Hey!

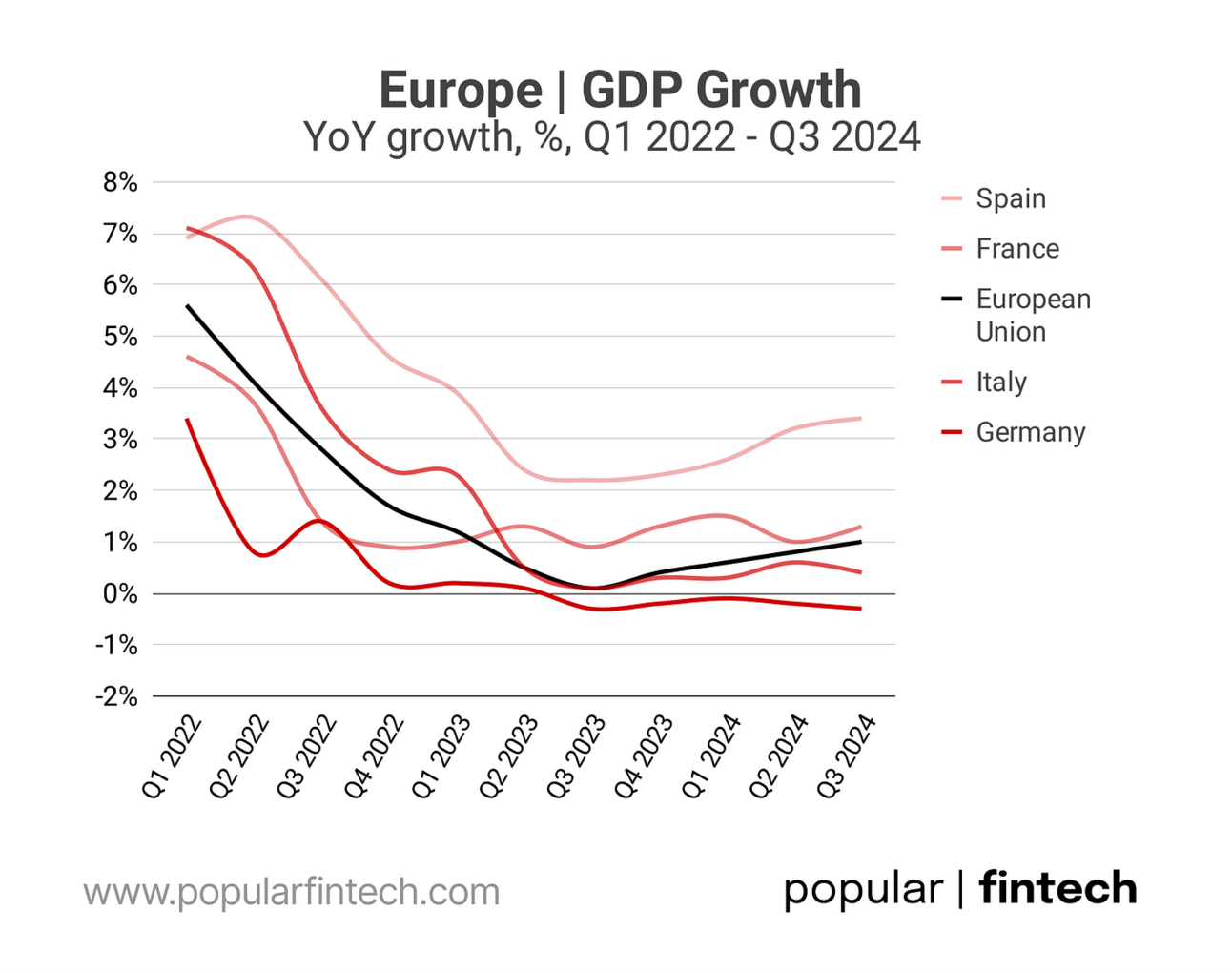

Most European economies are struggling. In the third quarter of 2024, the EU economy grew by only 1.0% year-over-year, significantly lagging behind the U.S. economy, which expanded by 2.8% year-over-year. However, card payments in Europe are booming!

