Hey!

I recently began researching Worldline and Nexi, two leading European merchant acquirers. Both companies badly missed the growth guidelines they provided at their latest investor days (Wordline in 2021 and Nexi in 2022), and both companies are trading below their IPO prices (Worldline stock is down 60% and Nexi is down 30%). Worldline’s Board went so far as to fire the CEO, who’d been with the company since the 1990s. So I got curious about what went so wrong there.

However, in the process of this research, I realized that I should have started with researching the European merchant acquiring market. It was difficult to understand the challenges that Worldline and Nexi faced without understanding market dynamics and competition. It was also silly that, as a European, I knew more about the U.S. market than I did about my own “home” market. So today’s post is a summary of what I have learned (so far) about the European merchant acquiring market and its players.

Hope you will learn something new! Enjoy!

Jevgenijs

p.s. if you have feedback just reply to this email or ping me on X/Twitter

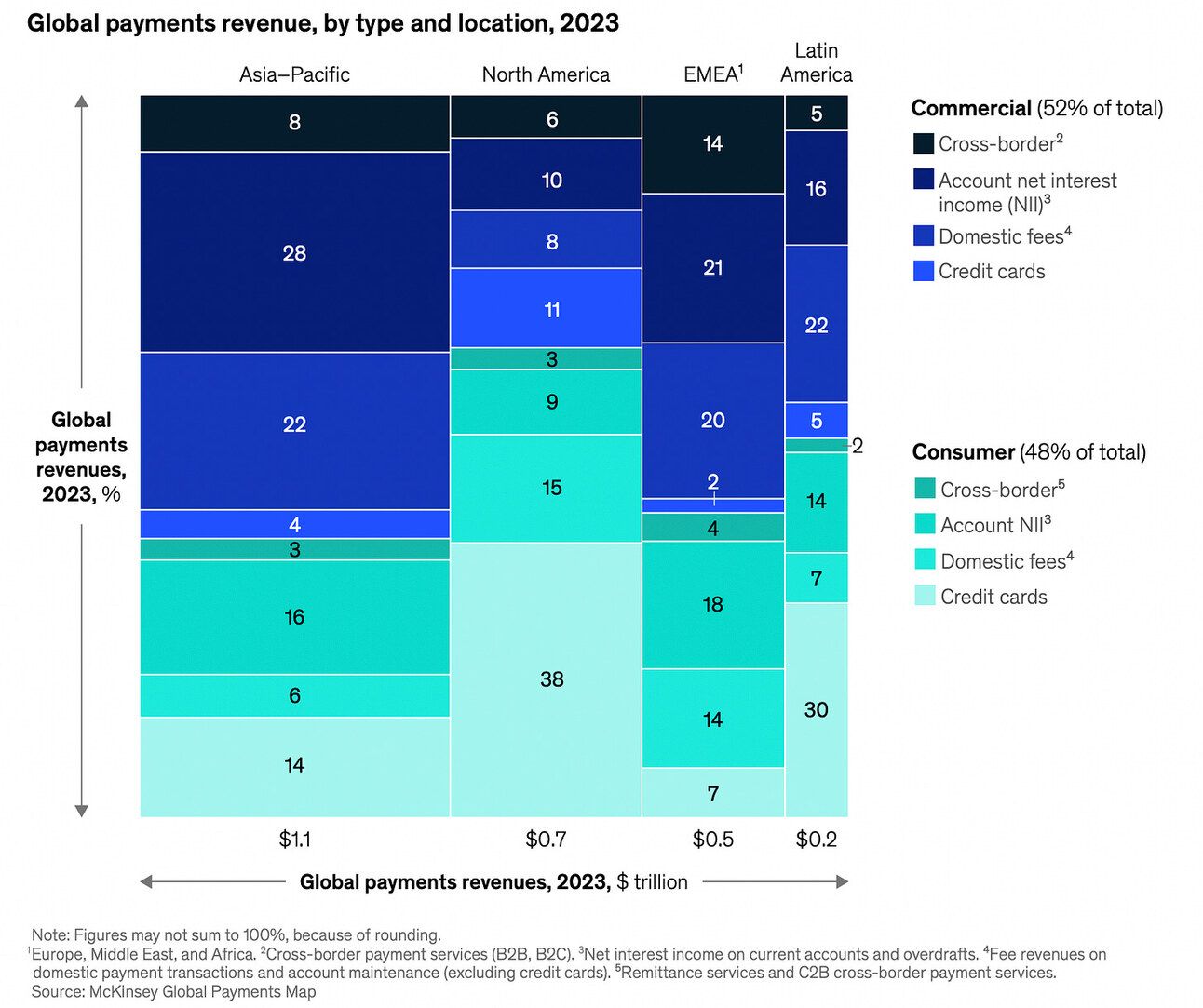

Every year, McKinsey & Company publishes the “McKinsey’s Global Payments Report”, which, among other things estimates the global payments revenue pool. As you can see from the chart below, McKinsey estimates that, in 2023, the global payments revenue stood at $2.4 trillion. The company estimates the revenue pool in North America to be $0.7 trillion, compared to $0.5 trillion in EMEA (Europe, Middle East and Africa).

However, there was a stark difference between North America and EMEA in terms of the revenue contribution from credit cards (interchange fees, scheme fees, acquirer fees, etc). Thus, according to McKinsey’s estimates, credit cards contributed 49% of the total payments revenue pool in North America ($0.34 trillion), while in EMEA cards contributed only 9% of the revenue pool or $0.05 trillion. If anything, these numbers tell how important credit cards are to the payment landscape in the U.S. and how unimportant they are in Europe.

