This Week in the Markets

The markets started the week on a positive note, advancing on the news of a promising meeting between President Biden and the Chinese leader Xi Jinping on Monday, as well as a lower-than-expected Producer Price Index reported on Tuesday. However, on Wednesday, the U.S. Census Bureau reported an unexpected increase in retail sales in October, which was followed by an (also) unexpected decline in applications for unemployment insurance reported by the U.S. Labour Department on Thursday. Again, the good news for the economy was bad news for the markets. Major U.S. indices gave up early gains and finished the week in the red.

Most of the Fintech companies finished the week in the red, including Nubank (NYSE: ), which reported strong Q3 2022 results on Monday (more on that below). This week also concluded the Q3 2022 reporting cycle.

↑↑ Stone (NASDAQ: ): shares of the Brazilian merchant acquirer, which boasts Warren Buffett’s Berkshire Hathaway as its investor, advanced 4.34% following the announcement of Q3 2022 earnings results. Stone returned to profitability after four quarters of losses that were caused by the rising interest rates and mounting bad debts (see below for more details).

↓↓ dLocal (NASDAQ: ): shares of dLocal, an Uruguay-based payments processor, declined 44.17% during the week following an accusation of fraud by a hedge fund Muddy Waters. The fund announced taking a short position in the company, as its research suggested several “red” flags in dLocal’s reporting (see below for more details).✔️ President Biden, Xi Jinping Move to Stabilize U.S.-China Relations✔️ Wholesale prices rose 0.2% in October, less than expected, as inflation eases✔️ U.S. Consumers Show Strength With Jump in Retail Sales✔️ US Jobless Claims Retreat Slightly, Hovering Near Historic Lows✔️ S&P 500 closes higher on Friday, but ends week with losses✔️ Fed’s Bullard says rate hikes have had ‘only limited effects’ on inflation so far✔️ Fed’s Waller says he’s open to a half-point rate hike at December meeting

Nubank Reaches Profitability

Nubank (NYSE: ) reported its Q3 2022 results on Monday. The company added 5.1 million new customers bringing the total to 70.4 million customers. Nubank is the primary banking partner for over 55% of its customers and 82% of its clients are active on a monthly basis, which makes Nubank the fifth-largest financial institution in Brazil. Revenue increased by 172% compared to Q3 2022 reaching $1.3 billion, and gross profit increased by 91% compared to Q3 2021 reaching $427 million. However, I believe that the most important piece of information in this earnings report was that Nubank reached profitability.

Nubank reported positive Adjusted Net Income in every quarter since becoming a public company in December 2021. However, in Q3 2022 the company reported a Net Income of $7.8 million reaching profitability on an unadjusted basis, which I believe is the result of Nubank navigating the rising interest rate environment masterfully. Thus, the company’s interest-earning credit portfolio increased from $1.4 billion a year ago to $3.5 billion, and the Net Interest Margin increased from 7.7% a year ago to 11.1% in Q3 2022. There’s something special about LatAm Fintech companies: they are usually profitable, and Nubank decided not to be an exception.

✔️ Nu Holdings Ltd. Reports Third Quarter 2022 Financial Results✔️ Buffett-Backed Nubank Surges After Profit Triples, Revenue Jumps✔️ Nubank Exceeds Expectations With $7.8M Q3 Net Profit As Loan Portfolio Swells

On Monday, dLocal (NASDAQ: ) , an Uruguay-based payments processor that helps large corporates, such as Uber, Amazon and Google, to receive and send payments in emerging markets, reported its Q3 2022 results. The company’s quarterly revenue grew 63% YoY reaching $111.9 million, reflecting the 51% YoY growth in Total Payment Volume, which increased from $1.8 billion in Q3 2021 to $2.7 billion in Q3 2022. The company reported a Profit for the Period of $32.3 million, which represents a 29% growth compared to Q3 2021.

However, on Wednesday, a hedge fund Muddy Waters disclosed its short position in the company stating that it suspects fraud, which caused the stock to lose half of its value by the end of the day. Thus, Muddy Waters found a number of discrepancies in dLocal’s disclosures, including inconsistency in reported TPV numbers, conflicting inter-company transactions, and corrections made to the reported dates for exercising options by the founders. The short seller continued to argue that the company’s Take Rates are unsustainable and rely primarily on currency fluctuations, and that the founders have been selling the stock following the IPO.

dLocal promised to address criticism in the future, stating for now that “the report contains numerous inaccurate statements, groundless claims and speculation. Short seller reports are often designed to drive the stock price downwards to serve the short seller’s interests to the detriment of the company’s shareholders.” Let’s see how this drama…story evolves.