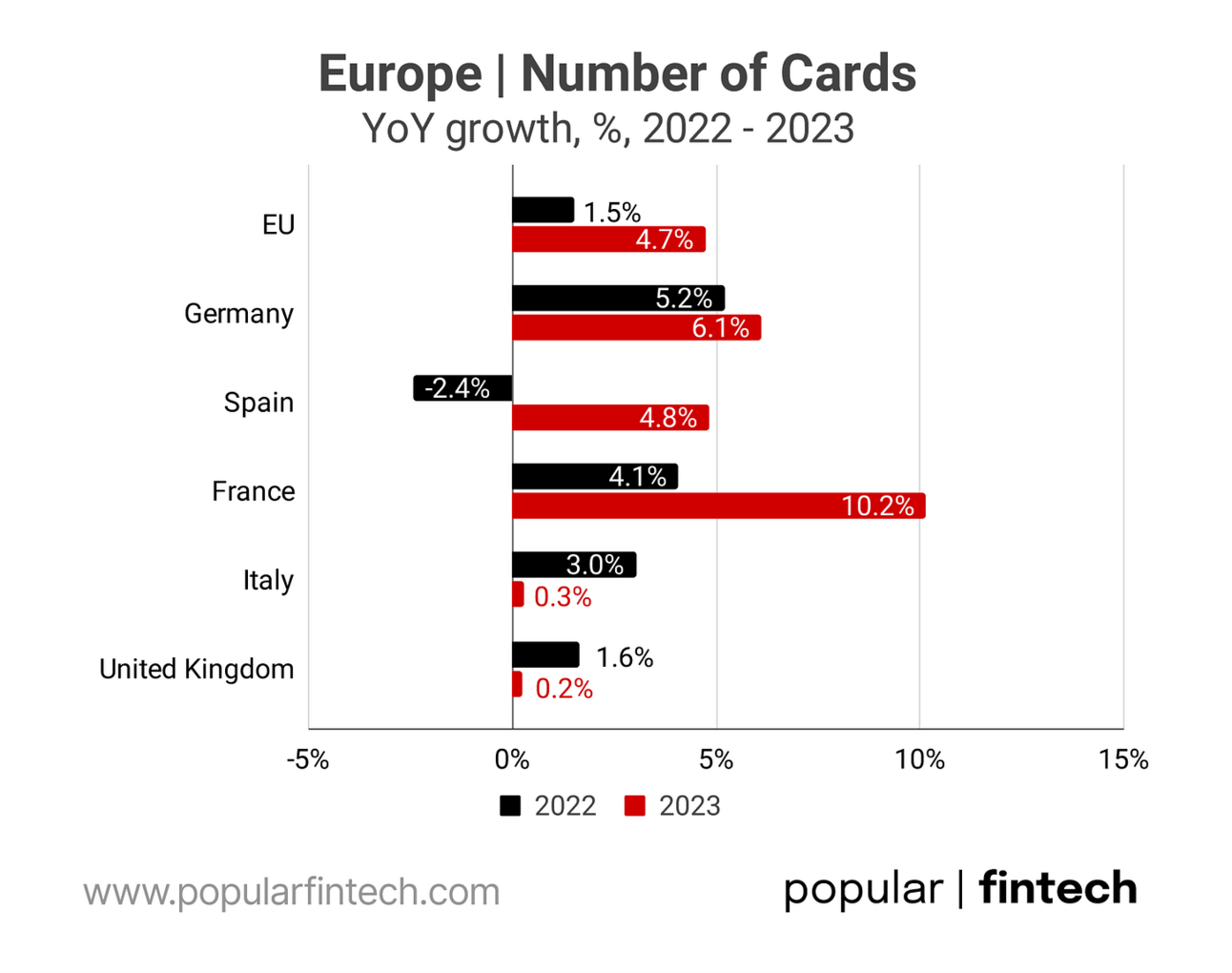

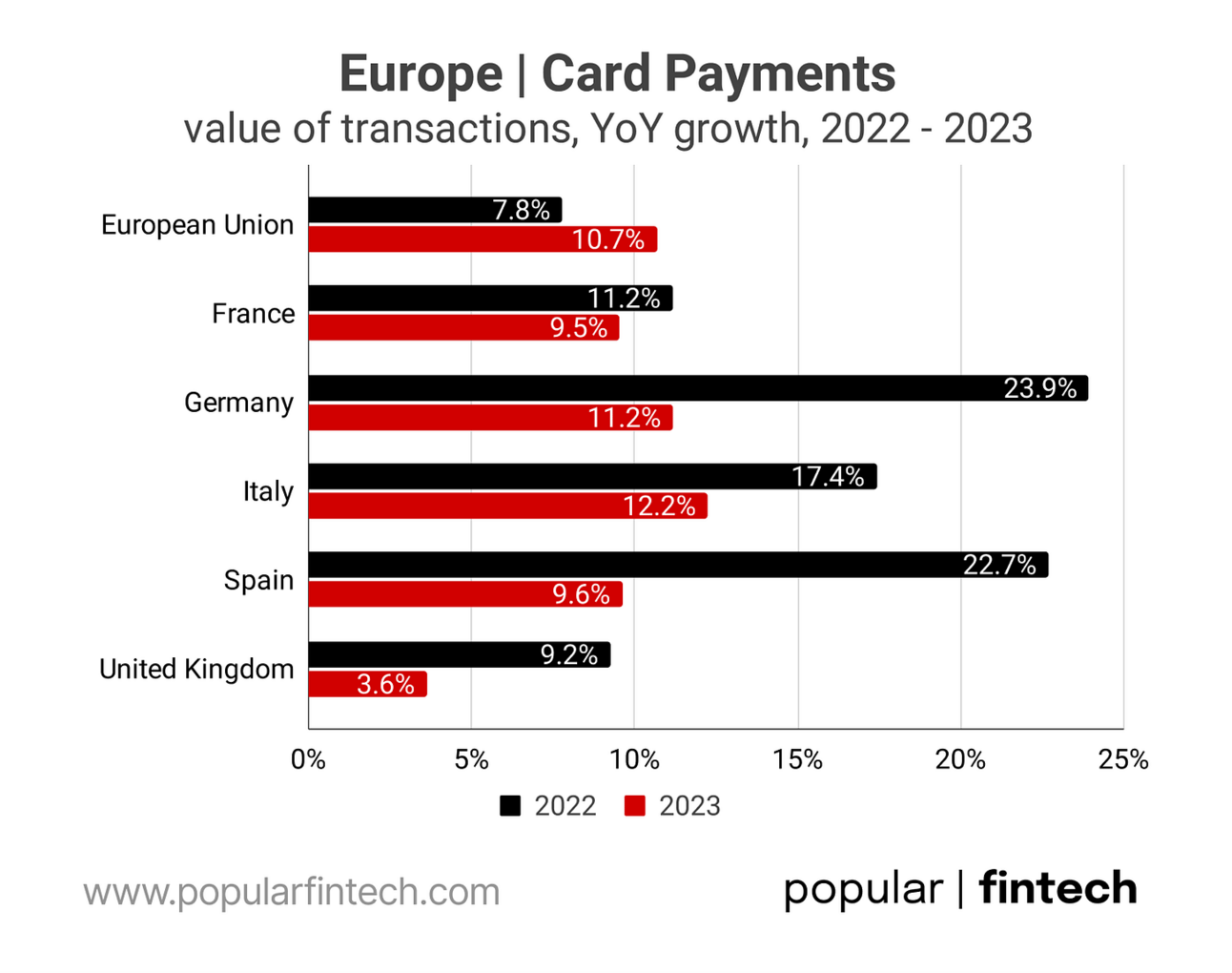

In 2023, the value of card payments in the European Union grew by 10.7% year-over-year, up from 7.8% year-over-year in 2022. The growth is driven by the shift toward card payments in traditionally cash-heavy economies like Germany, Italy, and France. In 2023 alone, the number of cards in Germany increased 6.1% YoY, and the value of card payments increased 11.2% YoY.