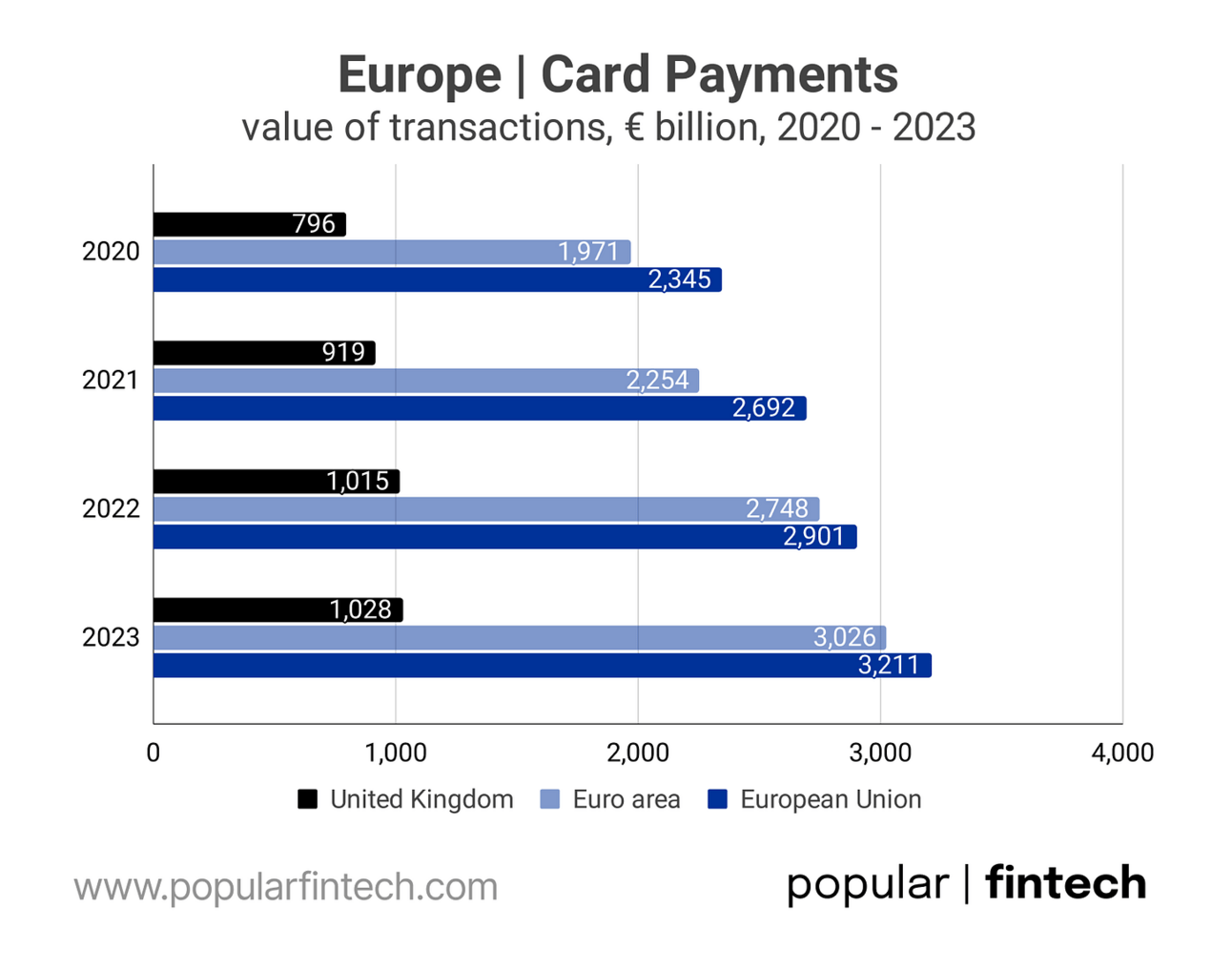

According to the European Central Bank, in 2023, the total value of card transactions in the European Union (all types of cards) reached €3.2 trillion ($3.5 trillion). The value of card transactions in the UK was €1.0 trillion ($1.1 trillion). For comparison, the U.S. market is over $11 trillion. Thus, if we define Europe as the EU + the UK, then it’s a much smaller market.

