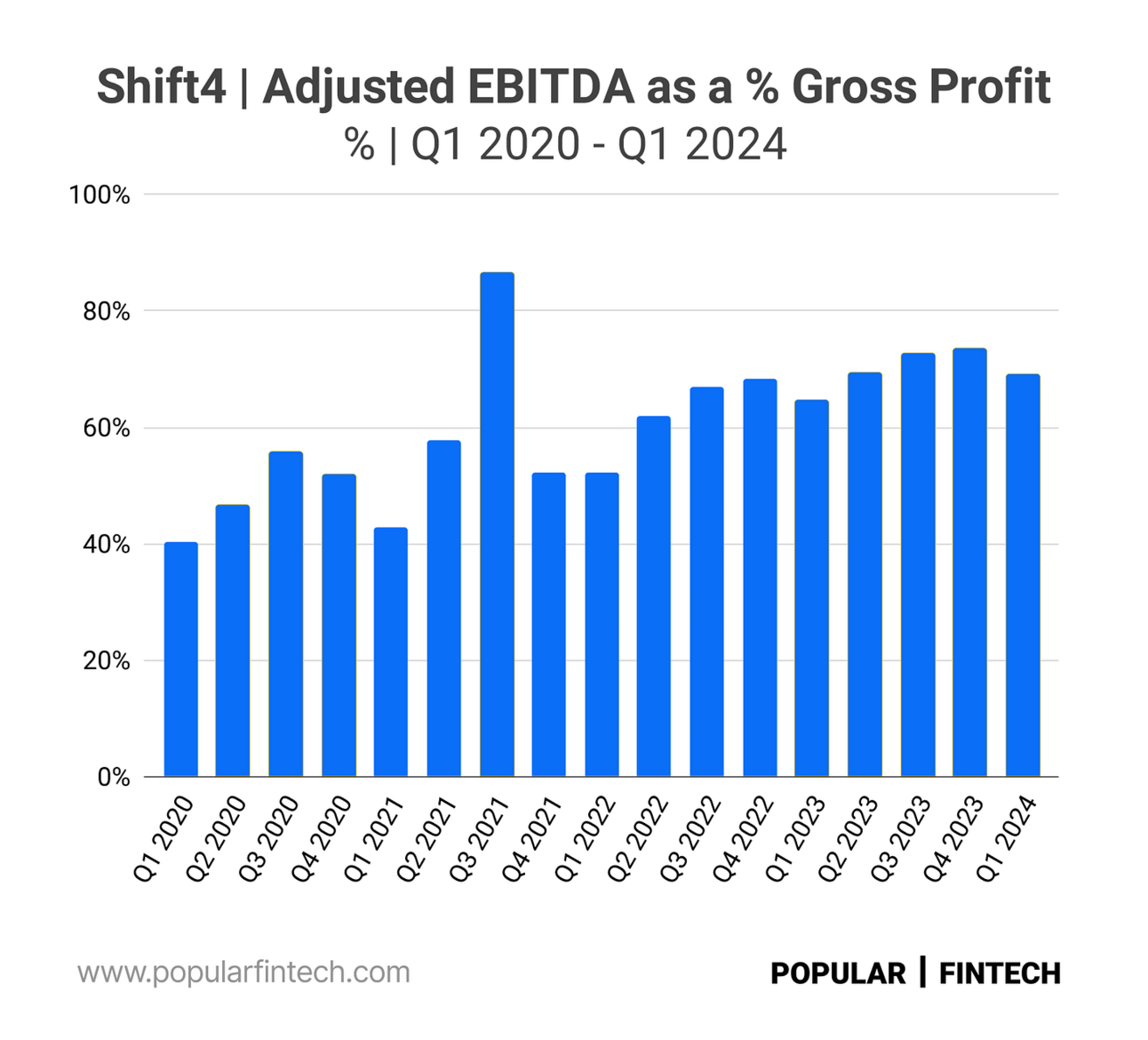

I calculated a similar metric for Shift4 and realized that Shift4 has been operating above this level even in 2020. Thus, Shift4’s Adjusted EBITDA / Gross Profit margin has been consistently higher than 60% in the last two years. This means that, even though analysts expect Toast to overtake Shift4 in revenue growth in 2026 (and I’d guess after that), Shift4 will still operate at a much higher profitability margin.