Visa and Mastercard are capitalizing on this secular trend, delivering double-digit growth in European payment volumes. However, the card payment ecosystem extends beyond these giants, meaning there are likely additional beneficiaries. Notably, these are not the incumbent payment companies.

So who else is capturing this growth?

Jevgenijs

p.s. if you have feedback just reply to this email or ping me on X/Twitter

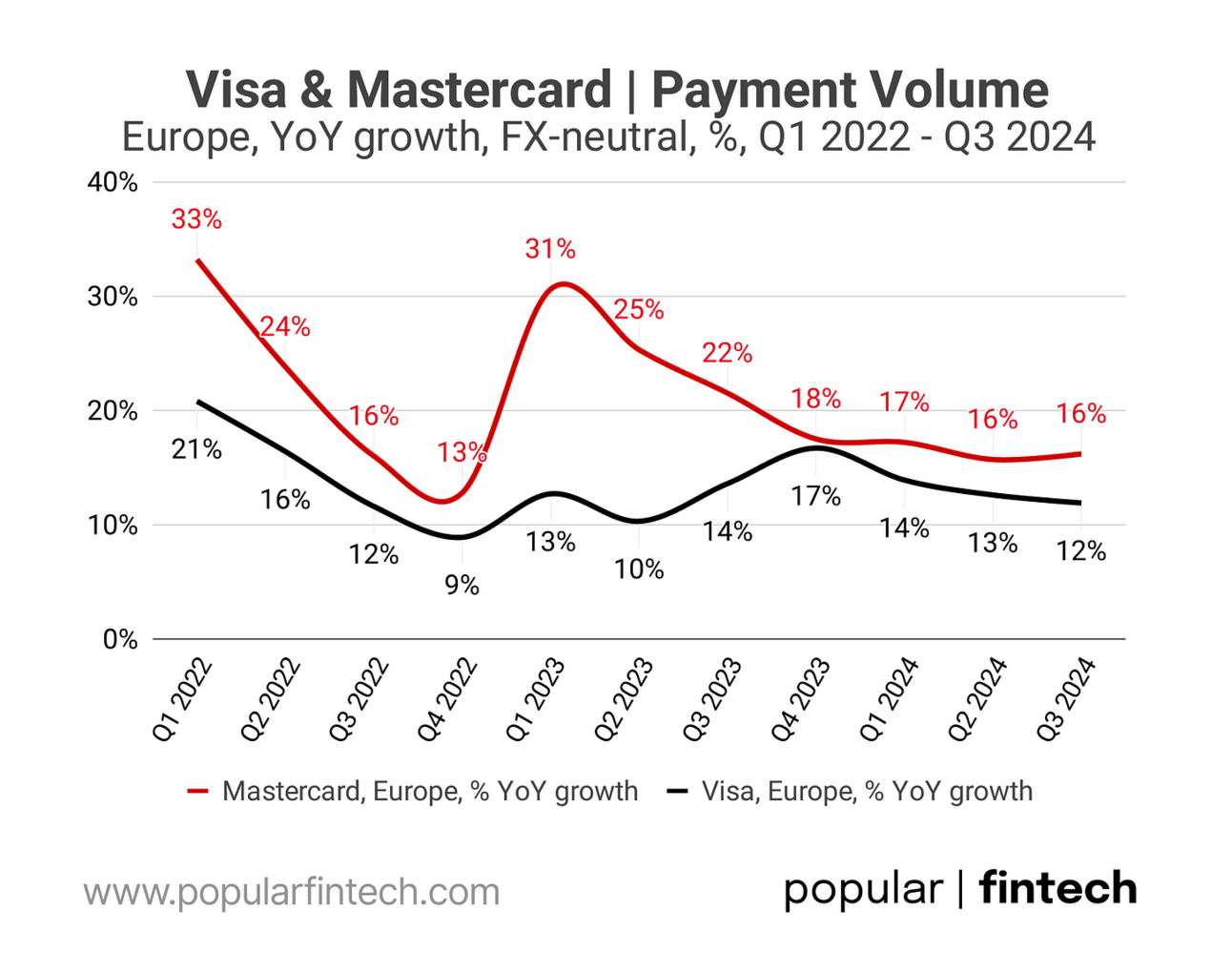

In Q3 2024, the EU economy grew just 1.0% YoY, significantly lower than the 2.8% YoY growth seen in the U.S. However, both Visa and Mastercard saw double-digit growth in European payment volumes. Thus, Visa’s European payment volume increased 11.9% YoY, while Mastercard’s payment volume increased 16.2% YoY. And the third quarter was not an anomaly, both Visa and Mastercard enjoyed double-digit growth in European payment volume for a while now.

There is probably a story in why Mastercard has consistently outperformed Visa in Europe, but that is not my focus for today. What sparked my curiosity is what fuels double-digit growth in an economy facing challenging times. I mean, if Mastercard’s payment volume growth is used as an indicator of the European economy’s health, then Europe appears to be thriving (but as the GDP growth rates suggest, it isn’t).

“…Europe is clearly a very important region. We continue to perform well in that region. What we're seeing from a macro standpoint, and you've probably seen this in the most recent economic data, is you're starting to see positive trends come through there with momentum in France and Spain, and even in Germany.”

Sachin Mehra, Mastercard CFO, Q3 2024 earnings call

There is a second question here: a whole ecosystem of companies exists around card payments (PSPs, acquirers, issuers, issuer processors, etc). If Visa and Mastercard volumes are growing by double digits, who else is benefiting from this growth? There have to be acquirers and issuers on both sides of Visa and Mastercard transactions.

Visa and Mastercard are the largest card schemes in Europe, but they are not the only ones. There are several domestic schemes such as Cartes Bancaires in France (over 70 million cards), girocard in Germany (over 100 million cards), or Dankort in Denmark (over 5 million cards). Visa and Mastercard executives often mention winning business from European domestic schemes. For instance, Visa claims to have converted more than 20 million cards from local schemes over the 2018-2023 period.

