As an observer of the industry, I am fascinated by the ongoing rivalries among prominent Fintech companies like Block and PayPal, Affirm and Klarna, as well as SoFi and LendingClub. Rivalries between publicly traded companies are especially interesting, as you get a lot of information about their past performance through quarterly reports, and, on top of that, you can use valuation multiples as a gauge for future growth. My research into these Fintech rivalries turned into a mini-series, and you can read previous issues by following the links below:

“Fintech Rivalries: How Fintech Companies Stack Up Against Each Other"

Today’s story is about two e-commerce giants, Shopify (NYSE: ) and Mercado Libre (NASDAQ: ). These companies have different business models: Shopify provides an e-commerce platform, while Mercado Libre operates a marketplace similar to Amazon. They also operate in different markets: Mercado Libre operates in 18 countries across Latin America, while Shopify operates globally. However, what unites them is the fact that financial services have become a crucial revenue component and growth driver for both companies.

A few highlights: both companies processed more than $100 billion in payments last year, and Shopify recently crossed the mark of 100 million buyers, who opted-in for its Shop Pay service. Mercado Libre boasts more than 23 million users of its digital wallet and over 40 million users across all financial products. Shopify partnered with Affirm (NASDAQ: ) to offer a BNPL product, Shopify Installments, as well as facilitated close to $5 billion in loans to merchants via Shopify Capital. Financial services already contribute more than half of Shopify’s revenue, and Mercado Libre is expected to cross this mark soon.

Shopify and Mercado Libre might not be direct competitors or pure Fintech companies for that matter. However, they are definitely on the frontier of Fintech innovation, and thus, are an exciting duo to follow, and, perhaps, capitalize on the disruption in financial services and e-commerce. Let’s see how these companies stack up against each other in terms of key operating and financial metrics!

Shopify and Mercado Libre are primarily recognized for their e-commerce businesses. Shopify's cloud-based platform provides a comprehensive commerce solution that has helped millions of merchants start, grow, market, and manage their online stores. On the other hand, Mercado Libre's centralized marketplace, which allows merchants and individuals to list merchandise and conduct sales, has become a household name, similar to Amazon. Additionally, Mercado Libre acts as a first-party seller for select product categories, further enhancing its appeal to users.

Over time, Shopify and Mercado Libre expanded their offerings to include payment processing and fulfillment services (see Shopify Fulfilment Network and Mercado Envios). While SFN and Mercado Envios are still in their early development phases, payment processing has already become a crucial component and a growth driver for both companies. Shopify provides payment processing only to merchants using its platform (see Shopify Payments), while Mercado Libre’s offering is generally available to any merchant through the company’s subsidiary Mercado Pago. Both companies also offer financing solutions for merchants and consumers (see Shop Pay Installments, Shopify Capital, and Mercado Credito).

Lastly, both companies are exploring opportunities in advertising technology solutions (see Shopify Audiences and Mercado Ads); however, these businesses, at least for now, do not make a material financial contribution.

