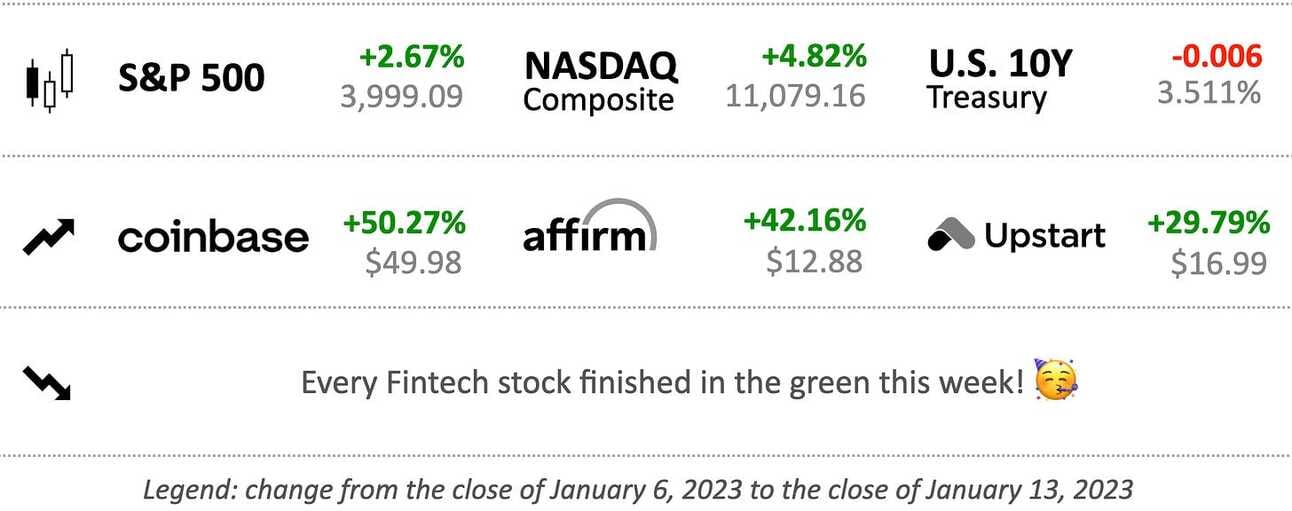

This Week in the Markets

On Thursday, the U.S. Department of Labor reported inflation data for December 2022. The Consumer Price Index declined 0.1% compared to November 2022 on a seasonally-adjusted basis (the largest month-over-month decline since April 2020) and increased 6.5% compared to December 2021 (the smallest year-over-year increase since October 2021), which was in line with the economists’ forecasts.

On Friday, the largest U.S. banks, including JPMorgan Chase (NYSE: ), Bank of America (NYSE: ), Citigroup (NYSE: ), and Wells Fargo (NYSE: ) reported their Q4 2022 and full-year results. The banks are preparing for a potential recession by setting aside reserves for credit losses, but otherwise, higher interest rates were good for business, and consumers are still fine.

Inflation is slowing down, and the economy is not collapsing under the weight of higher interest rates, as some macroeconomists suggested. Good enough reasons for a market rally this week!

Shares of Coinbase (NASDAQ: ), Affirm (NASDAQ: ), and Upstart (NASDAQ: ) lead this week’s rally. Do you know what’s common about a cryptocurrency exchange, a Buy Now Pay Layer company, and a consumer lender without its own balance sheet? These are some of the most beaten-down Fintech stocks! Before this week’s rally, Coinbase shares were down 90.30%, Affirm shares were down 94.48%, and Upstart shares were down 96.64% from their respective all-time highs. Coinbase also announced a second round of layoffs impacting 20% of the company’s workforce (more on that below).