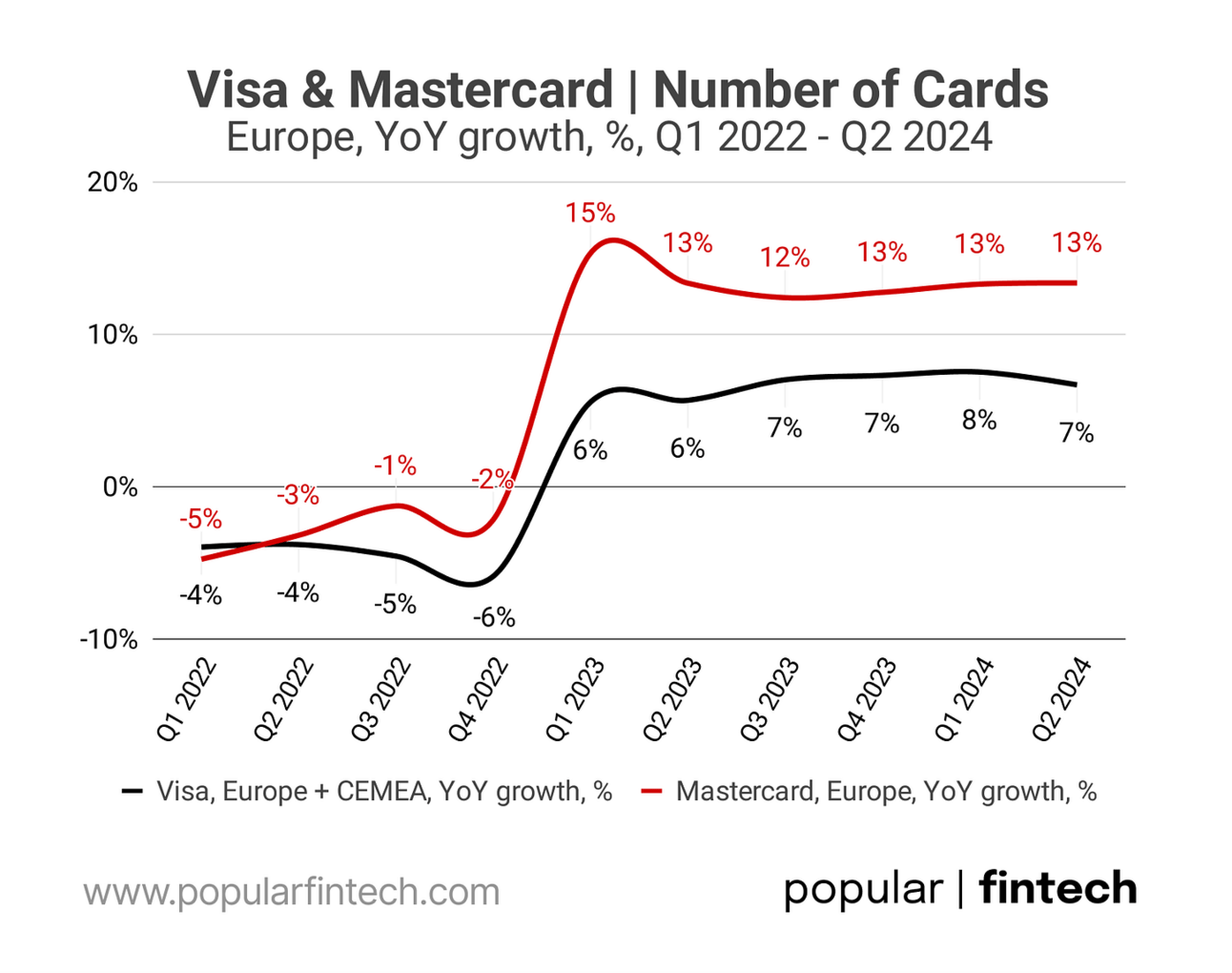

So one reason for Visa’s and Mastercard’s growth is their increasing market share in Europe, rather than overall market growth. Thus, in 2023 and 2024, the number of European cards carrying the Visa logo has been increasing at 6-7% YoY, and the number of cards carrying the Mastercard logo has been increasing at 12-15% YoY. The drop in the number of cards in 2022 is attributable to Russia’s invasion of Ukraine, which resulted in Visa and Mastercard leaving the market.

“One area of focus is in Europe, with the U.K. growing credentials at its fastest rate since 2016 driven in part by strong growth from fintech clients. In addition, from 2018 to 2023, we converted more than 20 million credentials in Europe that primarily ran on domestic networks to Visa Debit credentials, with millions more in the process of being migrated.”

Visa, Fiscal Q2 2024 (CY Q1 2024) earnings call

In 2023, the total number of cards in the European Union grew by 4.7% year-over-year. Interestingly, the countries with strong local schemes, Germany and France, experienced even higher growth in the number of cards (6.1% YoY and 10.2% YoY respectively). Visa and especially Mastercard have been expanding their portfolios at a rate that is higher than the EU average.

However, there is more to this than Visa and Mastercard winning business from the domestic schemes. Many large European countries experience double-digit growth in card payments (see the chart below). I mean, the European Union’s average growth in 2023 was 10.7%, up from 7.8% YoY in 2022! Many European economies are hardly growing, but card payments are booming in Europe.

“And I'm not seeing a short runway from where I sit. What I'm seeing is when we drive into these fast-growing economies, massive amounts of cash. You heard us talk about Africa, Asia and Latin America, 90% cash in Africa. You go into developed economies, still significant amounts of cash. Germany, Italy, Japan, 30%, 40% of cash out there.”