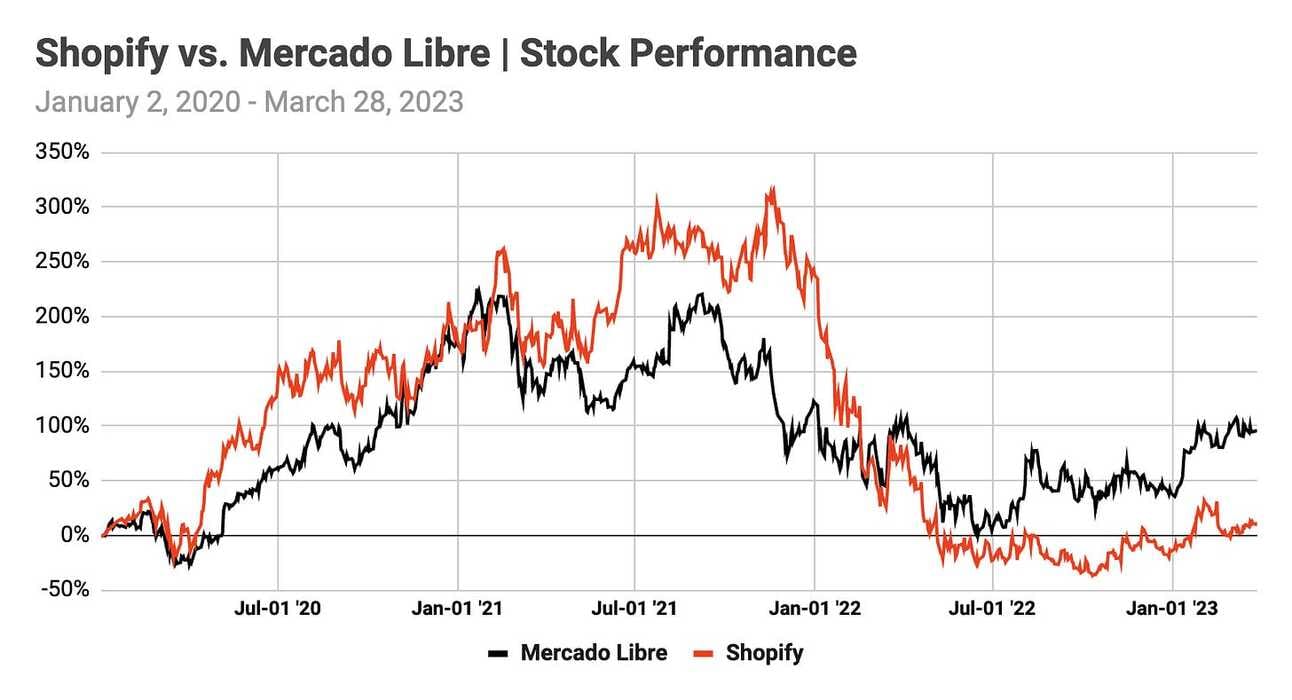

As of this writing, Shopify (NYSE: ) had a market capitalization of $58.8 billion, and an enterprise value of $55.1 billion, while Mercardo Libre (NASDAQ: ) had a market capitalization of $61.6 billion and enterprise value of $64.0 billion. The stock prices of both companies experienced a surge during the pandemic (see chart below); however, they lost all their 2020-2021 gains by mid-2022. Mercado Libre's shares have performed better since then, and I hope that this post might shed light on why this happened.

Starting with one of the fundamental metrics for commerce firms, Gross Merchandise Volume (GMV), Shopify's GMV figures dwarf Mercado Libre's, as seen in the chart below. For the full year of 2022, Shopify reported $197.3 billion in GMV, while Mercado Libre reported $34.5 billion. In comparison to 2021, Shopify's full-year 2022 GMV increased by 12.5%, and Mercado Libre's GMV increased by 21.3%. It should be noted, however, that Shopify's GMV represents the value of goods sold by merchants utilizing the Shopify platform (via their own stores), while Mercado Libre's GMV represents the value of goods sold through the Mercado Libre Marketplace.