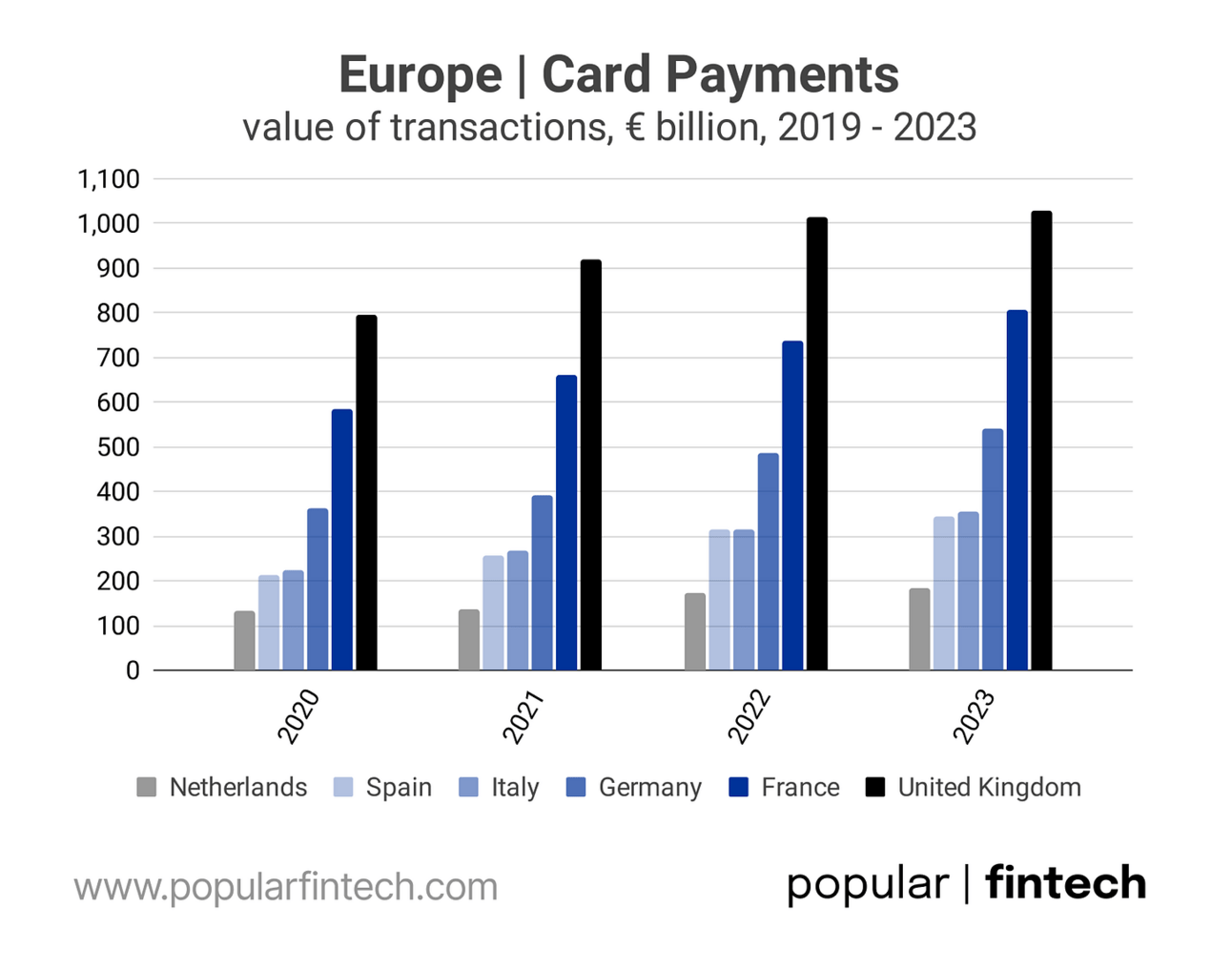

The UK is the largest market in Europe (in terms of card payment volume), followed by France (€807 billion in 2023), Germany (€540 billion), Italy (€354 billion), Spain (€344 billion) and the Netherlands (€185 billion). I found it interesting that Germany, despite being the largest country in Europe, ranks only third in card payment volume. I’d guess cash is still king there.