In summary, analysts’ estimates and management guidance suggest that Shift4 will generate more Adjusted EBITDA than Toast in the coming 5 years (at least). So, I started thinking, that perhaps, the market sees a higher risk in Shift4 delivering projected growth numbers.

During its Investor Day 2024, Toast management discussed at large expanding the company’s Total Addressable Market. Toast already has a meaningful share of the restaurant segment in the U.S. Therefore, the company is forced to expand beyond the restaurant segment and internationally to sustain the growth momentum.

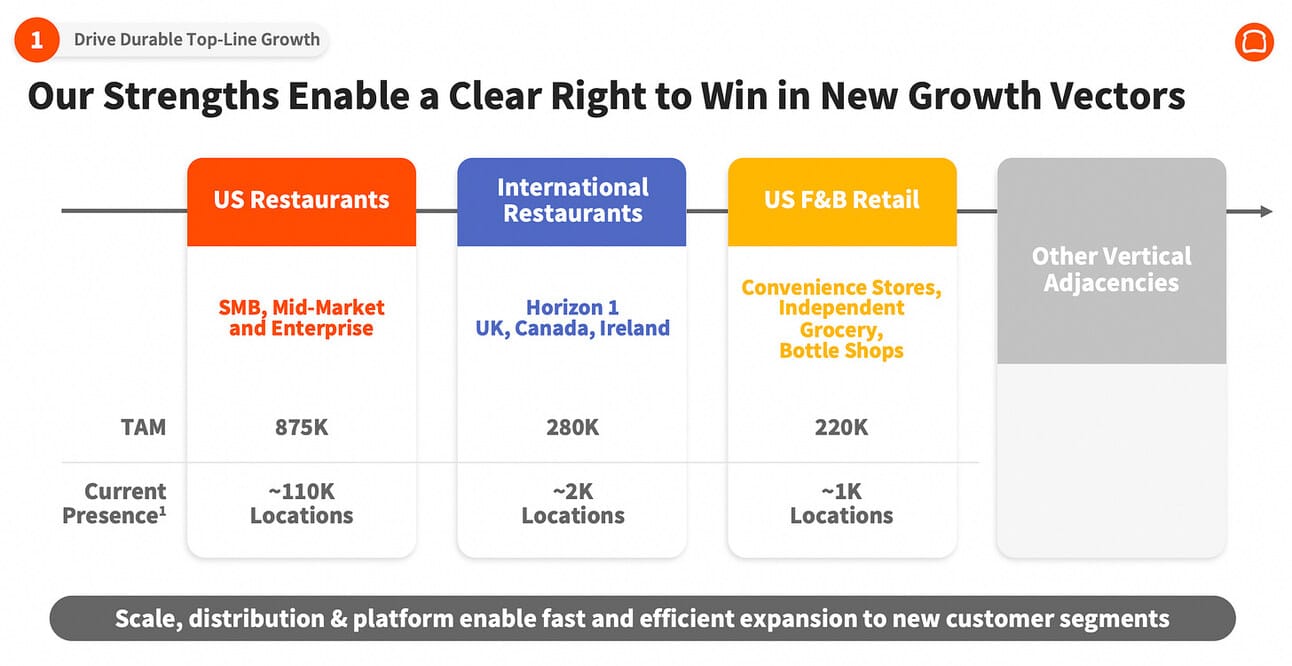

However, these TAM expansion efforts are still in their early phases. Thus, as of Q1 2024, Toast served only 2,000 restaurant locations outside of the U.S. (last year Toast expanded to Canada, the U.K., and Ireland), and 1,000 food & beverage locations in the U.S. (the company’s new segment).