Michael Miebach, Mastercard CEO, Investor Day 2024

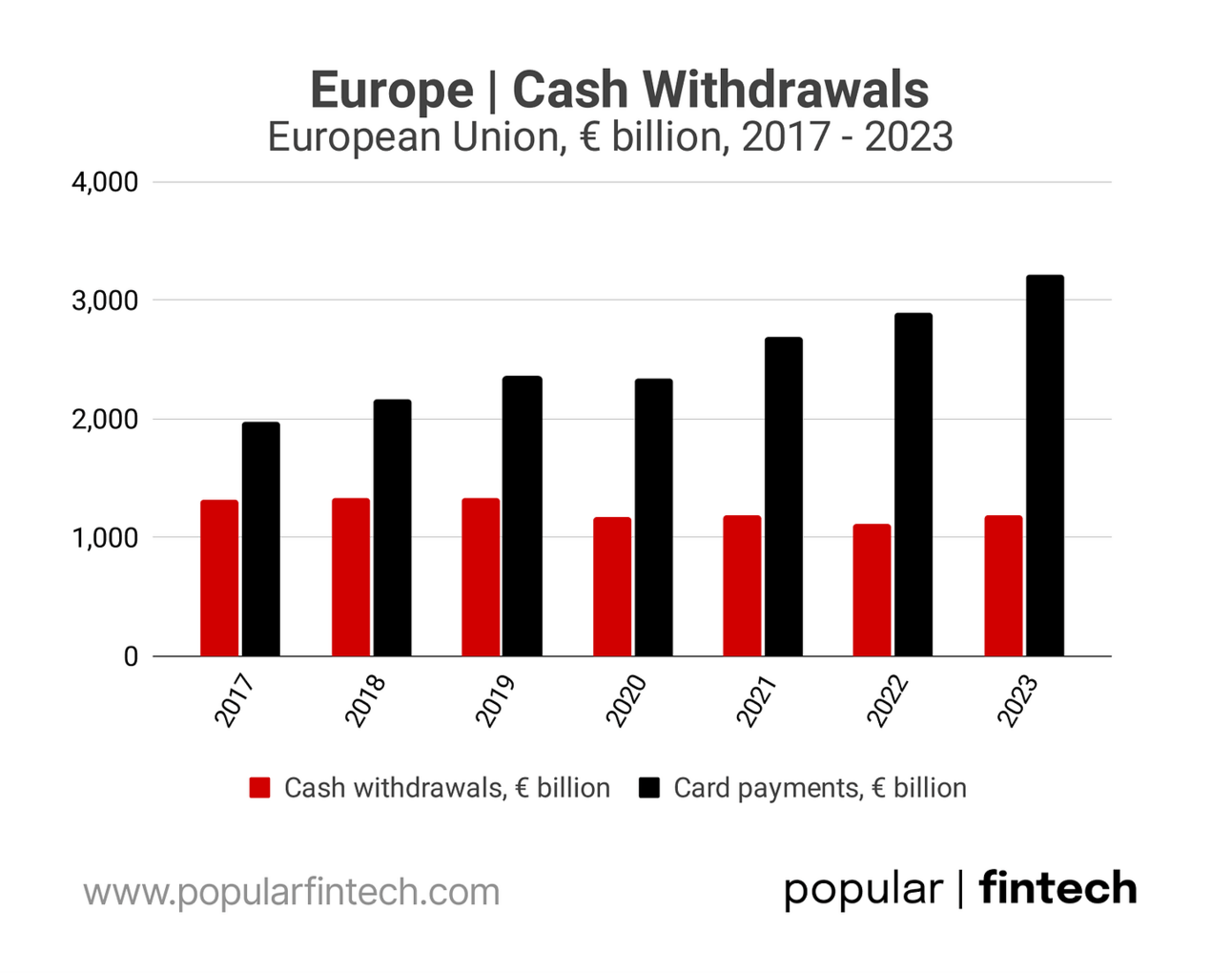

The driver behind this growth, at least according to the Visa and Mastercard executives, is the secular trend of payment digitalization. Thus, many large European economies still heavily rely on cash, and the transition from cash to card payments is still underway. The use of cash (proxied by cash withdrawals at ATMs) declined at the onset of the pandemic and remained flat since then (see the chart below).