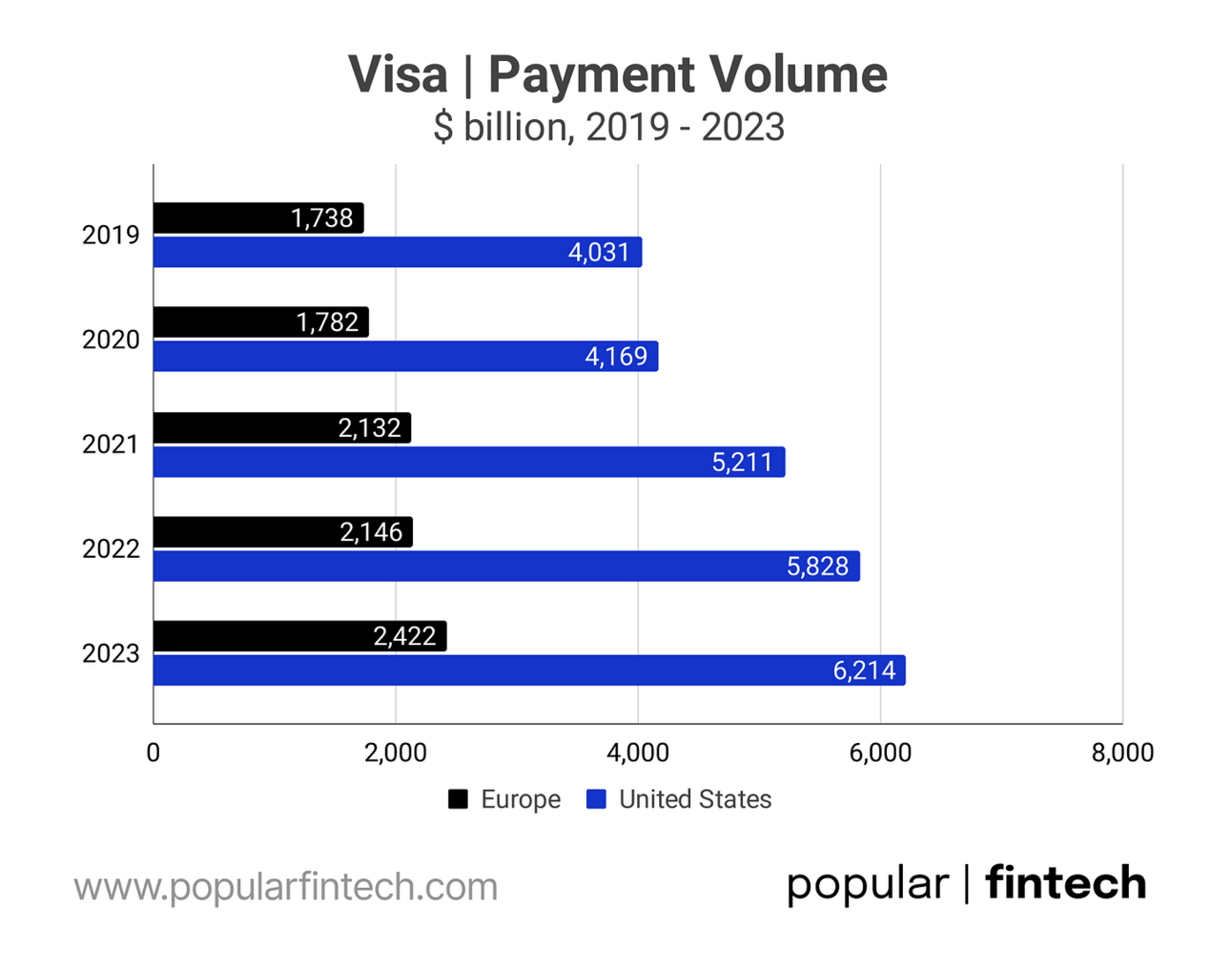

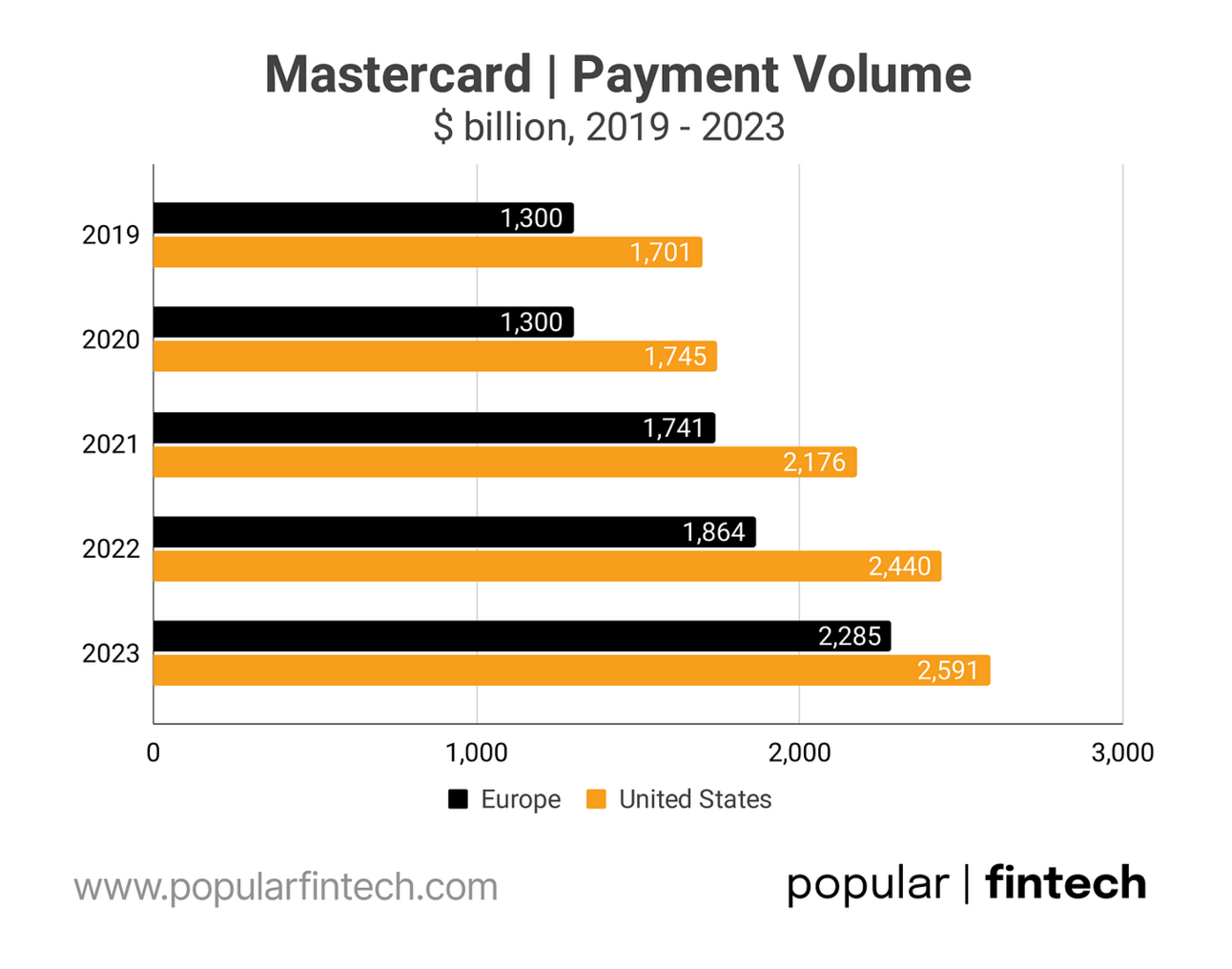

Another measure of the market size is the payment volume reported by Visa and Mastercard. There are numerous domestic schemes in Europe, such as Cartes Bancaires in France, girocard in Germany, and Dankort in Denmark). Nevertheless, Visa and Mastercard are still the two dominating schemes, and both are growing in double digits in Europe, as they take market share from the domestic schemes. In 2023, Visa reported a payment volume of $6.2 trillion in the U.S. and $2.4 trillion in Europe.

Mastercard, in turn, reported a payment volume of $2.6 trillion in the U.S. and $2.3 trillion in Europe. The combined volume in Europe (Visa + Mastercard) was $4.7 trillion, which is bigger than the total card payment volume in the EU and the UK mentioned above. However, Visa’s and Mastercard’s definition of “Europe” is broader and includes European countries outside of the European Union. The combined U.S. volume was $8.8 trillion.