✔️ Consumer prices fell 0.1% in December, in line with expectations from economists✔️ U.S. Inflation Slowed for Sixth Straight Month in December✔️ US Inflation Cools Again, Putting Fed on Track to Downshift✔️ JPMorgan tops estimates for fourth-quarter revenue, but says mild recession is now ‘central case’✔️ Bank of America tops expectations as higher rates help offset declines in investment banking✔️ Citigroup’s fourth-quarter profit declines by 21% as bank sets aside more money for credit losses✔️ US Banks See Consumers Piling On Debt, Boosting Bottom Lines

Coinbase Announces Second Round of Layoffs, Cuts 20% of Workforce

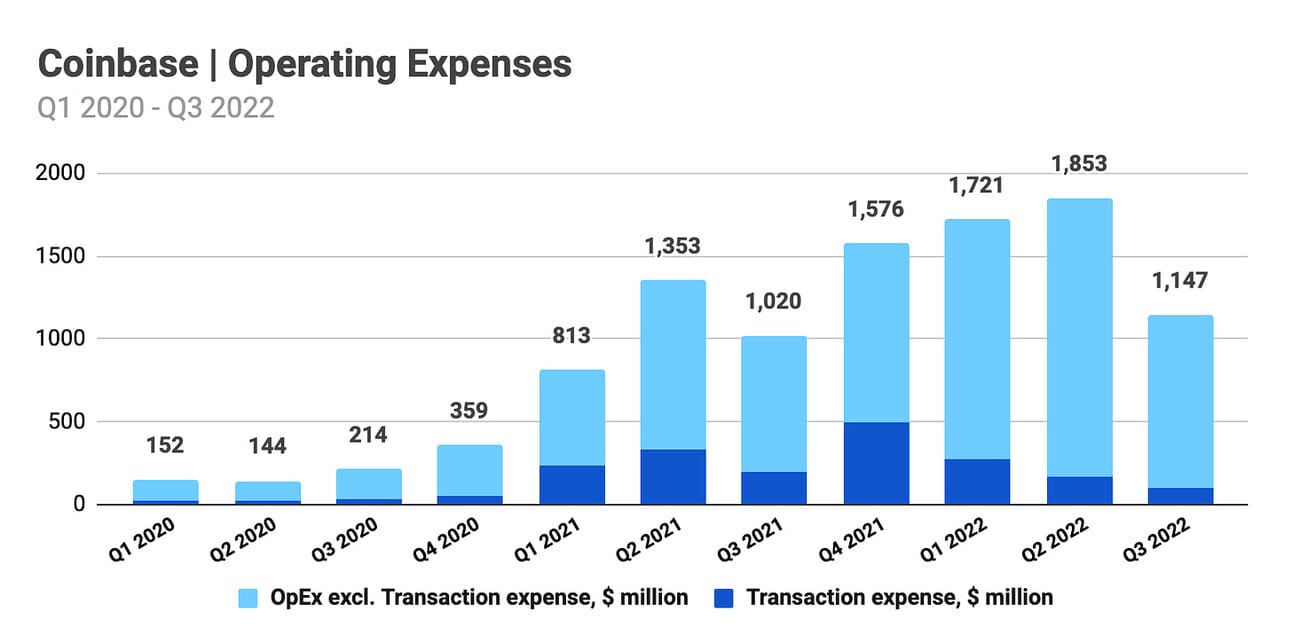

Coinbase (NASDAQ: ) announced a new round of layoffs that will impact 950 employees or approximately 20% of the company's workforce. In a blog post, the company's CEO and co-founder, Brian Armstrong, reasoned the layoffs with the ambition to “reduce operating expense by about 25%” in order to increase the company’s “chances of doing well in every scenario [in 2023].”. The layoffs are a culmination of another roller coaster quarter in the crypto industry, which included a collapse of FTX and further declines in cryptocurrency trading volumes. In June 2022, the company laid off approximately 1,100 employees, or 18% of its workforce at the time.

Investors welcomed the initiative, as the shares of the company advanced 50.27% during the week. In the 8-K filing with the SEC, Coinbase clarified that it expects its operating expenses, comprising Sales and Marketing, Technology and Development, and General and Administrative (including stock-based compensation, but excluding restructuring expenses), for Q1 2023 to be approximately 25% lower than those operating expenses for Q4 2022. Coinbase estimates that “it will incur approximately $149 million to $163 million in total restructuring expenses.” The company also expects to finish 2022 within the negative Adjusted EBITDA guardrail of $500 million, which it communicated to shareholders earlier in the year.