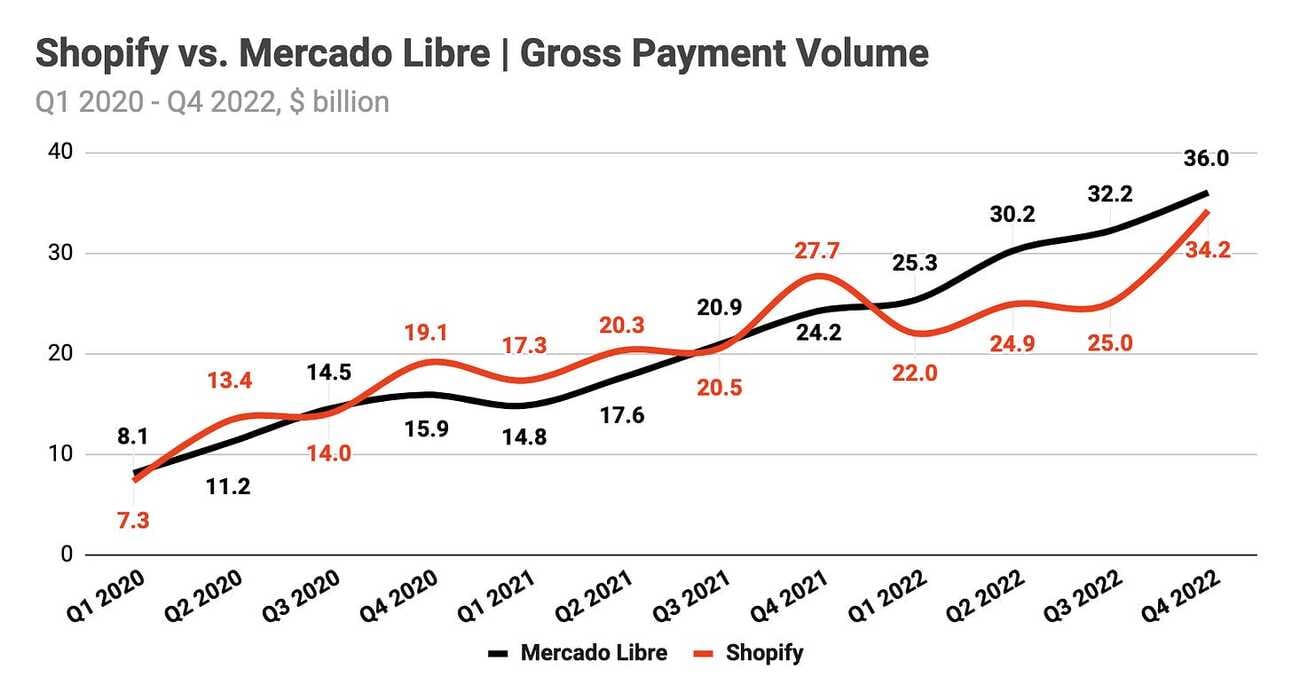

As mentioned previously, payment processing is a crucial revenue component and growth driver for both companies. However, Mercado Libre's payment solutions are available to any merchant, and hence not limited by the volumes transacted through the company's marketplace. As a result, Mercado Libre processed $123.6 billion in payments in 2022, with only 29.3% of those payments occurring on its marketplace. On the other hand, Shopify processed $106.1 billion in payments, which is equivalent to 53.8% of Gross Merchandise Volume sold through its platform. In 2022, Shopify's Gross Payment Volume increased by 23.7% from 2021, while Mercado Libre's Gross Payment Volume increased by 59.5% during the same period.