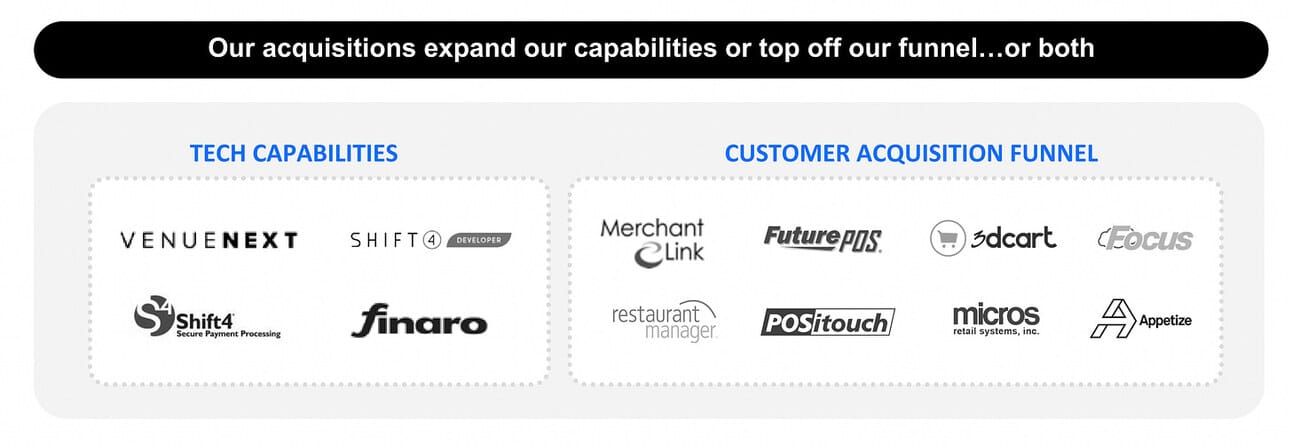

While Toast is entering new markets and segments organically, Shift4 pursued a number of acquisitions to accelerate the process. Thus, in 2021 the company acquired VenueNext, which allowed it to enter the stadiums segment. In 2023, Shift4 acquired VenueNext competitor Appetize to double down on its efforts in this customer segment.

Last year, Shift4 finally completed an acquisition of Finaro (the acquisition was announced in March 2022), which provided it with the payment infrastructure across the European continent. The company also made several acquisitions in Europe, such as Revel Systems and Vectron, which boosted its merchant base in the new geography. Revel system served 18,000 and Vectron served 65,000 POS locations across Europe (as of this writing, the Vectron deal has not closed yet).