✔️ Coinbase to slash 20% of workforce in second major round of job cuts✔️ Coinbase Crypto Exchange to Cut Nearly 1,000 Jobs✔️ A message from CEO and Co-Founder, Brian Armstrong, to Coinbase employees✔️ Coinbase shares pop 12% on company’s plans to slash workforce✔️ Coinbase’s Job Cuts Take Worst-Case Scenario for the Stock Off the Table✔️ Analysts ‘Encouraged’ by Coinbase Layoffs, Showing Company Is Being Disciplined✔️ Coinbase Gets a Downgrade. But Not Everyone on Wall Street Is Bearish✔️ As Crypto Crashes, Coinbase Bets Big on Europe✔️ The David Rubenstein Show: Coinbase's Brian Armstrong

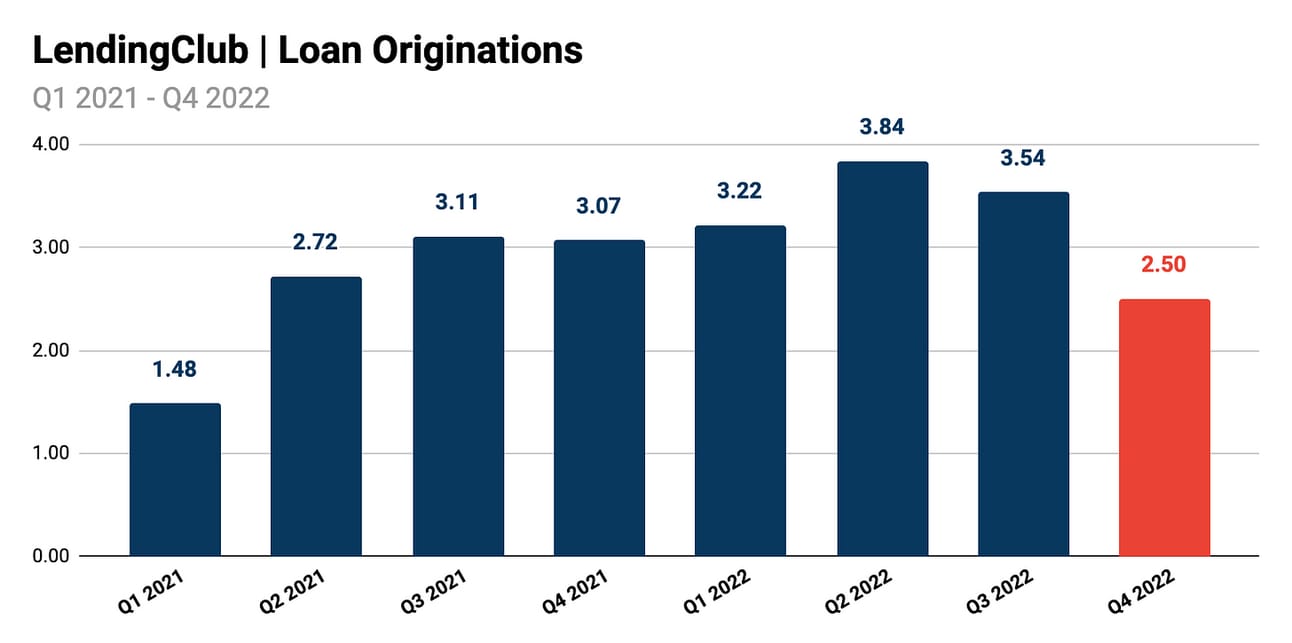

LendingClub Cuts 14% of its Workforce, Pre-Announces Q4 2022 Financial Results

LendingClub (NYSE: ), a pioneer in online lending, announced laying off 225 employees, or 14% of the company's workforce. "These measures enable us to more closely align our expense structure to loan volume and revenue, while ensuring effective execution against our strategic priorities and long-term vision," commented Scott Sanborn, the company's CEO, in the press release. The company also pre-announced Q4 2022 results, reporting a decline in origination volumes from $3.54 billion in Q3 2022 to $2.50 billion in Q4 2022. LendingClub will report its Q4 2022 results at the end of January, but, similar to Q3 2022, I would expect the decline in origination volumes to come from weaker demand for marketplace loans.