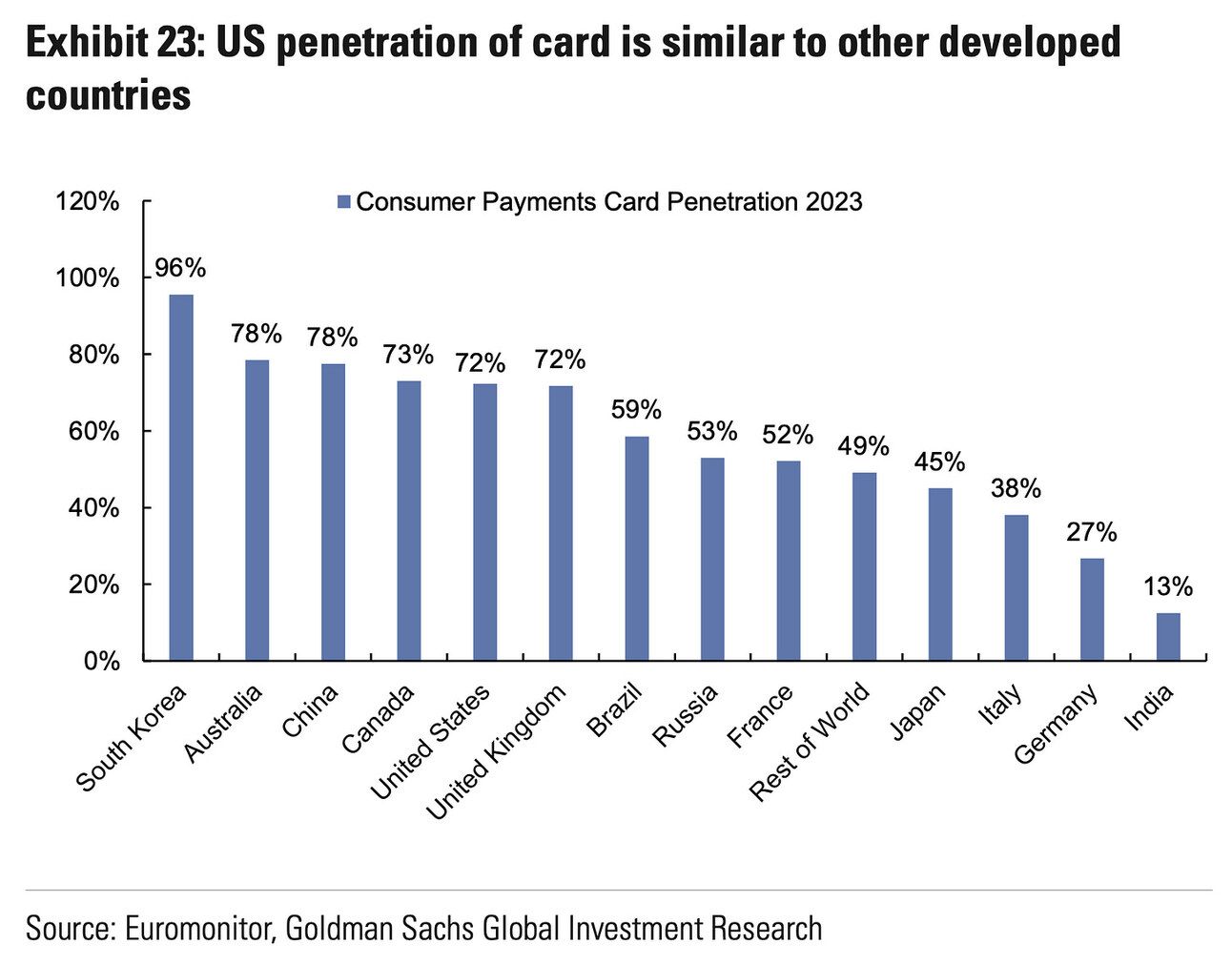

Germany, Italy, France, and Spain are the largest countries in the EU and contribute 2/3 of the union’s total card payment volume. These countries are also far behind the United Kingdom and the U.S. in terms of card penetration (see the chart below). Therefore, I would expect Visa and Mastercard to continue seeing rapid growth in Europe (though I understand that “Europe” for them is more than the EU).

In summary, the number of cards is growing at a high single-digit rate, while card payment volumes are increasing at a low double-digit rate across several major European countries. So, besides Visa and Mastercard, who else is benefiting from this growth? These are certainly not the European payment incumbents, Nexi and Worldline.

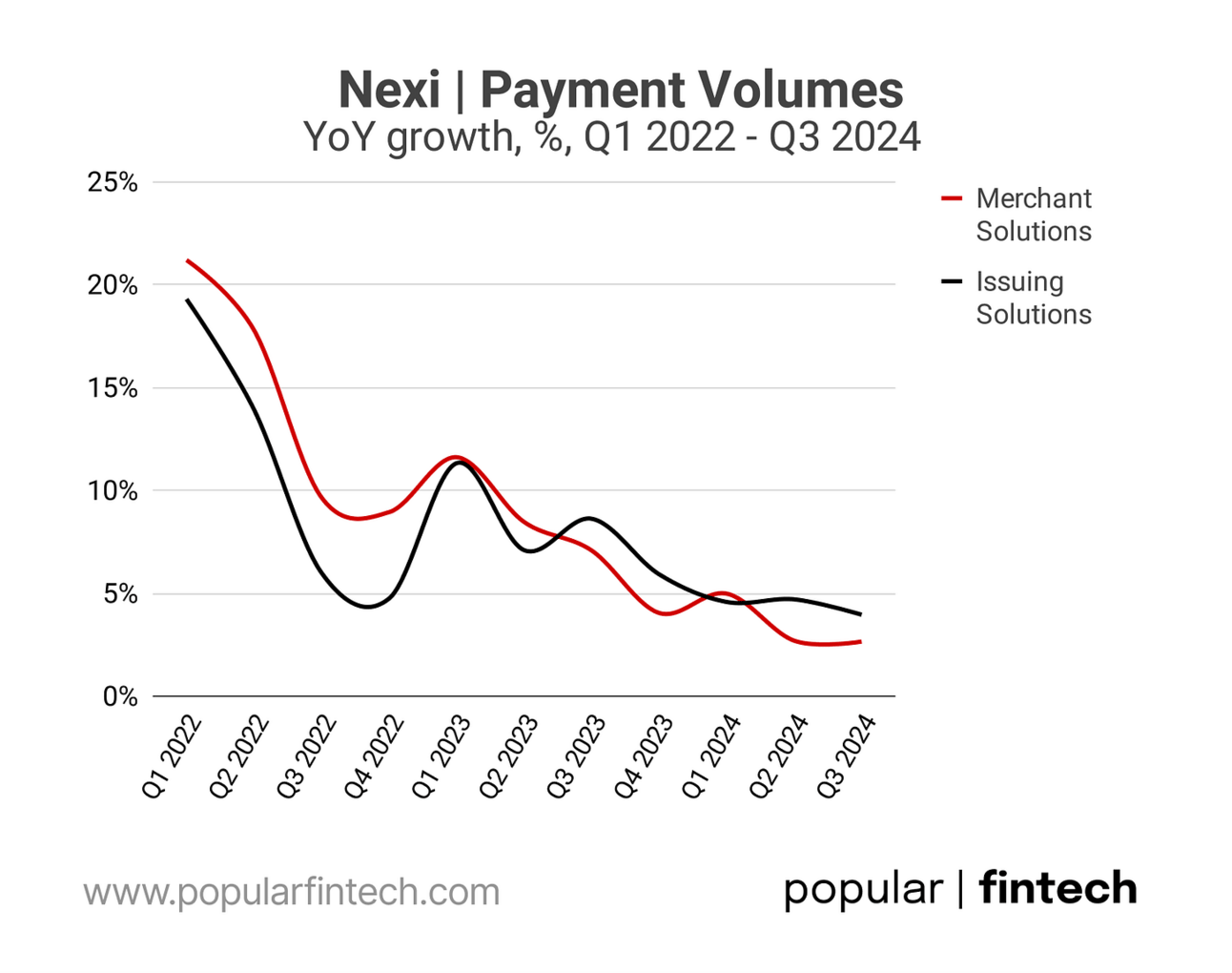

For example, in Q3 2024, Nexi reported a 2.7% YoY payment volume growth in its Merchant Solutions segment (6.6% YoY revenue growth), and a 4.0% YoY payment volume growth in its Issuing Solutions segment (2.8% YoY growth). Nexi guided for “mid-single digit revenue growth” for the full year of 2024.