According to the Nilson report, Europe’s largest merchant acquirers in 2023 (by the number of transactions) were Worldpay, Nexi, Barclays, Fiserv, Adyen, Worldline, and Global Payments (see the figure below). Naturally, I decided to see what this picture would look like if these companies were ranked based on revenue (and where the revenue comes from).

I use the terms “an acquirer” and “acquiring” in this text although a proper term would probably be “payment acceptance”. Sometimes the companies mentioned below act as an acquirer, sometimes as an acquirer processor, and sometimes provide gateway services.

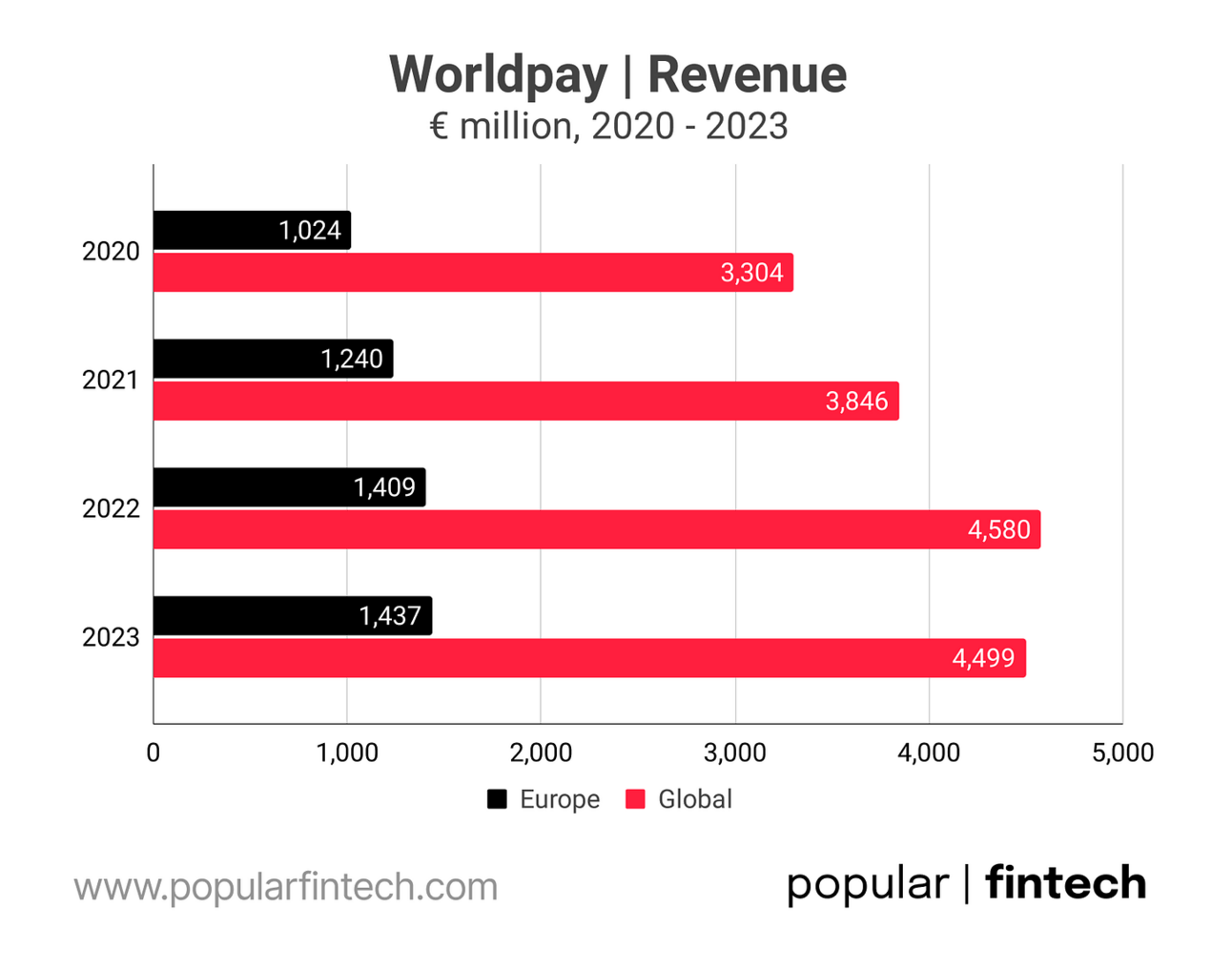

Let’s start with the U.S. companies, and in particular, Worldpay. Worldpay, as we know it now, came to life with the merger of U.S. company Vantiv and British Worldpay in 2017. In 2019, the combined company was acquired by FIS, which, in February of this year, sold the majority stake in it (55%) to a private equity firm GTCR.

In 2023, Worldpay’s global revenue was €4.5 billion ($4.9 billion), of which €1.4 billion ($1.6 billion) came from Europe. According to the annual report of Worldpay’s European legal entity, 62% of the revenue came from the “Global e-commerce” segment (segment servicing global enterprise clients), and 38% from the “Merchant UK” segment (segment servicing British SMBs).