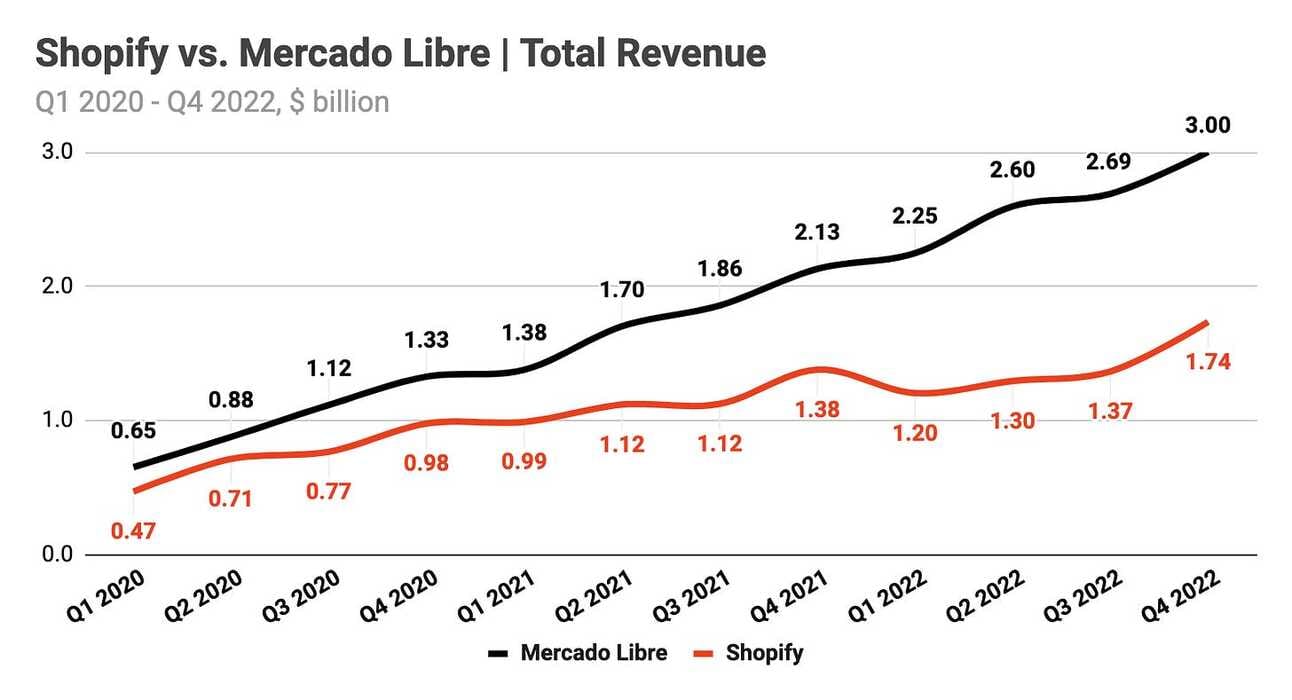

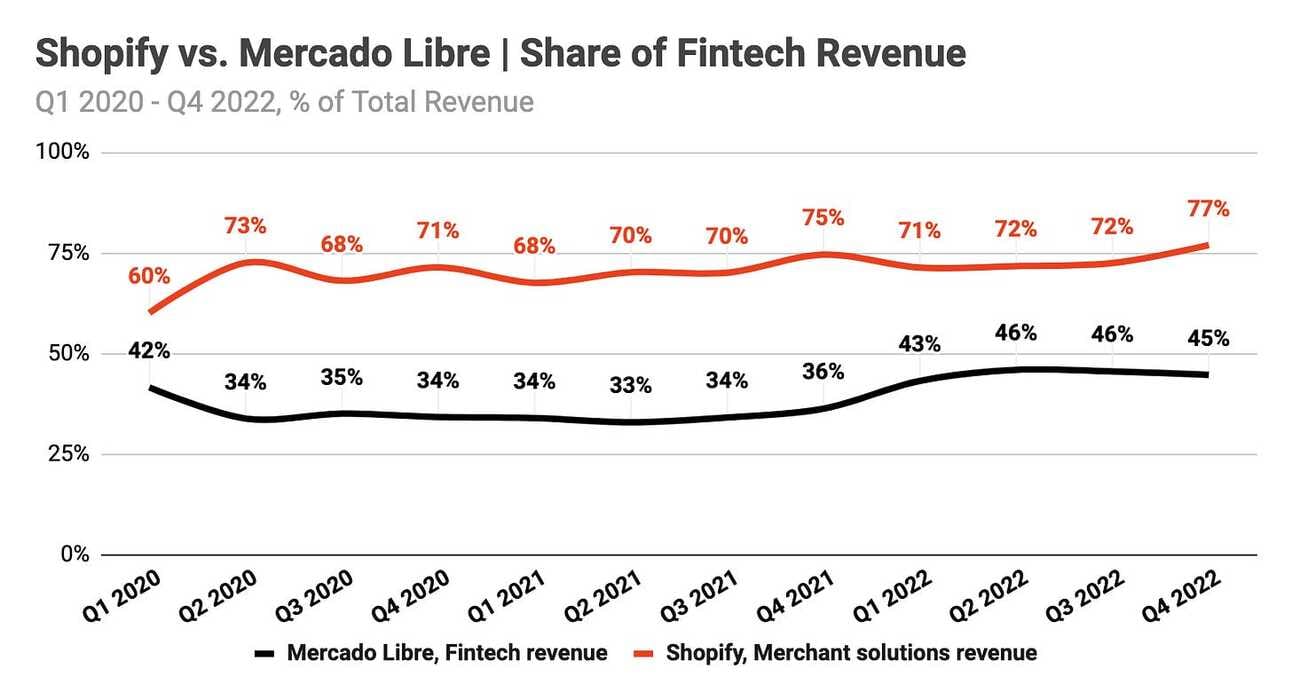

In the full year of 2022, Shopify reported revenue of $5.6 billion, while Mercado Libre reported revenue of $10.5 billion. Shopify's revenue increased by 21.5%, and Mercado Libre's revenue increased by 49.1% compared to 2021. Shopify reports revenue in two segments: revenue from the company's financial services (payments, lending) is reported under the "Merchant Solutions" segment, while platform subscription fees and revenue sharing with third-party application developers are reported under the "Subscription Solutions" segment. Meanwhile, Mercado Libre divides its revenue into "Commerce Revenue" and "Fintech Revenue".

In 2022, "Merchant solutions" accounted for $4.1 billion, or 73.4%, of Shopify's total revenue, representing a 25.8% increase from 2021. In comparison, the "Subscription solutions" segment revenue increased by 10.8% over the same period. For Mercado Libre, "Fintech revenue" contributed $4.7 billion, or 44.9%, of the company's total revenue in 2022, representing a 94.3% increase from 2021. "Commerce revenue" increased by 25.3% over the same period. Notably, Shopify reports its fulfillment services revenue under "Merchant solutions revenue", while Mercado Libre reports it under "Commerce revenue". However, both companies do not explicitly disclose the revenue generated by their fulfillment businesses.