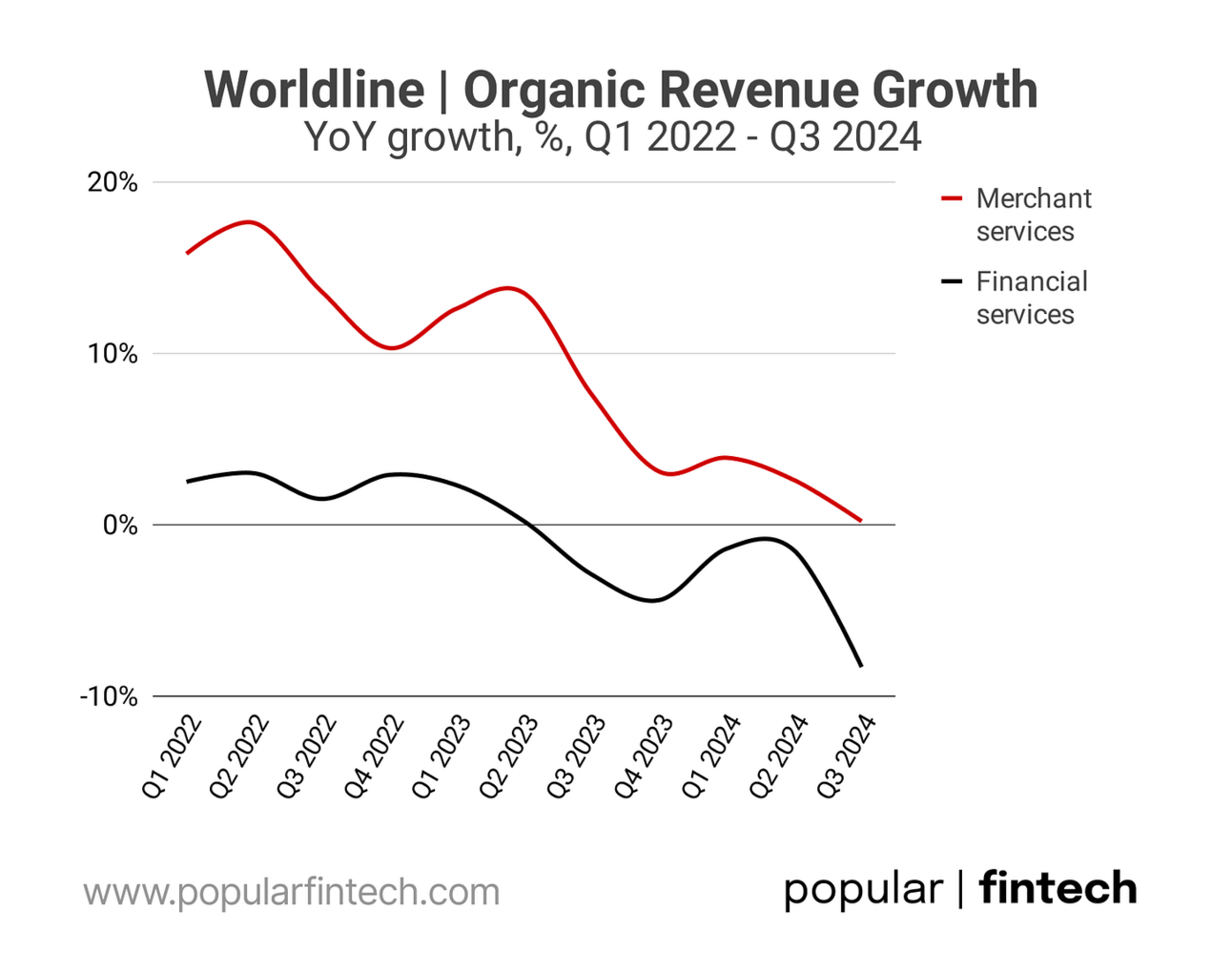

Worldline reported a 0.2% YoY organic revenue growth in its Merchant services segment (3% YoY growth in acquiring volume) and an 8.3% YoY decline in its Financial services segment (which includes issuing and processing). In September 2024, Worldline fired its CEO and lowered the full-year 2024 organic revenue growth guidance to 1% YoY.

Nexi and Worldline are the two largest European merchant acquirers based on revenue and their core markets are Italy, France, and Germany…exactly the countries that are going through the rapid growth in the number of cards and card payment volumes. The companies cite benefiting from the secular shifts from cash, and yet, still underperform the overall market growth.

Overall, there are three structural long-term growth drivers. First of all, the secular shift from cash to digital payments. This remains the stronger driver of the growth for the company, we believe, for the sector more broadly. Obviously, this can vary by market depending on the stage that they are in, but we see this continuing for the very, very, very long term.