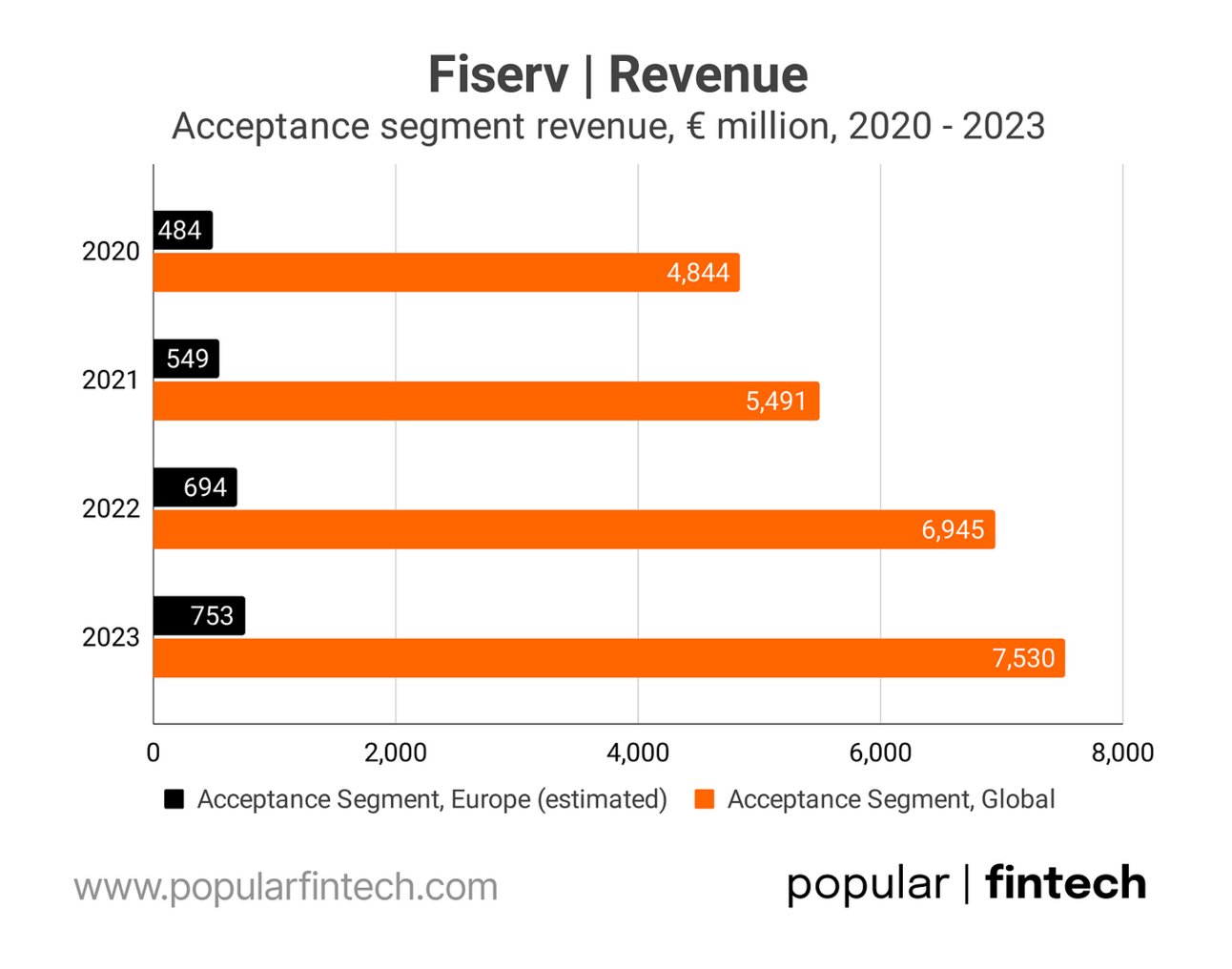

Until the end of 2023, Fiserv reported its merchant acquiring business under the segment “Acceptance”. Thus, in 2023, this segment contributed €7.5 billion ($8.1 billion) in revenue, of which €0.75 billion ($0.8 billion) came from Europe. Fiserv does not disclose European revenue, but it does disclose revenue generated outside of the North American region (15% of the total revenue in 2023). I assumed 10% for Europe based on the earlier disclosures. Per my understanding, most of Fiserv’s European revenue comes from the UK.