LendingClub’s management expects Q4 2022 revenue to be in the range of $260 to $263 million, and full-year revenue to be in the range of $1.18 to $1.19 billion. The company also expects a Net Income of $21 to $24 million for the quarter and a Net Income of $287 to $290 million for the full year of 2022. These results are in line with the guidance that the company provided in Q3 2022. The company expects to incur non-recurring charges related to layoffs of approximately $5.7 million (of which $4.4 million were written off in Q4 2022), and “anticipates the workforce reductions will result in annualized run-rate savings in compensation and benefits of approximately $25 to $30 million in 2023.”

In case you missed my review of LendingClub’s Q3 2022 results 👉🏻 “LendingClub Q3 2022 Earnings Review: getting a banking charter was a smart decision”

✔️ LendingClub to Cut 225 Workers, Take Charges of $5.7 Million✔️ LendingClub cuts 14% workforce to pare costs✔️ LendingClub Announces Plan to Streamline Operations✔️ LendingClub’s New CFO Tasked With Preparing Its Balance Sheet for a Downturn

Amazon Expands its “Buy with Prime” Service to All Eligible U.S.-based Merchants

Amazon announced expanding its “Buy with Prime” service to all eligible U.S.-based merchants by the end of January. The company launched the service, which allows online merchants to benefit from Amazon’s checkout, payments, shipping, and returns handling infrastructure, in April 2022, and until now piloted it in an invitation-only mode. “Buy with Prime” allows millions of Amazon Prime members to shop directly from merchants’ stores with the “trusted experience they expect from Amazon.” The company claims that enabling “Buy with Prime” as a payment option at checkout “increases shopper conversion by 25% on average.”

Image source: Amazon

Amazon is not the first company to attempt to monetize its infrastructure with independent retailers. Thus, Shopify (NYSE: ) allows merchants (that are not using the company's e-commerce platform) to use its checkout and payments product, "Shop Pay.", and Block (NYSE: ) is in the process of expanding “Cash App Pay” outside of its Square ecosystem of merchants. However, Amazon, and its approximately 150 million U.S. Prime Members, are definitely a force to reckon with, especially, given that the company’s offering goes beyond checkout and payments, and includes delivery and returns. Shopify, thanks to its “Shopify Fulfilment Network” service, is probably the only company that can match Amazon’s offering.

Want to learn more about Shopify? 👉🏻 “Shopify Profile (NYSE: SHOP): making commerce better for everyone”

✔️ Amazon to widely launch 'Buy with Prime'✔️ Amazon expands its service that adds Prime badge to other sites✔️ Amazon Is Expanding Its ‘Buy With Prime’ Program✔️ Amazon's Buy with Prime increases shopper conversion by 25% on average✔️ Shopify warns merchants against using Amazon’s ‘Buy With Prime’ service✔️ Amazon opens up Prime delivery service to other retailers