✔️ Short seller Muddy Waters bets against Uruguayan payments firm✔️ We are concerned that payment processor dLocal is a fraud, says Muddy Water✔️ Muddy Waters' Block shorts payments firm dLocal; shares halve in value✔️ Dlocal Comments on Short-Seller Report✔️ dLocal Limited Reports 2022 Third Quarter Financial Results✔️ Uruguay's dLocal posts higher quarterly profit as platform grows

Stone Leaves a Year of Losses Behind

Stone (NASDAQ: ), Brazil's leading independent merchant acquirer, reported its Q3 2022 results on Thursday. Revenue increased by 71% compared to Q3 2021 reaching R$2.51 billion, driven by an 84.1% YoY revenue growth in the financial services segment, and a 21.6% in the software segment. Stone posted a Net Income of R$197.1 for the quarter finally ending the streak of losses that was caused by the rising interest rates and credit losses from its lending initiatives.

Last year was tough for Stone. The Central Bank of Brazil started rising interest rates in a fight again inflation, which increased the cost of capital for the company and negatively impacted the profitability of its core business, payment acquiring (Stone allows its merchants to receive funds before they are settled by the card schemes, providing a form of working capital financing). On top of that, the company had to halt its other lending products, as it started facing mounting credit losses. And finally, the company had to mark down its investment in Banco Inter.

Stone’s Q3 2022 results suggest that the worst might be over: the Central Bank of Brazil stopped raising rates, the company is aggressively repricing its acquiring services, and does not rush into relaunching its lending operations. As the result, the company returned to profitability.

👉🏻 If you are new to Stone, I suggest reading the company profile that I published in September: “Stone Profile (NASDAQ: STNE): Warren Buffett's bet on Brazil's small businesses”

✔️ StoneCo Reports Third Quarter 2022 Results✔️ Brazil's StoneCo nearly doubles profits on more users, bigger prices✔️ StoneCo Shares Rise on 3Q Profit