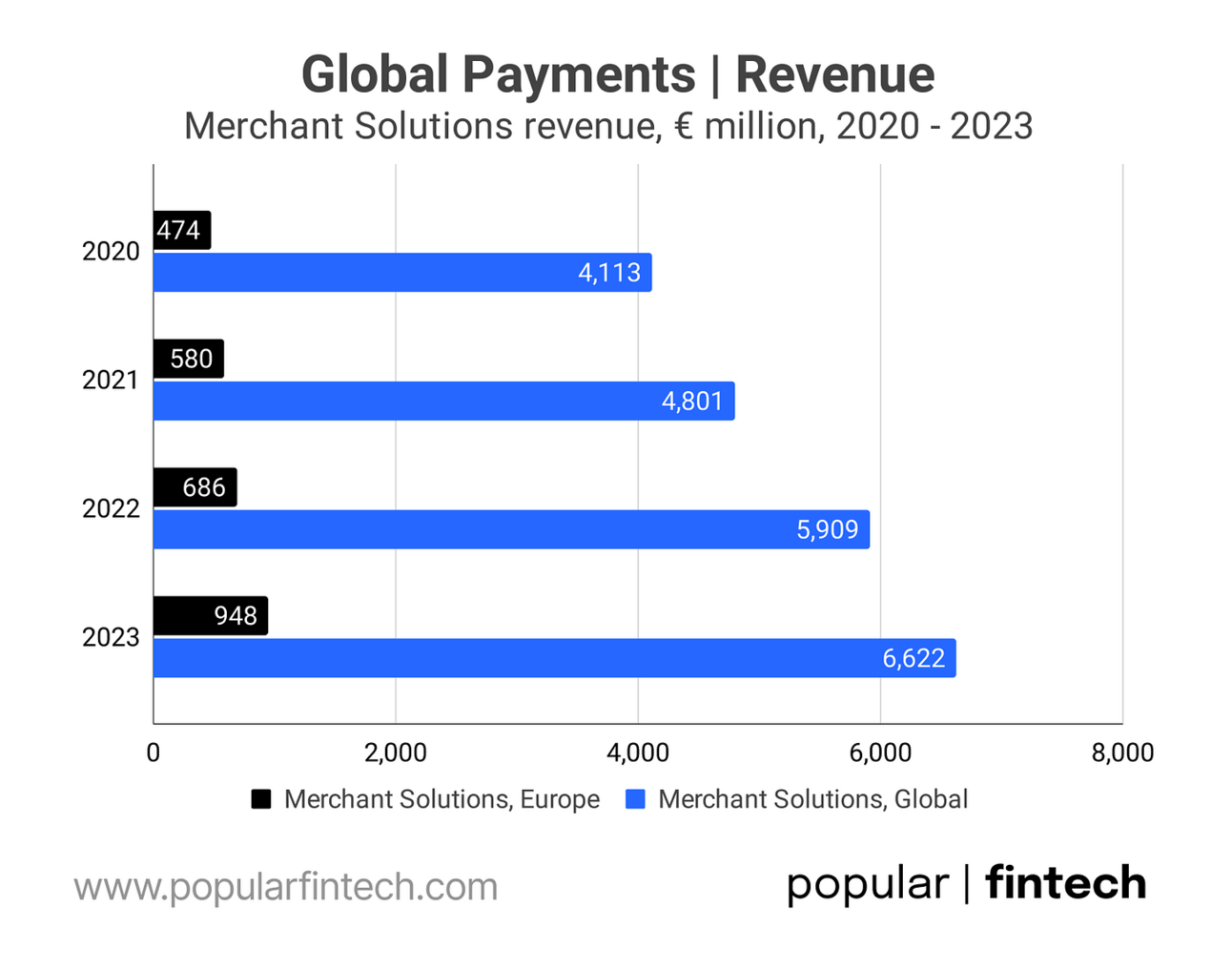

Global Payments’ Merchant Solutions segment generated €6.6 billion in revenue in 2023, of which €0.95 came from Europe. In 2022, Global Payments acquired EVO, which expanded its footprint to Poland, Germany, and Greece. Before the acquisition Global Payments operated in Spain, Ireland, and the UK. The acquisition, also allowed Global Payments to overtake Fiserv in terms of the revenue generated in Europe.

Moving on to the European players. In 2021, Nexi, the leading merchant acquirer in Italy, merged with the leading merchant acquirer Nets, forming a single company. In 2023, Nexi’s Merchant Solutions business generated €1.9 billion in revenue. The majority of the company’s revenue still comes from Italy and the Nordics, but it has a growing presence in Germany, Austria, and Switzerland, as well as Southern Europe.

In 2023, Nexi agreed to acquire the majority stake in the acquiring business of Spanish bank Sabadell. However, the deal stalled for now due to BBVA’s hostile takeover attempt of Sabadell. The deal would give Nexi a strong footprint in the Spanish market, which is dominated by local banks, but it is unlikely to go through should BBVA succeed in taking over Sabadell.