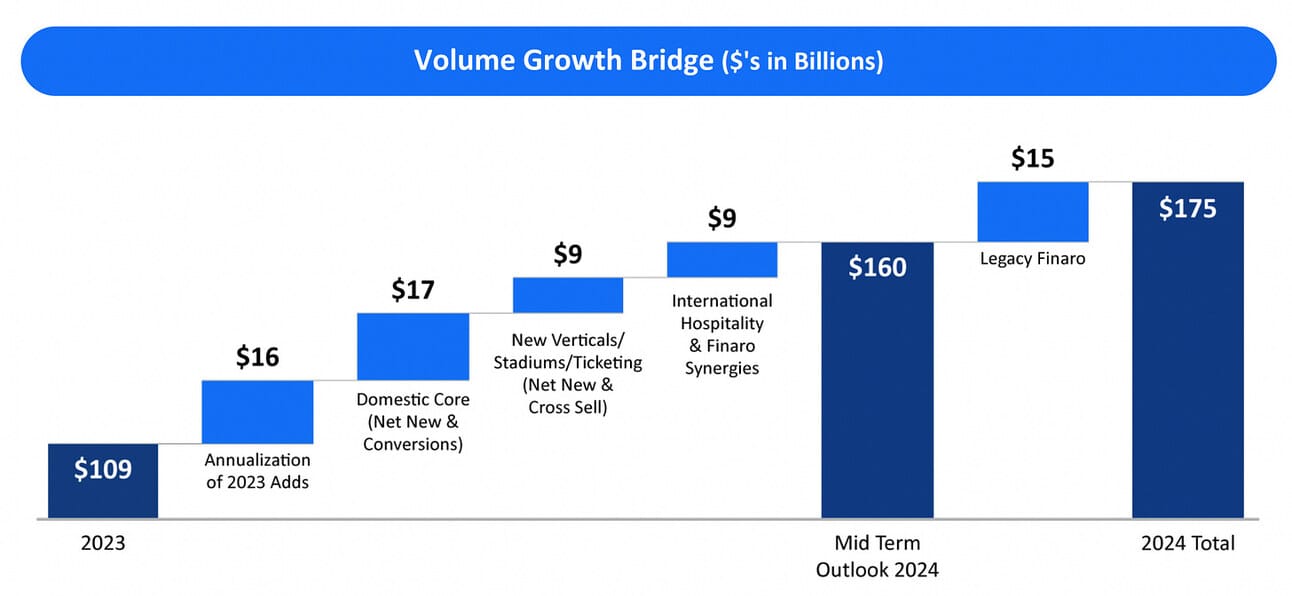

In Q3 2023, Shift4 provided a “volume growth bridge” (see below) quantifying the expected contribution of new verticals and international markets to the payment volume. As you can see, new verticals and international markets were expected to have a meaningful contribution to the company’s growth in 2024. Importantly, this “bridge” was provided before the Revel and Vectron acquisitions!

So my conclusion is that Toast’s future growth drivers (new segments, international expansion) are still early and yet to be proven, while for Shift4 those are already a reality. Don’t get me wrong, I don’t doubt that Toast can deliver on its promises. But at the same time, I think Shift4's 3-5 year projections are more tangible.

“….early international strides, organic product investments alongside our M&A strategy inspires confidence in our goal to sign 10,000 new restaurant and hotel customers, specifically in Europe and Canada before the year-end.”

Jared Isaacman, Shift4 Q1 2024 Earnings Call

So, perhaps, the reason, why the market values Shift4 lower than Toast, is that Shift4 is growing through acquisitions, while Toast is growing organically? I’ve heard this argument many times, so decided to look into this aspect next. Let’s maybe start with the fact that it is not really true that Toast grew purely organically.

Thus, in 2019, Toast acquired an HR and payroll software provider StratEx. In 2021, Toast acquired a provider of accounts payable automation and inventory management solution xtraCHEF. In 2022, the company acquired an employee scheduling, communication, and management solution Sling. And finally, in 2023, Toast acquired a digital display solution vendor Delphi Display System.

So while Shift4 uses acquisitions to enter new segments and geographies, Toast uses acquisitions to extend its software offering. Of course, Toast’s acquisitions are tiny compared to Shift4’s acquisitions (Shift4 spent $1.6 billion on acquisitions during the 2019 - 2023 period). Nevertheless, they became critical components of the company’s software platform.