Goldman Sachs Discloses a $3 Billion Loss in its Consumer Banking Business

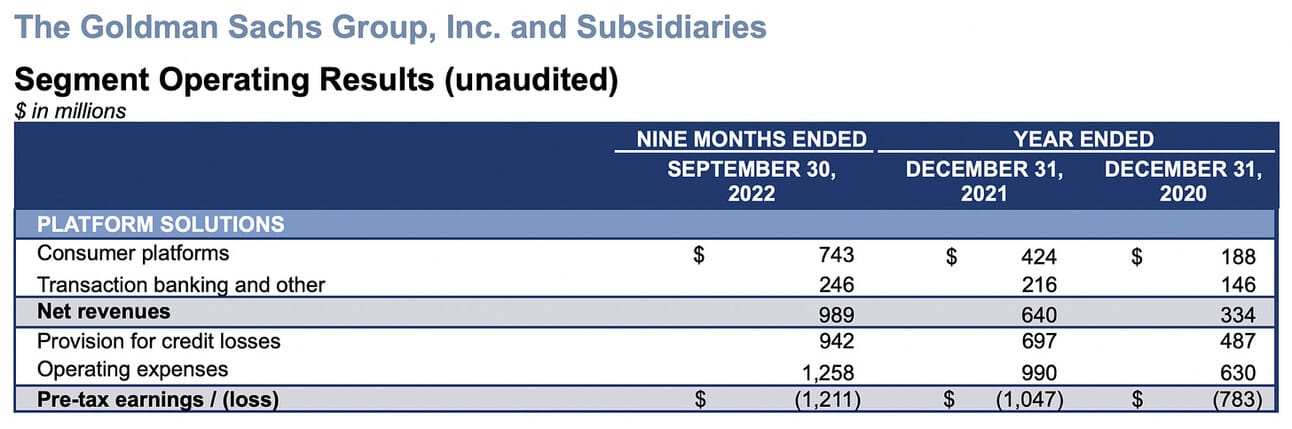

In Q3 2022, Goldman Sachs (NYSE: ) announced the plan to restructure its consumer banking business, Marcus by Goldman Sachs. Thus, consumer-facing products, such as personal loans and high-yield savings accounts, would be incorporated into the “Asset & Wealth Management” segment, while the partnerships with Apple and GM, as well as GreenSky business, would form a new segment “Platform Solutions”. Previously, Marcus’ results were reported under the “Consumer & Wealth Management” segment, so it was difficult to dissect the true performance of this business. However, on Thursday, Goldman Sach released preliminary Q4 2022 results of its new segments, including “Platform Solutions”…

Image source: Goldman Sachs

The released results (Form 8-K) showed that Goldman Sach’s “Platform Solutions” business lost $1.21 billion in the first nine months of 2022, and $3.04 billion since the beginning of 2020. The segment delivered net revenue of $0.99 billion in Q1-Q3 2022, while booking $0.94 billion in provisions for credit losses, and $1.26 billion in Operating expenses. Please note that these numbers exclude Goldman’s losses on Marcus’ consumer-facing products that were incorporated into the “Asset & Wealth Management” segment. Goldman Sachs will report its Q4 2022 results on Tuesday, January 17. I’d expect the company’s chief to get a lot of questions on the company’s plans for the “Platform Solutions” business.

✔️ Goldman Sachs Details Consumer Banking Losses for First Time✔️ Goldman Sachs Lost $3 Billion on Consumer Lending Push✔️ Goldman Lost $1.2 Billion in Just Nine Months in Newest Unit✔️ Goldman Sachs is cutting up to 3,200 employees this week

In Other News

✔️ Mortgage Rates Fell to 6.33%. Cooling Inflation Could Push Them Lower✔️ The Wait(list) is Over - Robinhood Retirement is Now Available to All Customers✔️ PayPal, Visa team on faster cross-border payments✔️ PayPal loses another finance executive✔️ Will PayPal get a new CEO?✔️ Stripe Cuts Valuation 11% to $63 Billion, The Information Says✔️ Payments Firm DLocal to Stick With Cash, Focus on Growth✔️ Crypto firms Genesis and Gemini charged by SEC✔️ Crypto.com to cut 20% jobs as industry rout deepens after FTX collapse✔️ BILL to Report Second Quarter Fiscal 2023 Financial Results on February 2, 2023✔️ Lightspeed Announces Fiscal Third Quarter 2023 Financial Results Conference Call✔️ Mastercard to Host Conference Call on Fourth Quarter and Full Year 2022 Results✔️ Blend Announces Strategic and Financial Initiatives to Achieve Path to Profitability✔️ Duck Creek Is Being Bought by Vista Equity Partners for $2.6 Billion✔️ SoFi Report Reveals 85% of Investors Plan to Change How They Invest in 2023✔️ Wells Fargo Dials Back Mortgages, Servicing in New Strategy✔️ Brazilian Fintech Ebanx Changes Leadership, Reinforces AI Push

Disclosure & Disclaimer: I own shares in several companies that I write about in this newsletter, as I am bullish on the transformation in the financial services industry. However, the information contained in this newsletter is intended for informational purposes only and should not be considered financial advice. You should do your own research or seek professional advice before making any investment decisions.