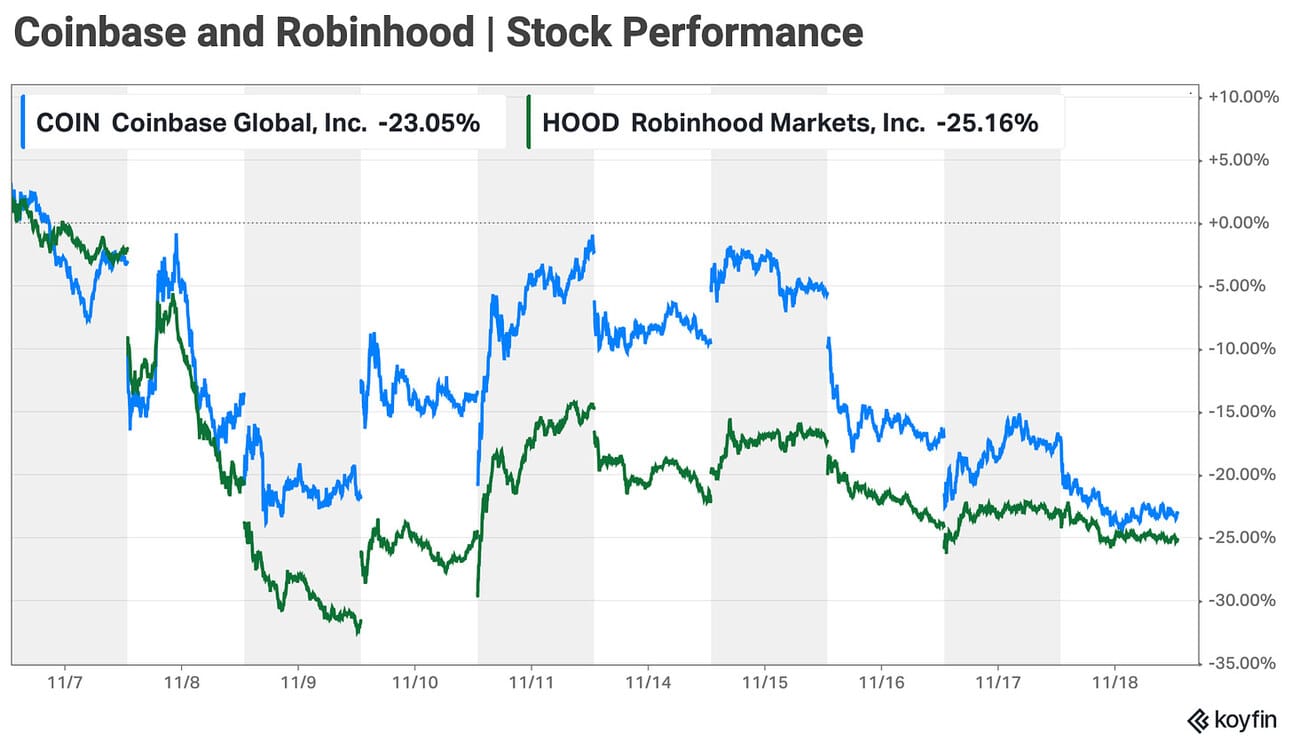

Coinbase and Robinhood Stocks Plunge Following FTX Collapse

Last week I wrote that Coinbase (NASDAQ: ) might be a beneficiary of the FTX collapse. Coinbase is a US-domiciled, regulated and public company, so my thinking was it should benefit from investors fleeing unregulated offshore exchanges. The same applies to Robinhood (NASDAQ: ), which is actively investing in its crypto offering, and is also a US-domiciled, regulated and public company. My thesis might eventually turn out to be correct, but for now everyone in the crypto industry, including Coinbase and Robinhood, is taking a beating.

A number of analysts have downgraded or cut the target prices for both Coinbase and Robinhood stocks, as cryptocurrency investors liquidate their positions or move to Decentralized Exchanges (DEXs) and self-custody. As the result, the share prices of both, Robinhood and Coinbase, have plunged more than 20% since the FTX collapse started unfolding. At the end of Q3 2022, Coinbase had $5 billion in cash, cash equivalents and stablecoins on its balances sheet, and Robinhood had $6.2 billion, so both companies have a sufficient cushion to whether the storm and survive a prolonged crypto winter.

In my latest review of Coinbase earnings results, I argued that investment in the company is a bet on the bright future of the crypto economy. If cryptocurrencies and blockchain technology become an important part of our lives, Coinbase will find its place. However, I looks like lots of investors are losing the hope for this bright crypto future lately.

✔️ FTX Collapse Shakes Wall Street’s Conviction in Coinbase✔️ After FTX, Crypto Exchanges Struggle to Convince Customers They’re Safe✔️ BoA Downgrades Crypto Exchange Coinbase to Neutral in FTX Aftermath✔️ Goldman Cuts Coinbase Price Target, Says It is Insulated From FTX Collapse✔️ FTX’s Collapse Does More Harm Than Good for Rival Coinbase, Analyst Says✔️ Wall Street Sours on Coinbase, Signaling Broad Crypto Doubts✔️ Crypto firm Multicoin expects contagion from FTX to wipe out many trading firms✔️ Coinbase CFO says full contagion impact of FTX collapse still to show✔️ Coinbase: FTX’s Collapse Will Likely Lead to an Extended Crypto Winter✔️ Uniswap overtakes Coinbase for Ethereum trades amid FTX fall-out✔️ Robinhood Seeks to Reassure Customers on Crypto Practices✔️ Mark Cuban-backed fintech Dave says no customers exposed to FTX✔️ Visa Ends Its Debit Card Pact With FTX

In Other News

✔️ Analysis: U.S. banks to pounce on fintech deals as valuations plunge✔️ U.S. Home Sales Fell for Ninth Straight Month in October✔️ Banking giants and New York Fed start 12-week digital dollar pilot✔️ Two Years Since Launching, Pix is the Most-Used Payment Method in Brazil✔️ Visa CEO Alfred Kelly to Retire✔️ Visa promotes McInerney to CEO as Kelly moves to board✔️ Visa CEO Al Kelly to step down, Ryan McInerney to become CEO✔️ Robinhood Markets, Inc. Reports October 2022 Operating Data✔️ Activist Investor Rips Envestnet’s Performance, Threatens Rival Board Slate✔️ Activist Impactive eyes proxy fight at Envestnet amid sluggish stock price✔️ PayPal launches return shopping feature✔️ Wells Fargo launches small-dollar loan product

Disclosure & Disclaimer: despite rocky performance in 2021 and 2022, I own shares in most of the companies that I write about in this newsletter, as I am extremely bullish on the transformation in the financial services industry. However, none of the above is financial advice, and you should do your own research.