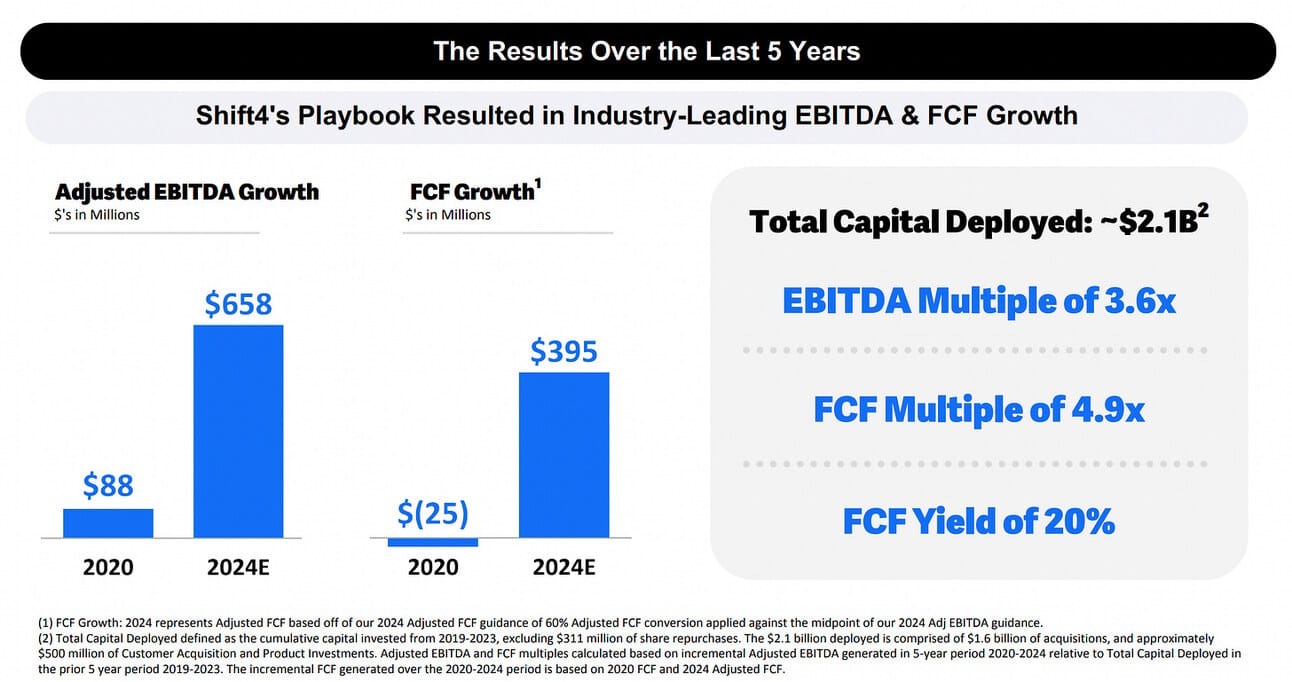

But back to Shift4…Shift4 “deployed” $2.1 billion in capital during the 2019-2023 period ($1.6 billion in acquisitions + $0.5 billion in product development and marketing). As a result, Adjusted EBITDA increased from $88 million in 2020 to $658 million in 2024 (per the company's guidance), and Free Cash Flow increased from negative $25 million in 2020 to $395 million in 2024 (again, per the company's guidance).

So if you attribute 100% of growth in Adjusted EBITDA and Free Cash Flow to the $2.1 billion investment, you’ll get 27% and 20% return on investment on Adjusted EBITDA and FCF basis respectively. Of course, it is a stretch to attribute all growth to the company’s investment (some of it came purely from the growth of their existing clients), but the business case is very strong.

In summary, Shift4 accelerated its entrance to new segments and new geographies, meaningfully diversifying its growth drivers, while still delivering impressive return on this investment. I’m not really sure why the market would penalize the company for such capital allocation.

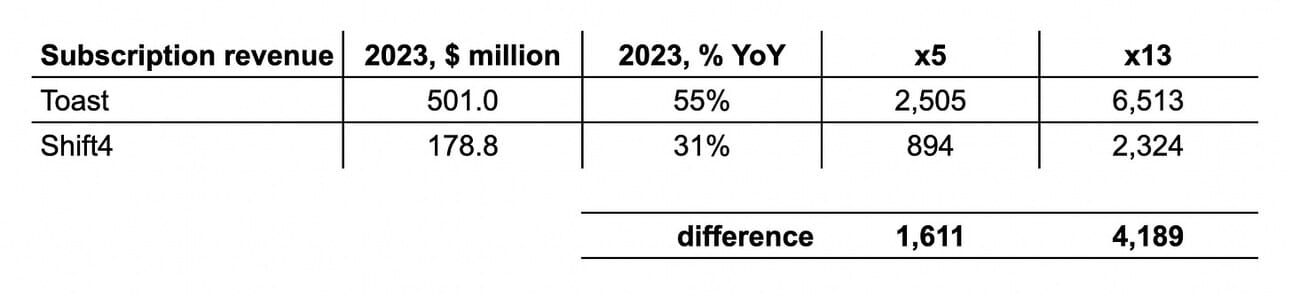

And this brings me to…software revenue (as in my last hope to understand the difference in the valuation of these two companies). Toast generates much higher subscription (read software) revenue in both absolute and relative terms (see the chart below). Toast software offering is much broader and Shift4 doesn’t charge for some of the modules or charges less than Toast.