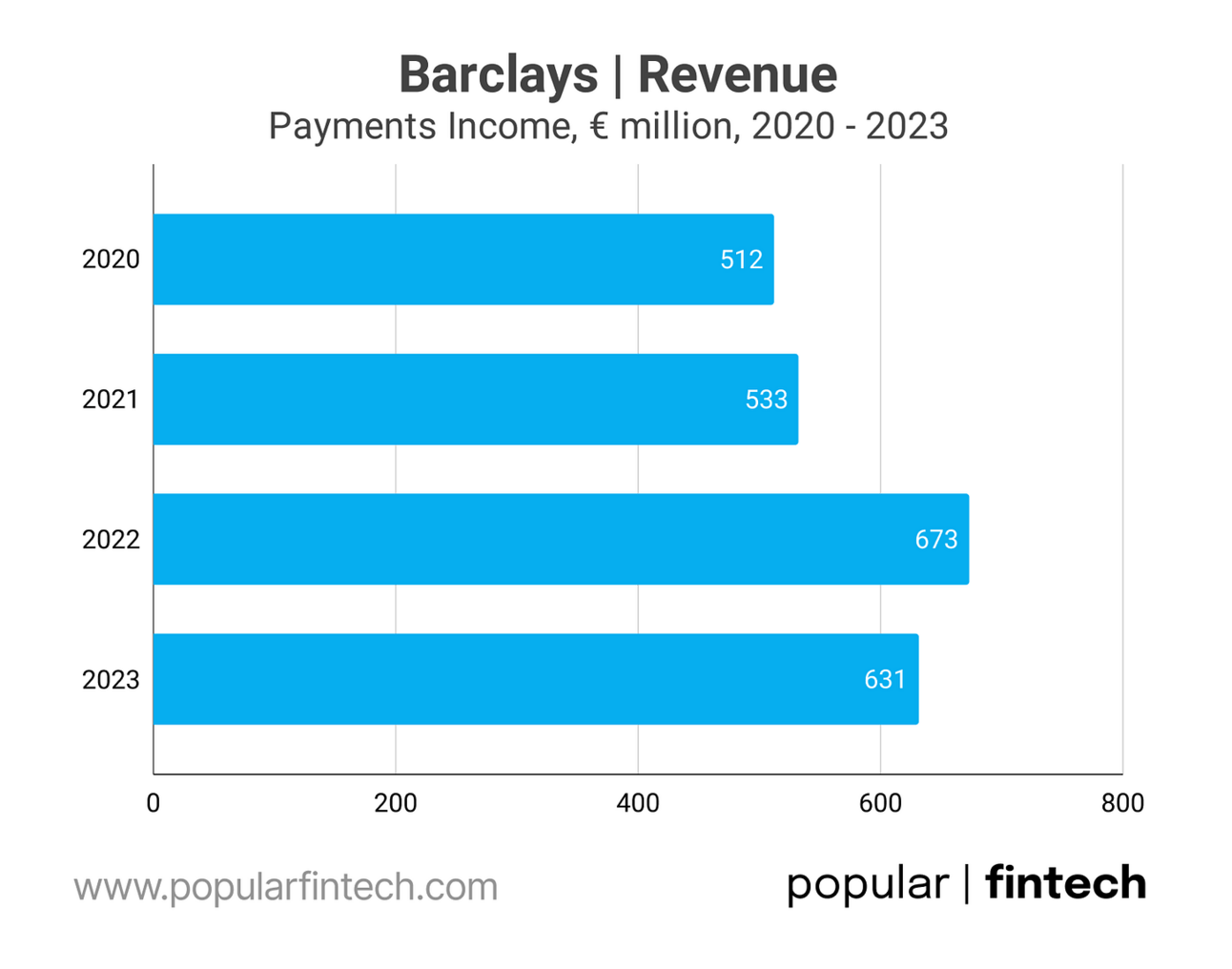

Barclays’ merchant acquiring business reported a payments income of €0.63 billion (£0.55 billion) in 2023. Barclays has been trying to sell its merchant-acquiring unit in an attempt to simplify its organization, but so far has not succeeded in finding a buyer. Lloyds has a joint venture with Fiserv and HSBC has a joint venture with Global Payments, so perhaps, instead of selling the business altogether, Barclays will follow a similar path. Barclays primarily serves British and international enterprise e-commerce merchants.

In 2023, Adyen reported a total net revenue of €1.6 billion, of which €0.9 billion came from the EMEA region (primarily Europe). Adyen is primarily known as an e-commerce acquirer serving enterprise clients. Nevertheless, it continues to scale its omnichannel business (15% of the payment volume, that the company processed in 2023, came from in-person commerce). In addition, Adyen partners with independent software vendors (e.g. Lightspeed Commerce) and commerce platforms (e.g. eBay and Wix) to reach SME segments through its Platforms business.

Finally, Worldline. In 2020, Worldline completed the acquisition of its rival Ingenico. The acquisition doubled the size of the company’s Merchant Services businesses (Worldline later sold Ingenico’s terminals business to Apollo, and kept only the acquiring part), as well as expanded its geographic footprint.

In 2023, Worldline’s Merchant Services segment generated €3.3 billion in revenue, contributing 72% of the company’s total revenue. 90% of the company’s revenue (all segments) came from Europe, including 35% from Northern Europe, 35% from Central and Eastern Europe and 20% from Southern Europe.

Please note that Worldline’s revenue excludes pass-through interchange fees, but includes scheme fees. This year the company started reporting “net net” revenue (revenue net of interchange and scheme fees). Thus, the Merchant Services segment's “net net revenue” in 2023 was €2.5 billion. Worldline also allocates processing revenue to its Financial Services segment, while, for example, Fiserv allocates processing revenue to its merchant acquiring segment.

Thus, in terms of the revenue generated in Europe, Worldline is Europe’s largest merchant acquirer, followed by Nexi, Worldpay, Global Payments, Adyen, Fiserv, and Barclays. Even if I use the “net net revenue” mentioned above, Worldline is still, by far, the largest acquirer in Europe.

Here are the main takeaways from researching the European merchant acquiring landscape:

European merchant acquiring market is about 2 times smaller than the U.S. market based on the card payment volume. It’s even smaller if you define Europe as the European Union and the United Kingdom.

The U.K. is the largest and the most competitive market in Europe, with Barclays, Worldpay, Global Payments, and Fiserv having strong footprints in the country. My understanding is that Elavon focuses on the UK market too.

Adyen and Worldpay generate most of their revenue from serving global and pan-European enterprise e-commerce businesses, with both companies generating close to a billion euros in e-commerce acquiring revenue in Europe alone. As I understand, JPMorgan also focuses on global e-commerce players.

This leaves the SME segment in Continental Europe to Worldline, Nexi, and the local banks (such as BNP Paribas in France, and Sabadell and BBVA in Spain)…

…and this brings me back to my initial question. If Worldline and Nexi face limited competition from global merchant acquirers and primarily compete with smaller players and banks, why are they struggling to deliver growth? I understand why they could be having a hard time winning enterprise e-commerce merchants (Adyen, Worldpay, Stripe), but who are they losing the market share to in the SME segment?

I will leave these questions for a future essay. In the meantime, please let me know if I got anything wrong in my research. As always, happy to hear feedback!

Thank you for reading and hope you learned something new today!

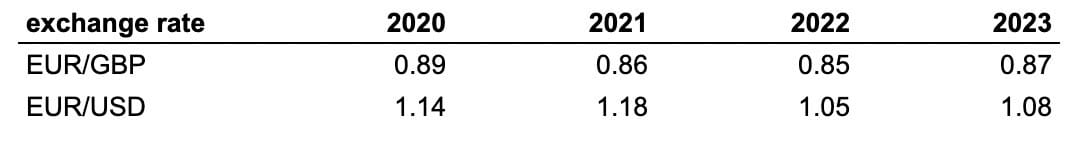

* exchange rates used to convert the numbers on the charts above:

Cover image source: Worldline

Disclaimer: Information contained in this newsletter is intended for educational and informational purposes only and should not be considered financial advice. You should do your own research or seek professional advice before making any investment decisions.