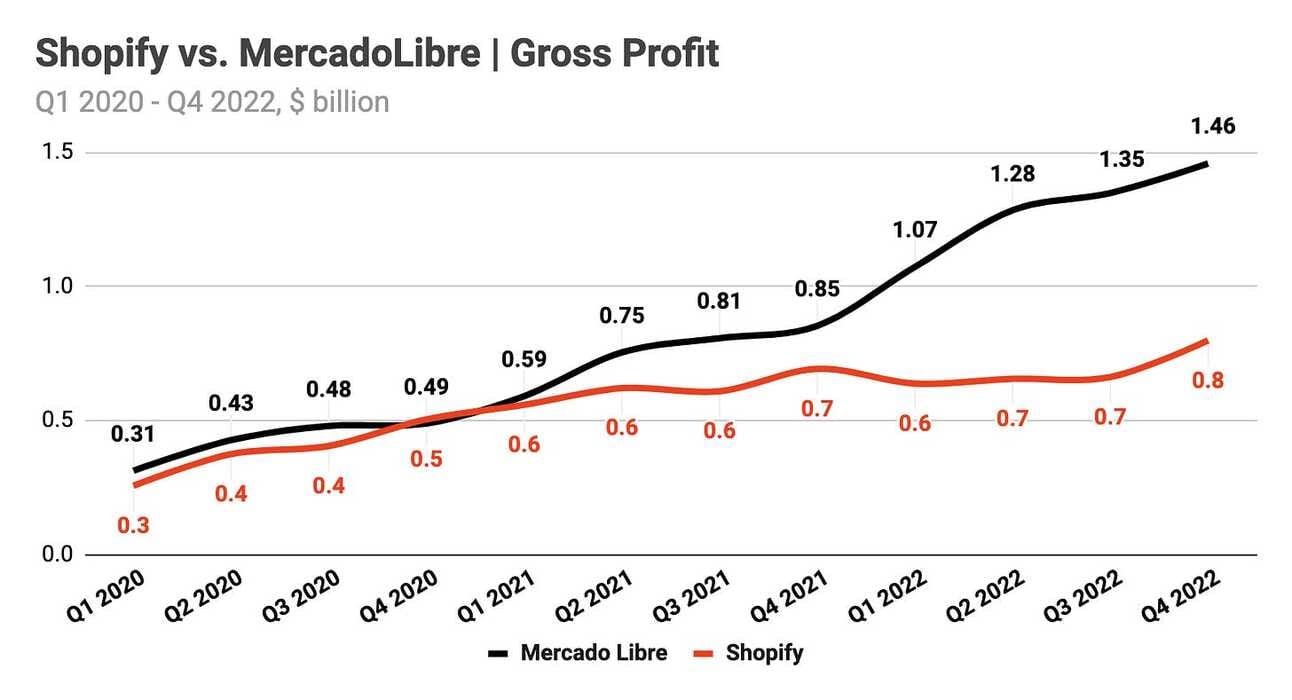

In full-year 2022, Shopify's gross profit was $2.75 billion, representing an 11.0% increase compared to 2021. Meanwhile, Mercado Libre reported a gross profit of $5.16 billion, representing a 71.8% increase compared to the previous year. In 2022, Shopify's revenue growth of 21.5% outpaced its gross profit growth of 11.0%, whereas Mercado Libre experienced the opposite trend, with gross profit growth outpacing revenue growth (49.1% vs. 71.8%). This discrepancy can be attributed to a gross profit margin compression in Shopify's case, whereas Mercado Libre experienced gross profit margin expansion.

Shopify's gross profit margin fell from 53.8% in 2021 to 49.2% in 2022, and further margin compression is expected in 2023. This trend is due to the faster growth of lower-margin businesses such as payments and fulfillment, which outpaces the growth of higher-margin businesses such as platform subscriptions. Meanwhile, Mercado Libre's gross profit margin increased from 42.5% in 2021 to 49.0% in 2022. The company benefited from economies of scale in its payments, lending, and fulfillment businesses, and also saw a decrease in the share of its lower-margin first-party business in the total GMV mix.