“I think we differentiate [ from Toast ] in pretty specific ways. You'll find we don't generally do things like capital offerings or payroll or these kind of run your business suites of software because we want the kind of merchant that would never pick our payroll. We want the kind of merchant that would never take a 30% APR loan from us.”

Taylor Lauber, Head of Strategy at Shift4

Mizuho Technology Conference 2024

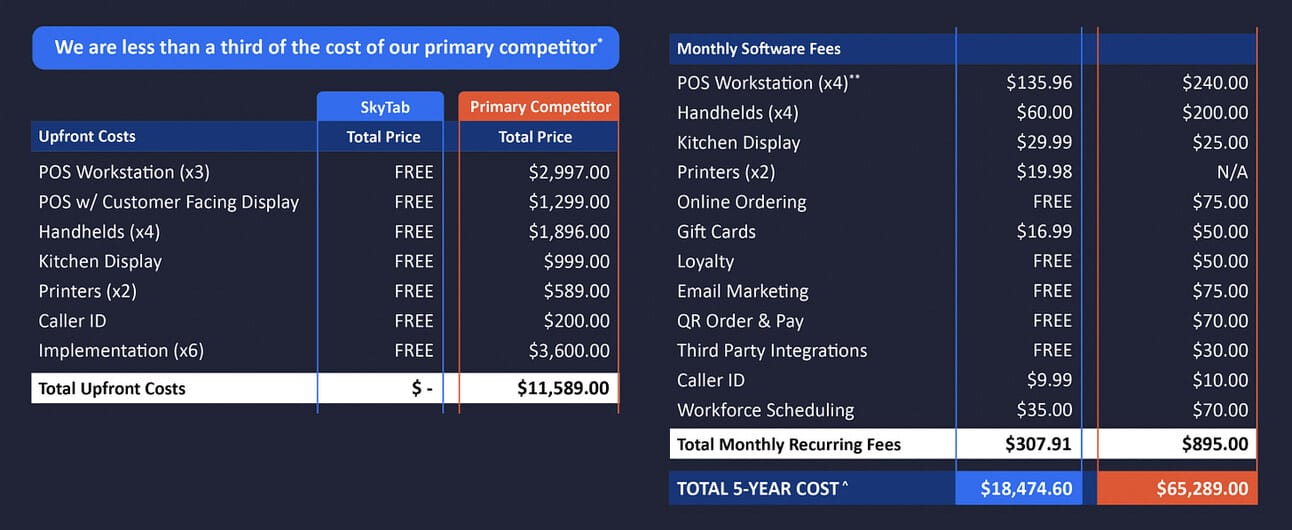

In Q2 2023, Shift4 compared its offering to Toast (see below). I believe this comparison exemplifies really well the reason why Shift4’s revenue from software subscriptions is much lower than Toast’s (you can see Shift4 “trolling” Toast quite often, either about the cost of ownership, or about the 99-cent fee, or about how much Toast spends on customer acquisition).

“We've released many modules, as indicated in our shareholder presentation, and we don't charge for any of them. We don't believe there is a restaurant out there that is excited to pay POS companies for more modules and instead prefer a lower overall cost of service.”

Jared Isaacman, Shift4 Q1 2024 Earnings Call

The beauty of the software revenue is twofold: a) it is less seasonal (and, in theory, less cyclical) than payments revenue, and b) it has a much higher gross profit margin. Thus, Toast’s gross profit margin on its “Subscription services” revenue is around 67%. This is considered low compared to other software vendors, but still much higher than the 21% gross profit margin on “Financial services” revenue.