Paolo Bertoluzzo, Nexi CEO, Q3 2024 earnigns call

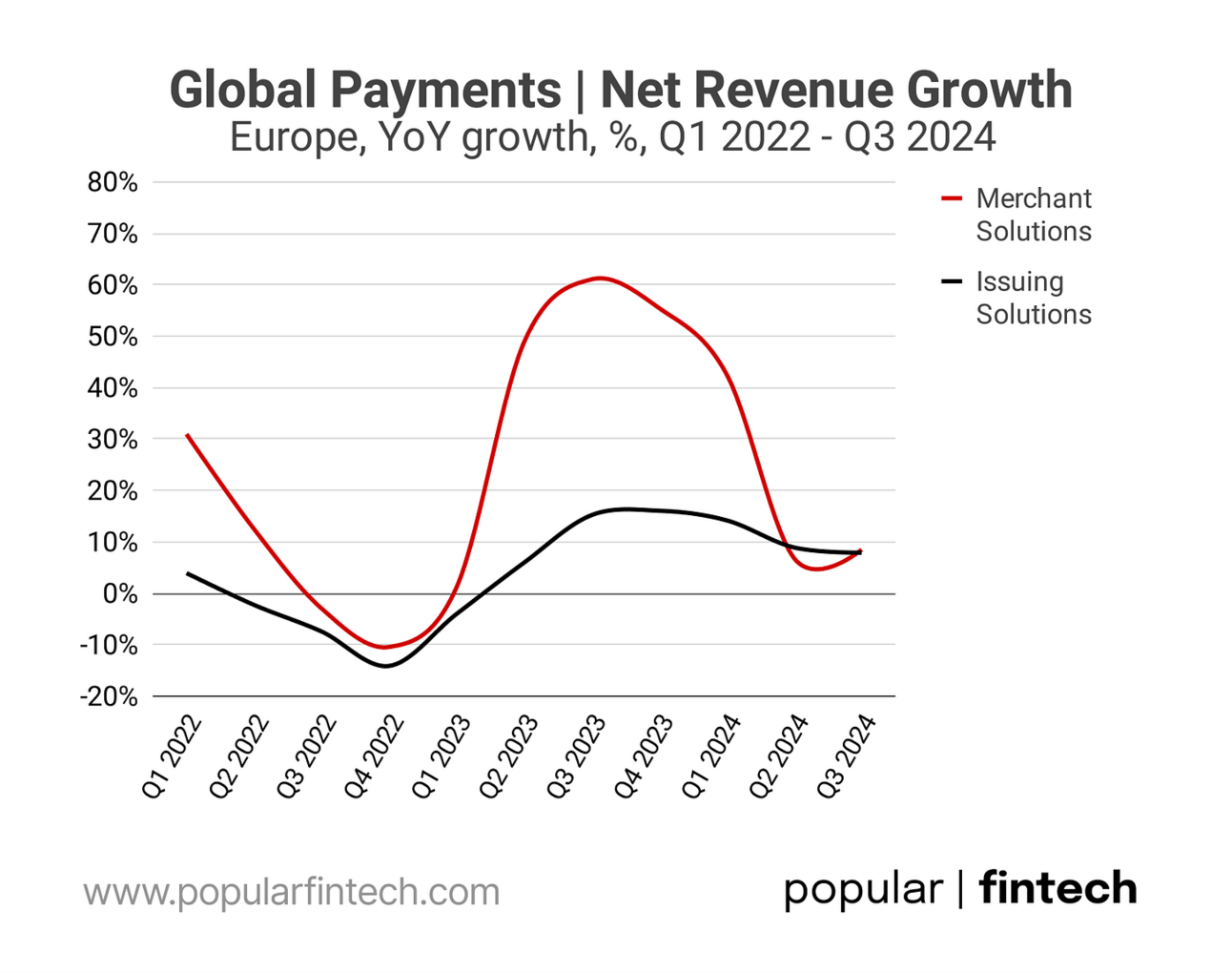

I wouldn’t say that Global Payments is doing any better. The company bought growth by acquiring EVO Payments in 2023. However, after the effects of the acquisition lapsed, Global Payments' revenue growth in its European acquiring and issuing businesses slowed to single digits. Global Payments is trying to repeat the trick by acquiring Takepayments in the United Kingdom.

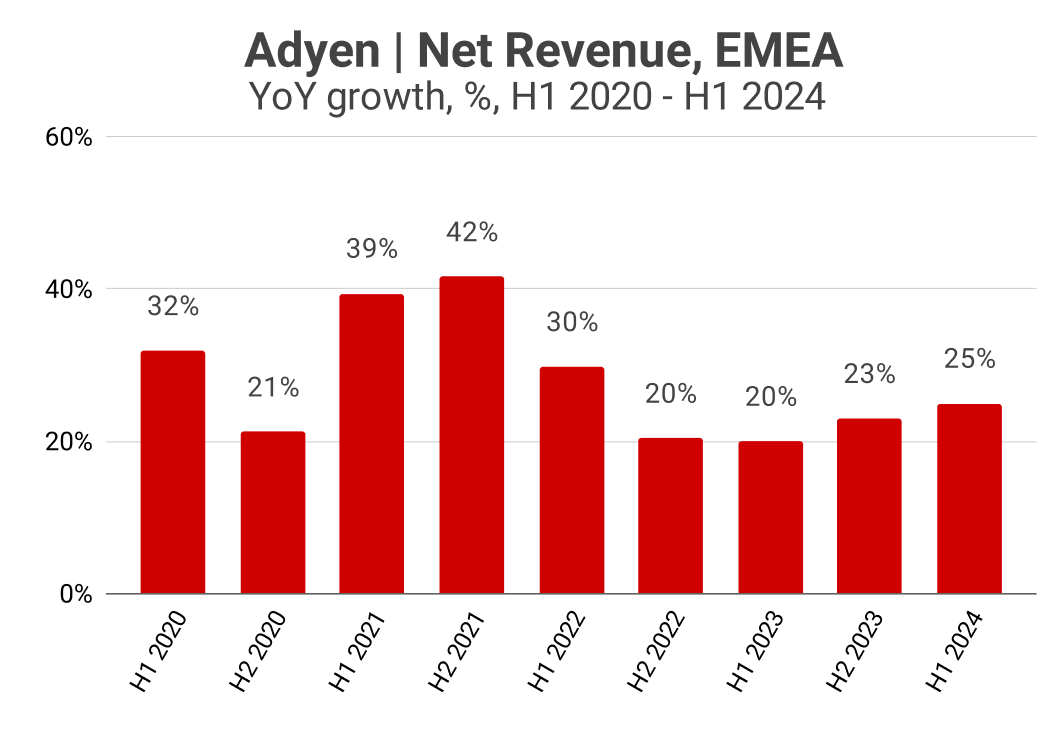

One company that is certainly winning in Europe is Adyen. Adyen's net revenue growth in the EMEA region re-accelerated to 25% YoY in the first half of 2024. Stripe is doing well in Europe too. According to the company’s annual report filed with the Companies Registration Office of Ireland, Stripe's revenue in Europe increased 26% YoY in 2022, and the growth accelerated to 34% YoY in 2023.

However, both Adyen and Stripe are primarily online acquirers. So who’s capturing growth in in-person acquiring and issuing? Could that be banks that still dominate acquiring in many European markets? (I’m somewhat skeptical) Or could that be nimble Fintech companies? (SumUp claims “over 30% top-line growth year on year”). My bet would be on the Fintech companies, but the time will tell.

Cover image source: Mastercard

Disclaimer: Information contained in this newsletter is intended for educational and informational purposes only and should not be considered financial advice. You should do your own research or seek professional advice before making any investment decisions.