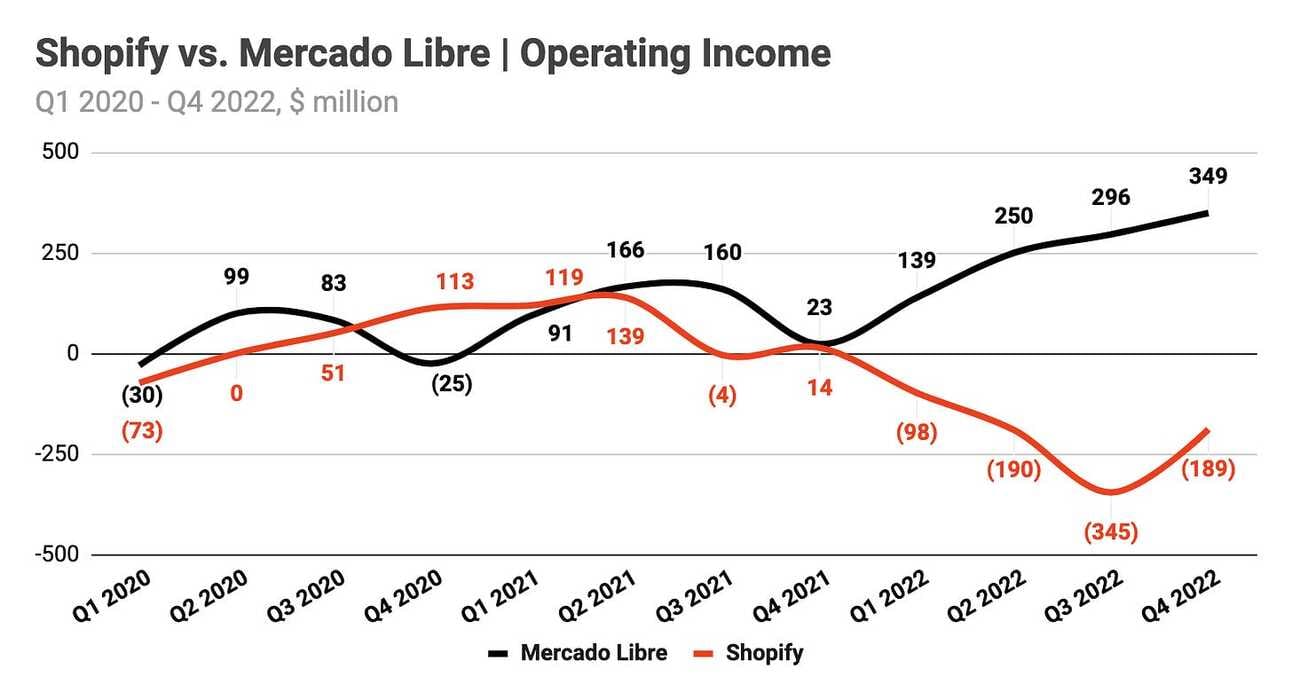

Shopify reported $3.58 billion in total operating expenses for 2022, while its gross profit stood at $2.75 billion, resulting in an operating loss of $0.82 billion. For comparison, Shopify recorded a gross profit of $2.48 billion, operating expenses of $2.21 billion, and operating income of $0.27 billion in 2021. Meanwhile, Mercado Libre reported total operating expenses of $4.13 billion in 2022 against a gross profit of $5.16 billion, leading to an operating income of $1.03 billion. In 2021, the company recorded a gross profit of $3.01 billion, operating expenses of $2.56 billion, and operating income of $0.44 billion.

The markets are forward-looking, so let’s take a look at the forecasts. Analysts predict that Shopify will generate $6.64 billion in revenue, $3.18 billion in gross profit, and an EBIT of negative $0.06 billion (excluding extraordinary and non-recurring items) in 2023. In comparison, Mercado Libre is expected to report $12.98 billion in revenue, $6.26 billion in gross profit, and an EBIT of $1.38 billion. It is evident, that as of now, Mercado Libre boasts stronger financials and higher growth rates, and is undervalued compared to Shopify even taking into account the country risk premium. However, I am equally excited about the future of both companies!

Want to learn more about Shopify?

Cover image: Shopify

Disclosure & Disclaimer: I own shares in several companies that I write about in this newsletter, as I am bullish on the transformation in the financial services industry. However, the information contained in this newsletter is intended for informational purposes only and should not be considered financial advice. You should do your own research or seek professional advice before making any investment decisions.