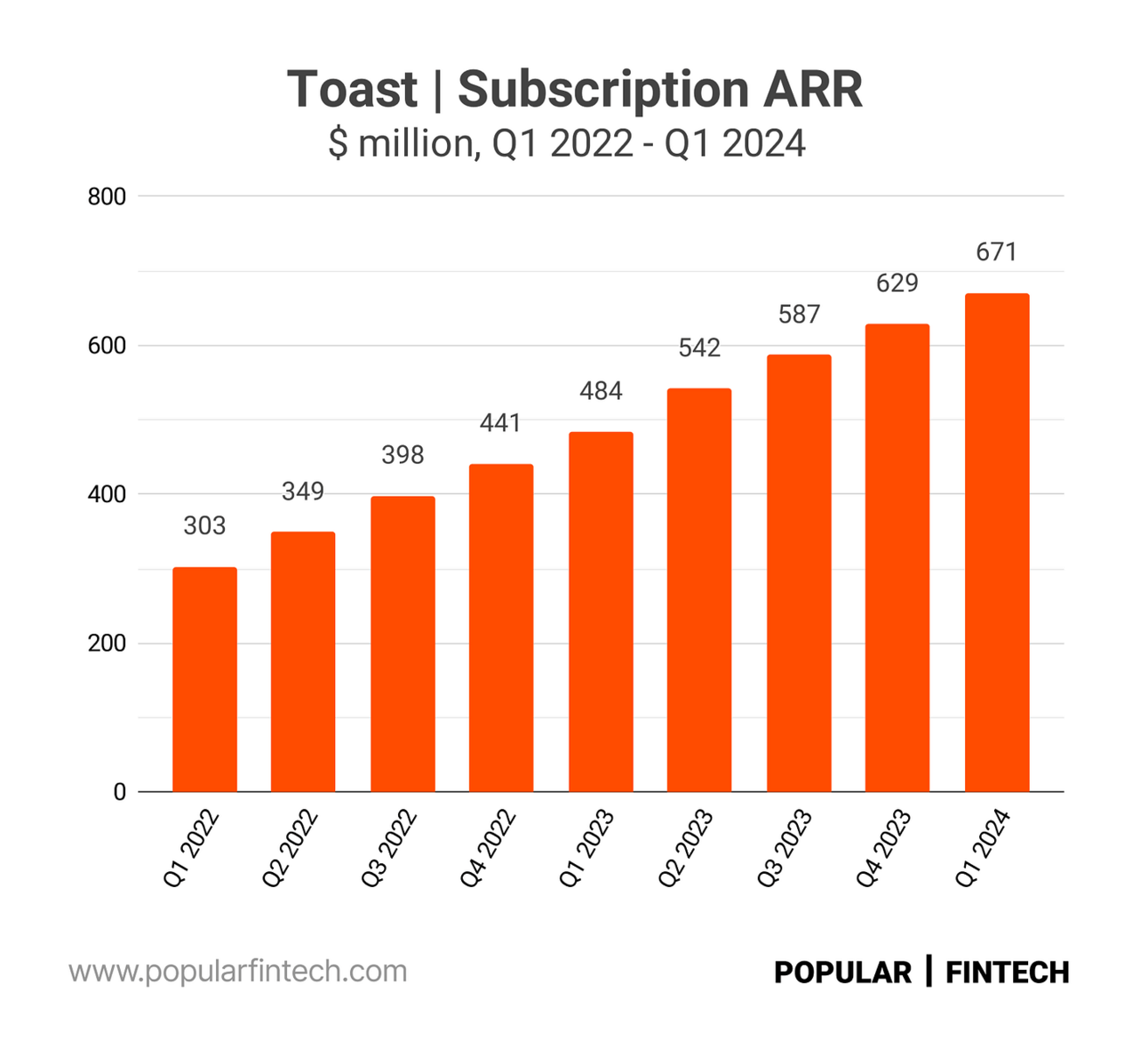

Toast even reports Subscription ARR (Annual Recurring Revenue) as other software companies (they also report Financial Technology ARR, which is annualized gross profit from payments and lending revenue, but I never understood the meaning of this metric). In Q1 2024, Toast reported $671 million in Subscription ARR, an increase of 39% compared to Q1 2023.

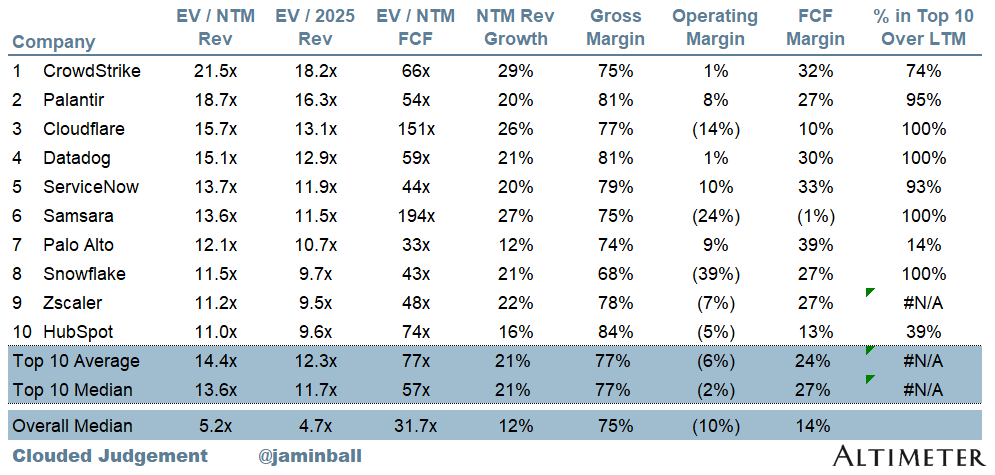

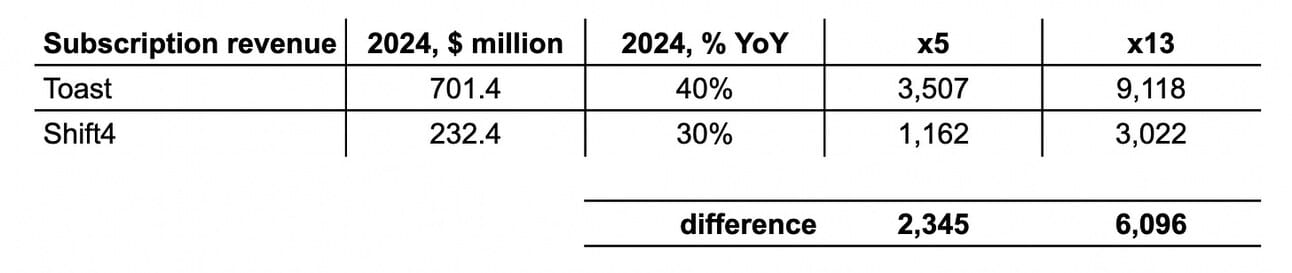

According to the data from the Clouded Judgement newsletter, the median EV/NTM Revenue multiple for software companies is 5.2x, while the top 10 companies trade at a median multiple of 13.6x. The median revenue growth for all software companies is projected to be 12% YoY, while the top 10 companies are expected to growth revenue at a median rate of 21% YoY.

Applying these multiples to Toast’s and Shift4’s 2023 “subscription revenue” suggests that the software component might be responsible for a $1.6 - 4.2 billion difference in valuation….which still does not (fully) explain the $5.5 billion difference in the enterprise values of Toast and Shift4.

So what if I assume growth in the software revenue (let’s say that in 2024, Toast will grow its subscription revenue at 40% YoY, and Shift4 at 30% YoY). Applying the median multiples for all and the top 10 software companies on 2024 revenue results in a $2.3 - 6.1 billion difference in valuation. Perhaps, the market valuing Toast as a software company is the reason for the valuation difference.

In summary, Shift4 will remain more profitable than Toast in the next 5 years (if not longer). Shift4 is more diversified in terms of customer segments and geography, and, as a result, has more levers to deliver the projected growth. Shift4’s acquisitions helped it get ahead of Toast in entering new markets and have fantastic business cases behind them.

The market might be valuing Toast as a software company, while putting Shift4 into the payments bucket. However, this begs a question: what prevents Shift4 from using Toast’s playbook and acquiring a bunch of software companies to extend its product offering? The Shift4 team knows how to play the M&A game, and they certainly know how to upsell merchants.

I guess, what Mr. Market is saying is that it might not be that easy, or might not happen anytime soon.

Cover image source: Shift4 Payments

Disclaimer: Information contained in this newsletter is intended for educational and informational purposes only and should not be considered financial advice. You should do your own research or seek professional advice before making any investment decisions.